UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

August 6, 2015

|

StemCells, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

000-19871

|

94-3078125

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

7707 Gateway Blvd, Suite 140, Newark, California

|

|

94560

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

510.456.4000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2015, StemCells, Inc. (the "Company") issued a press release announcing its financial results for the three months ended June 30, 2015. A copy of this press release is attached hereto as Exhibit 99.1.

StemCells will host a live conference call and webcast today, August 6, at 4:30 PM Eastern Time (1:30 PM Pacific Time) to discuss its financial results, recent business activities and clinical progress. Interested parties are invited to listen to the call over the Internet at: http://edge.media-server.com/m/p/78ib94kx. An archived version of the webcast will be available for replay beginning approximately two hours following the conclusion of the live call and continuing for a period of 30 days on the Company's website at http://investor.stemcellsinc.com/.

The information set forth in Items 2.02 and 9.01 of this current report Form 8-K, including the attached exhibit, is being furnished to the SEC and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended ("Exchange Act"), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press Release, dated August 6, 2015, announcing the Company's financial results for the three months ended June 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

StemCells, Inc.

|

|

|

|

|

|

|

|

August 6, 2015

|

|

By:

|

|

/s/ Kenneth Stratton

|

|

|

|

|

|

|

|

|

|

|

|

Name: Kenneth Stratton

|

|

|

|

|

|

Title: General Counsel

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated August 6, 2015

|

StemCells, Inc. Reports Second Quarter 2015 Financial Results,

Business Update and Clinical Program Highlights

Conference Call August 6, 2015, at 4:30 PM EDT (1:30 PM PDT) Including

New Information about Phase I/II AMD Trial Results

NEWARK, CA, August 6, 2015 (GLOBE NEWSWIRE) — StemCells, Inc. (NASDAQ: STEM), a world leader

in the research and development of cell-based therapeutics for the treatment of disorders of the

central nervous system, today reported its financial results for the three months ended June 30,

2015. The Company also provided a business update and clinical program highlights for the quarter.

“Our clinical programs achieved several key milestones since our last earnings release,” reported

StemCells CEO Martin McGlynn. “Based on the strength of the safety and preliminary efficacy data

from our Phase I/II clinical studies, our Phase II proof-of-concept trials are now underway in two

serious CNS disorders, each of which represents a large unmet medical need. Health Canada joined

the FDA in authorizing our Phase II clinical trial in spinal cord injury and, having completed

transplantation of the first cohort, we began enrolling the second cohort in this study. Enrollment

in our Phase II clinical trial in geographic atrophy of age-related macular degeneration also

commenced.”

Spinal Cord Injury Clinical Program: Highlights Q2 2015

With the commencement of our Phase II Pathway™ Study in cervical spinal cord injury (SCI),

StemCells, Inc. has once again made medical history: We have safely transplanted more neural stem

cells into the human spinal cord than has ever been done previously. In April 2015, we completed

transplantation of the first cohort, which was designed to confirm the cell dose to be used in the

blinded Cohort II testing. On June 4, we advanced to enrollment and transplantation of the second

cohort — the main body of the trial. On June 18, Health Canada authorized StemCells, Inc. to expand

the Pathway Study (already underway at eight sites in the United States), into Canada, which should

allow us to continue enrolling this study in a very efficient manner.

The Pathway Study will evaluate the safety and efficacy of transplanting the Company’s proprietary

HuCNS-SC® human neural stem cells into patients with traumatic injury in the cervical

region, which is where the majority of spinal cord injuries occur, resulting in loss of arm and leg

function. Conducted as a randomized, controlled, single-blind study, the primary efficacy outcome

will focus on change in motor function in the upper extremities.

May 2015 marked the one-year post-transplant anniversary for the twelve patients who participated

in our Phase I/II clinical trial in thoracic SCI, two of whom progressed during the study from the

most severe classification, AIS A, to the lesser degree of injury grade, AIS B. We presented

top-line results at the 4th Joint International Spinal Cord Society (ISCoS) and American

Spinal Injury Association (ASIA) meeting on May 14. In addition to the safety and tolerability

reported for our HuCNS-SC cells and the transplantation procedure, analysis of the 12-month data

showed sustained improvements involving multiple sensory pathways in seven patients, which

persisted through the end of the study.

| • |

|

More information about the Company’s Spinal Cord Injury Program can be found on the

StemCells, Inc. website at: http://www.stemcellsinc.com/Clinical-Programs/SCI. |

| • |

|

Additional information about the Pathway Study clinical trial is available at the U.S.

National Institutes of Health website at: http://clinicaltrials.gov/ct2/show/NCT02163876. |

Age-related Macular Degeneration Clinical Program: Highlights Q2 2015

In June, we began enrolling patients for our Phase II Radiant™ Study in geographic atrophy of

dry age-related macular degeneration (GA-AMD), and the first patient was transplanted in July.

Approximately twenty U.S. sites are expected to participate in this randomized, controlled study,

which will evaluate the safety and efficacy of our proprietary HuCNS-SC cells for the treatment of

GA-AMD, the most advanced stage of dry AMD. Designed as a “fellow eye” controlled study, all

patients must exhibit bi-lateral GA-AMD (geographic atrophy associated with age related macular

degeneration in both eyes). Patients will receive sub-retinal transplantation of HuCNS-SC cells via

a single injection into the eye with inferior best corrected visual acuity; the untreated eye will

serve as a control. The objective of the trial is to demonstrate a reduction in the rate of disease

progression in the treated eye versus the control eye.

A year has passed since we completed the first-ever transplants of neural stem cells into the human

eye with the dosing of the fifteen patients who participated in our Phase I/II clinical trial in

GA-AMD. On June 26, top-line outcomes of this study were reported at the 2015 Annual Meeting of the

International Society for Stem Cell Research (ISSCR). The data overall showed a positive safety

profile indicating tolerability of both the cells and the sub-retinal transplantation procedure, as

well as favorable preliminary data related to visual acuity, contrast sensitivity and anatomic

assessment of the retina.

| • |

|

More information about the Company’s clinical programs in AMD can be found on the

StemCells, Inc. website at: http://www.stemcellsinc.com/Clinical-Programs/AMD. |

| • |

|

Additional information about the Radiant Study clinical trial is available at the U.S.

National Institutes of Health website at: https://clinicaltrials.gov/show/NCT02467634 |

Business Update

In April 2015, the Company strengthened its balance sheet by raising net proceeds of

approximately $23.2 million through a public offering of 35,715,000 units. Each unit consisted of

one share of our common stock and a warrant to purchase three-quarters of a share of our common

stock. The warrants have an exercise price of $0.85 per share, are exercisable immediately, and

will expire five years from the date of issuance. We also granted the underwriters a thirty-day

option (the over-allotment option) to purchase up to an additional 5,357,250 shares of common stock

and/or warrants to purchase up to an additional 4,017,938 shares of common stock to cover

over-allotments, if any. The underwriters exercised the over-allotment option for the warrants and

so, in April 2015, we issued warrants to purchase up to an additional 4,017,938 shares of common

stock at $0.85 per share. In May 2015 the underwriters exercised, in part, the over-allotment

option for additional shares and purchased 2,757,250 shares of our common stock at a price

of $0.699 per share, before the underwriting discount. We received net proceeds of

approximately $1.8 million from the exercise of the over-allotment option, increasing our aggregate

net proceeds from the offering to approximately $25 million, after deducting offering expenses,

underwriting discounts and commissions.

Financial Results for the Quarter Ended June 30, 2015

Cash and cash equivalents totaled approximately $29.9 million at June 30, 2015, compared to

approximately $14.1 million at March 31, 2015. The increase was primarily due to our raising

approximately $25 million of net proceeds from an equity financing, offset by cash used in our

operations.

Total revenue from continuing operations during the second quarter of 2015 was $30,000, compared to

$23,000 in the same period of 2014. Revenue from continuing operations is primarily from royalties

received under various licensing agreements.

For the second quarter of 2015, cash used in operations totaled $7,577,000, compared to $7,770,000

in the second quarter of 2014.

Total operating expenses in the second quarter of 2015 were $9,303,000, compared to $7,983,000 in

the second quarter of 2014. The increased operating expenses were primarily attributable to an

increase in expenses to support our clinical activities.

Other income, net in the second quarter of 2015 was $811,000, compared to other expense, net of

$4,011,000 in the second quarter of 2014. The change in the second quarter of 2015 when compared to

the similar quarter in 2014 is primarily attributable to changes in the estimated fair value of our

warrant liability.

For the second quarter of 2015, the Company reported a net loss of $8,462,000 or $(0.09) per share.

In comparison, for the second quarter of 2014, the Company reported a net loss of $12,115,000 or

$(0.22) per share.

Excluding certain non-cash charges associated with stock based compensation, depreciation and

amortization and changes in the fair value of our warrant liability, for the second quarter of

2015, the Company reported a non-GAAP net loss of $7,823,000 or $(0.08) per share. In comparison,

for the second quarter of 2014, the Company reported a non-GAAP net loss of $7,611,000 or $(0.14)

per share. The approximately $200,000 increase is primarily associated with increased levels of

clinical activity and process development. Management believes that these non-GAAP financial

measures provide important insight into our operational results.

Conference Call

StemCells will host a live conference call and webcast on Thursday, August 6, 2015, at 4:30 PM

Eastern Time (1:30 PM Pacific Time) to discuss our financial results, recent business activities

and clinical progress. Interested parties are invited to listen to the call over the Internet at:

http://edge.media-server.com/m/p/78ib94kx.

An archived version of the webcast will be available for replay beginning approximately two

hours following the conclusion of the live call and continuing for a period of 30 days at

http://investor.stemcellsinc.com/.

About StemCells, Inc.

StemCells, Inc. is currently engaged in clinical development of its HuCNS-SC®

platform technology (purified human neural stem cells) as a potential treatment for both

neurological and retinal disorders. Top-line data from the Company’s Phase I/II clinical trial in

thoracic spinal cord injury (SCI) showed measurable gains involving multiple sensory modalities and

segments, including the conversion of two of seven patients enrolled in the study with complete

injuries to incomplete injuries, post-transplant. The Company’s Pathway™ Study, a Phase II

proof-of-concept trial in cervical SCI is actively enrolling at eight sites and interim data from

the first cohort of six patients is anticipated to be forthcoming in Q4 2015. StemCells, Inc. has

also completed its Phase I/II clinical trial in GA-AMD. Top-line results from this study show a

positive safety profile and favorable preliminary efficacy data related to visual acuity and

contrast sensitivity. The Company’s Radiant™ Study, a Phase II proof-of-concept trial in GA-AMD is

now enrolling at the first of approximately twenty U.S. sites expected to participate. In a Phase I

clinical trial in Pelizaeus-Merzbacher disease (PMD), a fatal myelination disorder in children, the

Company showed preliminary evidence of progressive and durable donor-derived myelination by MRI.

Further information about StemCells, Inc. is available at http://www.stemcellsinc.com.

Apart from statements of historical fact, the text of this press release constitutes

forward-looking statements within the meaning of the U.S. securities laws, and is subject to the

safe harbors created therein. These statements include, but are not limited to, statements

regarding the future business operations of StemCells, Inc. (the “Company”); the timing and

prospects associated with detecting potential clinical benefit from the use of the Company’s

HuCNS-SC cells and the prospect for continued clinical development of the Company’s HuCNS-SC cells

in CNS disorders. These forward-looking statements speak only as of the date of this news release.

The Company does not undertake to update any of these forward-looking statements to reflect events

or circumstances that occur after the date hereof. Such statements reflect management’s current

views and are based on certain assumptions that may or may not ultimately prove valid. The

Company’s actual results may vary materially from those contemplated in such forward-looking

statements due to risks and uncertainties to which the Company is subject, including uncertainties

with respect to the fact that additional trials will be required to confirm the safety and

demonstrate the efficacy of the Company’s HuCNS-SC cells for the treatment of spinal cord injury,

AMD, PMD, or any other condition; uncertainties about whether preliminary data in any Phase I

clinical study will prove to be reproducible or biologically meaningful in any future clinical

study; risks whether the FDA or other applicable regulatory agencies will permit the Company to

continue clinical testing or conduct future clinical trials; uncertainties about the design of

future clinical trials and whether the Company will receive the necessary support of a clinical

trial site and its institutional review board to pursue future clinical trials; uncertainties

regarding the Company’s ability to obtain the increased capital resources needed to continue its

current and planned research and development operations; uncertainty as to whether HuCNS-SC cells

and any products that may be generated in the future in the Company’s cell-based programs will

prove safe and clinically effective and not cause tumors or other adverse side effects;

uncertainties regarding whether results in preclinical research in animals will be indicative of

future clinical results in humans; uncertainties regarding the Company’s manufacturing capabilities

given its increasing preclinical and clinical commitments; uncertainties regarding the validity and

enforceability of the Company’s patents; uncertainties as to whether the Company will become

profitable; and other factors that are described under the heading “Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent reports on

Forms 10-Q and 8-K.

| |

|

|

CONTACT:

|

|

|

Greg Schiffman, Chief Financial Officer

StemCells, Inc.

(510) 456-4128

|

|

Lena Evans

Russo Partners

(212) 845-4262 |

— more —

1

StemCells, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30 |

|

June 30 |

| |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from licensing agreements |

|

$ |

30 |

|

|

$ |

23 |

|

|

$ |

51 |

|

|

$ |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

7,240 |

|

|

|

5,839 |

|

|

|

13,531 |

|

|

|

10,469 |

|

General and administrative |

|

|

2,063 |

|

|

|

2,144 |

|

|

|

4,753 |

|

|

|

4,380 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

9,303 |

|

|

|

7,983 |

|

|

|

18,284 |

|

|

|

14,849 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(9,273 |

) |

|

|

(7,960 |

) |

|

|

(18,233 |

) |

|

|

(14,802 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of warrant liability |

|

|

988 |

|

|

|

(3,654 |

) |

|

|

641 |

|

|

|

(3,981 |

) |

Interest expense, net |

|

|

(144 |

) |

|

|

(342 |

) |

|

|

(328 |

) |

|

|

(719 |

) |

Other income (expense), net |

|

|

(33 |

) |

|

|

(15 |

) |

|

|

108 |

|

|

|

(31 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense), net |

|

|

811 |

|

|

|

(4,011 |

) |

|

|

421 |

|

|

|

(4,731 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

|

(8,462 |

) |

|

|

(11,971 |

) |

|

|

(17,812 |

) |

|

|

(19,533 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations |

|

|

— |

|

|

|

(144 |

) |

|

|

— |

|

|

|

(202 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations |

|

|

— |

|

|

|

(144 |

) |

|

|

— |

|

|

|

(202 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,462 |

) |

|

$ |

(12,115 |

) |

|

$ |

(17,812 |

) |

|

$ |

(19,735 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

$ |

(0.09 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.36 |

) |

Net loss from discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

$ |

(0.09 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.36 |

) |

Shares used to compute basic and diluted |

|

|

95,190,823 |

|

|

|

55,711,717 |

|

|

|

82,277,137 |

|

|

|

55,529,818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

StemCells, Inc.

Unaudited Condensed Consolidated Balance Sheets

(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2015 |

|

|

|

|

|

December 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

(unaudited) |

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash & cash equivalents |

|

$ |

29,929 |

|

|

|

|

|

|

$ |

24,988 |

|

Other current assets |

|

|

1,097 |

|

|

|

|

|

|

|

1,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

31,026 |

|

|

|

|

|

|

|

26,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

5,266 |

|

|

|

|

|

|

|

5,187 |

|

Intangible assets, net |

|

|

315 |

|

|

|

|

|

|

|

357 |

|

Other assets, non-current |

|

|

374 |

|

|

|

|

|

|

|

375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

36,981 |

|

|

|

|

|

|

$ |

32,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

Loan payable net of discount, current |

|

$ |

3,466 |

|

|

|

|

|

|

$ |

4,686 |

|

Other current liabilities |

|

|

6,153 |

|

|

|

|

|

|

|

6,811 |

|

Fair value of warrant liability |

|

|

1,043 |

|

|

|

|

|

|

|

1,685 |

|

Loan payable net of discount, non-current |

|

|

8,917 |

|

|

|

|

|

|

|

10,334 |

|

Other non-current liabilities |

|

|

2,142 |

|

|

|

|

|

|

|

3,040 |

|

Stockholders’ equity |

|

|

15,260 |

|

|

|

|

|

|

|

5,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

36,981 |

|

|

|

|

|

|

$ |

32,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

StemCells, Inc.

Unaudited Reconciliation of GAAP to NON-GAAP Net Loss

(in thousands, except share and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30 |

|

June 30 |

| |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

GAAP net loss as per our condensed

consolidated statement of operations |

|

$ |

(8,462 |

) |

|

$ |

(12,115 |

) |

|

$ |

(17,812 |

) |

|

$ |

(19,735 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

1,351 |

|

|

|

514 |

|

|

|

2,660 |

|

|

|

1,035 |

|

Depreciation and amortization |

|

|

276 |

|

|

|

336 |

|

|

|

546 |

|

|

|

672 |

|

Change in fair value of warrant liability |

|

|

(988 |

) |

|

|

3,654 |

|

|

|

(641 |

) |

|

|

3,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non GAAP net loss |

|

|

(7,823) |

|

|

|

(7,611 |

) |

|

|

(15,247 |

) |

|

|

(14,047 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above table provides certain non-GAAP financial measures that include adjustments to GAAP

figures. StemCells, Inc. believes that these non-GAAP financial measures, when considered together

with the GAAP figures, can enhance an overall understanding of StemCells, Inc.’s financial

performance and its prospects for the future. The non-GAAP financial measures are included with the

intent of providing investors with a more complete understanding of operational results and trends.

We believe excluding these items provides important insight into our operational results, important

for a company at our stage in development. In addition, these non-GAAP financial measures are among

the indicators StemCells, Inc. management uses for planning and forecasting purposes and measuring

the Company’s performance. These non-GAAP financial measures are not intended to be considered in

isolation or as a substitute for GAAP figures.

#####

4

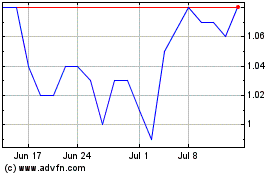

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Aug 2024 to Sep 2024

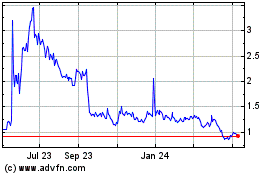

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Sep 2023 to Sep 2024