UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the

month of July 2015.

Commission

File Number 001-31722

New

Gold Inc.

Suite

1800 – 555 Burrard Street

Vancouver,

British Columbia V7XC 1M9

Canada

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☐ Form 40-F ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing

a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DOCUMENTS

FILED AS PART OF THIS FORM 6-K

| Exhibit |

|

Description |

| 99.1 |

|

News Release of July 20, 2015 - New Gold further enhances financial flexibility with $175 million Rainy River stream |

| |

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

NEW GOLD INC. |

| |

|

|

|

| |

|

By: |

/s/

Lisa Damiani |

|

| Date: July

20, 2015 |

|

|

Lisa

Damiani

Vice

President, General Counsel and Corporate Secretary |

Exhibit 99.1

New Gold further enhances financial flexibility with $175 million

Rainy River stream

(All dollar figures are in US dollars unless otherwise indicated)

TORONTO, July 20, 2015 /CNW/ - New Gold Inc. ("New

Gold") (TSX:NGD) (NYSE MKT:NGD) today announces that the company has entered into a $175 million streaming agreement with

RGLD Gold AG, a wholly-owned subsidiary of Royal Gold Inc. ("Royal Gold"). Under the terms of the agreement, Royal Gold

will provide New Gold with a deposit of $175 million, to be used for the ongoing development of the company's Rainy River project

(the "Project"), in exchange for a percentage of the future annual gold and silver production from the Project.

TRANSACTION DETAILS

Upfront Deposit

| · | Royal Gold to provide New Gold with a $175 million deposit for the development

of the company's Rainy River project |

| · | $100 million paid at signing with the remaining $75 million to be paid

when 60% of the Project development capital has been spent; expected by mid-2016 |

Gold and Silver Stream Percentage

| · | New Gold to deliver 6.50% of the Project's gold production up to a total

of 230,000 ounces of gold, and 3.25% of the Project's gold production thereafter |

| · | New Gold to deliver 60% of the Project's silver production up to a total

of 3.1 million ounces of silver, and 30% of the Project's silver production thereafter |

Ongoing Cash Purchase Price

| · | In addition to the upfront deposit, Royal Gold to pay 25% of the average

spot gold or silver price at the time each ounce of gold or silver is delivered under the stream |

"This transaction provides our company with an attractive

cost of capital. It further strengthens our financial position as construction at Rainy River continues," stated Randall Oliphant,

Executive Chairman of New Gold. "By partnering with Royal Gold we have been able to secure over 20% of the remaining development

capital for less than 6% of the estimated future revenues. It increases Rainy River's rate of return to our equity holders by approximately

3%. In addition, we have structured the stream in a manner that maximizes our exposure to both the continued exploration potential

of the Rainy River district and long-term gold and silver prices."

"We are delighted that Royal Gold's enthusiasm for the

project is entirely consistent with ours and we look forward to completing the development of Rainy River for the benefit of all

stakeholders," added Mr. Oliphant.

"The Rainy River project fits well into our high-quality

portfolio and met all our criteria for new investments with nearly four million ounces of gold reserves, continued exploration

upside and projected cash costs below $600 per ounce," stated Tony Jensen, President and Chief Executive Officer of Royal

Gold. "We are particularly pleased to add another piece of business in Canada and partner with New Gold - a company that is

well known for its development track record and operational expertise."

Additional Stream Agreement Details

Under the terms of the agreement, Royal Gold will provide

New Gold with a deposit of $175 million in exchange for the delivery by New Gold of a percentage of the future gold and silver

production from the Rainy River project. Royal Gold has paid $100 million of the deposit concurrent with entering into the transaction

and the remaining $75 million will be paid when 60% of the estimated Project development capital has been spent and other customary

conditions precedent are met. Based on the currently planned timing of development capital expenditures, it is estimated that 60%

of the Project development costs will have been spent by mid-2016.

Upon the start of production at Rainy River, New Gold will

deliver 6.50% of the Project's monthly gold production and 60% of the monthly silver production to Royal Gold until a total of

230,000 ounces of gold and 3.1 million ounces of silver have been delivered (the "Ounce Thresholds"). Once each of the

Ounce Thresholds has been satisfied, the stream percentage for that metal will decrease by 50% such that New Gold will be required

to deliver 3.25% of the Project's gold production and 30% of the silver production. In addition to the $175 million deposit, Royal

Gold will be required to pay New Gold in cash 25% of the average spot gold price and silver price at the time the stream ounces

are delivered.

The gold and silver stream will cover future production from

New Gold's current Rainy River land package, plus an additional two-kilometre area of interest, but excluding any potential future

mineralization discovered on New Gold's Off Lake exploration claims located several kilometres to the northeast of the Rainy River

deposit.

Rainy River Project Update

Development activity at New Gold's Rainy River project, located

in northwestern Ontario, has continued to advance on schedule, with first production remaining on target for mid-2017. Over its

first nine years of full production, the 21,000 tonne per day, combined open pit-underground operation is expected to produce an

average of 325,000 ounces of gold per year at well below industry average costs.

RAINY RIVER – SECOND QUARTER 2015 PROJECT UPDATES

| · | Permits to enable commencement of major earthworks construction received

in May |

| · | Detailed engineering – on schedule and approximately 95% complete

|

| · | Construction-related activities progressing on schedule |

| · | Temporary accommodation facility – 80% complete |

| · | First major earthworks for the process plant site commenced in May; scheduled

for completion in the fourth quarter of 2015 |

| · | Delivery of initial truck fleet and shovels scheduled for the third quarter

of 2015 |

| · | Delivery of mills scheduled for the fourth quarter of 2015 |

| · | Five prospective areas within five-kilometre radius of mine development

area identified for future drill testing |

Capital expenditures at Rainy River during the second quarter

totalled $32 million, bringing the project development capital spending through June 30, 2015 to $119 million. Through mid-2015,

New Gold has spent 14% of the total development capital estimate of $877 million.

New Gold Financial Flexibility

The completion of the stream transaction will provide New

Gold with a further $175 million of financial flexibility which supplements the liquidity already available to the company from

its current cash balance, future free cash flow generation from its four operations and New Gold's revolving credit facility.

New Gold's June 30, 2015 cash balance of $327 million together

with Royal Gold's full $175 million deposit and the amount available for drawdown under New Gold's revolving credit facility provide

the company with approximately $738 million of liquidity relative to Rainy River's remaining project development capital of approximately

$760 million. The amount of free cash flow generated by New Gold's four operations over the coming two years will determine the

amount, if any, that is required to be drawn on the company's revolving credit facility to complete the development of Rainy River.

In 2014, New Gold's net cash generated from operations less sustaining capital expenditures was $143 million.

The company looks forward to advancing the Rainy River project

and providing further updates on its development through the remainder of 2015 and beyond.

New Gold will discuss the transaction as part of the company's

second quarter earnings call scheduled for 9:00 a.m. Eastern time on Wednesday, July 29, 2015.

CONFERENCE CALL DETAILS

New Gold plans to release its second quarter 2015 financial

results after market close on Tuesday, July 28, 2015. A webcast and conference call to discuss these results and the streaming

transaction will be held on Wednesday, July 29, 2015 at 9:00 a.m. Eastern time. Participants may listen to the webcast by registering

on our website at www.newgold.com. You may also listen to the conference call by calling toll free 1-888-231-8191, or 1-647-427-7450

outside of the U.S. and Canada. A recorded playback of the conference call will be available until August 31, 2015 by calling toll

free 1-855-859-2056, or 1-416-849-0833 outside of the U.S. and Canada, passcode 76281198. An archived webcast will also be available

until October 28, 2015 at www.newgold.com.

ABOUT NEW GOLD INC.

New Gold is an intermediate gold mining company. The company

has a portfolio of four producing assets and three significant development projects. The New Afton Mine in Canada, the Mesquite

Mine in the United States, the Peak Mines in Australia and the Cerro San Pedro Mine in Mexico, provide the company with its current

production base. In addition, New Gold owns 100% of the Rainy River and Blackwater projects, both in Canada, as well as 30% of

the El Morro project located in Chile. New Gold's objective is to be the leading intermediate gold producer, focused on the environment

and social responsibility. For further information on the company, please visit www.newgold.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this news release, including

any information relating to New Gold's future financial or operating performance, is "forward looking". All statements

in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New

Gold expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects",

"is expected", "budget", "scheduled", "targeted", "estimates", "forecasts",

"intends", "anticipates", "projects", "potential", "believes" or variations of

such words and phrases or statements that certain actions, events or results "may", "could", "would",

"should", "might" or "will be taken", "occur" or "be achieved" or the negative

connotation of such terms. Forward-looking statements in this news release include, among others, statements with respect to: payment

of the remaining $75 million from Royal Gold and the timing of such payment, expected production, costs and operating parameters

of the Rainy River project; expected timing for production from Rainy River and the expected development cost; sources of future

liquidity to fund the construction of Rainy River; and expected timing of activities and deliveries at Rainy River.

All forward-looking statements in this news release are based

on the opinions and estimates of management as of the date such statements are made and are subject to important risk factors and

uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking

statements are discussed in this news release, New Gold's annual and quarterly management's discussion and analysis ("MD&A"),

its Annual Information Form and its Technical Reports filed at www.sedar.com. In addition to, and subject to, such assumptions

discussed in more detail elsewhere, the forward-looking statements in this news release are also subject to the following assumptions:

(1) there being no significant disruptions affecting New Gold's operations and development activities; (2) political and legal

developments in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold's current expectations;

(3) the accuracy of New Gold's current mineral reserve and resource estimates; (4) the exchange rate between the Canadian dollar

and U.S. dollar being approximately consistent with current levels; (5) prices for diesel, natural gas, fuel oil, electricity and

other key supplies being approximately consistent with current levels; (6) equipment, labour and materials costs increasing on

a basis consistent with New Gold's current expectations; (7) arrangements with First Nations and other Aboriginal groups in respect

of Rainy River being consistent with New Gold's current expectations; (8) all required permits, licenses and authorizations being

obtained from the relevant governments and other relevant stakeholders within the expected timelines; and (9) the results of the

feasibility study for the Rainy River projects being realized.

Forward-looking statements are necessarily based on estimates

and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results,

level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

statements. Such factors include, without limitation: significant capital requirements and the availability and management of capital

resources; additional funding requirements; price volatility in the spot and forward markets for metals and other commodities;

fluctuations in the international currency markets and in the rate of exchange between the Canadian and U.S. dollar; discrepancies

between actual and estimated production, between actual and estimated reserves and resources and between actual and estimated metallurgical

recoveries; changes in national and local government legislation in Canada; taxation; the speculative nature of mineral exploration

and development, including the risks of obtaining and maintaining the validity and enforceability of the necessary licenses and

permits and complying with the permitting requirements of each jurisdiction in which New Gold operates; the uncertainties inherent

to current and future legal challenges New Gold is or may become a party to; loss of key employees; rising costs of labour, supplies,

fuel and equipment; actual results of current exploration; uncertainties inherent to mining economic studies including the feasibility

study for Rainy River; changes in project parameters as plans continue to be refined; accidents; labour disputes; defective title

to mineral claims or property or contests over claims to mineral properties; unexpected delays and costs inherent to consulting

and accommodating rights of First Nations and other Aboriginal groups; uncertainties with respect to obtaining all necessary surface

and other land use rights or tenure for Rainy River; and risks, uncertainties and unanticipated delays associated with obtaining

and maintaining necessary licenses, permits and authorizations and complying with permitting requirements. In addition, there are

risks and hazards associated with the business of mineral exploration, development and mining, including environmental events and

hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the

risk of inadequate insurance or inability to obtain insurance to cover these risks) as well as "Risk Factors" included

in New Gold's Annual Information Form and Management's Discussion and Analysis for the year ended December 31, 2014 filed on and

available at www.sedar.com.

Forward-looking statements are not guarantees of future performance,

and actual results and future events could materially differ from those anticipated in such statements. All of the forward-looking

statements contained in this news release are qualified by these cautionary statements. New Gold expressly disclaims any intention

or obligation to update or revise any forward-looking statements.

SOURCE New Gold Inc.

%CIK: 0000800166

For further information: Hannes Portmann, Vice President,

Corporate Development, Direct: +1 (416) 324-6014, Email: info@newgold.com

CO: New Gold Inc.

CNW 08:00e 20-JUL-15

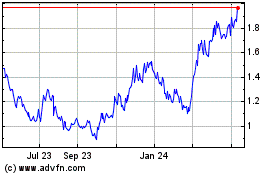

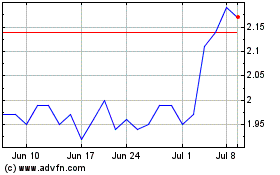

New Gold (AMEX:NGD)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Gold (AMEX:NGD)

Historical Stock Chart

From Apr 2023 to Apr 2024