Current Report Filing (8-k)

October 31 2014 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_________________

Date of Report (Date of earliest event reported): October 31, 2014

Centrus Energy Corp.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 1-14287 | 52-2107911 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

Two Democracy Center

6903 Rockledge Drive

Bethesda, MD 20817

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (301) 564-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

As previously reported, on March 5, 2014 (the "Petition Date"), USEC Inc. ("USEC" or the "Debtor") filed a voluntary petition for relief (the "Bankruptcy Filing") under Chapter 11 of Title 11 of the United States Code in the United States Bankruptcy Court for the District of Delaware (the "Bankruptcy Court") case number 14-10475. On September 5, 2014, the Bankruptcy Court entered an order approving and confirming the Debtor’s proposed Plan of Reorganization (the “Plan”). On September 30, 2014 (the "Effective Date"), the Company satisfied the conditions of the order and the Plan became effective. On the Effective Date, USEC’s name was changed to Centrus Energy Corp. (the "Company").

On October 31, 2014, the Company filed its monthly operating report for the month of September 2014 (the "Monthly Operating Report") with the Bankruptcy Court which will be the final monthly operating report filed in the bankruptcy case. The Monthly Operating Report is attached hereto as Exhibit 99.1. The Monthly Operating Report does not reflect the Company’s subsidiaries which were not part of the Bankruptcy Filing. This current report (including the exhibit hereto or any information included therein) shall not be deemed an admission as to the materiality of any information required to be disclosed solely by reason of Regulation FD.

In accordance with General Instruction B.2 of Form 8-K, the information in this current report, including the exhibit hereto, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Statement Regarding Financial and Operating Data

The Monthly Operating Report is limited in scope, covers limited time periods and has been prepared solely for the purpose of complying with the Bankruptcy Court’s monthly reporting requirements, including the Company’s use of assets and cash position during the bankruptcy case. The Monthly Operating Report was prepared in accordance with U.S. GAAP but certain information and notes normally included have been omitted, has not been audited or reviewed by independent accountants, is in a format prescribed by applicable bankruptcy laws and regulations and is subject to future adjustment and reconciliation.

The Company cautions investors and potential investors not to place undue reliance upon the information contained in the Monthly Operating Report, which was not prepared for the purpose of providing the basis for an investment decision relating to any of the securities of the Company. The Monthly Operating Report contains information that may not be indicative of the Company’s financial condition or operating results for the period that would be reflected in the Company’s financial statements or in its reports filed pursuant to the Securities Exchange Act, and are not comparable with those filings. There can be no assurance that, from the perspective of an investor or potential investor in the Company’s securities, that the Monthly Operating Report is complete. Results set forth in the Monthly Operating Report should not be viewed as indicative of future results.

Cautionary Statement Regarding Forward-Looking Statements

This current report on Form 8-K and the exhibits hereto contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 - that is, statements related to future events. In this context, forward-looking statements may address our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will” and other words of similar meaning. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For Centrus Energy Corp., particular risks and uncertainties that could cause our actual future results to differ materially from those expressed in our forward-looking statements include, but are not limited to, uncertainty regarding our ability to improve our operating structure, financial results and profitability following emergence from Chapter 11; risks related to the ongoing transition of our business; and other risks and uncertainties discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and quarterly reports on Form 10-Q. Revenue and operating results can fluctuate significantly from quarter to quarter, and in some cases, year to year. We do not undertake to update our forward-looking statements except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

Number Description

| |

99.1 | Monthly Operating Report for the month of September 2014 filed with the United States Bankruptcy Court for the District of Delaware. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| Centrus Energy Corp. |

| | | |

| | | |

October 31, 2014 | By: | /s/ John C. Barpoulis | |

| | John C. Barpoulis | |

| Senior Vice President and Chief Financial Officer |

| (Principal Financial Officer) |

EXHIBIT INDEX

Exhibit

| |

99.1 | Monthly Operating Report for the month of September 2014 filed with the United States Bankruptcy Court for the District of Delaware. |

|

| | | | |

| | | EXHIBIT 99.1 |

| UNITED STATES BANKRUPTCY COURT |

| FOR THE DISTRICT OF DELAWARE |

| | | | |

In re USEC Inc. | | | |

| | Case No. | 14-10475 (CSS) |

| | Reporting Period: | | 29-Sep-14 |

| | | | |

| | Federal Tax I.D. # | | 52-2107911 |

| | | | |

| CORPORATE MONTHLY OPERATING REPORT |

| | | | |

| File with the Court and submit a copy to the United States Trustee within 30 days after the end of | |

| the month and submit a copy of the report to any official committee appointed in the case. | |

| | | | |

| REQUIRED DOCUMENTS | Form No. | Document Attached | Explanation Attached |

| Schedule of Cash Receipts and Disbursements | MOR-1a | x | |

| Bank Account Information | MOR-1b | x | |

| Copies of bank statements (See Notes to the MOR) | | | x |

| Cash disbursements journals (See Notes to the MOR) | | | x |

| Statement of Operations (Income Statement) | MOR-2 | x | |

| Balance Sheet | MOR-3 | x | |

| Status of Post-petition Taxes | MOR-4 | x | |

| Copies of IRS Form 6123 or payment receipt (See Notes to the MOR) | | | x |

| Copies of tax returns filed during reporting period (See Notes to the MOR) | | | x |

| Summary of Unpaid Post-petition Debts | MOR-4 | x | |

| Listing of Aged Accounts Payable (See Notes to the MOR) | | | x |

| Accounts Receivable Reconciliation and Aging | MOR-5 | x | |

| Payments to Professionals | MOR-6 | x | |

| Post Petition Secured Notes Adequate Protection Payments | MOR-6 | x | |

| Debtor Questionnaire | MOR-7 | x | |

| | | | |

| I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents | |

| are true and correct to the best of my knowledge and belief. | | | |

| | | | |

| /s/ John R. Castellano | | October 31, 2014 |

| Signature of Authorized Individual* | | Date | |

| | | | |

| John R. Castellano | | | |

| Printed Name of Authorized Individual | | | |

| | | | |

| Chief Restructuring Officer | | | |

| Title | | | |

| | | | |

| *Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if | |

| debtor is a partnership; a manager or member if debtor is a limited liability company. | |

|

| | | |

| | | MOR NOTES |

| | | |

In re USEC Inc. | | | |

| | Case No. | 14-10475 (CSS) |

| | Reporting Period: | 29-Sep-14 |

| | | |

| | Federal Tax I.D. # | 52-2107911 |

| | | |

Notes to the Monthly Operating Report |

| | | |

GENERAL: | | | |

The report includes activity from the following Debtor: | | | |

| | | |

Debtor | Case Number | | |

USEC Inc. | 14-10475 (CSS) | | |

| | | |

Notes to MOR-1a: | | | |

| | | |

The period covered in this report, unless otherwise noted, ends September 29th (the last day prior to the Effective Date). |

As such, no Plan of Reorganization consummation transactions (such as payment of pre-petition liabilities) are shown. |

| | | |

Cash disbursements shown are based on a book basis which consider a disbursement made when a check is |

issued, as opposed to when a check is presented for payment. | | |

| | | |

Cash amounts do not include interest on the DIP Loan, which is accrued to the outstanding DIP Loan balance. |

| | | |

Notes to MOR-1b: | | | |

| | | |

All amounts listed represent the bank balances as of September 29th (the last day prior to the consummation of the Plan). |

| | | |

Copies of the bank statements and cash disbursement journals were not included with the MOR but are available |

upon request. | | | |

| | | |

Notes to MOR-2/3: | | | |

| | | |

The Income Statement shown on MOR-2 and Balance Sheet shown on MOR-3 cover activity through September 29th |

(the last day prior to the Effective Date) and as such exclude reorganization-related items such as relief of debt. |

| | | |

The cash amount shown on MOR-3 varies from the bank cash balance shown on MOR-1b due to deposits in transit. |

|

The unaudited condensed financial statements as of and for the one month ended September 29, 2014 have been |

prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Certain |

information and notes normally included in financial statements prepared in accordance with GAAP have been |

omitted. The unaudited condensed financial statements reflect all adjustments which are, in the opinion of management, |

necessary for a fair statement of the financial results for the interim period. | |

| | | |

The Income Statement reflects revenue and expenses that directly correspond to the debtor legal entity, USEC Inc., |

and does not include non-debtor affiliates and subsidiaries. | | |

| | | |

The Balance Sheet shows the amounts immediately prior to consummation of the Plan of Reorganization. |

| | | |

The Balance Sheet reflect assets, liabilities, and stockholders equity that directly correspond to the debtor legal entity, |

USEC Inc., and does not include non-debtor affiliates and subsidiaries. | | |

|

| | | |

| | | MOR NOTES |

| | | |

In re USEC Inc. | | | |

| | Case No. | 14-10475 (CSS) |

| | Reporting Period: | 29-Sep-14 |

| | | |

| | Federal Tax I.D. # | 52-2107911 |

| | | |

Notes to the Monthly Operating Report |

| | | |

Notes to MOR-4: | | | |

| | | |

The tax accrual, payments and ending liabilities reflect the period through September 30th and thus may include |

post-emergence activity. |

|

USEC Inc. received an order which allows the payment of pre-petition taxes. The tax walkforward will reflect |

both pre-petition and post-petition taxes. |

| | | |

USEC Inc. does not expect to be required to make any federal or state income tax payments. |

| | | |

USEC Inc. files tax returns and makes tax payments periodically. The tax returns and related payments will be made |

available upon request. | | | |

| | | |

USEC Inc. is current on all post petition payments other than disputes that arise in the ordinary course of business |

and amounts expected to be but not yet authorized for payment by the Bankruptcy Court. |

| | | |

Due to the volume of activity the detailed listing of aged post petition payables is not included. |

| | | |

The post petition accounts payable reported represent open and outstanding trade vendor invoices that have been |

entered into the Debtor's accounts payable system and does not include accruals for invoices not yet received or approved. |

| | | |

Notes to MOR-5: | | | |

| | | |

Accounts receivable represents amounts due from Oak Ridge National Laboratory for the American Centrifuge |

Demonstration and Operation (ACTDO) agreement. |

| | | |

Notes to MOR-6: | | | |

| | | |

Interest on the Debtor-in-Possession (DIP) Facility and Secured Intercompany Loan are accrued to the loan balance |

and do not result in a cash payment. | | |

| | | |

Notes to MOR-7: | | | |

| | | |

USEC Inc. has received orders that allow payment of certain pre-petition liabilities such as employee benefits |

and employee expense reimbursement. | | |

| | | |

The DIP Lender is the Debtor's non-debtor affiliate, United States Enrichment Corporation subsidiary. |

Funding was provided under the DIP during the month (amount shown on Schedule MOR-1a). |

|

In September 2014, the Debtor made property tax payments to the City of Oak Ridge based on property reported |

on assessment dates in the pre-petition period. |

|

| | | | |

| | | MOR-1a |

|

| | | |

In re USEC Inc. | | | |

| | Case No. | 14-10475 (CSS) |

|

| | Reporting Period: | 29-Sep-14 |

|

| | | |

| | Federal Tax I.D. # | 52-2107911 |

|

| | | |

Schedule of Cash Receipts and Disbursements |

(000's) |

| | | TIME PERIOD: |

| | | 9/1/2014 - 9/29/2014 |

| | | |

| | | |

Debtor | Activity | Amounts |

USEC Inc. | Beginning Total Cash (Bank Balance) | $7,998 |

| | Less: Outstanding Checks & Bank Adjustments | (702 | ) |

| Beginning Total Cash (Book Balance) | $7,296 |

| | | |

| Receipts | | |

| | DOE RD&D Reimbursement | — |

|

| | ORNL ACTDO Receipts | 6,742 |

|

| | Asset Proceeds | — |

|

| | Other Receipts | 4,085 |

|

| | Total Operating Receipts | 10,827 |

|

| | | |

| Disbursements (book basis) | |

| | Headquarters Payroll & Benefits | (3,295 | ) |

| | Headquarters Overhead | (680 | ) |

| | Headquarters Outside Services | (154 | ) |

| | ACP Payroll & Benefits | (2,912 | ) |

| | ACP Machine Technology & Operations | (1,565 | ) |

| | ACP Manufacturing, EPC and PETE | (5,464 | ) |

| | Total Operating Disbursements | (14,069 | ) |

| | | |

| Non-Operating Items: | |

| | Professional Fees | (632 | ) |

| | Interest | — |

|

| | Other (Utility Deposit) | — |

|

| | Total Non-Operating Disbursements | (632 | ) |

| | | |

| | Total Disbursements | (14,700 | ) |

| | | |

| Funding Activities: | |

| | Cash funding provided by draws on DIP: | 8,000 |

|

| | Cash payments on DIP | (10,826 | ) |

| | Cash payments on Pre-Petition Secured Loan | — |

|

| | Total Funding Activities | (2,826 | ) |

| | | |

| Total Change in Cash | (6,699 | ) |

| | | |

| Ending Cash (Book Balance) | 597 |

|

| | Plus: Bank Adjustment, Timing & Bank Interest | — |

|

| | Plus: Outstanding Checks | 677 |

|

| Ending Cash (Bank Balance) | 1,275 |

|

|

| | | |

| | | MOR-1b |

| | | |

| | | |

In re USEC Inc. | | | |

| Case No. | | 14-10475 (CSS) |

| Reporting Period: | | 29-Sep-14 |

| | | |

| Federal Tax I.D. # | | 52-2107911 |

| | | |

Bank Account Information |

(000's) |

| | | |

Legal Entity | Bank | Bank Account | Bank Balance |

USEC Inc. | JP Morgan Chase | XX6272 | $1,050 |

USEC Inc. | JP Morgan Chase | XX5349 | $0 |

USEC Inc. | JP Morgan Chase | XX4574 | $0 |

USEC Inc. | JP Morgan Chase | XX6241 | $175 |

USEC Inc. | JP Morgan Chase | XX7309 | $0 |

USEC Inc. | Merrill Lynch | XX3365 | $0 |

USEC Inc. | JP Morgan Chase | XX2733 | $50 |

| | | |

Total USEC Bank Account Balances, per statements | | $1,275 |

|

| | | | | |

| | | | MOR-2 |

In re USEC Inc. | | | | |

| | Case No. | 14-10475 (CSS) |

| | Reporting Period: | | 29-Sep-14 |

| | Federal Tax I.D. # | | 52-2107911 |

| | | | |

Statement of Operations (Income Statement) |

(000's) |

The Statement of Operations is to be prepared on an accrual basis. The accrual basis of accounting recognizes |

revenue when it is realized and expenses when they are incurred, regardless of when cash is actually received or paid. |

| | | | |

| USEC Inc. | | | |

| 14-10475 (CSS) | | | |

Revenue | | | | |

Separative Work Units | — |

| | | |

Uranium | — |

| | | |

U. S. Government Contracts and Other | 6,742 |

| | | |

Revenue | 6,742 |

| | | |

| | | | |

Cost of Sales | | | | |

Separative Work Units | | | | |

Production Costs | — |

| | | |

Purchase Costs | — |

| | | |

Change in Inventory | — |

| | | |

Non Production Pension Expense | — |

| | | |

| — |

| | | |

ARO Accretion Expense | — |

| | | |

Uranium | — |

| | | |

U. S. Government Contracts and Other | 5,398 |

| | | |

Cost of Sales | 5,398 |

| | | |

| | | | |

Gross Profit | | | | |

Separative Work Units | — |

| | | |

Uranium | — |

| | | |

U. S. Government Contracts and Other | 1,344 |

| | | |

Gross Profit | 1,344 |

| | | |

| | | | |

Gross Margin % | — |

| | | |

| | | | |

Special Charges | (1,832 | ) | | | |

Advanced Technology Costs | 5,023 |

| | | |

Selling, General and Administrative | 3,452 |

| | | |

Other (Income) Expense, Net | 74 |

| | | |

Intercompany Cost Recovery | (3,732 | ) | | | |

Operating Income (Loss) | (1,641 | ) | | | |

| | | | |

Interest Expense | 6,667 |

| | | |

Preferred Stock Financing Costs | — |

| | | |

Interest (Income) | (3 | ) | | | |

Reorganization Costs | 1,345 |

| | | |

Income (Loss) from Continuing Ops before Taxes | (9,650 | ) | | | |

Provision (benefit) for Income Taxes | — |

| | | |

Net Income (Loss) | (9,650 | ) | | | |

Equity in earnings (Loss) of non-filing entities | 3,166 |

| | | |

NET INCOME (LOSS) ATTRIBUTABLE TO USEC INC. | (6,484 | ) | | | |

|

| | | | | | |

| | | | MOR-3 |

|

In re USEC Inc. | | | | |

| | | Case No. | 14-10475 (CSS) |

|

| | | Reporting Period: | 29-Sep-14 |

|

| | | | |

| | | Federal Tax I.D. # | 52-2107911 |

|

| | | | |

Balance Sheet |

(000's) |

The Balance Sheet is to be completed on an accrual basis only. Pre-petition liabilities must be classified separately from post-petition obligations. |

| | | | |

| USEC Inc. | | | |

| 14-10475 (CSS) | | | |

ASSETS | | | LIABILITIES & STOCKHOLDERS' EQUITY | |

| | | | |

CURRENT ASSETS | | | CURRENT LIABILITIES | |

Cash and cash equivalents | 1,900 |

| | Short-term debt (DIP) | 13,200 |

|

Short-term investments | — |

| | Accounts payable and accrued liabilities | 23,800 |

|

Accounts receivable | | | Total Current Liabilities | 37,000 |

|

Customers | — |

| | | |

ORNL/DOE | 6,700 |

| | OTHER LIABILITIES | |

Total Receivables | 6,700 |

| | Postretirement health and life benefit obligations | — |

|

Inventories | | | Pension benefit liabilities | 23,900 |

|

Separative work units | — |

| | Deferred revenue and advances | — |

|

Uranium | — |

| | Other liabilities | 24,400 |

|

Uranium provided by customers | — |

| | Total Other Liabilities | 48,300 |

|

Materials & Supplies | 200 |

| | | |

Total Inventories | 200 |

| | LIABILITIES SUBJECT TO COMPROMISE | 1,001,300 |

|

| | | | |

Deferred Costs Related to Deferred Revenue | — |

| | TOTAL LIABILITIES | 1,086,600 |

|

Receivable from non-filing entity | — |

| | | |

Other | 11,300 |

| | STOCKHOLDERS' EQUITY | |

Total Current Assets | 20,100 |

| | Common stock, par value $.10 per share | 500 |

|

| | | Excess of capital over par value | 153,900 |

|

PROPERTY, PLANT AND EQUIPMENT | | Treasury stock | (38,800 | ) |

Construction work in progress | — |

| | Accumulated other comprehensive income (Loss) | (70,400 | ) |

Leasehold improvements | 1,700 |

| | Equity in Subsidiary | 472,900 |

|

Machinery & equipment | 8,400 |

| | Retained earnings | (1,080,200 | ) |

| 10,100 |

| | Total Stockholders' Equity | (562,100 | ) |

Less: Accumulated depreciation & amortization | (8,600 | ) | | | |

Property, Plant and Equipment, Net | 1,500 |

| | TOTAL LIABILITIES & | |

| | | STOCKHOLDERS' EQUITY | 524,500 |

|

OTHER ASSETS | | | | |

Investment in non-filing entity | 473,500 |

| | | |

Deposit for surety bonds | 29,400 |

| | | |

Total Other Assets | 502,900 |

| | | |

| | | | |

TOTAL ASSETS | 524,500 |

| | | |

| | | | |

| | | | |

|

| | | | | | | | | | | | | | | | | | |

| | | | | | MOR-4 |

|

| | | | | | |

In re USEC Inc. | | | | | | |

| | | | | Case No. |

| 14-10475 (CSS) |

|

| | | | Reporting Period: | | 29-Sep-14 |

|

| | | | | | |

| | | | Federal Tax I.D. # | | 52-2107911 |

|

| | | | | | |

Status of Post-petition Taxes |

| | | (000's) | | | |

| | | | | | |

USEC Inc. | Beginning Tax Liability | Amount Withheld or Accrued | Amount Paid | Ending Tax Liability |

Federal Taxes | | | | | | |

Withholding | | | $ | — |

| $ | 548 |

| $ | (548 | ) | $ | — |

|

FICA-Employee | | | — |

| 206 |

| (206 | ) | — |

|

FICA-Employer | | | 763 |

| 137 |

| (201 | ) | 699 |

|

Unemployment | | | 6 |

| — |

| — |

| 6 |

|

Income | | | — |

| — |

| — |

| — |

|

Other: | | | — |

| — |

| — |

| — |

|

Total Federal | | | $ | 769 |

| $ | 891 |

| $ | (955 | ) | $ | 705 |

|

| | | | | | |

State & Local | | | | | | |

Withholding | | | $ | 10 |

| $ | 118 |

| $ | (115 | ) | $ | 13 |

|

Unemployment | | | — |

| — |

| — |

| — |

|

Sales | | | (1 | ) | 23 |

| (23 | ) | (1 | ) |

Excise | | | — |

| — |

| — |

| — |

|

Real Property | | | — |

| — |

| — |

| — |

|

Personal Property | | | — |

| — |

| — |

| — |

|

Other: Income | | | (19 | ) | — |

| — |

| (19 | ) |

Other: Gross Receipts | | | 21 |

| 11 |

| — |

| 32 |

|

Other: Franchise | | | 12 |

| 15 |

| — |

| 27 |

|

Total State and Local | | | $ | 23 |

| $ | 167 |

| $ | (138 | ) | $ | 52 |

|

| | | | | | |

| | | | | | |

TOTAL Taxes | | | $ | 792 |

| $ | 1,058 |

| $ | (1,093 | ) | $ | 757 |

|

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Summary of Unpaid Post-petition Debts (See Notes to the MOR) |

| | | (000's) | | | |

| | | | | | |

| Days Past Due |

| Current | 1-30 | 31-60 | 61-90 | >91 | Total |

USEC Inc. | $ | 633 |

| $ | 52 |

| $ | 208 |

| $ | — |

| $ | (2 | ) | $ | 891 |

|

|

| | | | | | |

| | | | MOR-5 |

| |

| | | | | |

| | | | | |

In re USEC Inc. | | | | |

| | | Case No. | 14-10475 (CSS) |

| | Reporting Period: | 29-Sep-14 |

| | | | | |

| | | Federal Tax I.D. # | 52-2107911 |

| | | | | |

Accounts Receivable Reconciliation and Aging (See Notes to the MOR) |

(000's) |

| | | | | |

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING |

| Accounts Receivable Reconciliation | | | Amount | |

| Total Accounts Receivable (Net) at the beginning of the reporting period | | $6,797 | |

| + Amounts billed during the period | | | 6,742 |

| |

| - Amounts collected during the period | | | (6,742 | ) | |

| Total Accounts Receivable (Net) at the end of the reporting period | | $6,797 | |

| | | | | |

| Accounts Receivable Aging | | | Amount | |

| Current | | | $6,797 | |

| 0 - 30 days old | | | $0 | |

| 31 - 60 days old | | | $0 | |

| 61 - 90 days old | | | $0 | |

| 91+ days old | | | $0 | |

| Total Accounts Receivable | | | $6,797 | |

| Contractual Allowance / Uncollectible | | | $0 | |

| Accounts Receivable (Net) | | | $6,797 | |

|

| | | | | | | | | | |

| | | | | | MOR-6 |

| | | | | | |

In re USEC Inc. | | | | | |

| | | Case No. | 14-10475 (CSS) |

| | | Reporting Period: | 29-Sep-14 |

| | | | | | |

| | | Federal Tax I.D. # | 52-2107911 |

| | | | | | |

Payments to Professionals |

|

| | | | | | |

| Professionals | | | | | |

| Name | Amount Paid During Month | Total Paid to Date | | | |

| AKIN GUMP STRAUSS HAUER AND FELD LLP | $ | — |

| $ | 663,271 |

| | | |

| HOULIHAN LOKEY CAPITAL INC | 150,312 |

| 901,552 |

| | | |

| LOGAN AND CO INC | 49,672 |

| 271,451 |

| | | |

| BABCOCK & WILCOX (Reimbursement for EA Advisors & Baker Botts) | — |

| 602,239 |

| | | |

| TOSHIBA AMERICA NUCLEAR ENERGY CORP (Reimbursement for GLC & Morrison Foerster) | — |

| 325,851 |

| | | |

| US TRUSTEE | — |

| 40,400 |

| | | |

| AP SERVICES LLP | — |

| 1,857,670 |

| | | |

| LATHAM & WATKINS LLP | 271,465 |

| 1,299,463 |

| | | |

| RICHARDS LAYTON & FINGER | — |

| 204,925 |

| | | |

| YOUNG CONAWAY STARGATT AND TAYLOR LLP | — |

| 486,848 |

| | | |

| LAZARD FRERES AND CO LLC | 160,060 |

| 681,587 |

| | | |

| PRICEWATERHOUSECOOPERS LLP | — |

| 334,885 |

| | | |

| KPMG LLP | — |

| 59,286 |

| | | |

| MORRISON AND FOERSTER LLP | — |

| 69,175 |

| | | |

| MORRIS NICHOLS ARSHT AND TUNNELL LLP | — |

| 13,824 |

| | | |

| GLC ADVISORS AND CO LLC | — |

| 304,971 |

| | | |

| | | | | | |

| Total Payments to Professionals | $ | 631,509 |

| $ | 8,117,400 |

| | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Post Petition Secured Notes Adequate Protection Payments |

|

| | | | | | |

| Name of Creditor | Amount Paid During Month | | | | |

| United States Enrichment Corporation - DIP1 | $ | 164,535 |

| | | | |

| United States Enrichment Corporation - Secured Intercompany1 | 472,117 |

| | | | |

| | | | | | |

| Total Payments | $ | 636,652 |

| | | | |

| (1) Interest on the DIP and Secured Intercompany Loan is charged to the loan and is not a cash payment | |

|

| | | |

| | | MOR-7 |

| | | |

In re USEC Inc. | | |

| | Case No. | 14-10475 (CSS) |

| | Reporting Period: | 29-Sep-14 |

| | | |

| | Federal Tax I.D. # | 52-2107911 |

| | | |

Debtor Questionnaire |

| | | |

| Must be completed each month. If the answer to any of the questions is “Yes”, provide a detailed explanation of each item. Attach additional sheets if necessary. | Yes | No |

1 | Have any assets been sold or transferred outside the normal course of business this reporting period? | | X |

2 | Have any funds been disbursed from any account other than a debtor in possession account this reporting period? | | X |

3 | Is the Debtor delinquent in the timely filing of any post-petition tax returns? | | X |

4 | Are workers compensation, general liability or other necessary insurance coverages expired or cancelled, or has the debtor received notice of expiration or cancellation of such policies? | | X |

5 | Is the Debtor delinquent in paying any insurance premium payment? | | X |

6 | Have any payments been made on pre-petition liabilities this reporting period? | X | |

7 | Are any post petition receivables (accounts, notes or loans) due from related parties? | | X |

8 | Are any post petition payroll taxes past due? | | X |

9 | Are any post petition State or Federal income taxes past due? | | X |

10 | Are any post petition real estate taxes past due? | | X |

11 | Are any other post petition taxes past due? | | X |

12 | Have any pre-petition taxes been paid during this reporting period? | X | |

13 | Are any amounts owed to post petition creditors delinquent? | | X |

14 | Are any wage payments past due? | | X |

15 | Have any post petition loans been been received by the Debtor from any party? | X | |

16 | Is the Debtor delinquent in paying any U.S. Trustee fees? | | X |

17 | Is the Debtor delinquent with any court ordered payments to attorneys or other professionals? | | X |

18 | Have the owners or shareholders received any compensation outside of the normal course of business? | | X |

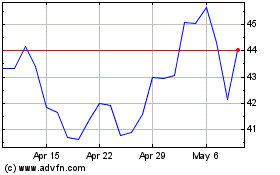

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

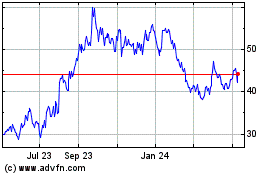

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Apr 2023 to Apr 2024