EDISON EQUITY RESEARCH - $22.8M RAISED AND STRONG UNIT SALES IN Q3

February 06 2015 - 9:44AM

InvestorsHub NewsWire

Ekso raised $22.8m from a warrant exercise in late November and as

a result the balance sheet is strengthened and earnings volatility

from warrant accounting reduced. Q3 results showed strong unit

sales growth, but at a lower average selling price due to a higher

proportion of sales made through distributors. We see higher

distributor sales as a positive since this will be a key route for

sales growth in the mid to long term. Also, in late December, Ekso

filed a 510(k) with the FDA as a result of the reclassification of

exoskeletons as Class II devices. We have updated our forecasts to

take into account Q3 results and a new valuation approach.

Ekso Bionics is a pioneer in the field of human

robotic exoskeletons that augment mobility, strength and endurance.

It is a development-stage company based in Richmond,

California.

To view our full report, please click here

Click here to view all of Edison

Investment Research’s published reports

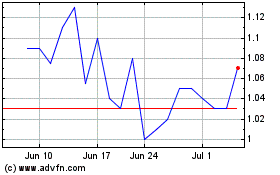

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Sep 2023 to Sep 2024