UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

SCHEDULE 14C

(Rule 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☐ |

Preliminary Information Statement |

| ☒ |

Definitive Information Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

LEGEND OIL

AND GAS, LTD.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| (1) |

Title of each class of securities to which transaction applies: _____________________ |

| (2) |

Aggregate number of securities to which transaction applies: _____________________ |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): _____________________ |

| (4) |

Proposed maximum aggregate value of transaction: _____________________ |

| (5) |

Total fee paid: _____________________ |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) |

Amount Previously Paid: _____________________ |

| (2) |

Form, Schedule or Registration Statement No.: _____________________ |

| (3) |

Filing Party: _____________________ |

| (4) |

Date Filed: _____________________ |

LEGEND OIL

& GAS, LTD.

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

678-366-4400

NOTICE OF ACTION BY

WRITTEN CONSENT OF MAJORITY

STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT

TO SEND US A PROXY

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

We are furnishing this

notice and the accompanying information statement (the “Information Statement”) to the holders of shares of common

stock, par value $0.0001 per share (“Common Stock”), of Legend Oil and Gas, Ltd., a Colorado corporation (the “Company”)

pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C

and Schedule 14C thereunder, in connection with the approval of the actions described below (the “Actions”) taken by

written consent of the holders of a majority of the issued and outstanding shares of Common Stock:

| 1. |

To effect

a reverse stock split of the outstanding shares of Common Stock at a specific ratio within a range from 1-for-10 to 1-for-100 as

the Board of Directors shall determine. |

| |

|

| 2. |

To elect

as directors of the Company the four persons named in the accompanying Information Statement for terms expiring at the 2016 annual

meeting of stockholders. |

| |

|

| 3. |

To approve the Company’s 2015 Incentive

Compensation Plan. |

| |

|

| 4. |

To hold an advisory vote on executive

compensation. |

| |

|

| 5. |

To hold an advisory vote on the frequency

of the advisory vote on executive compensation. |

| |

|

| 6. |

To ratify

the appointment of GBH CPAs, PC as the Company’s independent registered public accounting firm for the year ending December

31, 2015. |

The purpose of this Information

Statement is to notify our stockholders that on May 4, 2015, the owners of approximately 81% of our issued and outstanding shares

of Common Stock (the “Majority Stockholders”) executed a written consent approving the Actions. In accordance with

Rule 14c-2 promulgated under the Exchange Act, the Actions will become effective no sooner than 20 days after we mail this notice

and the accompanying Information Statement to our stockholders.

The written consent that

we received constitutes the only stockholder approval required for the Actions under Colorado law and, as a result, no further

action by any other stockholder is required to approve the Actions and we have not and will not be soliciting your approval of

the Actions.

This notice and the

accompanying Information Statement are being mailed to our stockholders on or about June 9, 2015. This notice and the

accompanying Information Statement shall constitute notice to you of the action by written consent in accordance with Rule

14c-2 promulgated under the Exchange Act.

A copy of this Information Statement and our 2014 Annual Report are available at www.midconoil.com.

| |

|

|

|

By Order of the Board of Directors, |

| |

|

|

|

|

| |

|

|

|

/s/ Andrew Reckles |

| |

|

|

|

Chairman and Chief Executive Officer |

Table

of Contents

LEGEND OIL

& GAS, LTD.

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

678-366-4400

INFORMATION STATEMENT

Action by Written Consent of Majority Stockholders

WE ARE NOT ASKING YOU FOR A

PROXY AND YOU ARE REQUESTED NOT TO SEND US A

PROXY

GENERAL

This Information Statement

is being furnished to the holders of shares of common stock, par value $0.001 per share (“Common Stock”), of Legend

Oil and Gas, Ltd. in connection with the action by written consent of the holders of a majority of our issued and outstanding shares

of Common Stock taken without a meeting to approve the actions described in this Information Statement. In this Information Statement,

all references to “the Company,” “we,” “us” or “our” refer to Legend Oil and Gas,

Ltd. We are mailing this Information Statement to our stockholders of record on or about June 9, 2015.

Pursuant to Rule 14c-2

promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), the actions described herein will not become effective until at least 20 calendar days following

the date on which this Information Statement is first mailed to our stockholders.

The entire cost of furnishing

this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and

other like parties to forward this Information Statement to the beneficial owners of the Company’s Common Stock held of record

by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

Actions by Board of Directors and Majority Stockholders

On May 4, 2015, the Board

of Directors (the “Board”) and the Majority Stockholders of the Company unanimously adopted resolutions approving the

following actions (the “Actions”):

| · |

Action One: The effectuation of a reverse stock split of the outstanding shares of Common Stock

at a specific ratio within a range from 1-for-10 to 1-for-100 as the Board of Directors shall determine (the “Reverse

Stock Split”). |

| · |

Action Two: The election to the Company’s Board of Directors of the four persons named in the accompanying

Information Statement for terms expiring at the 2016 annual meeting of stockholders. |

| · |

Action Three: The approval of the Company’s 2015 Incentive Compensation Plan. |

| · |

Action Four: The approval of the advisory vote on executive compensation. |

| · |

Action

Five: The approval of the advisory vote on the frequency of the advisory vote on executive compensation. |

| · |

Action Six: The ratification of the appointment of GBH CPAs. PC as the Company’s independent registered public

accounting firm for the year ending December 31, 2015. |

As of the close of business

on May 5, 2015, we had 879,000,629 shares of Common Stock outstanding and entitled to vote on the Actions. Each share of outstanding

Common Stock is entitled to one vote.

On May 4, 2015, pursuant

to Section 7-107-104 of the Colorado Revised Statutes (“CSR”) and as provided by the Company’s Restated Articles

of Incorporation, we received written consents approving the Actions from stockholders holding an aggregate of 714,580,689 shares

of our Common Stock representing 81% of our outstanding shares of Common Stock (the “Majority Stockholders”). Thus,

your consent is not required and is not being solicited in connection with the approval of the Actions.

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION

TO MATTERS TO BE ACTED UPON

No officer or director

of the Company has any substantial interest in the Actions, other than his role as an officer or director of the Company.

ACTION ONE – EFFECTUATION OF THE

REVERSE STOCK SPLIT

On May 4, 2015, the Board

adopted resolutions authorizing the effectuation of a reverse stock split of the outstanding shares of Common Stock at a specific

ratio within a range from 1-for-10 to 1-for-100 and at the appropriate time as the Board of Directors shall determine (the “Reverse

Stock Split”).

On May 4, 2015, we received

written consents from the Majority Stockholders approving the effectuation of the Reverse Stock Split at a ratio as determined

by the Board within the foregoing parameters.

Reasons for the Reverse Stock Split

The Reverse Stock Split

is intended to increase the per share stock price of our Common Stock. As of May 5, 2015, the last reported closing price of the

Common Stock was $0.0128 per share. The Board believes that if we are successful in maintaining a higher price per share of our

Common Stock, we will be able to generate greater interest among investors and institutions. If we are successful in generating

such interest, we anticipate that our Common Stock would have greater liquidity and a stronger investor base. Our Board also believes

that a higher stock price is necessary in order for our Common Stock to qualify for a listing on the NASDAQ Stock Market or another

national stock exchange.

The Company cannot assure

you that it will be successful in generating greater interest among investors and institutions or that the Common Stock will qualify

for a listing on the NASDAQ Stock Market or another a national stock exchange. Stockholders should also note that if the Company

elects to implement a Reverse Stock Split, there is no assurance that prices for shares of the Common Stock after the Reverse Stock

Split will increase proportionally to the exchange ratio of the Reverse Stock Split (or at all). Other factors such as our financial

results, market conditions and the market perception of our business may adversely affect the market price of our Common Stock.

The Company cannot guarantee to stockholders that the price of its shares will reach or sustain any price level in the future,

and it is possible the Reverse Stock Split will have no lasting impact on its share price. Furthermore, the liquidity of our Common

Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split. Consequently,

there can be no assurance that the Reverse Stock Split will achieve the desired results.

The Board may determine

in its discretion the exchange ratio for the Reverse Stock Split, provided that such exchange ratio is from of 1-for-10 to 1-for-100,

whereby one post-Reverse Stock Split share of Common Stock (the “New Shares”) is exchanged for up to 100 pre-Reverse

Stock Split shares of Common Stock outstanding immediately prior to the effectiveness of the Reverse Stock Split (the “Old

Shares”). In determining the range of Reverse Stock Split ratios, the Board considered numerous factors, including:

| • |

the historical and projected performance of the Common Stock and volume level before and after the Reverse Stock Split; |

| • |

the prevailing trading price for the Common Stock and the volume level thereof; |

| • |

potential devaluation of our market capitalization as a result of the Reverse Stock Split; |

| • |

prevailing market conditions and general economic and other related conditions prevailing in our industry and in the marketplace generally; and |

| • |

the projected impact of the Reverse Stock Split ratio on trading liquidity in the Common Stock. |

In evaluating the Reverse

Stock Split, the Board also took into consideration negative factors associated with reverse stock splits in general. These factors

include the negative perception of reverse stock splits held by some investors, analysts and other stock market participants, as

well as the fact that the stock price of some companies that have effected reverse stock splits has subsequently declined back

to pre-reverse stock split levels. The Board, however, determined that these negative factors were outweighed by the potential

benefits.

Effects of the Reverse Stock Split

At the Effective Time

(as defined below), each lot of up to 100 Old Shares, as determined by the Board, issued and outstanding immediately prior to the

Effective Time will, automatically and without any further action on the part of our stockholders, be combined into and become

one New Share, subject to the treatment for fractional shares described below, and each certificate which, immediately prior to

the Effective Time, represented Old Shares will be deemed, for all corporate purposes, to evidence ownership of New Shares. STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

If the Board determines

to effectuate the Reverse Stock Split as described above, the Reverse Stock Split will be effectuated sometime after the effective

date of the Actions, which will be twenty days following the mailing of the Information Statement to our stockholders. The Company’s

Articles authorize the issuance of up to 1,100,000,000 shares of Common Stock, par value $0.0001 per share. The proposed Reverse

Stock Split would therefore have the effect of increasing the number of shares of Common Stock remaining available for issuance.

The effective increase in authorized shares of Common Stock resulting from the proposed Reverse Stock Split would create a reserve

of authorized but unissued stock that is significantly more than what is necessary to account for the issued and outstanding shares

of the Company’s Common Stock, shares issuable pursuant to outstanding derivative securities and future issuances for various

corporate purposes.

The Reverse Stock Split

will be effected simultaneously for all our then-existing Old Shares and the exchange ratio will be the same for all of our shares

of outstanding Common Stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s

percentage ownership interests in the Company, subject to the treatment for fractional shares described below. See “Fractional

Shares” below. The New Shares issued pursuant to the Reverse Stock Split will be fully paid and non-assessable. All New Shares

will have the same par value, voting rights and other rights as Old Shares. Stockholders of the Company do not have preemptive

rights to acquire additional shares of Common Stock. The following table provides the effects of the Reverse Stock Split based

on the ratios in the specified range and is based on 879,000,629 shares of Common Stock outstanding as of May 5, 2015.

| Proposed Reverse Stock Split |

|

Percentage Reduction in the Outstanding Shares of Common Stock |

|

Common Stock Outstanding after the Reverse Stock Split |

|

Common Stock Available for Issuance after the Reverse Stock Split and Decrease in Authorized

Common Stock(1) |

| 1 for 10 |

|

90% |

|

87,900,063 |

|

912,099,937 |

| |

|

|

|

|

|

|

| 1 for 25 |

|

96% |

|

35,160,025 |

|

964,839,975 |

| |

|

|

|

|

|

|

| 1 for 50 |

|

98% |

|

17,580,013 |

|

982,419,987 |

| |

|

|

|

|

|

|

| 1 for 100 |

|

99% |

|

8,790,006 |

|

991,209,994 |

| |

(1) |

The numbers in this column are based on the decrease in authorized number of Common Stock remaining the same after the effectuation of the Reverse Stock Split. |

| |

|

|

|

|

|

|

|

|

A new CUSIP number will

also be assigned to the Common Stock following the Reverse Stock Split.

Commencing at the Effective

Time, all outstanding options, warrants and other convertible securities entitling holders thereof to purchase shares of Common

Stock would entitle such holders to receive, upon exercise of their securities, a fraction (depending on the actual exchange ratio

of the Reverse Stock Split) of the number of shares of Common Stock which such holders may purchase upon exercise or conversion

of their securities. In addition, commencing at the Effective Time, the exercise or conversion price of all outstanding options,

warrants and other convertible securities of the Company would be increased proportionally, based on the actual exchange ratio

of the Reverse Stock Split.

Effect on Voting Rights of, and Dividends on, Common Stock

Proportionate voting rights

and other rights of the holders of Common Stock would not be affected by the Reverse Stock Split. The percentage of outstanding

shares owned by each stockholder prior to the Reverse Stock Split, if implemented, will remain the same, except for adjustment

as a consequence of rounding up of any fractional shares created by the Reverse Stock Split. See “Fractional Shares”

above.

We have not in the past

declared, nor do we have any plans to declare in the immediately foreseeable future, any distributions of cash, dividends or other

property, and we are not in arrears on any dividends. Therefore, we do not believe that the Reverse Stock Split would have any

effect with respect to future distributions, if any, to our stockholders.

Effect on Liquidity

The decrease in the number

of shares of our Common Stock outstanding as a consequence of the Reverse Stock Split may decrease the liquidity in our Common

Stock if the anticipated beneficial effects do not occur. See “Purposes of the Reverse Stock Split” above. If implemented,

the Reverse Stock Split may result in some stockholders owning “odd-lots” of less than 100 shares of Common Stock on

a post-split basis. Odd lots may be more difficult to sell, or require greater transaction costs per share to sell than shares

in “even lots” of even multiples of 100 shares.

Certain U.S. Federal Income Tax Consequences

The following summary

of certain material federal income tax consequences of the Reverse Stock Split does not purport to be a complete discussion of

all of the possible federal income tax consequences and is included for general information only, is not intended as tax advice

to any person and is not a comprehensive description of the tax consequences that may be relevant to each shareholder’s own

particular circumstances. Further, it does not address any state, local, foreign or other income tax consequences, nor does it

address the tax consequences to shareholders that are subject to special tax rules, such as shareholders who are subject to the

alternative minimum tax, banks, insurance companies, regulated investment companies, personal holding companies, shareholders who

are not “United States persons” as defined in section 7701(a)(30) of the Code, broker-dealers and tax-exempt entities.

This summary is based on the Code, the Treasury regulations thereunder and proposed regulations, court decisions and current administrative

rulings and pronouncements of the IRS, all of which are subject to change, possibly with retroactive effect. This summary addresses

only those stockholders who hold their Old Shares as “capital assets” as defined in the Code (generally, property held

for investment), and will hold the New Shares as capital assets.

Holders of Common Stock

are advised to consult their own tax advisers regarding the federal income tax consequences of the Reverse Stock Split in light

of their personal circumstances and the consequences under state, local and foreign tax laws, and also as to any estate or gift

tax considerations.

We are structuring the

Reverse Stock Split in an effort to obtain the following consequences:

| |

• |

the Reverse Stock Split will qualify as a recapitalization under section 368(a)(1)(E) of the Code for U.S. federal income tax purposes; |

| |

• |

stockholders should not recognize any gain or loss as a result of the Reverse Stock Split; |

| |

• |

the aggregate basis of a stockholder’s Old Shares will become the aggregate basis of the New Shares held by such stockholder immediately after the Reverse Stock Split; and |

| |

• |

the holding period of the New Shares will include the stockholder’s holding period for the Old Shares. |

The above discussion is

not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. federal tax penalties. It

was written solely in connection with the proposed Reverse Stock Split of our Common Stock.

No Appraisal Rights

Our stockholders will

not have any right to elect to have the fair value of their shares judicially appraised and paid to them in cash in connection

with, or as a result of, the Reverse Stock Split.

Effective Date of the Reverse Stock Split

We intend to effectuate

the Reverse Stock Split sometime the effective date of the Actions, which will be twenty days following the mailing of the Information

Statement to our stockholders. However, the exact timing of the Reverse Stock Split will be determined by the Board based on its

evaluation as to when such action will be the most advantageous to the Company and our stockholders. In addition, the Board reserves

the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the

Reverse Stock Split if the Board, in its sole discretion, determines that it is no longer in our best interests and the best interests

of our stockholders.

Exchange of Stock Certificates

As soon as practicable

after the effective date of the Reverse Stock Split (the “Effective Date”), our transfer agent, acting as our “exchange

agent” for purposes of implementing the exchange of certificates, will mail each stockholder of record a transmittal form

accompanied by instructions specifying other details of the exchange. Upon receipt of the transmittal form, each stockholder should

surrender the certificates representing our Common Stock prior to the Reverse Stock Split in accordance with the applicable instructions.

Each holder who surrenders certificates will receive new certificates representing the whole number of shares of our Common Stock

that he or she holds as a result of the Reverse Stock Split. New certificates will not be issued to a stockholder until the stockholder

has surrendered his or her outstanding certificate(s) together with the properly completed and executed transmittal form to the

exchange agent.

If your shares are held

in an account at a brokerage firm or financial institution, which is commonly referred to as your shares being held in “street

name,” then you are the beneficial owner of those shares and the brokerage firm or financial institution holding your account

is considered to be the stockholder of record. We intend to treat stockholders holding common stock in street name in the same

manner as registered stockholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed

to effect the reverse stock split for their beneficial holders holding common stock in street name. However, these banks, brokers

or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. If you hold

your shares with a bank, broker or other nominee and if you have any questions in this regard, we encourage you to contact your

bank, broker or nominee.

Any stockholder whose

certificate has been lost, destroyed or stolen will be entitled to a new certificate only after complying with the requirements

that we and our transfer agent customarily apply in connection with replacing lost, stolen or destroyed certificates.

No service charges, brokerage

commissions or transfer taxes shall be payable by any holder of any old certificate, except that if any new certificate is to be

issued in a name other than that in which the old certificate(s) are registered, it will be a condition of such issuance that (i) the

person requesting such issuance must pay to us any applicable transfer taxes or establish to our satisfaction that such taxes have

been paid or are not payable, (ii) the transfer complies with all applicable federal and state securities laws, and (iii) the

surrendered certificate is properly endorsed and otherwise in proper form for transfer.

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT THEIR STOCK CERTIFICATES UNTIL THEY RECEIVE A TRANSMITTAL FORM

FROM OUR TRANSFER AGENT.

Fractional Shares

The reverse stock split

may result in some of our stockholders momentarily owning “fractional” shares. However, no fractional shares will be

issued in connection with the reverse stock split. Following the completion of the reverse stock split, the Company will aggregate

all fractional shares that otherwise would have been issued as a result of the reverse stock split and those shares will be sold

into the market. Stockholders who would otherwise hold a fractional share of Company common stock will receive a pro rata cash

payment from the proceeds of that sale in lieu of such fractional share. The Company will bear all costs of such sales.

Accounting Matters

The par value of our Common

Stock will remain unchanged at $0.0001 per share after the Reverse Stock Split. As a result, our stated capital, which consists

of the par value per share of the Common Stock multiplied by the aggregate number of shares of the Common Stock issued and outstanding,

will be reduced proportionately at the effective time of the Reverse Stock Split. Correspondingly, our additional paid-in capital,

which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently

outstanding shares of Common Stock, will be increased by a number equal to the decrease in stated capital. Further, net loss per

share, book value per share, net income and other per share amounts will be increased as a result of the Reverse Stock Split because

there will be fewer shares of Common Stock outstanding.

ACTION TWO – ELECTION OF DIRECTORS

We currently

have three members on our Board. The Majority

Stockholders have voted for the four nominees listed below to serve until our 2016 Annual Meeting of Shareholders and until

such director’s successor has been elected and qualified, or until such director’s death, resignation or

removal.

There are no family relationships

among our directors, director nominees or executive officers. If any nominee is unable or declines to serve as a director, the

Board may designate another nominee to fill the vacancy and the proxy will be voted for that nominee.

Directors and Executive Officers

As of May 12, 2015,

our Board of Directors consisted of three executive officers. Directors serve until their respective successors have been

elected and qualified. Executive officers are appointed by and serve at the pleasure of the Board of Directors.

Set forth below is biographical information

for each of our current directors and one nominee for the Board of Directors.

| Name |

|

Age |

|

Position |

|

Director Tenure |

| Andrew Reckles |

|

45 |

|

Chief Executive Officer

Chairman of the Board |

|

October 2014 – Current |

| |

|

|

|

|

|

|

| Warren Binderman |

|

51 |

|

President and Chief Financial Officer

and Director |

|

October 2014 – Current |

| |

|

|

|

|

|

|

| Albert Valentin |

|

42 |

|

Executive Vice President and Director |

|

April 2015 – Current |

| |

|

|

|

|

|

|

| Jeffrey Kaplin |

|

49 |

|

Director Nominee |

|

— |

Andrew S. Reckles

Andy Reckles is our Chairman

and Chief Executive Officer. Andy has been responsible for structuring and funding more than 200 domestic & international transactions

totaling in excess of $1.5 billion in closed deals. He has keen business acumen and experience in numerous disciplines, including

biotechnology, staffing, retail, energy, medical device technology, defense and advertising. Andy has significant buy-side experience,

which proves invaluable when negotiating on behalf of clients. He was the General Partner of a US-based hedge fund from 2001 until

2008; the fund’s mandate was primarily to provide senior and mezzanine credit facilities to growing companies across multiple

disciplines. Andy’s fund was the top performing hedge fund in the world in 2003 according to HedgeWorld database.

Andy has served on several

public and private company boards. Andy has both executive experience acting as CEO, President, and/or Chief Restructuring Officer

as well as held board positions at numerous companies across multiple industries over his career. In fact, his expertise while

serving on the board of Oxford Media, during its bankruptcy proceeding, was an instrumental component to that company being acquired

out of bankruptcy. Andy was also instrumental in negotiating and closing Australia’s largest biotech licensing agreement

on behalf of his client with Pfizer. He is a Certified Lean Six Sigma Green Belt holder and is currently pursuing his Six Sigma

Black Belt. Andy is also a Chartered Hedge Fund Professional (“CHP”).

Albert Valentin

Al is a founder and

the Chief Executive Officer of Maxxon Energy, the operational entity/subsidiary of Black Diamond Energy Holdings, LLC, which was

acquired by the Company on April 3, 2015. On that date, Al was elected Executive Vice President and a director of the Company.

As a founding partner of Maxxon, Al brings a great deal of experience as a serial entrepreneur, business owner, and a

veteran of the transportation industry of 16 years. He has worked for some of the leading Fortune 500 companies in the

world including Frito Lay, Pepsi Co., Conway Western Express and C.R. England. Al has been actively involved in the transportation

industry for over 16 years, earning several safety awards, and eventually serving as a senior trainer for C.R. England Trucking,

the largest “Refer” trucking company in North America. Already familiar with the trucking aspect of the Bakken Oil

Shale Formation located in North Dakota, he started Superior Trucking, a small trucking outfit which serviced many oil wells

throughout North Dakota. Based on the success of Superior Trucking, and already well integrated into the industry, Al was

able to quickly secure the necessary capital to co-found Maxxon Energy in

2012.

Warren S. Binderman

Warren is the President

and Chief Financial Officer of Legend, having been elected to the former office in April 2015, and has served Chief Financial Officer

since July 2014. He also serves on the Company’s Board and is the Secretary and Treasurer. He also serves as the managing

member of the Binderman Group, LLC, a specialized accounting and business consulting firm performing services for clientele throughout

the United States. Warren excels in servicing and communicating with clients as they move through the transaction process—from

IPO, private equity deals, mergers and acquisitions, public shell transactions and reverse mergers, and other such ownership transitions.

He is a skilled business partner who listens and is committed to helping Clients achieve their goals, ensuring that the transactions

being considered are properly supported and meet the appropriate financial and strategic objectives. Warren’s expertise includes

accounting and auditing for public companies, due diligence on mergers and acquisitions, private placement reviews, and restructuring

services. He has demonstrated experience in various industry sectors and has worked with many publicly held companies. Due to his

experience working with public companies, he has an excellent depth of knowledge in public company activities and transactions,

all of which require SEC compliance. Before working with Legend and starting the Binderman Group, Warren served in various capacities

with International accounting firms in the capacities of partner, director, manager and staff. He worked for Arthur Andersen LLP

for nine years and KPMG LLP for over three years, as well as other national and international firms throughout his career. Warren

received his Bachelor of Business Administration degree from the University of Maryland in 1990 and was a Magna Cum Laude graduate

of The Smith Business School, with a major in Accounting. He is a member of the AICPA and the Georgia Society of Certified Public

Accountants (GSCPA), and is an active CPA in both Georgia, and Maryland.

Jeffrey Kaplin

Jeff

has lived in Atlanta, GA since 1987. Jeff graduated from Indiana University in Bloomington, Indiana in May 1987 with a Bachelor

of Science with a major in Accounting. He has practiced public accounting for over 20 years and is the managing partner of the

public accounting firm, Rosenthal & Kaplin, P.C., which is a member firm of the AICPA. He is a financial expert in the areas

of taxation (corporate, individual and partnership), and as a CPA, practices auditing and attestation services. Other areas relative

to Jeff’s expertise include IRS representation, litigation support, and merger and acquisition services. Jeff is currently

serving on the B’nai Torah Board of Trustees, The Standard Country Club Board of Governors and is a former Epstein School

Trustee. He is a an active CPA in Georgia, and is a member of the American Institute of Certified Public Accountants (AICPA) and

the Georgia Society of Certified Public Accountants (GSCPA).

Unless otherwise stated

above, none of our directors or executive officers is a director of any other public company, nor are they related to any officer,

director or affiliate of the Company. Additionally, none of our directors or executive officers is a party to any pending legal

proceeding, is subject to a bankruptcy petition filed against them or have been convicted in, or is subject to, any criminal proceeding.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of

the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than 10%

of our common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in

ownership of our common stock. Such persons are also required by SEC regulations to furnish us with copies of all such ownership

reports they file. SEC regulations also require us to identify in this Report any person who failed to file any such report on

a timely basis.

We believe that all officers

and directors complied with all applicable Section 16(a) filing requirements for fiscal year 2014, other than Warren S. Binderman

who filed his initial Form 3 and 4 late. Such filings are now up to date. We do not know if any persons who own more than 10% of

our common stock filed such reports.

Code of Ethics

We have a Code of Ethics

that applies to our two key executives and directors. A copy of the Code of Ethics is available on our corporate website at http://legendoilandgas.com

in the section “About Legend.”

Director Independence

Under Rule 5605(b)(1)

of the Nasdaq Marketplace Rules, independent directors must comprise a majority of a listed company’s board of directors

within one year of listing. In addition, Nasdaq Marketplace Rules require that, subject to specified exceptions, each member of

a listed company’s audit, compensation and nominating and governance committees be independent. While the Company does not

currently qualify for listing on Nasdaq and will likely not qualify for some time after the date of this Information Statement,

it does intend to seek such listing as soon as possible and complies with its Marketplace Rules. Audit committee members must also

satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended. Under Nasdaq

Marketplace Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of that

company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent

judgment in carrying out the responsibilities of a director. In order to be considered to be independent for purposes of Rule 10A-3,

a member of an audit committee of a public company may not, other than in his or her capacity as a member of the audit committee,

the board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other

compensatory fee from the public company or any of its subsidiaries; or (2) be an affiliated person of the listed company

or any of its subsidiaries.

Our Board has undertaken

a review of the independence of each director and director nominee. Based upon information requested from and provided by each

director concerning his background, employment and affiliations, including family relationships, our Board has determined that

Mr. Kaplin does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities

of a director and that he is “independent” as that term is defined under Nasdaq Marketplace Rule 5605(a)(2).

Our Board also determined

that Mr. Kaplin, who will comprise our Audit Committee, satisfies the independence standards for those committees established by

applicable SEC rules and the Nasdaq Marketplace Rules. In making this determination, our Board considered the relationships that

Mr. Kaplin has with our company and all other facts and circumstances our Board deemed relevant in determining their independence,

including the beneficial ownership of our capital stock by Mr. Kaplin.

Audit Committee

As of December 31, 2014,

our audit committee was not independent, and the Board of Directors served in the role of the audit committee. Following the effectiveness

of the election of directors, the Audit Committee will consist of Jeffrey Kaplin.

Summary Compensation Table

The following table shows all compensation

awarded, earned by or paid to Mssrs. Andrew Reckles, Chairman of the Board and CEO, Marshall Diamond-Goldberg, former President

and COO, Warren S. Binderman, President, CFO and Secretary/Treasurer, James Vandeberg, former CFO and Secretary and Kyle Severson,

former Chief Financial Officer (our “NEOs”) for each of the fiscal years ended December 31, 2014 and 2013:

| Name and Principal Position |

|

|

Year |

|

|

|

Salary |

|

|

|

Bonus |

|

|

|

Stock Awards |

|

|

|

All Other Compensation |

|

|

|

Total Compensation |

|

Andrew Reckles

Chief Executive Officer |

|

|

2014 |

|

|

$ |

163,000 |

|

|

$ |

550,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

713,000 |

1 |

| Marshall Diamond-Goldberg |

|

|

2014 |

|

|

$ |

327,000 |

|

|

$ |

65,000 |

|

|

$ |

162,978 |

3 |

|

$ |

— |

|

|

$ |

554,978 |

|

| President and Chief Operating Officer2 |

|

|

2013 |

|

|

$ |

300,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

15,000 |

4 |

|

$ |

315,000 |

|

| James Vandeberg5 |

|

|

2014 |

|

|

$ |

51,500 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

51,500 |

|

| Secretary and Chief Financial Officer |

|

|

2013 |

|

|

$ |

60,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Kyle Severson6 |

|

|

2014 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Former Chief Financial Officer |

|

|

2013 |

|

|

$ |

180,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

180,000 |

|

Warren S. Binderman

Chief Financial Officer |

|

|

2014 |

|

|

$ |

73,500 |

|

|

$ |

38,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

111,500 |

|

Compensation Philosophy and Objectives

Our executive compensation program that we

apply to our NEOs will be designed to attract and retain qualified and experienced executives who will contribute to our success.

The executive compensation program is designed to attract, motivate and retain individuals with the skills and qualities necessary

to support and develop our business within the framework of our small size and available resources. The Board of Directors has

sole and unfettered discretion with respect to decisions regarding the compensation of the NEOs.

Elements of Compensation

Our executive compensation program is anticipated

to consist of two components: (i) base compensation, and (ii) a long-term compensation component in the form of stock

options and stock awards. Both components are determined and administered by the Board of Directors. The stock incentive component

is expected to form an essential part of the NEOs’ compensation.

Base Compensation

Base compensation for the NEOs is reviewed

from time to time and set by the Board of Directors, and is based on the individual’s job responsibilities, contribution,

experience and proven or expected performance, as well as to market conditions. In setting base compensation levels, consideration

will be given to such factors as level of responsibility, experience and expertise. Subjective factors such as leadership, commitment

and attitude will also be considered.

Stock Options and Awards

To provide a long-term component to the executive

compensation program, our executive officers, directors, employees and consultants may be granted Options and Awards (as those

terms are defined below) under our new 2015 Incentive Compensation Plan which was approved by the Majority Stockholders and will

become effective on the twentieth day following the mailing of this Information Statement to our stockholders. The maximization

of shareholder value is encouraged by granting equity incentive awards. The Chief Executive Officer will make recommendations to

the Board of Directors for the other executive officers and key employees. These recommendations take into account factors such

as equity compensation given in previous years, the number of Options and Awards outstanding per individual and the level of responsibility.

1

Mr. Reckles compensation includes amounts paid ($50,000) and the balance accrued at December 31, 2014.

2

Mr. Diamond-Goldberg’s independent contractor agreement with the Company was terminated on April 25, 2015.

3

Represents the value of 26,444,445 shares of Company common stock issued to Mr. Diamond-Goldberg in June 2014.

4

Represents tax gross-up payments paid to Mr. Diamond-Goldberg to cover applicable taxes as a Canadian citizen.

5

Effective May 1, 2012, Mr. Vandeberg’s compensation was decreased to $10,000 per month. Effective July 1, 2012, Mr. Vandeberg’s

compensation was decreased to $5,000 per month. Mr. Vandeberg was appointed as CFO on April 11, 2013.

6

Mr. Severson stepped down as CFO on April 11, 2013.

Director Compensation

We paid and/or accrued a monthly fee of $5,000 per month to Mr.

Reckles for his service as Chairman of the Board, commencing October 1, 2014.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS |

The following tables set forth information

with respect to the beneficial ownership of our Common Shares as of May 5, 2015 by our directors, named executive officers, and

directors and executive officers as a group, as well as each person (or group of affiliated persons) who is known by us to beneficially

own 5% or more of our Common Shares. As of the latest practical date before filing this mailing this Information Statement, there

were 879,000,629 Common Shares issued and outstanding.

The percentages of Common Shares beneficially

owned are reported on the basis of regulations of the Securities and Exchange Commission governing the determination of beneficial

ownership of securities. Under the rules of the Securities and Exchange Commission, a person is deemed to be a beneficial owner

of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security,

or investment power, which includes the power to dispose of or to direct the disposition of the security. To our knowledge, unless

indicated in the footnotes to the table, each beneficial owner named in the tables below has sole voting and sole investment power

with respect to all shares beneficially owned.

| |

|

|

|

Amount and Nature of |

|

|

| Title of Class |

|

Name of Beneficial Owner |

|

Beneficial Ownership |

|

Percent of Class |

| Common stock, par value |

|

Hillair Capital Investments, L.P. |

|

604,145,998 |

|

|

| $0.001 |

|

330 Primrose Rd., Suite 660 |

|

|

|

|

| |

|

Burlingame, CA 94010 |

|

|

|

69% |

| |

|

|

|

|

|

|

| Common stock, par value |

|

Albert Valentin |

|

90,817,356 |

|

|

| $0.001 |

|

555 Northpoint Center East, |

|

|

|

|

| |

|

Suite 400 |

|

|

|

|

| |

|

Alpharetta, GA 30022 |

|

|

|

10% |

| |

|

|

|

|

|

|

| Common stock, par value |

|

Warren S. Binderman |

|

7,500,000 |

|

|

| $0.001 |

|

President and Chief Financial |

|

|

|

|

| |

|

Officer |

|

|

|

|

| |

|

555 Northpoint Center East, |

|

|

|

|

| |

|

Suite 400 |

|

|

|

|

| |

|

Alpharetta, GA 30022 |

|

|

|

1% |

| |

|

|

|

|

|

|

| Common stock, par value |

|

Andrew Reckles (1) |

|

16,263,679 |

|

|

| $0.001 |

|

555 Northpoint Center East, |

|

|

|

|

| |

|

Suite 400 |

|

|

|

|

| |

|

Alpharetta, GA 30022 |

|

|

|

2% |

| |

|

|

|

|

|

|

| TOTAL: |

|

|

|

711,310,687 |

|

82% |

| (1) |

Mr. Reckles beneficially owns these shares through Northpoint Energy Partners, LLC, of which he is the managing member. |

Securities Authorized for Issuance Under Equity Compensation

Plans

On September 5, 2014,

our Board of Directors adopted the Legend Oil and Gas, Ltd. 2014 Incentive Compensation Plan, included in the Form S-8 filed on

that date. This Incentive Compensation Plan provides for the grant of options (“Options”) to purchase Common

Shares, and stock awards (“Awards”) consisting of Common Shares, to eligible participants, including our directors,

executive officers, employees and consultants. The terms and conditions of the 2014 Incentive Compensation Plan apply equally to

all participants. We reserved a total of 65,000,000 Common Shares for issuance under the Plan. No shares or stock options have

been issued under this Plan as of this date.

On October 17, 2013, our Board of Directors

adopted the Legend Oil and Gas, Ltd. 2013 Incentive Compensation Plan. We reserved a total of 10,000,000 Common Shares for issuance

under the Plan. This Plan has not been approved by shareholders. There are currently no options outstanding under the 2013 Incentive

Compensation Plan, and a grant for 750,000 Common Shares was issued on October 17, 2014.

The Company does not intend to issue any further

Options or Awards under any Incentive Compensation Plan other than the 2015 Incentive Compensation Plan. Further, the Company intends

to amend the Form S-8 registration statement referenced above to cover all Options and Awards awarded under the 2015 Incentive

Compensation Plan.

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

Related Party Transactions

We are not aware of any

material interest, direct or indirect, of any of our directors or executive officers, any person beneficially owning, directly

or indirectly, 10% or more of our voting securities, or any associate or affiliate of such person in any transaction since the

beginning of the last fiscal year or in any proposed transaction which in either case has materially affected or will materially

affect us.

Conflicts of Interest

Our business raises potential

conflicts of interest between certain with our officers and directors. Certain of our directors are directors of other natural

resource companies and, to the extent that such other companies may participate in ventures in which we may participate, our directors

may have a conflict of interest in negotiating and concluding terms regarding the extent of such participation. In the event that

such a conflict of interest arises at a meeting of the Board of Directors, a director who has such a conflict will abstain from

voting for or against the approval of such participation or such terms. In appropriate cases, we will establish a special committee

of independent directors to review a matter in which several directors, or management, may have a conflict.

ACTION THREE – 2015 INCENTIVE COMPENSATION

PLAN

2015 Incentive Compensation Plan

The purpose of our 2015

Incentive Compensation Plan (“2015 Plan”) is to maintain the ability of the Company and its subsidiaries to attract

and retain highly qualified and experienced directors, employees and consultants and to give such directors, employees and consultants

a continued proprietary interest in the success of the Company and its subsidiaries. In addition, the 2015 Plan is intended to

encourage ownership of our common stock by the directors, employees and consultants of the Company and its affiliates and to provide

increased incentive for such persons to render services and to exert maximum effort for the success of the Company’s business.

The 2015 Plan will provide eligible employees and consultants the opportunity to participate in the enhancement of stockholder

value by the grants of options (including incentive stock options for employees only), restricted or unrestricted common stock

and other awards under the 2015 Plan, including having their bonuses and/or consulting fees payable in restricted or unrestricted

common stock and other awards, or any combination thereof. The number of shares that currently may be issued under the 2015 Plan

is 100,000,000 shares of common stock, subject to adjustment in accordance with the adjustment provisions of the 2015 Plan. In

no event shall the number of shares subject to awards granted to any one participant during any one calendar year exceed the number

of shares that may be delivered under the Plan.

The Majority Stockholders approved the adoption

of the 2015 Incentive Compensation Plan.

ACTION FOUR – ADVISORY VOTE TO APPROVE

EXECUTIVE COMPENSATION

The Board of Directors

has established an executive compensation program that it believes appropriately supports the Company’s business goals in

attracting, motivating and retaining talented and entrepreneurial executives.

Section 14A of the Exchange

Act, which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, requires that, not less frequently

than once every three years, we provide stockholders with an advisory vote to approve the Company’s executive compensation

as disclosed herein. Accordingly, the Majority Stockholders were asked to approve the following advisory resolution:

RESOLVED, that the stockholders approve,

on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the compensation Discussion

and Analysis, the accompanying compensation tables and the related narrative disclosure in the Company’s Information Statement.

We urge stockholders to

read the “Compensation Discussion and Analysis” section of this Information Statement, which describes in more detail

how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well

as the Summary Compensation table and other related compensation tables and narratives, which provide detailed information on the

compensation of our listed officers. The Board believes that the policies and procedures articulated in “Compensation Discussion

and Analysis” are effective in achieving our goals and that the compensation of our listed officers reported in this proxy

statement will support and contribute to the Company’s long-term success.

Required Vote

There is no required vote

to this proposal. Nonetheless, the Majority Stockholders have approved the compensation paid to our executive officers.

ACTION FIVE – ADVISORY VOTE ON THE FREQUENCY

OF ADVISORY VOTES ON EXECUTIVE COMPENSATION

In addition to providing the Majority

Stockholders you with the opportunity to cast an advisory vote on executive compensation, we also asked such Stockholders to cast

an advisory vote on the frequency of that “say-on-pay” vote. The Majority Stockholders were asked to indicate whether

the advisory “say-on-pay” vote should be held every one, two or three years.

The Board recommended

that such advisory vote occurs on a triennial basis. The Majority Stockholders approved the proposal that such advisory vote occur

every three years.

ACTION SIX – RATIFICATION OF APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

GBH CPAs, PC audited our financial statements

for the year ended December 31, 2014, and Peterson Sullivan LLP audited our financial statements for the year ended December 31,

2013.

Policy for Approval of Audit and Permitted Non-Audit Services

The Board of Directors, in its discretion,

may direct the appointment of different public accountants at any time during the year, if the Board believes that a change would

be in the best interests of the shareholders. During 2014 and 2013, the Board of Directors considered the audit fees, audit-related

fees, tax fees and other fees paid to our accountants, as disclosed below, and determined that the provision of such services by

our independent registered public accounting firm was compatible with the maintenance of that firm’s independence in the

conduct of its auditing functions.

Audit and Related Fees

The following table sets forth the aggregate

fees billed by both GBH CPAs and Peterson Sullivan for professional services rendered in fiscal years ended December 31, 2014

and 2013.

|

|

2014 |

|

|

2013 |

|

| |

|

|

|

|

|

|

| Audit Fees (1) |

|

$ |

21,000 |

|

|

$ |

77,056 |

|

| |

|

|

|

|

|

|

|

|

| Audit-Related Fees (2) |

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Tax Fees (3) |

|

|

— |

|

|

|

5,360 |

|

| |

|

|

|

|

|

|

|

|

| All Other Fees |

|

|

— |

|

|

|

— |

|

| (1) |

“Audit Fees” represent fees for professional services provided in connection with the audit of our annual financial statements and review of our quarterly financial statements included in our reports on Form 10-Q, and audit services provided in connection with other statutory or regulatory filings. |

| (2) |

“Audit-Related Fees” generally represent fees for assurance and related services reasonably related to the performance of the audit or review of our financial statements. |

| (3) |

“Tax Fees” generally represent fees for tax advice. |

DELIVERY OF DOCUMENTS

TO SECURITY HOLDERS SHARING AN ADDRESS

If hard copies of the

materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single

address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a

separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement

was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your

shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the

Company at Legend Oil and Gas, Ltd., 555 Northpoint Center East, Suite 400, Alpharetta, GA 30022, 678-366-4400.

If multiple stockholders

sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company

to mail each stockholder a separate copy of future mailings, you may send notification to or call the Company’s principal

executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement

or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address,

notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual

reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information with

the SEC. You may obtain such SEC filings from the SEC’s website at http://www.sec.gov. You can also read and copy these materials

at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about the operation

of the SEC’s public reference room by calling the SEC at 1-800-SEC-0330.

ANNEX A

2015 INCENTIVE COMPENSATION PLAN

A copy of the 2015 Incentive Compensation Plan

is available on our Company website at www.midconoil.com.

14

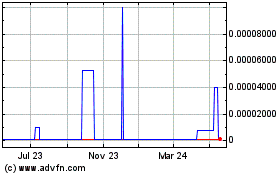

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Aug 2024 to Sep 2024

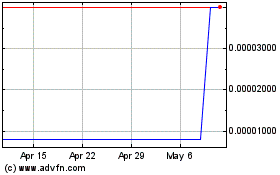

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Sep 2023 to Sep 2024