UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10-Q

| [X] | Quarterly

Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For

the quarterly period ended July 31, 2015

| [ ] | Transition

Report pursuant to 13 or 15(d) of the Securities Exchange Act of 1934 |

For

the transition period ___________________ to ___________________

Commission

File Number 0-23920

REGI

U.S., INC.

(Exact

name of Small Business Issuer as specified in its charter)

| Oregon

|

|

91-1580146 |

| (State

or other jurisdiction of |

|

(IRS

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| |

|

|

| #240

– 11780 Hammersmith Way |

|

|

| Richmond,

BC, Canada |

|

V7A

5A9 |

| (Address

of principal executive offices) |

|

(Postal

or Zip Code) |

| |

|

|

| Issuer’s

telephone number, including area code: |

|

(604)

278-5996 |

NA

(Former

name, former address and former fiscal year, if changed since last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Date File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files).

Yes

[ ] No [X]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See definition of ’‘accelerated filer and large accelerated filer’’ in Rule 12b-2 of

the Exchange Act. (Check one):

| Large accelerated filer |

[ ] |

|

Accelerated filer |

[ ] |

| Non-accelerated filer |

[ ] |

|

Smaller reporting company |

[X] |

Indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

[ ] No [X]

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 32,779,298

shares of common stock with no par value outstanding as of September 29, 2015.

TABLE OF CONTENTS

PART

I. FINANCIAL INFORMATION

Item

1. Financial Statements

REGI

U.S., Inc.

Consolidated

Balance Sheets

(Unaudited)

| | |

July

31, 2015 | | |

April

30, 2015 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 445 | | |

$ | 491 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 445 | | |

$ | 491 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’

DEFICIT | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 185,488 | | |

$ | 185,230 | |

| Due to related parties | |

| 1,860,790 | | |

| 1,791,680 | |

| Total Current Liabilities | |

| 2,046,278 | | |

| 1,976,910 | |

| | |

| | | |

| | |

| Stockholders’ Deficit: | |

| | | |

| | |

| Common stock, 100,000,000 shares authorized, no par value, 32,779,298 shares

issued and outstanding | |

| 10,780,946 | | |

| 10,750,946 | |

| Accumulated deficit | |

| (12,826,779 | ) | |

| (12,727,365 | ) |

| Total Stockholders’ Deficit | |

| (2,045,833 | ) | |

| (1,976,419 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Deficit | |

$ | 445 | | |

$ | 491 | |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

REGI

U.S., Inc.

Consolidated

Statements of Expenses

(Unaudited)

| | |

Three

Months Ended July 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Operating Expenses: | |

| | | |

| | |

| General and administrative | |

$ | 65,287 | | |

$ | 101,822 | |

| Research and development | |

| 33,767 | | |

| 9,624 | |

| | |

| | | |

| | |

| Loss from Operations: | |

| (99,054 | ) | |

| (111,446 | ) |

| | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | |

| Interest expense | |

| (360 | ) | |

| (360 | ) |

| Other Income (Expense) | |

| (360 | ) | |

| (360 | ) |

| | |

| | | |

| | |

| Net loss | |

$ | (99,414 | ) | |

$ | (111,806 | ) |

| | |

| | | |

| | |

| Net loss per share – basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding – basic and diluted | |

| 32,779,298 | | |

| 32,760,624 | |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

REGI

U.S., Inc.

Consolidated

Statements of Cash Flows

(Unaudited)

| | |

Three

Months Ended July 31, | |

| | |

2015 | | |

2014 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (99,414 | ) | |

$ | (111,806 | ) |

| Adjustments to reconcile loss to net cash used in operating activities: | |

| | | |

| | |

| Donated services | |

| 30,000 | | |

| 30,000 | |

| Options and warrants issued for services | |

| - | | |

| 34,236 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Due to related parties | |

| 360 | | |

| 360 | |

| Accounts payable and accrued liabilities | |

| 258 | | |

| (18,336 | ) |

| Net cash used in operating activities | |

| (68,796 | ) | |

| (65,546 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Advances from related parties | |

| 68,750 | | |

| 53,539 | |

| Proceeds from the sale of common stock, net of issuance costs | |

| - | | |

| 13,216 | |

| Net cash provided by financing activities | |

| 68,750 | | |

| 66,755 | |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| (46 | ) | |

| 1,209 | |

| Cash and cash equivalents, beginning of period | |

| 491 | | |

| 1,876 | |

| Cash and cash equivalents, end of period | |

$ | 445 | | |

$ | 3,085 | |

| | |

| | | |

| | |

| Supplemental Disclosures: | |

| | | |

| | |

| Interest paid | |

$ | - | | |

$ | - | |

| Income tax paid | |

| - | | |

| - | |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

REGI

U.S., Inc.

Notes

to Consolidated Financial Statements

(Unaudited)

NOTE

1. BASIS OF PRESENTATION

The

accompanying unaudited interim financial statements of REGI U.S., Inc. (“REGI”) have been prepared in accordance with

accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission,

and should be read in conjunction with the audited financial statements and notes thereto for the year ended April 30, 2015 filed

on Form 10-K with the SEC. In the opinion of management, the accompanying unaudited interim consolidated financial statements

reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly the financial position and the

results of operations for the interim period presented herein. The results of operations for interim periods are not necessarily

indicative of the results to be expected for the full year or for any future period. Notes to the unaudited consolidated financial

statements which would substantially duplicate the disclosures contained in the audited consolidated financial statements for

fiscal 2015 as reported in Form 10-K, have been omitted.

NOTE

2. GOING CONCERN

REGI

incurred net losses of $99,414 for the three months ended July 31, 2015 and has a working capital deficit of $2,045,833 and an

accumulated deficit of $12,826,779 at July 31, 2015. These factors raise substantial doubt about the ability of REGI to continue

as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of

this uncertainty. As a result, REGI’s unaudited consolidated financial statements as of July 31, 2015 and for the three

months ended have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities

and commitments in the normal course of business.

REGI

also receives interim support from affiliated companies and plans to raise additional capital through debt and/or equity financings.

There continues to be insufficient funds to provide enough working capital to fund ongoing operations for the next twelve months.

REGI may also raise additional funds through the exercise of warrants and stock options, if exercised. There is no assurance that

any of these activities will be successful.

NOTE

3. RELATED PARTIES

Amounts

due from related parties are unsecured, non-interest bearing and due on demand. Related parties consist of the President of REGI

and companies controlled or significantly influenced by the President of REGI. As of July 31, 2015, there was $1,860,790 due to

related parties. As of April 30, 2015, there was $1,791,680 due to related parties.

During

the three month period ended July 31, 2015, the President, CEO and director of REGI provided consulting services to REGI valued

at $22,500, which were accounted for as donated capital and charged to expense during the period. The same amount was recorded

in the three month period ended July 31, 2014.

During

the three month period ended July 31, 2015, the CFO, COO and director of REGI provided consulting services to REGI valued at $7,500,

which were accounted for as donated capital and charged to expense during the period. The same amount was recorded in the three

month period ended July 31, 2014.

During

each of three month periods ended July 31, 2015 and 2014, management fees of $7,500 were accrued to a company having a common

director.

During

the year ended April 30, 2012, the Company issued a promissory note of $24,000 for amounts previously accrued and owed to a company

with common director with the Company. The promissory note bears interest rate of 6% per annum, is unsecured and due on demand.

During the three months ended July 31, 2015 and 2014, there was no change to the principal amount of the promissory note and interest

expense of $360 was recorded each year. The principal balance of the note is included as due to related parties in the consolidated

balance sheets.

REGI

currently utilizes office space in a commercial business park building located in Richmond, British Columbia, Canada, a suburb

of Vancouver, shared by several companies related by common officers and directors. REGI does not pay rent for this office space.

NOTE

4. STOCKHOLDERS’ EQUITY

a)

Common Stock Options and Warrants

REGI

has a 2000 Stock Option Plan to issue up to 2,500,000 shares to certain key directors and employees.

All

transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for

based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably

measurable. Equity instruments issued to employees and the cost of the services received as consideration are measured and recognized

based on the fair value of the equity instruments issued.

All

options granted by REGI under the 2000 plan have the following vesting schedule:

| i) |

Up

to 25% of the option may be exercised at any time during the term of the option; such initial exercise is referred to as the

“First Exercise”. |

| |

|

| ii) |

The

second 25% of the option may be exercised at any time after 90 days from the date of First Exercise; such second exercise

is referred to as the “Second Exercise”. |

| |

|

| iii) |

The

third 25% of the option may be exercised at any time after 90 days from the date of Second Exercise; such third exercise is

referred to as the “Third Exercise”. |

| |

|

| iv) |

The

fourth and final 25% of the option may be exercised at any time after 90 days from the date of the Third Exercise. |

| |

|

| v) |

The

options expire 60 months from the date of grant. |

On

April 12, 2007, REGI adopted its 2007 Stock Option Plan to issue up to 2,000,000 shares to certain key directors and employees.

Pursuant to the 2007 plan, REGI has granted stock options to certain directors and employees.

All

options granted under the 2007 plan have the following vesting schedule:

| i) |

Up

to 25% of the option may be exercised 90 days after the grant of the option. |

| |

|

| ii) |

The

second 25% of the option may be exercised at any time after 1 year and 90 days after the grant of the option. |

| |

|

| iii) |

The

third 25% of the option may be exercised at any time after 2 years and 90 days after the grant of the option. |

| |

|

| iv) |

The

fourth and final 25% of the option may be exercised at any time after 3 years and 90 days after the grant of the option. |

| |

|

| v) |

The

options expire 60 months from the date of grant. |

During

the three month periods ended July 31, 2015 and 2014, the Company recorded aggregate stock-based compensation associated with

options and warrants of $Nil and $34,236, respectively. At July 31, 2015, the Company had $369,875 of total unrecognized compensation

cost related to non-vested stock options and warrants, which will be recognized over future periods.

The

fair value of each option and warrant grant or modification during the three months ended July 31, 2014 was determined using the

Black-Scholes option pricing model and the following assumptions. There was no option or warrant grant or modification during

the three months ended July 31, 2015.

| | |

| Three

Months Ended July 31, |

|

| | |

| 2015 | | |

| 2014 | |

| | |

| | | |

| | |

| Risk free interest rate | |

| - | | |

| 0.01% - 0.05 | % |

| Expected life | |

| - | | |

| 0.06-0.56 | |

| Annualized volatility | |

| - | | |

| 139.83% - 154.93 | % |

| Expected dividends | |

| - | | |

| - | |

Option

pricing models require the input of highly subjective assumptions including the expected price volatility. The subjective input

assumptions can materially affect the fair value estimate.

A

summary of REGI’s stock option activity for the three months ended July 31, 2015 is as follows:

| | | |

Three Months Ended July 31, 2015 | |

| | | |

| | |

Weighted | |

| | | |

| | |

Average | |

| | | |

| | |

Exercise | |

| | | |

Options | | |

Price | |

| Outstanding at beginning of

period | | |

| 2,488,000 | | |

| 0.15 | |

| Granted | | |

| - | | |

| - | |

| Exercised | | |

| - | | |

| - | |

| Expired | | |

| (50,000 | ) | |

| 0.10 | |

| Forfeited | | |

| - | | |

| - | |

| Outstanding at

end of period | | |

| 2,438,000 | | |

| 0.15 | |

| Exercisable at

end of period | | |

| 609,500 | | |

$ | 0.15 | |

| Weighted average

fair value of options granted | | |

| | | |

$ | - | |

At

July 31, 2015, the range of exercise prices and the weighted average remaining contractual life of the outstanding options was

$0.10 to $0.20 per share and 2.28 years, respectively. The intrinsic value of “in the money” exercisable options at

July 31, 2015 was $Nil.

A

summary of REGI’s common stock warrant activity for the three months ended July 31, 2015 is as follows:

| | | |

Three Months Ended July 31, 2015 | |

| | | |

| | |

Weighted | |

| | | |

| | |

Average | |

| | | |

| | |

Exercise | |

| | | |

Warrants | | |

Price | |

| Outstanding at beginning of

period | | |

| 1,709,333 | | |

| 0.19 | |

| Issued | | |

| - | | |

| - | |

| Exercised | | |

| - | | |

| - | |

| Expired | | |

| (965,000 | ) | |

| 0.15 | |

| Outstanding at

end of period | | |

| 744,333 | | |

| 0.25 | |

| Exercisable at

end of period | | |

| 744,333 | | |

$ | 0.25 | |

At

July 31, 2015, the exercise price and the weighted average remaining contractual life of the outstanding warrants was $0.25 per

share and 0.62 year, respectively. The intrinsic value of “in the money” exercisable warrants at July 31, 2015 was

$Nil.

NOTE

5. COMMITMENTS

Pursuant

to a letter of understanding dated December 13, 1993 between REGI, Rand and Reg (collectively called the grantors) and West Virginia

University Research Corporation (“WVURC”), the grantors have agreed that WVURC shall own 5% of all patented technology

with regards to RC/DC Engine technology and will receive 5% of all net profits from sales, licenses, royalties or income derived

from the patented technology. To date, no sales have been accrued and no royalties have been accrued or paid.

Pursuant

to an agreement dated August 20, 1992, REGI acquired the U.S. rights to the original RC/DC Engine from Rand. REGI will pay Rand

and the original owner a net profit royalty of 5% and 1%, respectively. To date no sales have been accrued and no royalties have

been accrued or paid.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking

Statements

Certain

statements contained in this Quarterly Report on Form 10-Q constitute “forward-looking statements.” These statements,

identified by words such as “plan,” “anticipate,” “believe,” “estimate,” “should,”

“expect” and similar expressions include our expectations and objectives regarding our future financial position,

operating results and business strategy. These statements reflect the current views of management with respect to future events

and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry

results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include

those set forth in our 10-K for the fiscal year ended April 30, 2015. We do not intend to update the forward- looking information

to reflect actual results or changes in the factors affecting such forward-looking information. We advise you to carefully review

the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”), particularly

our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

All

dollar amounts in this Quarterly Report are in U.S. dollars unless otherwise stated.

Nature

of Business

We

are a development stage company engaged in the business of developing and building an improved axial vane-type rotary engine known

as the RadMax™ rotary technology (the “RadMax® Engine”), used in the design of lightweight and high efficiency

engines, compressors and pumps. We have a project cost sharing agreement, whereby the development of the RadMax™ Engine

will be funded equally by us and by Reg Technologies Inc. (“Reg Tech”), a public company listed for trading on the

TSX Venture Exchange and on OTC.BB. Reg Tech holds approximately 10.17% of our issued and outstanding shares.

Recent

Development

On

June 1, 2015 we announced that Paul Porter, our chief mechanical engineer, was preparing test facilities for the 375hp diesel

engine. He would populate the engine with the new seals and prepare it for full spin testing. This phase of testing should be

the final set of tests prior to placing the engine on a dynamometer. The dynamometer testing would allow us to document friction,

fuel efficiency, net horsepower and emissions.

On

September 1, 2015 we announced that the prototype was being assembled, and would be spin tested when assembly was complete. After

spin testing, the engine would need to be tested on a dynameter in order to begin the fine tuning of the combustion and determine

the horsepower produced.

Going

Concern

We

incurred net losses of $99,414 for the three months ended July 31, 2015, has a working capital deficit of $2,045,833 and an accumulated

deficit of $12,826,779 at July 31, 2015. Further losses are expected until we enter into a licensing agreement with a manufacturer

and reseller. These factors raise substantial doubt about the ability of the Company to continue as a going concern.

We

may receive interim support from affiliated companies and plan to raise additional capital through debt and/or equity financings.

We may also raise additional funds through the exercise of warrants and stock options, if exercised. However, there is no assurance

that any of these activities will be successful.

Due

to the uncertainty of our ability to generate sufficient revenues from our operating activities and/or to obtain the necessary

financing to meet our obligations and repay our liabilities arising from normal business operations when they come due, in their

report on our financial statements for the year ended April 30, 2015, our registered independent auditors included additional

comments indicating concerns about our ability to continue as a going concern. Our financial statements contain additional note

disclosures describing the circumstances that led to this disclosure by our registered independent auditors. The financial statements

do not include any adjustments that might result from the outcome of this uncertainty.

Results

of Operations for Three Months Ended July 31, 2015 Compared to the Three Months Ended July 31, 2014

We

had a net loss of $99,414 during the three months ended July 31, 2015, decreased by $12,392 from net loss of $111,806 during the

three months ended July 31, 2014.

Research

and development expenses increased from $9,624 in three months ended July 31, 2014 to $33,767 in three months ended July 31, 2015,

due to increased expenditures we made on material for the prototype.

Total

general and administrative expenses decreased from $101,822 in three months ended July 31, 2014 to $65,287 in the three months

ended July 31, 2015.

General and administrative expense comparisons

are as follows:

| |

● |

Professional

fees including legal, accounting, audit and auditors’ review expenses decreased from $5,851 during the three months

ended July 31, 2014 to $4,598 during the three months ended July 31, 2015 as we had fewer and less complicated transactions

in the current period; |

| |

|

|

| |

● |

Office

and administrative expenses decreased slightly from $24,235 during the three months ended July 31, 2014 to $23,189 during

the three months ended July 31, 2015; |

| |

|

|

| |

● |

In

the three months ended July 31, 2014, we recorded fair value of $34,236 for warrant extension; in the three months ended July

31, 2015 we did not have such warrant extension or incur any other financing cost; and |

| |

|

|

| |

● |

Consulting

and management fees remained at $37,500 for each of the three months ended July 31, 2014 and 2015. |

During

each of the three months ended July 31, 2014 and 2015 we recorded interest expense of $360 on the same promissory note issued

to a related party.

We

have not attained profitable operations and are dependent upon obtaining financing to pursue exploration activities. For these

reasons our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

Liquidity

and Capital Resources

During

the three months ended July 31, 2015, we financed our operations mainly through advances from related parties of $68,750.

At

July 31, 2015 total amount owing to related parties is $1,860,790 or 90.94% of total liabilities as of July 31, 2015. This funding

was necessary with a downturn in the financial market to complete the RadMax™ Engine and place us in a position to attain

profit. The balances owing to related parties are non-interest bearing, unsecured and repayable on demand. Our affiliated companies

have indicated that they will not be demanding repayment of these funds during the next fiscal year.

We

also plan to raise additional capital through debt and/or equity financings. We cannot provide any assurance that additional funding

will be available to finance our operations on acceptable terms in order to enable us to complete our plan of operations. There

are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing.

If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue the

development of our RadMax™ Engine and our business will fail.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital

resources that is material to our stockholders.

Critical

Accounting Policies

We

have identified certain accounting policies that are most important to the portrayal of our current financial condition and results

of operations. Our significant accounting policies are disclosed in Note 1 of the consolidated financial statements for the three

months ended July 31, 2015, attached hereto.

Contractual

Obligations

We

do not currently have any contractual obligations requiring any payment obligation from us.

Item

3. Quantitative and Qualitative Disclosures about Market Risk

We

are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to

provide the information under this item.

Item

4. Controls and Procedures

(a)

Evaluation of disclosure controls and procedures

Based

upon an evaluation of the effectiveness of our disclosure controls and procedures performed by our management, with participation

of our Chief Executive Officer and our Chief Financial Officer as of the end of the period covered by this report, our Chief Executive

Officer and our Chief Financial Officer concluded that our disclosure controls and procedures were not effective due to inadequate

segregation of duties.

As

used herein, “disclosure controls and procedures” mean controls and other procedures of our company that are

designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Securities

Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules

and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information

required to be disclosed by us in the reports that we file or submit under the Securities Exchange Act is accumulated and communicated

to our management, including our principal executive and principal financial officers, or persons performing similar functions,

as appropriate to allow timely decisions regarding required disclosure.

We

are taking steps to enhance and improve the design of our disclosure controls. During the period covered by this interim report,

we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we need to appoint

additional qualified personnel to address inadequate segregation of duties, and adopt sufficient written policies and procedures

for accounting and financial reporting. These remediation efforts are largely dependent upon securing additional financing to

cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be

adversely affected.

(b)

Changes in Internal Control over Financial Reporting

There

were no changes in our internal control over financial reporting during the quarter ended July 31, 2015 that have materially affected,

or are reasonably likely to materially affect, our internal control over financial reporting.

PART

II- OTHER INFORMATION

Item

1. Legal Proceedings

We

are not a party to any pending legal proceeding. Management is not aware of any threatened litigation, claims or assessments.

Item

1A. Risk Factors

We

are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required

under this item.

Item

2. Unregistered Sales of Equity Securities and Use of Proceeds

None

during the period from May 1, 2015 to the date of this report.

Item

3. Defaults Upon Senior Securities

None.

Item

4. Mine Safety Disclosures

Not

applicable.

Item

5. Other Information

None.

Item

6. Exhibits

(a)

Exhibit(s)

| |

31.1 |

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* |

| |

|

|

| |

31.2 |

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* |

| |

|

|

| |

32.1 |

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002* |

| |

|

|

| |

32.2 |

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002* |

| |

|

|

| |

101.INS |

XBRL

Instance Document** |

| |

|

|

| |

101.SCH |

XBRL

Taxonomy Extension Schema Document** |

| |

|

|

| |

101.CAL |

XBRL

Taxonomy Extension Calculation Linkbase Document** |

| |

|

|

| |

101.DEF |

XBRL

Taxonomy Extension Definition Lable Linkbase Document** |

| |

|

|

| |

101.LAB |

XBRL

Taxonomy Extension** |

| |

|

|

| |

101.PRE |

XBRL

Taxonomy Extension Presentation Linkbase Document** |

*

Filed herewith.

**

In accordance with Regulation S-T, the XBRL-formatted interactive data files that comprise Exhibit 101 in this Quarterly Report

on Form 10-Q shall be deemed “furnished” and not “filed”.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

September

29, 2015

| |

REGI

U.S., INC. |

| |

|

| |

/s/

John G. Robertson |

| |

John G.

Robertson, |

| |

President and

Chief Executive Officer |

Exhibit

31.1

CERTIFICATION

OF CHIEF EXECUTIVE OFFICER PURSUANT TO

SECTION

302 OF THE SARBANES-OXLEY ACT OF 2002

I,

John G. Robertson, Chief Executive Officer of REGI U.S., Inc., certify that:

| 1. | I

have reviewed this quarterly report on Form 10-Q of REGI U.S., Inc.; |

| 2. | Based

on my knowledge, this report does not contain any untrue statement of material fact or

omit to state a material fact necessary to make the statements made, in light of the

circumstances under which such statements were made, not misleading with respect to the

period covered by quarterly report; |

| 3. | Based

on my knowledge, the financial statements, and other financial information included in

this quarterly report, fairly present in all material respects the financial condition,

results of operations and cash flows of the registrant as of, and for, the periods presented

in this report; |

| 4. | The

registrant’s other certifying officer(s) and I are responsible for establishing

and maintaining disclosure controls and procedures (as defined in Exchange Act Rules

13a-15(e) and 15d- 15(e)) and internal control over financial reporting (as defined in

Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | designed

such disclosure controls and procedures, or caused such disclosure control and procedures

to be designed under our supervision, to ensure that material information relating to

the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; |

| (b) | designed

such internal control over financial reporting, or caused such internal control over

financial reporting to be designed under our supervision, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; |

| (c) | evaluated

the effectiveness of the registrant’s disclosure controls and procedures and presented

in this report our conclusions about the effectiveness of the disclosure controls and

procedures, as of the end of the period covered by this report based on such evaluation; |

| (d) | disclosed

in this report any change in the registrant’s internal control over financial reporting

that occurred during the registrant’s most recent fiscal quarter (the registrant’s

fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control

over financial reporting; and |

| 5. | The

registrant’s other certifying officer(s) and I have disclosed, based on our most

recent evaluation of internal control over financial reporting, to the registrant’s

auditors and the audit committee of the registrant’s board of directors (or persons

performing the equivalent functions): |

| (a) | all

significant deficiencies and material weaknesses in the design or operation of internal

control over financial reporting which are reasonably likely to adversely affect the

registrant’s ability to record, process summarize and report financial information;

and |

| (b) | any

fraud, whether or not material, that involves management or other employees who have

a significant role in the registrant’s internal control over financial reporting |

| Date:

September 29, 2015 |

By: |

/s/

John G. Robertson |

| |

|

John G. Robertson |

| |

|

Chief Executive

Officer |

Exhibit

31.2

CERTIFICATION

OF CHIEF FINANCIAL OFFICER PURSUANT TO

SECTION

302 OF THE SARBANES-OXLEY ACT OF 2002

I,

James Vandeberg, Chief Financial Officer of REGI U.S., Inc., certify that:

| 1. | I

have reviewed this quarterly report on Form 10-Q of REGI U.S., Inc.; |

| 2. | Based

on my knowledge, this report does not contain any untrue statement of material fact or

omit to state a material fact necessary to make the statements made, in light of the

circumstances under which such statements were made, not misleading with respect to the

period covered by quarterly report; |

| 3. | Based

on my knowledge, the financial statements, and other financial information included in

this quarterly report, fairly present in all material respects the financial condition,

results of operations and cash flows of the registrant as of, and for, the periods presented

in this report; |

| 4. | The

registrant’s other certifying officer(s) and I are responsible for establishing

and maintaining disclosure controls and procedures (as defined in Exchange Act Rules

13a-15(e) and 15d- 15(e)) and internal control over financial reporting (as defined in

Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | designed

such disclosure controls and procedures, or caused such disclosure control and procedures

to be designed under our supervision, to ensure that material information relating to

the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; |

| (b) | designed

such internal control over financial reporting, or caused such internal control over

financial reporting to be designed under our supervision, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; |

| (c) | evaluated

the effectiveness of the registrant’s disclosure controls and procedures and presented

in this report our conclusions about the effectiveness of the disclosure controls and

procedures, as of the end of the period covered by this report based on such evaluation; |

| (d) | disclosed

in this report any change in the registrant’s internal control over financial reporting

that occurred during the registrant’s most recent fiscal quarter (the registrant’s

fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control

over financial reporting; and |

| 5. | The

registrant’s other certifying officer(s) and I have disclosed, based on our most

recent evaluation of internal control over financial reporting, to the registrant’s

auditors and the audit committee of the registrant’s board of directors (or persons

performing the equivalent functions): |

| (a) | all

significant deficiencies and material weaknesses in the design or operation of internal

control over financial reporting which are reasonably likely to adversely affect the

registrant’s ability to record, process summarize and report financial information;

and |

| (b) | any

fraud, whether or not material, that involves management or other employees who have

a significant role in the registrant’s internal control over financial reporting |

| Date:

September 29, 2015 |

By: |

/s/

James Vandeberg |

| |

|

James Vandeberg |

| |

|

Chief Financial

Officer |

Exhibit

32.1

CERTIFICATION

PURSUANT TO

18

U.S.C. SECTION 1350

AS

ADOPTED PURSUANT TO

SECTION

906 OF THE SARBANES-OXLEY ACT OF 2002

In

connection with the Quarterly Report of REGI U.S., Inc. (the “Company”) on Form 10-Q for the period

ended July 31, 2015 as filed with the Securities and Exchange Commission on the date hereof (the “Report”),

the undersigned, in the capacities and on the dates indicated below, hereby certifies pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to his knowledge:

| 1. | The

Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities

Exchange Act of 1934; and |

| 2. | The

information contained in the Report fairly presents, in all material respects, the financial

condition and results of operations of the Company. |

| Date:

September 29, 2015 |

By: |

/s/

John G. Robertson |

| |

|

John G. Robertson |

| |

|

President and

Chief Executive Officer |

Exhibit

32.2

CERTIFICATION

PURSUANT TO

18

U.S.C. SECTION 1350

AS

ADOPTED PURSUANT TO

SECTION

906 OF THE SARBANES-OXLEY ACT OF 2002

In

connection with the Quarterly Report of REGI U.S., Inc. (the “Company”) on Form 10-Q for the period

ended July 31, 2015 as filed with the Securities and Exchange Commission on the date hereof (the “Report”),

the undersigned, in the capacities and on the dates indicated below, hereby certifies pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to his knowledge:

| 1. | The

Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities

Exchange Act of 1934; and |

| 2. | The

information contained in the Report fairly presents, in all material respects, the financial

condition and results of operations of the Company. |

| Date:

September 29, 2015 |

By: |

/s/

James Vandeberg |

| |

|

James Vandeberg |

| |

|

Chief Financial

Officer |

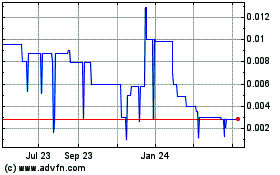

REGI US (CE) (USOTC:RGUS)

Historical Stock Chart

From Aug 2024 to Sep 2024

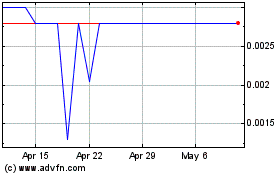

REGI US (CE) (USOTC:RGUS)

Historical Stock Chart

From Sep 2023 to Sep 2024