UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 13, 2015

CytoDyn Inc.

(Exact name of registrant as specified in charter)

Colorado

(State or other

jurisdiction of incorporation)

000-49908

(SEC File Number)

75-3056237

(IRS Employer

Identification No.)

|

|

|

| 1111 Main Street, Suite 660

Vancouver, Washington |

|

98660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(360) 980-8524

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant.

On May 15, 2015 CytoDyn Inc. (the “Company”) completed its previously reported private placement of

convertible promissory notes (the “Offering”). In the final two closings on May 13 and May 15, 2015, the Company issued $2.18 million in aggregate principal amount of unsecured convertible promissory notes (the “Notes”)

and related warrants (the “Warrants”) to purchase common stock of the Company (the “Common Stock”) in a private placement to various accredited investors, pursuant to subscription agreements entered into with each (collectively,

the “Subscription Agreements”), in exchange for cash in an equal amount. Including Notes sold in the previous two closings, Notes in the aggregate principal of $3,981,050, currently convertible into an aggregate of 5,308,040 shares of

Common Stock, together with Warrants to purchase an aggregate of 1,061,586 shares of Common Stock, were sold to investors in the Offering.

The terms of

the Offering and of the Notes and Warrants are described in the Current Reports on Form 8-K, filed by the Company on May 5, 2015, including the forms of the Notes, the Warrants and the Subscription Agreement filed as exhibits thereto, and

May 7, 2015 (the “Prior Form 8-Ks”), each of which is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity

Securities.

The Notes issued on May 13 and May 15, 2015 are convertible into an aggregate of 2,906,652 shares of the Company’s Common

Stock. As part of the investment in such Notes, the Company also issued Warrants for an aggregate of 581,318 shares of Common Stock. The Company relied on the exemption from registration afforded by Section 4(a)(2) of the Securities Act in

connection with the issuance of such Notes and Warrants.

In addition, on May 15, 2015, as part of the consideration for the services provided by it

in the Offering, the Company issued to Paulson Investment Company, LLC, as placement agent in the Offering (the “Placement Agent”), a warrant to purchase an aggregate of 530,802 shares of Common Stock, or 10% of the shares into which

the Notes sold in the Offering are convertible, with an exercise price of $0.75 per share and a term of five years (the “Placement Agent Warrant”). The Company relied on the exemption from registration afforded by Section 4(a)(2) of

the Securities Act in connection with the issuance of the Placement Agent Warrant. The form of the Placement Agent Warrant is attached as Exhibit 4.1 and is incorporated herein by reference.

Additional terms of the Offering and the Notes and the Warrants, as well as the Placement Agent Warrant and the consideration received by the Placement Agent,

are described in the Prior Form 8-Ks, each of which is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 4.1 |

|

Form of Placement Agent Warrant to Purchase Common Stock |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CytoDyn Inc. |

|

|

|

|

| Dated: May 18, 2015 |

|

|

|

By: |

|

/s/ Michael D. Mulholland |

|

|

|

|

|

|

Michael D. Mulholland Chief Financial

Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 4.1 |

|

Form of Placement Agent Warrant to Purchase Common Stock |

EXHIBIT 4.1

PURCHASE WARRANT

Issued to:

[ ]

Exercisable to Purchase

[ ] Shares of Common Stock

of

CYTODYN INC.

Warrant No. A – [ ]

Void after May 15, 2020

THIS WARRANT HAS NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933

AND IS NOT TRANSFERABLE

EXCEPT AS

PROVIDED HEREIN

This is to certify that, for value received and subject to the terms and conditions set forth

below, the Warrantholder (hereinafter defined) is entitled to purchase, and the Company (hereinafter defined) promises and agrees to sell and issue to the Warrantholder, at any time on or after the Issue Date and on or before the seventh anniversary

of the Issue Date, up to [ ] shares of Common Stock (hereinafter defined) at the per share Exercise Price (hereinafter defined).

This Warrant Certificate is issued subject to the following terms and conditions:

1. Definitions of Certain Terms. Except as may be otherwise clearly required by the context, the following terms have the following

meanings:

(a) “Cashless Exercise” means an exercise of a Warrant in which, in lieu of payment of the Exercise Price in cash, the

Warrantholder elects to receive a lesser number of Securities in payment of the Exercise Price, as determined in accordance with Section 2(b).

(b) “Closing Date” means the date or dates on which a closing under the Offering occurs.

(c) “Commission” means the Securities and Exchange Commission.

(d) “Common Stock” means the common stock, no par value, of the Company.

(e) “Company” means CytoDyn Inc., a Colorado corporation.

(f) “Exercise Price” means the price at which the Warrantholder may purchase one share of Common Stock or other Securities upon

exercise of a Warrant as determined from time to time pursuant to the provisions hereof, multiplied by the number of Securities as to which the Warrant is being exercised. The initial Exercise Price is $0.75 per share of Common Stock.

(g) “Issue Date” means the Closing Date on which this Warrant is issued.

(h) “Memorandum” means the offering materials described in the Placement Agent Agreement.

(i) “Offering” means the private offering of shares of Common Stock and warrants made pursuant to the Memorandum and the Placement

Agent Agreement.

(j) “Placement Agent Agreement” means that certain Placement Agent Agreement, dated April 16, 2015,

between the Company and Paulson Investment Company, Inc.

(k) “Rules and Regulations” means the rules and regulations of the

Commission adopted under the Securities Act.

(l) “Securities” means the securities obtained or obtainable upon exercise of the

Warrant or securities obtained or obtainable upon exercise, exchange, or conversion of such securities.

1

(m) “Securities Act” means the Securities Act of 1933, as amended.

(n) “Warrant” means the warrant evidenced by this certificate, any similar certificate issued in connection with the Offering, or any

certificate obtained upon transfer or partial exercise of the Warrant evidenced by any such certificate.

(o) “Warrant

Certificate” means a certificate evidencing the Warrant.

(p) “Warrantholder” means a record holder of the Warrant or

Securities.

2. Exercise of Warrant.

(a) All or any part of the Warrant represented by this Warrant Certificate may be exercised commencing on the Issue Date and ending at 5:00

p.m. Pacific Time on May 15, 2020 (the “Expiration Date”) by surrendering this Warrant Certificate, together with the Exercise Price and appropriate instructions, duly executed by the Warrantholder or by its duly authorized attorney,

at the office of the Company, 1111 Main Street, Suite 660, Vancouver, Washington, 98660; or at such other office or agency as the Company may designate. The date on which such instructions are received by the Company shall be the date of exercise.

If the Warrantholder has elected a Cashless Exercise, such instructions shall so state.

(b) If the Warrantholder elects a Cashless

Exercise, the Warrantholder may surrender in payment of the Exercise Price, shares of Common Stock equal in value to the Exercise Price by surrender of this Warrant at the principal office of the Company together with notice of such election, in

which event the Company shall issue to the Warrantholder a number of shares of Common Stock computed using the following formula:

Where: X = The number of shares of Common Stock to be issued to the Warrantholder pursuant to this Cashless

Exercise

Y = The number of shares of Common Stock in respect of which the Cashless Exercise election is made

A = The fair market value of one share of Common Stock at the time the Cashless Exercise election is made

B = The Exercise Price (as adjusted to the date of the Cashless Exercise)

For purposes of this Section 2(b), the fair market value of one share of Common Stock as of a particular date shall be determined as follows: (i) if

traded on a securities exchange, the value shall be deemed to be the average of the closing prices of the Common Stock on such exchange over the thirty (30) day period ending one (1) day prior to the Cashless Exercise; (ii) if traded

over-the-counter, the value shall be deemed to be the average of the closing bid or sale prices (whichever is applicable) of the Common Stock over the thirty (30) day period ending one (1) day prior to the Cashless Exercise; and

(iii) if there is no active public market, the value shall be the fair market value thereof, as determined in good faith by the Board of Directors of the Company.

2

(c) Subject to the provisions below, upon receipt of notice of exercise, the Company shall

promptly prepare or cause the preparation of certificates for the Securities to be received by the Warrantholder upon completion of the Warrant exercise. After such certificates are prepared, the Company shall notify the Warrantholder and, upon

payment in full by the Warrantholder, in lawful money of the United States, of the Exercise Price payable with respect to the Securities being purchased, or, in the case of a Cashless Exercise, upon deemed surrender of Securities equal in value to

the Exercise Price, deliver such certificates to the Warrantholder, or as per the Warrantholder’s instructions, promptly after such funds are available, if applicable, and otherwise promptly thereafter. The Securities to be obtained on exercise

of the Warrant will be deemed to have been issued, and any person exercising the Warrant will be deemed to have become a holder of record of those Securities, as of the date of receipt by the Company of (a) available funds in cash in payment of

the Exercise Price, or (b) notice of Cashless Exercise.

(d) If fewer than all the Securities purchasable under the Warrant are

purchased, the Company will, upon such partial exercise, execute and deliver to the Warrantholder a new Warrant Certificate (dated the date hereof), in form and tenor similar to this Warrant Certificate, evidencing that portion of the Warrant not

exercised.

(e) Notwithstanding the foregoing, in no event shall such Securities be issued, and the Company is authorized to refuse to

honor the exercise of the Warrant, if such exercise would result in the opinion of the Company’s Board of Directors, upon advice of counsel, in the violation of any law.

3. Adjustments in Certain Events. The number, class, and price of Securities for which this Warrant Certificate may be exercised are

subject to adjustment from time to time upon the happening of certain events as follows:

(a) If the outstanding shares of the

Company’s Common Stock are divided into a greater number of shares or a dividend in stock is paid on the Common Stock, the number of shares of Common Stock for which the Warrant is then exercisable will be proportionately increased and the

Exercise Price will be proportionately reduced; and, conversely, if the outstanding shares of Common Stock are combined into a smaller number of shares of Common Stock, the number of shares of Common Stock for which the Warrant is then exercisable

will be proportionately reduced and the Exercise Price will be proportionately increased. The increases and reductions provided for in this Section 3(a) will be made with the intent and, as nearly as practicable, the effect that neither the

percentage of the total equity of the Company obtainable on exercise of the Warrants nor the price payable for such percentage upon such exercise will be affected by any event described in this Section 3(a).

(b) In case of any change in the Common Stock through merger, consolidation, reclassification, reorganization, partial or complete liquidation,

purchase of substantially all the assets of the Company, or other change in the capital structure of the Company, then, as a condition of such change, lawful and adequate provision will be made so that the Warrantholder will have the right

thereafter to receive upon the exercise of the Warrant the kind and amount of shares of stock or other securities or property to which the Warrantholder would

3

have been entitled if, immediately prior to such event, the Warrantholder had held the number of shares of Common Stock obtainable upon the exercise of the Warrant. In any such case, appropriate

adjustment will be made in the application of the provisions set forth herein with respect to the rights and interest thereafter of the Warrantholder, to the end that the provisions set forth herein will thereafter be applicable, as nearly as

reasonably may be, in relation to any shares of stock or other securities or property thereafter deliverable upon the exercise of the Warrant. The Company will not permit any change in its capital structure to occur unless the issuer of the shares

of stock or other securities to be received by the holder of this Warrant Certificate, if not the Company, agrees to be bound by and comply with the provisions of this Warrant Certificate.

(c) When any adjustment is required to be made in the number of shares of Common Stock, other securities, or the property purchasable upon

exercise of the Warrant, the Company will promptly determine the new number of such shares or other securities or property purchasable upon exercise of the Warrant and (i) prepare and retain on file a statement describing in reasonable detail

the method used in arriving at the new number of such shares or other securities or property purchasable upon exercise of the Warrant and (ii) cause a copy of such statement to be mailed to the Warrantholder within thirty (30) days after

the date of the event giving rise to the adjustment.

(d) No fractional shares of Common Stock or other Securities will be issued in

connection with the exercise of the Warrant, and the number of shares of Common Stock to be issued shall be rounded to the nearest whole number.

(e) If securities of the Company or securities of any subsidiary of the Company are distributed pro rata to holders of Common Stock, such

number of securities will be distributed to the Warrantholder or its assignee upon exercise of its rights hereunder as such Warrantholder or assignee would have been entitled to if this Warrant had been exercised prior to the record date for such

distribution. The provisions with respect to adjustment of the Common Stock provided in this Section 3 will also apply to the securities to which the Warrantholder or its assignee is entitled under this Section 3(e).

(f) Notwithstanding anything herein to the contrary, there will be no adjustment made hereunder on account of the sale by the Company of the

Common Stock or any other Securities purchasable upon exercise of the Warrant.

4. Reservation of Securities. The Company agrees

that the number of shares of Common Stock or other Securities sufficient to provide for the exercise of the Warrant upon the basis set forth above will, at all times during the term of the Warrant, be reserved for issuance.

5. Validity of Securities. All Securities delivered upon the exercise of the Warrant will be duly and validly issued in accordance with

their terms and, upon payment of the Exercise Price, will be fully paid and non-assessable. The Company will pay all documentary and transfer taxes, if any, in respect of the original issuance thereof upon exercise of the Warrant.

6. Transferability. This Warrant Certificate and the Warrant may be transferred to individuals who are a partner, officer or other

representative of the Placement Agent. The Warrant may be divided or combined, upon request to the Company by the Warrantholder, into a certificate or certificates evidencing the same aggregate number of Warrants.

4

7. Securities Act Compliance. The Warrantholder hereby represents: (a) that this

Warrant and any Common Stock to be acquired by the Warrantholder on exercise of the Warrant will be acquired for investment for the Warrantholder’s own account and not with a view to the resale or distribution of any part thereof, and

(b) that the Warrantholder is an accredited investor as defined in Rule 501(a) of Regulation D promulgated under the Securities Act. In addition, as a condition of its delivery of certificates for the Common Stock, the Company will require the

Warrantholder to deliver to the Company representations regarding the Warrantholder’s sophistication, investor status, investment intent, acquisition for its own account and such other matters as are reasonable and customary for purchasers of

securities in an unregistered private offering as set forth in the attached Exercise Form. The Company may place conspicuously upon each certificate representing the Common Stock a legend substantially in the following form, the terms of which are

agreed to by the Warrantholder:

“THE SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF

1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. THE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER

THE SECURITIES ACT OR (2) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE STATE SECURITIES LAWS AND THE SECURITIES LAWS OF OTHER JURISDICTIONS AND, IN THE CASE OF A

TRANSACTION EXEMPT FROM REGISTRATION, UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSACTION DOES NOT REQUIRE REGISTRATION UNDER THE SECURITIES ACT AND SUCH OTHER APPLICABLE LAWS.”

8. No Rights as a Shareholder. Except as otherwise provided herein, the Warrantholder will not, by virtue of ownership of the Warrant,

be entitled to any rights of a shareholder of the Company but will, upon written request to the Company, be entitled to receive such quarterly or annual reports as the Company distributes to its shareholders.

9. Notice. Any notices required or permitted to be given hereunder will be in writing and may be served personally or by mail, including

by e-mail; and if served will be addressed as follows:

|

|

|

| If to the Company: |

|

CytoDyn Inc. Attn: Michael D. Mulholland

1111 Main Street, Suite 660 Vancouver, Washington 98660

Email: mmulholland@cytodyn.com |

5

|

|

|

| with a copy to: |

|

Lowenstein Sandler LLP Attn: Steven M.

Skolnick 1251 Avenue of the Americas New York, New York

10020 Email: sskolnick@lowenstein.com |

|

|

| If to the Warrantholder: |

|

c/o Paulson Investment Company, Inc. 1001 SW

Fifth Avenue, Suite 1460 Portland, Oregon 97204 |

Any notice so given by mail will be deemed effectively given 48 hours after mailing when deposited in the

United States mail, registered or certified mail, return receipt requested, postage prepaid and addressed as specified above. Any notice given by e-mail must be accompanied by confirmation of receipt, and will be deemed effectively given upon

confirmation of such receipt. Any party may by written notice to the other specify a different address for notice purposes.

10.

Applicable Law. This Warrant Certificate will be governed by and construed in accordance with the laws of the State of Washington, without reference to conflict of laws principles thereunder. All disputes relating to this Warrant Certificate

shall be tried before the courts of Washington located in Clark County, Washington to the exclusion of all other courts that might have jurisdiction.

Dated as of May 15, 2015

|

|

|

| CYTODYN INC. |

|

|

| By: |

|

|

|

|

Name: Michael D. Mulholland |

|

|

Title: Chief Financial Officer |

6

EXERCISE FORM

(To Be Executed by the Warrantholder

to Exercise the Warrant)

| 1. |

The undersigned hereby irrevocably elects to exercise the right to purchase shares of

Common Stock, represented by Warrant No. A – [ ] as follows: |

| |

¨ |

Exercise for Cash. Pursuant to Section 2(a) of the Warrant, the Holder hereby elects to exercise the Warrant for cash and tenders payment herewith (or has made a wire transfer) to the order of CytoDyn Inc.

in the amount of $ . |

| 2. ¨ |

Cashless Exercise. Pursuant to Section 2(b) of the Warrant, the Holder hereby elects to exercise the Warrant on a cashless basis. |

| 3. |

The undersigned requests that the applicable number of shares of Common Stock be issued and delivered to the following address: |

|

|

|

|

|

| Name: |

|

|

|

|

| Address: |

|

|

|

|

|

|

|

|

|

| Email: |

|

|

|

|

| SSN: |

|

|

|

|

| 4. |

The undersigned understands, agrees and recognizes that: |

| |

(a) |

No federal or state agency has made any finding or determination as to the fairness of the investment or any recommendation or endorsement of the securities. |

| |

(b) |

All certificates evidencing the shares of Common Stock, if any, may bear a legend substantially similar to the legend set forth in Section 7 of the Warrant regarding resale restrictions. |

Representations of the undersigned.

| 5. |

The undersigned acknowledges that the undersigned has received, read and understood the Warrant and agrees to abide by and be bound by its terms and conditions. |

| 6. |

(i) The undersigned has such knowledge and experience in business and financial matters that the undersigned is capable of evaluating the Company and the proposed activities thereof, and the risks and merits of this

prospective investment. |

¨ YES ¨ NO

7

(ii) If “No”, the undersigned is represented by a “purchaser representative,”

as that term is defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”).

¨ YES ¨ NO

| 7. |

(i) The undersigned is an “accredited investor,” as that term is defined in the Securities Act. |

¨ YES

¨ NO

(ii) If “Yes,” the undersigned comes

within the following category of that definition (check one):

| |

¨ |

The undersigned is a natural person whose present net worth (or whose joint net worth with his or her spouse), excluding the value of the undersigned’s primary residence, exceeds $1,000,000. For purposes of

calculating the undersigned’s present net worth, the undersigned has included the following as liabilities: (i) any indebtedness that is secured by the undersigned’s primary residence in excess of the estimated fair market value of

the undersigned’s primary residence at the time of the sale of the shares, and (ii) any incremental debt secured by the undersigned’s primary residence that was incurred in the 60 days before the sale of the shares, other than as a

result of the acquisition of the undersigned’s primary residence. |

| |

¨ |

The undersigned is a natural person who had individual income in excess of $200,000 in each of the last two years or joint income with the undersigned’s spouse in excess of $300,000 during such two years, and the

undersigned reasonably expects to have the same income level in the current year. |

| |

¨ |

The undersigned is an officer or director of the Company. |

| |

¨ |

The undersigned is a corporation or partnership not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000. |

| |

¨ |

The undersigned is a trust with total assets in excess of $5,000,000 whose purchase is directed by a person with such knowledge and experience in financial and business matters that such person is capable of evaluating

the merits and risks of the prospective investment. |

| |

¨ |

The undersigned is an entity, all of whose equity owners are accredited investors under one or more of the categories above. |

| 8. |

The undersigned understands that the shares purchased hereunder have not been registered under the Securities Act, in reliance upon the exemption from the registration requirements under the Securities Act pursuant to

Section 4(2) of the Securities Act and Rule 506 promulgated thereunder; and, therefore, that the undersigned must bear the economic risk of the investment for an indefinite period of time since the securities cannot be sold, transferred or

assigned to any person or entity without compliance with the provisions of the Securities Act |

8

Dated: ,

20 .

|

|

|

| By: |

|

|

| Name: |

|

|

| Print: |

|

|

|

| Note: Signature must correspond with the name as written upon the face of the Warrant in all respects, without alteration or enlargement or any change whatsoever. |

9

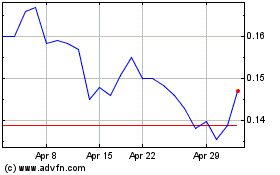

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

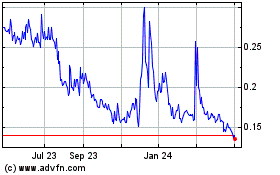

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024