As filed with the Securities and Exchange Commission on February 26, 2015

Registration No. 333- 172847

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 4

TO

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Vale S.A.

(Exact name of registrant as specified in its charter)

|

The Federative Republic of Brazil |

|

Not Applicable |

|

(State or other jurisdiction of incorporation or

organization) |

|

(I.R.S. Employer Identification No.) |

Avenida Graça Aranha, No. 26

20030-900 Rio de Janeiro, RJ, Brazil

(Address of Principal Executive Offices)

Matching Program

2015 Cycle

(Full Title of the plan)

Vale Americas Inc.

250 Pehle Ave., Suite 302

Saddlebrook, New Jersey 07663

1-201-368-4800

(Name, address and telephone Number, including area code, of agent for service)

with copies to:

Nicolas Grabar

Cleary, Gottlieb, Steen & Hamilton

One Liberty Plaza

New York, NY 10006

(212) 225-2000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

|

Large accelerated filer x |

Accelerated filer o |

|

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

EXPLANATORY NOTE

This Post-Effective Amendment No. 4 relates to the Registration Statement on Form S-8 (File No. 333-172847) (the “Registration Statement”) of Vale S.A. (the “Registrant”), which was filed with the U.S. Securities and Exchange Commission on March 16, 2011. The Registration Statement registered 20,000,000 Preferred Class A shares of the Registrant’s stock (“Shares”), to be offered pursuant to the Matching Program (the “Plan”).

On January 4, 2012, the Registrant filed with the Securities and Exchange Commission a Post-Effective Amendment No. 1 to the Registration Statement No. 333-172847 in order to add the Vale Matching Program 2012 Cycle to the Registration Statement.

On November 28, 2012, the Registrant filed with the Securities and Exchange Commission a Post-Effective Amendment No. 2 to the Registration Statement No. 333-172847 in order to add the Vale Matching Program 2013 Cycle to the Registration Statement.

On January 24, 2014, the Registrant filed with the Securities and Exchange Commission a Post-Effective Amendment No. 3 to the Registration Statement No. 333-172847 in order to add the Vale Matching Program 2014 Cycle to the Registration Statement

The purpose of this Post-Effective Amendment No. 4 is to add an additional plan cycle, the Vale Matching Program 2015 Cycle (the “2015 Matching Program”), to the Registration Statement. Under the 2015 Matching Program, as in the Plan, Shares will be offered to certain eligible employees, subject to the satisfaction of applicable vesting conditions, in connection with those employees’ own purchase of Shares. No additional securities are being registered hereby.

2

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 8. Exhibits.

The following exhibits are filed with this Post-Effective Amendment No. 4 to the Registration Statement:

|

Exhibit number |

|

Document |

|

|

|

|

|

4.5 |

|

Vale Matching Program 2015 Cycle (filed herewith) |

|

|

|

|

|

24 |

|

Power of Attorney (included on signature pages) |

3

SIGNATURES

Pursuant to the requirements of the Securities Act, Vale certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Post-Effective Amendment No. 4 to the Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Rio de Janeiro, State of Rio de Janeiro, Brazil on February 25, 2015.

|

|

VALE S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Murilo Ferreira |

|

|

Name: |

Murilo Pinto de Oliveira Ferreira |

|

|

Title: |

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Luciano Siani |

|

|

Name: |

Luciano Siani Pires |

|

|

Title: |

Chief Financial Officer |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Mr. Murilo Pinto de Oliveira Ferreira and Mr. Luciano Siani Pires, and each of them, his true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him and in his name, place and stead, in capacities, to sign any and all amendments (including post-effective amendments) to this registration statement and all additional registration statements pursuant to Rule 462(b) of the Securities Act of 1933, as amended, and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact and agents full power and authority to do and perform each and every act in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or either of them or their or his substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

SIGNATURE |

|

TITLE |

|

DATE |

|

|

|

|

|

|

|

/s/ Murilo Ferreira |

|

|

|

February 25, 2015 |

|

Murilo Pinto de Oliveira Ferreira |

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

/s/ Luciano Siani |

|

|

|

February 25, 2015 |

|

Luciano Siani Pires |

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

Vale Americas Inc. |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Paul Houston |

|

Authorized Representative of Vale S.A. in the United States |

|

February 25, 2015 |

|

Paul Houston |

|

|

|

|

|

|

|

|

|

|

|

/s/ Dan Conrado |

|

|

|

February 25, 2015 |

|

Dan Antonio Marinho Conrado |

|

Chairman of the Board of Directors |

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

Mário da Silveira Teixeira Júnior |

|

Vice-Chairman |

|

|

|

|

|

|

|

|

|

/s/ Marcel Juviniano Barros |

|

|

|

February 25, 2015 |

|

Marcel Juviniano Barros |

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Robson Rocha |

|

|

|

February 25, 2015 |

|

Robson Rocha |

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paulo Rogério Caffarelli |

|

Director |

|

|

|

|

|

|

|

|

|

/s/ Sérgio Alexandre Figueiredo Clemente |

|

|

|

February 25, 2015 |

|

Sérgio Alexandre Figueiredo Clemente |

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hiroyuki Kato |

|

Director |

|

|

|

|

|

|

|

|

|

/s/ Oscar Augusto de Camargo Filho |

|

|

|

February 25, 2015 |

|

Oscar Augusto de Camargo Filho |

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Luciano Galvão Coutinho |

|

Director |

|

|

|

|

|

|

|

|

|

/s/ Joao Batista Cavaglieri |

|

|

|

February, 25 2015 |

|

Joao Batista Cavaglieri |

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

José Mauro Mettrau Carneiro da Cunha |

|

Director |

|

|

5

EXHIBIT INDEX

|

Exhibit number |

|

Document |

|

|

|

|

|

4.5 |

|

Vale Matching Program 2015 Cycle (filed herewith) |

|

|

|

|

|

24 |

|

Power of Attorney (included on signature pages) |

6

Exhibit 4.5

Matching Program

2015 Cycle

Rewarding Long Term Sustainable Performance

Important notice: The concession of the Program and the definition of all its conditions are a prerogative of the company, and participation in this program is completely optional and voluntary to employees, once all of the eligibility criteria are met and all conditions for participation are formally accepted by the employee, and mandatory for Vale’s Executive Directors and CEO. The purchase of shares is characterized as a risky investment, since it represents the investment of funds in variable income (e.g. publicly traded shares). By choosing to enter the program, the employee recognizes and takes risks, such as: capital market volatility, share liquidity and oscillation of their amounts in the stock exchange. The combination of these risks may bring earnings or losses to the employee who enters the program.

The purchase and the sale of the shares issued by Vale S.A., after a certain time, as well as the profits (dividends, interests, etc) earned by each employee between the purchase and the sale, may have tax consequences, especially the eventual incurrence of personal income taxes, if there is a positive result from the sale of the shares. We clarify that the guidelines and eligibility criteria contained herein are subjected to changes and interpretation dynamics from country to country. The Human Resources Centers will provide generic and relevant information about these consequences and each employee should be responsible for evaluating their specific individual financial condition, and for consulting their own accountants/financial advisors to ensure they are aware of all of the financial implications linked to participating in this Program.

Human Resources

Variable Pay Department | RH CoE

January, 2015

|

I. |

Table of Contents |

|

|

|

|

|

|

I. |

Table of Contents |

2 |

|

|

|

|

|

II. |

About the Matching Program | 2015 Cycle |

3 |

|

|

|

|

|

III. |

Eligibility and Investment Options |

4 |

|

|

|

|

|

III.1. Fundamental Conditions for Eligibility to the Program |

4 |

|

|

|

|

III.2. Rules for Placing the Executives in Groups A, B or C |

4 |

|

|

|

|

|

IV. |

How to Join the Program |

6 |

|

|

|

|

|

IV.1. Enrollment Form |

6 |

|

|

|

|

IV.2. Opening of account and/or Updating the Registration Information with the Brokerage Firms |

6 |

|

|

|

|

IV.3. Funds for Investment in the Program |

8 |

|

|

|

|

|

V. |

Acquisition of Shares or ADRs with the Investment |

9 |

|

|

|

|

|

V.1. Acquisition Date and Type of Shares |

9 |

|

|

|

|

V.2. Calculation of the Number of Shares or ADRs Acquired |

9 |

|

|

|

|

V.3. Administration of the Acquired Shares or ADRs |

9 |

|

|

|

|

V.4. Brokerage Fees |

10 |

|

|

|

|

V.5. Dividends and Interests on Equity |

10 |

|

|

|

|

V.6. Conditions for Staying in the Program |

10 |

|

|

|

|

|

VI. |

Reward of Matching at the End of the Cycle |

11 |

|

|

|

|

|

VII. |

Specificities Regarding Expatriate and/or Repatriate Employees |

11 |

|

|

|

|

|

VIII. |

Early Payment for Employees Terminated During the Cycle of the Program |

12 |

|

|

|

|

|

VIII.1. Resignation or Dismissal for Cause |

12 |

|

|

|

|

VIII.2. Dismissal by Vale / Retirement |

12 |

|

|

|

|

VIII.3. Death or Retirement for Disability |

12 |

|

|

|

|

VIII.4. Executives from Associated or Subsidiary Companies that Undergo Change of Control or Vale’s Divestiture |

12 |

|

|

|

|

VIII.5. Summary Table of Conditions for Early Payment (Before the End of the Cycle) |

13 |

|

|

|

|

|

IX. |

Main Dates of the 2015 Cycle |

14 |

|

|

|

|

|

Annex A: List of Participating Companies |

15 |

|

|

|

|

Annex B: Methodology For Currency Conversion |

19 |

|

|

|

|

For Acquisition of Shares/ADRs |

19 |

|

|

|

|

For Payments Before the End of the Cycle |

19 |

|

|

|

|

Annex C: Methodology for Calculating the Average Price of Shares |

20 |

|

|

|

|

Annex E: Distribution for Placement of the Eligible Executives |

22 |

2

II. About the Matching Program | 2015 Cycle

Matching is a long term incentive program that composes the total reward of Vale’s executives and its associated/subsidiary companies’ employees that also participate in the program(1) according to rules and conditions set forth herein. The program aims to:

· Encourage the sense of “ownership”;

· Increase the capacity of retention and attraction of talents; and

· Reinforce the culture of sustainable performance and skill development of our executives.

Fundamental characteristics of the program:

· The level of investment with which an executive can enroll depends on:

(i) the position of the executive in the last cycle of Career & Succession (C&S);

(ii) the hierarchical level of the executive in the company on December 31st, 2014(2);

(iii) the location where the executive is based on and/or the group’s company he/she is active at, both on December 31st, 2014(2);

(iv) the base salary of the executive on December 31st, 2014(2).

· The program has duration of three years (vesting): it begins in March 18th, 2015 and it ends in March, 2018(3).

Important note:

Note that the rules described in this document are valid only for the Matching Program that starts in 2015(4).

(1) See the attached list of companies whose executives may be eligible to the Matching Program | 2015 Cycle. (Annex A: List of Participating Companies).

(2) As registered in payroll systems in that date. ¹The base/basic salary adopted must comply with the definition of “base salary” of each location.

(3) The closing date of the program may be reviewed if Vale is in a restricted negotiation period (“black-out period”), as stipulated by Vale´s Securities Trading Policy.

(4) The concession of the Matching Program, in the cycle starting in 2015, does not oblige Vale or its associated/subsidiary companies to grant this incentive, or any other similar program, in future years. Vale reserves the right to examine and determine the eventual concession of similar incentives in subsequent years. Thus, employee’s participation in the 2015 Cycle shall not generate expectations of future entitlement to similar programs.

3

III. Eligibility and Investment Options

III.1. Fundamental Conditions for Eligibility to the Program

The executives who meet all of the following conditions will be eligible to participate in the Matching | 2015 Cycle(5):

· He/she must be working for Vale or one of the participating companies (see Annex A: List of Participating Companies) on December 31st, 2014, and occupying one of the below positions:

(i) CEO;

(ii) Executive Director;

(iii) Director (or the equivalent in the Technical Career);

(iv) Manager (or the equivalent in the Technical Career); and

(v) Project Leader.

· He/she must be an active employee of Vale, or one of the participating companies at the time of the shares acquisition;

· He/she must accept all the conditions to participate in the Program through the formal enrollment option (Enrollment Form), within the deadline established.

III.2. Rules for Placing the Executives in Groups A, B or C

Investment Options

If the executive chooses to participate in the Matching | 2015 Cycle, there are two options for investment:

(i) Standard Option; and

(ii) Extra Option (option only granted to employees with potential and performance as described below, being mandatory for the Executive Directors and CEO).

In both possibilities, Standard and Extra, the investment amount varies by hierarchical level and by region or participating company (see Annex A: List of Participating Companies). The amount is defined according to the following criteria:

(i) Pre-set amount based on the base salary of the executive on December 31st, 2014(6); and

(ii) Time proportion, considering the number of months the executive worked at Vale, or any participating company, in the course of 2014.

Placement of the Executives in Groups A, B or C

In addition to meeting the main conditions, the executives must meet specific conditions to be classified into one of the three groups, A, B, or C, shown in Table III.1 below:

(5) Situations not covered in this Manual should be evaluated and defined case by case by the Matching Program Management Committee, composed of the CFO and the HR Executive Director.

(6) As registered in payroll systems in that date. The base/basic salary adopted must comply with the definition of “base salary” of each location.

4

Table III.1: Eligibility to the different investment options.

|

Group |

|

Who should be placed in the group |

|

Investment options |

|

Group A |

|

· Executives who meet the fundamental conditions (see section III.1) and are deemed (according to the last C&S evaluation) as employees with recognized potential and solid or high performance(7). |

|

· These executives have the following investment options in the Matching | 2015 Cycle:

· Extra Option related to their level and region/company;

· Standard Option related to their level and region/company; or

· Do not invest in the program. |

|

Group B |

|

· Executives who meet the fundamental conditions (see section III.1) and are deemed (according to the last C&S evaluation) as employees at potential and solid or high performance; and

· Executives who meet the fundamental conditions (see section III.1) and have been recently hired (not evaluated in the last C&S), recently shifted(8) or were evaluated in the C&S in a position hierarchically different to the one they are entitled to the program(9). |

|

· These executives have the following investment options in the Matching | 2015 Cycle:

· Standard Option related to their level and region/company; or

· Do not invest in the program. |

|

Group C |

|

· Executives who meet the fundamental conditions (see section III.1) and were evaluated (according to the last C&S evaluation) as low-performance employees, regardless his/her potential. |

|

· These executives are not eligible to invest in the program. |

Each approving manager must ensure that, amongst those eligible in his/her approval scope (executives from Groups A and B), only a maximum of 30%, are classified into Group A (for reasons of numerical rounding, the distribution indicated in Annex E: Distribution for Placement of the Eligible Executives must be used). The approving manager varies from executive to executive, as shown in the following table:

Table III.2: Approving manager for each hierarchical level.

|

Hierarchical level of the eligible executive |

|

Approving manager |

|

· Managers (and equivalent in the Technical Career); and

· Project Leaders (except Executive Project Leaders). |

|

· Immediate Director or Executive Project Leader. |

|

· Directors (and equivalent in the Technical Career); and

· Executive Project Leaders. |

|

· Immediate Director or Executive Director. |

(7) Executives with solid or high performance are the ones evaluated as such according to the most recent C&S cycle, and executives with recognized potential are those who have been evaluated with potential of “1 to 3 years” or potential of “0 to 1 year” according to the most recent C&S cycle.

(8) Recent shiftings: changes that took place after June 31st, 2014 and represent a rise in career of, at least, two (2) salary grades.

(9) Cases in which this occurs: (i) evaluated in the C&S as Staff or Supervisor and eligible to the program as Manager (or equivalent); (ii) evaluated in the C&S as Manager (or equivalent) and eligible to the program as Director (or equivalent).

5

IV. How to Join the Program

IV.1. Enrollment Form

The adhesion of the executive to the program will happen through his/her formal acceptance of the guidelines and rules of the Matching | 2015 Cycle by signing (electronically or physically) the Enrollment Form (except for Executive Directors, who don´t have an enrollment document, since their participation is mandatory), and by submitting the required documentation for registration or re-registration in the stock market regulatory bodies, and for opening their brokerage account, as follows:

· Bradesco, for the executives who are in Brazil when they sign the Enrollment Form;

· JP Morgan, for the executives who are outside Brazil when they sign the Enrollment Form.

IV.2. Opening of account and/or Updating the Registration Information with the Brokerage Firms

For Executives in Brazil on December 31st, 2014

Executives who receive their (monthly) fixed remuneration in Brazil, must complete/update the forms received from Bradesco and send them as follows:

(i) Registration of new executives

Executives who are not currently registered with Bradesco shall provide the following documentation:

· Bradesco Enrollment Form

· Intermediation and Sub-custody Contract

· Copy of documents (ID or Driver’s License with CPF (Individual Taxpayer’s Roll))

· Copy of proof of residence (this is the address where participants will receive important information regarding their account)

The Enrollment Form and the Intermediation and Sub-custody Contract must be filled in, signed and submitted (original documents), along with the copy of the other documents listed above, by the date informed by your local HR, to Bradesco, to the following address: Avenida Paulista, 1450 - 7th Floor - CEP: 01310-100, to Bruna Sampaio and Jessica Fanini.

Questions related to the documentation should be directly addressed with Bradesco, through the email address comercial@bradescobbi.com.br, or the phone number +55 11 2178 5088.

Important note:

The Enrollment Form and the Intermediation and Sub-custody Contract must have, in addition to the participant’s signature, the grant of an authorizer from Vale’s HR or from its associated and subsidiary companies (procurator) in order to be accepted by the brokerage. The Enrollment Form, on the other hand, must have the signature of a witness, besides the signature of the participant and the grant mentioned above.

(ii) Information revalidation of the executives already registered

Executives that are active in the company and willing to participate in the program must update, every 2 (two) years, their registration information. Therefore, the participant whose registration has been performed/revalidated 2 (two) years ago or more, will receive from Bradesco, by email, their registration form, which must be updated/revalidated and submitted to the brokerage firm, highlighting in the body of the email,

6

the updates in the Registration Form, if applicable, otherwise, the executive must return the email with the file stating that there was no change in their data to date, with the documents listed below. In order to be accepted by the brokerage, the information should be sent through the corporate business email (this will be the evidence for revalidation of the data). The documents necessary for the revalidation are listed below:

· Enrollment Form

· Copy of documents (ID or Driver’s License with CPF - Individual Taxpayer’s Roll)

· Copy of proof of residence (this is the address where participants will receive important information regarding their account).

Important note:

The information revalidation process is solely the responsibility of the participant. The executive that does not send the registration information within the deadline set by the broker may lose the right to participate in the program

(iii) Share status consultation via internet

For online consultation about transactions and number of shares, the participant may access the web address http://www.myportfolio.com.br/bradesco/ at anytime. Questions related to online access should be sorted out through the email address comercial@bradescobbi.com.br, or the phone number +55 11 2178 5088.

For executives outside Brazil on December 31st, 2014

Executives who receive their fixed remuneration outside Brazil (including those on international assignment) will be contacted by their local HR Center for filling/updating their enrollment information and will be required to submit it as below:

(i) Registration of new employees

The participants will receive the following documents from their local HR:

· Personal information sheet

· W-8BEN Form

Participants’ personal information sheet shall be filled in and submitted, via e-mail, to JP Morgan.

New participants must also fill in the W-8BEN Form (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding), referring to the income declaration, in case of receiving dividends or selling ADRs (American Depositary Receipt). If this form is not completed, the participant may be subject to pay taxes under his/her own responsibility.

The W-8BEN Form (original document) shall be filled in, dated, signed, and mailed to the brokerage firm.

Important note:

The W-8BEN Form is valid for 3 years and the brokerage firm will contact each participant by email about its update.

7

(ii) Information revalidation of the employees already registered

Annually, before the beginning of each Cycle, JP Morgan will request the validation, via e-mail, of the personal information of each executive participating in the Matching Program. The following information will need to be revalidated:

· Full address (this is the address where the participant will receive important information related to his/her account)

· Option for reinvesting, or not, the dividends in ADRs

Questions related to the required documentation, or the sale of ADRs, should be directly addressed with JP Morgan, contact person Marcos Rivero, through the email address marcos.rivero@jpmorgan.com, or the phone number +1 302 552 0257.

Participants who are outside the United States and wish to have general information about their account (registration, ADRs balance, dividends, etc.), may call 800 990 1135 (within the U.S.) or +1 651 453 2128 (outside the U.S.).

IV.3. Funds for Investment in the Program

The eligible executive, who voluntarily chooses to invest in this program, is responsible for funding the acquisition of the shares.

In order to facilitate the availability of funds for the participant to invest in the Matching | 2015 Cycle, Vale or the associated/subsidiary company will use funds from the Short-Term Variable Remuneration (AIP — Annual Incentive Plan), to be paid to the executive in 2015 (related to the year of 2014), via the automatic payroll deduction of the amount chosen by the executive to join the program. The deduction will be performed under the condition that the net amount of the Short-Term Variable Remuneration (AIP) is equal to or greater than the amount of the adhesion to the program, to be deducted, and that all of the conditions of enrollment have been formally accepted by him/her.

If the net amount of the Short-Term Variable Remuneration (AIP) of the employee is lower than the amount of his/her investment for joining the program, Vale or the associated/subsidiary company will not perform its deduction. In this case, the participant will be informed by local HR, that in order to participate in the Matching | 2015, they will need to carry out a wire transfer of the total amount of the investment for his/her enrollment to the program (amount in cash equivalent to the investment option - Standard or Extra - chosen by him/her and formalized through the signing of the Enrollment Form), until the date informed by the local HR, in local currency, to a specific account to be indicated by Vale or the associated/subsidiary company.

Important note:

Executives living abroad who have tax registration in Brazil (CPF) should take special care to ensure that the registry data reported to the broker reflect the current status of the tax situation in the Brazilian treasury department, ie, domiciled in Brazil or outside Brazil. Any discrepancy between the registers may cause tax implications to the executive.

8

V. Acquisition of Shares or ADRs with the Investment

V.1. Acquisition Date and Type of Shares

The Matching | 2015 Cycle starts on March 18th, 2015 upon the purchase of class “A” preferred shares(10) or ADRs(11) backed in preferred shares of same class, and issued by Vale(12) through the authorized brokerage firms for each location (in Brazil, Bradesco; in other countries, JP Morgan). The executives located in Brazil shall purchase VALE5 shares, while executives outside Brazil shall buy ADRs VALE.P.

V.2. Calculation of the Number of Shares or ADRs Acquired

For the executives that acquire shares at BM&FBOVESPA, the brokerage firm in Brazil (Bradesco) will purchase the largest number of whole shares, and the remaining funds shall be wired back to the executive bank account as informed in the Bradesco Enrollment Form(13). For the employees that acquire Vale ADRs at NYSE, the brokerage firm in the USA (JP Morgan) has a procedure that allows the purchase of fractional numbers of shares, therefore, no remaining funds will be returned.

The brokerage firm will execute the purchase of shares at market prices in March, 2015

(i) Example of calculation for executives that acquire shares at BM&FBOVESPA:

· Funds remitted = R$ 50,000.00

· Hypothetical share price = R$ 30.00

· Number of shares purchased = 1,666

· Remaining funds to be wired to the Employee’s bank account = R$ 20.00

(ii) Employee that has acquired Vale ADR’s at NYSE

· Funds remitted = $ 25,000.00

· Hypothetical share price = $ 15.50

· Number of shares purchased = 1,612.90

V.3. Administration of the Acquired Shares or ADRs

The brokerage firms will be responsible for the custody of shares and/or ADRs throughout the entire cycle of the program. Vale will be informed about any stock transaction made by the participants.

The executives may sell all or part of their shares and/or ADRs at any time. However, by doing so, they shall forfeit the right to receive the reward of the Matching | 2015 and shall also be responsible for any costs arising from such sale.

(10) They offer: (a) priority in receiving dividends, which will be calculated according to Vale’s Bylaws’ Chapter VII, corresponding to (i) at least 3% (three per cent) of the amount of the stockholder’s equity, calculated based on the obtained financial statements that served as reference for the payment of dividends, or (ii) 6% (six per cent) on the portion of capital represented by this class of shares, whichever is the highest one among them; (b) the right to participate in distributed profits, on an equal basis with common shares, after the latter paid a dividend equal to the minimum established in accordance with subparagraph “a”; and (c) the right to participate in occasional bonuses, on an equal basis with common shares, observing the established priority for the dividends distribution.

(11) American Depositary Receipt (ADR) is a negotiable title that represents shares of a non-US company that trades in the US financial markets.

(12) ADRs based on class “A” preferential shares traded on the New York Stock Exchange.

(13) Keeping the account information updated with the brokerage firm is responsibility of the executive.

9

V.4. Brokerage Fees

During the cycle, participants will not incur any administration or brokerage fee expenses (they will be defrayed by Vale or its associated/subsidiary companies).

The participants cannot acquire shares and/or ADRs for personal investment using the same account reserved for the Matching Program. Shares and/or ADRs purchased outside the program, through the same brokerage firms that administer the shares/ADRs of the Matching, should be acquired in a separate account and will be subject to the management and brokerage fees imposed by each brokerage firm, without any involvement of Vale.

V.5. Dividends and Interests on Equity

In the event of declaration of dividends and / or interest on equity by Vale:

· Executives who use a brokerage firm in Brazil will have the dividend amounts deposited into their respective bank accounts;

· Executives who use a brokerage firm outside of Brazil may receive a cheque in dollars or opt for automatic reinvestment in new ADRs.

The shares / ADRs acquired with amounts received as dividends and / or interest on equity will not be considered for Matching and therefore not accrue the balance of shares / ADRs to be awarded by the end of the cycle.

V.6. Conditions for Staying in the Program

In order to receive the Matching | 2015 reward, at the end of the cycle of 3 (three) years, the participating executives must meet the following conditions:

· They cannot sell and/or transfer shares from their account during the term of the cycle.

· Investments can only be performed in the Matching account with amounts received as dividends and/or interests on equity, when allowed by the brokerage. The Matching account shall be blocked for other share acquisitions, also subject to the provisions of section V.5 above.

· Transactions involving derivatives, that constitute short selling of Vale shares, are prohibited, as well as renting of purchased shares linked to the program to third parties, since the purpose of the plan is the exposure and alignment of executives to Vale listed shares during the period of the program.

· The transactions described above are also prohibited (involving derivatives or shares renting) for any Vale shares held by the executive, while he/she is an active participant, even if they were purchased outside of the program, while he is an active participant of the program. Any breach of this rule will be subject to consequences set out in Vale´s Code of Ethics.

10

VI. Reward of Matching at the End of the Cycle

At the end of the cycle, three years after the acquisition of shares, the executive’s balance will be checked with the brokerage firms. Participants who have kept, under their property, all of the shares/ADRs acquired in the beginning of the program, during the entirety of the term of the cycle, will be eligible to a reward equivalent (1:1) to the number of shares/ADRs purchased by the executive in the beginning of the cycle(14).

Some points should be taken into consideration at the time of payment:

· Vale or the associated/subsidiary company assumes the taxes on the payment of the participant’s reward (gross up).

· The area/company responsible for the executive costs at the time of the payment, will also be responsible for his/her Matching | 2015(15) reward.

VII. Specificities Regarding Expatriate and/or Repatriate Employees

The responsibility for monitoring the Matching process (communication, calculations, validations etc.) of the eligible expatriates will be with their respective local HR (in case of expatriates / repatriates, Host Country HR). If the participant is expatriated before the cycle completion, the purchased shares will remain in his/her account with the brokerage firm that acquired the shares in the beginning of the cycle, as well as the shares/ ADRs received as dividends. As for the Matching | 2015 reward, the payment will be made by the company in the country where he/she is located (this rule are valid for all the cycles the executive is participating in).

If the participant starts and ends a cycle outside his/her home country, the shares/ADRs purchased abroad will remain in his/her account and the reward will be paid by the respective brokerage. If the executive is repatriated before the end of the cycle, he will be rewarded in the country where he/she is located at the time of the payment.

According to the Brazilian legislation, non-resident employees are not allowed to purchase shares in Brazil. Therefore, Brazilians expatriates must have their participation acquired in ADRs with the brokerage outside Brazil, JP Morgan.

(14) In case of stock split of shares/ ADRs during the cycle, the number of shares / ADRs to be awarded will also be adjusted to reflect any stock split

(15) The amount to be disbursed by the respective areas/companies must be budgeted and provisioned by them, according to the guidelines of the applicable budget cycles.

11

VIII. Early Payment for Employees Terminated During the Cycle of the Program

The conditions below define what shall happen in case the executive leaves Vale or the associated/subsidiary companies before the conclusion of Matching | 2015 Cycle:

VIII.1. Resignation or Dismissal for Cause

The executive shall not be eligible for the Matching | 2015 reward. However, he/she may sell or keep the shares/ADRs that were acquired with his/her funds. The employee will become responsible for the administration costs of the fund, if applicable, starting from the effective date of resignation or dismissal for cause.

VIII.2. Dismissal by Vale / Retirement

The executive dismissed without cause or retired will receive his/her Matching | 2015 reward, in cash, proportionally to the number of months worked for Vale, or associated/subsidiary company (see Annex A: List of Participating Companies), during this cycle. The area/company responsible for the personnel expenses of the executive (e.g. base salary) at the time that he/she leaves Vale or the associated/subsidiary company, is also responsible for the payment of his/her Matching | 2015 reward. The employee may sell or keep the shares/ADRs that were acquired with his/her funds and he/she will become responsible for the administration costs of the fund, if applicable, starting from the effective date of dismissal.

VIII.3. Death or Retirement due to Disability

The employee or his/her legal heirs will receive the full Matching | 2015 Cycle reward in cash. The area/company responsible for the personnel expenses of the executive (e.g. base salary) at the time of his/her death or retirement due to permanent disability, is also responsible for the payment of the Matching | 2015 reward to the executive or his/her legal heirs. They may also sell or keep the shares/ADRs acquired with the executive’s funds. The employee or his/her legal heirs will become responsible for the administration costs of the fund, if applicable, starting from the effective date of retirement for disability or death.

VIII.4. Executives from Associated or Subsidiary Companies that Undergo Change of Control or Vale’s Divestiture

Executives from associated or subsidiary companies (see Annex A: List of Participating Companies) that undergo Change of Control or Vale´s divestiture, will receive the Matching | 2015 Cycle reward, in cash, proportionally to the number of months worked for the associated/subsidiary company during this cycle and before the Change of Control or Vale´s divestiture. The area/company responsible for the personnel expenses of the executive (e.g. base salary) on the date when the Change of Control or divestiture occurs, is also responsible for the payment of his/her Matching | 2015 reward. The employee may sell or keep the shares/ADRs acquired with his/her own funds and will become responsible for the administration costs of the fund, if applicable, starting from the effective date of the termination.

12

VIII.5. Summary Table of Conditions for Early Payment (Before the End of the Cycle)

Table VIII.1: Summary of conditions for early pay.

|

# |

|

Condition for

early pay |

|

Eligibility

for reward |

|

Reward

Form |

|

Reference date for

calculations(16) |

|

Time proportion for

calculating the

reward |

|

Timing of reward payment |

|

Responsibility for the

costs related to the

reward |

|

Ownership of

the shares

acquired to join

the program

(with

executive’s

funds) |

|

Responsibility

for

administration

costs of the

fund as of the

resignation date |

|

1 |

|

Resignation or Dismissal For Cause |

|

No |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Executive |

|

Executive |

|

2 |

|

Dismissal by Vale / Retirement |

|

Yes |

|

Cash |

|

Last business day of the month preceding the termination of the employment |

|

Number of months worked for Vale during this cycle |

|

Should follow local laws and practices and should be made, preferably, along with the payment of severance. |

|

Area/company responsible for the personnel expenses of the executive at the date of termination |

|

Executive |

|

Executive |

|

3 |

|

Death or Retirement due to Disability |

|

Yes |

|

Cash |

|

Last business day of the month preceding the termination or retirement of the employee |

|

Full reward (no time proportion) |

|

Should follow local laws and practices and should be made, preferably, along with other payments due upon the referred incident. |

|

Area/company responsible for the personnel expenses of the executive at the date of termination or retirement |

|

Executive or his/her heirs |

|

Executive or his/her heirs |

|

4 |

|

Executives from Associated or Subsidiary Companies that Undergo Change of Control or Vale’s Divestiture |

|

Yes |

|

Cash |

|

Last business day of the month preceding the date of the effective change of control (closing of operation) |

|

Number of months worked for the associated/subsidiary company during this cycle before the change of control or Vale’s divestiture |

|

Preferably on the first event of payroll after the change of control or Vale’s divestiture, or as stipulated in the change of control /Vale’s divestiture contracts. |

|

Area/company responsible for the personnel expenses of the executive at the date of the change of control or Vale’s divestiture |

|

Executive |

|

Executive |

(16) See Annex B: Methodology For Currency Conversion and Annex C: Methodology for Calculating the Average Price of Shares for methodologies for early pays (before the end of the cycle).

13

IX. Main Dates of the 2015 Cycle

Table IX.1: Main dates of the 2015 Cycle.

|

# |

|

Date |

|

Brief description of the event |

|

01 |

|

Jan/Feb, 2015 |

|

· Period for the executive to formalize the option of enrollment |

|

02 |

|

Feb/Mar, 2015 |

|

· Payroll deduction date of the amount of Matching|2015 Cycle(17) |

|

03 |

|

March/April, 2015(18) |

|

· Acquisition of shares and/or ADRs for the Matching|2015 Cycle |

|

04 |

|

March/April, 2018 |

|

· Payment of Matching|2015 reward to the eligible Executives |

(17) Eligible executives, who choose to participate in the program and do not have their bonus discounted from the short-term payment (STI) may make the contribution with its own resources.

(18) The amount invested by the Executive will not be adjusted in the period between investment (bonus discount or employee contribution) and the purchase of shares.

14

Annex A: List of Participating Companies

Below is the list of the associated/subsidiary companies whose executives may be eligible to the Matching Program commencing in 2015, with the respective countries where these companies are established and the HR teams in charge of them.

Important notes:

The pieces of information in the table below are subject to change during the cycle. It is the responsibility of the executive to stay updated about them through their local HR.

The following list indicates companies that may have eligible executives. It does not mean that executives of these companies are necessarily eligible to the program.

Table A.1: List of subsidiary and associated companies whose executives may be eligible to the Matching | 2015 Cycle.

|

# |

|

Empresa |

|

País sede |

|

Equipe de RH |

|

Solution Center de RH |

|

1 |

|

Associação Instituto Tecnologico Vale |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

2 |

|

California Steel Industries, Inc. |

|

UNITED STATES |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

3 |

|

Camberwell Coal Pty Ltd. |

|

AUSTRALIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

4 |

|

Carborough Downs Coal Management Pty Ltd. |

|

AUSTRALIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

5 |

|

Companhia Portuaria Baia de Sepetiba |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

6 |

|

Compañia Minera Miski Mayo S.R.L. |

|

PERU |

|

RH Fertilizantes |

|

Fertilizantes |

|

7 |

|

Fundação Vale do Rio Doce |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

8 |

|

Glennies Creek Coal Management Pty Ltd. |

|

AUSTRALIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

9 |

|

Integra Coal Operations Pty Ltd. |

|

AUSTRALIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

10 |

|

Potássio Rio Colorado S.A. |

|

ARGENTINA |

|

RH Fertilizantes |

|

Fertilizantes |

|

11 |

|

PT International Nickel Indonesia Tbk |

|

INDONESIA |

|

Base Metals & North America HR |

|

Base Metals & North America |

15

|

# |

|

Empresa |

|

País sede |

|

Equipe de RH |

|

Solution Center de RH |

|

12 |

|

PT Vale Eksplorasi Indonesia |

|

INDONESIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

13 |

|

Salobo Metais S.A |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

14 |

|

Transbarge Navegacion S.A |

|

PARAGUAY |

|

RH América Latina |

|

América Latina |

|

15 |

|

Vale Americas Inc |

|

UNITED STATES |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

16 |

|

Vale Asia Kabushiki Kaisha |

|

JAPAN |

|

Singapore HR |

|

Asia Pacific, Europe & Middle East |

|

17 |

|

Vale Australia Pty Ltd |

|

AUSTRALIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

18 |

|

Vale Canada Limited |

|

CANADA |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

19 |

|

Vale Europe Ltd. |

|

UNITED KINGDOM |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

20 |

|

Vale Exploracion Argentina S.A. |

|

ARGENTINA |

|

RH América Latina |

|

América Latina |

|

21 |

|

Vale Exploraciones Mexico S.A. |

|

MEXICO |

|

Austria HR |

|

Asia Pacific, Europe & Middle East |

|

22 |

|

Vale Exploration Peru SAC |

|

PERU |

|

RH América Latina |

|

América Latina |

|

23 |

|

Vale Exploration Pty Ltd |

|

AUSTRALIA |

|

Australia HR |

|

Asia Pacific, Europe & Middle East |

|

24 |

|

Vale Fertilizantes S.A. |

|

BRAZIL |

|

RH Fertilizantes |

|

Fertilizantes |

|

25 |

|

Vale International Holdings GmbH |

|

AUSTRIA |

|

Austria HR |

|

Asia Pacific, Europe & Middle East |

|

26 |

|

Vale International S.A |

|

SWITZERLAND |

|

Switzerland HR |

|

Asia Pacific, Europe & Middle East |

16

|

# |

|

Empresa |

|

País sede |

|

Equipe de RH |

|

Solution Center de RH |

|

27 |

|

Vale International SA-DIFC |

|

UAE |

|

Singapore HR |

|

Asia Pacific, Europe & Middle East |

|

28 |

|

Vale International Singapore |

|

SINGAPORE |

|

Singapore HR |

|

Asia Pacific, Europe & Middle East |

|

29 |

|

Vale International Korea |

|

KOREA |

|

Japan HR |

|

Asia Pacific, Europe & Middle East |

|

30 |

|

Vale Japan Ltd. |

|

JAPAN |

|

Singapore HR |

|

Asia Pacific, Europe & Middle East |

|

31 |

|

Vale Logística da Argentina S.A |

|

ARGENTINA |

|

RH América Latina |

|

América Latina |

|

32 |

|

VALE LOGISTICS LIMITED |

|

MALAWI |

|

RH África |

|

África |

|

33 |

|

Vale Malaysia Minerals SDN. BHD. |

|

MALAYSIA |

|

Malaysia HR |

|

Asia Pacific, Europe & Middle East |

|

34 |

|

Vale Manganês S.A |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

35 |

|

Vale Minerals China Co. Ltd |

|

CHINA |

|

China HR |

|

Asia Pacific, Europe & Middle East |

|

36 |

|

Vale Mozambique Ltda. |

|

MOZAMBIQUE |

|

RH África |

|

África |

|

37 |

|

Vale Newfoundland & Labrador Ltd. |

|

CANADA |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

38 |

|

Vale Nickel (Dalian) Co. Ltd |

|

CHINA |

|

China HR |

|

Asia Pacific, Europe & Middle East |

|

39 |

|

Vale Nouvelle-Calédonie S.A.S. |

|

NEW CALEDONIA |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

40 |

|

Vale Óleo e Gás S.A |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

41 |

|

Vale Oman Distribution Center LLC |

|

OMAN |

|

Oman HR |

|

Asia Pacific, Europe & Middle East |

|

42 |

|

Vale Oman Pelletizing Company LLC |

|

OMAN |

|

Oman HR |

|

Asia Pacific, Europe & Middle East |

17

|

# |

|

Empresa |

|

País sede |

|

Equipe de RH |

|

Solution Center de RH |

|

43 |

|

Vale Projectos e Desenvolvimento Moçambique Ltd. |

|

MOZAMBIQUE |

|

RH África |

|

África |

|

44 |

|

Vale S.A. |

|

BRAZIL |

|

RH Brasil |

|

América Latina |

|

45 |

|

Vale Taiwan Limited |

|

TAIWAN |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

46 |

|

Vale Technology Development (Canada) Limited |

|

CANADA |

|

Base Metals & North America HR |

|

Base Metals & North America |

|

47 |

|

Vale Trading (Shanghai) Co., Ltd |

|

CHINA |

|

China HR |

|

Asia Pacific, Europe & Middle East |

|

48 |

|

Vale Zambia, pty LTD. |

|

ZAMBIA |

|

RH África |

|

África |

|

49 |

|

ValeServe Malaysia Sdn. Bhd. |

|

MALAYSIA |

|

Malaysia HR |

|

Asia Pacific, Europe & Middle East |

18

Annex B: Methodology For Currency Conversion

For Acquisition of Shares/ADRs

When the currency conversion is needed, it is recommended to use the following calculation methodology:

· Source of information: http://www.oanda.com/;

· Reference currency [A]: Currency in which the executive received his/her base salary on December 31st, 2014(19) (in the case of expatriates, host country currency);

· Currency of share trading [B]: Currency in which shares/ADRs are negotiated (BRL for shares negotiated in Brazil and USD for ADRs negotiated outside Brazil);

· Reference date for calculation: AIP payment day;

· Conversion rate: average selling (bid) rate which reflects reference date, in the form [B] for 1 (one) unit of [A];

· Conversion: the reference amount shall be converted into the currency of share trading, thus, determining the amount for the purchase of shares/ADRs;

· Rounding rules: all amounts used in the calculations must be rounded to 2 (two) significant digits, following the internationally recognized rounding rules.

For Payments Before the End of the Cycle

Cases of payment before the end of the cycle are detailed in section VIII.1. For these cases, when the currency conversion is necessary, it is recommended to use the following calculation methodology:

· Source of information: http://www.oanda.com/;

· Reference currency [A]: Currency in which the executive receives his/her base salary (in the case of expatriates, host country currency);

· Currency of share trading [B]: Currency in which shares/ADRs are negotiated (BRL for shares negotiated in Brazil and USD for ADRs negotiated outside Brazil);

· Reference period for calculation: 30 trade sessions previous to the reference dates informed in Table VIII.1, according to each specific case;

· Conversion rate: weighted average of selling (bid) rate, based on the trading amount in each of the 30 trade sessions considered, in the form [A] for 1 (one) unit of [B];

· Conversion: the amount due (calculated in the currency of share trading) must be converted into the reference currency, thus, determining the amount for payment;

· Rounding rules: all amounts used in the calculations must be rounded to 2 (two) significant digits, following the internationally recognized rounding rules.

(19) As registered in payroll systems in that date.

19

Annex C: Methodology for Calculating the Average Price of Shares

Cases of payment before the end of the cycle are detailed in section VIII.1. For those cases, when the calculation of price of the share/ADR is needed, it is recommended to use the following calculation methodology:

· Source of information: http://www.vale.com;

· Reference currency [A]: Currency in which the executive receives his/her base salary (in the case of expatriates, host country currency);

· Currency of share trading [B]: Currency in which shares/ADRs are negotiated (BRL for shares negotiated in Brazil and USD for ADRs negotiated outside Brazil);

· Reference period for calculation: 30 trade sessions previous to the reference dates informed in Table VIII.1, according to each specific case;

· Average price (in [B]): weighted average of the daily closing prices of the shares/ADRs, based on the trading amount in each of the 30 trade sessions considered; and

· Rounding rules: all amounts used in the calculations must be rounded to 2 (two) significant digits, following the internationally recognized rounding rules.

20

Annex E: Distribution for Placement of the Eligible Executives

Table E.1: Distribution for placement of the executives according to the total of eligible executives.

|

Total number of

eligible

(Group A + Group B) |

|

Maximum number of

executives placed in

Group A |

|

1 |

|

1 |

|

2 |

|

1 |

|

3 |

|

1 |

|

4 |

|

2 |

|

5 |

|

2 |

|

6 |

|

2 |

|

7 |

|

3 |

|

8 |

|

3 |

|

9 |

|

3 |

|

10 |

|

3 |

|

11 |

|

4 |

|

12 |

|

4 |

|

13 |

|

4 |

|

14 |

|

5 |

|

15 |

|

5 |

|

16 |

|

5 |

|

17 |

|

6 |

|

18 |

|

6 |

|

19 |

|

6 |

|

20 |

|

6 |

|

21 |

|

7 |

|

22 |

|

7 |

|

23 |

|

7 |

|

24 |

|

8 |

|

25 |

|

8 |

|

26 |

|

8 |

|

27 |

|

9 |

|

28 |

|

9 |

|

29 |

|

9 |

|

30 |

|

9 |

|

31 |

|

10 |

|

32 |

|

10 |

|

33 |

|

10 |

|

34 |

|

11 |

|

35 |

|

11 |

|

36 |

|

11 |

|

37 |

|

12 |

|

38 |

|

12 |

|

39 |

|

12 |

|

40 |

|

12 |

|

41 |

|

13 |

|

42 |

|

13 |

|

43 |

|

13 |

|

44 |

|

14 |

|

45 |

|

14 |

|

46 |

|

14 |

|

47 |

|

15 |

|

48 |

|

15 |

|

49 |

|

15 |

|

50 |

|

15 |

21

|

Total number of

eligible

(Group A + Group B) |

|

Maximum number of

executives placed in

Group A |

|

51 |

|

16 |

|

52 |

|

16 |

|

53 |

|

16 |

|

54 |

|

17 |

|

55 |

|

17 |

|

56 |

|

17 |

|

57 |

|

18 |

|

58 |

|

18 |

|

59 |

|

18 |

|

60 |

|

18 |

|

61 |

|

19 |

|

62 |

|

19 |

|

63 |

|

19 |

|

64 |

|

20 |

|

65 |

|

20 |

|

66 |

|

20 |

|

67 |

|

21 |

|

68 |

|

21 |

|

69 |

|

21 |

|

70 |

|

21 |

|

71 |

|

22 |

|

72 |

|

22 |

|

73 |

|

22 |

|

74 |

|

23 |

|

75 |

|

23 |

|

76 |

|

23 |

|

77 |

|

24 |

|

78 |

|

24 |

|

79 |

|

24 |

|

80 |

|

24 |

|

81 |

|

25 |

|

82 |

|

25 |

|

83 |

|

25 |

|

84 |

|

26 |

|

85 |

|

26 |

|

86 |

|

26 |

|

87 |

|

27 |

|

88 |

|

27 |

|

89 |

|

27 |

|

90 |

|

27 |

|

91 |

|

28 |

|

92 |

|

28 |

|

93 |

|

28 |

|

94 |

|

29 |

|

95 |

|

29 |

|

96 |

|

29 |

|

97 |

|

30 |

|

98 |

|

30 |

|

99 |

|

30 |

|

100 |

|

30 |

22

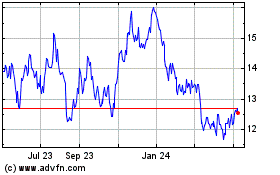

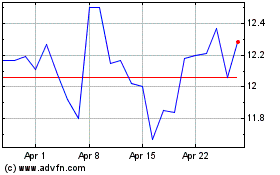

Vale (NYSE:VALE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Vale (NYSE:VALE)

Historical Stock Chart

From Sep 2023 to Sep 2024