UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 8, 2015

INFINERA

CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33486 |

|

77-0560433 |

| (State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

140 Caspian Court

Sunnyvale, CA 94089

(Address of principal executive offices, including zip code)

(408) 572-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Announcement of public offer to acquire outstanding shares of Transmode AB

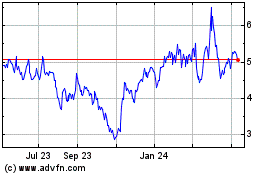

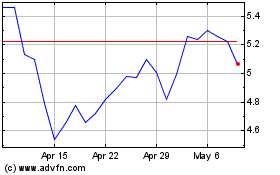

On April 8, 2015, Infinera Corporation (the “Company”) issued a press release in Sweden and in the U.S. announcing

the Company’s intent to combine with Sweden-based Transmode AB, a Swedish company (“Transmode”), pursuant to a public exchange offer to acquire all issued and outstanding shares of Transmode (the “Offer”). In the Offer, the

Company is offering Transmode’s shareholders cash and common stock as follows: (i) with respect to approximately 72.48 percent of the Transmode shares exchanged by such shareholder, approximately 0.6492 new shares of Infinera’s common

stock per Transmode share; and (ii) with respect to the remaining approximately 27.52 percent of the Transmode shares exchanged by such shareholder, approximately SEK 109 in cash per Transmode share. The board of directors of Transmode has

unanimously recommended that Transmode’s shareholders accept the Offer.

If the Offer is accepted in its entirety, 13,037,196 shares

of Infinera’s common stock (“Infinera Shares”) will be issued under the Offer, corresponding to approximately 10.1 percent of Infinera’s shares outstanding. Following completion of the Offer, if accepted in its entirety, former

Transmode shareholders would hold Infinera Shares representing approximately 9.2 percent of the outstanding shares of and voting power in the combined company and approximately 8.7 percent of the combined company on a fully diluted basis.

The completion of the Offer is conditional upon,

| |

1. |

the Offer being accepted to such an extent that Infinera becomes the owner of shares in Transmode representing more than 90 percent of the total number of shares of Transmode; |

| |

2. |

Infinera’s Registration Statement on Form S-4 in the United States, which will register the offer and issuance of the Infinera Shares, becoming effective under the Securities Act of 1933, as amended, and not being

the subject of any stop order or proceeding seeking a stop order by the Securities and Exchange Commission (the “SEC”); |

| |

3. |

the Infinera Shares to be issued under the Offer being approved for listing on the NASDAQ Global Select Market; |

| |

4. |

there being no circumstances, which Infinera did not have knowledge of at the time of the announcement of the Offer, having occurred which would have a material adverse effect or could reasonably be expected to have a

material adverse effect on Transmode’s sales, results, liquidity, equity ratio, equity or assets; |

| |

5. |

neither the Offer nor the acquisition of Transmode being rendered wholly or partially impossible or significantly impeded as a result of legislation or other regulation, any decision of court or public authority, or any

similar circumstance, which is actual or can reasonably be anticipated, and which Infinera could not reasonably have foreseen at the time of the announcement of the Offer; |

| |

6. |

Transmode not taking any action that is likely to impair the prerequisites for making or completing the Offer; |

| |

7. |

no information made public by Transmode or disclosed by Transmode to Infinera being materially inaccurate, incomplete or misleading, and Transmode having made public all information which should have been made public by

it; and |

| |

8. |

no other party announcing an offer to acquire shares in Transmode on terms more favorable to the shareholders of Transmode than the Offer. |

Infinera reserves the right to withdraw the Offer in the event it becomes clear that any of the above conditions is not satisfied or cannot be

satisfied. With regard to conditions 2 – 8, however, such withdrawal will only be made if the non-satisfaction is of material importance to Infinera’s acquisition of shares in Transmode.

Infinera reserves the right to waive, in whole or in part, one or more of the conditions above,

including with respect to condition 1 above, to complete the Offer at a lower level of acceptance.

If Infinera becomes the owner of more

than 90 percent of the shares of Transmode, Infinera intends to initiate a compulsory acquisition procedure with respect to the remaining shares in Transmode under the Swedish Companies Act. In connection therewith, Infinera intends to initiate a

delisting of the Transmode shares from Nasdaq Stockholm.

The largest shareholder in Transmode – Pod Investment AB (“Pod”)

– holding in aggregate 9,223,140 Transmode shares, representing approximately 33 percent of the total number of shares and votes in Transmode, has undertaken to accept the Offer, subject to certain conditions, pursuant to the terms of an

irrevocable undertaking agreement (the “Irrevocable Undertaking”). In the event that before the expiration of the acceptance period (including any extension) under the Offer a third party announces a public offer to acquire all the shares

in Transmode for a price which exceeds the price in the Offer by more than eight (8) percent (the “8 Percent Hurdle”) and such offer is recommended by the Board of Directors of Transmode (a “Superior Offer”), and

provided that Infinera has not publicly announced an increased Offer that is recommended by the Board of Directors of Transmode (an “Increased Offer”) no later than on the date preceding the last day of the acceptance period (excluding any

extension of it) under the Superior Offer (the “Right to Match”), then Pod’s undertaking to accept the Offer shall lapse and Pod shall be entitled to withdraw any acceptance of the Offer and accept the Superior Offer. In case an

Increased Offer is made and the Superior Offer is thereafter increased to exceed the Increased Offer and such increased Superior Offer is recommended by the Board of Directors of Transmode (an “Increased Superior Offer”), and provided that

Infinera does not exercise its Right to Match, then Pod’s undertaking to accept the Offer shall lapse and Pod shall be entitled to withdraw any acceptance of the Offer and accept the Superior Offer. The 8 Percent Hurdle shall apply to a

Superior Offer only (but not to any subsequent Increased Superior Offer), whereas the Right to Match shall apply to each and every Superior Offer and each and every Increased Superior Offer.

For the purposes of determining whether a Superior Offer exceeds the 8 Percent Hurdle, or, as the case may be, an Increased Superior Offer

exceeds an Increased Offer, the following shall apply: (i) the part of the consideration that consists of listed securities under the Offer or, as the case may be, an Increased Offer shall be valued based on the Prevailing Conditions (as

defined below) on the last completed trading day before announcement of the Offer or, as the case may be, the Increased Offer; (ii) if a Superior Offer or, as the case may be, an Increased Superior Offer includes a cash alternative coupled with

a not all cash alternative, then the value of the cash alternative shall be elected for the determination of the offer value and any alternative forms of consideration shall be disregarded; and (iii) if the consideration under a Superior

Offer or, as the case may be, an Increased Superior Offer consists (wholly or partly) of listed securities, such offer shall be valued based on the Prevailing Conditions (as defined below) on the last completed trading day before announcement of the

Superior Offer or, as the case may be, the Increase Superior Offer. The “Prevailing Conditions” shall mean (i) the quotation or price (as derived from the relevant exchange) of Infinera’s or the third party’s securities, as

relevant, at the close of business on the above specified trading day and (ii) if the currency of the consideration under an offer is not in SEK, the currency conversion shall be calculated based on the applicable currency/SEK exchange rate on

the day immediately preceding the date the offer was publicly announced, as derived from the European Central Bank daily foreign exchange reference rate at close of business.

Pod’s undertaking to accept the Offer shall terminate automatically and be of no further force or effect if the Offer lapses or is

withdrawn, or the undertaking has lapsed due to a Superior Offer in accordance with the above, i.e., in cases where Infinera has not exercised its Right to Match. Furthermore, all of Pod’s obligations under the undertaking will lapse, at the

option of Pod, if (a) the Offer is not being declared unconditional before September 15, 2015; (b) a circumstance has occurred, which could not have been reasonably known or anticipated by Pod at the time of entering into the

undertaking, which would have a material adverse effect or could reasonably be expected to have a material adverse effect on Infinera’s liquidity, sales, results, solidity, assets or equity; or (c) any information made public by Infinera

or disclosed by Infinera to Pod or Transmode is materially inaccurate, incomplete or misleading in respects that could reasonably be expected to have a materially adverse effect on Infinera’s liquidity, sales, results, solidity, assets or

equity.

The Irrevocable Undertaking executed by Pod and Infinera is attached to this report as

Exhibit 99.1.

In addition, Pod has executed a holding agreement (the “Holding Agreement”), pursuant to which Pod has

agreed not to dispose of the Infinera shares received as consideration for the Transmode shares tendered in the Offer during a certain period (the “Holding Period”). The Holding Period will commence upon settlement of the Offer and will

continue until all of the Infinera shares received have been released from the holding restrictions pursuant to the following: one-fifth (1/5) of the shares shall be released from the holding restrictions on the forty-fifth day after settlement

of the Offer; and one-fifth (1/5) of the shares shall be released from the holding restrictions each month thereafter on the same day of the month as the day of the settlement of the Offer. Thomas J. Fallon, CEO of Infinera, and David F. Welch,

Co-Founder of Infinera, have, subject to certain exemptions, entered into similar restrictions on their shares in Infinera.

The Holding

Agreement executed by Pod is attached to this report as Exhibit 99.2.

The Company provided supplemental information regarding the

Offer in connection with a presentation to analysts and investors in a conference call held on April 9, 2015 at 8:30 a.m. EDT. A copy of the investor presentation made available during the call is attached hereto as Exhibit 99.3. Supplemental

information regarding the Offer was also provided by both Infinera and Transmode to Transmode’s employees in connection with Transmode’s all-hands employee meeting held on April 9 at 1:00 p.m. CET. Copies of Infinera’s and

Transmode’s presentations are attached hereto as Exhibits 99.4 and 99.5, respectively. Copies of the Company’s press release announcing the Offer, which provides additional details on the terms of the Offer, and Transmode’s press

releases announcing the recommendation of Transmode’s board of directors and other matters relating to the Offer, are filed herewith as Exhibits 99.6, 99.7 and 99.8.

Important additional information will be filed with the Securities and Exchange Commission (SEC)

This current report is neither an offer to purchase nor a solicitation of an offer to sell any shares. This current report is for informational

purpose only. The Offer will not be made to, nor will exchanges be accepted from, or on behalf of, holders of shares in any jurisdiction in which the making of the exchange offer or the acceptance thereof would not comply with the laws of that

jurisdiction. Infinera has not commenced the acceptance period for the exchange offer described in this current report.

Infinera intends

to file a Registration Statement on Form S-4 with the SEC in connection with the proposed transaction. An offer document filed with the Swedish Financial Supervisory Authority related to the Offer will also be distributed to the shareholders of

Transmode.

Shareholders of Transmode are urged to read the above referenced documents and materials carefully when such documents and

materials become available because they contain important information about the transaction.

Shareholders of Transmode may obtain free

copies of these documents and materials, any amendments or supplements thereto and other documents containing important information about Infinera and the transaction, once such documents and materials are filed with the SEC, through the website

maintained by the SEC at www.sec.gov. Copies of the documents and materials filed with the SEC by Infinera will also be available free of charge on Infinera’s website at http://www.infinera.com/ under the heading “SEC Filings”

in the “Company—Investor Relations” portion of Infinera’s website. More information about the Offer, including the formal announcement of the Offer and the offer document to be filed with and approved by the Swedish Financial

Supervisory Authority, can be found on www.infinera.se.

Forward-Looking Statements

Statements in this current report relating to future events, status and circumstances, including statements regarding future financial or

operating performance, growth and other projections as well as benefits of the Offer, are forward-looking statements. These statements may generally, but not always, be identified by the use of words such as “anticipates,”

“expects,” “believes,” continue,” “intends,” “target,”

“projects,” “contemplates,” “plans,” “seeks,” “estimates,” “could,” “should,” “feels,” “will,”

“would,” “may,” “can,” “potential” or similar expressions or variations, or the negative of these terms. By their nature, forward-looking statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the future. There can be no assurance that actual results will not differ materially from those expressed or implied by these forward-looking statements due to a variety of factors,

many of which are outside the control of Infinera. These risks and uncertainties include, but are not limited to, the risk that Transmode shareholders fail to tender more than 90 percent of Transmode’s outstanding shares, that any of the other

closing conditions are not satisfied, and that the transaction may not close; the risk that Transmode’s and Infinera’s businesses will not be integrated successfully; the risk that synergies will not be realized or realized to the extent

anticipated; the risk that Infinera following the transaction will not realize on its financing or operating strategies; the risk that litigation in respect of either company or the transaction could arise; and the risk that disruption caused by the

Combined Company would make it difficult to maintain certain strategic relationships. These risks and uncertainties also include those identified under the heading “Risk Factors” in the Infinera Annual Report on Form 10-K for the year

ended December 27, 2014, and filed with the SEC, any subsequent reports filed with the SEC by Infinera, and those risks and uncertainties that will be discussed in the Registration Statement on Form S-4 to be filed with the SEC at a future date

by Infinera. We caution investors not to place considerable reliance on the forward-looking statements contained in this current report. You are encouraged to read Infinera’s filings with the SEC, available at www.sec.gov, for a discussion of

these and other risks and uncertainties. Any forward-looking statements contained in this current report speak only as of the date on which they were made and Infinera has no obligation (and undertakes no such obligation) to update or revise any of

them, whether as a result of new information, future events or otherwise, except for in accordance with applicable laws and regulations.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

|

|

| 99.1 |

|

Irrevocable Undertaking. |

|

|

| 99.2 |

|

Holding Agreement. |

|

|

| 99.3 |

|

Investor Presentation. |

|

|

| 99.4 |

|

Infinera Presentation to Transmode. |

|

|

| 99.5 |

|

Transmode Employee Presentation. |

|

|

| 99.6 |

|

Press Release of Infinera Corporation dated April 8, 2015. |

|

|

| 99.7 |

|

Press Release of Transmode AB dated April 9, 2015. |

|

|

| 99.8 |

|

Press Release of Transmode AB dated April 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

INFINERA CORPORATION |

|

|

|

|

| Date: April 9, 2015 |

|

|

|

By: |

|

/s/ JAMES L. LAUFMAN |

|

|

|

|

|

|

James L. Laufman Senior Vice President and

General Counsel |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Irrevocable Undertaking. |

|

|

| 99.2 |

|

Holding Agreement. |

|

|

| 99.3 |

|

Investor Presentation. |

|

|

| 99.4 |

|

Infinera Presentation to Transmode. |

|

|

| 99.5 |

|

Transmode Employee Presentation. |

|

|

| 99.6 |

|

Press Release of Infinera Corporation dated April 8, 2015. |

|

|

| 99.7 |

|

Press Release of Transmode AB dated April 9, 2015. |

|

|

| 99.8 |

|

Press Release of Transmode AB dated April 9, 2015. |

Exhibit 99.1

IRREVOCABLE UNDERTAKING

This irrevocable undertaking

(this “Undertaking”) is made on 8 April 2015

BETWEEN:

| (1) |

Infinera Corporation, a company duly incorporated and organized under the laws of Delaware, with corporate registration number 3325877, having its principal office at 140 Caspian Court, Sunnyvale, CA 94089, the U.S.

(“Offeror”); and |

| (2) |

Pod Investment AB, a company duly incorporated and organized under the laws of Sweden, with corporate registration number 556744-9441, having its principal office at Box 5358, 102 49 Stockholm, Sweden

(“Shareholder”). |

Offeror and Shareholder are hereinafter collectively referred to as the “Parties” and individually as

a “Party”.

BACKGROUND:

| (A) |

Offeror intends to make a recommended public offer to the shareholders in Transmode AB (publ) (“the Company”) to tender all their shares in the Company to the Offeror on the key terms and conditions set forth

in the draft press release (the “Offer”) attached as Appendix A (the “Offer Announcement”). For the purposes hereof, the “Offer” extends to any revised offer on behalf of the Offeror. |

| (B) |

Shareholder is the owner of 9,223,140 shares in the Company (the “Shares”) and has, in order to encourage the Offeror to make the Offer, agreed to make this irrevocable undertaking (the

“Undertaking”). |

IT IS AGREED as follows:

SHAREHOLDER’S UNDERTAKING

| 1.1 |

Shareholder represents and warrants that it is the owner of, and has all relevant authority to accept the Offer in respect of the Shares, which Shares are free and clear of encumbrances of any kind. The Shareholder

further represents and warrants that the Shares include all of the Shareholder’s shares in the Company. |

| 1.2 |

Subject to (i) the conditions precedent in clause 2, and (ii) the Shareholder having the benefit of any improvement of the Offer granted to other shareholders of the Company, the Shareholder hereby irrevocably

undertakes to accept the Offer in respect of all Shares immediately prior to, but conditioned upon, the Offer being declared unconditional. |

| 1.3 |

In the event that a third party before the expiration of the acceptance period (including any extension) under the Offer announces a public offer to

acquire all the shares in the Company for a price which exceeds the price in the Offer by more than eight (8) per cent (the “8 Per |

2

| |

Cent Hurdle”) and which is recommended by the Board of Directors of the Company (a “Superior Offer”), and provided that the Offeror has not publicly announced an increased Offer

that is recommended by the Board of Directors of the Company (“Increased Offer”) no later than on the date preceding the last day of the acceptance period (excluding any extension of it) under the Superior Offer (the “Right to

Match”), then this Undertaking shall lapse and the Shareholder shall be entitled to withdraw any acceptance of the Offer and accept the Superior Offer. In case an Increased Offer is made and the Superior Offer is thereafter increased to exceed

the Increased Offer and such increased Superior Offer is recommended by the Board of Directors of the Company (an “Increased Superior Offer”), and provided that the Offeror does not exercise its Right to Match, then this Undertaking shall

lapse and the Shareholder shall be entitled to withdraw any acceptance of offer and accept the increased Superior Offer. |

| 1.4 |

For the purposes of determining whether a Superior Offer exceeds the 8 Per Cent Hurdle, or, as the case may be, an Increased Superior Offer exceeds an Increased Offer, the following shall apply: (i) the part of the

consideration that consists of listed securities under the Offer or, as the case may be, an Increased Offer shall be valued based on the Prevailing Conditions (as defined below) on the last completed trading day before announcement of the Offer or,

as the case may be, the Increased Offer; (ii) if the Superior Offer or, as the case may be, the Increased Superior Offer includes a cash alternative coupled with a not all cash alternative, then the value of the cash alternative shall be

elected for the determination of the offer value and any alternative forms of consideration shall be disregarded; and (iii) if the consideration under the Superior Offer or, as the case may be, the Increased Superior Offer consists (wholly or

partly) of listed securities, such offer shall be valued based on the Prevailing Conditions (as defined below) on the last completed trading day before announcement of the Superior Offer or, as the case may be, the Increase Superior Offer.

|

The “Prevailing Conditions” shall mean (i) the quotation or price (as derived from the relevant

exchange) of the Offeror’s or the third party’s securities, as relevant, at the close of business on the above specified trading day and (ii) if the currency of the consideration under an offer is not in SEK, the currency conversion

shall be calculated based on the applicable currency/SEK exchange rate on the day immediately preceding the date the offer was publicly announced, as derived from the European Central Bank daily foreign exchange reference rate at close of business.

For the avoidance of doubt, the 8 Per Cent Hurdle shall apply to a Superior Offer only (but not to any subsequent Increased Superior

Offer), whereas the Right to Match shall apply to each and every Superior Offer and each and every Increased Superior Offer.

| 1.5 |

The Shareholder hereby irrevocably undertakes to not (i) offer, sell, transfer, charge, pledge or grant any option over or otherwise deal with or

dispose of any of the Shares or any |

3

| |

interest in any of the Shares, whether directly or indirectly, except to the Offeror under the Offer, (ii) accept (conditionally or unconditionally) any other offer in respect of any of the

Shares by whatever means it is to be implemented, (iii) solicit or encourage proposals or offers from third parties for the acquisition of shares in the Company, (iv) propose or vote in favor of any other resolution, or take any action or

make any statement, which could prejudice or frustrate the Offer or (v) enter into any agreement or arrangement (whether conditional or unconditional) to do any or all of the acts referred to in this Section 1.5. |

| 1.6 |

For the avoidance of doubt, the Shareholder shall be entitled to any increased consideration in the Offer. |

CONDITION PRECEDENT

| 2.1 |

Conditions precedent for this Undertaking to enter into force is that: |

| |

a) |

the Offer is made through a public announcement of the Offer on or before 15 April 2015; and |

| |

b) |

the Board of Directors of the Company recommends the Offer. |

| 2.2 |

Should the conditions precedent under Section 2.1 above not be met, then the Shareholder will have no obligations hereunder. |

TERMINATION

| 3.1 |

This Undertaking shall terminate automatically and be of no further force or effect if: |

| |

(i) |

the Offer lapses or is withdrawn, or |

| |

(ii) |

this Undertaking has lapsed due to a Superior Offer in accordance with Section 1.3 above, i.e. in cases where the Offeror has not exercised its Right to Match. |

| 3.2 |

Furthermore, all of the Shareholder’s obligations hereunder will lapse, at the option of the Shareholder, if |

| |

(a) |

the Offer is not being declared unconditional before 15 September 2015; |

| |

(b) |

a circumstance has occurred, which could not have been reasonably known or anticipated by Shareholder at the time of entering into this Undertaking, which would have a material adverse effect or could reasonably be

expected to have a material adverse effect on Offeror’s liquidity, sales, results, solidity, assets or equity; or |

| |

(c) |

any information made public by the Offeror or disclosed by the Offeror to Shareholder or the Company is materially inaccurate, incomplete or misleading in respects that could reasonably be expected to have a materially

adverse effect on the Offeror’s liquidity, sales, results, solidity, assets or equity. |

4

MISCELLANEOUS

| 4.1 |

Any public disclosure of the existence or contents of this Undertaking will need to be agreed in advance between the Parties, except (a) as required by applicable law in any relevant jurisdiction or stock exchange

regulation or regulatory or governmental body to which either Party is subject, in which case the Party required to disclose information hereof shall to the extent reasonably practicable consult with the other Party prior to such disclosure, and

(b) in the ordinary course in connection with the investor relations practices of the Parties. Notwithstanding the foregoing, the Shareholder agrees that this Undertaking may be (i) disclosed to the Company and/or (ii) made public by

the Offeror in relation to the Offer in order to comply with applicable rules and regulations, including any rules and regulations applicable to the Offer or the Offeror in Sweden, the European Union, the United States or any other relevant

jurisdiction. |

| 4.2 |

The Parties acknowledge that each of them has full knowledge of the contemplated Offer and that the Offeror has been or will be provided with information by the Company relating to the Company and its business through a

due diligence process. The Parties are further aware that each of the Company and the Offeror is a publicly traded company and that the discussions, negotiations and information relating to the Offer may constitute inside information under Swedish

law, the laws of the United States and/or other applicable law. |

| 4.3 |

To the extent the Offeror obtains an undertaking to accept the Offer from other shareholders of the Company on terms more favorable to that shareholder than those which apply to the Shareholder under this Undertaking,

such more favorable terms shall apply in relation to the Shareholder as if agreed between the Offeror and the Shareholder. |

| 4.4 |

Each of the Parties confirms that this Undertaking represents the entire understanding and constitutes the whole agreement between the Parties in relation to its subject matter and supersedes all prior agreements and

understandings, whether oral or written, between the Parties with respect to the subject matter hereof. |

| 4.5 |

This Undertaking shall be binding upon and inure to the benefit of the successors of the Parties but shall not be assignable by any of the Parties without the prior written consent of the other Party. This Undertaking

is not intended to, and does not, confer upon any person other than the Parties hereto any rights or remedies hereunder. |

| 4.6 |

If any provision of this Undertaking or the application of it shall be declared or deemed void, invalid or unenforceable in whole or in part for any reason, the Parties shall amend this Undertaking as shall be necessary

to give effect to the spirit of this Undertaking so far as possible. If the Parties fail to amend this Undertaking, the provision which is void, invalid or unenforceable, shall be deleted and the remaining provisions of this Undertaking shall

continue in full force and effect. |

5

| 4.7 |

Nothing in this Undertaking shall be construed as an obligation for the Offeror to make or complete the Offer. |

| 4.8 |

If the Offeror extends the acceptance period of the Offer and/or increases the offer price in the Offer and/or otherwise revises the Offer, this Agreement shall apply mutatis mutandis to such revised offer.

|

GOVERNING LAW AND DISPUTES

This Undertaking shall be governed by and construed in accordance with the laws of Sweden. Any dispute, controversy or claim arising out of, or

in connection with, this Undertaking, or the breach, termination or invalidity of the Undertaking, shall be settled by arbitration in accordance with the Rules of the Arbitration Institute of the Stockholm Chamber of Commerce. The place of

arbitration shall be Stockholm, Sweden. The language to be used in the arbitral proceedings shall be English.

This Undertaking has been duly

executed in two (2) original copies, of which each of the Parties has taken one (1) copy.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place: |

|

Stockholm |

|

|

|

|

|

Place: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

8 April, 2015 |

|

|

|

|

|

Date: |

|

8 April, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

POD INVESTMENT AB |

|

|

|

|

|

INFINERA CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

/s/ Axel Roos |

|

|

|

|

|

/s/ Brad Feller |

|

|

|

|

|

|

By: |

|

Axel Roos |

|

|

|

|

|

By: |

|

Brad Feller |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Tom Nyman |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

Tom Nyman |

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2

HOLDING AGREEMENT

April 8, 2015

Infinera Corporation

140 Caspian Court,

Sunnyvale, CA 94089

Ladies and Gentlemen:

Infinera Corporation, a

Delaware corporation (the “Offeror”), is considering making a public offer to acquire all outstanding shares in Transmode AB, a corporation organized under the laws of Sweden (the “Company”), pursuant to which all

of the issued and outstanding shares of capital stock of the Company (“Company Shares”) would be exchanged for (i) shares of common stock, par value $0.001 per share, of Infinera Corporation (the “Offeror

Shares”) and (ii) a cash payment (the “Offer”).

As a material inducement to the Offeror to make the Offer,

the undersigned shareholder (“Shareholder”) hereby agrees that during the period specified in the following paragraph (the “Holding Period”), Shareholder will not offer, sell, contract to sell, pledge or otherwise

dispose of, directly or indirectly, any of the Offeror Shares issued to Shareholder pursuant to the Offer in exchange for Shareholder’s Company Shares (the “Subject Shares”) or securities convertible into or exchangeable or

exercisable for any Subject Shares, enter into a transaction which would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of the Subject

Shares, whether any such aforementioned transaction is to be settled by delivery of the Subject Shares or such other securities, in cash or otherwise, or publicly disclose the intention to make any such offer, sale, pledge or disposition, or to

enter into any such transaction, swap, hedge or other arrangement, without, in each case, the prior written consent of the Offeror. Notwithstanding the foregoing, (i) for the avoidance of doubt, there shall be no restriction on the vesting of

any Subject Shares or securities convertible into or exchangeable or exercisable for any Subject Shares or the exercise of any options or conversion rights with respect to such securities, in each case so long as the Subject Shares so released from

vesting or so received following an exercise of options or conversion rights are held by the Shareholder and not themselves offered, sold, contracted to sell, pledged or otherwise disposed of, directly or indirectly, (ii) there shall be no

restriction on the transfer of Subject Shares or securities convertible into or exchangeable or exercisable for any Subject Shares upon a vesting event or exercise of the Offeror’s securities to cover tax withholding obligations of the

Shareholder in connection with such vesting or exercise and (iii) Shareholder may transfer Subject Shares as a distribution or distributions to partners, members or shareholders of Shareholder, provided that Shareholder is a limited

partnership, limited liability company, corporation or similar entity and the distributees thereof agree to be bound in writing by the terms of this agreement (this “Agreement”) prior to such distribution. Furthermore, subject to

compliance with Shareholder’s obligations under that certain Irrevocable Undertaking entered into substantially concurrently with this Agreement, nothing herein shall prevent Shareholder from accepting any public takeover/tender offer or

similar offer made to all shareholders of the Offeror.

The Holding Period will commence upon the exchange of Shareholder’s Company

Shares for Offeror Shares (the “Effective Date”) and shall continue with respect to the Subject Shares as follows, until all of the Subject Shares have been released from the restrictions set forth in this Agreement (such

restrictions, the “Transfer Restrictions”):

| |

• |

|

One-fifth (1/5th) of the Subject Shares shall be released from the Transfer Restrictions on the forty-fifth (45th) day after the Effective Date; and |

| |

• |

|

one-fifth (1/5th) of the Subject Shares shall be released from the Transfer Restrictions each month thereafter on the same day of the month as the Effective Date (and if there is no corresponding day, on the last

day of the month). |

Shareholder also agrees and consents to the entry of stop-transfer instructions with the

Offeror’s transfer agent and registrar against the transfer of the Subject Shares held by Shareholder except in compliance with the foregoing restrictions. The Offeror undertakes to take such actions, if any, in relation to the transfer agent

and registrar or otherwise that might be necessary for the Offeror to take in order to for the Subject Shares to be released from the Transfer Restrictions as per the dates specified above, or which might facilitate such release.

Substantially concurrently with the execution of this Agreement, each of Thomas J. Fallon and David F. Welch, who are each shareholders of the

Offeror (the “Other Shareholders”), have entered into a Holding Agreement with Offeror (each a “Holding Agreement,” and collectively, together with this Agreement, the “Holding Agreements”),

pursuant to which the Other Shareholders have agreed to certain transfer restrictions on all shares, warrants, options or other instruments convertible into shares issued by the Offeror held or controlled by Mr. Fallon and Mr. Welch

directly or indirectly (defined as “Subject Shares” in each other Holding Agreement, and herein as the “Other Subject Shares” and together with the Subject Shares covered by this Agreement, the “Holding

Shares”). The Offeror undertakes to ensure that the transfer restrictions agreed to by Mr. Fallon and Mr Welch in their respective Holding Agreement are no less restrictive than the Transfer Restrictions under this Agreement and are in

force for a restricted period that begins when Shareholder signs the Irrevocable Undertaking referred to above and ends at the end of the Holding Period. Notwithstanding the foregoing, the Other Shareholders shall not be restricted from effecting

dispositions of Other Subject Shares through their respective trading plans pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, that take place prior to May 1, 2015. To the extent that any Holding Shares are released

from the restrictions under any of the Holding Agreements prior to the end of the Holding Period, the number of Holding Shares so released early (measured at each such early release) from the transfer restrictions shall be allocated pro rata among

the Subject Shares and all Other Subject Shares, provided however that the Offeror undertakes to ensure that no such early release under the Holding Agreement entered into by Mr. Fallon and Mr Welch respectively is agreed without prior written

consent of Shareholder. Should no such Holding Agreement be validly entered to by the Other Shareholders, or if this paragraph or such Holding Agreement is not complied with by the Other Shareholders or the Offeror, then this Agreement shall lapse

and the Transfer Restrictions hereunder no longer have any effect. For the avoidance of doubt, the Holding Agreements for the Other Shareholders will lapse and terminate in the event that the Offer is withdrawn following the failure of any of the

conditions thereto.

This Agreement will lapse and terminate in the event that the Offer is withdrawn following the failure of any of the

conditions thereto.

The Offeror and Shareholder, in addition to being entitled to exercise all rights granted by law (including monetary

damages, if any), shall be entitled to specific performance of their rights under this Agreement. The Offeror and Shareholder agree that monetary damages would not be adequate compensation for any loss incurred by reason of breach of the provisions

of this Agreement and hereby agree to waive in any action for specific performance the defense that a remedy at law would be adequate or that there is need for a bond.

No provision of this Agreement shall be modified, waived or discharged unless the modification, waiver or discharge is agreed to in writing

and signed by the Shareholder and the Offeror. No waiver by either party of any breach of, or of compliance with, any condition or provision of this Agreement by the other party shall be considered a waiver of any other condition or provision or of

the same condition or provision at another time. Notwithstanding the foregoing, Shareholder agrees that the Offeror may unilaterally waive in whole or in part, or otherwise modify in a manner that is not adverse to Shareholder, the restrictions of

this Agreement.

No agreements, representations or understandings (whether oral or written and whether express or implied) which are not

expressly set forth in this Agreement have been made or entered into by either party with respect to the subject matter hereof.

This

Agreement shall be governed by, and construed in accordance with, the laws of the State of Delaware, without regard to applicable principles of conflicts of laws thereof.

This Agreement shall inure to the benefit of, and be binding upon, the successors and assigns of the Offeror and Shareholder.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned has executed, or has caused to be executed, this Agreement on

the date first written above.

|

| Very truly yours, |

|

| Pod Investment AB |

| Print Name of Shareholder |

|

| /s/ Axel

Roos /s/ Tom Nyman |

| Authorized Signature/s |

|

| Axel

Roos Tom Nyman |

| Names of Authorized Signatory/ies |

|

| Executive

Officer Executive Officer |

| Title/s |

|

| Agreed to and Accepted: |

|

| INFINERA CORPORATION |

|

| /s/ Brad Feller |

| Authorized Signature/s |

|

| Brad Feller |

| Names of Authorized Signatory/ies |

|

| CFO |

| Title/s |

[SIGNATURE PAGE TO HOLDING AGREEMENT]

|

|

| 1 |

© 2015 Infinera

Infinera To Acquire Transmode

Establishes an End-to-End Portfolio

Investor Briefing

April 2015

Exhibit 99.3 |

|

|

| 2 |

© 2015 Infinera

This presentation contains "forward-looking" statements that involve risks,

uncertainties and assumptions. If the risks or uncertainties ever materialize or the

assumptions prove incorrect, our results may differ materially from those expressed or

implied by such forward-looking statements. All statements other than statements of

historical fact could be deemed forward- looking, including, but not limited to, any

projections of financial information; any statements about historical results that may

suggest trends for our business; any statements of the plans, strategies, and objectives of

management for future operations; any statements of expectation or belief regarding

future events, potential markets or market size, technology developments, or

enforceability of our intellectual property rights; and any statements of assumptions

underlying any of the items mentioned. These statements are based on estimates and

information available to us at the time of this presentation and are not guarantees of

future performance. These risks and uncertainties include, but are not limited to, the risk that Transmode shareholders fail to

tender more than 90% of Transmode’s outstanding shares, that any other closing conditions

are not satisfied, and that the transaction may not close; the risk that

Transmode’s and Infinera’s businesses will not be integrated successfully; the risk that

synergies will not be realized or realized to the extent anticipated; the risk that the

combined company will not realize on its financing or operating strategies; the risk

that litigation in respect of either company or the transaction could arise; and the

risk

that disruption caused by the combined company would make it difficult to maintain certain

strategic relationships. These risks and uncertainties also include those risks and

uncertainties discussed in the offer document to be filed with the Swedish Financial

Supervisory Authority and in the Registration Statement on Form S-4 to be filed with the SEC, those risks and

uncertainties identified under the heading “Risk Factors”

in the Infinera Annual Report on Form 10-K for the year ended

December 27, 2014, filed with the SEC, and those risks and uncertainties identified in any

subsequent reports filed with the SEC by Infinera. Our SEC filings are available on our

website at www.infinera.com and the SEC’s website at www.sec.gov. We assume no obligation to, and do not

currently intend to, update any such forward-looking statements. Safe Harbor

|

|

|

| 3 |

© 2015 Infinera

Market Inflections

Transport Becoming Strategic

•

Networks

Simplifying

to

New

Model of Cloud Services and

Intelligent Transport

Vision: Enable An Infinite Pool of Intelligent Bandwidth

Poised to take off

•

Scalable

Optics

and

Integrated

Packet-Optical

Key

for

Simplification |

|

|

| 4 |

© 2015 Infinera

Multi

Market

Strategy

–

Horizontal

Expansion

$15.3B (2019) –

Transport Market

Source: Infonetics Q4 2014 Market Forecast

Metro

Edge

Metro

Access

Metro Aggregation

Metro

Core

3. Penetrate

LH Core

1. Grow

Cloud

2. Seize |

|

|

| 5 |

© 2015 Infinera

Building the End-to-End Portfolio

Metro

Edge

Metro

Access

Metro Aggregation

Metro

Core

Cloud

LH Core

Cloud Xpress

Sliceable Photonics

DTN-X

XTC4/10

XTC4

Opportunity to Accelerate into Metro Aggregation |

|

|

| 6 |

© 2015 Infinera

Introducing

Transmode:

A

Leader

in

Metro

Packet-Optical

•

Stockholm, Sweden

•

NASDAQ Stockholm (TRMO)

•

281 employees worldwide 2014

•

Packet-Optical metro network solutions

•

650 customers, 50000+ systems deployed

•

History of profitability

2014: $120M Net Sales, 50.7% Gross Margin, 7.6% Operating Margin

2009-2014: 50.3% Avg. Gross Margin, 13.4% Avg. Operating Margin

•

#1 Packet-Optical in EMEA

•

Applications: Business Ethernet, Mobile fronthaul/

backhaul, Broadband Aggregation

Source: Infonetics 2014

Financials as per IFRS; 1 USD = 7.78 SEK (Dec 2014) |

|

|

| 7 |

© 2015 Infinera

Outstanding Strategic Fit

Source: Q4 2014 INFN: Non-GAAP, TRMO: IFRS; Infonetics 2014,

Dell’Oro 2014 #1 Packet

Optical

EMEA

#1 100G

WDM

ex-China

Strong

NA Base

Strong

EMEA

Base

PICs

SDN

Power

Efficient

Systems

Long

Haul

Wireless

Back &

Fronthaul

Subsea

46%

Gross

Margin

52%

Gross

Margin

Metro

Core

Metro

Cloud

Metro

Access,

Edge, Core |

|

|

| 8 |

© 2015 Infinera

Transmode’s Leadership in Metro

Lowest

Power

& Space

50000+

Systems

650+

Customers

#1

Packet

Optical

EMEA

Source: Infonetics 2014

TM-Series

10G/100G

Packet-Optical

Ethernet,

Wireless

back-

haul

/

fronthaul

TG-Series

Biz.

Service

Wireless

backhaul

CPE / PON

Biz.

Service

Wireless

backhaul

WDM

access |

|

|

| 9 |

© 2015 Infinera

SDN Control

Metro

Edge

Metro

Access

Metro Aggregation

Metro

Core

Cloud

LH Core

DTN-X

XTC4/10

Cloud Xpress

XTC4

Sliceable Photonics

Complementary Product Set |

|

|

| 10 |

© 2015 Infinera

Common

#1 100G WDM WW ex-China

Leader in ICP, NA Cable, Wholesale & Ent.

First mover in Metro Cloud for ICPs

#1 Packet-Optical EMEA

Strength in cable, wireless back/front

haul, Ethernet services

Leverage Strengths, Cross-Sell

Source: Infonetics 2014, Dell’Oro 2014

Revenue Growth

Opportunity

Complementary Customer Base |

|

|

| 11 |

© 2015 Infinera

Product

Mix

Geographic

Mix

Complementary Market Offerings

2014

Metro 2%

Long-Haul

98%

Metro 100%

Americas

76%

APAC 4%

EMEA

20%

Americas

14%

APAC 4%

EMEA

82%

Combined

Entity

Metro

~18%

Americas

68%

EMEA

28%

APAC 4% |

|

|

| 12 |

© 2015 Infinera

Transmode’s Strong Financials

5-Year Track Record (‘09-‘14)

•

To grow faster

than the market

Yearly sales growth higher than the

yearly growth of the global market for

Metro WDM equipment

•

To grow profitably

Operating margin of 12% (excluding

extraordinary items) or more over a

business cycle

Management Financial Targets

Source: Transmode FY09 –

FY14 IFRS Financial Statements

Revenue

CAGR

Average

Operating Margin

Average

Gross Margin

10.3%

13.4%

50.3% |

|

|

| 13 |

© 2015 Infinera

Expected Accretive in 2016

Synergistic Financials

•

Complementary customer base

•

Complementary product & market

•

End-to-End portfolio

•

Shared culture of deal discipline

•

Volume synergies

•

Leverage technologies across portfolio

•

More leveraged investments

2015E is Financial Analyst Consensus

TRMO: IFRS statements

1 USD = 7.78 SEK (Dec 2014), 8.5 SEK (Mar 2015)

•

TAM expansion

•

Revenue growth

•

High Gross Margins

•

Increased R&D Pool |

|

|

| 14 |

© 2015 Infinera

Benchmarking Financial Performance

Source: Public financial statements, Weighted average

for INFN+TRMO, ALU = Entire business

YoY Revenue Growth, %

2014

20

10

0

-10

50

40

30

Gross Margin, %

2014

INFN +

TRMO

Ciena

ALU

Cyan

MRV

Adva |

|

|

| 15 |

© 2015 Infinera

Compatible Philosophies

•

Play to Win

•

Customer First

•

Top-rated for Services and Support

•

Product Excellence

•

#1 100G WDM Worldwide, ex-China

•

#1 Packet-Optical EMEA

•

Profitability

•

Market leading Operating & Gross Margins

Culture + Talent + Business + Technology

Source: Infonetics 2014, Dell’Oro 2014 |

|

|

| 16 |

© 2015 Infinera

A Transaction Good for All Stakeholders

Investors

•

Allows combined company to address $15.3B DWDM TAM (2019)

•

Combines two of the most profitable companies in the industry

•

Expected accretive to non-GAAP EPS in 2016; neutral to slightly dilutive 2H’15

Customers

•

Combined company would be able to deliver an End-to-End product portfolio

•

Shared culture of customer first, strong technology and product excellence

•

Scale of combined company would allow for further investment in

technologies to allow continued differentiation

Employees

•

Ability to market and sell an End-to-End portfolio of products to address

customers’

needs

•

Ability to develop compelling solutions with strong combined knowledge base

Source: Infonetics 2014 |

|

|

| 17 |

© 2015 Infinera

Infinera + Transmode

•

Full

Metro

portfolio

accelerates

100G

metro

share

•

End-to-End

portfolio,

$15B

market*

•

Complementary

customers

and

geographies

•

Expected

non-GAAP

EPS

accretive

in

2016

•

Common

philosophy

of

profitable

growth

has

led

to

strong

financial

results

•

Shared

culture

and

talent

driving

product

excellence

•

Technology

leadership

for

Packet-Optical

&

Metro

vision

acceleration

*Source: Infonetics Q4 2014 Market Forecast for 2019

|

|

|

| 18 |

© 2015 Infinera

Key Transaction Details

Anticipated Close

•

Third quarter of 2015

Closing Conditions

•

Tender of more than 90% of the shares of Transmode

•

Customary closing conditions and approvals

Transaction

Consideration

•

Approximately 109 SEK per share in stock and cash

o

For every 10 shares of Transmode, shareholders will receive SEK 300 in cash and

4.705 Infinera shares

o

Total of approximately 13.0 million new Infinera shares issued and $96 million in

cash

o

Transmode shareholders to own ~8.7% of combined company

•

Approximately $350 million total equity value

Financial Impact

•

Companies have highest gross margins in the industry

•

Cash consideration funded by Infinera balance sheet

•

Expected to be accretive to non-GAAP EPS in 2016; neutral to slightly dilutive

2H’15 Other Terms

•

POD Investment AB, Transmode’s largest shareholder has signed irrevocable

undertaking to support transaction and lockup agreement |

|

|

| 19 |

© 2015 Infinera

This communication is neither an offer to purchase nor a solicitation of an offer to sell any

shares. This communication is for informational purpose only. The exchange offer will

not be made to, nor will exchanges be accepted from, or on behalf of, holders of shares

in any jurisdiction in which the making of the exchange offer or the acceptance thereof

would not comply with the laws of that jurisdiction. The acceptance period for the

exchange offer for shares of Transmode described in this communication has not

commenced. In connection with the proposed combination of Infinera and Transmode,

Infinera will file an offer document with the Swedish Financial Supervisory Authority

and a prospectus and a Registration Statement on Form S-4 with the SEC.

Shareholders of Transmode should read the above referenced documents and materials carefully

when such documents and materials become available because they contain important

information about the transaction. Shareholders of Transmode may obtain free copies of

these documents and materials, any amendments or supplements thereto and other

documents containing important information about Infinera and the transaction, once such documents and materials

are filed or furnished, as applicable, with the SEC, through the

website maintained by the SEC at www.sec.gov. Copies of the

documents and materials filed with the SEC by Infinera will also

be available free of charge on Infinera’s website at

www.infinera.com

under the heading “SEC Filings”

in the “Company—Investor Relations”

portion of Infinera’s website. More

information about the exchange offer, including the formal announcement of the offer and the

offer document to be filed with and approved by the Swedish Financial Supervisory

Authority, can be found on www.infinera.se.

Disclaimer |

|

|

| 20 |

© 2015 Infinera

Thank You

www.infinera.com |

|

|

| 1 |

© 2015 Infinera

Infinera + Transmode

Tom Fallon, CEO

April 9, 2015

Exhibit 99.4 |

|

|

| 2 |

© 2015 Infinera

This presentation contains "forward-looking" statements that involve risks,

uncertainties and assumptions. If the risks or uncertainties ever materialize or the

assumptions prove incorrect, our results may differ materially from those expressed or

implied by such forward-looking statements. All statements other than statements of

historical fact could be deemed forward- looking, including, but not limited to, any

projections of financial information; any statements about historical results that may

suggest trends for our business; any statements of the plans, strategies, and objectives of

management for future operations; any statements of expectation or belief regarding

future events, potential markets or market size, technology developments, or

enforceability of our intellectual property rights; and any statements of assumptions

underlying any of the items mentioned. These statements are based on estimates and

information available to us at the time of this presentation and are not guarantees of

future performance. These risks and uncertainties include, but are not limited to, the risk that Transmode shareholders fail to

tender more than 90% of Transmode’s outstanding shares, that any other closing conditions

are not satisfied, and that the transaction may not close; the risk that

Transmode’s and Infinera’s businesses will not be integrated successfully; the risk that

synergies will not be realized or realized to the extent anticipated; the risk that the

combined company will not realize on its financing or operating strategies; the risk

that litigation in respect of either company or the transaction could arise; and the

risk

that disruption caused by the combined company would make it difficult to maintain certain

strategic relationships. These risks and uncertainties also include those risks and

uncertainties discussed in the offer document to be filed with the Swedish Financial

Supervisory Authority and in the Registration Statement on Form S-4 to be filed with the SEC, those risks and

uncertainties identified under the heading “Risk Factors”

in the Infinera Annual Report on Form 10-K for the year ended

December 27, 2014, filed with the SEC, and those risks and uncertainties identified in any

subsequent reports filed with the SEC by Infinera. Our SEC filings are available on our

website at www.infinera.com and the SEC’s website at www.sec.gov. We assume no obligation to, and do not

currently intend to, update any such forward-looking statements. Safe Harbor

|

|

|

| 3 |

© 2015 Infinera

Who is Infinera?

Innovator & Leader

•

Founded 2001 in Silicon Valley, IPO 2007

•

Photonic Integrated Circuits (PICs)

•

DWDM platforms with integrated switching

•

400+ Patents Filed/Granted

•

#1 Optical company WW rated by Infonetics

Global

•

~1,400 employees

•

Headquarters Sunnyvale, CA, USA

•

Global presence |

|

|

|

•

Leader

in

Intelligent

Transport

Network™

solutions

•

23% YoY revenue growth in 2014

•

140 customers in 73 countries; 59 DTN-X customers

•

Diversified customer base across multiple verticals

-

17 Tier 1s globally

-

3 of top 4 Internet Content Providers

-

4 of top 5 NA Cable/MSOs

-

Multiple top bandwidth wholesalers

Infinera Performance

4 | ©

2015 Infinera |

|

|

| 5 |

© 2015 Infinera

Infinera

–

Financial

Stability

And

Continuing

to

Grow

Source: Infinera Financial Reporting

*Wall Street consensus

**Dell’Oro

Group 3Q 2014 Optical Transport Report 2 Years 20+% Growth

Strong Balance Sheet

2014 Performance

•

$668 million revenue

•

44% Gross Margin

•

$50 million net income

(Non-GAAP)

2014 vs 2013

23% YoY Growth

vs. Market**

@11%

Revenue |

|

|

| 6 |

© 2015 Infinera

Building the End-to-End Portfolio

Metro

Edge

Metro

Access

Metro Aggregation

Metro

Core

Cloud

LH Core

Cloud Xpress

DTN-X

XTC4/10

XTC4

Opportunity to Accelerate into Metro Aggregation

Sliceable Photonics |

|

|

| 7 |

© 2015 Infinera

Infinera + Transmode

•

Full

Metro

portfolio

accelerates

100G

metro

share

•

End-to-End

portfolio,

$15B

market*

•

Complementary

customers

and

geographies

•

Expected

non-GAAP

EPS

accretive

in

2016

•

Common

philosophy

of

profitable

growth

has

led

to

strong

financial

results

•

Shared

culture

and

talent

driving

product

excellence

•

Technology

leadership

for

Packet-Optical

&

Metro

vision

acceleration

*Source: Infonetics Q4 2014 Market Forecast for 2019

|

|

|

| 8 |

© 2015 Infinera

Metro

Edge

Metro

Access

Metro Aggregation

Metro

Core

Cloud

LH Core

DTN-X

XTC4/10

Cloud Xpress

XTC4

SDN Control

Sliceable Photonics

Complementary Product Set |

|

|

| 9 |

© 2015 Infinera

Common

#1 100G WDM WW ex-China

Leader in ICP, NA Cable, Wholesale & Ent.

First mover in Metro Cloud for ICPs

#1 Packet-Optical EMEA

Strength in cable, wireless back/front

haul, Ethernet services

Leverage Strengths, Cross-Sell

Source: Infonetics 2014, Dell’Oro 2014

Revenue Growth

Opportunity

Complementary Customer Base |

|

|

| 10 |

© 2015 Infinera

•

In the near term, there are no changes. Business as usual.

•

For both companies, this is an expansion into new addressable

markets with very minimal overlap

•

By leveraging our combined industry impact we are anticipating

expansion, not reduction. We expect this growth to be reflected

in our staffing plans.

•

We are looking to both companies’

employees to identify

advantages and ensure success for the team and our customers

•

You will be updated as things progress

What does this mean for me? |

|

|

| 11 |

© 2015 Infinera

The Integration Plan and You

Owner

Early Q2

Q2 and Q3

Late Q3

Q4 and beyond

EXEC

TEAM

YOU

Read the

FAQ

Attend All

Hands

Ask

questions

Business as usual

(Your manager will reach out to you

specifically if necessary)

Identify and

respond to all

opportunities in

your area of

expertise to ensure

success of the

combined

organization

Create

Integration

Planning

Team

Integration Planning

Underway

Approximately 12

months to

achieve full

integration

Expected

Close |

|

|

| 12 |

© 2015 Infinera

This communication is neither an offer to purchase nor a solicitation of an offer to sell any

shares. This communication is for informational purpose only. The exchange offer will

not be made to, nor will exchanges be accepted from, or on behalf of, holders of shares

in any jurisdiction in which the making of the exchange offer or the acceptance thereof

would not comply with the laws of that jurisdiction. The acceptance period for the

exchange offer for shares of Transmode described in this communication has not

commenced. In connection with the proposed combination of Infinera and Transmode,

Infinera will file an offer document with the Swedish Financial Supervisory Authority

and a prospectus and a Registration Statement on Form S-4 with the SEC.

Shareholders of Transmode should read the above referenced documents and materials carefully

when such documents and materials become available because they contain important

information about the transaction. Shareholders of Transmode may obtain free copies of

these documents and materials, any amendments or supplements thereto and other

documents containing important information about Infinera and the transaction, once such documents and materials

are filed or furnished, as applicable, with the SEC, through the

website maintained by the SEC at www.sec.gov. Copies of the

documents and materials filed with the SEC by Infinera will also

be available free of charge on Infinera’s website at

www.infinera.com

under the heading “SEC Filings”

in the “Company—Investor Relations”

portion of Infinera’s website. More

information about the exchange offer, including the formal announcement of the offer and the

offer document to be filed with and approved by the Swedish Financial Supervisory

Authority, can be found on www.infinera.se.

Disclaimer |

|

|

| 13 |

© 2015 Infinera

Thank You

www.infinera.com |

|

|

| All

Staff Information Meeting 9 April 2015

Exhibit 99.5 |

|

|

|

Public offer from Infinera

Transmode shareholders has received a public offer

from Infinera to acquire 100% of outstanding shares in

Transmode

Our Board has recommended our shareholders to

accept the offer

Our largest shareholder, POD Investment, has already

accepted the offer under certain conditions

The Offer consideration consists of a mix of cash and

new Infinera shares

2

Confidential |

|

|

| The

combination of Infinera and Transmode would create one of the leading global

vendors of end-to-end optical transport solutions,

spanning Longhaul and Metro applications.

The

combined

worldwide

sales

operations

will

increase

market

coverage

and

open

a

larger

part

of

the

growing

optical

networking

market

fuelling

new

growth

opportunities.

A

broader

and

enhanced

product

portfolio

can

be

developed

combining

expertise

from

the

Company

and

Infinera

in

OTN,

Ethernet

and

optical

technologies.

The

combined

Infinera

and

Transmode

operations

will

together

be

well

position

to

face

challenges

associated

with

growing

in

the

networking

equipment

industry,

which

amongst

other

require

investments

in

new

markets

and

products.

3

Confidential

The Board’s recommendation to accept Infinera’s public offer

|

|

|

|

Strategic benefits to Transmode

There are a number of strategic benefits to Transmode from combining its

operations with Infinera:

Differentiated

and

comprehensive

product

portfolio

with

Transmode

Metro

aggregation

and

access

products,

combined

with

Infinera

long-haul

products

World

class

R&D

and

engineering

organization

with

complementary

strengths

to

develop

market

leading

solutions.

The

companies’

similar

engineering

culture

will

create

a

strong

platform

for

successful

integration

Complementary

geographical

footprint

with

Transmode

strengths

in

Europe

and

Infinera

strengths

in

North

America

Cross-selling

opportunities

to

complementary

customer-bases

Addressing

a

larger

portion

of

the

optical

networking

market

and

engineer

better

products

with

fast

time-to-market

4

Confidential |

|

|

|

Employees

For the near-term, Infinera does not intend to make any material changes to

Transmode’s employees or to Transmode’s existing organization and

operations, including the terms of employment and locations of the

business. Each company’s engineering structure is anticipated to remain

substantively intact and Infinera intends to have Transmode’s current

CEO lead the Metro Aggregation business operations of the Combined

Company For

the

long-term,

the

optimal

structures

of

each

function

will

be

determined

during

the period following the completion of the Offer and the creation of the Combined

Company, after an assessment of the Combined Company’s optimal

structure and staffing

It is expected that the Combined Company will maintain Infinera’s and

Transmode’s current facilities. The exact structure and assignments of

the Combined Company’s senior management team will be determined over

the course of the integration.

5

Confidential

Source: Infinera press release, –

Public Offer |

|

|

| The

offer in brief The total Offer consideration consists of a mixture of

cash and new shares of common stock in Infinera, which

values each Transmode share at SEK 109. Infinera is

offering each Transmode shareholder:

For

every 10 shares of Transmode, shareholders will receive SEK 300 in

cash and approximately 4.705 Infinera Shares

In prior to recommending the offer, the Board initiated a

third-party fairness opinion to evaluate the offer. This

opinion determined that the price was a fair from from a

financial point of view for shareholders –

full details in

the Transmode board press release

6

Confidential |

|

|

| Who

is Infinera Innovator & Leader

Founded 2001, IPO as “INFN”

2007 (NASDAQ)

Use unique Photonic Integrated Circuits (PICs)

DWDM platforms, Intelligent Transport Networks

400+ Patents Filed/Granted

#1 Optical company WW rated by Infonetics

Global

~1,500 employees

Headquarters Sunnyvale, CA, USA

Silicon Valley innovation, Global presence

8

Confidential

Source: Infinera |

|

|

|

Infinera Momentum

Leader

in

Intelligent

Transport

Network™

solutions

20%+ YoY revenue growth 2 consecutive years, 2x market growth rate

140 customers in 73 countries; 59 DTN-X customers

Diversified customer base across multiple verticals

-

7 Tier 1s globally

-

3 of top 4 Internet Content Providers

-

4 of top 5 NA Cable/MSOs

-

Multiple top Wholesale & Enterprise Carriers

9

Confidential

Source: Infinera |

|

|

|

Transition to multi-market; Right Products at the Right Time

10

Confidential

Source: Infinera estimates based on customer and analyst interaction

|

|

|

| The

combination of Infinera and Transmode 12

Confidential

Metro Edge

Metro Aggregation

Metro Core

$15.3B (2018) –

Transport Market

Infinera

Transmode

Source: Infinera

LH Core

Cloud |

|

|

|

Complementing

products

13

Confidential

Metro Access/ Edge/Core

Metro Aggregation

Cloud

LH Core

Ability to Service the Full Transport Market

TM-Series

DTN-X

XTC4/10

Cloud Xpress

Rich Eth.

Biz Service

Storage

Networks

FTTx/PON

Triple Play

xDSL

Triple Play

CATV/MSO

Triple Play

Mobile Back/

Front-haul

XTC4

SDN Enabled Portfolio

Source: Infinera

Sliceable Photonics |

|

|

|

Complementing geographic markets

14

Confidential

Neptune

Poseidon

Poseidon

Neptune

Neptune

Poseidon |

|

|

|

Indicative timetable

16

Confidential

Key Events

April

May

June

July

Announcement/Press release

Preparation of offer document and

Swedish Financial Supervisory

Authority (Finansinspektionen)

review

Estimated date for announcement of

the offer document

Estimated acceptance period

Estimated settlement date

9 April

29 July

25 June

26 June -

17 July

~11 weeks |

|

|

|

Information

13:00 CET All staff presentation by Tom Fallon, CEO, Infinera

16:00 CET All staff meeting at 16:00 CET (repeat of 9 am meeting)

All

questions

that

you

receive

from

investors/media

please

refer

to

Jenny Gunell

Frequent staff meetings to update you on the progress

Information will be published on the Intranet

Questions

can

be

sent

to

questions@transmode.com

Confidential |

|

|

|

Disclaimer

The Offer will not be made to, nor will exchanges be accepted from, or on behalf of,

holders of shares in any jurisdiction in which the making of the Offer or

the acceptance thereof would not comply with the laws of that jurisdiction.

The acceptance period for the Offer for shares of Transmode described in

this communication has not commenced.

In connection with the proposed combination of Infinera and Transmode, an offer

document related to the Offer will be filed with and published by the

Swedish Financial Supervisory Authority (the “SFSA”).

In addition, Infinera intends to file a Registration Statement on Form S-4

with the SEC.

Shareholders of Transmode should read the above referenced documents and materials

carefully

when

such

documents

and

materials

become

available,

as

well

as

other

documents

filed

with the SEC and with the SFSA, because they will contain important information

about the transaction.

Infinera may not exchange the common stock referenced in the preliminary

prospectus until

the

Registration

Statement

on

Form

S-4

filed

with

the

SEC

becomes

effective.

Shareholders

of