UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 28, 2015

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 000-49728 | | 87-0617894 |

(State of Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

27-01 Queens Plaza North, Long Island City, New York 11101

(Address of principal executive offices) (Zip Code)

(718) 286-7900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

On July 28, 2015, we provided an update for investors presenting information relating to our financial outlook for the third quarter ending September 30, 2015 and full year 2015, and other information regarding our business. The update is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | | |

| | |

Exhibit Number | | Description |

| |

99.1 |

| | Investor Update dated July 28, 2015 of JetBlue Airways Corporation. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | | | | | | |

| | | | | | | | |

| | | | JETBLUE AIRWAYS CORPORATION | |

| | | | (Registrant) | | |

| | | | | | |

Date: | July 28, 2015 | | | By: | | /s/ Alexander Chatkewitz | |

| | | | | | Vice President, Controller, and Chief Accounting Officer (Principal Accounting Officer) |

EXHIBIT INDEX

|

| | |

| | |

Exhibit Number | | Exhibit |

| |

99.1 | | Investor Update dated July 28, 2015 of JetBlue Airways Corporation. |

Investor Update

Investor Update Investor Update: July 28, 2015

This investor update provides JetBlue’s investor guidance for the third quarter ending September 30, 2015 and full year 2015.

Recent Announcements

JetBlue has recently announced service between the following city pairs:

|

| | |

City Pair | Frequency | Start Date |

New York (JFK) - Antigua (ANU) | 3x Weekly | November 5, 2015 |

Boston (BOS) - Barbados (BGI) | 1x Weekly | November 7, 2015 |

Fort Lauderdale (FLL) - Mexico City (MEX) | 1x Daily | October 1, 2015 |

Orlando (MCO) - Mexico City (MEX) | 1x Daily | October 1, 2015 |

Baltimore (BWI) - Orlando (MCO) | 1x Daily | November 12, 2015 |

Charleston (CHS) - Fort Lauderdale (FLL) | 1x Daily | November 19, 2015 |

Fort Lauderdale (FLL) - Providenciales, Turks & Caicos (PLS) | 1x Daily | November 19, 2015 |

Philadelphia (PHL) - Fort Lauderdale (FLL) | 2x Daily | November 19, 2015 |

New York (JFK) - Daytona Beach (DAB) | 1x Daily | January 7, 2016 |

Fort Lauderdale (FLL) - Quito, Ecuador (UIO) | 1x Daily | 1Q 2016 |

Boston (BOS) - Nashville (BNA) | 2x Daily | 2Q 2016 |

Nashville (BNA) - Fort Lauderdale (FLL) | 1x Daily | 2Q 2016 |

Capacity

Third quarter 2015 available seat miles (ASMs) are estimated to increase 8.5% to 10.5% year-over-year. Full year 2015 ASMs are estimated to increase 7.0% to 9.0% year-over-year, consistent with prior guidance; at present we anticipate ending the year at the higher end of the range.

JetBlue estimates the following distribution as a percentage of total ASMs by aircraft type:

|

| | | | | | |

Third Quarter 2015 | | Full Year 2015 |

A320 | A321 | E190 | | A320 | A321 | E190 |

73% | 13% | 14% | | 74% | 12% | 14% |

Average stage length is projected to be approximately 1,096 miles during the third quarter of 2015 versus 1,082 miles during the same prior year period and approximately 1,095 miles for the full year 2015 versus 1,088 miles for the full year 2014.

Operational Outlook

|

| | | |

| |

| Third Quarter | | Full Year |

| 2015 | | 2015 |

Operating Expense Year-Over-Year Percentage Change | | | |

Unit Operating Expense Excluding Fuel and Profit Sharing (CASM Ex-Fuel and Profit Sharing) | 1.0% - 3.0% | | 0.0% - 1.5% |

1

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor Update |

| | | | |

|

| | |

| Third Quarter | | Full Year | |

| 2015 | | 2015 | |

Fuel Expense | | | | |

Estimated Consumption (gallons) | 186 million | | 697 million | |

Estimated Fuel Price per Gallon, Net of Hedges ¹ | $1.95 ² | | | |

| |

¹Includes fuel taxes. ²JetBlue utilizes the forward Brent crude curve and the forward Brent crude to heating oil crack spread to calculate the unhedged portion of its prompt quarter. As of July 17, 2015, the forward Brent crude per barrel price was $58 and the crack spread averaged $13 per barrel for the Third quarter of 2015

| |

Fuel Hedges

As of July 17, 2015 JetBlue’s advanced fuel derivative contracts are as follows:

|

| | | | | | |

| | | | | | |

| | Gallons | | Estimated Percentage of Consumption | | Price |

| | | |

3Q15 | | 25 million | | 14% | | 5% in USGC jet fuel swaps at an average of $2.74/gal 9% in heat collars with the average cap at $2.90/gal and the average put at $2.60/gal

|

4Q15 | | 25 million | | 15% | | 5% in USGC jet fuel swaps at an average of $2.70/gal 10% in heat collars with the average cap at $2.92/gal and the average put at $2.62/gal

|

Other Income (Expense)

JetBlue estimates total Other Income (Expense) to be between ($27) and ($32) million in the third quarter and between ($120) and ($130) million for the full year.

2

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor Update Tax Rate

JetBlue expects an effective annual tax rate of approximately 39%. However, the actual tax rate in the third quarter and full year 2015 could differ due to a number of factors.

Capital Expenditures

(In millions)

|

| | | | | | |

Third Quarter 2015 | | Full Year 2015 |

Aircraft | Non-aircraft | Total | | Aircraft | Non-aircraft | Non-aircraft |

$125 | $45 | $170 | | $670 | $150 - $200 | $820 - $870 |

Aircraft Delivery Schedule

As of June 30, 2015 JetBlue’s fleet was comprised of 130 Airbus A320 aircraft, 19 Airbus A321 aircraft, and 60 EMBRAER 190 aircraft. 97 aircraft were on order from Airbus and 24 aircraft were on order from Embraer.

|

| | | | | | | | | | | |

| Airbus A320 | | Airbus A321 | | EMBRAER 190 |

| Aircraft | Mortgage | Lease | | Aircraft | Mortgage | Lease | | Aircraft | Mortgage | Lease |

| | | | | | | | | | | |

3Q15 | — | — | — | | 2 | — | — | | — | — | — |

4Q15 | — | — | — | | 4 | — | — | | — | — | — |

Total at Year End | 130 | 65 | 30 | | 25 | 8 | — | | 60 | 30 | 30 |

3

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor Update Share Count

Share count estimates for calculating basic and diluted earnings per share are as follows:

|

| | | | | | |

| | Third Quarter 2015 |

| | Basic Share Count | | Diluted Share Count | | Interest Add-back |

Net Income Range | | (in millions) | | (in millions) | | (in millions)* |

Zero - $12 million | | 314.8 | | 317.4 | | $— |

$12 million - $16 million | | 314.8 | | 326.9 | | $— |

$16 million or greater | | 314.8 | | 344.5 | | $1 |

| | | | | | |

| | Full Year 2015 |

| | Basic Share Count | | Diluted Share Count | | Interest Add-back |

Net Income Range | | (in millions) | | (in millions) | | (in millions)* |

Zero - $48 million | | 316.4 | | 319.2 | | $— |

$48 million - $64 million | | 316.4 | | 328.3 | | $1 |

$64 million or greater | | 316.4 | | 345.9 | | $5 |

* Net of taxes

These share count estimates assume 20% annual stock price appreciation and that all of the holders of the 5.5% convertible debentures due 2038 (Series B) will be converted to shares during the fourth quarter of 2015. These share count estimates do not include any share repurchases that may occur throughout the remainder of 2015 under JetBlue’s share buyback program. The number of shares used in JetBlue’s actual earnings per share will likely be different than those stated above.

This Investor Update contains statements of a forward-looking nature which represent our management's beliefs and assumptions concerning future events. When used in this document, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our ability to implement our growth strategy; our significant fixed obligations and substantial indebtedness; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market and the effect of increased congestion in this market; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our reliance on a limited number of suppliers; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches; changes in or additional government regulation; changes in our industry due to other airlines' financial condition; global economic conditions, or an economic downturn leading to a continuing or accelerated decrease in demand for domestic and business air travel; the spread of infectious diseases; and external geopolitical events and conditions. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2014 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may arise after the date of this release.

4

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

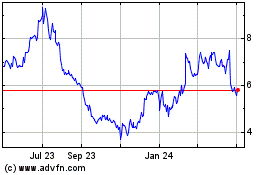

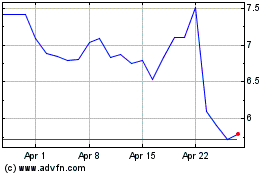

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024