| As filed with the Securities and Exchange Commission

on June 18, 2015 |

Registration No. 333-____________ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

_________________

Lion Biotechnologies, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Nevada |

75-3254381 |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification Number) |

21900 Burbank Blvd, Third Floor,

Woodland Hills, California 91367

(Address of registrant’s principal

executive offices, including zip code)

_________________________________

Genesis Biopharma, Inc. 2011 Equity Incentive

Plan

Lion Biotechnologies, Inc. 2014 Equity Incentive Plan

(Full title of the plans)

_________________

Elma Hawkins, Ph.D.

Chief Executive Officer

Lion Biotechnologies, Inc.

21900 Burbank Boulevard, Third Floor

Woodland Hills, California 91367

(818) 992-3126

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

_________________

With copies to:

Istvan Benko

Steven P. Mehr

TroyGould PC

1801 Century Park East, 16th Floor

Los Angeles, California 90067

(310) 553-4441

_________________

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

| Large accelerated filer |

o |

Accelerated filer |

þ |

| Non-accelerated filer |

o (Do not check if a smaller reporting company) |

Smaller reporting company |

o |

_________________

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Amount to be

registered(1) |

Proposed maximum offering price per share |

Proposed maximum aggregate offering price |

Amount of

registration fee |

| Common stock, par value $0.000041666 per share |

1,199,500(2) |

$7.24(3) |

$8,684,380 |

$1,009.12 |

| Common stock, par value $0.000041666 per share |

1,073,877(4) |

$7.83(3) |

$8,408,457 |

$977.06 |

| Common stock, par value $0.000041666 per share |

2,844,123(5) |

$10.67(6) |

$30,346,792 |

$3,526.30 |

| Total |

5,117,500 shares |

|

$47,439,629 |

$5,512.48 |

| (1) | Pursuant to Rule 416(a) of the Securities Act of 1933, this Registration Statement also covers such additional shares of common

stock as may become issuable under the plans in the event of a stock split, stock dividend, recapitalization or other similar change

in the outstanding shares of common stock. |

| (2) | Represents shares of common stock reserved for issuance upon the exercise of outstanding stock options under the 2011 Equity

Incentive Plan (the “2011 Plan”). |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(h) under the Securities Act

of 1933, as amended (the “Securities Act”), based on the weighted-average exercise price (rounded up to the nearest

cent) of the outstanding stock options. |

| (4) | Represents shares of common stock reserved for issuance upon the exercise of outstanding stock options under the 2014 Equity

Incentive Plan (the “2014 Plan”). |

| (5) | Represents shares of common stock reserved for future issuance under the 2014 Plan. |

| (6) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and (h) under the

Securities Act based on the average of the high and low sale prices of the common stock as reported on the Nasdaq Global

Market on June 17, 2015. |

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information required to be contained

in the Section 10(a) Prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act

of 1933, as amended (the “Securities Act”), and the Note to Part I of Form S-8.

| ITEM 2. | Registrant Information and Employee Plan Information |

The information required to be contained

in the Section 10(a) Prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act

and the Note to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

| ITEM 3. | Incorporation of Documents by Reference |

Registrant hereby incorporates by reference the following documents

previously filed with the Securities and Exchange Commission (the “Commission”):

| · | our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 16, 2015, as amended by Amendment

No. 1 on Form 10-K/A filed with the SEC on April 20, 2015; |

| · | our Current Reports on Form 8-K filed with the SEC on January 27, 2015, February 12, 2015, February 18, 2015, February 25,

2015, March 3, 2015, April 17, 2015, May 1, 2015, May 4, 2015, June 9, 2015 and June 15, 2015; and |

| · | the description of our stock contained in our registration statement on Form 8-A filed on February 25, 2015 pursuant to Section

12 of the Exchange Act, as such statement may be amended from time to time. |

All documents filed by the Registrant pursuant

to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act subsequent to the date of this Registration Statement and prior to the

filing of a post-effective amendment to this Registration Statement which indicates that all securities offered hereby have been

sold or which deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference herein and

to be a part hereof from the date of filing of such documents. Any statement contained in this Registration Statement, in an amendment

hereto or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed amendment

to this Registration Statement or in any document that is or is deemed to be incorporated by reference herein modifies or supersedes

such statement.

Under no circumstances shall any information

furnished prior to or subsequent to the date hereof under Item 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference

unless such Form 8-K expressly provides to the contrary.

| ITEM 4. | Description of Securities |

Not applicable.

| ITEM 5. | Interest of Named Experts and Counsel |

TroyGould PC, Los Angeles, California, has

rendered an opinion with respect to the validity of the shares of common stock issuable under the 2011 Plan and the 2014 Plan.

Sanford J. Hillsberg, a member of the Board of Directors of the Registrant, is an attorney with TroyGould PC. As of June 17, 2015,

Mr. Hillsberg and certain other attorneys and of counsel of that firm beneficially owned in the aggregate 464,000 shares and options

or warrants to acquire shares of our common stock. The beneficial ownership of our shares described above includes all options

that may be exercised within 60 days from June 17, 2015.

| ITEM 6. | Indemnification of Directors and Officers |

Registrant’s amended and restated

articles of incorporation provide that its directors or officers will have no personal liability to Registrant or its stockholders

for damages for breach of fiduciary duty as a director or officer, except for damages for breach of fiduciary duty resulting from

(1) acts or omissions which involve intentional misconduct, fraud or a knowing violation of law or (2) the payment of dividends

in violation of the applicable statutes of Nevada.

Section 78.7502 of the Nevada Revised Statutes

permits a corporation to indemnify a present or former director, officer, employee or agent of the corporation, or of another entity

or enterprise for which such person is or was serving in such capacity at the request of the corporation, who was or is a party

or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, except an action by or

in the right of the corporation, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement

actually and reasonably incurred in connection therewith, arising by reason of such person’s service in such capacity if

such person (1) is not liable pursuant to Section 78.138 of the Nevada Revised Statutes, which sets forth standards for the conduct

of directors and officers, or (2) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed

to the best interests of the corporation and, with respect to a criminal action or proceeding, had no reasonable cause to believe

his or her conduct was unlawful. In the case of actions brought by or in the right of the corporation, however, no indemnification

may be made for any claim, issue or matter as to which such person has been adjudged by a court of competent jurisdiction, after

exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless

and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines

upon application that in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity

for such expenses as the court deems proper.

Section 78.751 of the Nevada Revised Statutes

permits any discretionary indemnification under Section 78.7502 of the Nevada Revised Statutes, unless ordered by a court or advanced

to a director or officer by the corporation in accordance with the Nevada Revised Statutes, to be made by a corporation only as

authorized in each specific case upon a determination that indemnification of the director, officer, employee or agent is proper

in the circumstances. Such determination must be made (1) by the stockholders, (2) by the board of directors by majority vote of

a quorum consisting of directors who were not parties to the action, suit or proceeding, (3) if a majority vote of a quorum consisting

of directors who were not parties to the action, suit or proceeding so orders, by independent legal counsel in a written opinion,

or (4) if a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent

legal counsel in a written opinion.

Registrant’s amended and restated

bylaws require Registrant to indemnify its directors and officers in a manner that is consistent with the provisions of Nevada

law described in the preceding two paragraphs.

Registrant also has entered into indemnification

agreements with its directors in which Registrant agrees, among other things, to indemnify them against certain liabilities that

may arise by reason of their status or service as directors.

Registrant maintains a general liability

insurance policy that covers certain liabilities of directors and officers of Registrant arising out of claims based on acts or

omissions in their capacities as directors or officers.

| ITEM 7. | Exemption From Registration Claimed |

Not applicable.

See the Exhibit Index following the signature

page for a list of exhibits filed as part of this Registration Statement, which Exhibit Index is incorporated herein by reference.

(a) The undersigned Registrant hereby

undertakes:

(1) To file, during any period in which

offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required

by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any

facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement;

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such

information in this Registration Statement; provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information

required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished

to the Commission by Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference

in this Registration Statement.

(2) That, for the purpose of determining

any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby

undertakes that, for purposes of determining any liability under the Securities Act, each filing of Registrant’s annual report

pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of Registrant pursuant to the

indemnification provisions summarized in Item 6, or otherwise, Registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by Registrant of expenses incurred or paid by

a director, officer or controlling person of Registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, Registrant will, unless in

the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed

by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on

Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Woodland Hills , California, on June 17, 2015.

| |

LION BIOTECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Elma Hawkins |

| |

|

Elma Hawkins, Ph.D. |

| |

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that

each individual whose signature appears below constitutes and appoints Elma Hawkins, Ph.D. and Molly Henderson, and each of them,

his/her true and lawful attorneys-in-fact and agents with full power of substitution and re-substitution, for him/her and in his/her

name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this

Registration Statement, and to sign any registration statement for the same offering covered by this Registration Statement and

filed pursuant to Rule 462 under the Securities Act of 1933, as amended, and to file the same, with all exhibits thereto and all

documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents,

and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in

and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming

all that said attorneys-in-fact and agents or any of them, or her or his or their substitute or substitutes, may lawfully do or

cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Elma Hawkins |

|

Chief Executive Officer and Director |

|

June 17, 2015 |

| Elma Hawkins, Ph.D. |

|

(Principal Executive Officer) |

|

|

|

| |

|

|

|

|

|

| /s/ Molly Henderson |

|

Chief Financial Officer |

|

June 17, 2015 |

|

| Molly Henderson |

|

(Principal Financial and |

|

|

|

| |

|

Accounting Officer) |

|

|

|

| |

|

|

|

|

|

| /s/ Merrill A. McPeak |

|

Director |

|

June 17, 2015 |

|

| Michael A. McPeak |

|

|

|

|

| |

|

|

|

|

|

| /s/ Jay Venkatesan |

|

Director |

|

June 17, 2015 |

|

| Jay Venkatesan |

|

|

|

|

| |

|

|

|

|

|

| |

|

Director |

|

June 17, 2015 |

|

| Sanford J. Hillsberg |

|

|

|

|

| |

|

|

|

|

|

| /s/ Ryan Maynard |

|

Director |

|

June 17, 2015 |

|

| Ryan Maynard |

|

|

|

|

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 4.1 |

|

Amended and Restated Articles of Incorporation of Registrant (incorporated herein by reference to Registrant’s definitive Information Statement on Schedule 14C filed with the Commission on August 20, 2013). |

| |

|

|

| 4.2 |

|

Bylaws of Registrant (incorporated herein by reference to the Registrant’s Registration Statement on Form SB-2 (Reg. No. 333-148920) filed with the Commission on January 29, 2008). |

| |

|

|

| 4.3 |

|

Amendment to Bylaws (incorporated herein by reference to the Registrant’s Current Report on Form 8-K filed with the Commission on May 29, 2013). |

| |

|

|

| 4.4 |

|

Specimen Common Stock Certificate of Registrant (incorporated herein by reference to Registrant’s registration statement on Form 8-A filed on February 25, 2015). |

| |

|

|

| 4.5 |

|

Genesis Biopharma, Inc. 2011 Equity Incentive Plan (incorporated herein by reference to Registrant’s Current Report on Form 8-K filed with the Commission on October 20, 2011). |

| |

|

|

| 4.6 |

|

Lion Biotechnologies, Inc. 2014 Equity Incentive Plan, as amended (incorporated

herein by reference to Appendix A to Registrant’s definitive Proxy Statement on Schedule 14C filed with the Commission on

April 30, 2015). |

| |

|

|

| 4.7 |

|

Form of ISO Stock Option Agreement under the Genesis Biopharma, Inc. 2011 Equity Incentive Plan (incorporated herein by reference to Exhibit 10.4 of the Registrant’s Current Report on Form 8-K filed with the Commission on October 20, 2011). |

| |

|

|

| 4.8 |

|

Form of NQSO Stock Option Agreement under the Genesis Biopharma, Inc. 2011 Equity Incentive Plan (incorporated herein by reference to the Registrant’s Current Report on Form 8-K filed with the Commission on October 20, 2011) |

| |

|

|

| 4.9 |

|

Form of ISO Stock Option Agreement under 2014 Equity Incentive Plan. |

| |

|

|

| 4.10 |

|

Form of NQSO Stock Option Agreement under 2014 Equity Incentive Plan. |

| |

|

|

| 5.1 |

|

Opinion of TroyGould PC |

| |

|

|

| 23.1 |

|

Consent of TroyGould PC (included in Exhibit 5.1) |

| |

|

|

| 23.2 |

|

Consent of Weinberg & Company |

| |

|

|

| 24.1 |

|

Power of Attorney (included on the signature page herein) |

Exhibit 4.9

LION BIOTECHNOLOGIES, INC.

OPTION CERTIFICATE

(Incentive Stock Option)

THIS IS TO CERTIFY that Lion Biotechnologies,

Inc., a Nevada corporation (the “Company”), has granted to the employee named below (“Optionee”)

an incentive stock option (the “Option”) to purchase shares of the Company’s Common Stock (the “Shares”)

under its 2014 Equity Incentive Plan (the “Plan”) and upon the terms and conditions set forth below and in the

attached Stock Option Agreement:

| |

Name of Optionee: |

| |

|

| |

Address of Optionee: |

| |

|

| |

Number of Shares: |

| |

|

| |

Option Exercise Price: |

| |

|

| |

Date of Grant: |

| |

|

| |

Option Expiration Date: |

Exercise Schedule: The Option shall

become exercisable (“vest”) as follows:

In Witness Whereof, the Company has granted

to Optionee the Option as of the Date of Grant set forth above.

| OPTIONEE |

|

LION BIOTECHNOLOGIES, INC. |

| |

|

|

| |

|

By |

|

| |

|

Its |

|

STOCK OPTION AGREEMENT

(Incentive Stock Option)

This STOCK OPTION AGREEMENT (this “Agreement”)

is made and entered into as of the Date of Grant set forth in the Option Certificate to which this Agreement is attached (the “Certificate”)

by and between Lion Biotechnologies, Inc., a Nevada corporation (the “Company”), and the optionee (the “Optionee”)

named in the Certificate.

Pursuant to the 2014 Equity Incentive Plan

of the Company (the “Plan”), the Administrator has determined that Optionee is to be granted, on the terms and

conditions set forth in this Agreement and in the Plan, an option to purchase shares of the Company’s common stock (the “Common

Stock”). It is intended that the option qualify as an “incentive stock option” within the meaning of Section

422 of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized terms not otherwise

defined in this Agreement shall have the meanings ascribed to them in the Plan.

The Company and Optionee agree as follows:

1. Grant

of Option. The Company hereby grants to Optionee, upon the terms and subject to the conditions set forth in this

Agreement, an Option (the “Option”) to purchase all or any portion of that number of shares of

Common Stock set forth in the Certificate (the “Option Shares”), at the exercise price set forth in the

Certificate (the “Exercise Price”).

2. Vesting

2.1. The Option shall “vest” (that is, become exercisable) in installments upon and after the dates set forth

under the caption “Exercise Schedule” in the Certificate. The installments shall be cumulative; i.e.,

the Option may be exercised, as to any or all Shares covered by an installment, at any time or times after the installment first

becomes exercisable and until expiration or termination of the Option.

2.2. No

vesting shall occur after the Employment Termination Date (as defined in Section 4.2 of this Agreement).

2.3. Notwithstanding anything to the contrary contained in this Option Agreement, the Option may not be exercised, in

whole or in part, unless and until any then-applicable requirements of all state and federal laws and regulatory agencies shall

have been fully complied with to the satisfaction of the Company and its counsel.

3. Exercise of the Option.

3.1. The

Option may be exercised, in whole or in part, only by delivery to the Company of:

3.1.1 written notice of the exercise of the Option in form identical to Exhibit “A” attached to this

Agreement stating the number of Option Shares being purchased (the “Purchased Shares”); and

3.1.2 payment

of the Exercise Price (i) in cash or cash equivalent; or (ii) with the approval of the Administrator, by delivery to the

Company of such other consideration (such as a note or shares of Common Stock) acceptable to the Administrator.

3.2. Following

receipt of the exercise notice, any other applicable documents and the payment referred to above, the Company shall, within

30 days, cause certificates representing the Purchased Shares to be delivered to Optionee either at Optionee’s address

set forth in the records of the Company or at such other address as Optionee may designate in writing to the Company (or, if

no certificate is issued, by entry on the Company’s books and records of the foregoing); provided; however,

that the Company shall not be obligated to issue a fraction or fractions of a share otherwise issuable upon exercise of the

Option, and may pay to Optionee, in cash or cash equivalent, the fair market value of any such fraction or fractions of a

share as of the date of exercise.

3.3. If

requested by the Administrator, Optionee shall also deliver this Agreement to the Secretary of the Company, who shall endorse

hereon a notation of the exercise and return this Agreement to Optionee. The date of exercise of an Option that is validly

exercised shall be deemed to be the date on which there shall have been delivered to the Administrator the

instruments referred to in this Section 3. Optionee shall not be deemed to be a holder of any Option Shares pursuant to

exercise of the Option until the date of issuance of a stock certificate to him or her for such shares following payment in

full for the Option Shares purchased.

3.4. Should

this Option become a non-qualified stock option, in whole or in part, for any reason, then, as a condition to exercise of

this Option, the Company may require Optionee to pay over to the Company all applicable federal, state and local taxes which

the Company is required to withhold with respect to the exercise of such non-qualified stock option. At the discretion of the

Administrator and upon the request of Optionee, the minimum statutory withholding tax requirements may be satisfied by the

withholding of Shares otherwise issuable to Optionee upon the exercise of this Option.

4. Termination

of Option

4.1. The

Option shall terminate and expire upon the earliest to occur of: (i) the Option Expiration Date set forth in the Option

Certificate; (ii) the Termination Date; and (iii) a Corporate Transaction unless otherwise specified by the

Administrator.

4.2. For

purposes of this Agreement:

4.2.1 “Employment

Termination Date” shall mean the first day Optionee is not an employee of the Company or any of its Affiliates.

Optionee’s employment shall not be deemed to terminate by reason of a transfer to or from the Company or an Affiliate

or among such entities, or sick leave, military leave or other leave of absence approved by the Administrator, if the period

of any such leave does not exceed 90 days or, if longer, if Optionee’s right to reemployment by the Company or any

Affiliate is guaranteed either contractually or by statute.

4.2.2 “Termination

Date” shall be: (a) the date 90 days following the Employment Termination Date unless Optionee’s employment

is terminated For Cause or as a result of the death or disability of Optionee; (b) upon the Employment Termination Date if

Optionee’s employment is terminated For Cause; or (c) the date one year following the Employment Termination Date

as a result of the death or disability of Optionee.

4.2.3 “For

Cause” shall mean Optionee’s loss of employment by the Company or any of its Affiliates due to

Optionee’s (a) willful breach or habitual neglect or continued incapacity to perform Optionee’s required duties,

(b) commission of acts of dishonesty, fraud, misrepresentation or other acts of moral turpitude in connection with

Optionee’s services to the Company or its Affiliates or which in the determination of the Administrator would prevent

the effective performance of Optionee’s duties or (c) termination For Cause under any employment agreement between the

Company and Optionee (as for cause is defined therein).

5. Adjustment.

The number of shares and Exercise Price of this Option shall be subject to adjustment under the circumstances contemplated

by the Plan and the Option Expiration Date may be accelerated by the Administrator upon the circumstances set forth in the

Plan.

6. Corporate

Transactions. Upon the occurrence of a Corporate Transaction, the Option shall be subject to the actions of the

Administrator as contemplated in the Plan, including without limitation the termination of the Option immediately prior to

the consummation of the Corporate Transaction.

7. Modification.

Subject to the terms and conditions and within the limitations of the Plan, the Administrator may modify, extend or renew the

Option or accept the surrender of, and authorize the grant of a new option in substitution for, the Option (to the extent not

previously exercised). No modification of the Option shall be made which, without the consent of Optionee, would cause the

Option to fail to continue to qualify as an “incentive stock option” within the meaning of Section 422 of

the Code or would alter or impair any rights of Optionee under the Option.

8. Disqualifying

Disposition. Optionee agrees that, should he or she make a “disposition” (as defined in Section

424(c) of the Code) of all or any of the Purchased Shares within two years from the date of the grant of the Option or within

one year after the issuance of such Purchased Shares, he or she shall immediately advise the Company in writing as to the

occurrence of the sale and the price realized upon the sale of such Purchased Shares. Optionee agrees that he or she shall

maintain all Purchased Shares in his or her name so long as he or she maintains beneficial ownership of such Purchased

Shares.

9. Incorporation

of Plan. This Agreement is made pursuant to the Plan, and it is intended, and shall be interpreted in a manner, to

comply with the Plan. Any provision of this Agreement inconsistent with the Plan shall be superseded and governed by the

Plan.

10. Restrictions

on Sale of Purchased Shares. Optionee understands that: (a) unless the issuance of the Purchased Shares to Optionee upon

exercise of the Option is registered under the Securities Act of 1933, as amended (the “Securities Act”),

the Purchased Shares will be “restricted securities” within the meaning of Rule 144 under such Act; (b)

the Purchased Shares may not be sold, transferred or assigned by the Optionee except pursuant to an effective registration

statement under the Securities Act or an exemption from registration under the Securities Act; and (c) the Company is under

no obligation to file a registration statement under the Securities Act covering the Option Shares. Optionee agrees that any

certificates evidencing Purchased Shares may bear a legend indicating that their transferability is restricted in accordance

with applicable state and federal securities laws.

11. General

Provisions.

11.1. Further

Assurances. Optionee shall promptly take all actions and execute all documents requested by the Company that the Company

deems to be reasonably necessary to effectuate the term and intent of this Agreement.

11.2. Notices.

All notices, requests, demands and other communications (collectively, “Notices”) given pursuant to this

Agreement shall be in writing, and shall be delivered by personal service, courier, or by United States first class,

registered or certified mail, postage prepaid, addressed to the party at the address set forth on the signature page of this

Agreement. Any Notice, other than a Notice sent by registered or certified mail, shall be effective when received; a

Notice sent by registered or certified mail, postage prepaid return receipt requested, shall be effective on the earlier of

when received or the third day following deposit in the United States mails. Any party may from time to time change its

address for further Notices hereunder by giving notice to the other party in the manner prescribed in this Section.

11.3. Failure

to Enforce Not a Waiver. The failure of the Company to enforce at any time any provision of this Agreement shall in no

way be construed to be a waiver of such provision or of any other provision hereof.

11.4. Governing

Law. This Agreement shall be governed by and construed in accordance with the law of the State of Nevada applicable to

contracts made in, and to be performed within, that State.

11.5. Transfer

of Rights under this Agreement. The Company may at any time transfer and assign its rights and delegate its obligations

under this Agreement to any other person, corporation, firm or entity, with or without consideration.

11.6. Option Non-transferable. Optionee may not sell, transfer, assign or otherwise dispose of the Option except

by will or the laws of descent and distribution, and only Optionee or his or her legal representative or guardian may exercise

the Option during Optionee’s lifetime.

11.7. No Right to Employment. Nothing in this Option shall interfere with or limit in any way the right of the Company

or of any of its Affiliates to terminate Optionee’s employment, consulting or advising at any time, nor confer upon Optionee

any right to continue in the employ of, consult with or advise the Company or any of its Affiliates.

11.8. Delivery

of Plan to Optionee. Optionee acknowledges that a copy of the Plan has been delivered to Optionee and that Optionee has

read the Plan prior to signing this Agreement.

11.9.

Successors and Assigns. Except to the extent specifically limited by the terms and provision of this Agreement,

this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors, assigns,

heirs and personal representatives.

11.10. Miscellaneous.

Titles and captions contained in this Agreement are inserted for convenience of reference only and do not constitute a part

of this Agreement for any other purpose. Except as specifically provided herein, neither this Agreement nor any right

pursuant hereto or interest herein shall be assignable by any of the parties hereto without the prior written consent of the

other party hereto.

11.11.

Tax Treatment. Optionee acknowledges that the tax treatment of the Option, the Option Shares or any events or transactions

with respect thereto may be dependent upon various factors or events that are not determined by the Plan or this Agreement. The

Company makes no representations with respect to and hereby disclaims all responsibility as to such tax treatment.

The signature page of this Agreement consists

of the last page of the Certificate.

EXHIBIT “A”

NOTICE OF EXERCISE

(To be signed only upon exercise of the

Option)

| TO: | Lion Biotechnologies, Inc. |

The undersigned, the holder of the enclosed

Stock Option Agreement (Incentive Stock Option), hereby irrevocably elects to exercise the purchase right represented by the Option

and to purchase thereunder ______* shares of Common Stock of Lion Biotechnologies, Inc. (the “Company”) and

herewith encloses payment of $_________ in full payment of the purchase price of such shares being purchased.

| Dated: |

|

|

|

| |

|

|

| |

|

(Signature must conform in all respects

to name |

| |

|

of holder as specified on the face of the Option |

| |

|

|

| |

|

|

| |

|

|

| |

|

(Address) |

| |

|

|

| |

|

|

| |

|

Social Security Number |

*Insert here the number of shares being

exercised making all adjustments for stock splits, stock dividends or other additional Common Stock of the Company, other securities

or property which, pursuant to the adjustment provisions of Section 5 of the Option, may be deliverable upon exercise.

Exhibit 4.10

LION BIOTECHNOLOGIES, INC.

OPTION CERTIFICATE

(Non-Qualified Stock Option)

THIS IS TO CERTIFY that Lion Biotechnologies,

Inc., a Nevada corporation (the “Company”), has granted to the employee named below (“Optionee”)

a non-qualified stock option (the “Option”) to purchase shares of the Company’s Common Stock (the “Shares”)

under its 2014 Equity Incentive Plan (the “Plan”) and upon the terms and conditions set forth below and in the

attached Stock Option Agreement:

| |

Name of Optionee: |

| |

|

| |

Address of Optionee: |

| |

|

| |

Number of Shares: |

| |

|

| |

Option Exercise Price: |

| |

|

| |

Date of Grant: |

| |

|

| |

Option Expiration Date: |

Exercise Schedule: The Option shall

become exercisable (“vest”) as follows:

In Witness Whereof, the Company has granted

to Optionee the Option as of the Date of Grant set forth above.

| OPTIONEE |

|

LION BIOTECHNOLOGIES, INC. |

| |

|

|

| |

|

By |

|

| |

|

Its |

|

STOCK OPTION AGREEMENT

(Non-Qualified Stock Option)

This STOCK OPTION AGREEMENT (this “Agreement”)

is made and entered into as of the Date of Grant set forth in the Option Certificate to which this Agreement is attached (the “Certificate”)

by and between Lion Biotechnologies, Inc., a Nevada corporation (the “Company”), and the optionee (the “Optionee”)

named in the Certificate.

Pursuant to the 2014 Equity Incentive Plan

of the Company (the “Plan”), the Administrator has determined that Optionee is to be granted, on the terms and

conditions set forth in this Agreement and in the Plan, an option to purchase shares of the Company’s Common Stock (the “Common

Stock”). It is intended that the option not qualify as an “incentive stock option” within the meaning

of Section 422 of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized

terms not otherwise defined in this Agreement shall have the meanings ascribed to them in the Plan.

The Company and Optionee agree as follows:

1. Grant

of Option. The Company hereby grants to Optionee, upon the terms and subject to the conditions set forth in this

Agreement, an Option (the “Option”) to purchase all or any portion of that number of shares of

Common Stock set forth in the Certificate (the “Option Shares”), at the exercise price set forth in the

Certificate (the “Exercise Price”).

2. Vesting

2.1. The

Option shall “vest” and become exercisable in installments upon and after the dates set forth under the caption

“Exercise Schedule” in the Certificate. The installments shall be cumulative; i.e., the Option may

be exercised, as to any or all Shares covered by an installment, at any time or times after the installment first becomes

exercisable and until expiration or termination of the Option.

2.2. No vesting shall occur after the Employment Termination Date (as defined in Section 4.2 of this Agreement).

2.3. Notwithstanding anything to the contrary contained in this Option Agreement, the Option may not be exercised, in

whole or in part, unless and until any then-applicable requirements of all state and federal laws and regulatory agencies shall

have been fully complied with to the satisfaction of the Company and its counsel.

3. Exercise

of the Option.

3.1. The

Option may be exercised, in whole or in part, only by delivery to the Company of:

3.1.1 written notice of the exercise of the Option in form identical to Exhibit “A” attached to this

Agreement stating the number of Option Shares being purchased (the “Purchased Shares”); and

3.1.2 payment

of the Exercise Price (i) in cash or cash equivalent; or (ii) with the approval of the Administrator, by delivery to the

Company of such other consideration (such as a note or shares of Common Stock) acceptable to the Administrator.

3.2. Following

receipt of the exercise notice, any other applicable documents and the payment referred to above, the Company shall, within

30 days, cause certificates representing the Purchased Shares to be delivered to Optionee either at Optionee’s address

set forth in the records of the Company or at such other address as Optionee may designate in writing to the Company; provided; however,

that the Company shall not be obligated to issue a fraction or fractions of a share otherwise issuable upon exercise of the

Option, and may pay to Optionee, in cash or cash equivalent, the fair market value of any such fraction or fractions of a

share as of the date of exercise.

3.3. If

requested by the Administrator, Optionee shall also deliver this Agreement to the Secretary of the Company, who shall

endorse hereon a notation of the exercise and return this Agreement to Optionee. The date of exercise of an Option that is

validly exercised shall be deemed to be the date on which there shall have been delivered to the Administrator the

instruments referred to in this Section 3. Optionee shall not be deemed to be a holder of any Option Shares pursuant to

exercise of the Option until the date of issuance of a stock certificate to him or her for such shares following payment in

full for the Option Shares purchased.

3.4. As

a condition to exercise of this Option, the Company may require Optionee to pay over to the Company all applicable federal,

state and local taxes which the Company is required to withhold with respect to the exercise of this Option. At the

discretion of the Administrator and upon the request of Optionee, the minimum statutory withholding tax requirements may be

satisfied by the withholding of Shares otherwise issuable to Optionee upon the exercise of this Option.

4. Termination

of Option

4.1. The

Option shall terminate and expire upon the earliest to occur of: (i) the Option Expiration Date set forth in the Option

Certificate; (ii) the Termination Date; and (iii) a Corporate Transaction unless otherwise specified by the

Administrator.

4.2. For

purposes of this Agreement:

4.2.1 “Employment

Termination Date” shall mean the first day Optionee is not a director, employee or consultant to the

Company and its Affiliates. As long as Optionee is at least one of employee, director or consultant, the Employment

Termination Date shall not be deemed to have occurred. For example, if Optionee is an employee and a director, the

termination of employment as an employee while remaining a director shall not establish an Employment Termination Date (which

would only be established if and when Optionee ceases to be a director). Optionee’s employment shall not be deemed to

terminate by reason of a transfer to or from the Company or an Affiliate or among such entities, or sick leave, military

leave or other leave of absence approved by the Administrator, if the period of any such leave does not exceed 90 days or, if

longer, if Optionee’s right to reemployment by the Company or any Affiliate is guaranteed either contractually or by

statute.

4.2.2 “Termination

Date” shall be: (a) the date 90 days following the Employment Termination Date unless Optionee’s employment

is terminated For Cause or as a result of the death or disability of Optionee; (b) upon the Employment Termination Date if

Optionee’s employment is terminated For Cause; or (c) one year following the Employment Termination Date as a result of

the death or disability of Optionee.

4.2.3 “For

Cause” shall mean Optionee’s loss of employment, directorship or consulting engagement by the Company or any

of its Affiliates due to Optionee’s (a) willful breach or habitual neglect or continued incapacity to perform

Optionee’s required duties, (b) commission of acts of dishonesty, fraud, misrepresentation or other acts of moral

turpitude in connection with Optionee’s services to the Company or its Affiliates or which in the determination of the

Administrator would prevent the effective performance of Optionee’s duties or (c) termination For Cause under any

employment or consulting agreement between the Company and Optionee (as for cause is defined therein).

5. Adjustment.

The number of shares and Exercise Price of this Option shall be subject to adjustment under the circumstances contemplated

by the Plan and the Option Expiration Date may be accelerated by the Administrator upon the circumstances set forth in the

Plan.

6.

Corporate Transactions. Upon the occurrence of a Corporate Transaction, the Option shall be subject to the actions

of the Administrator as contemplated in the Plan, including without limitation the termination of the Option immediately prior

to the consummation of the Corporate Transaction.

7. Modification.

Subject to the terms and conditions and within the limitations of the Plan, the Administrator may modify, extend or renew

the Option or accept the surrender of, and authorize the grant of a new option in substitution for, the Option (to the extent

not previously exercised). No modification of the Option shall be made which, without the consent of Optionee, would alter or

impair any rights of Optionee under the Option.

8. Incorporation

of Plan. This Agreement is made pursuant to the Plan, and it is intended, and shall be interpreted in a manner, to

comply with the Plan. Any provision of this Agreement inconsistent with the Plan shall be superseded and governed by the

Plan.

9.

Restrictions on Sale of Purchased Shares. Optionee understands that: (a) unless the issuance of the Purchased Shares

to Optionee upon exercise of the Option is registered under the Securities Act of 1933, as amended (the “Securities Act”),

the Purchased Shares will be “restricted securities” within the meaning of Rule 144 under such Act; (b) the

Purchased Shares may not be sold, transferred or assigned by the Optionee except pursuant to an effective registration statement

under the Securities Act or an exemption from registration under the Securities Act; and (c) the Company is under no obligation

to file a registration statement under the Securities Act covering the Option Shares. Optionee agrees that any certificates evidencing

Purchased Shares may bear a legend indicating that their transferability is restricted in accordance with applicable state and

federal securities laws.

10. General

Provisions.

10.1. Further

Assurances. Optionee shall promptly take all actions and execute all documents requested by the Company that the Company

deems to be reasonably necessary to effectuate the term and intent of this Agreement.

10.2. Notices.

All notices, requests, demands and other communications (collectively, “Notices”) given pursuant to this

Agreement shall be in writing, and shall be delivered by personal service, courier, or by United States first class,

registered or certified mail, postage prepaid, addressed to the party at the address set forth on the signature page of this

Agreement. Any Notice, other than a Notice sent by registered or certified mail, shall be effective when received; a

Notice sent by registered or certified mail, postage prepaid return receipt requested, shall be effective on the earlier of

when received or the third day following deposit in the United States mails. Any party may from time to time change its

address for further Notices hereunder by giving notice to the other party in the manner prescribed in this Section.

10.3. Failure

to Enforce Not a Waiver. The failure of the Company to enforce at any time any provision of this Agreement shall in no

way be construed to be a waiver of such provision or of any other provision hereof.

10.4.

Governing Law. This Agreement shall be governed by and construed in accordance with the law of the State of Nevada

applicable to contracts made in, and to be performed within, that State.

10.5. Transfer

of Rights under this Agreement. The Company may at any time transfer and assign its rights and delegate its obligations

under this Agreement to any other person, corporation, firm or entity, with or without consideration.

10.6. Option Non-transferable. Optionee may not sell, transfer, assign or otherwise dispose of the Option except

by will or the laws of descent and distribution, and only Optionee or his or her legal representative or guardian may exercise

the Option during Optionee’s lifetime.

10.7. No Right to Employment. Nothing in this Option shall interfere with or limit in any way the right of the Company

or of any of its Affiliates to terminate Optionee’s employment, consulting or advising at any time, nor confer upon Optionee

any right to continue in the employ of, consult with or advise the Company or any of its Affiliates.

10.8. Delivery of Plan to Optionee. Optionee acknowledges that a copy of the Plan has been delivered to Optionee

and that Optionee has read the Plan prior to signing this Agreement.

10.9. Successors and Assigns. Except to the extent specifically limited by the terms and provision of this Agreement,

this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors, assigns, heirs

and personal representatives.

10.10. Miscellaneous. Titles and captions contained in this Agreement are inserted for convenience of reference only

and do not constitute a part of this Agreement for any other purpose. Except as specifically provided herein, neither this Agreement

nor any right pursuant hereto or interest herein shall be assignable by any of the parties hereto without the prior written consent

of the other party hereto.

10.11. Tax Treatment. Optionee acknowledges that the tax treatment of the Option, the Option Shares or any events

or transactions with respect thereto may be dependent upon various factors or events that are not determined by the Plan or this

Agreement. The Company makes no representations with respect to and hereby disclaims all responsibility as to such tax treatment.

The signature page of this Agreement consists

of the last page of the Certificate.

EXHIBIT “A”

NOTICE OF EXERCISE

(To be signed only upon exercise of the

Option)

| TO: | Lion Biotechnologies, Inc. |

The undersigned, the holder of the enclosed

Stock Option Agreement (Non-Qualified Stock Option), hereby irrevocably elects to exercise the purchase right represented by the

Option and to purchase thereunder ______* shares of Common Stock of Lion Biotechnologies, Inc. (the “Company”)

and herewith encloses payment of $_________ in full payment of the purchase price of such shares being purchased.

| Dated: |

|

|

|

| |

|

|

| |

|

(Signature must conform in all respects

to name |

| |

|

of holder as specified on the face of the Option) |

| |

|

|

| |

|

|

| |

|

|

| |

|

(Address) |

| |

|

|

| |

|

|

| |

|

Social Security Number |

*Insert here the number of shares being

exercised making all adjustments for stock splits, stock dividends or other additional Common Stock of the Company, other securities

or property which, pursuant to the adjustment provisions of Section 5 of the Option, may be deliverable upon exercise.

Exhibit 5.1

TroyGould PC

1801 Century Park East, 16th Floor

Los Angeles, California 90067

June 17, 2015

Lion Biotechnologies, Inc.

21900 Burbank Boulevard, Third Floor

Woodland Hills, California 91367

Ladies and Gentlemen:

We have acted as counsel to Lion Biotechnologies,

Inc., a Nevada corporation (the “Company”), in connection with a Registration Statement on Form S-8 (the “Registration

Statement”) to be filed with the Securities and Exchange Commission (the “Commission”) on or about

the date of this opinion letter and relating to a total of 5,117,500 shares of common stock of the Company, par value $0.000041666

per share (the “Shares”), issuable under the Company’s 2011 Equity Incentive Plan and 2014 Equity Incentive

Plan (collectively, the “Plans”). This opinion letter is furnished to you at your request and in connection

with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act of 1933, as amended.

As a basis for rendering our opinion expressed

below, we have reviewed originals or copies of originals, certified or otherwise identified to our satisfaction, of (i) the Registration

Statement, (ii) the Plans, (iii) the Company’s Amended and Restated Certificate of Incorporation and Bylaws, each

as amended to date, (iv) minutes or resolutions of the Company’s Board of Directors and stockholders pertaining to the

adoption of the Plans and authorization and issuance of the Shares, the Registration Statement and related matters, and (v) such

certificates of public officials, certificates of officers of the Company and other documents as we have considered necessary or

appropriate as a basis for rendering our opinion.

With your permission, in order to render

our opinion, we have made and relied upon such customary assumptions as we have deemed necessary or appropriate without any independent

investigation or inquiry by us. Among other things, we have assumed that: all signatures on documents reviewed by us are genuine;

all documents submitted to us as originals are authentic; and all documents submitted to us as copies conform to the originals

of such documents, and such originals are authentic.

The law covered by our opinion expressed

below is limited to the internal corporation laws of the State of Nevada (including applicable rules and regulations promulgated

thereunder and applicable reported judicial decisions interpreting the same). We neither express nor imply any opinion with respect

to any other laws or the laws of any other jurisdiction.

Based upon and subject to the foregoing,

we are of the opinion that the Shares, when issued and paid for in accordance with the terms of the Registration Statement and

the Plans, will be validly issued, fully paid, and non-assessable.

Lion Biotechnologies, Inc.

June 17, 2015

Page 2 of 2

This opinion letter is rendered to you solely

in connection with the transactions contemplated by the Registration Statement and may not be relied upon for any other purpose.

We consent to the filing with the Commission of this opinion letter as Exhibit 5.1 to the Registration Statement. In giving such

consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities

Act or the rules and regulations of the Commission thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ TroyGould PC |

| |

|

| |

TROYGOULD PC |

Exhibit

23.2

Consent of Independent Registered Public

Accounting Firm

We consent to the incorporation by reference

in this Registration Statement on Form S-8 pertaining to the Genesis Biopharma, Inc. 2011 Equity Incentive Plan and the Lion Biotechnologies,

Inc. 2014 Equity Incentive Plan of our reports dated March 16, 2015, relating to the financial statements and the effectiveness

of internal control over financial reporting of Lion Biotechnologies, Inc. which appear in its Annual Report on Form 10-K for the

year ended December 31, 2014, filed with the Securities and Exchange Commission.

/s/ WEINBERG & COMPANY, P.A.

Los Angeles, California

June 18, 2015

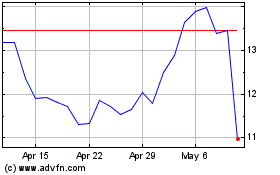

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

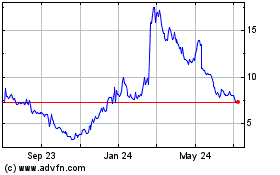

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Apr 2023 to Apr 2024