UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 13, 2015

Date of Report

(Date of earliest

event reported)

LABOR SMART INC.

(Exact name of Registrant as specified in its

Charter)

| Nevada | |

000-54654 | |

45-2433287 |

| (State or Other Jurisdiction of Incorporation) | |

(Commission File Number) | |

(I.R.S. Employer Identification No.) |

3270 Florence Road, Suite 200, Powder

Springs, GA 30127

(Address of Principal Executive

Offices)

(770) 222-5888

(Registrant’s Telephone Number, including

area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant

under any of the following provisions (see general instruction A.2. below):

[

] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[

] Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01

Entry into a Material Definitive Agreement.

On

January 13, 2015 Labor Smart, Inc. (the “Company”) entered into a Second Amendment to Purchase and Sale Agreement

(the “Amendment”) with Transfac Capital, Inc. (“Transfac”). The Amendment amended the original Purchase

and Sale Agreement dated July 19, 2013 executed by and between the Company and Transfac on July 31, 2013, as amended on September

26, 2014 (the “Agreement”). Under the terms of the Amendment, the definition of “Advance Rate” in Section

1 of the Agreement shall be amended to read: “Advance Rate” means ninety percent (90%), or such other percent as may

be determined from time to time by Transfac in its sole discretion. The definition of “Account Due Date” in Section

1 of the Agreement shall be amended to read: “Account Due Date” means ninety (90) days from the date of the invoice

evidencing the Account. The definition of “Maximum Advances” in Section 1 of the Agreement shall be amended to read:

“Maximum Advances” means the maximum aggregate amount of Outstanding Advances, which amount shall not exceed four

million dollars ($4,000,000.00), or such other amount as may be determined from time to time by Transfac in its sole discretion.

The definition of “Contract Term” in Section 1 of the Agreement shall be amended to read: “Contract Term”

means an initial period of twenty four (24) months commencing on the date of this signed Second Amendment to Purchase and Sale

Agreement and renewal periods of one (1) year thereafter. Finally, under Section 1 of the Agreement, the following definition

was added: “Origination Fee” means One Quarter of One Percent (.25%) of the Maximum Advances which shall

be due and payable on the date of this signed Second Amendment to Purchase and Sale Agreement. All other provisions of the Agreement

shall remain in full force and effect.

The

foregoing description of the Amendment and the terms thereof are qualified in their entirety by the full text of the Agreement,

which is filed as Exhibit 99.1 to, and incorporated by reference in, this report.

Item 3.02 Unregistered Sales of Equity

Securities.

During

the period commencing January 9, 2015 through January 13, 2015, the Company issued an aggregate of 127,331,602 shares of its common

stock as follows: on January 9, 2015, the Company issued 9,419,355 shares of its common stock to reduce an outstanding convertible

note payable by $5,840. On January 9, 2015, the Company issued 15,600,000 shares of its common stock to reduce an outstanding

convertible note payable by $8,580. On January 9, 2015, the Company issued 17,500,000 shares of its common stock to reduce an

outstanding convertible note payable by $10,597.50. On January 9, 2015, the Company issued 15,740,741 shares of its common stock

to reduce an outstanding convertible note payable by $8,500. On January 9, 2015, the Company issued 9,358,685 shares of its common

stock to reduce an outstanding convertible note payable by $4,885.23. On January 12, 2015, the Company issued 5,566,667 shares

of its common stock to reduce an outstanding convertible note payable by $3,340. On January 12, 2015, the Company issued 16,346,154

shares of its common stock to reduce an outstanding convertible note payable by $8,500. On January 13, 2015, the Company issued

18,950,000 shares of its common stock to reduce an outstanding convertible note payable by $10,233. On January 13, 2015, the Company

issued 18,850,000 shares of its common stock to reduce an outstanding convertible note payable by $10,367.50. These shares were

issued pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended pursuant to Section

4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other

things, the transactions did not involve a public offering.

The

number of shares of the Company’s common stock outstanding as of January 13, 2015 was 439,586,521.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

|

|

|

LABOR SMART, INC. |

| |

|

|

|

|

| Date: |

January 14, 2015 |

|

By: |

/s/ Ryan Schadel |

| |

|

|

Name: |

Ryan Schadel |

| |

|

|

Title: |

Chief Executive Officer |

SECOND AMENDMENT TO PURCHASE AND SALE AGREEMENT

| CLIENT |

Labor

Smart, Inc. |

|

| |

5604

Wendy Bagwell Parkway |

|

| |

Hiram,

GA 30141 |

|

| |

|

|

| TRANSFAC |

Transfac

Capital, Inc. |

|

| |

257

East 200 South |

|

| |

Salt

Lake City, UT 84111 |

|

| |

|

|

| |

|

|

The Purchase and Sale Agreement dated July

19, 2013 (“the Agreement”) between Labor Smart, Inc. and Transfac Capital, Inc. is being amended as set forth below.

| A.) | Under Section 1, Definitions: "Advance Rate" means

ninety percent (90%), or such other percent as may be determined from time to time by Transfac in its sole discretion. |

| B.) | Under Section 1, Definitions: "Account Due Date"

means ninety (90) days from the date of the invoice evidencing the Account. |

| C.) | Under Section 1, Definitions: “Maximum Advances”

is restated as follows: |

"Maximum Advances" means

the maximum aggregate amount of Outstanding Advances, which amount shall not exceed four million dollars ($4,000,000.00), or such

other amount as may be determined from time to time by Transfac in its sole discretion.

| D.) | Under Section 1, Definitions: The following definition is

hereby added to Section 1: |

“Origination Fee” means

One Quarter of One Percent (.25%) of the Maximum Advances which shall be due and payable on the date of this signed

Second Amendment to Purchase and Sale Agreement.

| E.) | Under Section 1, Definitions: "Contract Term" is

restated as follows: |

"Contract Term" means an

initial period of twenty-four (24) months commencing on the date of this signed Second Amendment to Purchase and Sale Agreement

and renewal periods of one (1) year thereafter.

In all other respects, the Agreement will remain

in full force and effect.

IN WITNESS HEREOF, CLIENT and TRANSFAC

have accepted and agreed to this Second Amendment to Purchase and Sale Agreement effective January ____, 2015.

Transfac Capital, Inc.

By: /s/ John D.Thompson____________________________

Name: John D. Thompson___________________________

Title: CFO_______________________________________

| Labor Smart, Inc. | Second Amendment to Purchase and Sale Agreement |

Labor Smart, Inc.

By: /s/ Ryan Schadel_____________________________

Name: Ryan Scahdel_____________________________

Title: CEO_____________________________________

REAFFIRMATION OF PERSONAL GUARANTY

The undersigned guarantor hereby acknowledges

the terms and conditions of this Second Amendment to Purchase and Sale Agreement and reaffirms the previously executed Personal

Guarantee dated July 19, 2013 of all obligations of Client to Transfac.

Guarantor:

/s/ Ryan Schadel__________________________________

Christopher Ryan Schadel

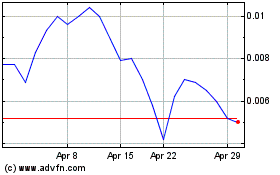

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024