SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(RULE 13D - 101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO 13d-2(a)

(Amendment No. 2)*

Searchlight Minerals Corp.

(Name of Issuer)

Common Stock, par value $.001

(Title of Class of Securities)

812224202

(CUSIP Number)

Jamie Nash, Esq.

Kleinberg, Kaplan, Wolff & Cohen, P.C.

551 Fifth Avenue, New York, New York 10176

Tel: (212) 986-6000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 25, 2015

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box [X].

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Capital Partners, LP

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

WC

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Delaware

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

26,511,348 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

26,511,348

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

26,511,348

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

16.3%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

PN

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Wavefront, LP

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

WC

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Delaware

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

4,731,289 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

4,731,289 (1)

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

4,731,289 (1)

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

3.1%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

PN

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Capital Partners Offshore Master Fund, LP

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

WC

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Cayman Islands

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

7,083,749 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

7,083,749

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

7,083,749

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

4.7%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

PN

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Capital Partners Offshore, Ltd.

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

AF

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Cayman Islands

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

7,083,749 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

7,083,749

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

7,083,749

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

4.7%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

CO

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Spectrum Offshore Master Fund, LP

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

WC

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Cayman Islands

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

1,420,429 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

1,420,429

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

1,420,429

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

1.0%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

PN

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Spectrum Offshore, Ltd.

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

AF

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Cayman Islands

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

1,420,429 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

1,420,429

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

1,420,429

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

1.0%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

CO

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Spectrum, LLC

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

WC

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Delaware

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

32,475 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

32,475

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

32,475

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

Less than 1%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

CO

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

LCG Holdings, LLC

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

AF

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Delaware

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

39,779,290 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

39,779,290

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

39,779,290

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

23.8%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

OO

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Capital Group, LP

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

AF, OO

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Delaware

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

40,810,379 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

40,810,379

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

40,810,379

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

24.4%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

PN

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Luxor Management, LLC

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

AF

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

Delaware

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

40,810,379 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

40,810,379

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

40,810,379

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

24.4%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

OO

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

| |

|

| |

Christian Leone

|

| |

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

|

| |

(a) [x]

|

| |

(b) [ ]

|

| |

|

|

3.

|

SEC USE ONLY

|

| |

|

|

4.

|

SOURCE OF FUNDS

|

| |

|

| |

AF

|

| |

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

| |

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

|

| |

USA

|

| |

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

| |

|

|

7.

|

SOLE VOTING POWER

|

| |

|

| |

0

|

| |

|

|

8.

|

SHARED VOTING POWER

|

| |

|

| |

40,810,379 (See Items 5(b) regarding the Voting Agreement)

|

| |

|

|

9.

|

SOLE DISPOSITIVE POWER

|

| |

|

| |

0

|

| |

|

|

10.

|

SHARED DISPOSITIVE POWER

|

| |

|

| |

40,810,379

|

| |

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

|

| |

40,810,379

|

| |

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

| |

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

|

| |

24.4%

|

| |

|

|

14.

|

TYPE OF REPORTING PERSON

|

| |

|

| |

IN

|

The following constitutes Amendment No. 2 to the Schedule 13D filed by the undersigned (“Amendment No. 2”). This Amendment No. 2 amends the Schedule 13D, as previously amended, as specifically set forth herein.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 is hereby amended and restated to read as follows:

A total of $28,984,994.84 was paid to acquire the Common Stock reported as beneficially owned by the Reporting Persons herein. The funds used to purchase these securities were obtained from the general working capital of the Onshore Fund, the Wavefront Fund, the Offshore Master Fund, the Spectrum Master Fund and the Separately Managed Account and margin account borrowings made in the ordinary course of business, although the Reporting Persons cannot determine whether any funds allocated to purchase such securities were obtained from any margin account borrowings.

|

Item 4.

|

Purpose of Transaction.

|

Item 4 is hereby amended to add the following:

On March 25, 2015, the Onshore Fund and the Issuer entered into a securities purchase agreement (the “Purchase Agreement”) pursuant to which the Reporting Persons acquired an aggregate of 4,250,000 “units” of the Issuer’s securities (the “Units”) at a purchase price of $0.3529 per Unit (the “Acquisition”). Each Unit consists of:

|

|

Ÿ

|

One share of Common Stock; and

|

|

|

Ÿ

|

One Common Stock purchase warrant, where each full warrant will entitle the warrant holder to purchase one share of the Common Stock, at an exercise price of $0.50 per share (the “March 2015 Warrants,” and as exercised, collectively, the “March 2015 Warrant Shares”). Such March 2015 Warrants will expire five years from the date of issuance.

|

The Purchase Agreement contains representations and warranties that are customary for transactions of the type contemplated in connection with the Acquisition.

On March 25, 2015, the Onshore Fund and the Issuer entered into registration rights agreement (the “Registration Rights Agreement”), pursuant to which, the Issuer agreed to, subject to certain conditions, file a registration statement covering the resale of the shares of Common Stock acquired in the Acquisition and the March 2015 Warrant Shares.

The foregoing descriptions of the terms and conditions of the Purchase Agreement, the Registration Rights Agreement and March 2015 Warrant do not purport to be complete and are qualified in their entirety by reference to the full text or form of such documents, as the case may be, which are attached as Exhibits 99.1, 99.2 and 99.3 hereto, respectively, and are incorporated herein by reference.

Additionally, in connection with the Acquisition the Issuer agreed to waive certain provisions of that certain Rights Agreement, dated August 24, 2009, between the Issuer and Empire Stock Transfer Inc. (the “Rights Agreement”), with respect to the Reporting Persons. Specifically, the Issuer agreed to waive the ownership limitations previously in the Rights Agreements with respect to the Reporting Persons to allow the Reporting Persons to become the beneficial owners of up to 26% of the outstanding shares of the Common Stock, without being deemed to be an “acquiring person” under the Rights Agreement.

On March 4, 2015, certain of the Reporting Persons (the “Secured Parties”) and the Issuer entered into a Partial Release From Security Agreement and Trust (the “Partial Release”), whereby the Secured Parties agreed to release any interest in the Real Property (as defined in the Partial Release). In exchange, the Issuer and the Reporting Persons agreed to use their best efforts to cause their respective designees to vote to expand the Issuer’s Board of Directors to seven members and appoint a designee identified by the Reporting Persons to fill such vacancy. The foregoing description of the Partial Release does not purport to be complete and is qualified in its entirety by reference to the full text of such document, which is attached as Exhibit 99.4 hereto and is incorporated herein by reference.

|

Item 5.

|

Interest in Securities of the Issuer.

|

Items 5(a) and (b) are hereby amended and restated to read as follows:

(a) The aggregate percentage of shares of Common Stock reported owned by each person named herein is based upon 148,920,208 shares, which is the total number of shares of Common Stock outstanding as of the date hereof based on information provided by the Issuer. As of the close of business on March 26, 2015:

(i) The Onshore Fund individually beneficially owned 26,511,348 shares of Common Stock representing approximately 16.3% of all of the outstanding shares of Common Stock. The 26,511,348 shares consist of: (A) 12,438,190 shares of Common Stock, (B) Warrants expiring on November 12, 2015 (the “November 2015 Warrants”) exercisable for 3,244,836 shares of Common Stock, (C) Warrants expiring on June 1, 2015 (the “2015 Warrants”) exercisable for 1,511,109 shares of Common Stock, (D) Warrants expiring on September 18, 2019 (the “2019 Warrants”) exercisable for 167,213 shares of Common Stock, (E) March 2015 Warrants expiring on March 25, 2020 exercisable for 4,250,000 shares of Common Stock and (F) Convertible Notes convertible into 4,900,000 shares of Common Stock.

(ii) The Spectrum Onshore Fund individually beneficially owned 32,475 shares of Common Stock representing less than 1% of all of the outstanding shares of Common Stock. The 32,475 shares consist of November 2015 Warrants exercisable for 32,475 shares of Common Stock.

(iii) The Wavefront Fund individually beneficially owned 4,731,289 shares of Common Stock representing approximately 3.1% of all of the outstanding shares of Common Stock. The 4,731,289 shares consist of: (A) 2,595,753 shares of Common Stock, and (B) 2015 Warrants exercisable for 488,891 shares of Common Stock, (C) 2019 Warrants exercisable for 54,338 shares of Common Stock and (D) Convertible Notes convertible into 1,592,308 shares of Common Stock.

(iv) The Offshore Master Fund individually beneficially owned 7,083,749 shares of Common Stock representing approximately 4.7% of all of the outstanding shares of Common Stock. The 7,083,749 shares consist of: (A) 5,638,840 shares of Common Stock and (B) November 2015 Warrants exercisable for 1,444,909 shares of Common Stock. The Offshore Feeder Fund, as the owner of a controlling interest in the Offshore Master Fund, may be deemed to beneficially own the shares of Common Stock held by the Offshore Master Fund.

(v) The Spectrum Offshore Master Fund individually beneficially owned 1,420,429 shares of Common Stock representing approximately 1.0% of all of the outstanding shares of Common Stock. The 1,420,429 shares consist of: (A) 1,139,334 shares of Common Stock, and (B) November 2015 Warrants exercisable for 281,095 shares of Common Stock. The Spectrum Offshore Feeder Fund, as the owner of a controlling interest in the Spectrum Offshore Master Fund, may be deemed to beneficially own the shares of Common Stock held by the Spectrum Offshore Master Fund.

(vi) Luxor Capital Group, as the investment manager of the Funds, may be deemed to beneficially own the 39,779,290 shares of Common Stock beneficially owned by them, and an additional 1,031,089 shares of Common Stock beneficially owned by the Separately Managed Accounts consisting of (A) 850,780 shares of Common Stock, (B) 2019 Warrants exercisable for 5,950 shares of Common Stock and (C) Convertible Notes convertible into 68,000 shares of Common Stock, representing 24.4%of all of the outstanding shares of Common Stock.

(vii) Luxor Management and Mr. Leone may each be deemed to be the beneficial owners of the 40,810,379 shares of Common Stock beneficially owned by Luxor Capital Group, representing 24.4%of all of the outstanding shares of Common Stock.

(viii) LCG Holdings may be deemed to be the beneficial owner of the 39,779,290 shares of Common Stock beneficially owned by the Onshore Fund, the Spectrum Onshore Fund, the Wavefront Fund, the Offshore Master Fund and the Spectrum Offshore Master Fund, representing 23.8% of all of the outstanding shares of Common Stock.

(ix) Mr. Leone may be deemed to be the beneficial owner of the 39,779,290 shares of Common Stock beneficially owned by LCG Holdings.

(x) Collectively, the Reporting Persons beneficially own 40,810,379 shares of Common Stock representing 24.4%of all of the outstanding shares of Common Stock.

(b) Subject to the terms of the Voting Agreement and Irrevocable Proxy Coupled with Interest (the “Voting Agreement”) previously entered into with the Issuer on June 7, 2012, as amended, whereby the Reporting Persons, subject to certain conditions, retain the right to vote, in the aggregate, up to that number of issued and outstanding shares of Common Stock that are equal to or less than 19.5% of the issued and outstanding shares of Common Stock, and vote all issued and outstanding shares of Common Stock in excess of 19.5% as instructed by our Board of Directors:

The Onshore Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared power to vote or direct the vote of the 26,511,348 shares of Common Stock individually beneficially owned by the Onshore Fund.

The Spectrum Onshore Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the 32,475 shares of Common Stock individually beneficially owned by the Spectrum Onshore Fund.

The Wavefront Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the 4,731,289 shares of Common Stock individually beneficially owned by the Wavefront Fund.

The Offshore Master Fund, the Offshore Feeder Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the 7,083,749 shares of Common Stock individually beneficially owned by the Offshore Master Fund.

The Spectrum Offshore Master Fund, the Spectrum Offshore Feeder Fund, Luxor Capital Group, LCG Holdings, Luxor Management and Mr. Leone have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the 1,420,429 shares of Common Stock individually beneficially owned by the Spectrum Offshore Master Fund.

Luxor Capital Group, Luxor Management and Mr. Leone have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the 1,031,089 shares of Common Stock held in the Separately Managed Account.

Item 5(c) is hereby amended to add the following:

(c) As further described in Item 4 above, on March 25, 2015 the Onshore Fund acquired 4,250,000 Units consisting of one share of Common Stock and one March 2015 Warrant at a purchase price of $0.3529 per Unit.

On March 18, 2015, the Onshore Fund, the Wavefront Fund and the Separately Managed Account, at their option, acquired securities in lieu of cash in connection with the semi-annual interest payment on the Issuer’s Secured Convertible Promissory Notes, dated September 18, 2013. In lieu of cash, the Onshore Fund, the Wavefront Fund and the Separately Managed Account received Common Stock, priced at $0.25 per share (the “Interest Acquisition”). In connection with the Interest Acquisition, the Onshore Fund, the Wavefront Fund and the Separately Managed Account entered into a Registration Rights Agreement with the Issuer regarding the shares of Common Stock acquired in the Interest Acquisition (the “Interest Acquisition Registration Rights Agreement”), a copy of which is attached as Exhibit 99.5 hereto and is incorporated herein by reference.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

|

Item 6 is hereby amended to add the following:

Reference is made to the Purchase Agreement, the Registration Rights Agreement, the March 2015 Warrant and the Partial Release defined and described in Item 4 above, which are attached as Exhibits 99.1, 99.2, 99.3 and 99.4 hereto, respectively, and are incorporated herein by reference. Reference is made to the Interest Acquisition Registration Rights Agreement defined and described in Item 5(c) above, which is attached as Exhibit 99.5 hereto and is incorporated herein by reference.

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 is hereby amended to add the following exhibits:

|

|

99.1

|

Common Stock and Warrant Purchase Agreement, dated March 25, 2015, by and between Searchlight Minerals Corp. and Luxor Capital Partners, LP.

|

|

|

99.2

|

Registration Rights Agreement dated March 25, 2015, by and between Searchlight Minerals Corp. and Luxor Capital Partners, LP.

|

|

|

99.4

|

Partial Release From Security Agreement and Deed of Trust dated March 4, 2015, by and between Searchlight Minerals Corp., Luxor Capital Partners, LP (for itself and the Managed Account) and Luxor Wavefront, LP.

|

|

|

99.5

|

Registration Rights Agreement dated March 18, 2015, by and between Searchlight Minerals Corp., Luxor Capital Partners, LP (for itself and the Managed Account) and Luxor Wavefront, LP.

|

SIGNATURES

After reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information with respect to it set forth in this statement is true, complete, and correct.

| |

LUXOR CAPITAL PARTNERS, LP

|

| |

|

|

| |

By:

|

LCG Holdings, LLC

General Partner

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR WAVEFRONT, LP

|

| |

|

|

| |

By:

|

LCG Holdings, LLC

General Partner

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR CAPITAL PARTNERS OFFSHORE MASTER FUND, LP

|

| |

|

|

| |

By:

|

LCG Holdings, LLC

General Partner

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR CAPITAL PARTNERS OFFSHORE, LTD.

|

| |

|

|

| |

By:

|

Luxor Capital Group, LP

Investment Manager

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR SPECTRUM OFFSHORE MASTER FUND, LP

|

| |

|

|

| |

By:

|

LCG Holdings, LLC

General Partner

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR SPECTRUM OFFSHORE, LTD.

|

| |

|

|

| |

By:

|

Luxor Capital Group, LP

Investment Manager

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR SPECTRUM, LLC

|

| |

|

|

| |

By:

|

LCG Holdings, LLC

Managing Member

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR CAPITAL GROUP, LP

|

| |

|

|

| |

By:

|

Luxor Management, LLC

General Partner

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LCG HOLDINGS, LLC

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

LUXOR MANAGEMENT, LLC

|

| |

|

|

| |

By:

|

/s/ Norris Nissim |

| |

|

Name:

|

Norris Nissim

|

| |

|

Title:

|

General Counsel

|

| |

/s/ Norris Nissim |

| |

NORRIS NISSIM, as Agent for Christian Leone

|

|

Please See PDF for document reference

|

|

Please See PDF for document reference

|

|

Please See PDF for document reference

|

|

Please See PDF for document reference

|

|

Please See PDF for document reference

|

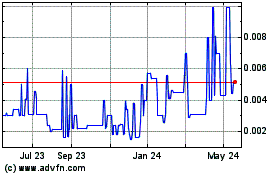

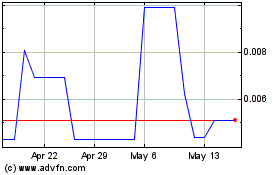

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Aug 2024 to Sep 2024

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Sep 2023 to Sep 2024