Statement of Changes in Beneficial Ownership (4)

March 04 2015 - 6:05PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

GROSS MICHAEL S

|

2. Issuer Name

and

Ticker or Trading Symbol

Solar Capital Ltd.

[

SLRC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

See Remarks

|

|

(Last)

(First)

(Middle)

C/O SOLAR CAPITAL LTD., 500 PARK AVENUE

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/2/2015

|

|

(Street)

NEW YORK, NY 10022

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

3/2/2015

|

|

P

|

|

36784

|

A

|

$20.24

(1)

|

2135786

|

I

|

See Footnote

(2)

(3)

|

|

Common Stock

|

3/3/2015

|

|

P

|

|

15452

|

A

|

$20.28

(1)

|

2151238

|

I

|

See Footnote

(2)

(3)

|

|

Common Stock

|

|

|

|

|

|

|

|

103195

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Restricted Stock Units

|

(4)

|

3/4/2015

|

|

A

(5)

|

|

|

72135.2582

(4)

|

(4)

|

(4)

|

Common Stock, par value $0.01 per share

|

72135.2582

|

$0.00

|

72135.2582

|

I

|

See Footnote

(4)

|

|

Explanation of Responses:

|

|

(

1)

|

The price reported in Column 4 is a weighted average price. These shares were purchased in multiple transactions. The reported price for the share purchases made on March 2, 2015 is based on prices ranging from a low of $20.10 per share to a high of $20.60 per share. The reported price for the share purchases made on March 3, 2015 is based on prices ranging from a low of $20.16 per share to a high of $20.39 per share. The reporting person undertakes to provide to Solar Capital Ltd. (the "Issuer"), any security holder of the Issuer or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares purchased at each separate price set forth above.

|

|

(

2)

|

Includes 131,225 shares of the Issuer held by Solar Capital Partners Employee Stock Plan, LLC (the "SCP Plan"), 52,236 of which is reported as purchased on this Form 4. The 52,236 shares acquired were purchased in the open market for the purpose of satisfying obligations related to its Restricted Stock Unit ("RSU") grants. The SCP Plan is controlled by Solar Capital Partners, LLC ("Solar Capital Partners"). Mr. Gross and Bruce J. Spohler may be deemed to indirectly beneficially own a portion of the shares held by the SCP Plan by virtue of their collective ownership interest in Solar Capital Partners. In addition, the total includes 20,000 shares of the Issuer held by a grantor retained annuity trust setup by and for Mr. Gross (the "GRAT"), which Mr. Gross may be deemed to directly beneficially own as the sole trustee of the GRAT. (Continued in Footnote 3)

|

|

(

3)

|

Also includes 1,285,013 shares of the Issuer held by Solar Capital Investors, LLC ("Solar Capital I") and 715,000 shares of the Issuer held by Solar Capital Investors II, LLC ("Solar Capital II"), a portion of both of which may be deemed to be indirectly beneficially owned by Mr. Gross, Mr. Spohler and the GRAT by virtue of their collective ownership interest therein. Mr. Gross disclaims beneficial ownership of any of the Issuer's securities directly held by the SCP Plan, Solar Capital I or Solar Capital II, except to the extent of his pecuniary interest therein, and this report shall not be deemed an admission that Mr. Gross is the beneficial owner of such securities for purposes of Section 16 or any other purpose.

|

|

(

4)

|

Grants of RSUs with respect to 72,135.2582 shares held by the SCP Plan, which is controlled by Solar Capital Partners, to certain of its employees pursuant to Restricted Stock Unit Agreements, dated March 4, 2015. Shares of the Issuer's common stock underlying these RSUs are scheduled to vest in installments of 50% on March 1, 2017 and 50% on March 1, 2018. Upon settlement, the RSUs will become payable on a one-for-one basis in shares of the Issuer's common stock or the cash value thereof at the election of the SCP Plan administrators, Messrs. Gross and Spohler.

|

|

(

5)

|

Pursuant to the SEC staff no-action letter to Babson Capital Management LLC (pub. avail. Dec. 14, 2006), an employee benefit plan sponsored by an investment adviser (or an affiliated person of an investment adviser) to a closed-end investment company regulated under the Investment Company Act of 1940, as amended, that offers plan participants equity securities of such investment company is considered an "employee benefit plan sponsored by the issuer" for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended.

|

Remarks:

Chief Executive Officer, President, Chairman of the Board

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

GROSS MICHAEL S

C/O SOLAR CAPITAL LTD.

500 PARK AVENUE

NEW YORK, NY 10022

|

X

|

|

See Remarks

|

|

Signatures

|

|

/s/ Michael S. Gross

|

|

3/4/2015

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

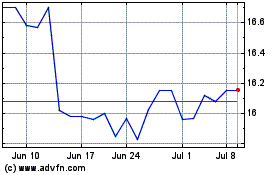

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Aug 2024 to Sep 2024

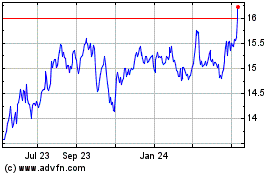

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Sep 2023 to Sep 2024