Coca-Cola To Sell Nine U.S. Plants

September 24 2015 - 8:15PM

Dow Jones News

(FROM THE WALL STREET JOURNAL 9/25/15)

By Mike Esterl

Coca-Cola Co. said Thursday it plans to sell nine U.S.

production plants worth about $380 million to three large bottling

partners as the beverage giant accelerates a refranchising drive

and lightens its balance sheet.

The company said it would create a new nationwide supply group

that will include Coke and independent U.S. bottlers Coca-Cola

Bottling Co. Consolidated, Coca-Cola Bottling Company United and

Swire Coca-Cola USA. Under the letter of intent, nine manufacturing

facilities will be transferred to the bottlers between 2016 and

2018.

Atlanta-based Coke began divesting U.S. distribution assets

including delivery trucks and warehouses in 2013 in a bid to cut

costs and boost profit amid weak soda sales. It accelerated those

plans last October, saying it aimed to refranchise the majority of

its U.S. distribution by the end of 2017 instead of 2020.

Thursday's announcement is the first time Coke confirmed it also

intends to shed U.S. manufacturing assets, signaling that it will

exit at least some of its low-margin, capital-intensive businesses

to refocus on selling beverage concentrate and marketing. It

wouldn't say how much of its manufacturing it plans to sell.

The company has been coy about whether it would sell its

manufacturing as part of the refranchising. The sale of additional

production facilities to bottling partners "will be considered in

due course," it said in a statement. A spokesman said Thursday that

the nationwide supply group will be collectively managed.

Thursday's refranchising deals are subject to the companies

reaching definitive agreements. Coke expects to receive the net

book value of the nine plants, estimated at $380 million, in cash

at closing.

Coke paid $12.3 billion in 2010 to buy the U.S. assets of

Coca-Cola Enterprises Inc., then its biggest U.S. bottler, securing

control of most production and distribution in its home market.

Coke said at the time the move would lower costs and allow it to

negotiate directly with major national retailers.

But the deal also hurt Coke's North American operating margin,

which fell to 11.4% in 2014 from 20.7% in 2009. Chief Financial

Officer Kathy Waller acknowledged last year that Coke likely

wouldn't book a positive return on its U.S. bottling investment

this decade.

Coke Chief Executive Muhtar Kent said in a news release on

Thursday that the company will tap the strengths of the bottling

partners "to operate as one highly aligned and highly competitive

national product supply system."

Coke says it currently has 71 plants in the U.S. after

shuttering several in recent years.

Tom Haynes, an industry consultant and former Coke executive,

said he expects the company will sign more deals to divest U.S.

manufacturing plants. "Coke's primary expertise is sales and

marketing," said Mr. Haynes, who headed the Coca-Cola Bottlers'

Association from 2002 to 2012.

Publicly traded Coca-Cola Consolidated will acquire six

production facilities in Sandston, Va., Baltimore and Silver

Spring, Md., Indianapolis and Portland, Ind., and Cincinnati after

striking earlier deals to expand its distribution territory.

Closely held Coca-Cola United will acquire a production facility

in New Orleans, and Swire will acquire production facilities in

Phoenix and Denver.

Coke also has been divesting bottling assets abroad and

consolidating its global manufacturing and distribution footprint.

Last month it agreed to merge its German bottling unit with

publicly traded Coca-Cola Enterprises and Spain's closely held

Coca-Cola Iberian Partners SA to create a bottler with $12 billion

in revenue across 13 European countries.

The maker of Minute Maid juices, Dasani water and its namesake

cola has warned it expects to fall short of long-term growth

targets for a third straight year in 2015 amid slowing consumption

of soda, which still represents about 70% of the company's sales

volume.

Last October it expanded a cost-cutting program, promising to

deliver $3 billion in annualized savings by 2019. In January it

began cutting at least 1,600 white-collar jobs globally.

---

Chelsey Dulaney contributed to this article.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 24, 2015 20:00 ET (00:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

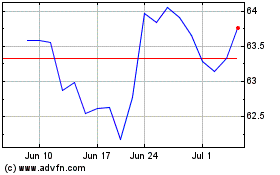

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024