UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): March 4, 2015

______________

InterDigital, Inc.

(Exact name of registrant as specified in charter)

|

| | |

Pennsylvania | 1-33579 | 23-1882087 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

200 Bellevue Parkway, Suite 300, Wilmington, Delaware | 19809-3727 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: 302-281-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

q Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

q Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

q Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

q Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

On March 4, 2015, InterDigital, Inc. (“InterDigital”) issued a press release (the “Launch Press Release”) announcing its intention to offer, subject to market and other conditions, $275 million aggregate principal amount of Senior Convertible Notes due 2020 (the “Notes”) in a transaction exempt from registration under the Securities Act of 1933, as amended.

On March 6, 2015, InterDigital issued a press release (the “Pricing Press Release”) announcing the pricing of its private offering of $275 million aggregate principal amount of Notes. The offering is expected to close on March 11, 2015, subject to certain closing conditions.

Copies of the Launch Press Release and the Pricing Press Release are attached to this Current Report on Form 8-K as Exhibit 99.1 and Exhibit 99.2, respectively, and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 InterDigital, Inc. press release dated March 4, 2015.

99.2 InterDigital, Inc. press release dated March 6, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INTERDIGITAL, INC. |

|

|

By: /s/ Jannie K. Lau |

Jannie K. Lau |

Executive Vice President, |

General Counsel and Secretary |

Date: March 9, 2015

EXHIBIT INDEX

Exhibit No. Description

99.1 InterDigital, Inc. press release dated March 4, 2015.

99.2 InterDigital, Inc. press release dated March 6, 2015.

Exhibit 99.1

INTERDIGITAL ANNOUNCES PROPOSED PRIVATE OFFERING OF

$275 MILLION OF SENIOR CONVERTIBLE NOTES

Wilmington, DE — March 4, 2015 — InterDigital, Inc. (“InterDigital”) (NASDAQ: IDCC) announced that it intends to offer, subject to market and other conditions, $275 million aggregate principal amount of Senior Convertible Notes due 2020 in a private offering. The notes will be offered only to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Act”). InterDigital also expects to grant to the initial purchasers of the notes a 13-day option to purchase up to an additional $41 million aggregate principal amount of notes, solely to cover over-allotments, if any.

The notes will pay interest semi-annually in cash on March 1 and September 1 and will mature on March 1, 2020. Prior to December 1, 2019, the notes will be convertible only upon the occurrence of certain events and during certain periods, and thereafter, at any time until the second scheduled trading day preceding the maturity date. Conversions of the notes will be settled in cash, shares of InterDigital's common stock or a combination thereof, at InterDigital's election. The interest rate, the conversion rate of notes and certain other terms of the notes will be determined by negotiations between InterDigital and the initial purchasers of the notes.

In connection with the pricing of the notes, InterDigital expects to enter into one or more privately negotiated convertible note hedge transactions with one or more of the initial purchasers of the notes or their affiliates or other financial institutions (the “hedge counterparties”). The convertible note hedge transactions collectively are expected to cover, subject to customary anti-dilution adjustments, the aggregate number of shares of InterDigital common stock that will initially underlie the notes. InterDigital also expects to enter into one or more privately negotiated warrant transactions with the hedge counterparties whereby InterDigital will sell to the hedge counterparties warrants relating to the same number of shares of InterDigital common stock, with such number of shares subject to customary anti-dilution adjustments. In addition, if the initial purchasers exercise their over-allotment option to purchase additional notes, InterDigital expects to enter into one or more additional warrant transactions and to use a portion of the proceeds from the sale of the additional notes and warrant transactions to enter into additional convertible note hedge transactions. The convertible note hedge transactions are expected to reduce the potential dilution with respect to InterDigital common stock and/or offset any potential cash payments InterDigital is required to make in excess of the principal amount of converted notes, as the case may be, upon any conversion of the notes in the event that the market price per share of InterDigital common stock exceeds the strike price of the convertible note hedge transactions. However, the warrant transactions will have a dilutive effect to the extent that the market price per share of InterDigital common stock exceeds the applicable strike price of the warrants on any expiration date of the warrants.

In connection with establishing their initial hedge of the convertible note hedge transactions and warrant transactions and concurrently with, or shortly after, the pricing of the notes, the hedge counterparties and/or their affiliates expect to purchase InterDigital common stock in open market transactions and/or privately negotiated transactions and/or enter into various cash-settled derivative transactions with respect to InterDigital common stock concurrently with, or shortly after, the pricing of the notes. In addition, the hedge counterparties and/or their affiliates may modify their hedge positions following the pricing of the notes by entering into or unwinding various derivative transactions with respect to InterDigital common stock and/or by purchasing or selling InterDigital common stock in open market transactions and/or privately negotiated transactions following the pricing of the notes from time to time (and are likely to do so during any conversion period related to a conversion of notes). Any of these hedging activities could also increase (or reduce the size of any decrease in) the market price of InterDigital common stock.

InterDigital expects to use a portion of the net proceeds from the offering of the notes and the proceeds from the sale of the warrants to fund the cost of the convertible note hedge transactions. The remaining net proceeds from the offering of the notes will be used for the repurchase of up to $50 million of shares of InterDigital common stock from institutional investors through one of the initial purchasers or its affiliate, as InterDigital’s agent, concurrently with the pricing of the offering of the notes, and for general corporate purposes, which may include, among other things, the repurchase or retirement of InterDigital’s outstanding indebtedness.

The notes and the shares of InterDigital common stock issuable upon conversion, if any, have not been registered under the Act or applicable state securities laws and may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Act and applicable state securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

About InterDigital

InterDigital develops technologies that are at the core of mobile devices, networks, and services worldwide. We solve many of the industry's most critical and complex technical challenges, inventing solutions for more efficient broadband networks and a richer multimedia experience years ahead of market deployment. InterDigital has licenses and strategic relationships with many of the world's leading wireless companies. Founded in 1972, InterDigital is listed on NASDAQ and is included in the S&P MidCap 400® index.

InterDigital is a registered trademark of InterDigital, Inc.

CONTACT: Patrick Van de Wille

Email: patrick.vandewille@interdigital.com

+1 (858) 210-4814

Exhibit 99.2

INTERDIGITAL ANNOUNCES PRICING OF PRIVATE OFFERING OF

$275 MILLION OF 1.50% SENIOR CONVERTIBLE NOTES

Wilmington, DE — March 6, 2015 — InterDigital, Inc. (“InterDigital”) (NASDAQ: IDCC) announced today the pricing of its private offering of $275 million aggregate principal amount of 1.50% Senior Convertible Notes due 2020 to be sold to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Act”). InterDigital has granted the initial purchasers of the notes a 13-day option to purchase up to an additional $41 million aggregate principal amount of notes, solely to cover over-allotments, if any. The offering is expected to close on March 11, 2015, subject to certain closing conditions.

The notes will be InterDigital’s senior unsecured obligations. The notes will pay interest semi-annually in cash on March 1 and September 1 at a rate of 1.50% per year, and will mature on March 1, 2020. The holders of the notes will have the ability to require InterDigital to repurchase all or any portion of their notes for cash in the event of a fundamental change. In such case, the repurchase price would be 100% of the principal amount of the notes being repurchased plus any accrued and unpaid interest.

Prior to December 1, 2019, the notes will be convertible only upon the occurrence of certain events and during certain periods, and thereafter, at any time until the second scheduled trading day preceding the maturity date. The notes will be convertible at an initial conversion rate of 13.8172 shares of InterDigital common stock per $1,000 principal amount of the notes, which is equivalent to an initial conversion price of approximately $72.37, which represents a 35% conversion premium to the closing sale price of $53.61 per share of InterDigital common stock on the NASDAQ Global Select Market on March 5, 2015. In addition, following certain corporate transactions that occur prior to the maturity date, InterDigital will, in certain circumstances, increase the conversion rate for a holder that elects to convert its notes in connection with such a corporate transaction. Upon any conversion, the notes will be settled in cash, shares of InterDigital's common stock or a combination thereof, at InterDigital's election.

In connection with the pricing of the notes, InterDigital has entered into privately negotiated convertible note hedge transactions with some of the initial purchasers of the notes or their affiliates (the “hedge counterparties”). The convertible note hedge transactions collectively will cover, subject to customary anti-dilution adjustments, the aggregate number of shares of InterDigital common stock that will initially underlie the notes. InterDigital has also entered into privately negotiated warrant transactions with the hedge counterparties whereby InterDigital has sold to the hedge counterparties warrants relating to the same number of shares of InterDigital common stock, with such number of shares subject to customary anti-dilution adjustments. The strike price of the warrant transactions will initially be approximately $88.46 per share, which represents a 65% premium to the closing sale price of InterDigital common stock on the NASDAQ Global Select Market on March 5, 2015. In addition, if the initial purchasers exercise their over-allotment option to purchase additional notes, InterDigital expects to enter into one or more additional warrant transactions and to use a portion of the proceeds from the sale of the additional notes and warrant transactions to enter into additional convertible note hedge transactions. The convertible note hedge transactions are expected to reduce the potential dilution with respect to InterDigital common stock and/or offset any potential cash payments InterDigital is required to make in excess of the principal amount of converted notes, as the case may be, upon any conversion of the notes in the event that the market price per share of InterDigital common stock exceeds the strike price of the convertible note hedge transactions. However, the warrant transactions will have a dilutive effect to the extent that the market price per share of InterDigital common stock exceeds the applicable strike price of the warrants on any expiration date of the warrants.

In connection with establishing their initial hedge of the convertible note hedge transactions and warrant transactions and concurrently with, or shortly after, the pricing of the notes, the hedge counterparties and/or their affiliates expect to purchase InterDigital common stock in open market transactions and/or privately negotiated transactions and/or enter into various cash-settled derivative transactions with respect to InterDigital common stock. In addition, the hedge counterparties and/or their affiliates may modify their hedge positions following the pricing of the notes by entering into or unwinding various derivative transactions with respect to InterDigital common stock and/or by purchasing or selling InterDigital common stock in open market transactions and/or privately negotiated transactions following the pricing of the notes from time to time (and are likely to do so during any conversion period related to a conversion of notes). Any of these hedging activities could also increase (or reduce the size of any decrease in) the market price of InterDigital common stock.

InterDigital estimates that the net proceeds from the offering of the notes will be approximately $267 million (or approximately $307 million if the initial purchasers exercise their over-allotment option in full), after deducting the initial purchasers’ fees and estimated offering expenses. In addition, InterDigital expects to receive proceeds from the sale of the

warrants described above. InterDigital expects to use a portion of the net proceeds from the offering of the notes and the proceeds from the sale of the warrants to fund the cost of the convertible note hedge transactions. InterDigital expects to use approximately $43 million of the remaining net proceeds from the offering of the notes to repurchase shares of InterDigital common stock at $53.61 per share, the closing price of the stock on March 5, 2015, from institutional investors through one of the initial purchasers or its affiliate, as InterDigital’s agent, concurrently with the pricing of the offering of the notes, and the remaining net proceeds for general corporate purposes, which may include, among other things, the repurchase or retirement of InterDigital’s outstanding indebtedness.

The notes and the shares of InterDigital common stock issuable upon conversion, if any, have not been registered under the Act or applicable state securities laws and may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Act and applicable state securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

About InterDigital

InterDigital develops technologies that are at the core of mobile devices, networks, and services worldwide. We solve many of the industry's most critical and complex technical challenges, inventing solutions for more efficient broadband networks and a richer multimedia experience years ahead of market deployment. InterDigital has licenses and strategic relationships with many of the world's leading wireless companies. Founded in 1972, InterDigital is listed on NASDAQ and is included in the S&P MidCap 400® index.

InterDigital is a registered trademark of InterDigital, Inc.

CONTACT: Patrick Van de Wille

Email: patrick.vandewille@interdigital.com

+1 (858) 210-4814

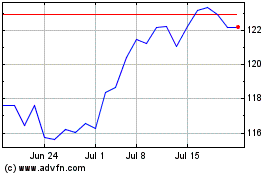

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Apr 2023 to Apr 2024