UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): April 30, 2015

NEKTAR

THERAPEUTICS

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

0-24006 |

94-3134940 |

| (State or Other Jurisdiction of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

|

|

455

Mission Bay Boulevard South

San

Francisco, California 94158

(Address

of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code: (415) 482-5300

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

| Item 2.02 |

Results

of Operations and Financial Condition. |

On

April 30, 2015, Nektar Therapeutics, a Delaware corporation (“Nektar”), issued a press release (the “Press Release”)

announcing its financial results for the quarter ended March 31, 2015. A copy of the Press Release is furnished herewith

as Exhibit 99.1.

On

April 23, 2015, Nektar announced that it would hold a Webcast conference call on April 30, 2015 to review financial results for

the quarter ended March 31, 2015. This conference call is accessible through a link that is posted on the home page and Investor

Relations section of the Nektar website: http://www.nektar.com.

The

information in this report, including the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall

not be incorporated by reference into any filing with the Securities and Exchange Commission made by Nektar Therapeutics, whether

made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01 |

Financial

Statements and Exhibits. |

Exhibit

No. |

|

Description |

| |

|

| 99.1 |

|

Press release titled

“Nektar Therapeutics Reports Financial Results for the First Quarter of 2015” issued by Nektar Therapeutics on

April 30, 2015. |

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

|

|

|

| |

|

|

| |

By: |

/s/

Gil M. Labrucherie |

| |

|

|

Gil

M. Labrucherie |

| |

|

|

General

Counsel and Secretary |

| |

|

|

| |

Date: |

April

30, 2015

|

EXHIBIT

INDEX

Exhibit

No. |

|

Description |

| |

|

| 99.1 |

|

Press release titled

“Nektar Therapeutics Reports Financial Results for the First Quarter of 2015” issued by Nektar Therapeutics on

April 30, 2015. |

News

Release

Nektar

Therapeutics Reports Financial Results for the

First

Quarter of 2015

SAN

FRANCISCO, Calif., April 30, 2015 -- Nektar Therapeutics (Nasdaq: NKTR) today reported its financial results for the first

quarter ended March 31, 2015.

Cash

and investments in marketable securities at March 31, 2015 were $325.8 million as compared to $262.8 million at December 31, 2014.

Our cash and investments in marketable securities at March 31, 2015 includes a $100.0 million milestone payment received from

AstraZeneca in Q1 2015 for the first commercial sale of Movantik™(naloxegol) in the U.S.

"The

recent U.S. launch of Movantik by AstraZeneca is progressing well and this first-in-class medicine to treat OIC is now being made

available in several European countries," said Howard W. Robin, President and Chief Executive Officer of Nektar. "In

the first quarter, we initiated enrollment for the SUMMIT-07 efficacy study of NKTR-181 in patients with chronic low back pain.

We are also finalizing preparations for our new cancer immunotherapy, NKTR-214, to enter clinical studies this year. With the

recent launch of Movantik and the anticipated approval of BAX 855 in Q4, we are beginning to see important new medicines emerging

from our late-stage pipeline that should drive Nektar's near-term revenue. Importantly, we have three additional partnered drug

candidates in Phase 3 which are expected to have data readouts in 2016 and should continue to build our revenue base in the future."

Revenue

for the first quarter of 2015 was $108.8 million as compared to $19.8 million in the first quarter of 2014. The increase in revenue

in the first quarter of 2015 as compared to the first quarter of 2014 is due to the recognition of $90.0 million of the $100.0

million milestone payment from AstraZeneca following the first commercial sale of Movantik in the U.S. Revenue also included non-cash

royalty revenue, related to our 2012 royalty monetization, of $4.0 million and $5.8 million in the three months ended March 31,

2015 and 2014, respectively. This non-cash royalty revenue is offset by non-cash interest expense.

Total

operating costs and expenses for the first quarter of 2015 were $65.8 million as compared to $56.2 million in the first quarter

of 2014. Total operating costs and expenses increased primarily as a result of increased research and development (R&D) expense.

R&D

expense in the first quarter of 2015 was $47.0 million as compared to $38.3 million for the first quarter of 2014. R&D expense

was higher in the first quarter of 2015 primarily due to the initiation of the Phase 3 efficacy study of NKTR-181 in patients

with chronic low back pain. Additionally, R&D expense in the first quarter of 2015 included costs related to the continued

production of devices for the ongoing Phase 3 studies of Amikacin Inhale, the ongoing Phase 3 study of NKTR-102 in breast cancer,

the ongoing Phase 1 study of NKTR-171, and IND enabling activities for NKTR-214 which will enter the clinic in 2015.

General

and administrative expense was $10.3 million in the first quarter of 2015 as compared to $9.9 million in the first quarter of

2014.

In

Q1 2015, net income was $33.8 million, or $0.26 basic earnings per share. This compared to a net loss of $46.2 million or ($0.37)

basic loss per share in Q1 2014.

Corporate

Highlights

| • | Movantik

launched in the U.S. on March 31, 2015 for the treatment of opioid-induced constipation

(OIC) in adult patients with chronic, non-cancer pain. First commercial sale triggered

$100 million milestone payment to Nektar by partner AstraZeneca. |

| • | New

drug application submitted for BAX 855 to Japan’s Ministry of Health, on April

16, 2015. |

| • | BAX

855 pediatric study completed enrollment. Data from the study will support post-approval

label expansion by Baxter in the U.S. for previously treated pediatric patients and European

regulatory submission in 2016. |

| • | NKTR-181

Phase 3 SUMMIT-07 study in opioid naïve patients with chronic low back pain began

enrollment in February 2015. |

| • | Data

from the Phase 3 BEACON study of NKTR-102 in metastatic breast cancer selected for oral

abstract presentation at the 2015 ASCO Annual Meeting in Chicago. |

Presentation

Details:

Abstract

#1001: "Phase III trial of etirinotecan pegol (EP) versus Treatment of Physician’s Choice (TPC) in patients (pts) with

advanced breast cancer (aBC) whose disease has progressed following anthracycline (A), taxane (T) and capecitabine (C): The BEACON

study.", Perez, E., et al.

Oral

Abstract Session: "Breast Cancer—Triple-Negative/Cytotoxics/Local Therapy"

Date:

June 1, 2015, 3:12 p.m. — 3:24 p.m. Central Time

Conference

Call to Discuss First Quarter 2015 Financial Results

Nektar management

will host a conference call to review the results beginning at 5:00 p.m. Eastern Time/2:00 p.m. Pacific Time today, Thursday,

April 30, 2015.

This press

release and a live audio-only Webcast of the conference call can be accessed through a link that is posted on the home page and

Investor Relations section of the Nektar website: http://www.nektar.com. The web broadcast of the conference call will be available

for replay through Monday, June 1, 2015.

| |

To access the conference call, follow these

instructions: |

| |

|

| |

Dial: (877) 881.2183 (U.S.); (970) 315.0453 (international) |

| |

Passcode: 33513793 (Nektar Therapeutics is the host) |

In

the event that any non-GAAP financial measure is discussed on the conference call that is not described in the press release,

or explained on the conference call, related information will be made available on the Investor Relations page at the Nektar website

as soon as practical after the conclusion of the conference call.

About

Nektar

Nektar

Therapeutics has a robust R&D pipeline in pain, oncology, hemophilia and other therapeutic areas. In the area of pain, Nektar

has an exclusive worldwide license agreement with AstraZeneca for MOVANTIK™ (naloxegol), the first FDA-approved once-daily

oral peripherally-acting mu-opioid receptor antagonist (PAMORA) medication for the treatment of opioid-induced constipation (OIC),

in adult patients with chronic, non-cancer pain. The product is also approved in the European Union as MOVENTIG® and is indicated

for adult patients with OIC who have had an inadequate response to laxatives. The AstraZeneca agreement also includes NKTR-119,

an earlier stage development program that is a co-formulation of MOVANTIK™ and an opioid. NKTR-181, a wholly-owned mu-opioid

analgesic molecule for chronic pain conditions, is in Phase 3 development. NKTR-171, a wholly-owned new sodium channel blocker

being developed as an oral therapy for the treatment of peripheral neuropathic pain, is in Phase 1 clinical development. In hemophilia,

BAX 855, a longer-acting PEGylated Factor VIII therapeutic is in Phase 3 development conducted by partner Baxter. A BLA for BAX

855 was filed by Baxter to the US FDA in December, 2014 and is currently under review. In anti-infectives, Amikacin Inhale is

in Phase 3 studies conducted by Bayer Healthcare as an adjunctive treatment for intubated and mechanically ventilated patients

with Gram-negative pneumonia.

Nektar's

technology has enabled nine approved products in the U.S. or Europe through partnerships with leading biopharmaceutical companies,

including AstraZeneca's MOVANTIK™, UCB's Cimzia® for Crohn's disease and rheumatoid arthritis, Roche's PEGASYS®

for hepatitis C and Amgen's Neulasta® for neutropenia.

Nektar

is headquartered in San Francisco, California, with additional operations in Huntsville, Alabama and Hyderabad, India. Further

information about the company and its drug development programs and capabilities may be found online at http://www.nektar.com.

MOVANTIK™

is a trademark and MOVENTIG® is a registered trademark of the AstraZeneca group of companies.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan,"

"expect," "believe," "should," "may," "will" and similar references to future

periods. Examples of forward-looking statements include, among others, statements we make regarding the potential of MOVANTIK

(naloxegol), BAX 855, the future revenue potential from our collaboration partnerships, the timing of availability of future clinical

trial data from our collaboration partners, the timing of the expected start date of the clinical program for NKTR-214, and the

value and potential of our polymer conjugate technology and research and development pipeline. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results

may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results to differ materially from those indicated in the forward-looking

statements include, among others, (i) the commercial potential of a new drug at the early stages of commercial launch, such as

MOVANTIK, is difficult to predict and will have a significant impact on our future results of operation and financial condition;

(ii) scientific discovery of new medical breakthroughs is an inherently uncertain process and the future success of the application

of our technology platform to potential new drug candidates is therefore highly uncertain and unpredictable and one or more research

and development programs could fail; (iii) patents may not issue from our patent applications for our drugs (including MOVANTIK

and BAX 855) and drug candidates, patents that have issued may not be enforceable, or additional intellectual property licenses

from third parties may be required; and (iv) the outcome of any existing or future intellectual property or other litigation related

to our drugs and drug candidates and those of our collaboration partners including MOVANTIK and BAX 855. Other important risks

and uncertainties set forth in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) on February

26, 2015 and our Current Report on Form 8-K filed with the SEC on March 17, 2015. Any forward-looking statement made by us in

this press release is based only on information currently available to us and speaks only as of the date on which it is made.

We undertake no obligation to update any forward-looking statement, whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or otherwise.

Contact:

Investors

Jennifer

Ruddock of Nektar Therapeutics

415-482-5585

Media

Nadia

Hasan of WCG

212-257-6738

| NEKTAR

THERAPEUTICS |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| (In

thousands) |

| (Unaudited) |

| ASSETS | |

| March

31,

2015 | |

| December

31, 2014 | |

| Current assets: | |

| | |

| | |

| Cash and

cash equivalents | |

$ | 129,452 | |

$ | 12,365 | |

| Restricted cash | |

| 25,000 | |

| 25,000 | |

| Short-term investments | |

| 171,353 | |

| 225,459 | |

| Accounts receivable,

net | |

| 2,885 | |

| 3,607 | |

| Inventory | |

| 12,511 | |

| 12,952 | |

| Other

current assets | |

| 6,092 | |

| 8,817 | |

| Total current assets | |

| 347,293 | |

| 288,200 | |

| | |

| | |

| | |

| Property, plant and

equipment, net | |

| 69,267 | |

| 70,368 | |

| Goodwill | |

| 76,501 | |

| 76,501 | |

| Other

assets | |

| 6,151 | |

| 6,552 | |

| Total

assets | |

$ | 499,212 | |

$ | 441,621 | |

| | |

| | |

| | |

| LIABILITIES

AND STOCKHOLDERS' EQUITY | |

| | |

| | |

| | |

| | |

| | |

| Current liabilities: | |

| | |

| | |

| Accounts payable | |

$ | 5,024 | |

$ | 2,703 | |

| Accrued compensation | |

| 9,356 | |

| 5,749 | |

| Accrued expenses | |

| 8,245 | |

| 6,418 | |

| Accrued clinical trial

expenses | |

| 8,747 | |

| 7,708 | |

| Interest payable | |

| 3,167 | |

| 6,917 | |

| Capital lease obligations,

current portion | |

| 5,412 | |

| 4,512 | |

| Deferred revenue,

current portion | |

| 24,959 | |

| 24,473 | |

| Other

current liabilities | |

| 10,534 | |

| 5,567 | |

| Total current liabilities | |

| 75,444 | |

| 64,047 | |

| | |

| | |

| | |

| Senior secured notes | |

| 125,000 | |

| 125,000 | |

| Capital lease obligations,

less current portion | |

| 4,386 | |

| 4,139 | |

| Liability related to

sale of future royalties | |

| 121,558 | |

| 120,471 | |

| Deferred revenue, less

current portion | |

| 78,418 | |

| 76,911 | |

| Other

long-term liabilities | |

| 17,101 | |

| 14,721 | |

| Total liabilities | |

| 421,907 | |

| 405,289 | |

| | |

| | |

| | |

| Commitments and contingencies | |

| | |

| | |

| | |

| | |

| | |

| Stockholders' equity: | |

| | |

| | |

| Preferred stock | |

| — | |

| — | |

| Common stock | |

| 13 | |

| 13 | |

| Capital in excess of par value | |

| 1,831,057 | |

| 1,824,195 | |

| Accumulated other

comprehensive loss | |

| (1,276 | ) |

| (1,567 | ) |

| Accumulated

deficit | |

| (1,752,489 | ) |

| (1,786,309 | ) |

| Total

stockholders' equity | |

| 77,305 | |

| 36,332 | |

| Total

liabilities and stockholders' equity | |

$ | 499,212 | |

$ | 441,621 | |

| (1) |

The

consolidated balance sheet at December 31, 2014 has been derived from the audited financial statements at that date but does

not include all of the information and notes required by generally accepted accounting principles in the United States for

complete financial statements. |

| |

|

|

|

|

|

|

|

|

|

|

| NEKTAR

THERAPEUTICS |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (In

thousands, except per share information) |

| (Unaudited) |

| | |

| |

|

| | |

Three Months Ended |

| | |

March

31, |

| | |

2015 | |

2014 |

| | |

| |

|

| Revenue: | |

| | | |

| | |

| Product

sales and royalty revenue | |

$ | 8,099 | | |

$ | 5,917 | |

| Non-cash

royalty revenue related to sale of future royalties | |

| 3,962 | | |

| 5,773 | |

| License,

collaboration and other revenue | |

| 96,740 | | |

| 8,081 | |

| Total revenue | |

| 108,801 | | |

| 19,771 | |

| | |

| | | |

| | |

| Operating costs and

expenses: | |

| | | |

| | |

| Cost

of goods sold | |

| 8,444 | | |

| 7,907 | |

| Research

and development | |

| 47,011 | | |

| 38,338 | |

| General

and administrative | |

| 10,303 | | |

| 9,928 | |

| Total

operating costs and expenses | |

| 65,758 | | |

| 56,173 | |

| | |

| | | |

| | |

| Income (loss) from

operations | |

| 43,043 | | |

| (36,402 | ) |

| | |

| | | |

| | |

| Non-operating income

(expense): | |

| | | |

| | |

| Interest

expense | |

| (4,171 | ) | |

| (4,533 | ) |

| Non-cash

interest expense on liability related to sale of future royalties | |

| (5,050 | ) | |

| (5,387 | ) |

| Interest

income and other income (expense), net | |

| 211 | | |

| 312 | |

| Total non-operating

expense, net | |

| (9,010 | ) | |

| (9,608 | ) |

| | |

| | | |

| | |

| Income (loss) before

provision for income taxes | |

| 34,033 | | |

| (46,010 | ) |

| | |

| | | |

| | |

| Provision

for income taxes | |

| 213 | | |

| 191 | |

| Net

income (loss) | |

$ | 33,820 | | |

$ | (46,201 | ) |

| | |

| | | |

| | |

| Net income (loss) per share: | |

| | | |

| | |

| Basic | |

$ | 0.26 | | |

$ | (0.37 | ) |

| | |

| | | |

| | |

| Diluted | |

$ | 0.25 | | |

$ | (0.37 | ) |

| | |

| | | |

| | |

| Weighted average shares

outstanding used in computing net income (loss) per share: | |

| | | |

| | |

| Basic | |

| 131,359 | | |

| 123,543 | |

| | |

| | | |

| | |

| Diluted | |

| 135,667 | | |

| 123,543 | |

| NEKTAR

THERAPEUTICS |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In

thousands) |

| (Unaudited) |

| | |

Three

Months Ended March 31, |

| | |

2015 | |

2014 |

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

income (loss) | |

$ | 33,820 | | |

$ | (46,201 | ) |

| Adjustments to reconcile

net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Non-cash royalty

revenue related to sale of future royalties | |

| (3,962 | ) | |

| (5,773 | ) |

| Non-cash interest

expense on liability related to sale of future royalties | |

| 5,050 | | |

| 5,387 | |

| Stock-based compensation | |

| 5,177 | | |

| 4,361 | |

| Depreciation and

amortization | |

| 2,973 | | |

| 3,264 | |

| Other non-cash

transactions | |

| (938 | ) | |

| 777 | |

| Changes in operating

assets and liabilities: | |

| | | |

| | |

| Accounts receivable,

net | |

| 722 | | |

| 374 | |

| Inventory | |

| 441 | | |

| 580 | |

| Other assets | |

| 2,809 | | |

| (718 | ) |

| Accounts payable | |

| 2,241 | | |

| (6,126 | ) |

| Accrued compensation | |

| 3,607 | | |

| (4,827 | ) |

| Accrued expenses | |

| 1,811 | | |

| 693 | |

| Accrued clinical

trial expenses | |

| 1,039 | | |

| (3,179 | ) |

| Interest payable | |

| (3,750 | ) | |

| (3,750 | ) |

| Deferred revenue | |

| 1,993 | | |

| (5,957 | ) |

| Other

liabilities | |

| 10,279 | | |

| (1,195 | ) |

| Net cash provided

by (used in) operating activities | |

| 63,312 | | |

| (62,290 | ) |

| | |

| | | |

| | |

| Cash

flows from investing activities: | |

| | | |

| | |

| Maturities of investments | |

| 73,434 | | |

| 56,972 | |

| Purchases of investments | |

| (24,432 | ) | |

| (110,661 | ) |

| Sale of investments | |

| 5,215 | | |

| — | |

| Purchases

of property and equipment | |

| (1,059 | ) | |

| (4,524 | ) |

| Net cash provided

by (used in) investing activities | |

| 53,158 | | |

| (58,213 | ) |

| | |

| | | |

| | |

| Cash

flows from financing activities: | |

| | | |

| | |

| Payment of capital

lease obligations | |

| (1,098 | ) | |

| (825 | ) |

| Repayment of proceeds

from sale of future royalties | |

| — | | |

| (7,000 | ) |

| Issuance of common

stock, net of issuance costs | |

| — | | |

| 116,619 | |

| Proceeds

from shares issued under equity compensation plans | |

| 1,685 | | |

| 5,074 | |

| Net cash provided

by financing activities | |

| 587 | | |

| 113,868 | |

| | |

| | | |

| | |

| Effect

of exchange rates on cash and cash equivalents | |

| 30 | | |

| 11 | |

| Net increase (decrease)

in cash and cash equivalents | |

| 117,087 | | |

| (6,624 | ) |

| Cash

and cash equivalents at beginning of period | |

| 12,365 | | |

| 39,067 | |

| Cash

and cash equivalents at end of period | |

$ | 129,452 | | |

$ | 32,443 | |

| | |

| | | |

| | |

| Supplemental disclosure

of cash flow information: | |

| | | |

| | |

| Cash

paid for interest | |

$ | 7,855 | | |

$ | 7,961 | |

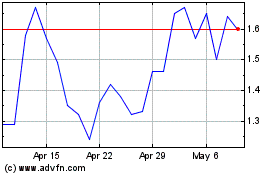

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Apr 2023 to Apr 2024