UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the

month of August 2015.

Commission

File Number 001-31722

New

Gold Inc.

Suite

1800 – 555 Burrard Street

Vancouver,

British Columbia V7XC 1M9

Canada

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☐ Form 40-F ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing

a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DOCUMENTS

FILED AS PART OF THIS FORM 6-K

| Exhibit |

|

Description |

| 99.1 |

|

News Release of August 27, 2015 - New Gold Announces Sale of El Morro Interest for $90 Million Cash and a 4% Gold Stream |

| |

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

NEW GOLD INC. |

| |

|

|

|

| |

|

By: |

/s/

Lisa Damiani |

|

| Date: August

27, 2015 |

|

|

Lisa

Damiani

Vice

President, General Counsel and Corporate Secretary |

Exhibit 99.1

New Gold Announces Sale of El Morro Interest for $90 Million Cash

and a 4% Gold Stream

(All dollar figures are in US dollars unless otherwise indicated)

TORONTO, Aug. 27, 2015 /CNW/ - New Gold Inc. ("New

Gold") (TSX:NGD) (NYSE MKT:NGD) today announces that the company has entered into an agreement with Goldcorp Inc. ("Goldcorp")

to sell New Gold's 30% interest in the El Morro project to Goldcorp in exchange for $90 million in cash, a 4% stream on gold production

from the El Morro property and the cancellation of New Gold's $93 million carried funding loan (the "Transaction"). The

Transaction provides New Gold with increased financial flexibility, strengthens the balance sheet and enables the company to maintain

exposure to El Morro's significant 8.9 million ounce gold reserve and ongoing exploration potential.

KEY TRANSACTION HIGHLIGHTS

$90 million cash consideration

| · | $90 million, less applicable withholding taxes, to be paid at closing

of the Transaction, expected to be in the fourth quarter of 2015 |

4% stream on gold production from the El Morro property

| · | 4% stream on life-of-project gold production from the 417 square kilometre

El Morro property |

| · | El Morro's currently estimated gold mineral reserves – 599 million

tonnes at an average gold grade of 0.46 grams per tonne, totalling 8.9 million ounces |

| · | Measured and Indicated mineral resources (exclusive of reserves) –

92 million tonnes at an average gold grade of 0.41 grams per tonne, totalling 1.2 million ounces |

| · | Inferred mineral resources (including open pit and underground resources)

– 678 million tonnes at an average gold grade of 0.30 grams per tonne, totalling 6.5 million ounces |

| · | New Gold to pay fixed $400 per ounce on the first 217,000 ounces of gold

delivered as part of the stream |

$93 million carried funding loan cancelled

| · | New Gold will no longer be obligated to repay the $93 million in debt

that Goldcorp (and previous joint venture partners) funded on the company's behalf |

In conjunction with the Transaction, Goldcorp and Teck Resources

Limited ("Teck") today announced that they plan to combine their respective El Morro and Relincho projects into a 50/50

joint venture with the interim name of Project Corridor.

"This transaction makes strategic sense for all of the

parties involved," stated Randall Oliphant, Executive Chairman of New Gold. "We believe Goldcorp and Teck have developed

a creative and thoughtful approach to bring their projects together. It is logical for two large, well-capitalized, proven operators

to carry Project Corridor forward. At the same time, New Gold has taken this opportunity to further enhance our financial flexibility

and strengthen our balance sheet while retaining a meaningful, low-cost stream on El Morro's significant gold reserves and ongoing

potential."

"Goldcorp has been an excellent partner at El Morro over

the last five years and we look forward to Goldcorp and Teck progressing Project Corridor for the benefit of all stakeholders,"

added Mr. Oliphant.

Additional Transaction Details

Based on the results of the Project Corridor Preliminary Economic

Assessment, when ore is sourced from El Morro, gold production is expected to average over 400,000 ounces per year which would

enable New Gold to purchase over 16,000 ounces of gold per year at $400 per ounce.

The cash purchase price for gold delivered under the stream

is fixed at $400 per ounce for the first 217,000 ounces of gold, where 217,000 ounces reflects 4% of El Morro's currently estimated

recoverable gold production. Thereafter, the cash purchase price will be $400 per ounce plus an annual 1% inflation adjustment.

Goldcorp and Teck are expecting to commence a Pre-Feasibility

Study in early 2016 which should be completed 12 to 18 months thereafter.

El Morro has generated a significant return for the company

since it was originally brought into the portfolio by one of New Gold's predecessor companies in 1996. Including the costs associated

with optioning into the property and subsequent exploration expenditures, the company has spent less than $7 million for its interest

in El Morro. In return for this investment, New Gold received a $50 million payment from Goldcorp in 2010 when Goldcorp became

the company's 70% joint venture partner, as well as the cash proceeds related to today's Transaction. Importantly, beyond these

two cash payments, New Gold continues to maintain meaningful exposure to the El Morro project through the 4% gold stream. From

an accounting perspective, the company expects to realize a non-cash loss of approximately $100 million on the sale of its 30%

interest in El Morro, primarily related to the purchase accounting value assigned to the project at the time of the New Gold's

three-way merger in 2008.

Closing of the Transaction is conditional upon the closing

of the El Morro-Relincho joint venture between Goldcorp and Teck as well as other customary conditions. The Transaction is expected

to close in the fourth quarter of 2015.

ABOUT NEW GOLD INC.

New Gold is an intermediate gold mining company. The company

has a portfolio of four producing assets and three significant development projects. The New Afton Mine in Canada, the Mesquite

Mine in the United States, the Peak Mines in Australia and the Cerro San Pedro Mine in Mexico, provide the company with its current

production base. In addition, New Gold owns 100% of the Rainy River and Blackwater projects, both in Canada, as well as an interest

in the El Morro project located in Chile. New Gold's objective is to be the leading intermediate gold producer, focused on the

environment and social responsibility. For further information on the company, please visit www.newgold.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this news release, including

any information relating to New Gold's future financial or operating performance are "forward looking". All statements

in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New

Gold expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects",

"is expected", "budget", "scheduled", "targeted", "estimates", "forecasts",

"intends", "anticipates", "projects", "potential", "believes" or variations of

such words and phrases or statements that certain actions, events or results "may", "could", "would",

"should", "might" or "will be taken", "occur" or "be achieved" or the negative

connotation of such terms. Forward-looking statements in this news release include, among others, statements with respect to the

anticipated benefits and effects of the Transaction, including the ability of the parties to satisfy the conditions of and complete

Transaction; the ability of Teck and Goldcorp to satisfy the conditions of and complete the El Morro-Relincho joint venture ("Project

Corridor"); the estimation of mineral reserves and mineral resources and metallurgical recoveries; the timing and amount of

estimated future production from the El Morro property; and the completion of a pre-feasibility study for Project Corridor.

All forward-looking statements in this news release are based

on the opinions and estimates of management as of the date such statements are made and are subject to important risk factors and

uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking

statements are discussed in this news release. In addition to, and subject to, such assumptions discussed in more detail elsewhere,

the forward-looking statements in this news release are also subject to assumptions regarding: (1) conditions to closing of the

Transaction being satisfied in a timely manner; (2) conditions to closing of Project Corridor being satisfied in a timely manner;

(3) the future business strategies and the environment in which Goldcorp and Teck will operate, including the price of commodities

and anticipated costs of developing Project Corridor; (4) political and legal developments in Chile being consistent with the parties'

current expectations; (5) the accuracy of current mineral reserve and resource estimates; (6) all required permits, licenses and

authorizations being obtained from the relevant governments and other relevant stakeholders within the expected timelines; and

(7) the results of the conceptual design of Project Corridor being realized.

Forward-looking statements are necessarily based on estimates

and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results,

level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

statements. Such factors include, without limitation: the Transaction not closing when planned; delay or failure to receive regulatory

approvals or the failure to satisfy other closing conditions to the Transaction or Project Corridor; future mineral prices; discrepancies

between actual and estimated production, mineral reserves and resources and metallurgical recoveries; estimated mine life and sequencing

of ore from the El Morro property and the Relincho property; conclusions of economic evaluations; litigation risks; mining operational

and development risks; general business, economic, competitive, political and social uncertainties; currency exchange rate fluctuations;

not realizing the potential benefits of the Transaction or Project Corridor; changes in parameters as plans continue to be refined;

as well as those risks identified in New Gold's filings with Canadian securities regulators, which may be viewed at www.sedar.com.

Although New Gold has attempted to identify important factors

that could cause actual results to differ materially from those contained in forward-looking statements and information, there

may be other factors that cause results not to be as anticipated, estimated or intended.

Forward-looking statements are not guarantees of future performance,

and actual results and future events could materially differ from those anticipated in such statements. All of the forward-looking

statements contained in this news release are qualified by these cautionary statements. New Gold expressly disclaims any intention

or obligation to update or revise any forward-looking statements whether as a result of new information, events or otherwise, except

in accordance with applicable securities laws.

CAUTIONARY NOTE TO U.S. READERS CONCERNING ESTIMATES OF

MINERAL RESERVES AND MINERAL RESOURCES

Information concerning the properties and operations of New

Gold has been prepared in accordance with Canadian standards under applicable Canadian securities laws, and may not be comparable

to similar information for United States companies. The terms "Mineral Resource", "Measured Mineral Resource",

"Indicated Mineral Resource" and "Inferred Mineral Resource" used in this news release are Canadian mining

terms as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral

Resources and Mineral Reserves adopted by CIM Council on May 10, 2014 and incorporated by reference in National Instrument 43-101

("NI 43-101"). While the terms "Mineral Resource", "Measured Mineral Resource", "Indicated

Mineral Resource" and "Inferred Mineral Resource" are recognized and required by Canadian securities regulations,

they are not defined terms under standards of the United States Securities and Exchange Commission. As such, certain information

contained in this news release concerning descriptions of mineralization and mineral resources under Canadian standards is not

comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of

the United States Securities and Exchange Commission.

An "Inferred Mineral Resource" has a great amount

of uncertainty as to its existence and as to its economic and legal feasibility. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of feasibility or pre-feasibility studies. It cannot be assumed that all or any

part of an "Inferred Mineral Resource" will ever be upgraded to a higher confidence category through additional exploration

drilling and technical evaluation. Readers are cautioned not to assume that all or any part of an "Inferred Mineral

Resource" exists or is economically or legally mineable.

Under United States standards, mineralization may not be classified

as a "Reserve" unless the determination has been made that the mineralization could be economically and legally produced

or extracted at the time the reserve estimation is made. Readers are cautioned not to assume that all or any part of the

measured or indicated mineral resources will ever be converted into mineral reserves. In addition, the definitions of "Proven

Mineral Reserves" and "Probable Mineral Reserves" under CIM standards differ in certain respects from the standards

of the United States Securities and Exchange Commission.

EL MORRO MINERAL RESERVES AND RESOURCES (ON A 100% BASIS)

| EL MORRO MINERAL RESERVES AND RESOURCES SUMMARY TABLE AS AT DECEMBER 31, 2014 (100% basis) |

| |

|

Metal grade |

Contained metal |

| |

Tonnes

000s |

Gold

g/t |

Silver

g/t |

Copper

% |

Gold

Koz |

Silver

Koz |

Copper

Mlbs |

| |

|

|

|

|

|

|

|

| MINERAL RESERVES |

|

|

| Proven |

321,814 |

0.56 |

- |

0.55 |

5,820 |

- |

3,877 |

| Probable |

277,240 |

0.35 |

- |

0.43 |

3,097 |

- |

2,627 |

| Total El Morro P&P |

599,054 |

0.46 |

- |

0.49 |

8,917 |

- |

6,503 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| MEASURED AND INDICATED MINERAL RESOURCE |

|

|

| Measured |

19,790 |

0.53 |

- |

0.51 |

340 |

- |

223 |

| Indicated |

72,563 |

0.38 |

- |

0.39 |

883 |

- |

630 |

| Total El Morro M&I |

92,353 |

0.41 |

- |

0.42 |

1,220 |

- |

853 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| INFERRED RESOURCE |

|

|

| El Morro - Open Pit |

564,217 |

0.16 |

- |

0.26 |

2,903 |

- |

3,233 |

| El Morro - Underground |

113,840 |

0.97 |

- |

0.78 |

3,550 |

- |

1,957 |

NOTES TO MINERAL RESERVE AND RESOURCE ESTIMATES

| 1. | New Gold's mineral reserves have been estimated in accordance with the

Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources and Mineral

Reserves adopted by CIM Council on May 10, 2014 and incorporated by reference in National Instrument 43-101 ("NI 43-101"). |

| 2. | For year-end 2014 mineral reserves for the El Morro property have been

estimated based on the following metal prices and lower cut-off criteria:

|

| Mineral Property |

Gold ($/oz) |

Silver ($/oz) |

Copper ($/lb) |

Lower Cut-off |

| El Morro |

$1,300 |

- |

$3.00 |

0.20% CuEq |

| |

|

|

|

|

| 4. | New Gold reports its Measured and Indicated mineral resources exclusive

of mineral reserves. Measured and Indicated mineral resources do not have demonstrated economic viability. Inferred mineral resources

have a greater amount of uncertainty as to their existence, economic and legal feasibility, do not have demonstrated economic viability,

and are likewise exclusive of mineral reserves. |

| 5. | For year-end 2014 mineral resources for the El Morro property have been

estimated based on the following metal prices and lower cut-off criteria: |

| Mineral Property |

Gold ($/oz) |

Silver ($/oz) |

Copper ($/lb) |

Lower Cut-off |

| El Morro |

$1,500 |

- |

$3.50 |

0.20% CuEq |

| |

|

|

|

|

| 7. | Mineral resources are classified as Measured, Indicated and Inferred

resources and are reported based on technical and economic parameters consistent with the methods most suitable for their potential

commercial exploitation. Where different mining and/or processing methods might be applied to different portions of a mineral resource,

the designators 'open pit' and 'underground' have been applied to indicate envisioned mining method. Mineral reserves and mineral

resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing and other

risks and relevant issues. Additional details regarding mineral reserve and mineral resource estimation, classification, reporting

parameters, key assumptions and associated risks for the El Morro property are provided in the NI 43-101 Technical Report for the

El Morro Project, Region III, Chile, dated March 26, 2012 which is available under New Gold's profile at www.sedar.com. |

| 8. | The preparation of the mineral reserve and mineral resource estimates

for the El Morro property has been done by Qualified Persons as defined under NI 43-101, under the oversight and review of Mr.

Mark A. Petersen, a Qualified Person under NI 43-101. |

SOURCE New Gold Inc.

%CIK: 0000800166

For further information: Hannes Portmann, Vice President,

Corporate Development, Direct: +1 (416) 324-6014, Email: info@newgold.com

CO: New Gold Inc.

CNW 07:58e 27-AUG-15

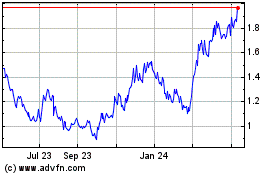

New Gold (AMEX:NGD)

Historical Stock Chart

From Aug 2024 to Sep 2024

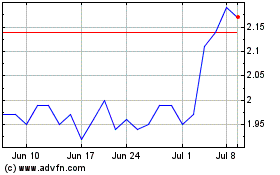

New Gold (AMEX:NGD)

Historical Stock Chart

From Sep 2023 to Sep 2024