UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 13, 2015

DOCUMENT SECURITY SYSTEMS, INC.

(Exact name of registrant as specified

in its charter)

| New York |

|

001-32146 |

|

16-1229730 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

First Federal Plaza, Suite 1525

28 East Main Street

Rochester, NY |

|

14614 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (585) 325-3610

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition |

On August 13, 2015,

Document Security Systems, Inc. (“Company”) issued a press release disclosing the Company’s unaudited financial

results for the second quarter ended June 30, 2015. A copy of the Company’s press release is attached as Exhibit 99.1 to

this Current Report on Form 8-K.

The information in

this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

| Item 9.01 | Financial Statements and Exhibits |

| Exhibit No. |

Description |

| |

|

| 99.1 |

Document Security Systems, Inc. Press Release dated August 13, 2015. |

| |

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

|

|

|

| |

|

DOCUMENT SECURITY SYSTEMS, INC. |

| |

|

|

| Dated: August 13, 2015 |

|

By: |

|

/s/ Jeffrey Ronaldi |

| |

|

|

|

|

| |

|

|

|

Jeffrey Ronaldi |

| |

|

|

|

Chief Executive Officer |

Exhibit 99.1.

Document Security Systems Reports Second

Quarter of 2015

Financial Results

ROCHESTER, NY—August 13, 2015

— Document Security Systems, Inc. (NYSE MKT: DSS), (DSS), a leader in anti-counterfeiting and authentication solutions,

reported results for the second quarter ended June 30, 2015.

Q2 2015 Financial Highlights

Revenue for the second quarter of 2015

decreased 14% to $4.2 million from $4.9 million in the same year-ago quarter. During the quarter, printed products revenue decreased

16% while technology sales, services and licensing increased 8%. Sales of ID cards with technology (including RFID, smart cards,

and prox cards) increased 34% from the second quarter of 2014 which partially offset significant declines in commercial offset

printing revenue during the quarter. Licensing revenue increased 80% as the result of licenses granted during the quarter from

settlements reached during the quarter of certain of the Company’s litigation.

Costs and expenses totaled $5.3 million,

a decrease of 25% from $7.1 million from the second quarter of 2014. The decrease reflected cost decreases in nearly every expense

category. Direct costs of goods sold, excluding depreciation and amortization, decreased to 63.5% of sales from 65.5% of sales

in the second quarter of 2014. In addition, depreciation and amortization costs decreased approximately $897,000 or 70% due to

a significant reduction in the carrying-value of the Company’s IP assets in 2015 as compared to 2014.

Net loss totaled $1.0 million or

$(0.02) per basic and diluted share, as compared to net loss of $2.3 million or ($0.06) per basic and diluted share in the second

quarter of 2014. The 56% decrease in net loss was the result of the improvement in results due to the reductions in costs of nearly

every expense category that more than offset the decrease in revenue incurred during the quarter.

Adjusted EBITDA loss, a non-GAAP

metric defined as earnings before interest, taxes, depreciation, amortization, and stock-based compensation, and other non-recurring

items, totaled $238,000 compared to an adjusted EBITDA loss of $633,000 in the second quarter of 2014 (see further discussion about

the use of adjusted EBITDA, below). The improvement reflected the benefit of the cost reductions made by the Company that significantly

reduced corporate costs and the licenses granted by the Company’s Technology Management division during the quarter.

As of June 30, 2015, the Company had cash and restricted cash

of approximately $1.3 million.

Management Commentary

With respect to the Company’s most

recent fiscal quarter, CEO Jeff Ronaldi stated “During the quarter we continued to solidify the financial footing of our

core operating businesses, by reviewing costs and product lines to ensure that we maximize the return on our resources in those

areas. While this has resulted in an improvement in financial performance, we were hoping to maintain revenue growth during the

quarter and first half of the year. While this has not happened primarily due to significant reductions in commercial printing,

we believe that some of our revenue miss is due to timing of orders from certain of our customers which should materialize in the

second half of the year. In addition, we are pleased with the product sales mix as we replace lost commercial printing sales with

higher value products sales. In regards to our AuthentiGuard sales efforts, while we continue to seek an impactful customer order

for that product, we are pleased to have received a smaller AuthentiGuard order during the quarter for usage of the product on

high value plastic cards. The order was for the development of a customized application for the customer along with an annual license

component. Finally, we reached license agreements to settle litigation with certain defendants of our IP litigation cases during

the quarter which we feel point to the strength of the patents in our portfolio.

About Document Security Systems

Document Security

Systems, Inc.’s (NYSE MKT: DSS) products and solutions are used by governments, corporations and financial institutions to

defeat fraud and to protect brands and digital information from the expanding world-wide counterfeiting problem. DSS technologies

help verify the authenticity of both digital and physical financial instruments, identification documents, sensitive publications,

brand packaging and websites. DSS continually invests in research and development to meet the ever-changing security needs of its

clients and offers licensing of its patented technologies through its subsidiary, DSS Technology Management, Inc.

For more information on the AuthentiGuard

Suite, please visit www.authentiguard.com. For more information on DSS and its subsidiaries,

please visit www.DSSsecure.com. To follow DSS on Facebook, click here.

For More Information

Investor Relations

Document Security Systems

(585) 325-3610

Email: ir@documentsecurity.com

Forward-Looking Statements

Forward-looking statements that may be

contained in this press release, including, without limitation, statements related to the Company’s plans, strategies, objectives,

expectations, potential value, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act and contain words such as “believes,” “anticipates,” “expects,”

“plans,” “intends” and similar words and phrases. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ materially from the results projected in any forward-looking statement.

In addition to the factors specifically noted in the forward-looking statements, other important factors, risks and uncertainties

that could result in those differences include, but are not limited to, those disclosed in the “Risk Factors” section

of the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, our Quarterly Report on Form 10-Q for the

quarter ended March 31, 2015, and updated in our Form 10-Q filed today with the Securities and Exchange Commission. Forward-looking

statements that may be contained in this press release are being made as of the date of its release, and the Company assumes no

obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected

in the forward-looking statements.

FINANCIAL TABLES FOLLOW

DOCUMENT SECURITY SYSTEMS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited)

| |

| | |

Three Months Ended June 30, 2015 | | |

Three Months Ended June 30, 2014 | | |

% change | | |

Six Months Ended June 30,

2015 | | |

Six Months Ended June 30,

2014 | | |

%

change | |

| Revenue | |

| | |

| | |

| | |

| | |

| | |

| |

| Printed products | |

$ | 3,683,000 | | |

$ | 4,407,000 | | |

| -16 | % | |

$ | 6,703,000 | | |

$ | 7,571,000 | | |

| -11 | % |

| Technology sales, services and licensing | |

| 513,000 | | |

| 476,000 | | |

| 8 | % | |

| 922,000 | | |

| 940,000 | | |

| -2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

$ | 4,196,000 | | |

$ | 4,883,000 | | |

| -14 | % | |

$ | 7,625,000 | | |

$ | 8,511,000 | | |

| -10 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold, exclusive of depreciation and amortization | |

$ | 2,663,000 | | |

$ | 3,197,000 | | |

| -17 | % | |

$ | 4,650,000 | | |

$ | 5,395,000 | | |

| -14 | % |

| Sales, general and administrative compensation | |

| 1,007,000 | | |

| 1,154,000 | | |

| -13 | % | |

| 2,013,000 | | |

| 2,446,000 | | |

| -18 | % |

| Depreciation and amortization | |

| 391,000 | | |

| 1,288,000 | | |

| -70 | % | |

| 770,000 | | |

| 2,602,000 | | |

| -70 | % |

| Professional fees | |

| 307,000 | | |

| 502,000 | | |

| -39 | % | |

| 1,026,000 | | |

| 1,042,000 | | |

| -2 | % |

| Stock based compensation | |

| 318,000 | | |

| 294,000 | | |

| 8 | % | |

| 643,000 | | |

| 841,000 | | |

| -24 | % |

| Sales and marketing | |

| 90,000 | | |

| 128,000 | | |

| -30 | % | |

| 193,000 | | |

| 301,000 | | |

| -36 | % |

| Rent and utilities | |

| 165,000 | | |

| 181,000 | | |

| -9 | % | |

| 324,000 | | |

| 366,000 | | |

| -11 | % |

| Other operating expenses | |

| 233,000 | | |

| 242,000 | | |

| -4 | % | |

| 413,000 | | |

| 465,000 | | |

| -11 | % |

| Research and development | |

| 117,000 | | |

| 112,000 | | |

| 4 | % | |

| 233,000 | | |

| 226,000 | | |

| 3 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total costs and expenses | |

$ | 5,291,000 | | |

$ | 7,098,000 | | |

| -25 | % | |

$ | 10,265,000 | | |

$ | 13,684,000 | | |

| -25 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (1,095,000 | ) | |

| (2,215,000 | ) | |

| -51 | % | |

| (2,640,000 | ) | |

| (5,173,000 | ) | |

| -49 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

$ | (90,000 | ) | |

$ | (89,000 | ) | |

| 1 | % | |

$ | (169,000 | ) | |

$ | (164,000 | ) | |

| 3 | % |

| Gains on sales of investment and equipment | |

| 146,000 | | |

| - | | |

| 100 | % | |

| 146,000 | | |

| - | | |

| 100 | % |

| Net loss on debt modification and extinguishment | |

| - | | |

| (35,000 | ) | |

| -100 | % | |

| (19,000 | ) | |

| (52,000 | ) | |

| -63 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other expense | |

$ | 56,000 | | |

$ | (124,000 | ) | |

| -145 | % | |

$ | (42,000 | ) | |

$ | (216,000 | ) | |

| -81 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (1,039,000 | ) | |

| (2,339,000 | ) | |

| -56 | % | |

| (2,682,000 | ) | |

| (5,389,000 | ) | |

| -50 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 5,000 | | |

| 5,000 | | |

| 0 | % | |

| 9,000 | | |

| 9,000 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (1,043,000 | ) | |

| (2,344,000 | ) | |

| -56 | % | |

| (2,690,000 | ) | |

| (5,399,000 | ) | |

| -50 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.02 | ) | |

$ | (0.06 | ) | |

| -67 | % | |

$ | (0.06 | ) | |

$ | (0.13 | ) | |

| -54 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares used in computing loss per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 46,302,404 | | |

| 42,040,907 | | |

| 10 | % | |

| 46,271,078 | | |

| 41,982,770 | | |

| 10 | % |

DOCUMENT SECURITY SYSTEMS, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

As of

| |

June 30, 2015 | | |

December 31, 2014 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | |

| |

| Current assets: | |

| |

| Cash | |

$ | 1,014,857 | | |

$ | 2,343,675 | |

| Restricted cash | |

| 306,215 | | |

| 355,793 | |

| Accounts receivable, net | |

| 1,667,531 | | |

| 2,097,671 | |

| Inventory | |

| 1,120,417 | | |

| 869,262 | |

| Prepaid expenses and other current assets | |

| 426,081 | | |

| 425,671 | |

| Deferred tax asset, net | |

| 2,499 | | |

| 2,499 | |

| Total current assets | |

| 4,537,600 | | |

| 6,094,571 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 5,295,495 | | |

| 5,016,539 | |

| Investments and other assets, net | |

| 626,337 | | |

| 686,912 | |

| Goodwill | |

| 12,046,197 | | |

| 12,046,197 | |

| Other intangible assets, net | |

| 3,445,040 | | |

| 3,908,399 | |

| | |

| | | |

| | |

| Total assets | |

$ | 25,950,669 | | |

$ | 27,752,618 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,624,519 | | |

$ | 1,037,359 | |

| Accrued expenses and other current liabilities | |

| 1,452,965 | | |

| 1,997,241 | |

| Current portion of long-term debt, net | |

| 1,555,222 | | |

| 754,745 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 4,632,706 | | |

| 3,789,345 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 6,791,564 | | |

| 7,439,036 | |

| Other long-term liabilities | |

| 517,621 | | |

| 520,180 | |

| Deferred tax liability, net | |

| 157,732 | | |

| 148,258 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Common stock, $.02 par value; 200,000,000 shares authorized, 46,302,404 shares issued and outstanding | |

| | | |

| | |

| (46,172,404 on December 31, 2014) | |

| 926,048 | | |

| 923,448 | |

| Additional paid-in capital | |

| 101,692,748 | | |

| 101,012,659 | |

| Accumulated other comprehensive loss | |

| (58,621 | ) | |

| (61,180 | ) |

| Accumulated deficit | |

| (88,709,129 | ) | |

| (86,019,128 | ) |

| Total stockholders' equity | |

| 13,851,046 | | |

| 15,855,799 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 25,950,669 | | |

$ | 27,752,618 | |

DOCUMENT SECURITY SYSTEMS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

For the Six Months Ended June 30,

(unaudited)

| | |

| | |

| |

| | |

2015 | | |

2014 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (2,690,001 | ) | |

$ | (5,398,680 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 770,126 | | |

| 2,601,684 | |

| Stock based compensation | |

| 643,138 | | |

| 840,879 | |

| Paid in-kind interest | |

| 44,000 | | |

| - | |

| Gain on sale of equipment | |

| (46,283 | ) | |

| - | |

| Net loss on debt modification and extinguishment | |

| 19,096 | | |

| 51,915 | |

| Change in deferred tax provision | |

| 9,474 | | |

| 9,474 | |

| Foreign currency translation (gain) loss | |

| (29,400 | ) | |

| 16,420 | |

| Decrease (increase) in assets: | |

| | | |

| | |

| Accounts receivable | |

| 430,140 | | |

| 359,137 | |

| Inventory | |

| (251,155 | ) | |

| (84,680 | ) |

| Prepaid expenses and other assets | |

| 60,165 | | |

| (174,616 | ) |

| Restricted cash | |

| 49,578 | | |

| 254,521 | |

| Increase (decrease) in liabilities: | |

| | | |

| | |

| Accounts payable | |

| 587,160 | | |

| 33,081 | |

| Accrued expenses and other liabilities | |

| (523,629 | ) | |

| 387,188 | |

| Net cash used by operating activities | |

| (927,591 | ) | |

| (1,103,677 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (57,486 | ) | |

| (157,789 | ) |

| Sale of equipment | |

| 46,283 | | |

| - | |

| Purchase of investments | |

| - | | |

| (750,000 | ) |

| Purchase of intangible assets | |

| (3,237 | ) | |

| (1,196,980 | ) |

| Net cash used by investing activities | |

| (14,440 | ) | |

| (2,104,769 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Net payments on revolving lines of credit | |

| - | | |

| (158,087 | ) |

| Payments of long-term debt | |

| (386,787 | ) | |

| (298,816 | ) |

| Borrowings of long-term debt | |

| - | | |

| 2,691,000 | |

| Issuances of common stock, net of issuance costs | |

| - | | |

| 301,974 | |

| Net cash (used) provided by financing activities | |

| (386,787 | ) | |

| 2,536,071 | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (1,328,818 | ) | |

| (672,375 | ) |

| Cash beginning of period | |

| 2,343,675 | | |

| 1,977,031 | |

| | |

| | | |

| | |

| Cash end of period | |

$ | 1,014,857 | | |

$ | 1,304,656 | |

About the Presentation of Adjusted

EBITDA

The Company uses Adjusted EBITDA as a non-GAAP financial performance

measurement. Adjusted EBITDA is calculated by the Company by adding back to net income (loss) interest, income taxes, depreciation

and amortization expense as further adjusted to add back stock-based compensation expense and non-recurring items. Adjusted EBITDA

is provided to investors to supplement the results of operations reported in accordance with GAAP. Management believes that Adjusted

EBITDA provides an additional tool for investors to use in comparing its financial results with other companies in the industry,

many of which also use Adjusted EBITDA in their communications to investors. By excluding non-cash charges such as amortization,

depreciation and stock-based compensation, as well as non-operating charges for interest and income taxes, investors can evaluate

the Company's operations and its ability to generate cash flows from operations and can compare its results on a more consistent

basis to the results of other companies in the industry. Management also uses Adjusted EBITDA to evaluate potential acquisitions,

establish internal budgets and goals, and evaluate performance of its business units and management. The Company considers Adjusted

EBITDA to be an important indicator of the Company's operational strength and performance of its business and a useful measure

of the Company's historical and prospective operating trends. However, there are significant limitations to the use of Adjusted

EBITDA since it excludes interest income and expense and income taxes and non-recurring items, all of which impact the Company's

profitability and operating cash flows, as well as depreciation, amortization and stock-based compensation. The Company believes

that these limitations are compensated by clearly identifying the difference between the two measures. Consequently, Adjusted EBITDA

should not be considered in isolation or as a substitute for net income and loss presented in accordance with GAAP. Adjusted EBITDA

as defined by the Company may not be comparable with similarly named measures provided by other entities. The following is a reconciliation

of net loss to Adjusted EBITDA loss:

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2015 | | |

2014 | | |

% change | | |

2015 | | |

2014 | | |

% change | |

| | |

(unaudited) | | |

(unaudited) | | |

| | |

(unaudited) | | |

(unaudited) | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Loss: | |

$ | (1,043,000 | ) | |

$ | (2,344,000 | ) | |

| -56 | % | |

$ | (2,690,000 | ) | |

$ | (5,399,000 | ) | |

| -50 | % |

| Add backs: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation & amortization | |

| 391,000 | | |

| 1,288,000 | | |

| -70 | % | |

| 770,000 | | |

| 2,602,000 | | |

| -70 | % |

| Stock based compensation | |

| 318,000 | | |

| 294,000 | | |

| 8 | % | |

| 643,000 | | |

| 841,000 | | |

| -24 | % |

| Interest expense | |

| 90,000 | | |

| 89,000 | | |

| 1 | % | |

| 169,000 | | |

| 164,000 | | |

| 3 | % |

| Amortization of note discount and net loss on debt extinguishment and modification | |

| - | | |

| 35,000 | | |

| 0 | % | |

| 19,000 | | |

| 52,000 | | |

| -63 | % |

| Income Taxes | |

| 5,000 | | |

| 5,000 | | |

| 0 | % | |

| 9,000 | | |

| 9,000 | | |

| 0 | % |

| Foreign currency translation (gain) loss | |

| - | | |

| - | | |

| 0 | % | |

| (29,000 | ) | |

| - | | |

| 100 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

| (239,000 | ) | |

| (633,000 | ) | |

| 62 | % | |

| (1,109,000 | ) | |

| (1,731,000 | ) | |

| 36 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA, by group (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Printed Products | |

$ | 339,000 | | |

$ | 469,000 | | |

| -28 | % | |

$ | 687,000 | | |

$ | 752,000 | | |

| -9 | % |

| Technology Management | |

| (97,000 | ) | |

| (386,000 | ) | |

| -75 | % | |

| (883,000 | ) | |

| (854,000 | ) | |

| 3 | % |

| Corporate | |

| (481,000 | ) | |

| (716,000 | ) | |

| -33 | % | |

| (913,000 | ) | |

| (1,629,000 | ) | |

| -44 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| (239,000 | ) | |

| (633,000 | ) | |

| 62 | % | |

| (1,109,000 | ) | |

| (1,731,000 | ) | |

| 36 | % |

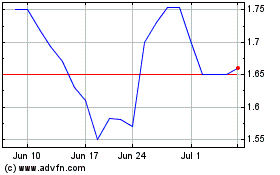

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024