UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2015

Commission File Number: 001-33869

STAR BULK CARRIERS CORP.

(Translation of registrant’s name

into English)

Star Bulk Carriers Corp.

c/o Star Bulk Management Inc.

40 Agiou Konstantinou Street,

15124 Maroussi,

Athens, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨.

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨.

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K

REPORT

Attached as Exhibit 99.1 is a copy of the

press release of Star Bulk Carriers Corp. dated May 18, 2015, titled Star Bulk Carriers Corp. Announces Closing of Primary Public

Offering of 56,250,000 Common Shares.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| Date: May 18, 2015 |

|

STAR BULK CARRIERS CORP. |

| (Registrant) |

| |

|

|

|

| |

|

By: |

/s/ Hamish Norton |

| |

|

|

Name: |

Hamish Norton |

| |

|

|

Title: |

President |

| Exhibit No. |

Name |

| 99.1 |

Press release of Star Bulk Carriers Corp. dated May 18, 2015, titled Star Bulk Carriers Corp. Announces Closing of Primary Public Offering of 56,250,000 Common Shares. |

| |

|

| |

|

Exhibit 99.1

STAR BULK CARRIERS

CORP. ANNOUNCES CLOSING OF PUBLIC OFFERING OF 56,250,000 COMMON SHARES

ATHENS, Greece, May 18, 2015 –

Star Bulk Carriers Corp. (NASDAQ:SBLK) (“Star Bulk” or “Company”) announced today the closing of its previously

announced public offering of 56,250,000 common shares (the “Shares”), at a price of $3.20 per share. The aggregate

proceeds to Star Bulk, net of placement agent fees and offering expenses, were approximately $176.0 million. Star Bulk intends

to use the net proceeds for general corporate purposes. These general corporate purposes may include, among others things, additions

to Star Bulk’s working capital, capital expenditures (which includes payments under Star Bulk’s newbuilding program),

repayment of debt or the financing of possible acquisitions and investments.

Oaktree

Capital Management, L.P. (“Oaktree”), advisory clients of Monarch Alternative Capital LP

(“Monarch”) and entities affiliated with the family of Mr. Petros

Pappas, our Chief Executive Officer (the “Pappas Affiliates”), which are some of Star Bulk’s

significant shareholders, purchased approximately 21,562,500 of the common shares in this offering. On an as-adjusted basis,

giving effect to this offering and assuming all 29,917,312 common shares comprising the share consideration issued to Excel

Maritime Carriers Ltd. (“Excel”), pursuant to the vessel purchase agreement previously announced in August 2014,

are distributed by Excel to its equity holders, each of Oaktree, Monarch and

the Pappas Affiliates would beneficially own approximately 52.5 %, 5.2 % and 5.8

%, respectively, of our outstanding common shares.

Clarksons Platou Securities and DVB

Capital Markets acted as book-running managers for the offering. ABN AMRO, BNP PARIBAS, Credit Agricole CIB and SEB acted as co-managers.

Copies of the prospectus supplement and

accompanying base prospectus related to the offering may be obtained from Clarksons Platou Securities, Inc. Attention: Raquel Lucas,

410 Park Avenue, Suite 710, New York, NY 10022, or office@platou.com, or by calling toll-free 1-855 864 2265.

This press release does not constitute

an offer to sell or a solicitation of an offer to buy the securities described herein and there shall not be any sale of these

securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. A shelf registration statement relating to the offering of

the common stock was filed with the U.S. Securities and Exchange Commission and is effective.

About Star Bulk

Star Bulk is a global shipping company

providing worldwide seaborne transportation solutions in the dry bulk sector. Star Bulk’s vessels transport major bulks,

which include iron ore, coal and grain and minor bulks which include bauxite, fertilizers and steel products. Star Bulk was incorporated

in the Marshall Islands on December 13, 2006 and maintains executive offices in Athens, Greece. Its common stock trades on the

Nasdaq Global Select Market under the symbol “SBLK”. On a fully delivered basis, Star Bulk will have a fleet of 97 vessels,

with an aggregate capacity of 11.3 million dwt, consisting of Newcastlemax, Capesize, Kamsarmax, Panamax, Post Panamax, Ultramax,

Supramax and Handymax vessels with carrying capacities between 45,588 dwt and 209,000 dwt. Our fleet currently includes 70 operating

vessels and 27 newbuilding vessels under construction at shipyards in Japan and China. All of the newbuilding vessels are expected

to be delivered during 2015 and 2016.

Cautionary

Note Regarding Forward Looking Statements:

Matters discussed

in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides

safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about

their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements, which are other than statements of historical facts. Star Bulk desires

to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The words “believe,” “anticipate,” “intends,”

“estimate,” “forecast,” “project,” “plan,” “potential,” “may,”

“should,” “expect,” “pending” and similar expressions identify forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon

further assumptions, including without limitation, examination by Star Bulk’s management of historical operating trends,

data contained in its records and other data available from third parties. Although Star Bulk believes that these assumptions were

reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond Star Bulk’s control, Star Bulk cannot assure you that it will achieve or

accomplish these expectations, beliefs or projections.

In addition to

these important factors, other important factors that, in Star Bulk’s view, could cause actual results to differ materially

from those discussed in the forward-looking statements include general dry bulk shipping market conditions, including fluctuations

in charterhire rates and vessel market values and appraised values, the strength of world economies, the stability of Europe and

the Euro, fluctuations in interest rates and foreign exchange rates, changes in demand in the dry bulk shipping industry, including

the market for our vessels, changes in our operating expenses, including bunker prices, dry docking and insurance costs, changes

in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation,

general domestic and international political conditions, potential disruption of shipping routes due to accidents or political

events, the availability of financing and refinancing, our ability to meet requirements for additional capital and financing to

complete our newbuilding program and grow our business, vessel breakdowns and instances of off-hire, risks associated with vessel

construction, potential exposure or loss from investment in derivative instruments, potential conflicts of interest involving our

Chief Executive Officer, his family and other members of our senior management, and our ability to complete acquisition transactions

as planned. Please see our filings with the Securities and Exchange Commission for a more complete discussion of these and other

risks and uncertainties. The information set forth herein speaks only as of the date hereof, and Star Bulk disclaims any intention

or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication.

Contact Information

| Star Bulk: |

Investor Relations/Financial Media: |

|

Simos Spyrou and Christos

Begleris

Co-CFOs

Star Bulk Carriers Corp.

c/o Star Bulk Management

Inc.

40 Ag. Konstantinou Av.

Maroussi 15124

Athens Greece

www.starbulk.com

|

Nicolas Bornozis

President

Capital Link, Inc.

230 Park Avenue, Suite

1536

New York, NY 10169

Tel/ (212) 661-7566

E-mail: starbulk@capitallink.com

www.capitallink.com

|

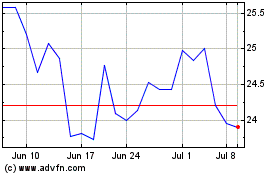

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

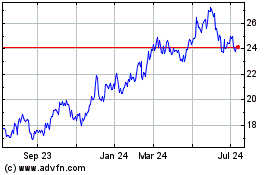

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Apr 2023 to Apr 2024