UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

LyondellBasell Industries N.V.

(Name of Issuer)

Ordinary shares, par value €0.04 per share

(Title of Class of Securities)

N53745100

(CUSIP Number)

Alejandro Moreno

c/o Access Industries, Inc.

730 Fifth Avenue, 20th Floor

New York, New York 10019

(212) 247-6400

with copies to:

Matthew E. Kaplan

Debevoise & Plimpton LLP

919 Third Avenue

New

York, New York 10022

(212) 909-6000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 29, 2014

(Date of Event which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rules 13d-1(e), 13d-1(f) or 13d-1(g), check the following

box. ¨

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI International Chemicals S.à r.l. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Luxembourg |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

52,372,438 shares |

| |

8 |

|

SHARED VOTING POWER

36,570,928 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

52,372,438 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

36,570,928 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Len Blavatnik |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) IN |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI Investments Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI SMS L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI SMS GP Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin Islands |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries Management, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Altep 2010 L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

297,080 shares |

| |

8 |

|

SHARED VOTING POWER

88,646,286 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

297,080 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,646,286 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Altep 2011 L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

185,235 shares |

| |

8 |

|

SHARED VOTING POWER

88,758,131 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

185,235 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,758,131 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries, Inc. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

570,928 shares |

| |

8 |

|

SHARED VOTING POWER

88,372,438 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

570,928 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,372,438 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) CO |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Access Industries Investment Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI European Holdings L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI European Holdings GP Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI European Holdings S.à r.l. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

16,000,000 shares |

| |

8 |

|

SHARED VOTING POWER

72,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

16,000,000 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

72,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AI Petroleum Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 shares |

| |

8 |

|

SHARED VOTING POWER

88,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. AIPH Holdings LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION New York |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

20,000,000 shares |

| |

8 |

|

SHARED VOTING POWER

68,943,366 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

20,000,000 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

68,943,366 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) OO (Limited Liability Company) |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

CUSIP No. N53745100

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON. Altep 2014 L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

88,613 shares |

| |

8 |

|

SHARED VOTING POWER

88,854,753 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

88,613 shares |

| |

10 |

|

SHARED DISPOSITIVE POWER

88,854,753 shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,943,366 shares |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11);

17.76%(1) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| (1) |

All percentages are based on an aggregate of 500,667,961 ordinary shares issued and outstanding as of October 22, 2014, as reported in the Issuer’s quarterly report filed on Form 10-Q on October 24, 2014.

|

Amendment No. 5 to Schedule 13D

This amendment to Schedule 13D is being filed by AI International Chemicals S.à r.l. (“AIIC”), Len Blavatnik, AI Investments

Holdings LLC (“AIIH”), AI SMS L.P., AI SMS GP Limited, Access Industries, LLC, Access Industries Holdings LLC, Access Industries Management, LLC, Altep 2010 L.P. (“Altep 2010”), Altep 2011 L.P. (“Altep 2011”), Access

Industries, Inc., Access Industries Investment Holdings LLC, AI European Holdings L.P., AI European Holdings GP Limited, AI European Holdings S.à r.l. (“AIEH”), AI Petroleum Holdings LLC (“AIPH”), AIPH Holdings LLC and

Altep 2014 L.P. (“Altep 2014”) (collectively, the “Reporting Persons”, and each, a “Reporting Person”) to report changes in beneficial ownership of ordinary shares, par value €0.04 per share (the

“ordinary shares”) of the issuer as a result of an internal reorganization.

The Schedule 13D (the “Schedule”) filed

with the Securities and Exchange Commission on January 10, 2011, as amended and supplemented by Amendment No. 1, filed February 23, 2011, Amendment No. 2, filed on February 16, 2012, Amendment No. 3, filed on

December 17, 2012 and Amendment No. 4, filed on August 5, 2013, is hereby amended and supplemented by the Reporting Persons as set forth below in this Amendment No. 5. This amendment is filed by the Reporting Persons in

accordance with Rule 13d-2 of the Securities Exchange Act of 1934, as amended, and refers only to information that has materially changed since the filing of the Schedule 13D. The items identified below, or the particular paragraphs of such items

which are identified below, are amended as set forth below. Unless otherwise indicated, all capitalized terms used and not defined herein have the respective meanings assigned to them in the Schedule.

Item 2 Identity and Background

The

agreement among the Reporting Persons relating to the joint filing of this Schedule 13D is filed as Exhibit 99.1.6 hereto.

Item 3 Source and

Amount of Funds or Other Considerations

The disclosure in Item 3 is hereby supplemented by adding the following to the end

thereof:

On December 29, 2014, as a result of an internal corporate restructuring, there was a transfer of shares between affiliated

entities which resulted in a change in the form of beneficial ownership. AIIC distributed 20,000,000 ordinary shares to AIIH, which transferred such shares to AIPH Holdings LLC. No funds were exchanged in connection with these transfers.

On December 30, 2014, as a result of the internal corporate restructuring, AIPH Holdings LLC distributed all of its interests in AI

Investments Holdings LLC and AIPH to its equityholders. No funds were exhanged in connection with these transfers.

Item 5 Interest in Securities

of the Issuer

The disclosure in Items 5(a) and 5(b) is hereby amended and restated in its entirety to read as follows:

(a) and (b) The responses of each of the Reporting Persons with respect to Rows 11, 12, and 13 of the cover pages of this Schedule 13D

that relate to the aggregate number and percentage of ordinary shares (including but not limited to footnotes to such information) are incorporated herein by reference.

The responses of each of the Reporting Persons with respect to Rows 7, 8, 9, and 10 of the cover pages of this Schedule 13D that relate to the

number of ordinary shares as to which each of the persons or entities referenced in Item 2 above has sole or shared power to vote or to direct the vote of and sole or shared power to dispose of or to direct the disposition of (including but not

limited to footnotes to such information) are incorporated herein by reference.

AIIC holds 52,372,438 ordinary shares directly. Each of AI

Investments Holdings LLC, Access Industries, LLC, Access Industries Holdings LLC, Access Industries Management, LLC and Len Blavatnik may be deemed to beneficially own the 52,372,438 ordinary shares to be held directly by AIIC. AI Investments

Holdings LLC holds a

majority of the outstanding voting interests in AIIC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC. Access Industries

Holdings LLC holds a majority of the outstanding voting interests in AI Investments Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC and AI Investments Holdings

LLC. Access Industries, LLC holds a majority of the outstanding voting interests in Access Industries Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC, AI

Investments Holdings LLC and Access Industries Holdings LLC. Access Industries Management, LLC controls Access Industries, LLC, Access Industries Holdings LLC and AI Investments Holdings LLC and, as a result, may be deemed to share voting and

investment power over the shares beneficially owned by AIIC, AI Investments Holdings LLC, Access Industries Holdings LLC, and Access Industries, LLC. Mr. Blavatnik controls Access Industries Management, LLC and a majority of the outstanding

voting interests in Access Industries, LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIIC, AI Investments Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC,

and Access Industries Management, LLC. Because of their relationships with the other Reporting Persons, Altep 2010, Altep 2011, Altep 2014, Access Industries, Inc., AIPH Holdings LLC, AIEH, AI European Holdings L.P., AI European Holdings GP Limited,

Access Industries Investment Holdings LLC, AIPH, AI SMS L.P. and AI SMS GP Limited may be deemed to share investment and voting power over the ordinary shares beneficially owned by AIIC, AI Investments Holdings LLC, Access Industries Holdings LLC,

Access Industries, LLC, Access Industries Management, LLC, and Mr. Blavatnik. Each of AI Investments Holdings LLC, AIPH Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep

2011, Altep 2014, Access Industries, Inc., AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, AIPH, and Len Blavatnik, and each of their affiliated entities

and the officers, partners, members, and managers thereof, other than AIIC, disclaims beneficial ownership of the shares held by AIIC.

AIPH Holdings LLC holds 20,000,000 ordinary shares directly. Each of Access Industries, LLC, Access Industries Holdings LLC, Access Industries

Management, LLC and Len Blavatnik may be deemed to beneficially own the 20,000,000 ordinary shares held directly by AIPH Holdings LLC. Access Industries Holdings LLC holds a majority of the outstanding voting interests in AIPH Holdings LLC and, as a

result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIPH Holdings LLC. Access Industries, LLC holds a majority of the outstanding voting interests in Access Industries Holdings LLC and, as a

result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by Access Industries Holdings LLC and AIPH Holdings LLC. Access Industries Management, LLC controls Access Industries, LLC, Access Industries

Holdings LLC and AIPH Holdings LLC and, as a result, may be deemed to share voting and investment power over the shares beneficially owned by AIPH Holdings LLC, Access Industries Holdings LLC, and Access Industries, LLC. Mr. Blavatnik controls

Access Industries Management, LLC and a majority of the outstanding voting interests in Access Industries, LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIPH Holdings LLC,

Access Industries Holdings LLC, Access Industries, LLC, and Access Industries Management, LLC. Because of their relationships with the other Reporting Persons, Altep 2010, Altep 2011, Altep 2014, Access Industries, Inc., AIIC, AI Investments

Holdings LLC, AIEH,

AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AIPH, AI SMS L.P. and AI SMS GP Limited may be deemed to share investment and voting power

over the ordinary shares beneficially owned by AIPH Holdings LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, and Mr. Blavatnik. Each of AI Investments Holdings LLC, AIIC, AI Investments Holdings

LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Altep 2014, Access Industries, Inc., AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries

Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, AIPH, and Len Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than AIPH Holdings LLC, disclaims beneficial ownership of the

shares held directly by AIPH Holdings LLC.

AIEH holds 16,000,000 ordinary shares directly. Each of Access Industries Investment Holdings

LLC, AI European Holdings L.P., AI European Holdings GP Limited, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, AIPH, Access Industries Management, LLC, and Len Blavatnik may be deemed to beneficially own the

16,000,000 ordinary shares held directly by AIEH. AI European Holdings L.P. controls AIEH and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH. AI European Holdings GP Limited is

the general partner of AI European Holdings L.P. and, as such, may be deemed to share voting and investment power over the ordinary shares deemed beneficially owned by AIEH and AI European Holdings L.P. Access Industries Investment Holdings LLC

controls AI European Holdings GP Limited and, as such, may be deemed to share voting and investment power over the ordinary shares deemed beneficially owned by AIEH, AI European Holdings L.P. and AI European Holdings GP Limited. AI SMS L.P. is the

sole member of Access Industries Investment Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings L.P., AI European Holdings GP Limited and Access

Industries Investment Holdings LLC. AI SMS GP Limited is the general partner of AI SMS L.P. and, as such, may be deemed to share voting and investment power over the ordinary shares deemed beneficially owned by AIEH, AI European Holdings L.P., AI

European Holdings GP Limited, Access Industries Investment Holdings LLC and AI SMS L.P. AIPH owns a majority of the equity of AI SMS L.P. and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially

owned by AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC and AI SMS L.P. Access Industries Holdings LLC holds a majority of the outstanding voting interests in AIPH and, as a result, may be

deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings L.P., AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P. and AIPH. Access Industries, LLC

controls AI SMS GP Limited and holds a majority of the outstanding voting interests in Access Industries Holdings LLC and, as a result, may be deemed to share voting and investment power over the shares beneficially owned by AIEH, AI European

Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, and AIPH and Access Industries Holdings LLC. Access Industries Management, LLC controls Access Industries, LLC and Access

Industries Holdings LLC and AI Investments Holdings LLC and, as a result, may be deemed to share voting and investment power over the ordinary shares beneficially owned by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access

Industries Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, AIPH, Access Industries Holdings LLC and Access Industries, LLC.

Mr. Blavatnik controls Access Industries Management, LLC and a majority of the voting interests in Access Industries, LLC and, as a result, may be deemed to share voting and investment power

over the ordinary shares beneficially owned by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, AIPH, Access Industries Holdings LLC, Access Industries, LLC

and Access Industries Management, LLC. Because of their relationships with the other Reporting Persons, Altep 2010, Altep 2011, Altep 2014, AIPH Holdings LLC and Access Industries, Inc. may be deemed to share investment and voting power over the

ordinary shares beneficially owned by AIEH, AI European Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, AIPH, Access Industries Holdings LLC, Access Industries, LLC, Access

Industries Management, LLC and Mr. Blavatnik. Each of AIIC, AI Investments Holdings LLC, AI European Holdings LP, AI European Holdings GP Limited, Access Industries Investment Holdings LLC, AI SMS L.P., AI SMS GP Limited, AIPH, AIPH Holdings

LLC, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Altep 2014, Access Industries, Inc., and Len Blavatnik, and each of their affiliated entities and the officers, partners,

members, and managers thereof, other than AIEH, disclaims beneficial ownership of the shares held by AIEH.

Altep 2010 holds 297,080

ordinary shares directly. Each of Access Industries, Inc. and Len Blavatnik may be deemed to beneficially own the 297,080 ordinary shares held directly by Altep 2010. Access Industries, Inc. is the general partner of Altep 2010 and, as a result, may

be deemed to have voting and investment control over the shares owned directly by Altep 2010. Mr. Blavatnik controls Access Industries, Inc. and, as a result, may be deemed to share voting and investment power over the 297,080 ordinary shares

held by Altep 2010. Because of their relationships with the other Reporting Persons, each of AIIC, AI Investments Holdings LLC, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management,

LLC, Altep 2011, Altep 2014, Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI European Holdings L.P., AIPH, and AIPH Holdings LLC may be deemed to share investment and voting power over the ordinary shares

beneficially owned by Altep 2010, Access Industries, Inc., and Mr. Blavatnik. Each of AIIC, AI Investments Holdings LLC, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management,

LLC, Access Industries, Inc., Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI European Holdings L.P., AIPH, AIPH Holdings LLC, Altep 2011, Altep 2014 and Mr. Blavatnik, and each of their affiliated entities

and the officers, partners, members, and managers thereof, other than Altep 2010, disclaims beneficial ownership of the shares held by Altep 2010.

Altep 2011 holds 185,235 ordinary shares directly. Each of Access Industries, Inc. and Len Blavatnik may be deemed to beneficially own the

185,235 ordinary shares held directly by Altep 2011. Access Industries, Inc. is the general partner of Altep 2011 and, as a result, may be deemed to have voting and investment control over the shares owned directly by Altep 2011. Mr. Blavatnik

controls Access Industries, Inc. and, as a result, may be deemed to share voting and investment power over the 185,235 ordinary shares held by Altep 2011. Because of their relationships with the other Reporting Persons, each of AIIC, AI Investments

Holdings LLC, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2014, Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited,

AI European Holdings L.P., AIPH and AIPH Holdings LLC

may be deemed to share investment and voting power over the ordinary shares beneficially owned by Altep 2011, Access Industries, Inc., and Mr. Blavatnik. Each of AIIC, AI Investments

Holdings LLC, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Access Industries, Inc., Access Industries Investment Holdings LLC, AIEH, AI European Holdings GP Limited, AI

European Holdings L.P., AIPH, AIPH Holdings LLC, Altep 2010, Altep 2014 and Mr. Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than Altep 2011, disclaims beneficial ownership of

the shares held by Altep 2011.

Altep 2014 holds 88,613 ordinary shares directly. Each of Access Industries, Inc. and Len Blavatnik

may be deemed to beneficially own the 88,613 ordinary shares to be held directly by Altep 2014. Access Industries, Inc. is the general partner of Altep 2014 and, as a result, may be deemed to have voting and investment control over the shares owned

directly by Altep 2014. Mr. Blavatnik controls Access Industries, Inc. and, as a result, may be deemed to share voting and investment power over the shares held by Altep 2014. Because of their relationships with the other Reporting Persons,

each of AIIC, AI Investments Holdings LLC, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Altep 2010, Altep 2011, Access Industries Investment Holdings LLC, AIEH, AI

European Holdings GP Limited, AI European Holdings L.P., AIPH and AIPH Holdings LLC may be deemed to share investment and voting power over the ordinary shares beneficially owned by Altep 2014, Access Industries, Inc., and Mr. Blavatnik. Each

of AIIC, AI Investments Holdings LLC, AI SMS L.P., AI SMS GP Limited, Access Industries Holdings LLC, Access Industries, LLC, Access Industries Management, LLC, Access Industries, Inc., Access Industries Investment Holdings LLC, AIEH, AI European

Holdings GP Limited, AI European Holdings L.P., AIPH, AIPH Holdings LLC, Altep 2010, Altep 2011 and Mr. Blavatnik, and each of their affiliated entities and the officers, partners, members, and managers thereof, other than Altep 2014,

disclaims beneficial ownership of the shares held by Altep 2014.

The disclosure in Item 5(c) is hereby supplemented by adding

the following at the end thereof:

(c) The following transactions in the Issuer’s securities have been effected by Reporting Persons

within the 60 days prior to this filing:

On December 29, 2014 and December 30, 2014, the transfers described in the last two

paragraphs of Item 3 were effectuated.

Item 7 Materials to Be Filed as Exhibits

The disclosure in Item 7 is hereby supplemented by adding the following in appropriate numerical order:

Exhibit 99.1.6 Joint Filing Agreement, dated as of December 30, 2014.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

| Date: December 30, 2014 |

|

| AI INTERNATIONAL CHEMICALS S.À R.L. |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Class A Manager |

|

| LEN BLAVATNIK |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Attorney-in-Fact |

|

| AI INVESTMENTS HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| AI SMS L.P. |

|

| By: AI SMS GP Limited, its general partner

By: Belvaux Management Limited, its director |

|

|

| By: |

|

/s/ RONAN J.E. KUCZAJ |

|

|

Name: |

|

Ronan J.E. Kuczaj |

|

|

Title: |

|

Director |

|

| AI SMS GP LIMITED |

|

| By: Belvaux Management Limited, its director |

|

|

| By: |

|

/s/ RONAN J.E. KUCZAJ |

|

|

Name: |

|

Ronan J.E. Kuczaj |

|

|

Title: |

|

Director |

|

|

|

|

|

| ACCESS INDUSTRIES HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES, LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES MANAGEMENT, LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ALTEP 2010 L.P. |

|

| By: Access Industries, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ALTEP 2011 L.P. |

|

| By: Access Industries, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES, INC. |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES INVESTMENT HOLDINGS LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Manager |

|

|

|

|

|

| AI EUROPEAN HOLDINGS L.P. |

|

| By: AI European Holdings GP Limited, its general partner

By: Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

|

|

Name: |

|

Dawn E. Shand |

|

|

Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS GP LIMITED |

|

| By: Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

|

|

Name: |

|

Dawn E. Shand |

|

|

Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS S.À R.L. |

|

| By: Access Industries Management, LLC, its Class A Manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

|

| By: |

|

/s/ DAWN E. SHAND |

|

|

Name: |

|

Dawn E. Shand |

|

|

Title: |

|

Class B Manager |

|

| AI PETROLEUM HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| AIPH HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

|

|

|

|

| ALTEP 2014 L.P. |

|

| By: Access Industries, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

Exhibit 99.1.6

Joint Filing Agreement

The undersigned hereby agree that they are filing this statement jointly pursuant to Rule 13d-1(k)(1). Each of them is responsible for the

timely filing of such Schedule 13D and any amendments thereto, and for the completeness and accuracy of the information concerning such person contained therein; but none of them is responsible for the completeness or accuracy of the information

concerning the other persons making the filing, unless such person knows or has reason to believe that such information is inaccurate.

In

accordance with Rule 13d-1(k)(1) promulgated under the Securities and Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with each other on behalf of each of them of such a statement on Schedule 13D (and any

amendments thereto) with respect to the ordinary shares beneficially owned by each of them, of LyondellBasell Industries N.V., a public limited liability company incorporated under the laws of the Netherlands. This Joint Filing Agreement shall be

included as an exhibit to such Schedule 13D.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing Agreement as of the 30th day of December, 2014.

|

|

|

|

|

| AI INTERNATIONAL CHEMICALS S.À R.L. |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Class A Manager |

|

| LEN BLAVATNIK |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Attorney-in-Fact |

|

| AI INVESTMENTS HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| AI SMS L.P. |

|

| By: AI SMS GP Limited, its general partner

By: Belvaux Management Limited, its director |

|

|

| By: |

|

/s/ RONAN J.E. KUCZAJ |

|

|

Name: |

|

Ronan J.E. Kuczaj |

|

|

Title: |

|

Director |

|

| AI SMS GP LIMITED |

|

| By: Belvaux Management Limited, its director |

|

|

| By: |

|

/s/ RONAN J.E. KUCZAJ |

|

|

Name: |

|

Ronan J.E. Kuczaj |

|

|

Title: |

|

Director |

|

| ACCESS INDUSTRIES HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

|

|

|

|

| ACCESS INDUSTRIES, LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES MANAGEMENT, LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ALTEP 2010 L.P. |

|

| By: Access Industries, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ALTEP 2011 L.P. |

|

| By: Access Industries, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES, INC. |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| ACCESS INDUSTRIES INVESTMENT HOLDINGS LLC |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Manager |

|

|

|

|

|

| AI EUROPEAN HOLDINGS L.P. |

|

| By: AI European Holdings GP Limited, its general partner

By: Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

|

|

Name: |

|

Dawn E. Shand |

|

|

Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS GP LIMITED |

|

| By: Hudson Administration S.A., its director |

|

|

| By: |

|

/s/ DAWN E. SHAND |

|

|

Name: |

|

Dawn E. Shand |

|

|

Title: |

|

Director |

|

| AI EUROPEAN HOLDINGS S.À R.L. |

|

| By: Access Industries Management, LLC, its Class A Manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

|

| By: |

|

/s/ DAWN E. SHAND |

|

|

Name: |

|

Dawn E. Shand |

|

|

Title: |

|

Class B Manager |

|

| AI PETROLEUM HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

| AIPH HOLDINGS LLC |

|

| By: Access Industries Management, LLC, its manager |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

|

|

|

|

|

| ALTEP 2014 L.P. |

|

| By: Access Industries, Inc., its general partner |

|

|

| By: |

|

/s/ ALEJANDRO MORENO |

|

|

Name: |

|

Alejandro Moreno |

|

|

Title: |

|

Executive Vice President |

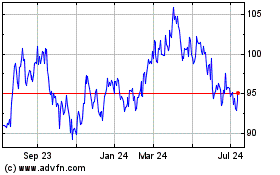

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

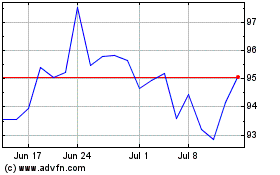

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024