UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2015

————————————

THE HAIN CELESTIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

————————————

|

| | |

Delaware | 0-22818 | 22-3240619 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1111 Marcus Avenue, Lake Success, NY 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 587-5000

Not Applicable

(Former name or former address, if changed since last report)

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events

On January 13, 2014, through our wholly-owned subsidiary Hain Frozen Foods UK Limited, we entered into an agreement (the “Purchase Agreement”) with Braunstone Properties Limited, a company registered in England and Wales (“BPL”), Tilda Rice Limited, a Company registered in England and Wales (“Tilda”), and SalCott Associated Limited, a company registered in the Isle of Man (“Salcott,” and together with BPL and Tilda, the “Sellers”) to acquire (1) the entire issued share capital of Tilda Limited, a company incorporated in England and Wales, (2) the entire issued share capital of Brand Associates Limited, a company incorporated in the Isle of Man, and (3) certain other assets belonging directly or indirectly to the Sellers, including certain intellectual property (collectively, the “Share Purchase”).

As partial consideration for the Share Purchase, the Company issued, at closing on January 13, 2014, loan notes amounting to the sum of £20,000,000 to certain of the Sellers and their related parties, which were due and payable on or before January 13, 2015 (the “Vendor Loan Notes”). In full satisfaction of the Vendor Loan Notes, we paid £10,000,000 in cash and issued 266,984 shares of Hain Celestial common stock, par value $0.01 per share, to certain of the Sellers and their related parties.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

5.1* | | Opinion of DLA Piper LLP (US) |

| | |

23.1* | | Consent of DLA Piper LLP (US) (included in Exhibit 5.1) |

(*) - Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 13, 2015

|

| | |

| THE HAIN CELESTIAL GROUP, INC. (Registrant) |

| |

| By: | /s/ Denise M. Faltischek |

| Title: | Executive Vice President and General Counsel, Chief Compliance Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

5.1* | | Opinion of DLA Piper LLC (US) |

| | |

23.1* | | Consent of DLA Piper LLP (US) (included in Exhibit 5.1) |

(*) - Filed herewith

|

| |

| DLA Piper LLP (US) The Marbury Building

6225 Smith Avenue

Baltimore, Maryland 21209-3600

www.dlapiper.com

T 410.580.3000

F 410.580.3001 |

January 13, 2015

The Hain Celestial Group, Inc.

1111 Marcus Avenue

Lake Success, New York 11042

Re: The Hain Celestial Group, Inc.

Ladies and Gentlemen:

We have acted as outside counsel to The Hain Celestial Group, Inc., a Delaware corporation (the “Company”), and have been requested to render this opinion in connection with the offer and sale of 266,984 shares of Common Stock, par value $0.01 per share, of the Company (the “Securities”) from time to time by the selling shareholders (the “Selling Shareholders”) named in the prospectus supplement dated January 13, 2015 (together with the Prospectus (as herein defined), the “Final Prospectus”), filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), and the accompanying prospectus dated October 24, 2012 (the “Prospectus”) that form a part of the automatic shelf registration statement on Form S-3 (File No. 333-184584) dated October 24, 2012 and filed by the Company with the Commission on October 25, 2012 (excluding the documents incorporated by reference therein, the “Registration Statement”) under the Securities Act. The Securities were issued and sold by the Company to the Selling Shareholders pursuant to the exercise of the Consideration Shares Option under that certain Deed relating to the issue of £20,000,000 Interest Free Unsecured Loan Notes 2015 made by the Company (the “Deed”) pursuant to the Agreement for the Sale and Purchase of the Tilda Reporting Group, dated as of January 13, 2014 (the “Purchase Agreement”), by and among the Company, Hain Frozen Foods UK Limited, a company registered in England and Wales and a wholly-owned subsidiary of the Company, as the buyer, Braunstone Properties Limited, a company registered in England and Wales, Tilda Rice Limited, a Company registered in England and Wales, and Salcott Associates Limited, a company registered in the Isle of Man. This opinion is being provided at your request pursuant to Item 601(b)(5) of Regulation S-K, 17 C.F.R. §229.601(b)(5), in connection with the filing of a Current Report on Form 8-K by the Company with the Commission on the date hereof (the “Form 8-K”) and supplements our opinion, dated October 24, 2012, previously filed as Exhibit 5.1 to the Registration Statement.

In our capacity as the Company’s outside counsel, we have reviewed originals or copies, certified or otherwise identified to our satisfaction, of the following documents (collectively, the “Documents”):

(a)The charter of the Company, as in effect on the date hereof, representedby the Amended and Restated Certificate of Incorporation of the Company as filed with the Secretary of State of the State of Delaware on May 30, 2000, as amended by the Certificate of Amendment to Amended and Restated Certificate of Incorporation of the Company as filed with the Secretary of State of the State of Delaware on November 21, 2014 and as modified by the Certificate of Correction to such Certificate of Amendment as filed with the Secretary of State of the State of Delaware on November 26, 2014 (in the form attached to the Officer’s Certificate (as defined below)) (the “Charter”);

(b)The Amended and Restated By-Laws of the Company, as amended through November 20, 2014 and as in effect on the date hereof (in the form attached to the Officer’s Certificate) (the “By-Laws”);

The Hain Celestial Group, Inc.

January 13, 2015

Page 2

(c)The Registration Statement, including the Prospectus contained therein;

(d)The Final Prospectus;

(e)An executed copy of the Purchase Agreement (as attached to the Officer’s Certificate);

(f)An executed copy of the Deed (as attached to the Officer’s Certificate);

(g)Executed copies of the Interest Free Unsecured Loan Notes 2015 made by the Company to each of the Selling Shareholders (as attached to the Officer’s Certificate) (the “Vendor Loan Notes”);

(h)An executed copy of that certain notice dated December 23, 2014 from the Company to the Selling Shareholders, exercising the Consideration Shares Option under Section 6.6 of the Deed pursuant to which an aggregate of £10,000,000 of the principal amount payable in respect of the Vendor Loan Notes was paid and satisfied by the issuance of the Securities (as attached to the Officer’s Certificate);

(i)Copies of the stock certificates evidencing the Securities (as attached to the Officer’s Certificate);

(j)A certificate of an officer of the Company, dated as of the date hereof, as to certain factual matters (the “Officer’s Certificate”);

(k)Resolutions adopted by the Company’s Board of Directors on June 26, 2012 and December 20, 2013 relating to, among other things, the preparation and filing of the Registration Statement and the Prospectus contained therein at the time the Registration Statement became effective, the preparation and filing of the Final Prospectus, the authorization, execution and delivery of the Purchase Agreement, the Deed and the Vendor Loan Notes and the consummation of the transactions contemplated thereby, and the issuance, offer and sale of the Securities (in each case, as attached to the Officer’s Certificate);

(l)A short form good standing certificate with respect to the Company issued by the Secretary of State of the State of Delaware, dated as of a recent date; and

(m)Such other documents as we have considered necessary to the rendering of the opinion expressed below.

In examining the Documents, and in rendering the opinion set forth below, we have assumed, without independent investigation, the following: (a) each of the parties to the Documents (other than the Company) has duly and validly authorized, executed and delivered each of the Documents to which such party (other than the Company) is a signatory and each instrument, agreement and other document executed in connection with the Documents to which such party (other than the Company) is a signatory and each such party’s (other than the Company’s) obligations set forth in such Documents and each other instrument, agreement and other document executed in connection with such Documents, are its legal, valid and binding obligations, enforceable in accordance with their respective terms; (b) each person executing any Document and any other instrument, agreement and other document executed in connection with the Documents on behalf of any such party (other than the Company) is duly authorized to do so; (c) each natural person executing any Document and any other instrument, agreement and other document executed in connection

The Hain Celestial Group, Inc.

January 13, 2015

Page 3

with the Documents is legally competent to do so; (d) there are no oral or written modifications of or amendments or supplements to the Documents (other than such modifications or amendments or supplements identified above and attached to the Officer’s Certificate) and there has been no waiver of any of the provisions of the Documents by actions or conduct of the parties or otherwise; and (e) all Documents submitted to us as originals are authentic, all Documents submitted to us as certified or photostatic copies or telecopies or portable document file (“.PDF”) copies conform to the original Documents (and the authenticity of the originals of such copies), all signatures on all documents submitted to us for examination (and including signatures on photocopies, telecopies and .PDF copies) are genuine, and all public records reviewed are accurate and complete. As to all factual matters relevant to the opinion set forth below, we have relied upon the representations and warranties made in the Purchase Agreement and in the Officer’s Certificate as to the factual matters set forth therein, which we assume to be accurate and complete, and on the written statements and representations of public officials and our review of the Documents.

Based upon the foregoing, and subject to the assumptions, limitations and qualifications stated herein, it is our opinion that the Securities have been duly authorized and are validly issued, fully paid and non-assessable.

The opinion expressed above is subject to the following assumptions, exceptions, qualifications and limitations:

(a)The foregoing opinion is rendered as of the date hereof. We assume no obligation to update such opinion to reflect any facts or circumstances that may hereafter come to our attention or changes in the law which may hereafter occur.

(b)We are members of the bar of the State of Maryland and we have made no investigation of, and we express no opinion as to, the laws of any jurisdiction other than the Delaware General Corporation Law (including the statutory provisions, all applicable provisions of the Delaware Constitution and the reported judicial decisions interpreting the foregoing) and we do not express any opinion herein concerning any other law. This opinion concerns only the effect of such laws (exclusive of the principles of conflict of laws) of the State of Delaware as currently in effect. As to matters of such laws of the State of Delaware, we have based our opinion solely upon our examination of such laws and the rules and regulations of the authorities administering such laws, all as reported in standard, unofficial compilations. The opinion expressed herein is subject to the effect of judicial decisions which may permit the introduction of parol evidence to modify the terms or the interpretation of agreements.

(c)We express no opinion as to compliance with the securities (or “blue sky”) laws of any jurisdiction.

(d)This opinion is limited to the matters set forth herein, and no other opinion should be inferred beyond the matters expressly stated.

The Hain Celestial Group, Inc.

January 13, 2015

Page 4

We consent to the filing of this opinion with the Commission as an exhibit to the Current Report on Form 8-K and to the reference to our firm under the heading “Legal Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

DLA Piper LLP (US)

/s/ DLA Piper LLP (US)

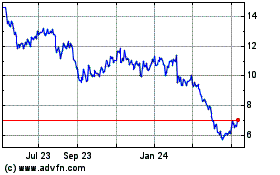

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

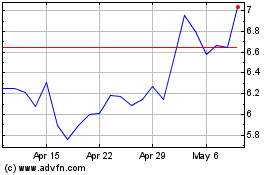

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Apr 2023 to Apr 2024