US SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

[ ] Registration Statement Pursuant to Section 12 of the Securities Exchange Act of 1934

or

[x] Annual Report Pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2014

Commission file number 0-24762

FirstService Corporation

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English (if applicable))

Ontario, Canada

(Province or other jurisdiction of incorporation or organization)

6500

(Primary Standard Industrial Classification Code Number (if applicable))

N/A

(I.R.S. Employer Identification Number (if applicable))

1140 Bay Street, Suite 4000

Toronto, Ontario, Canada M5S 2B4

416-960-9500

(Address and telephone number of Registrant’s principal executive offices)

Mr. Santino Ferrante, Ferrante & Associates

126 Prospect Street, Cambridge, MA 02139

617-868-5000

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Subordinate Voting Shares

|

NASDAQ Stock Market

Toronto Stock Exchange

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

[x] Annual information form [x] Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

34,481,261 Subordinate Voting Shares and 1,325,694 Multiple Voting Shares

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

[x] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

[x] Yes [ ] No

PRINCIPAL DOCUMENTS

The following documents have been filed as part of this Annual Report on Form 40-F:

A. Annual Information Form

For the Registrant’s Annual Information Form for the year ended December 31, 2014, see Exhibit 1 of this Annual Report on Form 40-F.

B. Audited Annual Financial Statements

For the Registrant’s audited consolidated financial statements as at December 31, 2014 and 2013 and for the years ended December 31, 2014, 2013 and 2012, see Exhibit 2 of this Annual Report on Form 40-F.

C. Management’s Discussion and Analysis

For the Registrant’s management’s discussion and analysis for the year ended December 31, 2014, see Exhibit 3 of this Annual Report on Form 40-F.

DISCLOSURE CONTROLS AND PROCEDURES

The Registrant’s Chief Executive Officer and Chief Financial Officer have evaluated the effectiveness of the Registrant’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this annual report (the “Evaluation Date”). Based on that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that, as of the Evaluation Date, the Registrant’s disclosure controls and procedures were effective to ensure that information required to be disclosed by the Registrant in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission (the “SEC”) and (ii) accumulated and communicated to the Registrant’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Registrant. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of its effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management has excluded seventeen individually insignificant entities acquired by the Registrant during the last fiscal period from its assessment of internal control over financial reporting as at December 31, 2014. The total assets and total revenues of the seventeen majority-owned entities represent 4.2% and 3.6%, respectively, of the related consolidated financial statement amounts as at and for the year ended December 31, 2014.

Management has assessed the effectiveness of the Registrant’s internal control over financial reporting as at December 31, 2014, based on the criteria set forth in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management has concluded that, as at December 31, 2014, the Registrant’s internal control over financial reporting was effective.

The effectiveness of the Registrant’s internal control over financial reporting as at December 31, 2014 has been audited by PricewaterhouseCoopers LLP, the Registrant’s independent registered public accounting firm, as stated in their report filed in Exhibit 2 of this Annual Report on Form 40-F.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

During the year ended December 31, 2014, there were no changes in the Registrant’s internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Registrant sent during the year ended December 31, 2014 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE FINANCIAL EXPERT

The Registrant’s board of directors (the “Board of Directors”) has determined that it has at least one audit committee financial expert (as such term is defined in item 8(a) of General Instruction B to Form 40-F) serving on its audit committee (the “Audit Committee”). Mr. Peter F. Cohen has been determined by the Board of Directors to be such audit committee financial expert and is independent (as such term is defined by the NASDAQ Stock Market’s corporate governance standards applicable to the Registrant).

Mr. Cohen is a Chartered Professional Accountant and a former partner in an audit practice of a public accounting firm. Mr. Cohen is currently the Chair of the Board of the Registrant and President and Chief Executive Officer of the Dawsco Group, a private real estate and investment company owned by Mr. Cohen and his family. Mr. Cohen was a co-founder and Chair and Chief Executive Officer of Centrefund Realty Corporation, a publicly traded shopping center investment company until August 2000 when control of the company was sold. Mr. Cohen is a member of the boards of a number of private companies and charities.

The SEC has indicated that the designation of Mr. Peter F. Cohen as an audit committee financial expert does not make him an “expert” for any purpose, impose on him any duties, obligations or liability that are greater than the duties, obligations or liability imposed on him as a member of the Audit Committee and the Board of Directors in absence of such designation, or affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

CODE OF ETHICS

The Registrant has adopted a Code of Ethics and Conduct that applies to all directors, officers and employees of the Registrant and its subsidiaries, and a Financial Management Code of Ethics, which applies to senior management and senior financial and accounting personnel of the Registrant and its subsidiaries. A copy of the Code of Ethics and Conduct and the Financial Management Code of Ethics can be obtained, free of charge, on the Registrant’s website (www.firstservice.com) or by contacting the Registrant at (416) 960-9500.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table sets out the fees billed to the Registrant by PricewaterhouseCoopers LLP for professional services rendered in each of the fiscal periods ended December 31, 2014 and 2013. During these periods, PricewaterhouseCoopers LLP was the Registrant’s only external auditor.

|

(in thousands of C$)

|

|

Year ended

December 31, 2014

|

|

|

Year ended

December 31, 2013

|

|

|

Audit fees (note 1)

|

|

$ |

2,460 |

|

|

$ |

2,254 |

|

|

Audit-related fees (note 2)

|

|

|

21 |

|

|

|

55 |

|

|

Tax fees (note 3)

|

|

|

512 |

|

|

|

371 |

|

|

All other fees (note 4)

|

|

|

10 |

|

|

|

4 |

|

| |

|

$ |

3,003 |

|

|

$ |

2,684 |

|

Notes:

|

1.

|

Refers to the aggregate fees billed by the Registrant's external auditor for audit services relating to the audit of the Registrant and statutory audits required by subsidiaries.

|

|

2.

|

Refers to the aggregate fees billed for assurance and related services by the Registrant's external auditor that are reasonably related to the performance of the audit or review of the Registrant's financial statements and are not reported under (1) above, including professional services rendered by the Registrant's external auditor for accounting consultations on proposed transactions and consultations related to accounting and reporting standards. Such fees included amounts incurred in respect of: due diligence and other work related to the disposition and acquisition of businesses, such work being unrelated to the audit of the Registrant's financial statements; accounting consultations with respect to proposed transactions, as well as other audit-related services.

|

|

3.

|

Refers to the aggregate fees billed for professional services rendered by the Registrant's external auditor for tax compliance, tax advice and tax planning.

|

|

4.

|

Refers to fees for licensing and subscriptions to accounting and tax research tools.

|

The Registrant’s Audit Committee pre-approves all audit services and permitted non-audit services provided to the Registrant by PricewaterhouseCoopers LLP. The Audit Committee has delegated to the Chair of the Audit Committee, who is independent, the authority to act on behalf of the Audit Committee with respect to the pre-approval of all audit and permitted non-audit services provided by its external auditors from time to time. Any approvals by the Chair are reported to the full Audit Committee at its next meeting. All of the services described in footnotes 2, 3 and 4 under “Principal Accountant Fees and Services” above were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future material effect on the Registrant’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The information provided in the table entitled “Contractual Obligations” under the section entitled “Liquidity and Capital Resources” in the management’s discussion and analysis included as Exhibit 3 to this Annual Report on Form 40-F, is incorporated herein by reference.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Registrant has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee are Messrs. Bernard I. Ghert (Chair), Peter F. Cohen, Michael Stein, and John (Jack) P. Curtin, Jr.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the staff of the SEC, and to furnish promptly, when requested to do so by the SEC staff, information relating to the securities in relation to which the obligation to file an Annual Report on Form 40-F arises or transactions in said securities.

B. Consent to Service of Process

The Registrant has previously filed with the SEC an Appointment of Agent for Service of Process and Undertaking on Form F-X in connection with its Subordinate Voting Shares.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| |

FIRSTSERVICE CORPORATION

|

| |

|

| |

|

|

Date: February 24, 2015

|

By: /s/ John B. Friedrichsen

|

| |

Name: John B. Friedrichsen

|

| |

Title: Senior Vice President and

|

| |

Chief Financial Officer

|

EXHIBIT INDEX

|

1.

|

Annual Information Form of the Registrant for the year ended December 31, 2014.

|

|

2.

|

Audited consolidated financial statements of the Registrant as at December 31, 2014 and 2013 and for years ended December 31, 2014, 2013 and 2012, in accordance with generally accepted accounting principles in the United States.

|

|

3.

|

Management’s discussion and analysis of the Registrant for the year ended December 31, 2014.

|

|

23.

|

Consent of PricewaterhouseCoopers LLP.

|

|

31.

|

Certifications of Chief Executive Officer and Chief Financial Officer pursuant to Rule 13(a)-14(a) or 15(d)-14 of the Securities Exchange Act of 1934.

|

|

32.

|

Certifications of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

101.

|

Interactive Data File.

|

FIRSTSERVICE CORPORATION

ANNUAL INFORMATION FORM

For the year ended December 31, 2014

February 24, 2015

TABLE OF CONTENTS

|

Forward-looking statements

|

3

|

|

Corporate structure

|

4

|

|

General development of the business

|

4

|

|

Business description

|

6

|

|

Seasonality

|

25

|

|

Trademarks

|

26

|

|

Employees

|

26

|

|

Non-controlling interests

|

26

|

|

Dividends and dividend policy

|

26

|

|

Capital structure

|

27

|

|

Market for securities

|

28

|

|

Transfer agents and registrars

|

28

|

|

Directors and officers

|

28

|

|

Legal proceedings and regulatory actions

|

30

|

|

Properties

|

30

|

|

Reconciliation of non-GAAP financial measures

|

30

|

|

Risk factors

|

32

|

|

Interest of management and others in material transactions

|

35

|

|

Material contracts

|

35

|

|

Cease trade orders, bankruptcies, penalties or sanctions

|

36

|

|

Conflicts of interest

|

37

|

|

Experts

|

37

|

|

Audit Committee

|

37

|

|

Additional information

|

39

|

|

Exhibit "A" – Audit Committee Mandate

|

Forward-looking statements

This Annual Information Form contains, and incorporates by reference, "forward looking statements" which reflect the current expectations, estimates, forecasts and projections of management regarding our future growth, results of operations, performance and business prospects and opportunities. Wherever possible, words such as "may," "would," "could," "will," "anticipate," "believe," "plan," "expect," "intend," "estimate," "aim," "endeavour" and similar expressions have been used to identify these forward-looking statements. The forward-looking statements contained, or incorporated by reference, in this Annual Information Form, in part, relate, but are not limited, to the approvals for, the completion and proposed terms of, and matters relating to, the Arrangement (as defined below) and the expected timing related thereto; the expected benefits of the Arrangement to shareholders and FirstService and the anticipated effect of the completion of the Arrangement on FirstService, and the new separately companies, Colliers International and new FirstService Corporation, and their respective future operations; certain tax consequences resulting from the completion of the Arrangement; and expectations with respect to future general economic and market conditions. These statements reflect management's current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, without limitation, those listed in the "Risk Factors" section of this Annual Information Form as well as risks associated with our ability to obtain any necessary approvals, waivers, consents, court orders, tax rulings and other requirements necessary or desirable to permit or facilitate the proposed Arrangement transaction (including regulatory, board and shareholder approvals). Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this Annual Information Form. These factors should be considered carefully and prospective investors should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this Annual Information Form are based upon what management currently believes to be reasonable assumptions, we cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this Annual Information Form and we do not intend, and do not assume any obligation, to update or revise these forward-looking statements.

FIRSTSERVICE CORPORATION

ANNUAL INFORMATION FORM

February 24, 2015

All amounts referred to in this Annual Information Form ("AIF") are in United States dollars unless otherwise indicated. All financial and statistical data in this AIF is presented as at December 31, 2014 unless otherwise indicated.

Corporate structure

FirstService Corporation ("we," "us," "our," the "Company" or "FirstService") was formed under the Business Corporations Act (Ontario) by Certificate of Incorporation dated February 25, 1988. The Company amalgamated with Coloma Resources Limited pursuant to a Certificate of Amalgamation dated July 31, 1988, and the amalgamated corporation continued under the name "FirstService Corporation".

By Certificate of Amendment dated April 2, 1990, the Company: (i) consolidated each of its Class A Subordinate Voting Shares on a 30 to 1 basis and changed the designation of that class of shares to "Subordinate Voting Shares", each such share carrying one vote; and (ii) consolidated each of its Class B shares on a 30 to 1 basis and changed the designation of that class of shares to "Multiple Voting Shares", each such share carrying 20 votes.

By Certificate of Amendment dated June 27, 2007, the first series of Preference Shares of the Company were created and designated as 7% cumulative preference shares, series 1 (the "Preferred Shares"), with each Preferred Share having a stated value of US$25.00 and carrying a fixed cumulative annual dividend of US$1.75 payable quarterly. All outstanding Preferred Shares were eliminated on May 3, 2013 by way of a partial redemption for cash of $39.2 million immediately followed by a mandatory conversion of all then remaining Preferred Shares into Subordinate Voting Shares, which resulted in the issuance of 2.89 million new Subordinate Voting Shares.

Our Subordinate Voting Shares are publicly traded on both the Toronto Stock Exchange ("TSX") (symbol: FSV) and The NASDAQ Stock Market ("NASDAQ") (symbol: FSRV). Our head and registered office is located at 1140 Bay Street, Suite 4000, Toronto, Ontario, M5S 2B4.

Our fiscal year-end is December 31. On May 14, 2008, our Board of Directors approved a change in year-end to December 31, effective December 31, 2008. Our previous fiscal year-end was March 31.

The following chart sets out the significant subsidiaries of the Company as of December 31, 2014. The voting securities of such subsidiaries not controlled by us are those owned by operating management of each respective subsidiary.

|

Name of subsidiary

|

Percentage of voting securities owned by FirstService

|

Jurisdiction of incorporation or formation

|

|

American Pool Enterprises, Inc.

|

96.4%

|

Delaware

|

|

Colliers Macaulay Nicolls Inc.

|

91.2%

|

Ontario

|

|

FirstService Commercial Real Estate Services Inc.

|

91.2%

|

Ontario

|

|

FirstService International Holdings s.a.r.l.

|

100.0%

|

Luxembourg

|

|

FirstService RE Holdings (USA), Inc.

|

99.0%

|

Delaware

|

|

FirstService Residential, Inc.

|

97.6%

|

Delaware

|

|

FirstService Residential Florida, Inc.

|

97.6%

|

Florida

|

|

FirstService Residential Management Canada Inc.

|

100.0%

|

Ontario

|

|

FirstService (USA), Inc.

|

100.0%

|

Delaware

|

|

FS Brands, Inc.

|

95.7%

|

Delaware

|

General development of the business

Our origins date back to 1972 when Jay S. Hennick, the Founder and CEO of the Company, started a Toronto commercial swimming pool and recreational facility management business, which became the foundation of FirstService. In 1993, we completed our initial public offering on the TSX, raising C$20 million. In 1995, our shares were listed on NASDAQ. In 1997, a second stock offering was completed in Canada and the United States raising US$20 million. In December 2004, a stock dividend was declared effectively achieving a 2-for-1 stock split for all outstanding Subordinate Voting Shares and Multiple Voting Shares (together, the "Common Shares").

From 1994 to present, we completed numerous acquisitions and selected divestitures, developing, growing and focusing on the real estate services provided by us today.

In 1996, we obtained a revolving credit facility from a syndicate of banks, which has been amended and/or restated at various times to the present, most recently on May 22, 2014 when the facility was increased to $500 million with a five year term ending March 1, 2017. In October 2003, we completed a private placement of $50 million of 6.40% Senior Notes due September 30, 2015, of which $12.5 million remained outstanding as of December 31, 2014. In April 2005, we completed a private placement of $100 million of 5.44% Senior Notes due April 1, 2015, of which $20 million remained outstanding as of December 31, 2014. In January 2013, we completed a private placement of $150 million of 3.84% Senior Notes due January 16, 2025, all of which remained outstanding as of December 31, 2014.

In 2004, we established a new commercial real estate services division under the "Colliers International" brand with the acquisition of Colliers Macaulay Nicolls Inc. ("CMN"). CMN's real estate services offerings included brokerage (sale and leasing), property management, valuation and advisory services.

In 2006, we disposed of Resolve Corporation, our Business Services division, through an initial public offering of trust units in Canada of a related income trust. In 2008, we disposed of our Integrated Security Services division, which included Intercon Security in Canada and SST in the United States, for gross cash proceeds of approximately $187.5 million. These disposals marked a significant milestone in the execution of our strategy of focusing on real estate services for future growth.

In November 2009, we completed a public offering in Canada of $77 million principal amount of 6.5% Convertible Unsecured Subordinated Debentures (the "Convertible Debentures"). The Convertible Debentures were convertible into Subordinated Voting Shares at the option of the holder at any time prior to the earlier of December 31, 2014 or the date specified by us for redemption, at a conversion price of $28.00 per Subordinate Voting Share, subject to adjustment in certain events. In September 2013, we completed the early redemption of our Convertible Debentures in accordance with the redemption rights attached to the Convertible Debentures. Leading up to the redemption, we received conversion requests from substantially all holders of the Convertible Debentures, which resulted in the issuance of 2.74 million new Subordinate Voting Shares.

In September 2013, we completed the sale of Field Asset Services, LLC, a property preservation and distressed asset management services provider within our Property Services segment, for gross cash proceeds of $55 million.

In 2013 and 2014, we completed several acquisitions in our Commercial Real Estate Services division that significantly increased our presence in Europe. In 2013, we acquired controlling interests in the businesses that previously operated as Colliers International in Germany. In October 2014, we acquired a controlling interest in AOS Group, a real estate and workplace consulting firm with operations in France, Belgium and several other countries; these operations were immediately rebranded as Colliers International. We also acquired two firms in operating in London, England, increasing our office and retail leasing capabilities in that market.

Plan to separate into two independent public companies

On February 10, 2015, we announced that our Board of Directors had approved, in principle, a plan to separate FirstService into two independent publicly traded companies – "Colliers International", one of the top three global leaders in commercial real estate services and new "FirstService Corporation", the North American leader in residential property management and services. After the separation, FirstService Corporation will be comprised of the Residential Real Estate Services and Property Services segments. The proposed spin-off will be implemented through a court-approved Plan of Arrangement (the "Arrangement") and is subject to final approval from our Board of Directors. The Arrangement will also be subject to regulatory, court and shareholder approvals. Our press release issued on February 10, 2015 with respect to the Arrangement, which is incorporated herein by reference and is available under the Company's profile on SEDAR at www.sedar.com, sets out further details on the Arrangement.

Business description

FirstService is a global leader in the rapidly growing real estate services sector. As one of the largest property managers in the world, FirstService manages more than 2.5 billion square feet of residential and commercial properties through its industry-leading service platforms in Commercial Real Estate Services, delivered through Colliers International, one of the top global players in commercial real estate services; Residential Real Estate Services, delivered through FirstService Residential, the largest provider of residential property management services in North America, and Property Services, delivered through FirstService Brands, a leading provider of essential property services through franchise systems and company-owned operations.

Each service line provides near-essential services, generates a significant percentage of recurring revenues, has substantial operating cash flow, generates superior returns on invested capital and can be leveraged through margin enhancement, cross-selling or consolidation.

Our business is conducted through three operating segments as shown below:

|

Revenues

by operating segment

|

|

Year ended December 31

|

|

|

(in thousands of US$)

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

Commercial Real Estate Services

|

|

$ |

1,582,039 |

|

|

$ |

1,306,334 |

|

|

$ |

1,158,948 |

|

|

$ |

984,019 |

|

|

$ |

851,079 |

|

|

Residential Real Estate Services

|

|

|

919,545 |

|

|

|

844,952 |

|

|

|

768,994 |

|

|

|

691,343 |

|

|

|

598,131 |

|

|

Property Services

|

|

|

212,457 |

|

|

|

193,135 |

|

|

|

170,827 |

|

|

|

165,856 |

|

|

|

157,072 |

|

|

Corporate

|

|

|

232 |

|

|

|

204 |

|

|

|

218 |

|

|

|

188 |

|

|

|

180 |

|

|

Total

|

|

$ |

2,714,273 |

|

|

$ |

2,344,625 |

|

|

$ |

2,098,987 |

|

|

$ |

1,841,406 |

|

|

$ |

1,606,462 |

|

|

Adjusted EBITDA1

by operating segment

|

|

Year ended December 31

|

|

|

(in thousands of US$)

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

Commercial Real Estate Services

|

|

$ |

157,406 |

|

|

$ |

114,435 |

|

|

$ |

77,733 |

|

|

$ |

51,023 |

|

|

$ |

38,712 |

|

|

Residential Real Estate Services

|

|

|

45,611 |

|

|

|

53,235 |

|

|

|

56,214 |

|

|

|

53,974 |

|

|

|

52,586 |

|

|

Property Services

|

|

|

37,759 |

|

|

|

33,521 |

|

|

|

28,717 |

|

|

|

23,805 |

|

|

|

20,382 |

|

|

Corporate

|

|

|

(19,031 |

) |

|

|

(17,298 |

) |

|

|

(11,617 |

) |

|

|

(14,362 |

) |

|

|

(19,511 |

) |

|

Total

|

|

$ |

221,745 |

|

|

$ |

183,893 |

|

|

$ |

151,047 |

|

|

$ |

114,440 |

|

|

$ |

92,169 |

|

__________________________

1Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. For a reconciliation of this and other non-GAAP financial measures, see "Reconciliation of non-GAAP financial measures" in this AIF.

Commercial Real Estate Services

FirstService, operating under the Colliers International brand name, is one of the world's largest commercial real estate services providers offering a full range of commercial real estate services in the United States, Canada, Australia, the United Kingdom, Germany, France and several other countries in Asia, Europe and Latin America. In 2014, operations in the Americas generated 52% of total revenues for this segment, while the Asia-Pacific region generated 26% and Europe generated 22%. We provide services to owners, investors and tenants, including brokerage (sale, leasing, and mortgage), property management and maintenance, valuation, project management and corporate advisory services.

Commercial real estate brokers match buyers and sellers of real estate (investors, developers or owners-users) as well as owners and tenants of space for lease in return for a commission generally based on the value of the transaction. Our brokerage activities focus primarily on office, industrial, retail and multi-unit residential properties. Investment sale brokerage, leasing brokerage, and mortgage brokerage activities represent approximately 32%, 33%, and 1% of segment revenues, respectively, and provide opportunities for cross selling other real estate services. In 2014, through a network of approximately 3,100 brokers in 219 offices in 41 countries, we executed transactions across a diverse client base, including corporations, financial institutions, governments and individuals. Typically, brokers earn a direct commission on individual transactions, which provides variability in the cost structure.

Commercial property management and maintenance focus on the same client segments as brokerage; however, fees are typically multi-year fixed fee contracts that are largely recurring in nature.

Our international corporate advisory services group partners with large corporations in managing their overall real estate portfolio and transactions. Professional staff combines proprietary technology with high level strategic planning, portfolio management, lease administration and facilities and project management. Fees in corporate advisory services are derived from a combination of fixed fee services and transaction-based brokerage fees.

Commercial real estate brokerage is cyclical and seasonal in nature, affected by external factors, including interest rates, access to financing, investor and consumer confidence and other macroeconomic factors and political risk in any specific region. Our revenues in this segment are weighted more heavily to the latter half of the calendar year, with approximately 60% of transactions occurring in fiscal quarters ending in September and December.

We are the largest member and controlling shareholder of Colliers International Property Consultants ("CIPC"), the owner of the global "Colliers International" commercial real estate services brand and trademarks. Each member of CIPC is entitled to use the "Colliers International" brand and trademarks exclusively within a designated country (or region in the case of the United States). Colliers International is recognized (in The Lipsey Company's 2014 Top 25 Commercial Real Estate Brands Survey for service firms) as the number 2 most recognized commercial real estate services brand worldwide with 502 offices in 67 countries. Colliers International is a global brand name supported by local market intelligence to serve the international community of investors, owners and users of real estate. In addition to the Colliers International brand, we also own and operate the MHPM Project Leaders brand.

Commercial real estate firms can be segmented into two tiers: (i) large global full-service firms with international service capabilities; and (ii) regional and niche firms with strengths in their respective local markets. Recent industry trends have seen an increase in outsourcing by multi-national clients with global needs creating an opportunity for full-service global players like Colliers International, and by extension, FirstService. There has also been a recent trend amongst larger firms to further improve their market position through consolidation. However, the commercial real estate competitive landscape market remains highly fragmented.

Our growth strategy in this segment is to expand the suite of complementary service offerings and the geographical markets where services are offered. This will continue to be achieved both organically and through selective acquisitions. We also plan to enhance our brand and service delivery through increased recruiting of real estate professionals, broker training and continued development of proprietary market tools and research resources.

Residential Real Estate Services

We are a manager of private residential communities in North America. Private residential communities include condominiums, cooperatives, homeowner associations, master-planned communities and a variety of other residential developments governed by common interest or multi-unit residential community associations (collectively referred to as "community associations"). Residents of community associations appoint or elect volunteer homeowner board members to oversee the operations of the community associations. The board may choose to hire a professional property manager like FirstService. In total, we manage over 1.6 million residential units in more than 7,000 community associations in 22 American states and 3 Canadian provinces.

We operate under the brand name FirstService Residential. In June 2013, we re-branded and replaced 18 legacy regional brands with one brand to create a unified North American market presence to allow a simplified and consistent sales strategy, as well as to streamline certain operations. Approximately 92% of revenues are generated from U.S. operations, and 8% from Canadian operations.

In the Residential Real Estate Services industry, there are two types of professional property management companies: (i) traditional property managers; and (ii) full-service property managers. Traditional property managers primarily handle administrative property management functions on behalf of their community association clients, such as advising homeowner boards on matters relating to the operation of their communities, collecting monthly maintenance fees, sourcing and paying suppliers, preparing financial statements and contracting out support services. Full-service property managers provide the same services as traditional property managers but also provide a variety of other services under one comprehensive contract.

We are a full-service property manager and in many markets provide a full range of ancillary services, including facility maintenance, janitorial, front-desk, swimming pool management, heating and air conditioning, energy advisory, commercial association management, concierge services, resale processing, sales, leasing, landscaping and pest control. In most markets we provide financial services (cash management and other transaction-related services, collections, specialized property insurance brokerage and energy retrofit financing) utilizing the scale of our operations to economically benefit clients. Ancillary services are provided under the following brands: American Pool Enterprises, Planned Companies, FirstService Financial, MarWest Commercial, FS Energy, and Superior Pool.

Residential property management and recurring ancillary services are generally provided under contract, with a fixed monthly fee. Contracts range in duration from 1 to 3 years, but are generally cancellable by either party with 30 to 90 days’ notice.

The aggregate budget of all the community associations in the United States is estimated by the Community Associations Institute (“CAI”) (a national U.S. organization dedicated to fostering community associations) to be approximately US$51 billion. The aggregate budget of the community associations managed by FirstService is estimated at approximately US$6.5 billion. Currently, we estimate that we access in the range of 12-15% of the aggregate budget of our communities through the various services that we offer. Our strategy is to continue to add communities under management while striving to earn a greater percentage of the aggregate budget by introducing additional value-added services and products, thereby offering clients a single point of accountability and leveraging our scale and purchasing power to the benefit of the community associations we serve.

Based on 2013 U.S. industry data compiled by the CAI in 2014, we estimate that: (i) approximately 65.7 million Americans, representing 26.3 million households, live in condominiums, cooperatives, planned communities and other residential developments governed by common interest or multiple unit residential community associations; this represents 24% of U.S. homes (ii) more than 50% of new homes currently being built in and around major metropolitan areas in the United States are within these categories; and (iii) there are approximately 328,500 community associations in the United States. The market is currently growing at a rate of approximately 2% per year as a result of the 4,000 to 8,000 new community associations formed each year. Similar growth rates are expected in Canada.

Typically, owners of private residential units are required to pay monthly or quarterly fees to cover the expenses of managing the community association's business activities and maintaining the common areas of the property. Historically, decision making for communities was delegated to volunteer boards of directors elected by the owners. Increasingly, these volunteer boards have outsourced the responsibility to manage the day-to-day operation and maintenance of community property to professional property management companies. The CAI estimates that 30-40% of community associations are self-managed by homeowner boards. There is a growing trend from self-management to professional management, which is believed to increase the effective growth rate for professional property management companies.

The residential property management industry is extremely fragmented and dominated by numerous local and regional management companies of which there are estimated to be 8,000 across North America. Only a small number of such companies, however, have the expertise and capital to provide both traditional property management services as well as the other support services provided by full-service property managers. We estimate our market share at 5% (based on the number of units we manage in the U.S. relative to the CAI’s data for the number of households governed by community associations in the U.S.). We currently operate in major markets that constitute over 70% of the total North American market. We enjoy a competitive advantage because of our size and geographic footprint, depth of management and financial resources, and operating expertise.

Our business in this segment is subject to regulation by the U.S. states and Canadian provinces in which we operate. In many regions, laws require that property managers must be licensed, which involves certain examinations and continuing education. In addition, our residential real estate sales and leasing operations are subject to regulation as a real estate brokerage by the various states and provinces in which we operate.

Property Services

In our Property Services division, we provide a variety of residential and commercial services in North America through franchise networks and company-owned locations. The principal brands in this division include Paul Davis Restoration, CertaPro Painters, California Closets, College Pro Painters, Pillar to Post Home Inspectors, Floorcoverings International and Service America.

Franchise brands

We own and operate six franchise networks as follows:

|

(i)

|

Paul Davis Restoration is a Jacksonville, Florida based franchisor of residential and commercial restoration services serving the insurance industry in the United States through 367 franchises. Paul Davis provides full service water, fire and mold cleanup and restoration services for property damaged by natural or man-made disasters. Royalties are earned from franchisees based on a percentage of franchisee gross revenues.

|

|

(ii)

|

CertaPro Painters is a residential and commercial painting franchise system with 350 franchises operating in major markets across the United States and Canada as well as master franchises in other countries around the world. CertaPro Painters focuses on high-end residential and commercial painting and decorating work and other programs for property managers who have portfolios of condominium and commercial properties. Royalties are earned based on a percentage of franchisee gross revenues or a fixed monthly fee, plus administrative fees for various ancillary services.

|

|

(iii)

|

California Closets is a provider of installed closet and home storage solutions. Headquartered in San Francisco, California Closets has 86 franchises in the United States and Canada as well as master franchises in other countries around the world. There are currently 105 branded California Closets retail showrooms in operation in North America which are used by franchisees to demonstrate and sell the product. Royalties are earned based on a percentage of franchisee gross revenues.

|

|

(iv)

|

College Pro Painters is a seasonal exterior residential painting and window cleaning franchise system operating in most U.S. states and across Canada with 593 franchises. It recruits students and trains them to operate the business, including price estimating, marketing, operating procedures, hiring, customer service and safety. Royalties are earned based on a percentage of franchisee gross revenues. College Pro Painters’ operations are seasonal with revenue and earnings generated in the June and September quarters followed by losses in the December and March quarters.

|

|

(v)

|

Pillar to Post Home Inspectors is one of North America's largest home inspection service providers. Services are provided through a network of 415 franchises. Royalties are earned on a percentage of franchisee gross revenues.

|

|

(vi)

|

Floorcoverings International is a residential and commercial floor coverings design and installation franchise system operating in North America with 102 franchises. Royalties are earned based on a percentage of franchisee gross revenues.

|

The aggregate system-wide revenues of our 1,913 franchisees were $1.3 billion for 2014. Franchise agreements are for terms of five or ten years, with the exception of College Pro Painters where the agreements are for a term of one year. Royalties are reported and paid to us monthly in arrears. All franchise agreements contain renewal provisions that can be invoked by FirstService at little or no cost.

The franchised services industry is highly fragmented, consisting principally of a large number of smaller, single-service or single-concept companies. Due to the large size of the overall market for these services, dominant market share is not considered necessary for becoming a major player in the industry. However, because of the low barriers to entry in this segment, we believe that brand name recognition among consumers is a critical factor in achieving long-term success in the businesses we operate.

Franchise businesses are subject to U.S. Federal Trade Commission regulations and state and provincial laws that regulate the offering and sale of franchises. Presently, the Company is authorized to sell franchises in 40 states, in all Canadian provinces and in several other countries around the world. In all jurisdictions, we endeavor to have our franchises meet or exceed regulatory standards.

Company-owned operations

We own and operate 10 California Closets retail operations located in major population centers in the United States and Canada. These operations were acquired from franchisees with the goal of accelerating revenue growth, in part through investment in branded retail showrooms. We also own and operate Service America, a Florida-based provider of heating, ventilation and air conditioning services and related service contracts to residential and commercial customers.

Seasonality

Certain segments of the Company's operations are subject to seasonal variations. This seasonality results in variations in quarterly revenues and operating margins. In particular, the Commercial Real Estate Services operation generates peak revenues and earnings in the month of December followed by a low in January and February as a result of the timing of closings on commercial real estate brokerage transactions. Revenues and earnings during the balance of the year are relatively even. These brokerage operations comprised approximately 35% of 2014 consolidated revenues. Variations can also be caused by acquisitions or dispositions, which alter the consolidated service mix.

Trademarks

Our trademarks are important for the advertising and brand awareness of all of our businesses and franchises. We take precautions to defend the value of our trademarks by maintaining legal registrations and by litigating against alleged infringements, if necessary.

In our Commercial Real Estate Services division, the Colliers International trademark is recorded as an acquired intangible asset in our consolidated financial statements. The Colliers International trademark is highly recognized in the commercial real estate industry.

Our Residential Real Estate Services operations adopted the FirstService Residential trademark in June 2013, replacing 18 legacy regional brands. The adoption of common branding was designed to create a unified North American market presence signifying our market leadership, to showcase our commitment to service excellence and to leverage our strengths to the benefit of current and future clients. No value has been ascribed to the FirstService Residential trademark in our consolidated financial statements. The legacy regional brands were subject to accelerated amortization totaling $11.2 million in 2013, resulting in a carrying value of nil as of December 31, 2013.

In our Property Services unit, three franchise systems – California Closets, Paul Davis Restoration, and Pillar to Post Home Inspectors – have trademarks to which value has been ascribed in our consolidated financial statements. The value of these trademarks is derived from the recognition they enjoy among the target audiences for the respective property services. These trademarks have been in existence for many years, and their prominence among consumers has grown over time through the addition of franchisees and the ongoing marketing programs conducted by both franchisees and the Company.

Employees

We have approximately 24,000 employees.

Non-controlling interests

We own a majority interest in substantially all of our operations, while operating management of each subsidiary owns the remaining shares. This structure was designed to maintain control at FirstService while providing significant risks and rewards of equity ownership to management at the operating businesses. In almost all cases, we have the right to "call" management's shares, usually payable at our option with any combination of Subordinate Voting Shares or cash. We may also be obligated to acquire certain of these non-controlling interests in the event of death, disability or cessation of employment or if the shares are "put" by the holder, subject to annual limitations on these puts imposed by the relevant shareholder agreements. These arrangements provide significant flexibility to us in connection with management succession planning and shareholder liquidity matters.

Dividends and dividend policy

Dividend policy

Our Board of Directors adopted a new dividend policy, effective on May 3, 2013, pursuant to which we make quarterly cash dividends to holders of Common Shares of record at the close of business on the last business day of each calendar quarter. The quarterly dividend was initially set at US$0.10 per Common Share (a rate of US$0.40 per annum). Each quarterly dividend is paid within 30 days after the record date.

We commenced paying the quarterly Common Share dividend under the new dividend policy effective for the quarter ended June 30, 2013. For the purposes of the Income Tax Act (Canada) and any similar provincial legislation, all dividends on the Common Shares will be eligible dividends unless indicated otherwise.

Our outstanding Preferred Shares were eliminated effective May 3, 2013. The final quarterly Preferred Share dividend of US$0.4375 was paid on March 31, 2013.

The terms of the Common Share dividend policy remain, among other things, at the discretion of our Board of Directors. Future dividends on the Common Shares, if any, will depend on the results of FirstService's operations, cash requirements, financial condition, contractual restrictions, business opportunities, provisions of applicable law and other relevant factors. Under the terms of the Company's amended and restated credit facility, the Company is not permitted to pay dividends, whether in cash or in specie, in the circumstances of an event of default thereunder occurring and continuing or an event of default occurring as a consequence thereof. See "Material contracts" below.

Dividend history

The aggregate cash dividends declared per Common Share in respect of the years ended December 31, 2014, 2013 and 2012 were US$0.40, US$0.30 and nil, respectively.

The aggregate of the cash dividends declared per Preferred Share in respect of the years ended December 31, 2014, 2013 and 2012 were nil, US$0.4375 and US$1.75, respectively.

Capital structure

Share capital

The authorized capital of the Company consists of an unlimited number of preference shares, issuable in series, at the discretion of the Board of Directors of the Company, of which are authorized 2,500 Series 1 preference shares and an unlimited number of Preferred Shares, an unlimited number of Subordinate Voting Shares and an unlimited number of convertible Multiple Voting Shares. As of February 24, 2015, there were 34,603,011 Subordinate Voting Shares and 1,325,694 Multiple Voting Shares issued and outstanding.

The holders of Subordinate Voting Shares are entitled to one (1) vote in respect of each Subordinate Voting Share held at all meetings of the shareholders of the Company. The holders of Multiple Voting Shares are entitled to twenty (20) votes in respect of each Multiple Voting Share held at all meetings of the shareholders of the Company. Each Multiple Voting Share is convertible into one Subordinate Voting Share at the option of the holder. Effective December 15, 2004, a stock dividend was declared, effectively achieving a 2-for-1 stock split for all outstanding Subordinate and Multiple Voting Shares.

A summary of certain rights attaching to the Subordinate Voting Shares is set out in the section entitled "Certain Rights of Holders of Subordinate Voting Shares" contained in the Company's Management Information Circular (the "2014 Circular") filed in connection with the Company's annual and special meeting of shareholders to be held on April 8, 2014, which section is incorporated herein by reference.

Market for securities

The Company's Subordinate Voting Shares are listed for trading on the TSX and NASDAQ. The Company's Multiple Voting Shares are not listed and do not trade on any public market or quotation system.

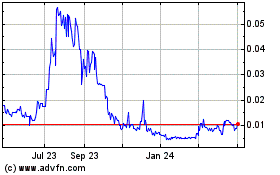

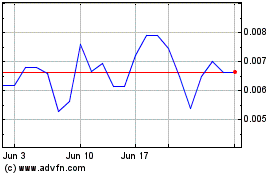

The tables below detail the price ranges and volumes traded of Subordinate Voting Shares on NASDAQ in U.S. dollars and the TSX in Canadian dollars, in each case, on a monthly basis, during the year ended December 31, 2014:

| |

NASDAQ

|

TSX

|

|

Month

|

High

Price

(US$)

|

Low

Price

(US$)

|

Volume

Traded

|

High

Price

(C$)

|

Low

Price

(C$)

|

Volume

Traded

|

|

January 2014

|

43.86

|

38.19

|

402,112

|

47.28

|

42.75

|

1,002,283

|

|

February 2014

|

45.85

|

39.70

|

427,150

|

50.76

|

43.85

|

1,219,623

|

|

March 2014

|

50.10

|

45.53

|

335,773

|

55.39

|

50.50

|

1,171,274

|

|

April 2014

|

49.97

|

46.81

|

219,156

|

54.67

|

51.49

|

911,068

|

|

May 2014

|

50.864

|

48.14

|

434,178

|

55.37

|

52.85

|

954,920

|

|

June 2014

|

53.15

|

50.17

|

299,983

|

58.00

|

53.675

|

1,014,391

|

|

July 2014

|

56.68

|

49.88

|

331,709

|

61.88

|

53.25

|

715,773

|

|

August 2014

|

55.85

|

52.93

|

233,048

|

60.74

|

57.90

|

796,219

|

|

September 2014

|

57.20

|

50.71

|

286,846

|

62.40

|

56.26

|

1,002,575

|

|

October 2014

|

56.07

|

49.99

|

460,661

|

62.99

|

56.01

|

1,432,331

|

|

November 2014

|

54.73

|

50.51

|

440,645

|

62.38

|

57.35

|

1,047,937

|

|

December 2014

|

58.06

|

49.41

|

399,583

|

65.95

|

57.59

|

1,021,064

|

Transfer agents and registrars

The transfer agent and registrar for the Subordinate Voting Shares is TMX Equity Transfer Services, 200 University Ave., Suite 300, Toronto, Ontario, M5H 4H1. The transfer agent and registrar for the Multiple Voting Shares is the Company at 1140 Bay Street, Suite 4000, Toronto, Ontario, M5S 2B4.

Directors and officers

Directors – The following are the directors of the Company as at February 24, 2015:

|

Name and province/country of residence

|

Age

|

Present position and tenure

|

Principal occupation during

last five years

|

|

David R. Beatty 2,3

Ontario, Canada

|

73

|

Director since May 15, 2001

|

Corporate Director; Chair and CEO, Beatinvest Limited (an investment company); formerly the Managing Director of the Canadian Coalition for Good Governance; Director of the Institute of Corporate Directors; Director of the Clarkson Centre for Business Ethics and Board Effectiveness and Professor of Strategic Management at The Rotman School of Management, University of Toronto

|

|

Brendan Calder 2,3

Ontario, Canada

|

68

|

Director since June 14, 1996

|

Corporate Director;

Effective Executive in Residence & Adjunct Professor of Strategic Management at the Rotman School of Management, University of Toronto; Chair of Rotman's Desautels Centre for Integrative Thinking; formerly the founding Chair of the Rotman International Centre for Pension Management

|

|

Peter F. Cohen1,3

Ontario, Canada

|

62

|

Director since March 30, 1990; Chair of the Board since May 2005

|

President, Dawsco Group

(an Ontario-based real estate and investment company)

|

|

Bernard I. Ghert1

Ontario, Canada

|

75

|

Director since June 23, 2004

|

Corporate Director;

Chairman of the Independent Review Committee of the Middlefield Group of Funds; President of the B.I. Ghert Family Foundation

|

|

Jay S. Hennick

Ontario, Canada

|

58

|

Chief Executive Officer and Director since May 30, 1988

|

Founder and Chief Executive Officer of the Company

|

|

Name and province/country of residence

|

Age

|

Present position and tenure

|

Principal occupation during

last five years

|

|

Michael D. Harris 2

Ontario, Canada

|

70

|

Director since June 26, 2006

|

Senior Business Advisor, Fasken Martineau DuMoulin LLP; Former Senior Business Advisor, Cassels Brock & Blackwell LP; Former Senior Business Advisor, Goodmans LLP; President of own consulting firm, Steane Consulting Ltd.; Corporate Director; Senior Fellow, The Fraser Institute;

Former Premier of the Province of Ontario

|

|

Michael Stein1

Ontario, Canada

|

64

|

Director since December 12, 2013

|

Chairman and Chief Executive Officer of MPI Group Inc.; Chairman and Founder of Canadian Apartment Properties Real Estate Investment Trust (CAPREIT)

|

|

Frederick F. Reichheld

Massachusetts, USA

|

63

|

Director since April 8, 2014

|

Partner, Bain & Company, Inc. (global business consulting firm); Speaker and Author; Corporate Director

|

|

John (Jack) P. Curtin, Jr.1

Ontario, Canada

|

64

|

Director since February 10, 2015

|

Advisory Director, Investment Banking Division, Goldman Sachs & Co.; prior to December 2014, Chairman & Chief Executive Officer of Goldman Sachs Canada Inc.

|

|

1.

|

Member of Audit Committee

|

|

2.

|

Member of Executive Compensation Committee

|

|

3.

|

Member of Nominating and Corporate Governance Committee

|

Each director remains in office until the following annual shareholders' meeting of the Company or until the election or appointment of his successor, unless he resigns, his office becomes vacant or he becomes disqualified to act as a director. All directors stand for election or re-election annually.

Further background information regarding the directors of the Company will be set out in the Company's Management Information Circular (the "2015 Circular") to be filed in connection with the Company's upcoming annual and special meeting of shareholders, the relevant sections of which are incorporated herein by reference.

Officers – The following are the executive officers of the Company as at February 24, 2015:

|

Name and province/country of residence

|

Age

|

Present position with the Company

|

First became

an officer

|

|

Jay S. Hennick

Ontario, Canada

|

58

|

Founder and Chief Executive Officer

|

1988

|

|

D. Scott Patterson

Ontario, Canada

|

54

|

President and Chief Operating Officer

|

1995

|

|

John B. Friedrichsen Ontario, Canada

|

53

|

Senior Vice President and Chief Financial Officer

|

1998

|

|

Elias Mulamoottil

Ontario, Canada

|

45

|

Senior Vice President, Strategy and Corporate Development

|

2007

|

|

Douglas G. Cooke Ontario, Canada

|

55

|

Vice President, Corporate Controller and Corporate Secretary

|

1995

|

|

Christian Mayer

Ontario, Canada

|

42

|

Vice President, Finance

|

2010

|

|

Neil Chander

Ontario, Canada

|

42

|

Vice President, Tax

|

2010

|

|

Jeremy Rakusin

Ontario, Canada

|

46

|

Vice President, Strategy and Corporate Development

|

2012

|

As of February 24, 2015, the directors and executive officers of the Company, as a group, owned or controlled 3,710,761 Subordinate Voting Shares, which represents 10.8% of the total Subordinate Voting Shares outstanding on such date. The directors and officers, as a group, controlled 49.6% of the total voting rights as of such date when all Multiple Voting Shares and Subordinate Voting Shares are considered. Mr. Hennick controls all of the Company's Multiple Voting Shares.

Legal proceedings and regulatory actions

In the normal course of operations, the Company is subject to routine claims and litigation incidental to its business. Litigation currently pending or threatened against the Company includes disputes with former employees and commercial liability claims related to services provided by the Company. The Company believes resolution of such proceedings, combined with amounts set aside, will not have a material impact on the Company's financial condition or the results of operations.

Properties

The following chart provides a summary of the properties occupied by the Company and its subsidiaries as at December 31, 2014:

|

(square feet)

|

|

United States (leased)

|

|

|

United States

(owned)

|

|

|

Canada

(leased)

|

|

|

Canada

(owned)

|

|

|

International

(leased)

|

|

|

International

(owned)

|

|

|

Commercial Real Estate Services

|

|

|

615,000 |

|

|

|

- |

|

|

|

301,000 |

|

|

|

- |

|

|

|

676,000 |

|

|

|

- |

|

|

Residential Real Estate Services

|

|

|

977,000 |

|

|

|

114,000 |

|

|

|

71,000 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Property Services

|

|

|

338,000 |

|

|

|

- |

|

|

|

49,000 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Corporate

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

20,000 |

|

|

|

- |

|

|

|

- |

|

Reconciliation of non-GAAP financial measures

In this AIF, we make reference to "adjusted EBITDA" and "adjusted EPS," which are financial measures that are not calculated in accordance with GAAP.

Adjusted EBITDA is defined as net earnings from continuing operations, adjusted to exclude: (i) income tax; (ii) other expense (income); (iii) interest expense; (iv) depreciation and amortization; (v) acquisition-related items; and (vi) stock-based compensation expense. The Company uses adjusted EBITDA to evaluate its own operating performance and its ability to service debt, as well as an integral part of its planning and reporting systems. Additionally, this measure is used in conjunction with discounted cash flow models to determine the Company's overall enterprise valuation and to evaluate acquisition targets. Adjusted EBITDA is presented as a supplemental measure because the Company believes such measure is useful to investors as a reasonable indicator of operating performance because of the low capital intensity of its service operations. The Company believes this measure is a financial metric used by many investors to compare companies, especially in the services industry. This measure is not a recognized measure of financial performance under GAAP in the United States, and should not be considered as a substitute for operating earnings, net earnings from continuing operations or cash flow from operating activities, as determined in accordance with GAAP. The Company's method of calculating adjusted EBITDA may differ from other issuers and accordingly, this measure may not be comparable to measures used by other issuers. A reconciliation of net earnings from continuing operations to adjusted EBITDA appears below.

|

|

|

Year ended

|

|

|

(in thousands of US$)

|

|

December 31

|

|

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings from continuing operations

|

|

$ |

89,399 |

|

|

$ |

46,601 |

|

|

$ |

41,393 |

|

|

Income tax

|

|

|

31,799 |

|

|

|

22,204 |

|

|

|

20,733 |

|

|

Other expense (income)

|

|

|

(1,008 |

) |

|

|

(1,524 |

) |

|

|

(2,441 |

) |

|

Interest expense, net

|

|

|

14,237 |

|

|

|

21,499 |

|

|

|

19,563 |

|

|

Operating earnings

|

|

|

134,427 |

|

|

|

88,780 |

|

|

|

79,248 |

|

|

Depreciation and amortization

|

|

|

62,410 |

|

|

|

71,882 |

|

|

|

48,039 |

|

|

Acquisition-related items

|

|

|

11,825 |

|

|

|

10,498 |

|

|

|

16,326 |

|

|

Stock-based compensation expense

|

|

|

13,083 |

|

|

|

12,733 |

|

|

|

7,434 |

|

|

Adjusted EBITDA

|

|

$ |

221,745 |

|

|

$ |

183,893 |

|

|

$ |

151,047 |

|

Adjusted EPS is defined as diluted net earnings (loss) per common share from continuing operations, adjusted for the effect, after income tax, of: (i) the non-controlling interest redemption increment; (ii) acquisition-related items; (iii) amortization of intangible assets recognized in connection with acquisitions; and (iv) stock-based compensation expense. The Company believes this measure is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company and enhances the comparability of operating results from period to period. Adjusted EPS is not a recognized measure of financial performance under GAAP, and should not be considered as a substitute for diluted net earnings per common share from continuing operations, as determined in accordance with GAAP. The Company's method of calculating this non-GAAP measure may differ from other issuers and, accordingly, this measure may not be comparable to measures used by other issuers. A reconciliation of diluted net earnings (loss) per common share from continuing operations to adjusted EPS appears below.

| |

|

Year ended

|

|

|

(in US$)

|

|

December 31

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

|

|

|

Diluted net (loss) earnings per common share

|

|

|

|

|

|

|

|

|

|

|

from continuing operations

|

|

$ |

1.15 |

|

|

$ |

(0.48 |

) |

|

$ |

(0.10 |

) |

|

Non-controlling interest redemption increment

|

|

|

0.53 |

|

|

|

1.25 |

|

|

|

0.70 |

|

|

Acquisition-related items

|

|

|

0.31 |

|

|

|

0.30 |

|

|

|

0.51 |

|

|

Amortization of intangible assets, net of tax

|

|

|

0.43 |

|

|

|

0.73 |

|

|

|

0.35 |

|

|

Stock-based compensation expense, net of tax

|

|

|

0.31 |

|

|

|

0.33 |

|

|

|

0.16 |

|

|

Adjusted EPS

|

|

$ |

2.73 |

|

|

$ |

2.13 |

|

|

$ |

1.62 |

|

We believe that the presentation of adjusted EBITDA and adjusted EPS, which are non-GAAP financial measures, provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations. We use these non-GAAP financial measures when evaluating operating performance because we believe that the inclusion or exclusion of the items described above, for which the amounts are non-cash or non-recurring in nature, provides a supplemental measure of our operating results that facilitates comparability of our operating performance from period to period, against our business model objectives, and against other companies in our industry. We have chosen to provide this information to investors so they can analyze our operating results in the same way that management does and use this information in their assessment of our core business and the valuation of the Company. Adjusted EBITDA and adjusted EPS are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs or benefits associated with the operations of our business as determined in accordance with GAAP. As a result, investors should not consider these measures in isolation or as a substitute for analysis of our results as reported under GAAP.

Risk factors

Investors in the Company's securities should carefully consider the following risks, as well as the other information contained in this AIF and our management's discussion and analysis for the year ended December 31, 2014. If any of the following risks actually occurs, our business could be materially harmed. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those of which we are currently unaware or we currently deem immaterial, may also adversely affect our business.

Economic conditions, especially as they relate to credit conditions and consumer spending

During periods of economic slowdown or contraction, our business is impacted directly. Credit conditions affect commercial real estate transactions, which reduces the demand for our services. Consumer spending directly impacts our Property Services operations businesses because as consumers spend less on property services, our revenues decline. These factors could also negatively impact the timing or the ultimate collection of accounts receivable, which would negatively impact our operating revenues, profitability and cash flow.

Commercial real estate property values, vacancy rates and general conditions of financial liquidity for real estate transactions