Big Number

November 24 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/24/15)

By Emily Chasan

$25.7B: Total value of goodwill write-downs in 2014.

Corporate acquisitions that haven't worked out are taking a toll

on balance sheets.

U.S. public companies recorded $25.7 billion in goodwill

impairments, or write-downs, last year,according to a study of more

than 8,700 firms from corporate financial adviser Duff &

Phelps.The figure is upfrom $21.7 billion in 2013 but still less

than levels in 2012, when impairmentstopped $50 billion.

The biggest number of companies in at least five years took hits

to goodwill, or intangible assets, in 2014, with 341 companies

reporting write-downs, up from 274 in 2013.

"The trend is moving toward bigger impairments," said Greg

Franceschi, a managing director at Duff & Phelps.

The energy sector, hurt by the decline in oil prices, dominated

goodwill write-downs last year with 32 companies, or 23% of the

industry, reporting charges to goodwill, according to the study.

The sector tallied $5.8 billion ingoodwillwrite-downsin 2014, up

from $2.1 billion in 2013.

Devon Energy Corp. recorded the largest goodwill write-down last

year, according to Duff & Phelps. The firm took a $1.9 billion

fourth-quarter charge on a decade-old Canadian acquisition of gas

assets. Devon Energysaid at the time that the noncash charge was

"related to the recent drop in oil prices."

On average, individual companies took charges to goodwill of

about $75 million last year, down 5% from the average in 2013,

according to Duff & Phelps.

The torrent of deals announced this year means write-downs could

surge next year, since companies often take their impairment one or

two years after a deal closes, Mr. Franceschi said. If interest

rates rise, that could affect the overall market value of companies

and spur larger goodwill write-downs next year. Microsoft Corp.,

for example, said in July that it was taking a $7.6 billion

goodwill write-down on its $9.4 billion deal for Nokia's handset

business. The deal closed in April 2014.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 24, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

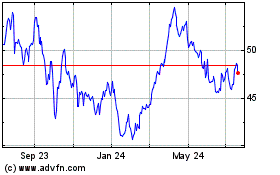

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Aug 2024 to Sep 2024

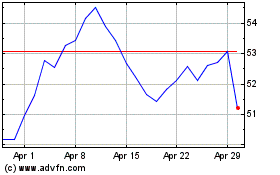

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Sep 2023 to Sep 2024