UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2014

|

SEARCHCORE, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-51225

|

|

43-2041643

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

500 North Northeast Loop 323

Tyler, TX 75708

(Address of principal executive offices) (zip code)

(855) 266-4663

(Registrant’s telephone number, including area code)

_______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

Item 1.02 Termination of a Material Definitive Agreement.

On May 19, 2014, we sold the domain names listed in our Current Report on Form 8-K dated May 12, 2014, and filed with the Commission on May 23, 2014, to Platinum Technology Ventures, LLC. In connection with Platinum’s acquisition of those domain names, and to assist in its operations, we agreed to loan Platinum Fifteen Thousand Dollars ($15,000) per month for six (6) months, for an aggregate loan of Ninety Thousand Dollars ($90,000). Platinum was obligated to begin repaying this loan seven (7) months after it was issued, and its repayment obligations will continue for the following six (6) months.

After making payments to Platinum in the sum of Forty Five Thousand Dollars ($45,000), on October 28, 2014, we entered into a Waiver and Mutual Release, pursuant to which both parties agreed to release one another from any and all rights and liabilities arising under the promissory note pertaining to the operating expense payments. Accordingly, we have no continuing obligation to make operating expense payments to Platinum, and Platinum has no obligation to repay the monies already paid.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

10.1(1)

|

Non-Recourse Secured Promissory Note dated May 19, 2014 (Operating Expenses)

|

| |

|

|

10.2

|

Waiver and Mutual Release

|

(1) Incorporated by reference from our Current Report on Form 8-K dated May 12, 2013, and filed with the Securities and Exchange Commission on May 23, 2013.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SearchCore, Inc.

|

|

| |

|

|

|

|

Dated: October 29, 2014

|

|

/s/ James Pakulis

|

|

| |

By: |

James Pakulis

|

|

| |

Its: |

President and Chief Executive Officer

|

|

3

EXHIBIT 10.2

WAIVER AND MUTUAL RELEASE

This Waiver and Mutual Release (this “Agreement”), is made and entered into on October 23, 2014 (the “Effective Date”), between Platinum Technologies Ventures, LLC, a Nevada limited liability company (“Payor”) and SearchCore, Inc., a Nevada corporation (“Holder”). Payor and Holder may be referred to herein as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, Payor is obligated to pay Holder, pursuant to that certain Operating Expesnes Non-Recourse Secured Promissory Note (the “Note”), the sum of up to Ninety Thousand Dollars ($90,000), which amount was to be advanced to Payor by Holder for operating expenses at the rate of Fifteen Thousand Dollars ($15,000) per month (the “Operating Expense Advances”);

WHEREAS, as of the date hereof, Holder has advanced a total of Forty Five Thousand Dollars ($45,000) to Payor as Operating Expense Advances pursuant to the Note;

WHEREAS, the Parties wish to discharge one another from any further obligations arising under the Note and forever resolve any disputes among them related thereto.

NOW, THEREFORE, in consideration of the conditions, covenants and agreements set forth below, and other good and valuable consideration, the sufficiency of which is hereby acknowledged, Payor and Holder agree as follows:

AGREEMENT

1. Incorporation. The above-mentioned recitals are hereby incorporated into, and made a part of, this Agreement.

2. Consideration. As consideration for the release, promises, and restrictive covenants set forth in this Agreement, (i) Payor agrees that Holder has no obligation to pay any additional Operating Expense Advances and (ii) Holder agrees that Payor is not obligated to repay Holder any outstanding principal amount or any accrued interest arising under the Note.

3. Release. As a material inducement for the Parties to enter into this Agreement, the Parties hereby release and forever discharge one another and each of their respective past and present predecessors, successors, affiliates, subsidiaries, parents, insurers, officers, directors, employees, managers, members, shareholders, heirs, agents, and attorneys from any and all known and unknown claims, disputes, demands, debts, liabilities, obligations, contracts, agreements, causes of action, suits, attorneys’ fees and/or costs, of whatever nature, character or description, which the Parties had, now have, or may have related to the Note. For purposes of this Agreement, “affiliate” shall include, but not be limited to, any officers or directors of the Parties as of the date of this Agreement.

4. Scope of Release. This release does not preclude an action to enforce the specific terms of this Agreement.

5. Waiver of Claims. It is understood and agreed by the Parites that all rights under Section 1542 of the Civil Code of California, which provides as follows:

“A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his settlement with the debtor,”

are hereby expressly waived. The Parties acknowledge, agree and understand the consequences of a waiver of Section 1542 of the California Civil Code and assume full responsibility for any and all injuries, damages, losses or liabilities that may hereinafter arise out of or be related to matters released hereunder. The Parties understand and acknowledge that the significance and consequence of this waiver of Section 1542 of the Civil Code is that even if the Parties should eventually suffer additional damages arising out of the subject matter hereof, they will not be permitted to make any claim for those damages. Furthermore, the Parties acknowledge that they intend these consequences even as to claims for damages that may exist as of the date of this Agreement but which they do not know exist, and which, if known, would materially affect their decision to execute this Agreement, regardless of whether the Parties’ lack of knowledge is the result of ignorance, oversight, error, negligence, or any other cause.

6. Further Action. The Parties shall execute and deliver all documents, provide all information and take or forebear from taking all such action(s) as may be necessary or appropriate to achieve the purpose of this Agreement.

7. Legal Counsel. Each Party acknowledges and represents that, in executing this Agreement, such Party has had the opportunity to consult legal counsel, and has not relied on any inducements, promises, or representations made by any Party or any party representing or serving such Party, unless expressly set forth herein.

8. No Admission of Liability. This Agreement does not constitute an admission of liability by any Party for any purpose, except as otherwise provided herein.

9. Amendment; Cancellation. This Agreement may not be amended, canceled, revoked or otherwise modified except by written agreement subscribed by all of the Parties to be charged with such modification.

10. Binding Effect. This Agreement shall be binding upon and shall inure to the benefit of the Parties hereto and their respective partners, employees, agents, servants, heirs, administrators, executors, successors, representatives and assigns.

11. Choice of Law and Venue. This Agreement and the rights of the parties hereunder shall be governed by and construed in accordance with the laws of the State of California including all matters of construction, validity, performance, and enforcement and without giving effect to the principles of conflict of laws. Venue for any action brought under this Agreement shall be in the appropriate court in Orange County, California.

12. Entire Agreement. This Agreement and the attached exhibit sets forth the entire agreement and understanding of the Parties hereto and supersedes any and all prior agreements, arrangements and understandings related to the subject matter hereof.

13. Attorneys’ Fees. The Parties hereto agree that in the event of any breach of this Agreement, the Party determined to be responsible for the breach will pay all costs and fees incurred by the Party enforcing this Agreement, including attorney fees, whether incurred with or without suit or before or after judgment.

14. Authority to Sign. Each person executing this Agreement hereby warrants and represents that he or she has the power and authority to execute this Agreement on behalf of such Party and on behalf of any other person and/or entity that such signing Party purports to bind.

15. Interpretation of Agreement. This Agreement shall be construed as though all Parties equally drafted it.

16. Counterparts. The Parties agree that this Agreement may be executed in multiple counterparts and, upon such execution, all the counterparts taken together shall constitute one and the same agreement. Counterparts and signatures transmitted by facsimile or email (pdf) shall be valid and effective as originals.

[remainder of page intentionally left blank; signature page to follow]

PLEASE READ CAREFULLY, THIS SETTLEMENT AGREEMENT, WAIVER AND MUTUAL RELEASE INCLUDES A RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS.

IN WITNESS WHEREOF, the Parties hereto have duly executed this Agreement as of the date first above written.

|

“Payor”

|

|

“Holder”

|

|

|

|

|

|

|

|

|

Platinum Technology Ventures, LLC,

|

|

SearchCore, Inc.,

|

|

|

a Nevada limited liability company

|

|

a Nevada corporation

|

|

|

|

|

|

|

|

|

|

/s/ Brent Inzer

|

|

|

/s/ James Pakulis

|

|

|

By:

|

Brent Inzer

|

|

By:

|

James Pakulis

|

|

|

Its:

|

Member/Manager

|

|

Its:

|

Chief Executive Officer

|

|

4

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

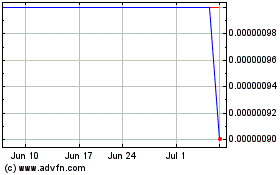

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Apr 2023 to Apr 2024