SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 1

to

SCHEDULE TO

(Rule 14d-100)

Tender Offer

Statement under Section 14(d)(1) or 13(e)(1)

of the Securities

Exchange Act of 1934

VAPOR CORP.

(Name of Subject Company (Issuer) and Name

of Filing Person (Issuer))

Units Consisting of Shares of Series A Convertible

Preferred Stock and Series A Warrants

(Title of

Class of Securities)

922099502

(CUSIP Number of Class of Securities)

Jeffrey Holman

Chief Executive Officer

Vapor Corp.

3001 Griffin Road

Dania Beach, Florida 33312

(888) 766-5351

(Name, Address

and Telephone Number of Person

Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

with a copy to:

Martin T. Schrier

Christopher J. Bellini

Cozen O’Connor

Southeast Financial Center

200 South Biscayne Blvd

Suite 4410

Miami, Florida 33131

(305) 704-5940

CALCULATION OF FILING FEE

| |

|

|

| Transaction valuation* |

|

Amount of filing fee |

| $22,532,325.43 |

|

$2,269.01 |

| * |

|

Estimated for purposes of calculating the amount of the filing fee only. Vapor Corp. (the “Company”) is offering holders of the Company’s Units, each consisting of one-fourth of a share of the Company’s Series A Convertible Preferred Stock convertible into 10 shares of common stock and 20 Series A Warrants each exercisable into one share of common stock (the “Units”), the opportunity to exchange such Units for shares of the Company’s common stock, par value $0.001 per share (the “Shares”) and warrants to purchase 64 Shares, at an exercise price equal to 120% of the closing market price of the Shares on the expiration date of the offer (the “Warrants”) by tendering one Unit in exchange for 128 Shares and one Warrant (exercisable for 64 Shares). The amount of the filing fee assumes that all outstanding Units will be exchanged and is calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, as modified by Fee Rate Advisory No. 1 for fiscal year 2016, which equals $100.70 per million dollars of the value of the transaction. The transaction value was determined by using the last sale price of the Units as reported on The NASDAQ Capital Market on December 10, 2015, which was $5.99. |

| |

|

| þ |

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: $2,269.01 |

|

N/A |

|

Filing Party: |

|

Vapor Corp. |

| Form or Registration No.: SC TO-I |

|

N/A |

|

Date Filed: |

|

December 11, 2015 |

¨ Check the box if the filing relates solely to preliminary communications made before the

commencement of a tender offer.

Check the appropriate boxes below to designate any transactions

to which the statement relates:

¨ third-party

tender offer subject to Rule 14d-1.

þ issuer

tender offer subject to Rule 13e-4.

¨ going-private

transaction subject to Rule 13e-3.

¨ amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting

the results of the tender offer: þ

SCHEDULE TO

This Amendment No. 1 amends and supplements the Tender Offer Statement

on Schedule TO (together with the exhibits thereto, and as amended or supplemented from time to time, the “Schedule

TO”) filed by Vapor Corp., a Delaware corporation (the “Company”). The Schedule

TO relates to the offer by the Company to all holders of the Company’s outstanding Units (the “Units”),

each consisting of one-fourth of a share of the Company’s Series A Convertible Preferred Stock (convertible into 10 shares

of the Company’s common stock, par value $0.001 per share (the “Shares”)), and 20 Series A Warrants

(each exercisable into one Share), to receive 128 Shares and warrants to purchase 64 Shares, at an exercise price equal to 120%

of the closing market price of the Shares on the expiration date of the offer in exchange for one Unit, upon the terms

and subject to the conditions set forth in the Offer to Purchase, dated December 11, 2015 (as amended or supplemented from time

to time, the “Offer to Purchase”), and in the related Letter of Transmittal to tender Units,

copies of which were filed with the Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively (which, together with any amendments

or supplements thereto, collectively constitute the “Offer”). Capitalized terms used and not otherwise

defined herein shall have the meanings assigned thereto in the Offer to Purchase.

Items 1 through 9,

and Item 11.

The Offer

to Purchase and Items 1 through 9 and Item 11 of the Schedule TO, to the extent such Items incorporate by reference the information

contained in the Offer to Purchase, are hereby amended and supplemented as follows:

On January

8, 2016, the Company issued a press release announcing the termination of the Offer. A copy of the press release is filed herewith

as Exhibit (a)(1)(F).

Item 12. Exhibits.

Exhibit

Number |

|

Description |

| |

|

| (a)(1)(F) |

|

Press Release dated January 8, 2016. |

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

VAPOR CORP.

| By: |

/s/ Jeffrey Holman |

|

| |

Jeffrey Holman |

|

| |

Chief Executive Officer |

|

Date: January 8, 2016

INDEX TO EXHIBITS

Exhibit

Number |

|

Description |

| |

|

| (a)(1)(A) |

|

Offer Letter dated December 11, 2015. |

| |

|

| (a)(1)(B) |

|

Letter of Transmittal (including Guidelines of the Internal Revenue Service for Certification of Taxpayer Identification Number on Substitute Form W-9). |

| |

|

| (a)(1)(C) |

|

Form of Notice of Guaranteed Delivery. |

| |

|

| (a)(1)(D) |

|

Form of letter to brokers, dealers, commercial banks, trust companies and other nominees to their clients. |

| |

|

| (a)(1)(E) |

|

Form of letter to be used by brokers, dealers, commercial banks, trust companies and other nominees for their clients. |

| |

|

| (a)(1)(F)* |

|

Press Release dated January 8, 2016. |

| |

|

|

| (a)(5)(A) |

|

The Company’s Annual Report on Form 10-K filed with the SEC on March 31, 2015, incorporated herein by reference. |

| |

|

| (a)(5)(B) |

|

The Company’s Quarterly Report on Form 10-Q filed with the SEC on November 16, 2015, incorporated herein by reference. |

| |

|

| (b) |

|

Not applicable. |

| |

|

| (d)(1) |

|

Specimen Common Stock Certificate, incorporated herein by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K filed with the SEC on December 31, 2013. |

| |

|

| (d)(2) |

|

Form of Series A Warrant, incorporated herein by reference to Exhibit 4.2 of the Company’s Registration Statement on Form S-1 (Registration No. 333-204599) filed with the SEC on July 20, 2015. |

| |

|

| (d)(3) |

|

Form of Registration Rights Agreement, incorporated herein by reference to Exhibit 10.7 of the Company’s Current Report on Form 8-K filed with the SEC on June 25, 2015. |

| |

|

| (d)(4) |

|

Form of Exchange Warrant to be issued in connection with the Offer, incorporated by reference to Exhibit 4.2 of the Company’s Registration Statement on Form S-4 (Registration No. 333- 208481) filed with the SEC on December 11, 2015). |

| |

|

| (g) |

|

Not applicable. |

| |

|

| (h) |

|

Not applicable. |

*Filed herewith

Exhibit (a)(1)(F)

Vapor Corp. Announces Withdrawal

of Exchange Offer for Units Issued In July 2015

DANIA BEACH, Fla., January 8, 2016 /PRNewswire/ — Vapor Corp.

(NASDAQ CM: VPCO & VPCOU) (“Vapor”), a leading U.S.-based distributor and retailer of vaporizers, e-liquids, e-cigarettes

and e-hookahs, announced today that it has withdrawn and terminated its previously announced offer to issue shares of its common

stock and warrants in exchange for the outstanding Units sold in the July 2015 offering (NASDAQ: VPCOU). The exchange offer was

made pursuant to an offer to purchase dated December 11, 2015 and a related letter of transmittal. None of the Units were accepted

for exchange in the exchange offer, and all Units previously tendered and not withdrawn will be promptly returned to their respective

tendering holders.

The Board of Directors of Vapor and its representatives had engaged

in a dialogue with certain holders of Units purporting to beneficially own over 10% of the outstanding Units about their willingness

to participate in the exchange offer. Such holders have communicated that they would not be participating in the exchange offer

and, accordingly, Vapor believes that the minimum tender condition for the exchange offer will not be satisfied.

Persons with questions regarding the termination of the exchange

offer relating to the Units should contact Okapi Partners, LLC, the Information Agent for the exchange offer, at 1212 Avenue of

the Americas, 24th Floor, New York, NY 10036, (telephone number: (212) 297-0720 or toll free: (877) 629-6355) and email info@okapipartners.com).

This press release does not constitute an offer to sell or the solicitation

of an offer to buy any security and shall not constitute an offer, solicitation or sale of any securities in any jurisdiction in

which such offering, solicitation or sale would be unlawful.

Important Notice

This press release is for informational purposes only and is neither

an offer to exchange nor a solicitation of an offer to exchange any of the company’s securities.

About Vapor Corp.

Vapor Corp., a Nasdaq company, is a U.S.-based distributor and retailer

of vaporizers, e-liquids and electronic cigarettes. It recently acquired the retail store chain “The Vape Store” as

part of a merger with Vaporin, Inc. The Company’s innovative technology enables users to inhale nicotine vapor without smoke,

tar, ash or carbon monoxide. Vapor Corp. has a streamlined supply chain, marketing strategies and wide distribution capabilities

to deliver its products. The Company’s brands include VaporX®, Krave®, Hookah Stix® and Vaporin™ and are

distributed to retail stores throughout the U.S. and Canada. The Company sells direct to consumer via e-commerce and Company-owned

brick-and-mortar retail locations operating under “The Vape Store” brand.

Safe Harbor Statement

Safe Harbor Statements under the Private Securities Litigation

Reform Act of 1995: The Material contained in this press release may include statements that are not historical facts and are considered

“forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements reflect Vapor Corp.’s current views about future events, financial performances, and project development. These

“forward-looking” statements are identified by the use of terms and phrases such as “will,” “believe,”

“expect,” “plan,” “anticipate,” and similar expressions identifying forward-looking statements.

Investors should not rely on forward-looking statements because they are subject to a variety of risks, uncertainties, and other

factors that could cause actual results to differ materially from Vapor’s expectations. These risk factors include, but are

not limited to, the risks and uncertainties identified by Vapor Corp. under the headings “Risk Factors” in its latest

Annual Report on Form 10-K. These factors are elaborated upon and other factors may be disclosed from time to time in Vapor Corp.’s

filings with the Securities and Exchange Commission. Vapor Corp. expressly does not undertake any duty to update forward-looking

statements.

SOURCE Vapor Corp.

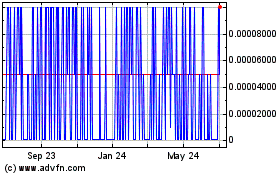

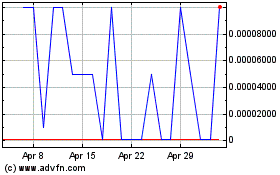

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Sep 2023 to Sep 2024