UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 17, 2015

MGT

Capital Investments, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-32698 |

|

13-4148725 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

500

Mamaroneck Avenue, Suite 204, Harrison, NY 10528

(Address of principal executive offices,

including zip code)

(914) 630-7431

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results

of Operations and Financial Condition. |

On August 17, 2015, MGT Capital Investments,

Inc. (the “Company”) issued a press release relating to its financial and operational results for the fiscal

quarter ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information contained in this Current

Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as

amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing. The furnishing of the information in this Current Report on Form 8-K is not intended to, and does not, constitute

a representation that such furnishing is required by Regulation FD or that the information contained in this Current Report on

Form 8-K constitutes material investor information that is not otherwise publicly available.

The Securities and Exchange Commission

encourages registrants to disclose forward-looking information so that investors can better understand the future prospects of

a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain these types of statements,

which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

and which involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current Report on Form

8-K. Forward-looking statements may relate to, among other things, operating results and are indicated by words or phrases such

as “expects,” “should,” “will,” and similar words or phrases. These statements are subject

to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of

this Current Report on Form 8-K. The Company disclaims any obligation to, and will not, update any forward-looking statements to

reflect events or circumstances after the date hereof. Investors are cautioned not to rely unduly on forward-looking statements

when evaluating the information presented within.

| Item 9.01. | Financial

Statements and Exhibits. |

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated August 17, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: August 17, 2015

| |

MGT Capital Investments, Inc. |

| |

|

| |

|

| |

By: |

/s/ Robert B. Ladd |

| |

Name:

Title: |

Robert B. Ladd

President and Chief Executive Officer |

Exhibit 99.1

MGT Capital Reports Financial Results

for the Second Quarter ending June 30, 2015

HARRISON, NY (August 17, 2015) MGT Capital Investments, Inc. (NYSE MKT: MGT) today reported financial and operational

results for the three and six-month periods ended June 30, 2015.

Financial

and Operational Results

For

the three months ended June 30, 2015, revenues from our fantasy sports business were $249,000, up 15% from the $217,000 recorded

in the first quarter of this year. Second quarter 2015 revenues were down 12% from the same quarter in 2014, as the Company adopted

a strategy to reduce overlay in its guaranteed contests. As a result, the gross margin from gaming operations was $153,000 (61%

of revenue), up 32% as compared to $116,000 (41% of revenue) for the same period last year, and up 20% sequentially from the first

quarter 2015 gross margin of $127,000 (58% of revenue).

Total

operating expenses for the second quarter 2015 were down 39% year over year, and down over 30% sequentially from the first quarter

of this year. Operating loss improved to ($855,000) in the second quarter of 2015, compared to ($1.5 million) in the year ago second

quarter, and ($1.3 million) in this year’s first quarter.

For

the six months, ended June 30, 2015, gaming revenues were up 43%, and gross margin from gaming was up 157%, with the six month

gross margin improving to 60% of revenue, as compared to 34% of revenue for the same period last year.

Management Commentary and Outlook

As

reported on Forms 8–K, filed with the Securities and Exchange Commission on June 12, 2015, July 6, 2015 and July 20, 2015,

the Company has entered into an Asset Purchase Agreement (as amended) for the sale of its fantasy sports assets to a group managed

by Sportech PLC. Under the terms of the Agreement, at closing, the Company will receive over $4.3 million in cash plus a 10% residual

equity ownership in the buyer. The necessary fundraising for the deal is being led by Macquarie Capital Markets Canada Ltd., although

there can be no assurance that Macquarie will be successful prior to the expected closing date on or before August 31, 2015.

About MGT Capital Investments, Inc.

MGT Capital and its subsidiaries operate

social and real money gaming sites online and in the mobile space, including ownership of the 3rd largest daily fantasy sports

wagering platform, DraftDay.com. The Company also offers games of skill through MGTplay.com

and social casino games with SlotChamp™. MGT also launched Daily Fantasy Legend in partnership with Facebook to become

the first daily fantasy sports platform on social media. In addition, the Company owns intellectual property relating to

slot machines and has asserted its claims via patent infringement lawsuits.

Forward-looking Statements

This press release contains forward-looking

statements. The words or phrases “would be,” “will allow,” “intends to,” “will likely result,”

“are expected to,” “will continue,” “is anticipated,” “estimate,” “project,”

or similar expressions are intended to identify “forward-looking statements.” MGT’s financial and operational results

reflected above should not be construed by any means as representative of the current or future value of its common stock. All

information set forth in this news release, except historical and factual information, represents forward-looking statements. This

includes all statements about the Company’s plans, beliefs, estimates and expectations. These statements are based on current estimates

and projections, which involve certain risks and uncertainties that could cause actual results to differ materially from those

in the forward-looking statements. These risks and uncertainties include issues related to: rapidly changing technology and evolving

standards in the industries in which the Company and its subsidiaries operate; the ability to obtain sufficient funding to continue

operations, maintain adequate cash flow, profitably exploit new business, license and sign new agreements; the unpredictable nature

of consumer preferences; and other factors set forth in the Company’s most recently filed annual report and registration statement.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only

as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events

or circumstances that arise after the date hereof. Readers should carefully review the risks and uncertainties described in other

documents that the Company files from time to time with the U.S. Securities and Exchange Commission.

Company Contact

MGT Capital Investments, Inc.

Robert Traversa, Chief Financial Officer

rtraversa@mgtci.com

914-630-7431

MGT CAPITAL INVESTMENTS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per–share amounts)

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,097 | | |

$ | 1,455 | |

| Accounts receivable | |

| 12 | | |

| 5 | |

| Prepaid expenses and other current assets | |

| 123 | | |

| 172 | |

| Note receivable | |

| 251 | | |

| – | |

| Total current assets | |

| 1,483 | | |

| 1,632 | |

| | |

| | | |

| | |

| Non–current assets | |

| | | |

| | |

| Restricted cash | |

| 39 | | |

| 138 | |

| Property and equipment, at cost, net | |

| 26 | | |

| 43 | |

| Intangible assets, net | |

| 2,117 | | |

| 2,417 | |

| Goodwill | |

| 6,444 | | |

| 6,444 | |

| Other non–current assets | |

| – | | |

| 2 | |

| Total assets | |

$ | 10,109 | | |

$ | 10,676 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 324 | | |

$ | 245 | |

| Accrued expenses | |

| 152 | | |

| 180 | |

| Player deposit liability | |

| 742 | | |

| 952 | |

| Other payables | |

| 2 | | |

| 2 | |

| Total current liabilities | |

| 1,220 | | |

| 1,379 | |

| | |

| | | |

| | |

| Total liabilities | |

| 1,220 | | |

| 1,379 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| Redeemable convertible preferred stock – Temporary equity | |

| | | |

| | |

| Preferred stock, series A convertible preferred, $0.001 par value; 1,416,160 and 1,416,160 shares authorized at June 31, 2015 and December 31, 2014, respectively; 10,296 and 9,993 shares issued and outstanding at June 31, 2015 and December 31, 2014, respectively | |

| – | | |

| – | |

| Stockholders' equity | |

| | | |

| | |

| Undesignated preferred stock, $0.001 par value; 8,583,840 and 8,583,840 shares authorized at June 31, 2015 and December 31, 2014, respectively. No shares authorized, issued and outstanding at March 31, 2015 and December 31, 2014 respectively | |

| – | | |

| – | |

| Common Stock, $0.001 par value; 75,000,000 shares authorized; 14,116,999 and 10,731,160 shares issued and outstanding at June 31, 2015 and December 31, 2014, respectively | |

| 14 | | |

| 11 | |

| Additional paid–in capital | |

| 310,108 | | |

| 308,288 | |

| Accumulated other comprehensive loss | |

| (281 | ) | |

| (281 | ) |

| Accumulated deficit | |

| (301,285 | ) | |

| (299,163 | ) |

| Total stockholders' equity | |

| 8,556 | | |

| 8,855 | |

| Non–controlling interests | |

| 333 | | |

| 442 | |

| Total equity | |

| 8,889 | | |

| 9,297 | |

| | |

| | | |

| | |

| Total stockholders' equity, liabilities and non–controlling interest | |

$ | 10,109 | | |

$ | 10,676 | |

MGT CAPITAL INVESTMENTS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except share and per-share amounts)

(Unaudited)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Licensing | |

$ | 12 | | |

$ | 37 | | |

$ | 12 | | |

$ | 80 | |

| Gaming | |

| 249 | | |

| 283 | | |

| 466 | | |

| 325 | |

| | |

| 261 | | |

| 320 | | |

| 478 | | |

| 405 | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Gaming | |

| 96 | | |

| 167 | | |

| 186 | | |

| 216 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross margin | |

| 165 | | |

| 153 | | |

| 292 | | |

| 189 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 981 | | |

| 1,536 | | |

| 2,369 | | |

| 2,800 | |

| Sales and marketing | |

| 39 | | |

| 91 | | |

| 118 | | |

| 108 | |

| Research and development | |

| – | | |

| 53 | | |

| – | | |

| 113 | |

| | |

| 1,020 | | |

| 1,680 | | |

| 2,487 | | |

| 3,021 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (855 | ) | |

| (1,527 | ) | |

| (2,195 | ) | |

| (2,832 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other non–operating (expense) / income | |

| | | |

| | | |

| | | |

| | |

| Interest and other income | |

| 5 | | |

| 2 | | |

| (36 | ) | |

| 5 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before income taxes and non–controlling interest | |

| (850 | ) | |

| (1,525 | ) | |

| (2,231 | ) | |

| (2,827 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax (expense) / benefit | |

| – | | |

| 1 | | |

| – | | |

| 11 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before non–controlling interest | |

$ | (850 | ) | |

$ | (1,524 | ) | |

| (2,231 | ) | |

| (2,816 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to non–controlling interest | |

| (1 | ) | |

| 133 | | |

| 109 | | |

| 303 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to MGT Capital Investments, Inc. | |

$ | (851 | ) | |

$ | (1,391 | ) | |

$ | (2,122 | ) | |

$ | (2,513 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Per–share data: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share | |

$ | (0.06 | ) | |

$ | (0.15 | ) | |

$ | (0.17 | ) | |

$ | (0.28 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| 13,578,181 | | |

| 9,057,867 | | |

| 12,373,621 | | |

| 8,921,935 | |

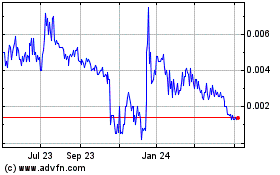

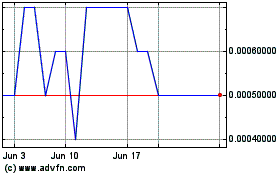

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024