SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

November 26, 2015

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

BANCO MACRO

S.A.

Financial Statements as of September 30, 2015,

together with the review report on interim-period financial

statements

CONTENTS

| · | Review

report on interim-period financial statements |

| · | Statements

of changes in shareholders’ equity |

| · | Statements

of cash flows |

| · | Notes

to the financial statements |

| · | Exhibits

A through L, N and O |

| · | Consolidated

balance sheets |

| · | Consolidated

statements of income |

| · | Consolidated

statements of cash flows |

| · | Consolidated

statements of debtors by situation |

| · | Notes

to the consolidated financial statements with subsidiaries |

REVIEW REPORT

ON INTERIM-PERIOD FINANCIAL STATEMENTS

To the Directors of

BANCO MACRO S.A.

Registered office: Sarmiento 447

City of Buenos Aires

| I. | Report on the financial statements

|

Introduction

| 1. | We have reviewed (a) the accompanying

interim financial statements of BANCO MACRO S.A. (“the Bank”), (b) the accompanying

interim consolidated financial statements of BANCO MACRO S.A. and its subsidiaries, which

comprise the related balance sheets as of September 30, 2015, and the statements of income,

changes in shareholders’ equity and cash flows and cash equivalents for the nine-month

period then ended, and (c) a summary of the significant accounting policies and additional

explanatory information. |

Responsibility of the Bank’s

Management and Board in connection with the financial statements

| 2. | The Bank’s Management and Board

of Directors are responsible for the preparation and fair presentation of these financial

statements in accordance with the accounting standards established by the BCRA (Central

Bank of Argentina) and are also responsible for performing the internal control procedures

that they may deem necessary to allow for the preparation of interim period financial

statements that are free from material misstatements, either due to errors or irregularities. |

Auditor’s responsibility

| 3. | Our responsibility is to express a

conclusion on the accompanying financial statements based on our review, which was performed

in accordance with the standards of the Argentine Federation of Professional Councils

in Economic Sciences Technical Resolution No. 37 and with the “Minimum external

auditing standards” issued by the BCRA, applicable to the review of interim period

financial statements, and in compliance with the ethical requirements relevant to the

audit of the Bank’s annual financial statements. A review of interim period financial

statements consists of making inquiries, mainly of the persons in charge of accounting

and financial matters, as well as applying analytical procedures and other review procedures.

A review is substantially less in scope than an audit of financial statements; therefore,

we cannot obtain reasonable assurance that we will become aware of all the material issues

that may arise in an audit. Therefore, we do not express an audit opinion. |

Conclusion

| 4. | Based on our review, we have not become

aware of anything that may lead us to believe that the accompanying financial statements

have not been prepared, in all material respects, in accordance with the accounting standards

established by the BCRA. |

Emphasis on certain issues disclosed

in the financial statements

| 5. | Attention should be paid to note 5.

to the accompanying stand-alone financial statements, where valuation differences between

the BCRA accounting regulations used in preparing the accompanying financial statements

and the Argentine professional accounting standards effective in the City of Buenos Aires

are identified and quantified. This issue does not change the conclusion expressed in

paragraph 4. |

| 6. | As further explained in note 24. to

the accompanying stand-alone financial statements, certain accounting practices used

by the Bank to prepare the accompanying financial statements conform with the accounting

standards established by the BCRA but may not conform with the accounting principles

generally accepted in other countries. |

| II. | Report on other legal and

regulatory requirements |

In compliance with current legal requirements,

we report that:

| a) | Based on our review, we have

not become aware of anything that may lead us to believe that the financial statements

mentioned in paragraph 1. have not been prepared, in all material respects, in conformity

with the applicable Argentine General Associations Law provisions, the CNV (Argentine

Securities Commission) regulations, and BCRA rules. |

| b) | The financial statements mentioned

in paragraph 1. have been transcribed to the “Inventory and Financial Statements”

Book and arise from the accounting books kept, in all formal respects, pursuant to current

legal requirements and the applicable BCRA rules. |

| c) | As of September 30, 2015, the

liabilities accrued in employee and employer contributions to the Integrated Pension

Fund System, as recorded in the Bank’s books, amounted to Ps. 42,742,720, none

of which was due as of that date. |

| d) | As of September 30, 2015, as

stated in note 17.1. to the accompanying individual financial statements, the Bank carries

shareholder´s equity and offsetting eligible assets that exceed the minimum amounts

required by applicable CNV regulations for these items. |

City of Buenos Aires,

November 10, 2015

| PISTRELLI,

HENRY MARTIN Y ASOCIADOS S.R.L. |

| C.P.C.E.C.A.B.A.

Vol. 1 – Fo. 13 |

| |

| NORBERTO

M. NACUZZI |

| Partner |

| Certified

Public Accountant (U.B.A.) |

| C.P.C.E.C.A.B.A.

Vol. 196 – Fo. 142 |

FINANCIAL STATEMENTS AS OF

SEPTEMBER 30, 2015

BUSINESS NAME: Banco Macro SA

REGISTERED OFFICE: Sarmiento 447 – City of Buenos

Aires

CORPORATE PURPOSE AND MAIN BUSINESS: Commercial bank

BCRA (CENTRAL BANK OF ARGENTINA): Authorized as “Argentine

private bank” under No. 285.

REGISTRATION WITH THE PUBLIC

REGISTRY OF COMMERCE: Under No. 1,154 - By-laws book No. 2, Folio 75 dated

March 8, 1967

EXPIRATION OF ARTICLES OF INCORPORATION: March 8, 2066

REGISTRATION WITH THE IGJ (BUSINESS ASSOCIATIONS REGULATORY

AGENCY): Under No. 9,777 – Corporations Book No. 119 Volume A, dated October 8, 1996.

SINGLE TAX IDENTIFICATION NUMBER: 30-50001008-4

REGISTRATION DATES OF AMENDMENTS TO BY-LAWS:

| August

18, 1972, August 10, 1973, July 15, 1975, May 30, 1985, September 3, 1992, May 10, 1993, November 8, 1995, October 8, 1996,

March 23, 1999, September 6, 1999, June 10, 2003, December 17, 2003, September 14, 2005, February 8, 2006, July 11, 2006,

July 14, 2009, November 14, 2012, August 2, 2014. |

BALANCE SHEETS

AS OF SEPTEMBER 30, 2015

AND DECEMBER 31, 2014

(Translation of financial statements

originally issued in Spanish - See Note 24)

(Figures stated in thousands

of pesos)

| |

| |

09/30/2015 | | |

12/31/2014 | |

| ASSETS | |

| | | |

| | |

| | |

| |

| | | |

| | |

| A. | |

CASH | |

| | | |

| | |

| | |

Cash on hand | |

| 2,923,123 | | |

| 3,829,909 | |

| | |

Due from banks and correspondents | |

| | | |

| | |

| | |

Central Bank of Argentina | |

| 6,532,373 | | |

| 8,701,883 | |

| | |

Local Other | |

| 21,781 | | |

| 17,568 | |

| | |

Foreign | |

| 504,427 | | |

| 582,887 | |

| | |

Other | |

| 589 | | |

| 535 | |

| | |

| |

| 9,982,293 | | |

| 13,132,782 | |

| | |

| |

| | | |

| | |

| B. | |

GOVERNMENT AND PRIVATE SECURITIES (Exhibit

A) | |

| | | |

| | |

| | |

Holdings booked at market value | |

| 3,286,613 | | |

| 2,606,409 | |

| | |

Holdings booked at amortized cost | |

| 511,829 | | |

| 332,061 | |

| | |

Instruments issued by the Central Bank of Argentina | |

| 11,517,646 | | |

| 5,199,976 | |

| | |

Investments in listed private securities | |

| 805,697 | | |

| 776,655 | |

| | |

| |

| 16,121,785 | | |

| 8,915,101 | |

| | |

| |

| | | |

| | |

| C. | |

LOANS (Exhibits B, C

and D) | |

| | | |

| | |

| | |

To the non-financial government sector | |

| 504,205 | | |

| 604,391 | |

| | |

To the financial sector | |

| | | |

| | |

| | |

Interfinancing (granted call) | |

| 180,000 | | |

| | |

| | |

Other financing to Argentine Financial Institutions | |

| 94,450 | | |

| 107,657 | |

| | |

Accrued interest, adjustments, foreign exchange and quoted price differences receivable | |

| 1,333 | | |

| 1,043 | |

| | |

To the non-financial private sector and foreign residents | |

| | | |

| | |

| | |

Overdrafts | |

| 5,399,752 | | |

| 3,230,037 | |

| | |

Documents | |

| 5,711,440 | | |

| 4,598,728 | |

| | |

Mortgage loans | |

| 2,725,010 | | |

| 2,290,152 | |

| | |

Pledge loans | |

| 2,098,160 | | |

| 1,786,490 | |

| | |

Personal loans | |

| 17,925,313 | | |

| 13,457,356 | |

| | |

Credit cards | |

| 10,581,901 | | |

| 8,501,522 | |

| | |

Other (Note 7.1.) | |

| 6,496,923 | | |

| 5,720,144 | |

| | |

Accrued interest, adjustments, foreign exchange and quoted price differences receivable | |

| 834,401 | | |

| 749,125 | |

| | |

less: Unearned discount | |

| (214,006 | ) | |

| (203,744 | ) |

| | |

less: Allowances (Exhibit J) | |

| (1,232,739 | ) | |

| (1,083,760 | ) |

| | |

| |

| 51,106,143 | | |

| 39,759,141 | |

Jorge P. Brito

Director and Acting Chairperson

BALANCE SHEETS

AS OF SEPTEMBER 30, 2015 AND DECEMBER

31, 2014

(Translation of financial statements originally

issued in Spanish - See Note 24)

(Figures stated in thousands of pesos)

| | |

| |

09/30/2015 | | |

12/31/2014 | |

| D. | |

OTHER RECEIVABLES FROM FINANCIAL INTERMEDIATION | |

| | | |

| | |

| | |

Central Bank of Argentina | |

| 908,230 | | |

| 695,631 | |

| | |

Amounts receivable from spot and forward sales pending settlement | |

| 1,711,225 | | |

| 198,564 | |

| | |

Securities and foreign currency receivables from spot and forward purchases pending settlement (Exhibit O) | |

| 392,506 | | |

| 299,209 | |

| | |

Unlisted corporate bonds (Exhibits B, C and D) | |

| 234,095 | | |

| 448,167 | |

| | |

Receivables from forward transactions without delivery of underlying asset | |

| 30,256 | | |

| 136,613 | |

| | |

Other receivables not covered by debtors classification standards (Note 7.2.) | |

| 451,029 | | |

| 401,664 | |

| | |

Other receivables covered by debtors classification standards (Exhibits B, C and D) | |

| 222,774 | | |

| 163,482 | |

| | |

Accrued interest receivables covered by debtors classification standards (Exhibit B, C and D) | |

| 243 | | |

| 668 | |

| | |

less: Allowances (Exhibit J) | |

| (230,152 | ) | |

| (231,346 | ) |

| | |

| |

| 3,720,206 | | |

| 2,112,652 | |

| | |

| |

| | | |

| | |

| E. | |

RECEIVABLES FROM FINANCIAL LEASES (Exhibits

B, C and D) | |

| | | |

| | |

| | |

Receivables from financial leases | |

| 438,262 | | |

| 391,841 | |

| | |

Accrued interest and adjustments | |

| 5,899 | | |

| 5,191 | |

| | |

less: Allowances (Exhibit J) | |

| (4,824 | ) | |

| (4,456 | ) |

| | |

| |

| 439,337 | | |

| 392,576 | |

| | |

| |

| | | |

| | |

| F. | |

INVESTMENTS IN OTHER COMPANIES (Exhibit

E) | |

| | | |

| | |

| | |

In financial institutions | |

| 1,465,441 | | |

| 1,205,308 | |

| | |

Other | |

| 169,968 | | |

| 125,142 | |

| | |

less: Allowances (Exhibit J) | |

| (727 | ) | |

| (609 | ) |

| | |

| |

| 1,634,682 | | |

| 1,329,841 | |

| | |

| |

| | | |

| | |

| G. | |

OTHER RECEIVABLES | |

| | | |

| | |

| | |

Receivables from sale of assets (Exhibits B, C and D) | |

| 1,491 | | |

| 2,804 | |

| | |

Other (Note 7.3.) | |

| 694,419 | | |

| 566,668 | |

| | |

Accrued interest and adjustments on receivable from sales of assets (Exhibits B, C and D) | |

| 126 | | |

| 160 | |

| | |

Other accrued interest and adjustments receivable | |

| | | |

| 14 | |

| | |

less: Allowances (Exhibit J) | |

| (4,141 | ) | |

| (5,180 | ) |

| | |

| |

| 691,895 | | |

| 564,466 | |

| | |

| |

| | | |

| | |

| H. | |

BANK PREMISES AND EQUIPMENT, NET (Exhibit

F) | |

| 1,041,276 | | |

| 829,804 | |

| | |

| |

| | | |

| | |

| I. | |

OTHER ASSETS (Exhibit

F) | |

| 1,213,847 | | |

| 800,913 | |

| | |

| |

| | | |

| | |

| J. | |

INTANGIBLE ASSETS (Exhibit

G) | |

| | | |

| | |

| | |

Goodwill | |

| 34,197 | | |

| 44,736 | |

| | |

Organization and development costs | |

| 393,238 | | |

| 344,667 | |

| | |

| |

| 427,435 | | |

| 389,403 | |

| | |

| |

| | | |

| | |

| K. | |

ITEMS PENDING ALLOCATION | |

| 7,306 | | |

| 12,359 | |

| | |

| |

| | | |

| | |

| TOTAL ASSETS | |

| 86,386,205 | | |

| 68,239,038 | |

Jorge P. Brito

Director and Acting Chairperson

BALANCE SHEETS

AS OF SEPTEMBER 30, 2015

AND DECEMBER 31, 2014

(Translation of financial statements

originally issued in Spanish - See Note 24)

(Figures stated in thousands

of pesos)

| | |

| |

09/30/2015 | | |

12/31/2014 | |

| LIABILITIES | |

| | | |

| | |

| | |

| |

| | | |

| | |

| L. | |

DEPOSITS (Exhibits H

and I) | |

| | | |

| | |

| | |

From the non-financial government sector (Note 7.4.) | |

| 7,145,800 | | |

| 5,580,418 | |

| | |

From the financial sector | |

| 29,560 | | |

| 38,663 | |

| | |

From the non-financial private sector and foreign residents | |

| | | |

| | |

| | |

Checking accounts | |

| 11,613,874 | | |

| 10,380,946 | |

| | |

Savings accounts | |

| 12,143,725 | | |

| 10,184,033 | |

| | |

Time deposits | |

| 28,137,335 | | |

| 20,424,705 | |

| | |

Investment accounts | |

| 375,379 | | |

| 190,503 | |

| | |

Other (Note 7.5.) | |

| 1,261,382 | | |

| 1,072,578 | |

| | |

Accrued interest, adjustments, foreign exchange and quoted price differences payable | |

| 628,210 | | |

| 342,577 | |

| | |

| |

| 61,335,265 | | |

| 48,214,423 | |

| | |

| |

| | | |

| | |

| M. | |

OTHER LIABILITIES FROM FINANCIAL INTERMEDIATION | |

| | | |

| | |

| | |

Central Bank of Argentina (Exhibit I) | |

| | | |

| | |

| | |

Other | |

| 12,501 | | |

| 16,835 | |

| | |

International Banks and Institutions (Exhibit I) | |

| 125,589 | | |

| 87,858 | |

| | |

Non-subordinated Corporate Bonds (Note 11. and Exhibit I) | |

| 1,002,156 | | |

| 909,890 | |

| | |

Amounts payable for spot and forward purchases pending settlement | |

| 390,633 | | |

| 274,452 | |

| | |

Securities and foreign currency to be delivered under spot and forward sales pending settlement (Exhibit O) | |

| 1,750,976 | | |

| 213,090 | |

| | |

Financing received from Argentine financial institutions (Exhibit I) | |

| | | |

| | |

| | |

Interfinancing (received call) | |

| | | |

| 100,000 | |

| | |

Other financing received from Argentine financial institutions | |

| 16,496 | | |

| 20,489 | |

| | |

Accrued interest payable | |

| | | |

| 142 | |

| | |

Other (Note 7.6. and Exhibit I) | |

| 3,866,372 | | |

| 3,724,800 | |

| | |

Accrued interest, adjustments, foreign exchange and quoted price differences payable (Exhibit I) | |

| 42,581 | | |

| 65,406 | |

| | |

| |

| 7,207,304 | | |

| 5,412,962 | |

| | |

| |

| | | |

| | |

| N. | |

OTHER LIABILITIES | |

| | | |

| | |

| | |

Dividends Payable | |

| 596,254 | | |

| | |

| | |

Fees | |

| 111 | | |

| 10,069 | |

| | |

Other (Note 7.7.) | |

| 1,669,597 | | |

| 1,688,295 | |

| | |

| |

| 2,265,962 | | |

| 1,698,364 | |

| | |

| |

| | | |

| | |

| O. | |

PROVISIONS (Exhibit

J) | |

| 205,995 | | |

| 130,413 | |

| | |

| |

| | | |

| | |

| P. | |

SUBORDINATED CORPORATE BONDS (Note 11. and Exhibit I) | |

| 1,451,911 | | |

| 1,287,317 | |

| | |

| |

| | | |

| | |

| Q. | |

ITEMS PENDING ALLOCATION | |

| 10,552 | | |

| 3,742 | |

| | |

| |

| | | |

| | |

| TOTAL LIABILITIES | |

| 72,476,989 | | |

| 56,747,221 | |

| | |

| |

| | | |

| | |

| SHAREHOLDERS' EQUITY (As

per related statement) | |

| 13,909,216 | | |

| 11,491,817 | |

| | |

| |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | |

| 86,386,205 | | |

| 68,239,038 | |

Jorge P. Brito

Director and Acting Chairperson

BALANCE SHEETS

AS OF SEPTEMBER 30, 2015 AND DECEMBER

31, 2014

(Translation of financial statements originally

issued in Spanish - See Note 24)

(Figures stated in thousands of pesos)

| | |

09/30/2015 | | |

12/31/2014 | |

| MEMORANDUM ACCOUNTS | |

| | | |

| | |

| | |

| | | |

| | |

DEBIT-BALANCE

ACCOUNTS | |

| 193,758,253 | | |

| 93,116,336 | |

| | |

| | | |

| | |

| Contingent | |

| 17,366,462 | | |

| 12,956,202 | |

| Guarantees received | |

| 15,796,133 | | |

| 12,465,903 | |

| Other not covered by debtors classification standards | |

| 64 | | |

| 126 | |

| Contingent debit-balance contra accounts | |

| 1,570,265 | | |

| 490,173 | |

| Control | |

| 174,337,434 | | |

| 75,035,132 | |

| Receivables classified as irrecoverable | |

| 1,553,695 | | |

| 1,305,187 | |

| Other (Note 7.8.) | |

| 171,891,043 | | |

| 73,101,887 | |

| Control debit-balance contra accounts | |

| 892,696 | | |

| 628,058 | |

| Derivatives (Exhibit

O) | |

| 2,054,357 | | |

| 5,125,002 | |

| Notional value of put options taken (Note 12.b)) | |

| 9,135 | | |

| 8,759 | |

| Notional value of forward transactions without delivery of underlying asset (Note 12.a)) | |

| 956,613 | | |

| 2,432,466 | |

| Derivatives debit-balance contra accounts | |

| 1,088,609 | | |

| 2,683,777 | |

| | |

| | | |

| | |

CREDIT-BALANCE

ACCOUNTS | |

| 193,758,253 | | |

| 93,116,336 | |

| | |

| | | |

| | |

| Contingent | |

| 17,366,462 | | |

| 12,956,202 | |

| Other guarantees provided covered by debtors classification standards (Exhibits B, C and D) | |

| 137,251 | | |

| 113,723 | |

| Other guarantees provided not covered by debtors classification standards | |

| 140,953 | | |

| 145,861 | |

| Other covered by debtors classification standards (Exhibits B, C and D) | |

| 1,246,229 | | |

| 219,559 | |

| Other not covered by debtors classification standards | |

| 45,832 | | |

| 11,030 | |

| Contingent credit-balance contra accounts | |

| 15,796,197 | | |

| 12,466,029 | |

| Control | |

| 174,337,434 | | |

| 75,035,132 | |

| Checks to be credited | |

| 892,696 | | |

| 628,058 | |

| Control credit-balance contra accounts | |

| 173,444,738 | | |

| 74,407,074 | |

| Derivatives (Exhibit

O) | |

| 2,054,357 | | |

| 5,125,002 | |

| Notional value of call options sold (Note 12.c)) | |

| 131,996 | | |

| 114,479 | |

| Notional value of forward transactions without delivery of underlying asset (Note 12.a)) | |

| 956,613 | | |

| 2,569,298 | |

| Derivatives credit-balance contra accounts | |

| 965,748 | | |

| 2,441,225 | |

The accompanying Notes 1 through 24 and exhibits A through

L, N, O and the consolidated financial statements are an integral part of these financial statements.

Jorge P. Brito

Director and Acting Chairperson

STATEMENTS OF INCOME

FOR THE NINE-MONTH PERIODS

ENDED SEPTEMBER 30, 2015 AND 2014

(Translation on financial statements

originally issued in Spanish - See Note 24)

(Figures stated in thousands

of pesos)

| | |

| |

09/30/2015 | | |

09/30/2014 | |

| | |

| |

| | | |

| | |

| A. | |

FINANCIAL INCOME | |

| | | |

| | |

| | |

Interest on cash and due from banks | |

| 111 | | |

| 91 | |

| | |

Interest on loans to the financial sector | |

| 30,372 | | |

| 33,977 | |

| | |

Interest on overdrafts | |

| 981,749 | | |

| 1,022,443 | |

| | |

Interest on documents | |

| 785,906 | | |

| 701,160 | |

| | |

Interest on mortgage loans | |

| 360,049 | | |

| 342,439 | |

| | |

Interest on pledge loans | |

| 272,685 | | |

| 188,549 | |

| | |

Interest on credit card loans | |

| 1,743,416 | | |

| 1,249,193 | |

| | |

Interest on financial leases | |

| 60,710 | | |

| 59,051 | |

| | |

Interest on other loans (Note 7.9.) | |

| 5,414,239 | | |

| 3,920,509 | |

| | |

Net income from government and private securities (Note 7.10.) | |

| 2,332,473 | | |

| 1,493,937 | |

| | |

Interest on other receivables from financial intermediation | |

| 2,970 | | |

| 1,543 | |

| | |

Income from guaranteed loans - Presidential Decree No. 1387/01 | |

| 18,506 | | |

| 33,252 | |

| | |

CER (Benchmark Stabilization Coefficient) adjustment | |

| 33,633 | | |

| 68,086 | |

| | |

CVS (Salary Variation Coefficient) adjustment | |

| 448 | | |

| 542 | |

| | |

Difference in quoted prices of gold and foreign currency | |

| 232,594 | | |

| 692,766 | |

| | |

Other (Note 7.11.) | |

| 144,177 | | |

| 313,565 | |

| | |

| |

| 12,414,038 | | |

| 10,121,103 | |

| | |

| |

| | | |

| | |

| B. | |

FINANCIAL EXPENSE | |

| | | |

| | |

| | |

Interest on savings accounts | |

| 45,605 | | |

| 34,389 | |

| | |

Interest on time deposits | |

| 4,292,147 | | |

| 3,527,779 | |

| | |

Interest on interfinancing received loans (received call) | |

| 8,046 | | |

| 1,923 | |

| | |

Interest on other financing from Financial Institutions | |

| 1 | | |

| 16 | |

| | |

Interest on other liabilities from financial intermediation | |

| 69,565 | | |

| 69,539 | |

| | |

Interest on subordinated bonds | |

| 98,409 | | |

| 88,886 | |

| | |

Other interest | |

| 1,991 | | |

| 2,372 | |

| | |

CER adjustment | |

| 3,746 | | |

| 7,732 | |

| | |

Contribution to Deposit Guarantee Fund | |

| 272,822 | | |

| 55,418 | |

| | |

Other (Note 7.12.) | |

| 887,641 | | |

| 675,377 | |

| | |

| |

| 5,679,973 | | |

| 4,463,431 | |

| | |

| |

| | | |

| | |

| | |

GROSS INTERMEDIATION MARGIN - GAIN | |

| 6,734,065 | | |

| 5,657,672 | |

| | |

| |

| | | |

| | |

| C. | |

PROVISION FOR LOAN LOSSES | |

| 499,360 | | |

| 408,936 | |

| | |

| |

| | | |

| | |

| D. | |

SERVICE-CHARGE INCOME | |

| | | |

| | |

| | |

Related to lending transactions | |

| 78,186 | | |

| 59,646 | |

| | |

Related to deposits | |

| 2,401,312 | | |

| 1,929,572 | |

| | |

Other commissions | |

| 83,062 | | |

| 54,409 | |

| | |

Other (Note 7.13.) | |

| 1,434,887 | | |

| 1,076,260 | |

| | |

| |

| 3,997,447 | | |

| 3,119,887 | |

Jorge P. Brito

Director and Acting Chairperson

STATEMENTS OF INCOME

FOR THE NINE-MONTH PERIODS ENDED SEPTEMBER

30, 2015 AND 2014

(Translation on financial statements originally

issued in Spanish - See Note 24)

(Figures stated in thousands of pesos)

| | |

| |

09/30/2015 | | |

09/30/2014 | |

| | |

| |

| | |

| |

| E. | |

SERVICE-CHARGE EXPENSE | |

| | | |

| | |

| | |

Commissions | |

| 275,676 | | |

| 190,395 | |

| | |

Other (Note 7.14.) | |

| 829,253 | | |

| 606,563 | |

| | |

| |

| 1,104,929 | | |

| 796,958 | |

| | |

| |

| | | |

| | |

| F. | |

ADMINISTRATIVE EXPENSES | |

| | | |

| | |

| | |

Personnel expenses | |

| 2,866,476 | | |

| 2,074,446 | |

| | |

Directors' and statutory auditors' fees | |

| 143,677 | | |

| 127,997 | |

| | |

Other professional fees | |

| 149,086 | | |

| 126,066 | |

| | |

Advertising and publicity | |

| 93,216 | | |

| 75,516 | |

| | |

Taxes | |

| 268,435 | | |

| 214,684 | |

| | |

Depreciation of bank premises and equipment | |

| 113,822 | | |

| 88,538 | |

| | |

Amortization of organization costs | |

| 101,756 | | |

| 81,567 | |

| | |

Other operating expenses (Note 7.15.) | |

| 667,001 | | |

| 535,682 | |

| | |

Other | |

| 349,938 | | |

| 271,506 | |

| | |

| |

| 4,753,407 | | |

| 3,596,002 | |

| | |

| |

| | | |

| | |

| | |

NET INCOME FROM FINANCIAL INTERMEDIATION - GAIN | |

| 4,373,816 | | |

| 3,975,663 | |

| | |

| |

| | | |

| | |

| G. | |

OTHER INCOME | |

| | | |

| | |

| | |

Income from long-term investments | |

| 344,035 | | |

| 339,356 | |

| | |

Penalty interest | |

| 56,126 | | |

| 46,078 | |

| | |

Recovered loans and allowances reversed | |

| 95,462 | | |

| 76,337 | |

| | |

CER adjustment | |

| 25 | | |

| 86 | |

| | |

Other (Note 7.16.) | |

| 122,784 | | |

| 94,011 | |

| | |

| |

| 618,432 | | |

| 555,868 | |

| | |

| |

| | | |

| | |

| H. | |

OTHER EXPENSE | |

| | | |

| | |

| | |

Penalty interest and charges payable to the Central Bank of Argentina | |

| 8 | | |

| 1 | |

| | |

Charges for other receivables uncollectibility and other allowances | |

| 123,886 | | |

| 26,327 | |

| | |

Depreciation and loss of other assets | |

| 2,780 | | |

| 1,490 | |

| | |

Goodwill amortization | |

| 10,539 | | |

| 10,539 | |

| | |

Other (Note 7.17.) | |

| 185,480 | | |

| 78,625 | |

| | |

| |

| 322,693 | | |

| 116,982 | |

| | |

| |

| | | |

| | |

| | |

NET INCOME BEFORE INCOME TAX - GAIN | |

| 4,669,555 | | |

| 4,414,549 | |

| | |

| |

| | | |

| | |

| I. | |

INCOME TAX (Note 4.) | |

| 1,628,000 | | |

| 1,510,000 | |

| | |

| |

| | | |

| | |

| | |

NET INCOME FOR THE PERIOD - GAIN | |

| 3,041,555 | | |

| 2,904,549 | |

The accompanying Notes 1 through 24 and exhibits A through

L, N, O and the consolidated financial statements are an integral part of these financial statements.

Jorge P. Brito

Director and Acting Chairperson

STATEMENTS OF CHANGES IN

SHAREHOLDERS' EQUITY

FOR THE NINE-MONTH PERIODS

ENDED SEPTEMBER 30, 2015 AND 2014

(Translation on financial statements

originally issued in Spanish - See Note 24)

(Figures stated in thousands

of pesos)

| | |

09/30/2015 | | |

09/30/2014 | |

| | |

| | |

| | |

| | |

Earnings

reserved | | |

| | |

| | |

| |

| Changes | |

Capital stock

(1) | | |

Stock

issuance

premium | | |

Adjustments

to

Shareholders'

equity | | |

Legal | | |

Subordinated

Corporate

Bonds (2) | | |

Voluntary | | |

Unappropriated earnings | | |

Total | | |

Total | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at the beginning of the fiscal year | |

| 584,563 | | |

| 399,499 | | |

| 4,511 | | |

| 1,988,882 | | |

| | | |

| 4,929,430 | | |

| 3,584,932 | | |

| 11,491,817 | | |

| 8,627,431 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Distribution of unappropiated earnings, as approved by the Shareholders´

Meeting held on April 23, 2015 and April 29, 2014, respectively: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Legal reserve | |

| | | |

| | | |

| | | |

| 695,908 | | |

| | | |

| | | |

| (695,908 | ) | |

| | | |

| | |

| - Cash dividends (3) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (596,254 | ) | |

| | | |

| (596,254 | ) | |

| (596,254 | ) |

| - Special reserve for Subordinated Corporate Bonds (2) | |

| | | |

| | | |

| | | |

| | | |

| 125,073 | | |

| | | |

| (125,073 | ) | |

| | | |

| | |

| - Voluntary reserve for future distribution of earnings | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 2,736,054 | | |

| (2,736,054 | ) | |

| | | |

| | |

| - Personal assets tax on share and interests | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (27,902 | ) | |

| (27,902 | ) | |

| (19,712 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reversal of special reserve for Subordinated Corporate Bonds (2) | |

| | | |

| | | |

| | | |

| | | |

| (102,925 | ) | |

| | | |

| 102,925 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other changes derived from the legal merger with Banco Privado

de Inversiones SA | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 821 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income for the period - Gain | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 3,041,555 | | |

| 3,041,555 | | |

| 2,904,549 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at the end of the period | |

| 584,563 | | |

| 399,499 | | |

| 4,511 | | |

| 2,684,790 | | |

| 22,148 | | |

| 7,069,230 | | |

| 3,144,475 | | |

| 13,909,216 | | |

| 10,916,835 | |

(1) See Note 10.

(2) See Notes 3.5.o.2) and 11.

(3) See Note 22.

The accompanying Notes 1 through 24 and exhibits A through

L, N, O and the consolidated financial statements are an integral part of these financial statements.

Jorge P. Brito

Director and Acting Chairperson

STATEMENTS OF CASH FLOWS

AND CASH EQUIVALENTS

FOR THE NINE-MONTH PERIODS

ENDED SEPTEMBER 30, 2015 AND 2014

(Translation on financial statements

originally issued in Spanish - See Note 24)

(Figures stated in thousands

of pesos)

| | |

09/30/2015 | | |

09/30/2014 | |

| CHANGES IN CASH AND CASH EQUIVALENTS (Note 3.6.) | |

| | | |

| | |

| Cash at the beginning of the fiscal year | |

| 14,690,022 | | |

| 11,249,840 | |

| Cash at the end of the period | |

| 11,753,279 | | |

| 9,959,441 | |

| Net decrease in cash | |

| (2,936,743 | ) | |

| (1,290,399 | ) |

| | |

| | | |

| | |

| CAUSES OF CHANGES IN CASH | |

| | | |

| | |

| | |

| | | |

| | |

| Operating activities | |

| | | |

| | |

| Net collections / (payments): | |

| | | |

| | |

| Government and private securities | |

| (3,417,244 | ) | |

| (8,775,511 | ) |

| Loans | |

| | | |

| | |

| To the financial sector | |

| (136,711 | ) | |

| 167,054 | |

| To the non-financial government sector | |

| 152,079 | | |

| 100,714 | |

| To the non-financial private sector and foreign residents | |

| (1,330,728 | ) | |

| 4,740,682 | |

| Other receivables from financial intermediation | |

| (1,633,927 | ) | |

| 365,374 | |

| Receivables from financial leases | |

| 13,615 | | |

| 82,409 | |

| Deposits | |

| | | |

| | |

| From the financial sector | |

| (9,103 | ) | |

| 2,331 | |

| From the non-financial government sector | |

| 1,246,823 | | |

| 2,205,664 | |

| From the non-financial private sector and foreign residents | |

| 7,271,174 | | |

| 1,924,610 | |

| Other liabilities from financial intermediation | |

| | | |

| | |

| Financing facilities from the financial sector (received calls) | |

| (108,188 | ) | |

| (60,019 | ) |

| Others (except liabilities included under financing activities) | |

| 588,278 | | |

| 895,293 | |

| Collections related to service-charge income | |

| 4,000,851 | | |

| 3,112,438 | |

| Payments related to service-charge expenses | |

| (1,109,929 | ) | |

| (790,774 | ) |

| Administrative expenses paid | |

| (4,478,213 | ) | |

| (3,380,520 | ) |

| Payment of organization and development costs | |

| (150,327 | ) | |

| (129,734 | ) |

| Net collections from penalty interest | |

| 56,118 | | |

| 46,077 | |

| Differences from payments related to court orders | |

| (4,097 | ) | |

| (3,540 | ) |

| Collections of dividends from other companies | |

| 32,213 | | |

| 27,417 | |

| Other collections related to other income and losses | |

| 40,913 | | |

| 78,721 | |

| Net payments from other operating activities | |

| (1,759,299 | ) | |

| (1,000,246 | ) |

| Payment of income tax | |

| (1,685,727 | ) | |

| (1,199,558 | ) |

| Net cash flows used in operating activities | |

| (2,421,429 | ) | |

| (1,591,118 | ) |

Jorge P. Brito

Director and Acting Chairperson

STATEMENTS OF CASH FLOWS

AND CASH EQUIVALENTS

FOR THE NINE-MONTH PERIODS

ENDED SEPTEMBER 30, 2015 AND 2014

(Translation on financial statements

originally issued in Spanish - See Note 24)

(Figures stated in thousands

of pesos)

| | |

09/30/2015 | | |

09/30/2014 | |

| Investing activities | |

| | | |

| | |

| Net payments for bank premises and equipment | |

| (288,752 | ) | |

| (189,628 | ) |

| Net payments for other assets | |

| (428,011 | ) | |

| (233,735 | ) |

| Collections for sales of investment in other companies | |

| | | |

| 11,126 | |

| Net cash flows used in investing activities | |

| (716,763 | ) | |

| (412,237 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Net collections / (payments) for: | |

| | | |

| | |

| Non-subordinated corporate bonds | |

| (80,680 | ) | |

| (73,443 | ) |

| Central Bank of Argentina | |

| | | |

| | |

| Other | |

| (4,978 | ) | |

| (4,111 | ) |

| International Banks and Institutions | |

| 34,052 | | |

| (126,544 | ) |

| Subordinated corporate bonds | |

| (66,175 | ) | |

| (59,460 | ) |

| Financing received from Argentine financial institutions | |

| (3,994 | ) | |

| (3,418 | ) |

| Payment of dividends | |

| | | |

| (596,254 | ) |

| Net cash flows used in financing activities | |

| (121,775 | ) | |

| (863,230 | ) |

| | |

| | | |

| | |

| Financial income and holding gains on cash and cash equivalents | |

| 323,224 | | |

| 1,576,186 | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (2,936,743 | ) | |

| (1,290,399 | ) |

The accompanying Notes 1 through 24 and exhibits A through

L, N, O and the consolidated financial statements are an integral part of these financial statements.

Jorge P. Brito

Director and Acting Chairperson

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

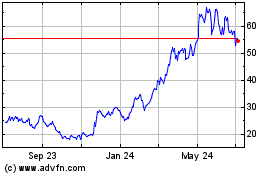

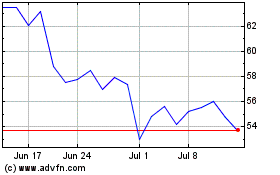

| 1. | BRIEF HISTORY OF THE BANK |

Macro Compañía

Financiera SA was created in 1977 as a non-banking financial institution. In May 1988, it received the authorization to operate

as a commercial bank and it was incorporated as Banco Macro SA. Subsequently, as a result of the merger process with other entities,

it adopted other names (among them, Banco Macro Bansud SA) and since August 2006, Banco Macro SA (hereinafter, the Bank).

The Bank´s shares have

been publicly listed on the BCBA (Buenos Aires Stock Exchange) since November 1994, as from March 24, 2006, they are listed on

the New York Stock Exchange (NYSE). Additionally, on October 15, 2015 they were authorized to list on the Mercado Abierto Electrónico

SA (MAE).

Since 1994, Banco Macro SA’s

market strategy was mainly focused on the regional areas outside the City of Buenos Aires. Following this strategy, in 1996, Banco

Macro SA started the process to acquire entities and assets and liabilities during the privatization of provincial and other banks.

In 2001, 2004, 2006 and 2010,

the Bank acquired the control of Banco Bansud SA, Nuevo Banco Suquía SA, Nuevo Banco Bisel SA and Banco Privado de Inversiones

SA, respectively. Such entities merged with and into Banco Macro SA in December 2003, October 2007, August 2009 and December 2013,

respectively. In addition, during fiscal year 2006, Banco Macro S.A. acquired control over Banco del Tucumán SA.

The Bank currently offers traditional

bank products and services to companies, including those operating in regional economies, as well as to individuals, thus reinforcing

the Bank's objective to be a multi-services bank.

In addition, the Bank performs

certain transactions through its subsidiaries, Banco del Tucumán SA, Macro Bank Limited (an entity organized under the

laws of Bahamas), Macro Securities SA, Macro Fiducia SA and Macro Fondos SGFCISA.

| 2.1. | Agreement with the Misiones Provincial Government |

The Bank and the Misiones

Provincial Government entered into a special-relationship agreement whereby the Bank was appointed, for a five-year term since

January 1, 1996, as the Provincial Government’s exclusive financial agent, as well as revenue collection and obligation

payment agent.

On November 25, 1999, and

December 28, 2006, extensions to such agreement were agreed upon, making it currently effective through December 31, 2019.

As of September 30, 2015 and

December 31, 2014, the deposits held by the Misiones Provincial Government with the Bank amounted to 1,971,141 and 2,303,677 (including

80,780 and 63,924 related to court deposits), respectively.

| 2.2. | Agreement with the Salta Provincial Government |

The Bank and the Salta Provincial

Government entered into a special-relationship agreement whereby the Bank was appointed, for a ten-year term since March 1, 1996,

as the Provincial Government’s exclusive financial agent, as well as revenue collection and obligation payment agent.

On February 22, 2005 and August

22, 2014, extensions to such agreements were agreed upon, making it currently effective through February 28, 2026.

As of September 30, 2015 and

December 31, 2014, the deposits held by the Salta Provincial Government with the Bank amounted to 819,308 and 1,058,824 (including

289,907 and 273,786 related to court deposits), respectively.

| 2.3. | Agreement with the Jujuy Provincial Government |

The Bank and the Jujuy Provincial

Government entered into a special-relationship agreement whereby the Bank was appointed, for a ten-year term since January 12,

1998, as the Provincial Government’s exclusive financial agent, as well as revenue collection and obligation payment agent.

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

On April 29, 2005 and July 8,

2014, extensions to such agreement were agreed upon, making it currently effective through September 30, 2024.

As of September 30, 2015 and

December 31, 2014, the deposits held by the Jujuy Provincial Government with the Bank amounted to 751,429 and 1,545,710 (including

180,633 and 127,743 related to court deposits), respectively.

| 2.4. | Banco del Tucumán S.A. |

Banco del Tucumán SA

entered into special-relationship agreements with the Tucumán Provincial Government and with the Municipality of San Miguel

de Tucumán, appointing it their exclusive financial agent, as well as revenue collection and obligation payment agent,

through 2011 and 2013, respectively.

On June 30, 2010, the service

agreement with the Tucumán Provincial Government was extended through July 8, 2021, while the agreement executed with the

Municipality of San Miguel de Tucumán was automatically extended through July 8, 2018, as set forth in the original agreement.

As of September 30, 2015 and

December 31, 2014, the deposits held by the Tucumán Provincial Government and the Municipality of San Miguel de Tucumán

with Banco del Tucumán SA amounted to 3,144,632 and 2,525,505 (including 716,644 and 608,089 related to court deposits),

respectively.

| 2.5. | Uniones Transitorias de Empresas (joint ventures) |

| a) | Banco Macro SA - Siemens Itron

Business Services SA |

On April 7, 1998, the Bank

entered into a joint venture agreement with Siemens Itron Business Services SA, in which each holds a 50% equity interest, whereby

a provincial data processing center would be provided to manage tax-related issues, to modernize tax collection systems and procedures

in the Province of Salta, and to manage and perform the recovery of taxes and municipal assessments payable.

| b) | Banco Macro SA – Gestiva

SA |

On May 4, 2010, and August

15, 2012, the Bank and Gestiva SA entered into a joint venture under the name “Banco Macro SA – Gestiva SA –

Unión Transitoria de Empresas” which is jointly controlled and is engaged in providing a comprehensive tax processing

and management system for the Province of Misiones, its administration and collection of taxes thereof. The Bank has a 5% interest

in its capital stock.

As of September 30, 2015 and

December 31, 2014, the net assets of such joint ventures recorded and consolidated in the Bank’s financial statements through

the equity method amounted to 31,651 and 19,663, respectively.

Also, as of September 30,

2015 and 2014, net income recorded through the method mentioned in the previous paragraph amounted to 36,055 and 25,839, respectively.

| 3. | SIGNIFICANT ACCOUNTING POLICIES |

These financial statements,

which are taken from the Bank’s books of account, are stated in thousands of pesos and have been prepared in accordance

with Central Bank rules.

| 3.1. | Consolidated financial statements |

As required under Central

Bank rules, the Bank presents consolidated financial statements with its subsidiaries Banco del Tucumán SA, Macro Bank

Limited, Macro Securities SA, Macro Fiducia SA and Macro Fondos SGFCISA as supplementary information.

| 3.2. | Comparative information |

As required under Central

Bank rules, the balance sheet as of September 30, 2015 and supplementary information, are presented comparatively with those of

the prior fiscal year, while the statements of income, changes in shareholders’ equity and cash flows and cash equivalents

for the nine-month period ended September 30, 2015, are presented comparatively with data for the same period in the prior fiscal

year.

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

Argentine professional accounting

standards effective in the City of Buenos Aires establish that the financial statements should be stated in constant pesos. The

adjustment methodology and the need to apply it arise from requirements contained in Technical Resolutions (TR) No. 6 and No.

17 issued by FACPCE (Argentine Federation of Professional Councils in Economic Sciences), which were amended by provisions of

TR No. 39 approved by Professional Council in Economic Sciences of the City of Buenos Aires on April 16, 2014, as supplemented

by Interpretation No. 8, both of them issued by the abovementioned Federation in October 2013 and June 2014, respectively.

These standards establish

mainly, the existence of an inflation rate accumulated over a three-year period reaching or exceeding 100%, considering the domestic

wholesale price index of the INDEC (Argentine Institute of Statistics and Censuses), as a key indicator and essential condition,

that identifies an inflationary context that warrants adjusting the financial statements so that they are stated in constant currency

as of the related date. Additionally, if the adjustment to the financial statements to reflect the effect of changes in the peso

purchasing power had to reinstated after a period of discontinuation, such adjustments shall be applicable from the beginning

of the fiscal year when the existence of the characteristics identifying inflationary context are verified, and the changes to

be considered shall be ones existing as from the moment the adjustment was discontinued or as from a subsequent date, as applicable

to the items to be adjusted.

The Bank’s financial

statements recognize the changes in the peso purchasing power until February 28, 2003, when the adjustments to reflect those changes

were discontinued, as provided by the professional accounting standards effective in the City of Buenos Aires and as required

by Presidential Decree 664/2003, Article N° 268 of General Resolution No. 7/2005 of the Business Association Regulatory Agency,

Central Bank Communiqué “A” 3921 and CNV (Argentine Securities Commission) General Resolution No. 441.

However, the interpretation

of the financial statements should consider the fact that, in recent fiscal years, there have been significant changes in the

prices for relevant economic variables, such as salary cost, interest and exchange rates, which do not require such adjustments

according to the abovementioned regulations.

| 3.4. | Significant accounting judgments, estimates and assumptions |

The preparation of financial

statements requires the Bank to make, in certain cases, estimates to determine the book values of assets and liabilities, income,

expenses and contingencies, as well as the disclosure thereof, as of each date of accounting information filing. The Bank´s

records are based on the best estimate regarding the probability of occurrence of different future events and, therefore, the

final amount may differ from such estimates, which may have a positive or negative impact on future fiscal years.

The main valuation methods

used to prepare the accompanying financial statements as of September 30, 2015 and 2014 and December 31, 2014, were as follows:

| a) | Assets and liabilities denominated in foreign currency: |

The assets and liabilities

denominated in US dollars were valued at Central Bank benchmark US dollar exchange rate effective as of the closing date of transactions

on the last respective business day. Additionally, assets and liabilities denominated in other foreign currencies were translated

at the exchange rate communicated by the Central Bank´s dealing room. Foreign exchange differences were recorded in the

related statements of income.

| b) | Government and private securities: |

| b.1) | Government securities - Holdings

booked at market value: |

They were valued at the quoted

prices or present values reported by the Central Bank, as the case may be. Differences in quoted prices and present values were

recorded in the related statements of income.

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

| b.2) | Government securities - Holdings

booked at amortized cost: |

As set forth in Central Bank

Communiqué “A” 5180, as supplemented, except what is mentioned in the third paragraph, they were valued at

acquisition cost increased by the accrued internal rate of return, net of the related offset account, also compared with the present

values calculated by the Bank. The acquisition value previously mentioned is related to the present value of each security at

acquisition date.

As of September 30, 2015 and

December 31, 2014, the present value calculated by the Bank for these securities amounted to 377,255 and 194,538, respectively.

As required under Central Bank

Communiqué “A” 5506, BAADEs (Argentine saving bonds for the economy development) were valued at acquisition

cost increased by the accrued internal rate of return.

| b.3) | Listed Instruments issued by

the Central Bank – Holdings booked at market value: |

They were valued at the quoted

price as of the last respective business day. Differences in quoted prices were recorded in the related statements of income.

| b.4) | Instruments issued by the Central

Bank – Holdings booked at amortized cost: |

Holdings with no volatility published

by the Central Bank were valued at acquisition cost plus accrued interest, exponentially applying the internal rate of return

as per their issuance terms and conditions. The accruals of the internal rate of return mentioned above were recorded in the related

statements of income.

| b.5) | Private Securities – Investment in listed private

securities: |

They were valued at the quoted

price as of the last respective business day. Differences in quoted prices were recorded in the related statements of income.

| c) | Guaranteed loans – Presidential Decree No. 1387/2001: |

As set forth in Central Bank

Communiqués “A” 4898, “A” 5180, as supplemented, the guaranteed loans issued by the Argentine Government

under Presidential Decree No. 1387/01 were valued at the specific acquisition value of each security, increased by accrued income

including the benchmark stabilization coefficient (CER), net of the related offset account, compared in turn with the present

values reported by the Central Bank.

As of September 30, 2015 and

December 31, 2014, the present value reported by the Central Bank for these securities amounted to 481,952 and 429,982, respectively.

Interest has been accrued according

to a compound interest formula in the period in which it was generated, except interest on transactions in foreign currency and

those whose maturity does not exceed 92 days, on which interest has been accrued according to a simple interest formula.

The Bank suspends the interest

accrual whenever loan payments are not settled (generally, after 90 days) or when the recoverability of the collection of principal

or interest accrued is doubtful. Accrued interest is considered part of the loan balance when determining the allowances for loan

losses. Afterwards, interest is only recognized on a cash basis.

Receivables and payables have

been indexed by the CER, wherever applicable, as follows:

| e.1) | Guaranteed loans: as explained

in Note 3.5.c). |

| e.2) | Deposits and other assets and

liabilities: the CER as of the last respective business day was applied. |

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

| f) | Allowance for loan losses and provision for contingent

commitments: |

These provisions have been

calculated based on the estimated uncollectibility risk of the Bank's credit portfolio, which, among other factors, results from

the evaluation of the degree of debtors compliance and the guarantee/security supporting the respective transactions, considering

Central Bank Communiqué “A” 2950, as supplemented, and the Bank’s provisioning policies.

When loans covered by specific

allowances are settled or generate a reversal of the allowances recorded in the current period, and in cases where the allowances

set in prior years exceed what is considered necessary, the excess allowance is reversed with effects on income for the current

period.

The recovery of receivables

previously classified under “Debit-balance control memorandum accounts - Receivables classified as irrecoverable”

are recorded directly in the related statements of income.

The Bank assesses the credit

risk related to possible commitments and determines the appropriate amount of allowances to be recorded. The allowances related

to amounts recorded in memorandum accounts, contingent commitments, are included under “Provisions”.

| g) | Other receivables from financial intermediation and Other

liabilities from financial intermediation: |

| g.1) | Amounts receivable from spot

and forward sales pending settlement and amounts payable for spot and forward purchases

pending settlement: |

They were valued based on

the prices agreed upon for each transaction, plus related premiums accrued.

| g.2) | Securities and foreign currency

to be received for spot and forward purchases pending settlement and to be delivered

for spot and forward sales pending settlement: |

| i. | With volatility (active market):

they were valued at the effective quoted prices for each of them at the last respective

business day. Differences in quoted prices were recorded in the related statements of

income. |

| ii. | Without volatility (without

active market): they were valued at their cost value increased exponentially by their

internal rate of return. Such accruals were recorded in the related statements of income. |

| g.3) | Debt securities and certificates

of participation in financial trusts: |

| i. | Debt securities: they were valued

as provided by Central Bank Communiqué “A” 4414, at their cost value,

increased exponentially by their internal rate of return, translated into pesos according

to the method described in Note 3.5.a), as the case may be. |

| ii. | Certificates of participation:

they were stated at cost or face value increased as the case may be, by interest accrued

until the last respective business day, translated into Argentine pesos according to

the method described in Note 3.5.a), as appropriate. |

The values recorded, net of allowances,

do not exceed the recoverable values from the respective trusts.

| g.4) | Unlisted corporate bonds purchased: |

They were valued by the accrual

method based on their internal rate of return, as provided by Central Bank Communiqué "A" 4414 and supplementary

regulations. Such accruals were recorded in the related statements of income.

| g.5) | Non subordinated corporate bonds

issued: |

They were valued at the amount

due for principal and interest accrued, translated into pesos pursuant to the method described in Note 3.5.a). Such accruals were

recorded in the related statements of income.

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

| h) | Receivables from financial leases: |

In accordance with Central

Bank Communiqué “A” 5047, as supplemented, they were valued according to the discounted value of the sum of

minimum installments pending collection (excluding any contingent installments), from the previously agreed residual value and

the purchase options, for the financial lease agreements in which the Bank acts as lessor. The discounted value is calculated

by applying the imputed interest rate of each lease agreement.

The effective financial lease

agreements do not represent significant amounts with respect to the total financing granted by the Bank. Additionally, their characteristics

are among the usual ones for this kind of transactions, and there are no differentiating issues of any kind compared with the

transactions agreed on the Argentine financial market. These transactions are distributed among the Bank’s customers, and

there are no pre-established contingent installments or automatic renewal clauses.

| i) | Investments in other companies: |

| i.1) | In controlled financial institutions,

supplementary and authorized activities: they were valued by the equity method. |

| i.2) | In non-controlled financial

institutions, supplementary and authorized activities: |

| i. | In pesos: they were valued at

acquisition cost, plus the nominal value of share-dividends received, restated as explained

in Note 3.3., as the case may be. |

| ii. | In foreign currency: they were

valued at the acquisition cost in foreign currency, plus the nominal value of share-dividends

received, translated into pesos in accordance with the criterion stated in Note 1.3.

to the consolidated financial statements. |

Such net values do not exceed

the values calculated by the equity method on the basis of the latest financial statements published by the companies.

| i.3) | In other non-controlled companies:

they were valued at acquisition cost, plus the nominal value of share-dividends received,

restated as described in Note 3.3., as the case may be, net of allowances for impairment

in value. Such net values do not exceed the values calculated by the equity method on

the basis of the latest financial statements published by the companies. |

| j) | Bank premises and equipment, other assets and intangible

assets: |

They were valued at their acquisition

cost, restated as explained in Note 3.3., less the related accumulated depreciation and amortization, calculated based on their

estimated useful life using the straight line method.

| k) | Valuation of derivatives: |

| k.1) | Forward transactions without

delivery of underlying asset: they were valued at the quoted price of the underlying

assets upon maturity, as of the last respective business day. Differences in quoted prices

were recorded in the related statements of income. |

| k.2) | Put options taken and call option

sold: valued at the agreed-upon exercise price. |

See also Note 12.

The Bank charges these payments

directly to expenses.

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

| m) | Provisions included in liabilities: |

The Bank carries certain contingent

liabilities related to current or future claims, lawsuits and other proceedings, including those related to labor and other obligations.

Liabilities are recorded when it is probable that future costs will be incurred and whenever such costs may be reasonably estimated.

Additionally, and as provided

by Central Bank Communiqué “A” 5689, includes provisions for summary judgements and sanctions applied by the

Central Bank and other regulators, which are equivalent to the relevant amounts not yet paid (see Note 19.).

| n) | Subordinated

corporate bonds: |

They were valued at the amount

due for principal and interest accrued, translated into pesos pursuant to the method described in Note 3.5.a). Such accruals were

recorded in the related statements of income.

| o) | Shareholders’

equity accounts: |

| o.1) | They are restated as explained

in Note 3.3., except for the "Capital stock" account which has been kept at

its original value. The adjustment resulting from its restatement as explained in such

note was included in the "Adjustments to shareholders’ equity" account. |

| o.2) | Special reserve for subordinated

corporate bonds: related to the reserve created for paying the financial services of

the subordinated corporate bonds issued by the Bank (see Note 11.a.1)). This reserve

is reversed on a monthly basis as the related interests are recorded in the related statement

of income. |

| p) | Statement-of-income

accounts: |

| p.1) | The accounts comprising monetary

transactions (financial income (expense), service-charge income (expense), provision

for loan losses, administrative expenses, among others) were computed at their historical

amounts on a monthly accrual basis. |

| p.2) | The accounts reflecting the

effects on income from the sale, retirement or consumption of non-monetary assets were

computed on the basis of the amounts of such assets, which were restated as mentioned

in Note 3.3. |

| p.3) | The income (loss) from equity

interests in subsidiaries were computed on the basis of such companies’ income

(loss). |

| 3.6. | Statement of cash flows and cash equivalents |

The Bank considers “cash

and cash equivalents” to include the following accounts: Cash and investments which mature less than three months from their

date of acquisition. Below is a breakdown of the reconciliation of the “Cash” item on the Statement of cash flows

with the related balance sheet accounts:

| | |

09/30/2015 | | |

12/31/2014 | | |

09/30/2014 | |

| | |

| | |

| | |

| |

| Cash | |

| 9,982,293 | | |

| 13,132,782 | | |

| 9,663,558 | |

| | |

| | | |

| | | |

| | |

| Government and private securities | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Holdings booked at market value | |

| 2,904 | | |

| | | |

| | |

| Instruments issued by the Central Bank | |

| 1,768,082 | | |

| 1,557,240 | | |

| 295,883 | |

| | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 11,753,279 | | |

| 14,690,022 | | |

| 9,959,441 | |

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

| 4. | INCOME TAX AND MINIMUM PRESUMED

INCOME TAX |

The Bank calculates income

tax by applying the effective 35% rate to the estimated taxable income for each period, without considering the effect of temporary

differences between book and taxable income.

In 1998, Law No. 25,063 established

minimum presumed income tax for a ten-year term. At present, after subsequent extensions, such tax is effective through December

30, 2019. This tax is supplementary to income tax, while the latter is levied on the taxable income for the year, minimum presumed

income tax is a minimum levy assessment by applying 1% over 20% of certain assets as provided by the law for financial institutions.

Therefore, the Bank’s tax obligation for each year will be equal to the higher of these taxes. However, if minimum presumed

income tax exceeds income tax in a given tax year, such excess may be computed as a payment on account of any income tax in excess

of minimum presumed income tax that may occur in any of the following ten years, once accumulated net operating losses (NOLs)

have been used.

As of September 30, 2015 and

2014, the Bank estimated an income tax charge of 1,628,000 and 1,510,000, respectively; hence, no minimum presumed income tax

should be assessed for the nine-month periods ended on such dates.

Additionally, as of September

30, 2015, the Bank made income tax prepayments for 866,573 for the 2015 fiscal year, which will be applied to the tax amount assessed

in the 2015 tax return.

| 5. | DIFFERENCES BETWEEN CENTRAL

BANK RULES AND THE ARGENTINE PROFESSIONAL ACCOUNTING STANDARDS EFFECTIVE IN THE CITY

OF BUENOS AIRES |

Argentine professional accounting

standards effective in the City of Buenos Aires differ, in certain valuation aspects, from Central Bank accounting standards.

The main items with differences

in valuation matters as of September 30, 2015 and December 31, 2014 are as follows:

| | |

Adjustments under professional accounting standards | |

| | |

Stand-alone financial statements | | |

Consolidated financial statements | |

| | |

to equity | | |

to total

income

(1) | | |

to equity | | |

to total

income

(1) | |

| Item | |

09/30/2015 | | |

12/31/2014 | | |

09/30/2015 | | |

09/30/2015 | | |

12/31/2014 | | |

09/30/2015 | |

| Government securities and assistance to the government sector (a) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Government securities - Holdings booked at amortized cost | |

| (555 | ) | |

| (22,815 | ) | |

| 22,260 | | |

| 736 | | |

| (21,420 | ) | |

| 22,156 | |

| Instruments issued by the Central Bank and booked at amortized cost | |

| 22,172 | | |

| 2,443 | | |

| 19,729 | | |

| 24,480 | | |

| 2,381 | | |

| 22,099 | |

| Guaranteed loans – Presidential Decree No. 1387/01 | |

| 21,372 | | |

| 15,155 | | |

| 6,217 | | |

| 21,372 | | |

| 15,155 | | |

| 6,217 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Business combinations (b) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition of Nuevo Banco Bisel SA | |

| (75,961 | ) | |

| (83,157 | ) | |

| 7,196 | | |

| (75,961 | ) | |

| (83,157 | ) | |

| 7,196 | |

| Other | |

| (50,010 | ) | |

| (53,359 | ) | |

| 3,349 | | |

| (50,010 | ) | |

| (53,359 | ) | |

| 3,349 | |

| Interests in other companies (c) | |

| 48,606 | | |

| 35,725 | | |

| 12,881 | | |

| | | |

| | | |

| | |

| Deferred assets – Income tax (d) | |

| 237,480 | | |

| 209,462 | | |

| 28,018 | | |

| 282,487 | | |

| 243,854 | | |

| 38,633 | |

| Liabilities – Provisions (e) | |

| (28,100 | ) | |

| (81,534 | ) | |

| 53,434 | | |

| (28,100 | ) | |

| (81,534 | ) | |

| 53,434 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

| 175,004 | | |

| 21,920 | | |

| 153,084 | | |

| 175,004 | | |

| 21,920 | | |

| 153,084 | |

NOTES TO THE FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2015

(Translation of financial statements originally

issued in Spanish – See Note 24)

(Figures stated in thousands of pesos,

except for where indicated)

| (1) | Additionally, according to the

Argentine professional accounting standards effective in the City of Buenos Aires, individual

and consolidated income for the nine-month period ended September 30, 2014, would have

increased by 85,683. |

| (a) | Holdings of government securities,

instruments issued by the Central Bank and credit assistance to the nonfinancial government

sector: these holdings and financing are valued based on the specific regulations and

standards issued by the Argentine government and the Central Bank, which set forth, among

other issues, the use of present values, technical values and offset accounts, as explained

in Notes 3.5.b.2), 3.5.b.4) and 3.5.c). Pursuant to the Argentine professional accounting

standards effective in the City of Buenos Aires, the securities, instruments and assistance

mentioned in those notes should be stated at their market and/or present values, as the

case may be. In addition, current Central Bank regulations establish that financing to

the nonfinancial government sector is not subject to loan-loss provisioning, whereas

the Argentine professional accounting standards effective in the City of Buenos Aires

require that assets in general to be compared with their recoverable value every time

financial statements are prepared. |

| (b) | Business combinations: under

the standards set forth by Central Bank, business acquisitions are recorded according

to the book values of the acquired company and, if the purchase price exceeds the book

value, the excess amount is recorded in the acquiring company´s books as a positive

goodwill. On the other hand, if the purchase price is lower than book value, the difference

is recorded in the acquiring company´s books as a negative goodwill. If the goodwill

is positive, Central Bank standards establish that such goodwill should be amortized

under the straight-line method based on an estimated useful life of ten years. If the

goodwill is negative, Central Bank Communiqué “A” 3984 establishes

specific amortization methods; the maximum amortization allowed per year is 20%. |

According to the Argentine

professional accounting standards effective in the City of Buenos Aires, business combinations are recorded based on the market

values of the acquired company’s identifiable net assets and the difference between the purchase price and the identifiable

net asset measurement value is recorded as either a positive or a negative goodwill, as the case may be. If a positive goodwill

is recognized, this goodwill will be amortized systematically over the estimated useful life, unless it has an indefinite useful

life considering the estimates made by the Bank´s Management, in which case it shall not be amortized, but compared with

its recoverable value as of each year-end. If a negative goodwill is recognized due to expected losses or future expenses of the

acquired entity and which should not have been recorded as liabilities as of the acquisition date, it will either be charged to

the statement of income according to the change in specific circumstances that gave rise to it or systematically, taking into

account an average weighted useful life of the acquired entity’s assets subject to depreciation and amortization.

| (c) | Subsidiary Banco del Tucumán

SA prepares its financial statements in conformity with Central Bank rules which differ

from the Argentine professional accounting standards effective in the City of Buenos