Financial Highlights

- $1,014 million of Adjusted EBITDA in

the third quarter and $2,501 million in the first nine months of

2014

- $526 million of Free Cash Flow (FCF)

before growth investments in the third quarter and $812 million in

the first nine months of 2014

- $3,594 million of total liquidity as of

September 30, 2014

- $830 million in cumulative proceeds to

NRG from drop-downs during 2014, including $480 million from second

drop-down to NRG Yield expected to close in fourth quarter

- $190 million in tax-equity financing

proceeds primarily from EME wind assets

Financial Guidance

- Revising 2014 Guidance as follows:

- Adjusted EBITDA from $3,200-$3,400 to

$3,100-$3,200 million, which incorporates a projected negative

contribution of $50 million from NRG Home Solar

- FCF before Growth investments from

$1,200-$1,400 to $950-$1,050 million

- Initiating 2015 Financial Guidance

- Adjusted EBITDA of $3,200-$3,400

million, which excludes a projected negative contribution of $100

million from our growing NRG Home Solar business

- FCF before Growth Investments of

$1,100-$1,300 million

Business and Operational Highlights

- Acquired Pure Energies Group, Inc.

(Pure Energies), adding a leading web- and telephonic-based

customer acquisition platform to NRG Home Solar’s capabilities

- Acquired Goal Zero, extending NRG’s

retail brand and offerings into personal solar devices

- Acquired, through NRG Yield, North

America’s largest wind farm, the 947 megawatt (MW) Alta Wind

facility located in Tehachapi, California, for

$870 million1

- Began construction of a brownfield 360

MW2 natural gas peaking plant in Houston (approximately $400/kw

installed cost)

- Received SCE contracts for 440 MW of

new gas generation and “Preferred Resources”

NRG Energy, Inc. (NYSE:NRG) today reported third quarter 2014

Adjusted EBITDA of $1,014 million with Wholesale contributing $678

million, Retail contributing $196 million and NRG Yield

contributing $140 million. Year-to-date adjusted cash flow from

operations totaled $1,226 million. Net income for the first nine

months of 2014 was $15 million, or $0.02 per diluted common share

compared to net loss of ($89) million, or ($0.30) per diluted

common share for the first nine months of 2013.

“While NRG's financial performance was constrained in the third

quarter by an absence of summer weather events, NRG's underlying

performance across our wholesale and retail operations was quite

strong,” said NRG’s President and Chief Executive Officer David

Crane. "I am confident that we are well positioned for a more

robust financial outcome in 2015."

Segment Results

Table 1: Adjusted EBITDA

($ in millions) Three Months Ended Nine Months Ended

Segment 9/30/14 9/30/13 9/30/14 9/30/13

Retail 196 180 477 423 Wholesale Gulf Coast 181 248

326 454 East 342 415 1,023 742 West 113 47 199 106 NRG Yield (1)

140 103 341 200 Renewables 88 40 192 92 Corporate (2) (46)

(33) (57) (50) Adjusted EBITDA (3)

1,014 1,000 2,501 1,967

(1)

In accordance with GAAP, 2014 and 2013 results restated to

include full impact of the assets in the ROFO dropdown transaction

which closed on June 30, 2014

(2)

Includes $25 million and $31 million of negative contribution from

NRG Home Solar for three and nine months ended September 30, 2014,

respectively

(3)

Detailed adjustments by region are shown in Appendix A

Table 2: Net Income / (Loss)

($ in millions) Three Months Ended Nine Months Ended Segment

9/30/14 9/30/13 9/30/14 9/30/13 Retail 88

(56) 267 231 Wholesale Gulf Coast 147 282 (56) 31

East 223 241 448 216 West 76 22 117 54 NRG Yield(1) 25 40 75 86

Renewables (34) (7) (101) (45) Corporate (357) (403)

(735) (662) Net Income/ (Loss) 168 119

15 (89) (1) In accordance with GAAP, 2014 and

2013 results restated to include full impact of the assets in the

ROFO drop-down transaction which closed on June 30, 2014

Retail: Third quarter Adjusted EBITDA was $196 million; $16

million higher than in third quarter 2013 primarily driven by

increased margin from the Dominion acquisition, continued

advancement in customer and product growth, and a focus on

maintaining unit margins, partially offset by lower C&I

volumes.

Wholesale

Gulf Coast: Third quarter Adjusted EBITDA was $181 million; $67

million lower than in third quarter 2013. Gross margin declined by

$43 million primarily due to decrease in average realized prices

and decrease in coal generation from lower economic dispatch due to

higher outage hours, partially offset by gains in South Central due

to higher energy prices in MISO which also resulted in higher

generation. The balance of the decline was due to higher

maintenance and operating expenses at South Texas Project and gain

on sale of land recorded in 2013.

East: Third quarter Adjusted EBITDA was $342 million; $73

million lower than in third quarter 2013. The lower results were

primarily driven by 67% lower capacity pricing in PJM and lower

gross margin due to lower generation and realized energy prices

partially offset by the favorable impact of the Midwest Generation

assets from the acquisition of substantially all of the assets of

Edison Mission Energy (EME).

West: Third quarter Adjusted EBITDA was $113 million; $66

million higher than in third quarter 2013. Increases were primarily

driven by the addition of the EME gas fleet of $43 million and

higher priced resource adequacy contracts.

NRG Yield: Third quarter Adjusted EBITDA was $140 million; $37

million higher than in third quarter 2013. The improved performance

was the result of additional generating capacity, higher sales

volumes in the Thermal business, and the Alta Wind acquisition in

August 2014.

Renewables: Third quarter Adjusted EBITDA was $88 million; $48

million higher than in third quarter 2013. The improved performance

was driven by the addition of the EME wind assets that contributed

$23 million, as well as the CVSR and Ivanpah solar plants that

achieved commercial operations in late 2013 and early 2014.

Liquidity and Capital Resources

Table 3: Corporate Liquidity

($ in millions) 9/30/14 6/30/14 12/31/13 Cash

and Cash Equivalents 1,953 1,481 2,254

Restricted cash 339 286 268 Total 2,292 1,767

2,522 NRG Corporate Credit Facility Availability 1,302

1,243 1,173 Total Liquidity 3,594 3,010 3,695

Total liquidity as of September 30, 2014, was $3,594 million, a

decrease of $101 million from December 31, 2013. The increase of

$129 million in available credit facilities was more than offset by

the decrease in cash of $230 million, consisting of the

following:

- $3,573 million of cash outflows through

September 2014, consisting of:

- $2,869 million for acquisitions and

growth projects, net, including $1,596 million net cash used in the

EME transaction on April 1, 2014 and $901 million net cash used to

acquire Alta Wind on August 12, 2014;

- $100 million of collateral;

- $369 million of maintenance and

environmental capital expenditures, net;

- $140 million common and preferred stock

dividends; and

- $95 million of merger and integration

expenses and capital costs.

- Partially offset by $3,343 million of

cash inflows through September 2014, consisting of:

- $1,944 million of net financing

activities consisting of: $2,100 million of proceeds from senior

note debt issuance; $337 million of proceeds from NRG Yield

convertible note issuance, net of fees; $492 million of proceeds

from NRG Yield “Green Bond” issuance, net of fees; $630 million of

proceeds from NRG Yield Class A equity issuance, net of fees;

partially offset by $1,615 million of debt payments;

- $1,226 million of adjusted cash flow

from operations;

- $81 million of net proceeds from sale

of assets; and

- $92 million of other net investing and

financing activities.

Drop-Down of Assets to NRG Yield

On November 4, 2014, NRG entered into a definitive agreement

with NRG Yield, Inc. to sell the following facilities for total

cash consideration of $480 million, subject to customary working

capital adjustments, plus the assumption of $746 million3 in

project debt:

- Walnut Creek – 500 MW natural gas

facility located in City of Industry, CA

- Tapestry – three wind facilities

totaling 204 MW, including Buffalo Bear 19 MW in Oklahoma, Taloga

130 MW in Oklahoma, and Pinnacle 55 MW in West Virginia

- Laredo Ridge – 81 MW wind facility

located in Petersburg, NE

The assets represent $120 million of Adjusted EBITDA and $35

million of CAFD on an annualized basis. The transaction is expected

to close in the fourth quarter of 2014 and will result in

$480 million of net cash to NRG, bringing the cumulative

amount raised from dropdowns during 2014 to $830 million.

Tax-Equity Financing of Wind Assets

On November 3, 2014, NRG closed on a tax-equity financing,

receiving approximately $190 million in net cash proceeds from

a new facility which monetizes future tax attributes (including

Production Tax Credits) to be generated primarily by the NRG

Yield-eligible wind assets acquired earlier this year as part of

the EME transaction. The tax equity facility is structured to

maintain the levelized cash available for distribution from the

wind assets, preserving the ability to monetize the cash flows from

these assets through drop downs to NRG Yield beyond 2014.

NRG Strategic Developments

NRG Home SolarNRG continues to enhance its competitiveness and

strategic positioning of NRG Home Solar through the acquisition of

Pure Energies, which is expected to significantly enhance our

customer acquisition platform by offering full service,

point-to-point, customizable rooftop solutions through our

proprietary web- and telephonic-based system.

Combined with NRG’s prior acquisition of Roof Diagnostics Solar,

a leader in home solar direct sales and installation, and NRG’s own

Residential Solar Solutions, which has focused on the financing and

contract management associated with solar leasing, NRG Home Solar

is now a vertically integrated branded provider of residential

solar solutions nationwide and, as such, is well positioned to be

an industry leader in the rapidly growing distributed generation

industry.

By year end 2015, NRG Home Solar expects to have 35,000-40,000

installed leases, of which 25,000-30,000 are expected to be

installed in 2015, totaling approximately 245 MW-280 MW while

driving cost per watt down to a range of $3.20-$3.30/per watt

(including overhead allocations).

RetailThe acquisition of Goal Zero, a leader in the

portable solar energy market, is expected to enhance our ability to

offer the benefits of solar energy to all consumers, regardless of

whether they are homeowners with a roof suitable for solar

installation, while enabling us to emphasize the key convenience

benefit of portability, which is a distinct advantage of solar

power compared to other forms of power generation.

WholesaleNRG has begun construction of a 360 MW4, natural

gas-fired peaking plant at our PH Robinson site near Houston at a

cost of approximately $400 per kilowatt, a significant discount to

typical new build costs. The cost savings are primarily driven by

the repurposing of six GE 7E, economical, fast-start combustion

turbines acquired in the secondary market. The units require no

water for cooling, making them well-suited to operate in

water-constrained Texas. With their fast-start capability, the

peaking units have the potential to help integrate renewable power

from intermittent wind and solar generation into the ERCOT grid.

The project will be partially financed through $43 million of Ike

bonds.

NRG was selected by Southern California Edison (SCE) to repower

the Company’s Mandalay facility in Oxnard with 262 MW of new simple

cycle generation and to install 178 MW of “Preferred Resources,”

including both demand response and energy efficiency products at

sites across southern California.

NRG YieldNRG Yield closed the acquisition of Alta Wind, the

largest wind farm in North America, on August 12, 2014, for $870

million, as well as a payment for working capital of $53 million,

plus the assumption of $1.6 billion of non-recourse project

financings. By 2016, this transaction is expected to increase both

the annual run-rate EBITDA by approximately $220 million and CAFD

by approximately $70 million before debt service associated with

acquisition financing. The facilities are contracted with SCE under

long-term power purchase agreements (PPAs) with an average 21 years

of remaining contract life.

Outlook for 2014 and Initiation of 2015 Guidance

The Company is reducing its guidance range for fiscal year 2014

with respect to both Adjusted EBITDA and FCF before Growth

investments as detailed below as a result of less-than-expected

market opportunity arising out of subdued summer pricing and volume

as well as fuel inventory build ahead of winter, interest payments

associated with Alta Wind project debt, and timing of working

capital and environmental capex. NRG's 2014 Adjusted EBITDA

guidance also includes a projected negative $50 million

contribution from NRG Home Solar business.

The Company is also initiating guidance for fiscal year 2015 as

set forth below. NRG’s Adjusted EBITDA guidance excludes the impact

from NRG Home Solar activities.

Table 4: 2014 Adjusted EBITDA and FCF

before Growth investments Guidance(1)

2014 2015 Prior Revised Guidance

($ in millions) Guidance Guidance

Adjusted EBITDA2 3,200 –3,400 3,100 –3,200 3,200 – 3,400 Interest

payments (1,061) (1,114) (1,160) Income tax (40) (40) (40) Working

capital/other changes (70) (215) 250 Adjusted

Cash flow from operations 2,029 – 2,229 1,731 – 1,831 2,250 – 2,450

Maintenance capital expenditures, net (375)-(395) (375)-(395)

(540)-(570) Environmental capital expenditures, net (340)-(360)

(290)-(310) (300)-(320) Adjusted EBITDA from NRG Home Solar

-

-

(100) Preferred dividends (9) (9) (7) Distributions to

non-controlling interests (100) (100)

(220)-(230) Free cash flow – before Growth investments 1,200 –

1,400 950 – 1,050 1,100 – 1,300 1 Subtotals and totals are

rounded 2 2014 guidance includes negative contribution of $50

million from NRG Home Solar; 2015 guidance excludes negative

contribution of $100 million from NRG Home Solar

2014 Dividend ProgramOn October 14, 2014, NRG declared a

quarterly dividend on the Company's common stock of $0.14 per

share, payable November 17, 2014, to stockholders of record as of

November 3, 2014.

The Company's common stock dividend is subject to available

capital, market conditions and compliance with associated laws and

regulations.

Earnings Conference CallNRG will host a conference call at 9:00

am Eastern today to discuss these results. Investors, the news

media and others may access the live webcast of the conference call

and accompanying presentation materials by logging on to NRG’s

website at http://www.nrg.com and clicking on “Presentations and

Webcasts” under the “Investors” section at the bottom of the home

page. The webcast will be archived on the site for those unable to

listen in real time.

About NRGNRG is leading a customer-driven change in the U.S.

energy industry by delivering cleaner and smarter energy choices,

while building on the strength of the nation’s largest and most

diverse competitive power portfolio. A Fortune 250 company, we

create value through reliable and efficient conventional generation

while driving innovation in solar and renewable power, electric

vehicle ecosystems, carbon capture technology and customer-centric

energy solutions. Our retail electricity providers serve almost 3

million residential and commercial customers throughout the

country. More information is available at www.nrgenergy.com.

Connect with NRG Energy on Facebook and follow us on Twitter

@nrgenergy.

Safe Harbor DisclosureIn addition to historical information, the

information presented in this communication includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Exchange Act. These

statements involve estimates, expectations, projections, goals,

assumptions, known and unknown risks and uncertainties and can

typically be identified by terminology such as “may,” “should,”

“could,” “objective,” “projection,” “forecast,” “goal,” “guidance,”

“outlook,” “expect,” “intend,” “seek,” “plan,” “think,”

“anticipate,” “estimate,” “predict,” “target,” “potential” or

“continue” or the negative of these terms or other comparable

terminology. Such forward-looking statements include, but are not

limited to, statements about the Company’s future revenues, income,

indebtedness, capital structure, plans, expectations, objectives,

projected financial performance and/or business results and other

future events, and views of economic and market conditions.

Although NRG believes that its expectations are reasonable, it

can give no assurance that these expectations will prove to have

been correct, and actual results may vary materially. Factors that

could cause actual results to differ materially from those

contemplated above include, among others, general economic

conditions, hazards customary in the power industry, weather

conditions, competition in wholesale power markets, the volatility

of energy and fuel prices, failure of customers to perform under

contracts, changes in the wholesale power markets, changes in

government regulation of markets and of environmental emissions,

the condition of capital markets generally, our ability to access

capital markets, unanticipated outages at our generation

facilities, adverse results in current and future litigation,

failure to identify or successfully implement acquisitions and

repowerings, our ability to implement value enhancing improvements

to plant operations and companywide processes, our ability to

obtain federal loan guarantees, the inability to maintain or create

successful partnering relationships, our ability to operate our

businesses efficiently including NRG Yield, our ability to retain

retail customers and to grow our NRG Home Solar business, our

ability to realize value through our commercial operations strategy

and the creation of NRG Yield, the ability to successfully

integrate the businesses of acquired companies, the ability to

realize anticipated benefits of acquisitions (including expected

cost savings and other synergies) or the risk that anticipated

benefits may take longer to realize than expected, our ability to

close the drop-down transactions to NRG Yield and our ability to

pay dividends and initiate share repurchases under our Capital

Allocation Plan, which may be made from time to time subject to

market conditions and other factors, including as permitted by

United States securities laws. Furthermore, any common stock

dividend is subject to available capital and market conditions.

NRG undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. The adjusted

EBITDA and free cash flow guidance are estimates as of November 5,

2014. These estimates are based on assumptions believed to be

reasonable as of that date. NRG disclaims any current intention to

update such guidance, except as required by law. The foregoing

review of factors that could cause NRG’s actual results to differ

materially from those contemplated in the forward-looking

statements included in this Earnings Presentation should be

considered in connection with information regarding risks and

uncertainties that may affect NRG's future results included in

NRG's filings with the Securities and Exchange Commission at

www.sec.gov.

1 Excludes $53 million of payments for working capital

2 Represents average annual peaking capacity

3 Prior to the closing of the transaction, debt associated with

Laredo Ridge will be refinanced. As of September 30, 2014 project

debt was $705 million.

4 Represents average annual peaking capacity

NRG ENERGY, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

Three months ended Nine months ended

September 30, September 30,

(In millions,

except for per share amounts)

2014 2013 2014 2013

Operating Revenues Total operating revenues $ 4,569 $

3,490 $ 11,676 $ 8,500

Operating Costs and

Expenses Cost of operations 3,278 2,373 8,828 6,177

Depreciation and amortization 375 327 1,096 947 Impairment losses

70

-

70

-

Selling, general and administrative 258 213 752 670

Acquisition-related transaction and integration costs 17 26 69 95

Development activity expenses 22 24 62 63

Total operating costs and expenses 4,020 2,963 10,877 7,952

Gain on sale of assets

-

-

19

-

Operating Income 549 527 818 548

Other Income/(Expense) Equity in earnings/(loss) of

unconsolidated affiliates 18 (5 ) 39 6 Other (expense)/income, net

(3 ) 5 13 9 Loss on debt extinguishment (13 ) (1 ) (94 ) (50 )

Interest expense (280 ) (228 ) (809 ) (630 ) Total other expense

(278 ) (229 ) (851 ) (665 )

Income/(Loss) Before Income

Taxes 271 298 (33 ) (117 ) Income tax expense/(benefit) 89

160 (68 ) (55 )

Net Income/(Loss) 182 138 35

(62 ) Less: Net income attributable to noncontrolling interest 14

19 20 27

Net Income/(Loss)

Attributable to NRG Energy, Inc. 168 119 15 (89 ) Dividends for

preferred shares 2 2 7 7

Income/(Loss) Available for Common Stockholders $ 166

$ 117 $ 8 $ (96 )

Earnings/(Loss) Per Share

Attributable to NRG Energy, Inc. Common Stockholders

Weighted average number of common shares

outstanding - basic

338 323 333 323

Earnings/(Loss) per Weighted Average

Common Share - Basic

$ 0.49 $ 0.36 $ 0.02 $ (0.30 )

Weighted average number of common shares

outstanding - diluted

343 327 338 323

Earnings/(Loss) per Weighted Average

Common Share - Diluted

$ 0.48 $ 0.36 $ 0.02 $ (0.30 )

Dividends

Per Common Share $ 0.14 $ 0.12 $ 0.40 $

0.33

NRG ENERGY, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE (LOSS)/INCOME (Unaudited) Three

months ended Nine months ended September 30,

September 30, 2014 2013 2014

2013 (In millions) Net Income/(Loss) $

182 $ 138 $ 35 $ (62 )

Other Comprehensive (Loss)/Income, net of

tax Unrealized gain/(loss) on derivatives, net of income tax

expense/(benefit) of $4, $(5), $(11), and $(2) 4 (16 ) (24 ) 8

Foreign currency translation adjustments, net of income tax

(benefit)/expense of $(6), $(1), $(2), and $(13) (6 ) 5 (3 ) (14 )

Available-for-sale securities, net of income tax (benefit)/expense

of $(1), $0, $0, and $1 (2 )

-

2 2 Defined benefit plans, net of tax expense/(benefit) of $0, $0,

$(7), and $4 (3 )

-

9 25 Other comprehensive (loss)/income (7 )

(11 ) (16 ) 21

Comprehensive Income/(Loss) 175 127 19

(41 ) Less: Comprehensive income attributable to noncontrolling

interest 17 18 14 26

Comprehensive

Income/(Loss) Attributable to NRG Energy, Inc. 158 109 5 (67 )

Dividends for preferred shares 2 2 7 7

Comprehensive Income/(Loss) Available for Common

Stockholders $ 156 $ 107 $ (2 ) $ (74 )

NRG ENERGY, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)

September 30, 2014 December 31, 2013

(In millions,

except shares)

(unaudited) ASSETS Current

Assets Cash and cash equivalents $ 1,953 $ 2,254 Funds

deposited by counterparties 3 63 Restricted cash 339 268 Accounts

receivable — trade, less allowance for doubtful accounts of $27 and

$40 1,554 1,214 Inventory 1,051 898 Derivative instruments 1,397

1,328 Cash collateral paid in support of energy risk management

activities 375 276 Deferred income taxes 79 258 Renewable energy

grant receivable, net 614 539 Current assets held-for-sale 32 19

Prepayments and other current assets 475 479 Total

current assets 7,872 7,596

Property, plant and

equipment, net of accumulated depreciation of $7,584 and $6,573

22,181 19,851

Other Assets Equity investments

in affiliates 797 453 Notes receivable, less current portion 80 73

Goodwill 2,452 1,985 Intangible assets, net of accumulated

amortization of $1,333 and $1,977 2,880 1,140 Nuclear

decommissioning trust fund 569 551 Derivative instruments 427 311

Deferred income taxes 1,476 1,202 Non-current assets held-for-sale

54 — Other non-current assets 1,281 740 Total other

assets 10,016 6,455

Total Assets $ 40,069

$ 33,902

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities Current portion of long-term debt and

capital leases $ 854 $ 1,050 Accounts payable 1,098 1,038

Derivative instruments 1,365 1,055 Cash collateral received in

support of energy risk management activities 3 63 Current

liabilities held-for-sale 23 — Accrued expenses and other current

liabilities 1,200 998 Total current liabilities 4,543

4,204

Other Liabilities Long-term debt and

capital leases 19,919 15,767 Nuclear decommissioning reserve 306

294 Nuclear decommissioning trust liability 323 324 Deferred income

taxes 24 22 Derivative instruments 326 195 Out-of-market contracts

1,245 1,177 Non-current liabilities held-for-sale 31 — Other

non-current liabilities 1,385 1,201 Total non-current

liabilities 23,559 18,980

Total Liabilities

28,102 23,184 3.625% convertible perpetual preferred

stock (at liquidation value, net of issuance costs) 249 249

Redeemable noncontrolling interest in subsidiaries 28 2

Commitments and Contingencies Stockholders’ Equity

Common stock 4 4 Additional paid-in capital 8,314 7,840 Retained

earnings 3,564 3,695 Less treasury stock, at cost — 77,219,145 and

77,347,528 shares, respectively (1,939 ) (1,942 ) Accumulated other

comprehensive (loss)/income (5 ) 5 Noncontrolling interest 1,752

865

Total Stockholders’ Equity 11,690

10,467

Total Liabilities and Stockholders’ Equity $

40,069 $ 33,902

NRG ENERGY, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (Unaudited) Nine months ended September

30, 2014 2013 (In millions) Cash

Flows from Operating Activities Net Income/(loss) $ 35 $ (62 )

Adjustments to reconcile net income/(loss) to net cash provided by

operating activities: Distributions and equity in earnings of

unconsolidated affiliates 32 23 Depreciation and amortization 1,096

947 Provision for bad debts 49 49 Amortization of nuclear fuel 33

27 Amortization of financing costs and debt discount/premiums (9 )

(22 ) Adjustment for debt extinguishment 24 (15 ) Amortization of

intangibles and out-of-market contracts 52 75 Amortization of

unearned equity compensation 32 32 Changes in deferred income taxes

and liability for uncertain tax benefits (75 ) 39 Changes in

nuclear decommissioning trust liability 12 25 Changes in derivative

instruments 248 189 Changes in collateral deposits supporting

energy risk management activities (100 ) (59 ) Loss/(gain) on sale

of emission allowances 2 (8 ) Gain on sale of assets (26 ) —

Impairment losses 70 — Cash used by changes in other working

capital (361 ) (417 )

Net Cash Provided by Operating

Activities 1,114 823

Cash Flows from Investing

Activities Acquisitions of businesses, net of cash acquired

(2,832 ) (374 ) Capital expenditures (675 ) (1,581 ) Increase in

restricted cash, net (52 ) (67 ) Decrease/(increase) in restricted

cash to support equity requirements for U.S. DOE funded projects 21

(20 ) Decrease/(increase) in notes receivable 21 (22 ) Investments

in nuclear decommissioning trust fund securities (475 ) (369 )

Proceeds from sales of nuclear decommissioning trust fund

securities 463 344 Proceeds from renewable energy grants 431 52

Proceeds from sale of assets, net of cash disposed of 153 13 Cash

proceeds to fund cash grant bridge loan payment 57 — Other (70 ) (7

)

Net Cash Used by Investing Activities (2,958 ) (2,031 )

Cash Flows from Financing Activities Payment of dividends to

common and preferred stockholders (140 ) (113 ) Payment for

treasury stock — (25 ) Net (payments for)/receipts from settlement

of acquired derivatives that include financing elements (64 ) 177

Proceeds from issuance of long-term debt 4,456 1,605 Contributions

and sale proceeds from noncontrolling interest in subsidiaries 639

504 Proceeds from issuance of common stock 15 14 Payment of debt

issuance costs (57 ) (43 ) Payments for short and long-term debt

(3,308 ) (868 )

Net Cash Provided by Financing Activities

1,541 1,251 Effect of exchange rate changes on cash

and cash equivalents 2 (1 )

Net (Decrease)/Increase in

Cash and Cash Equivalents (301 ) 42

Cash and Cash

Equivalents at Beginning of Period 2,254 2,087

Cash and Cash Equivalents at End of Period $ 1,953 $

2,129

Appendix Table A-1: Third Quarter 2014

Regional Adjusted EBITDA Reconciliation

The following table summarizes the calculation of Adjusted EBITDA

and provides a reconciliation to net income/ (loss)

Gulf NRG ($

in millions)

Retail Coast

East West Yield

Renewables Corp Total Net

Income/(Loss) Attributable to NRG Energy, Inc. 88 147

223 76 25 (34) (357) 168

Plus:

Net Income Attributable to Non-Controlling

Interest

- - - - 6 12 (4) 14 Interest Expense, net - 4 13 4 40 34 182 277

Loss on Debt Extinguishment - - - - - - 13 13 Income Tax - - - - 10

- 79 89

Depreciation, Amortization and ARO

Expense

32 153 68 20 34 64 13 384 Amortization of Contracts -

5 (17) 7 8 4 (1) 6

EBITDA 120 309 287 107

123 80 (75) 951

Adjustment to reflect NRG share of

Adjusted EBITDA in unconsolidated affiliates

- - - 2 15 (4) 8 21 Integration and Transaction Costs 1 - 1 - 2 -

14 18 Deactivation Costs - - 8 1 - - - 9 Sale of Businesses - - - -

- - - - Asset Write Offs and Impairments - 10 60 - - 12 7 89

Market to Market (MtM) Losses/(Gains) on

economic hedges

75 (138) (14) 3 - -

- (74)

Adjusted EBITDA 196

181 342 113

140 88 (46) 1,014

Appendix Table A-2: Third Quarter 2013

Regional Adjusted EBITDA Reconciliation

The following table summarizes the calculation of Adjusted EBITDA

and provides a reconciliation to net income/ (loss)

Gulf

NRG ($ in millions)

Retail Coast

East West Yield

Renewables Corp Total Net

Income/(Loss) Attributable to NRG Energy, Inc. (56)

282 241 22 40 (7) (403)

119 Plus:

Net Income Attributable to Non-Controlling

Interest

-

-

- -

9

17

(7)

19 Interest Expense, net 1 4 12 1 20 12

174

224 Loss on Debt Extinguishment -

-

- -

-

-

1

1 Income Tax -

-

- -

5

-

155

160

Depreciation, Amortization and ARO

Expense

37 142 89 13 19 26

3

329 Amortization of Contracts 10 3 17

(2)

1

-

2

31

EBITDA (8) 431 359 34

94 48 (75) 883

Adjustment to reflect NRG share of

Adjusted EBITDA in unconsolidated affiliates

- 1 - 13

8

(12)

17

27 Integration and Transaction Costs -

-

- -

-

-

26

26 Deactivation Costs -

-

5 2

-

-

-

7 Asset Write Offs and Impairments -

-

1 -

1

3

(1)

4

Market to Market (MtM) Losses/(Gains) on

economic hedges

188 (184) 50 (2)

-

1

-

53

Adjusted EBITDA 180

248 415 47

103

40 (33) 1,000

Appendix Table A-3: YTD Third Quarter

2014 Regional Adjusted EBITDA Reconciliation

The following table summarizes the calculation of Adjusted EBITDA

and provides a reconciliation to net income/ (loss)

Gulf NRG ($

in millions)

Retail Coast

East West Yield

Renewables Corp Total Net

Income/(Loss) Attributable to NRG Energy, Inc. 267

(56) 448 117 75

(101)

(735) 15 Plus:

Net Income Attributable to Non-Controlling

Interest

- - - - 16 15 (11) 20 Interest Expense, net 1 39 10 8 96 92 552 798

Loss on Debt Extinguishment - - - - - - 94 94 Income Tax 1 - - - 15

- (84) (68)

Depreciation, Amortization and ARO

Expense

98 442 208 63 94 171 35 1,111 Amortization of Contracts 3

17 (36) 4 8 4 (1)

(1)

EBITDA 370 442 630 192

304 181 (150) 1,969

Adjustment to reflect NRG share of

Adjusted EBITDA in unconsolidated affiliates

- 1 - (2) 35 (1) 19 52 Integration and Transaction Costs 1 - 2 - 2

- 65 70 Deactivation Costs - - 10 5 - - - 15 Legal Settlement 4 - -

- - - - 4 Sale of Businesses - (23) 5 - - - - (18) Asset Write Offs

and Impairments - 15 60 - - 12 9 96

Market to Market (MtM) Losses/(Gains) on

economic hedges

102 (109) 316 4 - -

- 313

Adjusted EBITDA 477

326 1,023 199 341

192 (57) 2,501

Appendix Table A-4: YTD Third Quarter

2013 Regional Adjusted EBITDA Reconciliation

The following table summarizes the calculation of Adjusted EBITDA

and provides a reconciliation to net income/ (loss)

Gulf NRG ($

in millions)

Retail Coast

East West Yield

Renewables Corp Total Net

Income/(Loss) Attributable to NRG Energy, Inc. 231 31

216 54

86

(45) (662) (89) Plus:

Net Income Attributable to Non-Controlling

Interest

-

-

- - 9 27 (9) 27 Interest Expense, net 2 12 39 1 31 34 502 621 Loss

on Debt Extinguishment -

-

- -

-

- 50 50 Income Tax -

-

- -

5

- (60) (55)

Depreciation, Amortization and ARO

Expense

105 416 267 41 39 73 18 959 Amortization of Contracts 49

14 (4) (5)

1

- - 55

EBITDA 387 473

518 91

171

89 (161) 1,568

Adjustment to reflect NRG share of

Adjusted EBITDA in unconsolidated affiliates

- 2 - 14 28 -

16

60 Integration and Transaction Costs -

-

- -

-

-

95

95 Deactivation Costs -

-

14 4

-

-

-

18 Asset Write Offs and Impairments - 3 1 -

1

3

-

8

Market to Market (MtM) Losses/(Gains) on

economic hedges

36 (24) 209 (3)

-

-

-

218

Adjusted EBITDA 423

454 742 106

200

92 (50) 1,967

Appendix Table A-5: 2014 and 2013 Third

Quarter Adjusted Cash Flow from Operations Reconciliations

The following table summarizes the calculation of adjusted cash

flow operating activities providing a reconciliation to net cash

provided by operating activities

Three months ended

Three months ended ($ in millions)

September 30,

2014

September 30, 2013 (1)

Net Cash Provided by Operating Activities 744

901 Adjustment for change in collateral (197) (99)

Reclassifying of net receipts (payments) for settlement of acquired

derivatives that include financing elements 103 6 Add: Merger and

integration expenses 12 36

Adjusted Cash Flow from

Operating Activities 662 844

Maintenance CapEx, net2 (27) (52) Environmental CapEx, net (92)

(17) Preferred dividends (2) (2) Distributions to non-controlling

interests (15) _ Free cash flow – before Growth

investments 526 773 (1) Revised to reflect new

Adjusted Cash Flow from Operating Activities methodology (2)

Excludes merger and integration CapEx of $7 million and $11 million

in 2014 and 2013, respectively

Appendix Table A-6: 2014

and 2013 YTD Third Quarter Adjusted Cash Flow from Operations

Reconciliations

The following table summarizes the

calculation of adjusted cash flow operating activities providing a

reconciliation to net cash provided by operating activities

Nine months ended Nine months ended ($

in millions)

September 30, 2014

September 30, 2013 (1)

Net Cash Provided by Operating Activities 1,114

823 Adjustment for change in collateral 100 59 Reclassifying

of net receipts (payments) for settlement of acquired derivatives

that include financing elements (64) 177 Add: Merger and

integration expenses 76 116

Adjusted Cash Flow

from Operating Activities 1,226

1,175 Maintenance CapEx, net2 (191) (222) Environmental

CapEx, net (178) (50) Preferred dividends (7) (7) Distributions to

non-controlling interests (38) _ Free cash flow –

before Growth investments 812 896 (1)

Revised to reflect new Adjusted Cash Flow from Operating Activities

methodology (2) Excludes merger and integration CapEx of $20

million and $21 million in 2014 and 2013, respectively

Appendix Table A-8: Adjusted NRG Yield Drop Down Assets

Projected Reg G.The following table summarizes the

calculation of Adjusted EBITDA and CAFD and provides a

reconciliation to income before taxes:

2014 Q4 Drop Downs (dollars in millions)

Income Before Taxes 3 Adjustments to

net income to arrive at Adjusted EBITDA: Depreciation and

amortization 81 Interest expense, net 36

Adjusted

EBITDA 120 Cash Interest Paid (33) Working Capital /

Other 1 Maintenance capital expenditures ‒ Principal amortization

of indebtedness (53)

Cash Available for Distribution

35

EBITDA and Adjusted EBITDA are non-GAAP financial measures.

These measurements are not recognized in accordance with GAAP and

should not be viewed as an alternative to GAAP measures of

performance. The presentation of Adjusted EBITDA should not be

construed as an inference that NRG’s future results will be

unaffected by unusual or non-recurring items.

EBITDA represents net income before interest (including loss on

debt extinguishment), taxes, depreciation and amortization. EBITDA

is presented because NRG considers it an important supplemental

measure of its performance and believes debt-holders frequently use

EBITDA to analyze operating performance and debt service capacity.

EBITDA has limitations as an analytical tool, and you should not

consider it in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are:

- EBITDA does not reflect cash

expenditures, or future requirements for capital expenditures, or

contractual commitments;

- EBITDA does not reflect changes in, or

cash requirements for, working capital needs;

- EBITDA does not reflect the significant

interest expense, or the cash requirements necessary to service

interest or principal payments, on debt or cash income tax

payments;

- Although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and EBITDA does not

reflect any cash requirements for such replacements; and

- Other companies in this industry may

calculate EBITDA differently than NRG does, limiting its usefulness

as a comparative measure.

Because of these limitations, EBITDA should not be considered as

a measure of discretionary cash available to use to invest in the

growth of NRG’s business. NRG compensates for these limitations by

relying primarily on our GAAP results and using EBITDA and Adjusted

EBITDA only supplementally. See the statements of cash flow

included in the financial statements that are a part of this news

release.

Adjusted EBITDA is presented as a further supplemental measure

of operating performance. Adjusted EBITDA represents EBITDA

adjusted for mark-to-market gains or losses, asset write offs and

impairments; and factors which we do not consider indicative of

future operating performance. The reader is encouraged to evaluate

each adjustment and the reasons NRG considers it appropriate for

supplemental analysis. As an analytical tool, Adjusted EBITDA is

subject to all of the limitations applicable to EBITDA. In

addition, in evaluating Adjusted EBITDA, the reader should be aware

that in the future NRG may incur expenses similar to the

adjustments in this news release.

Adjusted cash flow from operating activities is a non-GAAP

measure NRG provides to show cash from operations with the

reclassification of net payments of derivative contracts acquired

in business combinations from financing to operating cash flow, as

well as the add back of merger and integration related costs. The

Company provides the reader with this alternative view of operating

cash flow because the cash settlement of these derivative contracts

materially impact operating revenues and cost of sales, while GAAP

requires NRG to treat them as if there was a financing activity

associated with the contracts as of the acquisition dates. The

Company adds back merger and integration related costs as they are

one time and unique in nature and do not reflect ongoing cash from

operations and they are fully disclosed to investors.

Free cash flow (before Growth investments) is adjusted cash flow

from operations less maintenance and environmental capital

expenditures, net of funding, and preferred stock dividends and is

used by NRG predominantly as a forecasting tool to estimate cash

available for debt reduction and other capital allocation

alternatives. The reader is encouraged to evaluate each of these

adjustments and the reasons NRG considers them appropriate for

supplemental analysis. Because we have mandatory debt service

requirements (and other non-discretionary expenditures) investors

should not rely on free cash flow before Growth investments as a

measure of cash available for discretionary expenditures.

NRG Energy, Inc.Media:Karen Cleeve, 609-524-4608David Knox,

832-357-5730orInvestors:Chad Plotkin, 609-524-4526

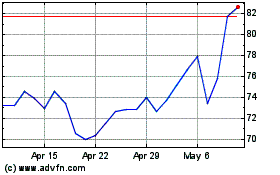

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2024 to May 2024

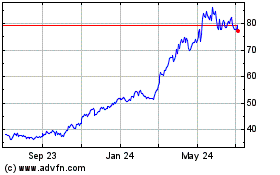

NRG Energy (NYSE:NRG)

Historical Stock Chart

From May 2023 to May 2024