Information Statements (revised) (prer14c)

January 26 2016 - 6:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

(Amendment

No. 1)

Check

the appropriate box:

| [X] |

Preliminary

Information Statement |

| |

|

| [ ] |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| [ ] |

Definitive

Information Statement |

| |

Nano

Mobile Healthcare, Inc. |

|

| |

(Name

of Registrant As Specified In Its Charter) |

|

Payment

of Filing Fee (Check the appropriate box):

| [X] |

No

fee required |

| |

|

| [ ] |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| |

|

| (1) |

Title

of each class of securities to which transaction applies: |

| |

|

| |

|

| (2) |

Aggregate

number of securities to which transaction applies: |

| |

|

| |

|

| (3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined): |

| |

|

| |

|

| (4) |

Proposed

maximum aggregate value of transaction: |

| |

|

| |

|

| (5) |

Total

fee paid: |

| |

|

| |

|

| [ ] |

Fee

paid previously with preliminary materials. |

| |

|

| [ ] |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing. |

| |

|

| (1) |

Amount

Previously Paid: |

| |

|

| |

|

| (2) |

Form,

Schedule or Registration Statement No.: |

| |

|

| |

|

| (3) |

Filing

Party: |

| |

|

| |

|

| (4) |

Date

Filed: |

| |

|

Nano

Mobile Healthcare, Inc.

3

Columbus Circle

New

York, NY 10019

The

following information is being provided to amend Nano Mobile Healthcare Inc.’s (the “Company”) preliminary information

statement filed on January 8, 2016, or the information statement. Text that is bold and struck through in the disclosures below

shows text being removed from those disclosures and text that is bold and underlined below shows text being added to those disclosures.

Terms used but not otherwise defined herein have the meanings given to them in the information statement, and all references to

captions and page numbers refer to captions and page numbers in the information statement, respectively, unless otherwise provided.

THE

INFORMATION STATEMENT CONTAINS IMPORTANT ADDITIONAL INFORMATION AND THIS AMENDMENT SHOULD BE READ IN CONJUNCTION WITH THE INFORMATION

STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

| 1. | The

fifth paragraph in the “Approval by Our Stockholders of the Amendments to our Charter

to Effectuate the Capital Stock increase and the Reverse Stock Split” under the

subsection heading “Approval Required” is amended in its entirety as follows: |

On

January 8 25, 2016, there were 341,699,478 398,755,933 shares of

Common Stock issued and outstanding and 23,473,368 shares of Series A Convertible Preferred issued and outstanding for a total

of 459,066,318 516,122,773 shares of Common Stock (on an as-converted basis) entitled to vote as

a single class on the amendment to our Charter to effectuate the Capital Stock Increase and the Reverse Stock Split. On January

8 25, 2016, Stockholders holding an aggregate of 246,728,384 258,728,384

shares of Common Stock (on an as-converted basis), or approximately 53.75 50.13%

of the outstanding Common Stock (on an

as-converted basis), entitled to vote on the matters described herein, executed and delivered a written consent that approved

the amendments to our Charter to effectuate the Capital Stock Increase and Reverse Stock Split.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting requirements of the SEC. Accordingly, we are required to file reports with the SEC including annual

reports, quarterly reports, current reports and other reports as required by SEC rules. All reports that we file electronically

with the SEC are available for viewing free of charge over the Internet via the SEC’s EDGAR system at http://www.sec.gov.

We will provide without charge to each person who receives a copy of this Information Statement, upon written or oral request,

a copy of any information that is incorporated by reference in this Information Statement. Requests should be directed to Nano

Mobile Healthcare, Inc., Attention: Secretary, 3 Columbus Circle, 15th Floor, New York, NY 10019 or call (713) 973-5738.

For further information about us, you may read and copy any reports, statements and other information filed by us at the SEC’s

Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549-0102. You may obtain further information on the

operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

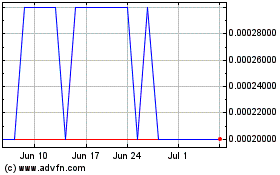

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

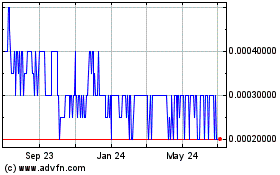

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Apr 2023 to Apr 2024