Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2015.

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO .

COMMISSION FILE NUMBER 1-13627

GOLDEN MINERALS COMPANY

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

DELAWARE |

|

26-4413382 |

|

(STATE OR OTHER JURISDICTION OF |

|

(I.R.S. EMPLOYER |

|

INCORPORATION OR ORGANIZATION) |

|

IDENTIFICATION NO.) |

|

|

|

|

|

350 INDIANA STREET, SUITE 800 |

|

|

|

GOLDEN, COLORADO |

|

80401 |

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) |

|

(ZIP CODE) |

(303) 839-5060

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

INDICATE BY CHECK MARK WHETHER THE REGISTRANT (1) HAS FILED ALL REPORTS REQUIRED TO BE FILED BY SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO FILE SUCH REPORTS), AND (2) HAS BEEN SUBJECT TO SUCH FILING REQUIREMENTS FOR THE PAST 90 DAYS: YES x NO o

INDICATE BY CHECK MARK WHETHER THE REGISTRANT HAS SUBMITTED ELECTRONICALLY AND POSTED ON ITS CORPORATE WEB SITE, IF ANY, EVERY INTERACTIVE DATA FILE REQUIRED TO BE SUBMITTED AND POSTED PURSUANT TO RULE 405 OF REGULATION S-T (§232.405 OF THIS CHAPTER) DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO SUBMIT AND POST SUCH FILES): YES x NO o

INDICATE BY CHECK MARK WHETHER THE REGISTRANT IS A LARGE ACCELERATED FILER, AN ACCELERATED FILER, A NON-ACCELERATED FILER, OR A SMALLER REPORTING COMPANY:

|

LARGE ACCELERATED FILER o |

ACCELERATED FILER o |

|

|

|

|

NON-ACCELERATED FILER o |

SMALLER REPORTING COMPANY x |

INDICATE BY CHECK MARK WHETHER THE REGISTRANT IS A SHELL COMPANY (AS DEFINED IN RULE 12B-2 OF THE EXCHANGE ACT): YES o NO x

INDICATE BY CHECK MARK WHETHER THE REGISTRANT HAS FILED ALL DOCUMENTS AND REPORTS REQUIRED TO BE FILED BY SECTIONS 12, 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 SUBSEQUENT TO THE DISTRIBUTION OF SECURITIES UNDER A PLAN CONFIRMED BY A COURT: YES x NO o

AT NOVEMBER 13, 2015, 53,335,333 SHARES OF COMMON STOCK, $0.01 PAR VALUE PER SHARE, WERE ISSUED AND OUTSTANDING.

Table of Contents

GOLDEN MINERALS COMPANY

FORM 10-Q

QUARTER ENDED September 30, 2015

INDEX

2

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

GOLDEN MINERALS COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed in United States dollars)

(Unaudited)

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands, except share data) |

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents (Note 5) |

|

$ |

921 |

|

$ |

8,579 |

|

|

Short-term investments (Note 5) |

|

75 |

|

— |

|

|

Trade receivables |

|

67 |

|

— |

|

|

Inventories (Note 7) |

|

908 |

|

1,497 |

|

|

Value added tax receivable, net (Note 8) |

|

583 |

|

1,316 |

|

|

Prepaid expenses and other assets (Note 6) |

|

373 |

|

835 |

|

|

Total current assets |

|

2,927 |

|

12,227 |

|

|

Property, plant and equipment, net (Note 9) |

|

11,798 |

|

29,031 |

|

|

Total assets |

|

$ |

14,725 |

|

$ |

41,258 |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and other accrued liabilities (Note 10) |

|

$ |

1,728 |

|

$ |

1,639 |

|

|

Other current liabilities (Note 12) |

|

927 |

|

2,551 |

|

|

Total current liabilities |

|

2,655 |

|

4,190 |

|

|

Asset retirement obligation (Note 11) |

|

2,524 |

|

2,685 |

|

|

Warrant liability (Note 13) |

|

486 |

|

1,554 |

|

|

Other long-term liabilities (Note 12) |

|

87 |

|

95 |

|

|

Total liabilities |

|

5,752 |

|

8,524 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity (Note 15) |

|

|

|

|

|

|

Common stock, $.01 par value, 100,000,000 shares authorized; 53,335,333 and 53,162,833 shares issued and outstanding for the respective periods |

|

534 |

|

532 |

|

|

Additional paid in capital |

|

484,660 |

|

484,197 |

|

|

Accumulated deficit |

|

(476,096 |

) |

(451,995 |

) |

|

Accumulated other comprehensive loss |

|

(125 |

) |

— |

|

|

Shareholder’s equity |

|

8,973 |

|

32,734 |

|

|

Total liabilities and equity |

|

$ |

14,725 |

|

$ |

41,258 |

|

The accompanying notes form an integral part of these condensed consolidated financial statements.

3

Table of Contents

GOLDEN MINERALS COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Expressed in United States dollars)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

(in thousands, except share data) |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

Sale of metals (Note 16) |

|

$ |

1,788 |

|

$ |

— |

|

$ |

6,086 |

|

$ |

— |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Costs applicable to sale of metals (exclusive of depreciation shown below) (Note 16) |

|

(2,598 |

) |

— |

|

(8,385 |

) |

— |

|

|

Exploration expense |

|

(615 |

) |

(1,009 |

) |

(2,851 |

) |

(4,262 |

) |

|

El Quevar project expense |

|

(177 |

) |

(489 |

) |

(988 |

) |

(1,244 |

) |

|

Velardeña project expense |

|

— |

|

(2,034 |

) |

(119 |

) |

(2,034 |

) |

|

Velardeña shutdown and care & maintenance costs |

|

(393 |

) |

— |

|

(393 |

) |

(2,457 |

) |

|

Administrative expense |

|

(1,047 |

) |

(782 |

) |

(3,375 |

) |

(3,587 |

) |

|

Stock based compensation |

|

(99 |

) |

(181 |

) |

(372 |

) |

(768 |

) |

|

Reclamation and accretion expense |

|

(48 |

) |

(50 |

) |

(206 |

) |

(148 |

) |

|

Impairment of long lived assets |

|

(13,181 |

) |

— |

|

(13,181 |

) |

— |

|

|

Other operating income, net |

|

7 |

|

687 |

|

477 |

|

691 |

|

|

Depreciation, depletion and amortization |

|

(1,209 |

) |

(751 |

) |

(3,743 |

) |

(2,375 |

) |

|

Total costs and expenses |

|

(19,360 |

) |

(4,609 |

) |

(33,136 |

) |

(16,184 |

) |

|

Loss from operations |

|

(17,572 |

) |

(4,609 |

) |

(27,050 |

) |

(16,184 |

) |

|

Other income and (expense): |

|

|

|

|

|

|

|

|

|

|

Interest and other income, net (Note 17) |

|

623 |

|

882 |

|

2,006 |

|

1,763 |

|

|

Warrant derivative gain (Note 18) |

|

200 |

|

— |

|

1,068 |

|

— |

|

|

(Loss) gain on foreign currency |

|

(71 |

) |

115 |

|

(125 |

) |

108 |

|

|

Total other income |

|

752 |

|

997 |

|

2,949 |

|

1,871 |

|

|

Loss from operations before income taxes |

|

(16,820 |

) |

(3,612 |

) |

(24,101 |

) |

(14,313 |

) |

|

Income tax benefit |

|

— |

|

— |

|

— |

|

— |

|

|

Net loss |

|

$ |

(16,820 |

) |

$ |

(3,612 |

) |

$ |

(24,101 |

) |

$ |

(14,313 |

) |

|

Comprehensive loss, net of tax: |

|

|

|

|

|

|

|

|

|

|

Unrealized loss on securities |

|

(88 |

) |

— |

|

(125 |

) |

— |

|

|

Comprehensive loss |

|

$ |

(16,908 |

) |

$ |

(3,612 |

) |

$ |

(24,226 |

) |

$ |

(14,313 |

) |

|

Net loss per common share – basic |

|

|

|

|

|

|

|

|

|

|

Loss |

|

$ |

(0.32 |

) |

$ |

(0.08 |

) |

$ |

(0.46 |

) |

$ |

(0.33 |

) |

|

Weighted average common stock outstanding - basic (1) |

|

52,960,212 |

|

45,029,388 |

|

52,921,542 |

|

43,621,634 |

|

(1) Potentially dilutive shares have not been included because to do so would be anti-dilutive.

The accompanying notes form an integral part of these condensed consolidated financial statements.

4

Table of Contents

GOLDEN MINERALS COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in United States dollars)

(Unaudited)

|

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands) |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net cash used in operating activities |

|

$ |

(8,030 |

) |

$ |

(12,147 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Proceeds from sale of assets |

|

416 |

|

973 |

|

|

Capitalized costs and acquisitions of property, plant and equipment |

|

(44 |

) |

(427 |

) |

|

Net cash provided by investing activities |

|

$ |

372 |

|

$ |

546 |

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of stock units, net of issue costs |

|

— |

|

7,410 |

|

|

Net cash provided by financing activities |

|

$ |

— |

|

$ |

7,410 |

|

|

Net decrease in cash and cash equivalents |

|

(7,658 |

) |

(4,191 |

) |

|

Cash and cash equivalents - beginning of period |

|

8,579 |

|

19,146 |

|

|

Cash and cash equivalents - end of period |

|

$ |

921 |

|

$ |

14,955 |

|

See Note 19 for supplemental cash flow information.

The accompanying notes form an integral part of these condensed consolidated financial statements.

5

Table of Contents

GOLDEN MINERALS COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Expressed in United States dollars)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

Other |

|

|

|

|

|

|

Common Stock |

|

Paid-in |

|

Accumulated |

|

Comprehensive |

|

Total |

|

|

|

|

Shares |

|

Amount |

|

Capital |

|

Deficit |

|

loss |

|

Equity |

|

|

|

|

(in thousands except share data) |

|

|

Balance, December 31, 2013 |

|

43,530,833 |

|

$ |

435 |

|

$ |

494,647 |

|

$ |

(448,626 |

) |

$ |

— |

|

$ |

46,456 |

|

|

Stock compensation accrued |

|

140,000 |

|

2 |

|

924 |

|

— |

|

— |

|

926 |

|

|

KELTIP mark-to-market |

|

— |

|

— |

|

12 |

|

— |

|

|

|

12 |

|

|

Registered offering stock units, net (Note 15) |

|

3,692,000 |

|

37 |

|

1,502 |

|

— |

|

— |

|

1,539 |

|

|

Private placement stock units, net (Note 15) |

|

5,800,000 |

|

58 |

|

2,729 |

|

— |

|

— |

|

2,787 |

|

|

Reclassification to reflect warrant liability (Note 15) |

|

— |

|

— |

|

(15,617 |

) |

15,454 |

|

— |

|

(163 |

) |

|

Net loss |

|

— |

|

— |

|

— |

|

(18,823 |

) |

— |

|

(18,823 |

) |

|

Balance, December 31, 2014 |

|

53,162,833 |

|

$ |

532 |

|

$ |

484,197 |

|

$ |

(451,995 |

) |

$ |

— |

|

$ |

32,734 |

|

|

Stock compensation accrued |

|

— |

|

— |

|

371 |

|

— |

|

— |

|

371 |

|

|

KELTIP mark-to-market |

|

— |

|

— |

|

40 |

|

— |

|

|

|

40 |

|

|

KELTIP shares issued |

|

172,500 |

|

2 |

|

52 |

|

— |

|

|

|

54 |

|

|

Unrealized loss on marketable equity securities, net of tax |

|

— |

|

— |

|

— |

|

— |

|

(125 |

) |

(125 |

) |

|

Net loss |

|

— |

|

— |

|

— |

|

(24,101 |

) |

— |

|

(24,101 |

) |

|

Balance, September 30, 2015 |

|

53,335,333 |

|

$ |

534 |

|

$ |

484,660 |

|

$ |

(476,096 |

) |

$ |

(125 |

) |

$ |

8,973 |

|

The accompanying notes form an integral part of these condensed consolidated financial statements.

6

Table of Contents

GOLDEN MINERALS COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in United States dollars)

1. Basis of Preparation of Financial Statements and Nature of Operations

Golden Minerals Company (the “Company”), a Delaware corporation, has prepared these unaudited interim condensed consolidated financial statements in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). Such rules and regulations allow the omission of certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), so long as such omissions do not render the financial statements misleading. The year-end balance sheet data was derived from audited financial statements, but does not include all disclosures normally required by GAAP.

In the opinion of management, these financial statements reflect all adjustments that are necessary for a fair presentation of the financial results for the periods presented. These interim financial statements should be read in conjunction with the annual financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and filed with the SEC on February 27, 2015.

The Company is a mining company, holding a 100% interest in the Velardeña and Chicago precious metals mining properties in Mexico (the “Velardeña Properties”). During the first half of November 2015 the Company suspended mining and processing activities at its Velardeña Properties in order to conserve the asset until the Company is able to develop mining and processing plans that at then current prices for silver and gold indicate a sustainable positive operating margin (defined as revenues less costs of sales) or the Company is able to locate, acquire and develop alternative mineral sources that could be economically mined and transported to the Velardeña Properties for processing. The Company has placed the mine and sulfide processing plant on care and maintenance to enable a re-start of either the mine or mill when mining and processing plans and metals prices support a cash positive outlook for the property. The Company expects to incur approximately $1.5 to $2.0 million in related costs for employee severance, net working capital obligations, and other shutdown expenditures to place the property on care and maintenance in the fourth quarter 2015 and expects to incur approximately $0.3 million in quarterly holding costs while mining and processing remain suspended. The Company currently plans to retain a core group of employees, most of which will be assigned to operate the oxide plant, which is leased to a third party and not affected by the shutdown. The Company expects the oxide plant to begin processing material in January 2016, and expects to receive net cash under the lease of between $4.0 and $5.0 million in 2016. The retained employees also include an exploration group and an operations and administrative group to continue to advance the Company’s plans in Mexico, oversee corporate compliance activities, and to maintain and safeguard the longer term value of the Velardeña assets.

The Company remains focused on establishing a second group of mining assets in order to generate sufficient revenue to fund continuing business activities. These assets may include the Santa Maria Mine located in the Parral District in Chihuahua State, Mexico or the Santa Rosa vein, located in the San Luis de Cordero District in Durango, which the Company has acquired the rights to mine. The Company is continuing its exploration efforts on selected properties in its portfolio of approximately 10 exploration properties located primarily in Mexico. It continues to hold its El Quevar advanced exploration property in Argentina on care and maintenance until it can find a partner to further advance the project. The Company is also reviewing strategic opportunities, focusing primarily on development or operating properties in North America, including Mexico.

The Company is considered an exploration stage company under the criteria set forth by the SEC as the Company has not yet demonstrated the existence of proven or probable mineral reserves, as defined by SEC Industry Guide 7, at the Velardeña Properties, or any of the Company’s other properties. As a result, and in accordance with GAAP for exploration stage companies, all expenditures for exploration and evaluation of the Company’s properties are expensed as incurred. As such the Company’s financial statements may not be comparable to the financial statements of mining companies that do have proven and probable mineral reserves. Such companies would typically capitalize certain development costs including infrastructure development and mining activities to access the ore. The capitalized costs would be amortized on a units-of-production basis as reserves are mined. The amortized costs are typically allocated to inventory and eventually to cost of sales as the inventories are sold. As the Company does not have proven and probable reserves, substantially all expenditures at the Company’s Velardeña Properties for mine construction activity, as well as costs associated with the mill

7

Table of Contents

facilities, and for items that do not have a readily identifiable market value apart from the mineralized material, have been expensed as incurred. Such costs are charged to cost of metals sold or project expense during the period depending on the nature of the costs. Certain of the costs may be reflected in inventories prior to the sale of the product. The term “mineralized material” as used herein, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC standards. The Company cannot be certain that any deposits at the Velardeña Properties or any other exploration property will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”.

2. Liquidity, Capital Resources and Going Concern

At September 30, 2015 the Company’s aggregate cash and cash equivalents totaled $0.9 million and the Company expects to have a cash balance of approximately $2.0 million at December 31, 2015, including $5.0 million borrowed in October 2015 pursuant to a secured convertible loan arrangement from The Sentient Group (“Sentient”) (discussed in more detail below), which manages funds holding approximately 27% of the Company’s outstanding common stock. The lease of the oxide plant at the Velardeña Properties is expected to generate approximately $0.2 million in net cash flow during the fourth quarter of 2015. During 2016, leasing the oxide plant is expected to generate between $4.0 and $5.0 million of net cash flow. The actual amount that the Company spends during the remainder of 2015 and the projected yearend cash balance may vary significantly from the amounts specified above and will depend on a number of factors, including variations in anticipated costs incurred in the suspension of mining and processing activities at the Velardeña Properties and in the cost of continued project assessment work at our other exploration properties.

The Company’s cash and cash equivalents balance at September 30, 2015 of $0.9 million is $7.7 million lower than the $8.6 million in similar assets held at December 31, 2014 due primarily to the negative operating margin (defined as revenues less costs of sales) at the Velardeña Properties of $2.3 million, $2.9 million in exploration expenditures, $1.0 million in maintenance and property holding costs at the El Quevar project and $3.4 million in general and administrative expenses, offset in part by $0.4 million of proceeds from sales of non strategic property and equipment and a $1.5 million reduction in working capital and other items primarily due to collections of value added tax (“VAT”) receivables, decreases in product inventories and an increase in accounts payable associated with mining and processing activities at the Velardeña Properties.

On October 27, 2015 the Company borrowed $5.0 million from Sentient pursuant to a secured convertible loan arrangement (the “Sentient Loan”) with principal and accrued interest due on October 27, 2016. Subject to approval of the Company’s stockholders as required by NYSE MKT rules, the Sentient Loan principal and accrued interest will be convertible at Sentient’s option into shares of the Company’s common stock at a price equal to the lowest of: 1) $0.29, 90 percent of the 15-day volume weighted average price (“VWAP”) for the period immediately preceding the loan closing date, 2) 90 percent of the 15-day VWAP for the period immediately preceding the loan conversion date, or 3) an anti-dilution adjusted price based on the lowest price for which the Company has sold its stock following the loan closing date. The Company plans to seek stockholder approval promptly, and is required to have obtained stockholder approval by January 31, 2016, subject to extension under certain circumstances. The Sentient Loan bears interest at a rate of 14 percent per annum, compounded monthly. If the Company’s shareholders approve the convertibility of the loan, then the interest rate declines to 9 percent per annum, compounded monthly, retroactively applied to the initial borrowing date. The interest is due on the earlier of the loan conversion or at loan maturity. The Loan Agreement contains customary representations, warranties, covenants and default provisions and is secured by the stock of the Company’s principal subsidiaries, including the stock of subsidiaries that own directly or indirectly the Velardeña Properties and the El Quevar project.

With the cash balance at September 30, 2015 of $0.9 million and the $5.0 million of proceeds from the Sentient Loan received in October, 2015, the Company plans to spend the following amounts totaling approximately $3.9 million during the fourth quarter 2015.

· Approximately $2.0 million at the Velardeña Properties for costs associated with the suspension of mining and processing activities, including employee statutory severance, net working capital obligations, and other costs to place the property on care and maintenance;

· Approximately $0.6 million on other exploration activities and property holding costs related to the Company’s portfolio of exploration properties located primarily in Mexico, including the initial payment under the exploration and exploitation agreement relating to the San Luis de Cordero property;

· Approximately $0.3 million at the El Quevar project to fund ongoing maintenance activities, property holding costs, and continuing project evaluation costs; and

8

Table of Contents

· Approximately $1.0 million on general and administrative costs.

The actual amount that the Company spends during the remainder of 2015 and the projected yearend cash balance may vary significantly from the amounts specified above and will depend on a number of factors, including variations from anticipated costs of the suspension of mining and processing activities at the Velardeña Properties and continued project assessment work at the Company’s other exploration properties.

The Company does not currently expect it will generate sufficient funds internally to pay principal and interest on the Sentient Loan when it becomes due on October 27, 2016. The Company plans, and is required by the Loan Agreement, to seek external funding through the sale of equity or securities convertible into equity in order to raise sufficient funds to repay principal and pay interest on the Sentient Loan. There can be no assurance that the Company will be successful in obtaining sufficient external funding on terms acceptable to the Company or at all. If the Sentient Loan is converted in full, the Company’s projected cash balance at the end of 2015 and the anticipated net cash flow from the leasing of the oxide plant should provide adequate funds to continue the Company’s business plans through 2016.

The financial statements have been prepared on a going concern basis under which an entity is considered to be able to realize its assets and satisfy its liabilities in the normal course of business. However, the continuing operations of the Company are dependent upon its ability to secure sufficient funding and to generate future profitable operations. The underlying value and recoverability of the amounts shown as property, plant and equipment in Note 9 are dependent on the ability of the Company to generate positive cash flows from operations and to continue to fund exploration and development activities that would lead to profitable mining activities or to generate proceeds from the disposition of property, plant and equipment. There can be no assurance that the Company will be successful in generating future profitable operations or securing additional funding in the future on terms acceptable to the Company or at all. These material uncertainties, including repayment of the Sentient Loan, may cast significant doubt on the Company’s ability to continue as a going concern. These interim statements do not include any adjustments relating to the recoverability and classification of recorded assets or liabilities which might be necessary should we not be able to continue as a going concern.

3. Impairment of Long Lived Assets

Velardeña Properties Asset Groups

The Velardeña Properties consists of two separate asset groups, one involving the oxide plant, which has been leased to a third party, and the other involving the mineral and exploration properties, sulfide plant, and mining and other equipment and working capital related to the mining and processing activities at the Velardeña Properties (the “Mineral Properties Asset Group”). Per the guidance of ASC 360, “Property, Plant and Equipment” (“ASC 360”), the Company assesses the recoverability of its long-lived assets, including property, plant and equipment, at least annually, or whenever events or changes in circumstances indicate that the carrying value of the assets may not be recoverable. Prices for silver during 2015 have remained well below third quarter 2015 and 2015 year to date cash costs per payable silver ounce, net of by-product credits, at the Velardeña Properties, generating negative gross margin (defined as revenues less costs of sales) through September 30, 2015. (“Cash costs per payable silver ounce, net of by-product credits” is a non-GAAP financial measure defined below in “None-GAAP Financial Measures”.) Ongoing efforts to improve the grade of mined material delivered to the sulfide plant for processing by limiting dilution in the stopes has not improved grades to a level sufficient to generate positive gross margins at current metals prices. As a result, the Company suspended mining and processing activities at the Velardeña mine and sulfide plant during the first half of November 2015 (see Note 1).

The continued negative gross margin and the suspension of mining and sulfide processing activities at the Velardeña Properties during the first half of November 2015 were events that required an assessment of the recoverability of the Mineral Properties Asset Group at September 30, 2015. Per the guidance of ASC 360, recoverability of an asset group is not achieved if the projected undiscounted, pre-tax cash flows related to the asset group are less than its carrying amount. In its analysis of projected cash flows for the Mineral Properties Asset Group, the Company determined that the Mineral Properties Asset Group was impaired. As a result, at September 30, 2015 the Company recorded impairment charges totaling $13.2 million to arrive at a remaining book value for the Mineral Properties Asset Group of $3.7 million at September 30, 2015, as shown in the table below.

To determine whether the Mineral Properties Asset Group was impaired at September 30, 2015 the Company used a cash flow valuation approach, which the Company deemed reasonable under the circumstances, that considered metals price projections using a greater weighting of current prices. Based on the metals price projections and current operating

9

Table of Contents

experience for silver and gold grades, recoveries, and mining and processing costs, total projected net cash flow from mining and processing activities was negative, requiring that each of the individual components of the Mineral Properties Asset Group be written down to fair value.

The Mineral Properties Asset Group includes the mineral and exploration properties associated with the mining and sulfide processing activities at the Velardeña Properties. The discounted cash flow analysis performed by the Company implies a zero value for the mineral and exploration properties from mining and processing activities in the current economic environment, but the Company believes those properties have a residual value that could be realized from a sale to a third party. With assistance from a third-party mining consulting and engineering firm, in reviewing comparable sales of similar properties in the region and considering the location of the Company’s properties to other active mining operations in close proximity to the Company’s properties, the Company has concluded that the mineral and exploration properties included in the Mineral Properties Asset Group has a fair value of $1.4 million.

The tangible assets included in the Mineral Properties Asset Group, which includes buildings, plant and equipment, were separately analyzed by a third party valuation firm in 2013 using available market data to determine a fair value based on the net realizable value that could be received in a sale to a third party. The market data was derived by researching the secondary equipment market on sales and/or offers for sale of similar assets. The Mineral Properties Asset Group tangible assets were determined to have a fair value of approximately $6.0 million as of June 30, 2013, and have since been further depreciated, reflecting a current net book value of approximately $3.2 million. The Company believes the current net book value of the Mineral Properties Asset Group tangible assets does not exceed fair value. The assets continue to be used or held in condition for use to support future profitable operations from the acquisition, exploration and development of other mineral sources located near the Velardeña Properties.

The following table details the components of the impairment of the Mineral Properties Asset Group:

|

|

|

Net Book Value |

|

|

|

Net Book Value |

|

|

|

|

Prior to |

|

Sept. 30, 2015 |

|

After |

|

|

|

|

Impairment at |

|

Impairment |

|

Impairment at |

|

|

|

|

Sept. 30, 2015 |

|

Charges |

|

Sept. 30, 2015 |

|

|

|

|

|

|

(in thousands) |

|

|

|

|

Mineral and exploration properties |

|

$ |

13,660 |

|

$ |

12,306 |

|

$ |

1,354 |

|

|

Exploration properties |

|

458 |

|

458 |

|

— |

|

|

Buildings, plant and equipment |

|

3,236 |

|

— |

|

3,236 |

|

|

Asset retirement cost |

|

417 |

|

417 |

|

— |

|

|

Other working capital, net |

|

(872 |

) |

— |

|

(872 |

) |

|

|

|

$ |

16,899 |

|

$ |

13,181 |

|

$ |

3,718 |

|

Prior to assessing the recoverability of the assets comprising the Mineral Properties Asset Group, the Company also assessed the fair value of its material and supplies inventory at September 30, 2015, which is included in the Mineral Properties Asset Group. Because of the suspension of mining and processing activities at the Velardeña Properties, as noted above, a portion of the material and supplies inventory is expected to be sold at a discount to its pre-shutdown book value or to decline in value prior to its use in future mining and processing activities. As a result, the Company has increased its reserve for obsolescence of the materials and supplies inventory and recorded a noncash charge to shutdown costs of approximately $0.4 million.

Because of the close proximity of the asset group involving the oxide plant (the “Oxide Plant Asset Group”) the Company also assessed the recoverability of the Oxide Plant Asset Group. The Oxide Plant Asset Group, which has been leased to a third party, consists primarily of the oxide plant facilities with a carrying value at September 30, 2015 of $1.3 million. The projected net cash flows from the lease are in excess of the carrying value of the Oxide Plant Asset Group and the Company therefore determined that the Oxide Plant Asset Group was not impaired.

The discounted cash flow valuation approach used in the determination of fair value falls within Level 3 of the fair value hierarchy per ASC 820 “Fair Value Measurements and Disclosures” (“ASC 820”) (see Note 13) and relies upon assumptions for future metals prices and projections of costs related to future mining and processing activities.

10

Table of Contents

4. New Accounting Pronouncements

On August 27, 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-15, “Presentation of Financial Statements - Going Concern (Subtopic 205-40), Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” (“ASU No. 2014-15”). ASU No. 2014-15 will require management to evaluate whether there are conditions and events that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the financial statements are issued on both an interim and annual basis. Management will be required to provide certain footnote disclosures if it concludes that substantial doubt exists or when its plans alleviate substantial doubt about the Company’s ability to continue as a going concern. ASU No. 2014-15 becomes effective for annual periods beginning in 2016 and for interim reporting periods starting in the first quarter of 2017. The Company does not expect the adoption of this amendment to have a material impact on its consolidated financial position or results of operations.

On May 28, 2014, FASB and the International Accounting Standards Board issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” (“ASU 2014-09”). ASU 2014-09 outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. In addition, the guidance requires improved disclosures to help users of financial statements better understand the nature, amount, timing and uncertainty of revenue that is recognized and the related cash flows. ASU 2014-09 is effective for interim and annual periods beginning after December 15, 2016; early application is not permitted. The Company is evaluating the financial statement implications of adopting ASU 2014-09 but does not believe adoption of ASU 2014-09 will have a material impact on its consolidated financial position or results of operations. In August 2015, FASB issued ASU No. 2015-14, “Revenue from Contracts with Customers (Topic 606)” (“ASU 2015-14”). ASU 2015-14 defers the effective date one year and allows early adoption for annual and interim periods after December 31, 2016.

On April 10, 2014, FASB issued ASU No. 2014-08 “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity” (“ASU 2014-08)”. ASU 2014-08 changes the criteria for reporting discontinued operations while enhancing disclosures in this area. Under ASU 2014-08, only disposals representing a strategic shift in operations will be presented as discontinued operations. Additionally, ASU 2014-08 requires expanded disclosures about discontinued operations that will provide financial statement users with more information about the assets, liabilities, income, and expenses of discontinued operations. ASU 2014-08 became effective for the Company January 1, 2015. The Company does not believe the adoption of ASU 2014-08 will have a material impact on the Company’s consolidated financial position or results of operations.

5. Cash and Cash Equivalents and Short-term Investments

The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. Short-term investments include investments with maturities greater than three months, but not exceeding 12 months, or highly liquid investments with maturities greater than 12 months that the Company intends to liquidate during the next 12 months for working capital needs.

The Company determines the appropriate classification of its investments in equity securities at the time of acquisition and re-evaluates those classifications at each balance sheet date. Available for sale investments are marked to market at each reporting period with changes in fair value recorded as a component of other comprehensive income (loss). If declines in fair value are deemed other than temporary, a charge is made to net income (loss) for the period.

The following tables summarize the Company’s short-term investments at September 30, 2015:

|

September 30, 2015 |

|

Cost |

|

Estimated

Fair Value |

|

Carrying

Value |

|

|

|

|

|

|

(in thousands) |

|

|

|

|

Investments: |

|

|

|

|

|

|

|

|

Short-term: |

|

|

|

|

|

|

|

|

Available for sale common stock |

|

$ |

199 |

|

$ |

75 |

|

$ |

75 |

|

|

Total available for sale |

|

199 |

|

75 |

|

75 |

|

|

Total short term |

|

$ |

199 |

|

$ |

75 |

|

$ |

75 |

|

The available for sale common stock consists of 5,000,000 shares of a junior mining company received during the first quarter 2015 in a transaction involving the Company’s 50% interest in the San Diego exploration property in Mexico. The Company received shares in the junior mining company that holds the other 50% interest in the property in exchange for

11

Table of Contents

extending by two years from March 24, 2015 the period of time in which the junior mining company can earn an additional 10% interest in the property by completing an additional $0.8 million of exploration work. The shares were issued with a restriction requiring the Company to hold the shares for a minimum of four months. Following the receipt of the shares the Company owns approximately 9% of the outstanding shares of the junior mining company. The extension agreement was executed on March 23, 2015 and the value of shares on that date was recorded by the Company as a short-term investment using quoted market prices. See Note 13 for further discussion on the fair value measurement techniques used by the Company to value the above investments.

The Company had no short-term investments at December 31, 2014.

6. Prepaid Expenses and Other Assets

Prepaid expenses and other current assets consist of the following:

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands) |

|

|

Prepaid insurance |

|

$ |

180 |

|

$ |

542 |

|

|

Prepaid contractor fees and vendor advances |

|

66 |

|

100 |

|

|

Taxes recievable |

|

— |

|

90 |

|

|

Recoupable deposits and other |

|

127 |

|

103 |

|

|

|

|

$ |

373 |

|

$ |

835 |

|

The prepaid contractor fees and vendor advances consist of advance payments made to contractors and suppliers primarily at the Company’s Velardeña Properties in Mexico.

7. Inventories

Inventories at the Velardeña Properties at September 30, 2015 and December 31, 2014 consist of the following:

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands) |

|

|

Metals inventory |

|

$ |

184 |

|

$ |

477 |

|

|

In-process inventory |

|

331 |

|

307 |

|

|

Material and supplies |

|

$ |

393 |

|

$ |

713 |

|

|

|

|

$ |

908 |

|

$ |

1,497 |

|

For the nine months ended September 30, 2015 the Company had written down its metals and in-process inventories to net realizable value including a charge to cost of metals sold of approximately $0.1 million.

At September 30, 2015, as a result of the shutdown of mining and processing activities at the Velardeña Properties in early November, 2015, the Company has increased its reserve for obsolescence of the materials and supplies inventory and recorded a noncash charge to shutdown costs of approximately $0.4 million (see Note 3).

For the year ended December 31, 2014 the Company had written down its metals and in-process inventories to net realizable value including a charge to cost of metals sold of $1.2 million and a charge to depreciation expense of approximately $0.7 million.

12

Table of Contents

8. Value Added Tax Receivable, Net

The Company has recorded VAT paid in Mexico and related to the Velardeña Properties as a recoverable asset. Mexico law allows for certain VAT payments to be recovered through ongoing applications for refunds. The Company expects that the current amounts will be recovered within a one year period.

The Company has also paid VAT in Mexico as well as other countries, primarily related to exploration projects, which has been charged to expense as incurred because of the uncertainty of recoverability.

9. Property, Plant and Equipment, Net

The components of property, plant and equipment are as follows:

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands) |

|

|

Mineral properties |

|

$ |

9,630 |

|

$ |

22,397 |

|

|

Exploration properties |

|

2,543 |

|

2,743 |

|

|

Royalty properties |

|

200 |

|

200 |

|

|

Buildings |

|

4,377 |

|

4,378 |

|

|

Mining equipment and machinery |

|

17,181 |

|

17,694 |

|

|

Other furniture and equipment |

|

841 |

|

841 |

|

|

Asset retirement cost |

|

1,285 |

|

2,002 |

|

|

|

|

36,057 |

|

50,255 |

|

|

Less: Accumulated depreciation and amortization |

|

(24,259 |

) |

(21,224 |

) |

|

|

|

11,798 |

|

29,031 |

|

|

|

|

|

|

|

|

|

The asset retirement cost (“ARC”) is all related to the Company’s Velardeña Properties. The decrease in the ARC during the period is related to an adjustment to the asset retirement obligation (“ARO”) (see Note 11) and to the impairment of the ARC, as discussed below.

At September 30, 2015 the Company reduced the carrying value of the Velardeña Properties mineral and exploration properties by $12.8 million and the ARC by $0.4 million and recorded a $13.2 million impairment charge on the accompanying consolidated statement of operations (see Note 3). The table below sets forth the detail of the impairment charges recorded to the Velardeña Properties property, plant and equipment:

|

|

|

|

|

Impairment |

|

|

|

|

|

|

Gross Value |

|

Charge |

|

Gross Value |

|

|

|

|

Prior to |

|

Minerals |

|

After |

|

|

|

|

Impairment at |

|

Properties |

|

Impairment at |

|

|

|

|

Sept. 30, 2015 |

|

Asset Group |

|

Sept. 30, 2015 |

|

|

|

|

|

|

(in thousands) |

|

|

|

|

Mineral properties |

|

$ |

21,936 |

|

$ |

12,306 |

|

$ |

9,630 |

|

|

Exploration properties |

|

3,001 |

|

458 |

|

2,543 |

|

|

Royalty properties |

|

200 |

|

— |

|

200 |

|

|

Buildings |

|

4,377 |

|

— |

|

4,377 |

|

|

Mining equipment and machinery |

|

17,181 |

|

— |

|

17,181 |

|

|

Other furniture and equipment |

|

841 |

|

— |

|

841 |

|

|

Asset retirement cost |

|

1,702 |

|

417 |

|

1,285 |

|

|

|

|

49,238 |

|

13,181 |

|

36,057 |

|

|

|

|

|

|

|

|

|

|

|

|

The carrying value after the impairment at September 30, 2015 represents the fair value of the assets as discussed in Note 3.

13

Table of Contents

10. Accounts Payable and Other Accrued Liabilities

The Company’s accounts payable and other accrued liabilities consist of the following:

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

Accounts payable and accruals |

|

$ |

961 |

|

$ |

893 |

|

|

Accrued employee compensation and benefits |

|

767 |

|

746 |

|

|

|

|

$ |

1,728 |

|

$ |

1,639 |

|

September 30, 2015

Accounts payable and accruals at September 30, 2015 are primarily related to amounts due to contractors and suppliers in the amounts of $0.7 million and $0.2 million related to the Company’s Velardeña Properties and corporate administrative activities, respectively. In the case of the Velardeña Properties, amounts due also include VAT payable that is not an offset to the VAT receivable.

Accrued employee compensation and benefits at September 30, 2015 consist of $0.1 million of accrued vacation payable and $0.7 million related to withholding taxes and benefits payable, of which $0.4 million is related to activities at the Velardeña Properties.

December 31, 2014

Accounts payable and accruals at December 31, 2014 are primarily related to amounts due to contractors and suppliers in the amounts of $0.7 million and $0.2 million related to the Company’s Velardeña Properties and corporate administrative activities, respectively. In the case of the Velardeña Properties, amounts due also include VAT payable that is not an offset to the VAT receivable.

Accrued employee compensation and benefits at December 31, 2014 consist of $0.1 million of accrued vacation payable and $0.6 million related to withholding taxes and benefits payable, of which $0.3 million is related to activities at the Velardeña Properties.

Key Employee Long-Term Incentive Plan

In December 2013, the Board of Directors of the Company approved and the Company adopted the 2013 Key Employee Long-Term Incentive Plan (the “KELTIP”). The KELTIP provides for the grant of units (“KELTIP Units”) to certain officers and key employees of the Company, which units will, once vested, entitle such officers and employees to receive an amount, in cash or in Company common stock issued pursuant to the Company’s Amended and Restated 2009 Equity Incentive Plan, at the option of the Board of Directors, measured generally by the price of the Company’s common stock on the settlement date. KELTIP Units are not actual equity interests in the Company and are solely unfunded and unsecured obligations of the Company that are not transferable and do not provide the holder with any stockholder rights. Payment of the settlement amount of vested KELTIP Units is deferred generally until the earlier of a change of control of the Company or the date the grantee ceases to serve as an officer or employee of the Company.

The KELTIP Units are marked to market at the end of each reporting period. On September 1, 2015 the Company settled its remaining KELTIP liability upon the retirement of the Company’s previous Chief Executive Officer, and therefore did not report a KELTIP liability as of September 30, 2015. At December 31, 2014 the Company had recorded a liability of approximately $93,000 related to KELTIP Unit grants which is included in accrued employee compensation and benefits in the table above.

11. Asset Retirement Obligations

The Company retained the services of a mining engineering firm to prepare a detailed closure plan for the Velardeña Properties. The plan was completed during the second quarter 2012 and indicated that the Company had an ARO and offsetting ARC of approximately $1.9 million. The estimated $3.5 million ARO and ARC that was recorded at the time of the acquisition of the Velardeña Properties was adjusted accordingly.

14

Table of Contents

The Company will continue to accrue additional estimated ARO amounts based on an asset retirement plan as activities requiring future reclamation and remediation occur. During the first nine months of 2015 the Company recognized approximately $0.1 million of accretion expense and approximately $0.2 million of amortization expense related to the ARC.

The following table summarizes activity in the Velardeña Properties ARO:

|

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

(in thousands) |

|

|

Beginning balance |

|

$ |

2,582 |

|

$ |

2,467 |

|

|

|

|

|

|

|

|

|

Changes in estimates, and other |

|

(300 |

) |

(85 |

) |

|

Accretion expense |

|

148 |

|

149 |

|

|

Ending balance |

|

$ |

2,430 |

|

$ |

2,531 |

|

The decreases in the ARO recorded during the 2014 and 2015 periods are the result of changes in assumptions related to inflation factors and the timing of future expenditures used in the determination of future cash flows.

The ARO set forth on the accompanying Condensed Consolidated Balance Sheets at September 30, 2015 and December 31, 2014 includes approximately $0.1 million of reclamation liabilities related to activities at the El Quevar project in Argentina.

12. Other Liabilities

The Company recorded other current liabilities of approximately $0.9 million and $2.6 million at September 30, 2015 and December 31, 2014, respectively. The amounts include a loss contingency of $0.4 million and $2.2 million at September 30, 2015 and December 31, 2014, respectively for foreign withholding taxes that the government could assert are owed by the Company, acting as withholding agent, on certain interest payments made to a third party. The amounts include estimated interest, penalties and other adjustments.

The September 30, 2015 and December 31, 2014 amounts also include a net liability of approximately $0.5 million related to the Argentina tax on equity due for years 2009 through 2012 stemming from a tax audit of those years. The amount includes $0.2 million in taxes, which is net of certain VAT credits due the Company of $0.6 million, and $0.3 million in estimated interest and penalties. The $0.2 million in net taxes due will be paid ratably over a six month period ending March 31, 2016. The Company is awaiting the final assessment of interest and penalties, estimated to be approximately $0.3 million, payable immediately upon final assessment, which is expected by the end of 2015.

13. Fair Value Measurements

Financial assets and liabilities and nonfinancial assets and liabilities are measured at fair value under a framework of a fair value hierarchy which prioritizes the inputs into valuation techniques used to measure fair value into three broad levels. This hierarchy gives the highest priority to quoted prices (unadjusted) in active markets and the lowest priority to unobservable inputs. Further, financial assets and liabilities should be classified by level in their entirety based upon the lowest level of input that was significant to the fair value measurement. The three levels of the fair value hierarchy per ASC 820 are as follows:

Level 1: Unadjusted quoted market prices in active markets for identical assets or liabilities that are accessible at the measurement date.

Level 2: Quoted prices in inactive markets for identical assets or liabilities, quoted prices for similar assets or liabilities in active markets, or other observable inputs either directly related to the asset or liability or derived principally from corroborated observable market data.

15

Table of Contents

Level 3: Unobservable inputs due to the fact that there is little or no market activity. This entails using assumptions in models which estimate what market participants would use in pricing the asset or liability.

The following table summarizes the Company’s financial assets and liabilities at fair value on a recurring basis at September 30, 2015 and December 31, 2014, by respective level of the fair value hierarchy:

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

|

|

|

(in thousands) |

|

|

At September 30, 2015 |

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

921 |

|

$ |

— |

|

$ |

— |

|

$ |

921 |

|

|

Short-term investments |

|

75 |

|

— |

|

— |

|

75 |

|

|

Trade accounts receivable |

|

67 |

|

— |

|

— |

|

67 |

|

|

|

|

$ |

1,063 |

|

$ |

— |

|

$ |

— |

|

$ |

1,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

Warrant liability |

|

— |

|

— |

|

486 |

|

486 |

|

|

|

|

$ |

— |

|

$ |

— |

|

$ |

486 |

|

$ |

486 |

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2014 |

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

8,579 |

|

$ |

— |

|

$ |

— |

|

$ |

8,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

KELTIP liability |

|

$ |

93 |

|

$ |

— |

|

$ |

— |

|

$ |

93 |

|

|

Warrant liability |

|

— |

|

— |

|

1,554 |

|

1,554 |

|

|

|

|

$ |

93 |

|

$ |

— |

|

$ |

1,554 |

|

$ |

1,647 |

|

The Company’s cash equivalents, comprised principally of U.S. treasury securities, are classified within Level 1 of the fair value hierarchy. The Company’s short-term investments consist of available for sale common stock of a junior mining company for which quoted prices exist in an active market and are also classified within Level 1 (see Note 5). The Company’s trade accounts receivable is classified within Level 1 of the fair value hierarchy and is related to the sale of metals at its Velardeña Properties and is valued at published metals prices per the terms of the refining and smelting agreements.

The KELTIP liabilities are related to employee and officer compensation as discussed in Note 10 and are marked to market at the end of each period based on the closing price of the Company’s common stock resulting in a classification of Level 1 within the fair value hierarchy. The KELTIP liability was settled in September 2015 and as of September 30, 2015 there are no KELTIP units outstanding.

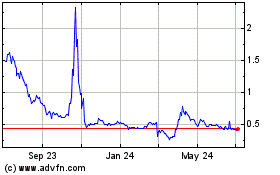

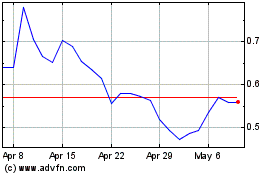

At September 30, 2015 and December 31, 2014 the Company has recorded a liability for warrants to acquire the Company’s stock as a result of anti-dilution clauses in the warrant agreements that could result in a resetting of the warrant exercise price in the event the Company were to issue additional shares of its common stock in a future transaction at an offering price lower than the current exercise price of the warrants (see Note 15). The Company assesses the fair value of its warrant liability at the end of each reporting period, with changes in the value recorded as a separate line item on the Company’s Condensed Consolidated Statements of Operations and Comprehensive Loss. The valuation policies are approved by the Chief Financial Officer who reviews and approves the inputs used in the fair value calculations and the changes in fair value measurements from period to period for reasonableness. Fair value measurements are discussed with the Company’s Chief Executive Officer, as deemed appropriate. The warrant liability has been recorded at fair value as of September 30, 2015 and December 31, 2014 based primarily on a valuation performed by a third party expert using a Monte Carlo simulation, which falls within Level 3 of the fair value hierarchy. The valuation model takes into account the probability that the Company could issue additional shares in a future transaction at a lower price than the current exercise price of the warrants. In addition to the warrant exercise prices (see Note 15) other significant inputs to the valuation model included the following:

16

Table of Contents

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Company’s ending stock price |

|

$ |

0.28 |

|

$ |

0.54 |

|

|

Company’s stock volatility |

|

85 |

% |

90 |

% |

|

Applicable risk free interest rate |

|

1.2 |

% |

1.6 |

% |

|

|

|

|

|

|

|

|

An increase or decrease in the Company’s stock price, in isolation, would result in a relatively lower or higher fair value measurement respectively. A decrease in the probability of the issuance of additional common stock at a lower price than the current warrant exercise price would result in a lower value for the warrants. The table below highlights the change in fair value of the warrant liability.

|

|

|

Fair Value Measurements |

|

|

|

|

Using Significant Unobservable |

|

|

|

|

Inputs (Level 3) |

|

|

|

|

Warrant Liabilities |

|

|

|

|

(in thousands) |

|

|

Beginning balance at January 1, 2015 |

|

$ |

1,554 |

|

|

Change in estimated fair value |

|

(1,068 |

) |

|

Ending balance at September 30, 2015 |

|

$ |

486 |

|

Non-recurring Fair Value Measurements

The following table summarizes the Company’s non-recurring fair value measurements at September 30, 2015 by respective level of the fair value hierarchy:

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

|

|

|

(in thousands) |

|

|

At September 30, 2015 |

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

Mineral properties |

|

$ |

— |

|

$ |

— |

|

$ |

1,354 |

|

$ |

1,354 |

|

|

|

|

$ |

— |

|

$ |

— |

|

$ |

1,354 |

|

$ |

1,354 |

|

The Company assesses the fair value of its long lived assets at least annually or more frequently if circumstances indicate a change in the fair value has occurred. The valuation policies are approved by the Chief Financial Officer who reviews and approves the inputs used in the fair value calculations and the changes in fair value measurements from period to period for reasonableness. Fair value measurements are discussed with the Company’s Chief Executive Officer, as deemed appropriate.

To determine the fair value of mineral properties the Company uses a discounted cash flow evaluation approach, which falls within Level 3 of the fair value hierarchy. The discounted cash flow valuation approach relies upon assumptions for future metals prices and projected silver and gold grades, recoveries, and mining and processing costs related to the Velardeña Properties. See Note 3 for further details related to the determination of fair value.

There were no non-recurring fair value measurements at December 31, 2014.

14. Income Taxes

The Company accounts for income taxes in accordance with the provisions of ASC 740, “Income Taxes” (“ASC 740”), on a tax jurisdictional basis. For the nine months ended September 30, 2015 and September 30, 2014 the Company had no income tax benefit or expense. The Company operates in jurisdictions that have generated ordinary losses on a year-to-date basis, however, the Company is unable to recognize a benefit for those losses, thus an estimated effective tax rate has not been used to report the year-to-date results.

17

Table of Contents

In accordance with ASC 740, the Company presents deferred tax assets net of its deferred tax liabilities on a tax jurisdictional basis on its Condensed Consolidated Balance Sheets. As of September 30, 2015 and as of December 31, 2014, the Company had no net deferred tax assets or net deferred tax liabilities reported on its balance sheet.

The Company, a Delaware corporation, and its subsidiaries file tax returns in the United States and in various foreign jurisdictions. The tax rules and regulations in these countries are highly complex and subject to interpretation. The Company’s income tax returns are subject to examination by the relevant taxing authorities and in connection with such examinations, disputes can arise with the taxing authorities over the interpretation or application of certain tax rules within the country involved. In accordance with ASC 740, the Company identifies and evaluates uncertain tax positions, and recognizes the impact of uncertain tax positions for which there is less than a more-likely-than-not probability of the position being upheld upon review by the relevant taxing authority. Such positions are deemed to be “unrecognized tax benefits” which require additional disclosure and recognition of a liability within the financial statements. The Company had no unrecognized tax benefits at September 30, 2015 or December 31, 2014.

15. Equity

Registered offering

On September 10, 2014 the Company completed a registered public offering (the “Offering”) of 3,692,000 units (the “Units”), with each Unit consisting of one share of the Company’s common stock (the “Shares”) and a warrant to purchase .50 of a share of the Company’s common stock (the “Warrants”). Each Unit was priced at $0.86 per Unit, before discount to the underwriters. The Warrants became exercisable on March 11, 2015 at an exercise price of $1.21 per share and will expire on September 10, 2019, five years from the date of issuance. The Shares and the Warrants were immediately separable and were issued separately. The Company received net proceeds from the Offering of approximately $2.7 million after the underwriter commissions and expenses of approximately $0.5 million.

In arriving at the value of the Shares and Warrants the Company first valued and recorded the Warrants as a liability on the balance sheet as a result of anti-dilution clauses in the warrant agreements that could result in a resetting of the warrant exercise price in the event the Company were to issue additional shares of its common stock in a future transaction at an offering price lower than the current exercise price of the warrants. A third party expert determined a value for the Warrants at September 4, 2014, the date prior to the announcement of the Offering, using a Monte Carlo simulation, which falls within Level 3 of the fair value hierarchy (see Note 13). The valuation model takes into account the probability that the Company could issue additional shares in a future transaction at a lower price than the current exercise price of the Warrants. Significant inputs to the valuation model included the Company’s closing stock price at September 4, 2014 of $1.01, the exercise price for the Warrants disclosed above, the Company’s stock volatility measured as of September 4, 2014, the applicable risk free interest rate of 1.6%, and the probability of an additional issuance of the Company’s common stock at a lower price than the current warrant exercise price. The fair value of the Warrants on the date of issuance was determined to be $1.2 million, with the remaining $1.5 million of net proceeds from the Offering being allocated to additional paid in capital. The warrants were revalued as at September 30, 2015 and December 31, 2014 (see Note 13).

Private placement

On September 10, 2014 the Company also completed a private placement (the “Private Placement”) with Sentient, the Company’s largest stockholder, pursuant to which Sentient purchased, pursuant to Regulation S under the U.S. Securities Act of 1933, a total of 5,800,000 Units (the “Private Placement Units”), with each Private Placement Unit consisting of one share of the Company’s common stock and a warrant to purchase one half of a share of the Company’s common stock. The Warrants became exercisable on March 11, 2015 at an exercise price of $1.21 per share and will expire on September 10, 2019, five years from the date of issuance. Each Private Placement Unit was priced at $0.817, the same discounted price paid by the underwriters in the Offering. The Company received net proceeds from the Private Placement of approximately $4.7 million after the discount and expenses of approximately $0.3 million.

Following the completion of the Private Placement and the Offering, Sentient holds approximately 27.2% (on a non-diluted basis) of the Company’s outstanding common stock (excluding restricted common stock held by the Company’s employees and shares of common stock issuable upon exercise of outstanding warrants).

In arriving at the value of the Shares and Warrants the Company first valued and recorded the Warrants as a liability on the balance sheet as a result of anti-dilution clauses in the warrant agreements that could result in a resetting of the warrant exercise price in the event the Company were to issue additional shares of its common stock in a future transaction at an offering price lower than the current exercise price of the warrants. A third party expert determined a value for the Warrants at September 4, 2014, the date prior to the announcement of the Offering, using a Monte Carlo simulation, which falls

18

Table of Contents

within Level 3 of the fair value hierarchy (see Note 13). The valuation model takes into account the probability that the Company could issue additional shares in a future transaction at a lower price than the current exercise price of the Warrants. Significant inputs to the valuation model included the Company’s closing stock price at September 4, 2014 of $1.01, the exercise price for the Warrants disclosed above, the Company’s stock volatility measured as of September 30, 2014, the applicable risk free interest rate of 1.6%, and the probability of an additional issuance of the Company’s common stock at a lower price than the current warrant exercise price. The fair value of the Warrants on the date of issuance was determined to be $1.9 million, with the remaining $2.7 million of net proceeds from the Offering being allocated to additional paid in capital. The warrants were revalued as at September 30, 2015 and December 31, 2014 (see Note 13).

Equity Incentive Plans

In May 2014, the Company’s stockholders approved amendments to the Company’s 2009 Equity Incentive Plan, adopting the Amended and Restated 2009 Equity Incentive Plan (the “Equity Plan”) pursuant to which awards of the Company’s common stock may be made to officers, directors, employees, consultants and agents of the Company and its subsidiaries. The Company recognizes stock-based compensation costs using a graded vesting attribution method whereby costs are recognized over the requisite service period for each separately vesting portion of the award.

The following table summarizes the status of the Company’s restricted stock grants issued under the Equity Plan at September 30, 2015 and the changes during the nine months then ended:

|

Restricted Stock Grants |

|

Number of

Shares |

|

Weighted Average

Grant Date Fair

Value Per Share |

|

|

Outstanding at December 31, 2014 |

|

600,838 |

|

$ |

1.48 |

|

|

Granted during the period |

|

— |

|

— |

|

|

Restrictions lifted during the period |

|

(130,833 |

) |

2.66 |

|

|

Forfeited during the period |

|

— |

|

— |

|

|

Outstanding at September 30, 2015 |

|

470,005 |

|

$ |

1.15 |

|

Restrictions were lifted on 130,833 shares during the nine months ended September 30, 2015 according to the terms of grants made to officers and employees in prior years.

For the nine months ended September 30, 2015 the Company recognized approximately $0.2 million of compensation expense related to the restricted stock grants. The Company expects to recognize additional compensation expense related to these awards of approximately $0.1 million over the next 15 months.

The following table summarizes the status of the Company’s stock option grants issued under the Equity Plan at September 30, 2015 and the changes during the nine months then ended:

|

Equity Plan Options |

|

Number of

Shares |

|

Weighted

Average

Exercise

Price Per

Share |

|

|

Outstanding at December 31, 2014 |