U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 10-Q

[X] Quarterly report under Section 13 or 15(d) of the Securities

Exchange Act of 1934 For the quarterly period ended September 30, 2014

[ ] Transition report pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Commission File No. 000-33053

_____________________________________

MIND SOLUTIONS, INC.

(Exact name of registrant as specified in its

charter)

| |

|

|

Nevada

(State or other jurisdiction of

incorporation or organization) |

01-0719410

(I.R.S. Employer Identification Number) |

|

3525 Del Mar Heights Road, Suite 802

San Diego, California

(Address of principal executive offices) |

92130

(Zip Code) |

|

(888) 461-3932

(registrant’s telephone number,

including area code) |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirement for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule

12b-2 of the Exchange Act (Check One):

| Large accelerated filer [ ] |

Accelerated filer [ ] |

| Non-accelerated filer [ ] |

Smaller reporting company [X] |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12(b)-2 of the Exchange Act). Yes [ ] No [ X ]

Indicate the number of shares outstanding

of each of the registrant’s classes of common stock, as of the latest practicable date. At October 17, 2014, the registrant

had outstanding 1,081,384,647 shares of common stock.

Table of Contents

|

|

PAGE |

| PART I - FINANCIAL INFORMATION |

|

| Item 1. |

Financial Statements |

3 |

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 |

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

32 |

| Item 4. |

Controls and Procedures |

32 |

| Item

4 (T) |

Controls

and Procedures |

33 |

| PART II - OTHER INFORMATION |

|

| Item 1. |

Legal Proceedings |

33 |

| Item 1A. |

Risk Factors |

34 |

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

34 |

| Item 3. |

Defaults Upon Senior Securities |

34 |

| Item 4. |

Mining Safety Disclosures |

34 |

| Item 5. |

Other Information |

34 |

| Item 6. |

Exhibits |

34 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

| MIND SOLUTIONS, INC. |

| BALANCE SHEETS |

| (Development Stage Registrant) |

| | |

| | | |

| | |

| | |

| (Unaudited) | | |

| (Audited) | |

| | |

| September 30, | | |

| December 31, | |

| Assets: | |

| 2014 | | |

| 2013 | |

| Current Assets | |

| | | |

| | |

| Cash and Cash Equivalents | |

$ | 181,682 | | |

$ | 47,428 | |

| Prepaids | |

| 135,520 | | |

| 289,550 | |

| Total Current Assets | |

| 317,202 | | |

| 336,978 | |

| | |

| | | |

| | |

| Fixed Assets | |

| | | |

| | |

| Property Plant & Equipment | |

| 89,653 | | |

| 86,717 | |

| Accumulated Depreciation | |

| (86,171 | ) | |

| (84,299 | ) |

| Total Fixed Assets | |

| 3,482 | | |

| 2,418 | |

| | |

| | | |

| | |

| Other Assets | |

| | | |

| | |

| Marketable Securities: Available-for-Sale | |

| 1,667 | | |

| — | |

| Total Other Assets | |

| 1,667 | | |

| — | |

| | |

| | | |

| | |

| Total Assets | |

$ | 322,351 | | |

$ | 339,396 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity: | |

| | | |

| | |

| Accounts Payable & Accrued Expenses | |

$ | 378,044 | | |

$ | 394,859 | |

| Accounts Payable to Related Parties | |

| 3,500 | | |

| 3,500 | |

| Accrued Interest | |

| 314,040 | | |

| 277,560 | |

| Notes Payable | |

| 145,000 | | |

| 145,000 | |

| Convertible Notes Payable | |

| 691,667 | | |

| 248,358 | |

| Derivative Liability | |

| 1,043,967 | | |

| 19,907,242 | |

| Total Liabilities | |

| 2,576,218 | | |

| 20,976,519 | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Series A Preferred Stock, $0.001 par value 10,000,000 | |

| | | |

| | |

| shares authorized, 10,000,000 shares issued and outstanding | |

| 10,000 | | |

| — | |

| Common Stock, $0.001 par value 5,000,000,000 | |

| | | |

| | |

| shares authorized, 1,041,355,943 and 36,024,969 shares | |

| | | |

| | |

| issued and outstanding | |

| 1,041,356 | | |

| 36,025 | |

| Stock Payable | |

| — | | |

| 235,375 | |

| Additional Paid-In Capital | |

| 16,933,954 | | |

| 2,807,266 | |

| Accumulated Comprehensive Loss | |

| (378,333 | ) | |

| (330,000 | ) |

| Deficit Accumulated During the Development Stage | |

| (19,860,844 | ) | |

| (23,385,789 | ) |

| Total Stockholders’ Equity (Deficit) | |

| (2,253,867 | ) | |

| (20,637,123 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 322,351 | | |

$ | 339,396 | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. |

| MIND SOLUTIONS, INC. |

| STATEMENTS OF OPERATIONS |

(Development Stage registrant)

(Unaudited)

|

| | |

| |

| |

| |

| |

|

| | |

| |

| |

| |

| |

From Inception |

| | |

For the Three Months Ended | |

For the Nine Months Ended | |

(May 24, 2002) to |

| | |

September 30, | |

September 30, | |

September 30, | |

September 30, | |

September 30, |

| | |

2014 | |

2013 | |

2014 | |

2013 | |

2014 |

| | |

| |

| |

| |

| |

|

| Product Revenues | |

$ | 534 | | |

$ | — | | |

$ | 534 | | |

$ | — | | |

$ | 1,697 | |

| Service Revenues | |

| — | | |

| — | | |

| 50,000 | | |

| — | | |

| 50,000 | |

| Total Revenues | |

| 534 | | |

| — | | |

| 50,534 | | |

| — | | |

| 51,697 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of Sales | |

| 174 | | |

| — | | |

| 174 | | |

| — | | |

| 852 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 360 | | |

| — | | |

| 50,360 | | |

| — | | |

| 50,845 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Consulting | |

| 621,871 | | |

| 460,880 | | |

| 1,040,397 | | |

| 1,566,372 | | |

| 3,012,614 | |

| Professional Fees | |

| 52,014 | | |

| 58,984 | | |

| 144,439 | | |

| 149,923 | | |

| 373,859 | |

| General and Administration | |

| 15,872 | | |

| 4,095 | | |

| 91,251 | | |

| 22,118 | | |

| 1,294,856 | |

| Total operating expenses | |

| 689,757 | | |

| 523,959 | | |

| 1,276,087 | | |

| 1,738,413 | | |

| 4,681,329 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (689,397 | ) | |

| (523,959 | ) | |

| (1,225,727 | ) | |

| (1,738,413 | ) | |

| (4,630,484 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Income and (Expenses): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest Expense | |

| (16,048 | ) | |

| (10,112 | ) | |

| (50,218 | ) | |

| (33,012 | ) | |

| (105,895 | ) |

| Gain/(Loss) on Derivative adjustment | |

| 5,871,123 | | |

| (2,133,379 | ) | |

| 4,800,890 | | |

| (2,268,166 | ) | |

| (15,236,075 | ) |

| Forgiveness of Debt | |

| — | | |

| — | | |

| — | | |

| 111,610 | | |

| 111,610 | |

| Total Other Income and (Expenses) | |

| 5,855,075 | | |

| (2,143,491 | ) | |

| 4,750,672 | | |

| (2,189,568 | ) | |

| (15,230,360 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Gain (Loss) before taxes | |

| 5,165,678 | | |

| (2,667,450 | ) | |

| 3,524,945 | | |

| (3,927,981 | ) | |

| (19,860,844 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tax provisions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Gain (Loss) After Taxes | |

$ | 5,165,678 | | |

$ | (2,667,450 | ) | |

$ | 3,524,945 | | |

$ | (3,927,981 | ) | |

$ | (19,860,844 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive Income: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gain (Loss) on Available-for-Sale Securities | |

| (10,833 | ) | |

| — | | |

| (48,333 | ) | |

| 90,000 | | |

| (378,333 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive Income (Loss) | |

$ | 5,154,845 | | |

$ | (2,667,450 | ) | |

$ | 3,476,612 | | |

$ | (3,837,981 | ) | |

$ | (20,239,177 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic & diluted loss per share | |

$ | 0.01 | | |

$ | (5.97 | ) | |

$ | 0.01 | | |

$ | (14.06 | ) | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding | |

| 769,545,084 | | |

| 446,494 | | |

| 535,689,559 | | |

| 272,914 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. |

| MIND SOLUTIONS, INC. |

| STATEMENTS OF CASH FLOWS |

| (Development Stage registrant) |

| (Unaudited) |

| | |

| |

| |

From Inception |

| | |

For the Nine Months Ended | |

(May 24, 2002) to |

| | |

September 30, | |

September 30, |

| | |

2014 | |

2013 | |

2014 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | | |

| | |

| Net Gain (Loss) for the period | |

$ | 3,524,945 | | |

$ | (3,927,981 | ) | |

$ | (19,860,844 | ) |

| Adjustments to reconcile net loss to net cash | |

| | | |

| | | |

| | |

| provided by operating activities: | |

| | | |

| | | |

| | |

| Stock for services | |

| 647,598 | | |

| 1,039,587 | | |

| 2,891,401 | |

| Derivative (gain)/loss adjustment | |

| (4,800,890 | ) | |

| 2,268,166 | | |

| 15,106,352 | |

| Available-for-sale securities transferred as compensation | |

| — | | |

| 480,000 | | |

| 480,000 | |

| Available-for-sale securities received for service revenues | |

| 50,000 | | |

| — | | |

| 50,000 | |

| Forgiveness of debt | |

| — | | |

| (111,610 | ) | |

| (111,610 | ) |

| Depreciation | |

| 1,872 | | |

| 1,981 | | |

| 4,532 | |

| Changes in Operated Assets and Liabilities: | |

| | | |

| | | |

| — | |

| Accounts payable and accrued expenses | |

| 19,665 | | |

| (3,429 | ) | |

| 30,831 | |

| Accounts payable to related parties | |

| — | | |

| 45 | | |

| 115,110 | |

| Net cash used in operating activities | |

| (556,810 | ) | |

| (253,241 | ) | |

| (1,294,228 | ) |

| | |

| | | |

| | | |

| | |

| CASH FLOW FROM INVESTING ACTIVITIES: | |

| | | |

| | | |

| | |

| Purchase Equipment | |

| (2,936 | ) | |

| — | | |

| (3,620 | ) |

| Net cash used by investing activities | |

| (2,936 | ) | |

| — | | |

| (3,620 | ) |

| | |

| | | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | | |

| | |

| Proceeds from sale of stock | |

| — | | |

| — | | |

| 10,000 | |

| Proceeds from officer contributions | |

| — | | |

| — | | |

| 61,000 | |

| Proceeds from convertible notes | |

| 694,000 | | |

| 248,500 | | |

| 1,119,345 | |

| Proceed from convertible note to related party | |

| — | | |

| 48,526 | | |

| 48,526 | |

| Payments on convertible note to related party | |

| — | | |

| (38,805 | ) | |

| (38,474 | ) |

| Proceeds from notes payable to related parties | |

| — | | |

| — | | |

| 418,769 | |

| Payments on notes payable to related parties | |

| — | | |

| — | | |

| (139,636 | ) |

| Net cash provided by financing activities | |

| 694,000 | | |

| 258,221 | | |

| 1,479,530 | |

| | |

| | | |

| | | |

| | |

| Net (Decrease) Increase in Cash | |

| 134,254 | | |

| 4,980 | | |

| 181,682 | |

| Cash at Beginning of Period | |

| 47,428 | | |

| 208 | | |

| — | |

| Cash at End of Period | |

$ | 181,682 | | |

$ | 5,188 | | |

$ | 181,682 | |

| | |

| | | |

| | | |

| | |

| Supplemental Disclosures: | |

| | | |

| | | |

| | |

| Income Taxes Paid | |

$ | — | | |

$ | — | | |

$ | — | |

| Interest Paid | |

$ | — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | | |

| | |

| Issuance of common stock in payment of non related | |

| | | |

| | | |

| | |

| party convertible debt | |

$ | 314,050 | | |

$ | 317,520 | | |

$ | 777,234 | |

| | |

| | | |

| | | |

| | |

| Issuance of common stock in payment of related party debt | |

$ | — | | |

$ | 51,000 | | |

$ | 51,000 | |

| | |

| | | |

| | | |

| | |

| Issuance of convertible note for consulting services | |

$ | 200,000 | | |

$ | — | | |

$ | 200,000 | |

| | |

| | | |

| | | |

| | |

| Consulting fees paid with available-for-sale securities | |

| | | |

| | | |

| | |

| asset | |

$ | — | | |

$ | 480,000 | | |

$ | 480,000 | |

| | |

| | | |

| | | |

| | |

| Stock issued for assets | |

$ | — | | |

$ | 90,000 | | |

$ | 90,000 | |

| | |

| | | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | |

MIND SOLUTIONS, INC.

(A Development Stage registrant)

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2014, AND DECEMBER 31,

2013

NOTE 1-ORGANIZATION

AND DESCRIPTION

OF BUSINESS

Mind Solutions, Inc. (the “registrant”)

was initially incorporated in the state of Delaware on May 19, 2000 as Medical Records by Net, Inc. On October 17, 2000, the

registrant changed its name to Lifelink Online, Inc. In January 2001, its name was changed to MedStrong Corporation, and on March

9, 2001, the registrant name was changed to MedStrong International Corporation. On March 30, 2007, the registrant’s name

was changed to VOIS, Inc. and the domicile was changed to the State of Florida. On October 19, 2012, the registrant executed a

merger agreement with Mind Solutions, Inc. whereas Mind Solutions, Inc. became a wholly owned subsidiary of the registrant. Mind

Solutions, Inc. was incorporated under the laws of Nevada on May 24, 2002, under the name Red Meteor Media, Inc. The registrant

changed its name to Prize Entertainment, Inc. in November 2003, and then again to Mind Solutions, Inc. in January 2011. On October

28, 2013, the registrant changed its name from VOIS, Inc. to Mind Solutions, Inc. as well as changing its domicile from Florida

to Nevada.

On October 28, 2013, the registrant closed

an Agreement and Plan of Merger with Mind Solutions, Inc. For accounting purposes this agreement was treated as a reverse merger.

The operations of the registrant became those solely of Mind Solutions, Inc. In connection with the merger agreement, the registrant

changed its fiscal year end to coincide with that of Mind Solutions, Inc., which is December 31. Pursuant to the Plan of Merger

with Mind Solutions, Inc., the holders of stock in VOIS, Inc. received one share of common stock, $0.001 par value per share, in

Mind Solutions, Inc. for every 2,000 shares of common stock in VOIS, Inc. (in effect, a one for 2,000 reverse split). As a result,

the then current common stockholders of VOIS, Inc. held all of the issued and outstanding shares of common stock in the surviving

corporation Mind Solutions, Inc.

The registrant has developed

software

applications which are compatible with

EEG headsets on the market. The registrant is working with the most advanced electronics manufacturing

companies to develop the most advanced EEG headset on the market. This BCI headset will allow users to operate thought-controlled

applications on their mobile phone devices as well as on traditional PC computers. The registrant has completed a working

prototype which has been successfully tested on several Android devices. EEG headset can read

brainwaves and allow

for interaction with

a computer.

The registrant develops software for

thought controlled technologies, allowing the user to interact with the computer and other machines through the power of the mind.

The technology involves the use of a wireless headset, which detects brainwaves on both the conscious and non-conscious level.

This revolutionary neural processing technology makes it possible for computers to interact directly with the human brain. The

registrant has created three applications currently available through the registrant’s website and is developing a micro

EEG headset that is compatible with mobile smart phones and other devices.

NOTE 2 - PREPARATION OF FINANCIAL STATEMENTS

Basis of presentation

The registrant’s financial statements

have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The accompanying unaudited quarterly

financial statements have been prepared on a basis consistent with generally accepted accounting principles in the United States

(“GAAP”) for interim financial information and pursuant to the rules of the Securities and Exchange Commission (“SEC”).

In the opinion of management, the accompanying unaudited financial statements reflect all adjustments, consisting of only normal

and recurring adjustments, necessary for a fair presentation of the results of operations, financial position and cash flows for

the periods presented. The results of operations for the periods are not necessarily indicative of the results expected for the

full year or any future period. These statements should be read in conjunction with the registrant’s Annual Report on Form

10-K for the year ended December 31, 2013, as filed with the SEC on April 14, 2014, as amended by the registrant’s Form 10-K/A,

Amendment No. 1, filed May 14, 2014, and the registrant’s Form 10-K/A, Amendment No. 2, filed August 1, 2014 (the “2013

Annual Report”).

Development Stage registrant

The registrant is currently a development

stage enterprise reporting under the provisions of FASB ASC Topic 915, Development Stage Entity. The accompanying financial

statements have been prepared in accordance with accounting principles generally accepted in the United States of America.

Restated Financial Statements

Certain amounts in the prior period financial

statements have been adjusted to conform to the one for 2,000 reverse stock split on October 15, 2013.

Prior Year Financial Statement Presentation

The prior year financial statements were

prepared to show the effect of the reverse merger and to show the mark to market adjustment as other comprehensive income for comparative

purposes in the prior year financial statements.

NOTE 3-SUMMARY

OF SIGNIFICANT

ACCOUNTING

POLICIES

The

registrant considers

all cash on hand

and in banks,

including

accounts in book overdraft

positions, certificates of

deposit and

other highly-liquid

investments with maturities

of three months

or less, when

purchased,

to be cash and equivalents.

Fixed assets are recorded at cost.

Major renewals and improvements

are capitalized, while maintenance

and repairs are expensed

when incurred.

Expenditures for major additions and betterments are capitalized in amounts greater or equal to $500. Depreciation of equipment

is computed by the straight-line method (after taking into account their respective estimated residual values) over the assets

estimated useful life of three, five (5), or seven (7) years. Upon sale or retirement of equipment, the related cost and accumulated

depreciation are removed from the accounts and any gain or loss is reflected in statements of operations.

C. Advertising

expenses

Advertising

and marketing expenses

are charged

to operations

as incurred.

For the nine months ended

September 30, 2014, and year ended December 31, 2013, advertising

and marketing

expense

were $0, respectively.

D. Revenue recognition

The registrant follows paragraph 605-10-S99-1

of the FASB Accounting Standards Codification for revenue recognition. The registrant will recognize revenue when it is

realized or realizable and earned. The registrant considers revenue realized or realizable and earned when all of the following

criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been

rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

E. Stock-based

compensation

We record share based payments

under the provisions of FASB ASC Topic 718, Compensation - Stock Compensation. Under FASB ASC 718, companies

are required to measure the compensation costs of share-based compensation arrangements based on the grant-date fair value

and recognize the costs in the financial statements over the period during which employees are required to provide services.

Share-based compensation arrangements include stock options, restricted share plans, performance-based awards, share

appreciation rights and employee share purchase plans. In March 2005, the SEC issued Staff Accounting Bulletin No. 107, or

“SAB 107,” SAB 107 expresses views of the staff regarding the interaction between FASB ASC 718 and certain SEC

rules and regulations and provides the staff’s views regarding the valuation of share-based payment arrangements for

public companies. FASB ASC 718 permitted public companies to adopt its requirements using one of two methods. On

April 14, 2005, the SEC adopted a new rule amending the compliance dates for FASB ASC 718. Companies may elect to apply

this statement either prospectively, or on a modified version of retrospective application under which financial statements

for prior periods are adjusted on a basis consistent with the pro forma disclosures required for those periods under SFAS

123. Effective with its fiscal 2006 year, the registrant adopted the provisions of FASB ASC 718 and related interpretations

as provided by SAB 107 prospectively. As such, compensation cost is measured on the date of grant as its fair value. Such

compensation amounts are amortized over the respective vesting periods of the options granted.

F. Income

Taxes

The registrant adopted FASB ASC Topic

740, Income Taxes, at its inception. Under FASB ASC Topic 740, the deferred tax provision is determined under the liability

method. Under this method, deferred tax assets and liabilities are recognized based on the differences between the financial statement

carrying amounts and the tax bases of assets and liabilities using presently enacted tax rates.

G. Earnings

(loss) per share

The registrant adopted FASB ASC Topic

260, Earnings Per Share. Basic earnings per share is based on the weighted effect of all common shares issued and outstanding

and is calculated by dividing net income (loss) available to common stockholders by the weighted average shares outstanding during

the period. Diluted earnings per share is calculated by dividing net income available to common stockholders by the weighted average

number of common shares used in the basic earnings per share calculation plus the number of common shares, if any, that would be

issued assuming conversion of all potentially dilutive securities outstanding. For all periods diluted earnings per share is not

presented, as potentially issuable securities are anti-dilutive.

There are approximately 319,029,426 potentially

dilutive post reverse stock-split shares of common stock outstanding as of September 30, 2014, which are derived from the outstanding

convertible promissory notes. The registrant also has 10,000,000 shares of Series A Preferred Stock outstanding, each share of

which can be converted into 100 shares of the registrant’s common stock.

H. Use of estimates

The preparation of financial statements

in conformity with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect certain reported amounts and disclosures. Significant estimates for the periods reported include certain

assumptions used in deriving the fair value of share-based compensation recognized, the useful life of tangible assets and the

future value of our website development costs. Assumptions and estimates used in these areas are material to our reported financial

condition and results of our operations. Actual results will differ from those estimates.

I. Fair value of financial instruments measured on a recurring

basis

The registrant follows paragraph 825-10-50-10

of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37

of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial

instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted

in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements. To increase consistency and

comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which

prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The fair value hierarchy gives

the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority

to unobservable inputs. The three levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1 |

|

Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| |

|

|

| Level 2 |

|

Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| |

|

|

| Level 3 |

|

Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level

3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least

one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest

priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable

inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the

categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amount of the registrant’s

financial assets and liabilities, such as cash, prepaid expenses and accrued expenses approximate their fair value because of the

short maturity of those instruments. The registrant’s line of credit and notes payable approximate the fair value of such

instruments based upon management’s best estimate of interest rates that would be available to the registrant for similar

financial arrangements at September 30, 2014, and December 31, 2013.

Transactions involving related parties

cannot be presumed to be carried out on an arm’s-length basis, as the requisite conditions of competitive, free-market dealings

may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions

were consummated on terms equivalent to those that prevail in arm’s-length transactions unless such representations can be

substantiated.

It is not, however, practical to determine

the fair value of advances from stockholders due to their related party nature.

J. Commitments and contingencies

The registrant follows subtopic 450-20

of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of

the date the consolidated financial statements are issued, which may result in a loss to the registrant but which will only be

resolved when one or more future events occur or fail to occur. The registrant assesses such contingent liabilities, and such assessment

inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against

the registrant or un-asserted claims that may result in such proceedings, the registrant evaluates the perceived merits of any

legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought

therein.

If the assessment of a contingency indicates

that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated

liability would be accrued in the registrant’s consolidated financial statements. If the assessment indicates that a potential

material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of

the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote

are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not

believe, based upon information available at this time, that these matters will have a material adverse effect on the registrant’s

consolidated financial position, results of operations or cash flows. However, there is no assurance that such matters will not

materially and adversely affect the registrant’s business, financial position, and results of operations or cash flows.

K. Related parties

The registrant follows subtopic 850-10

of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party

transactions.

Pursuant to Section 850-10-20 the

Related parties include (a) affiliates of the registrant; (b) Entities for which investments in their equity securities would

be required, absent the election of the fair value option under the Fair Value Option Subsection of Section

825–10–15, to be accounted for by the equity method by the investing entity; (c) trusts for the benefit of

employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; (d)

principal owners of the registrant; (e) management of the registrant; (f) other parties with which the registrant may deal if

one party controls or can significantly influence the management or operating policies of the other to an extent that one of

the transacting parties might be prevented from fully pursuing its own separate interests; and (g) Other parties that can

significantly influence the management or operating policies of the transacting parties or that have an ownership interest in

one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting

parties might be prevented from fully pursuing its own separate interests.

The financial statements shall include

disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar

items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated

or combined financial statements is not required in those statements. The disclosures shall include: (a) the nature of the relationship(s)

involved; (b) description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for

each of the periods for which income statements are presented, and such other information deemed necessary to an understanding

of the effects of the transactions on the financial statements; (c) the dollar amounts of transactions for each of the periods

for which income statements are presented and the effects of any change in the method of establishing the terms from that used

in the preceding period; and (d) amounts due from or to related parties as of the date of each balance sheet presented and, if

not otherwise apparent, the terms and manner of settlement.

L. Cash flows reporting

The registrant adopted paragraph 230-10-45-24

of the FASB Accounting Standards Codification for cash flows reporting, classifies cash receipts and payments according

to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the

indirect or reconciliation method (“Indirect method”) as defined by paragraph 230-10-45-25 of the FASB Accounting Standards

Codification to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating

activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected

future operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash

receipts and payments. The registrant reports the reporting currency equivalent of foreign currency cash flows, using the current

exchange rate at the time of the cash flows and the effect of exchange rate changes on cash held in foreign currencies is reported

as a separate item in the reconciliation of beginning and ending balances of cash and cash equivalents and separately provides

information about investing and financing activities not resulting in cash receipts or payments in the period pursuant to paragraph

830-230-45-1 of the FASB Accounting Standards Codification.

M. Subsequent events

The registrant follows the guidance in

Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The registrant

will evaluate subsequent events through the date when the financial statements were issued. Pursuant to ASU 2010-09 of the

FASB Accounting Standards Codification, the registrant as an SEC filer considers its financial statements issued when they are

widely distributed to users, such as through filing them on EDGAR.

Recently Issued Accounting Standards

The registrant has adopted all accounting

pronouncements issued since December 31, 2007, none of which had a material impact on the registrant’s financial statements.

NOTE 4 –GOING CONCERN

The accompanying financial statements

have been prepared assuming that the registrant will continue as a going concern, which contemplates continuity of operations,

realization of assets, and liquidation of liabilities in the normal course of business.

As of September 30, 2014, the registrant

had an accumulated deficit during development stage of $19,860,844. Also, during the nine months ended September 30, 2014, the

registrant used net cash of $556,810 for operating activities. These factors raise substantial doubt about the registrant’s

ability to continue as a going concern.

While the registrant is attempting to

commence operations and generate revenues, the registrant’s cash position may not be significant enough to support the registrant’s

daily operations. Management intends to raise additional funds by way of a public or private offering. Management believes that

the actions presently being taken to further implement its business plan and generate revenues provide the opportunity for the

registrant to continue as a going concern. While the registrant believes in the viability of its strategy to generate revenues

and in its ability to raise additional funds, there can be no assurances to that effect. The ability of the registrant to continue

as a going concern is dependent upon the registrant’s ability to further implement its business plan and generate revenues.

The financial statements do not include

any adjustments that might be necessary if the registrant is unable to continue as a going concern.

NOTE 5– PREPAIDS

The prepaid asset recorded at September

30, 2014, was the result of:

| a.) | The registrant executing a one year consulting contract with its chief executive officer on December 25, 2013, whereby the

registrant issued 120,000,000 post reverse-split shares of common stock for one year of executive services. The 120,000,000 shares

were valued at the closing price of $0.0022 on the date of the agreement which will result in the registrant recording officer

compensation of $264,000 over the life of the contract. |

| b.) | The registrant executing a three month consulting agreement on August 20, 2014, whereby the registrant issued 30,000,000 free

trading S-8 shares to Brent Fouch. The consultant will coordinate with Design Catapult Inc. to provide sensor and EEG technology

assistance. The 30,000,000 shares were valued at the closing price of $0.0012 on the date of the agreement which will result in

the registrant recording consulting expense of $36,000 over the life of the contract. |

| c.) | The registrant executing a six month consulting agreement on September 2, 2014, whereby the registrant issued 30,000,000 free

trading S-8 shares to Noah Fouch to provide weekly marketing services through social media platforms. The 30,000,000 shares were

valued at the closing price of $0.0016 on the date of the agreement which will result in the registrant recording consulting expense

of $48,000 over the life of the contract. |

| d.) | The registrant executing a one year service agreement on September 12, 2014, whereby the registrant issued 5,000,000 shares

of Series A Preferred Stock to its CEO, Kerry Driscoll. The 5,000,000 shares were valued at par $0.001 which will result in the

registrant recording officer compensation expense of $5,000 over the life of the contract. |

| e.) | The registrant executing a (1) year service agreement on September 12, 2014, whereby the registrant issued 5,000,000 shares

of Series A Preferred Stock to a former officer of the registrant. The 5,000,000 shares were valued at par $0.001 which will result

in the registrant recording officer compensation expense of $5,000 over the life of the contract. |

As of September 30, 2014, and December

31, 2013, the registrant had a prepaid balance of $135,520 and $289,550 which are derived from the uncompleted portion of the consulting

agreements with the registrant.

NOTE 6– PROPERTY PLANT &

EQUIPMENT

| | |

September 30, 2014 | |

December 31, 2013 |

| | |

| | | |

| | |

| Equipment | |

$ | 85,467 | | |

$ | 82,531 | |

| Furniture | |

| 4,186 | | |

| 4,186 | |

| Total | |

| 89,653 | | |

| 86,717 | |

| Less accumulated Depreciation | |

| (86,171 | ) | |

| (84,299 | ) |

| Property and equipment, net | |

$ | 3,482 | | |

$ | 2,418 | |

Furniture

and Equipment

consisted of the

following:

- On April 30, 2013, the registrant acquired all the assets of Mind Technologies,

Inc. through an executed Asset Purchase Agreement (Described in Note 9).

- Depreciation expense

for the nine months ended September 30,

2014, and 2013 was $1,872 and $1,981.

NOTE 7 –

RELATED PARTY TRANSACTIONS

Convertible note payable to related party

On January 2, 2014, the registrant entered

into a convertible promissory note with Brent Fouch, in the amount of $61,096, bearing no interest, convertible at the closing

market price on the date of conversion. On January 5, 2014, Brent Fouch entered into an assignment agreement with Magna Group,

LLC, whereby Brent Fouch assigned his convertible promissory note dated January 2, 2014, in the amount of $61,096.

Consulting agreement(s) with CEO

The registrant executed a consulting

agreement on December 25, 2013, with its current Chief Executive Officer whereby the registrant issued 120,000,000 post reverse-split

shares of common stock for one year of executive services. The 120,000,000 shares were valued at the closing price of $0.0022 on

the date of the agreement which will result in the registrant recording officer compensation of $264,000 over the life of the contract.

The registrant executed a service agreement

on September 12, 2014, with its current Chief Executive Officer, Kerry Driscoll, whereby the registrant issued 5,000,000 shares

of Series A Preferred Stock for one year of services such as compliance, guidance, infrastructure and business strategy. The 5,000,000

shares were valued at par $0.001which resulted in the registrant recording officer compensation of $5,000 over the life of the

contract.

Service Agreement with Former Officer

The registrant executed a service agreement

on September 12, 2014, with a former officer, whereby the registrant issued 5,000,000 shares of Series A Preferred Stock for one

year services to facilitate the development of BCI software compatibility with the registrant’s micro BCI headset. The 5,000,000

shares were valued at par $0.001which resulted in the registrant recording officer compensation of $5,000 over the life of the

contract.

Asset Purchase Agreement

On

April 30, 2013, the registrant executed an asset purchase agreement with Mind Technologies, Inc., (MTEK), whereby the registrant

purchased all the assets of MTEK for 15,000 post reverse-split common shares. The assets purchased include those previously licensed

from MTEK, described in Note 9.

Free office space provided by chief executive officer

The registrant has been provided office

space by its chief executive officer Kerry Driscoll at no cost. Management has determined that such cost is nominal and did not

recognize the rent expense in its financial statements.

NOTE 8– AVAILABLE-FOR-SALE

SECURITIES

Other Comprehensive Income/Loss

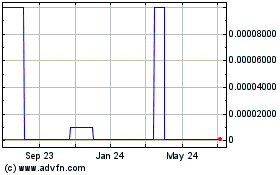

On February 12, 2014, the registrant

entered into a consulting agreement with Monster Arts, Inc. (“Monster”), whereby the registrant will provide Monster

with thought controlled software development services over a one year term. The registrant will be paid four quarterly payments

of $50,000 in restricted common stock of Monster. As of September 30, 2014, the registrant has only received its first payment

of 8,333,333 common shares of Monster Arts Inc. worth approximately $50,000, based on the closing stock price of $0.006 on February

12, 2014, which was recorded as an available-for-sale security asset with the credit to deferred revenues. The registrant revalued

the 8,333,333 shares on September 30, 2014, which resulted in an unrealized loss on available-for-sale securities of $48,333 as

the stock price of Monster decreased to $0.0002.

As of September 30, 2014, and December

31, 2013, the registrant had available for sale securities balance of $1,667 and $0.

NOTE 9 –

LICENSED PRODUCTS & ASSET PURCHASE

On

December 18, 2012, the registrant signed a licensing agreement with Mind Technologies, Inc., (MTEK), for the right to use, develop,

improve, manufacture, and sale the licensed software application which uses wireless headsets

to read brainwaves

and allow interaction

with a computer.

The registrant issued 3,500 post reverse-split common shares to MTEK as consideration

for the licensing agreement. The shares were valued at the amortized holding cost of the related party. The amortized holding cost

was $-0- at September 30, 2013, and December 31, 2012, respectively.

On

April 30, 2013, the registrant executed an asset purchase agreement with MTEK, whereby the registrant purchased all the assets

of MTEK for 15,000 post reverse-split common shares. The assets purchased were previously licensed from MTEK as described previously.

The cost basis of the assets acquired is $86,033, with accumulated depreciation of $81,638, which resulted in a net asset balance

of $4,395. The registrant recorded the excess consideration as additional paid in capital inasmuch as it was a related party transaction.

The former CEO of Mind Solutions, Inc. is also the former CEO of Mind Technologies, Inc. The registrant acquired all the assets

involved with the former operations of MTEK which include three thought-controlled software applications named Mind Mouse,

Master Mind and Think-Tac-Toe. These purchased assets constitute neural processing software for thought-controlled technologies,

allowing the user to interact with computers, gaming devices, and other machines through the power of the mind. Included in the

purchase are all Mind Technologies’ inventory, fixed assets, intellectual property, and an assignment of rights and assumption

of obligations under Mind Technologies’ existing contracts.

NOTE 10 –

CONVERTIBLE NOTES PAYABLE

In the nine months ended September 30,

2014, the registrant entered into eighteen convertible note agreements. As of September 30, 2014,

and December 31, 2013, the registrant has $691,667 and $248,358 in outstanding convertible notes payable with eight non-related

entities.

On January 2, 2014, the registrant entered

into a convertible promissory note with Brent Fouch, a related party to the registrant, in the amount of $61,096, bearing no interest,

convertible at the closing market price on the date of conversion. On January 5, 2014, Brent Fouch entered into an assignment agreement

with Magna Group, LLC, whereby Brent Fouch assigned his convertible promissory note dated January 2, 2014, in the amount of $61,096.

On February 4, 2014, the

registrant entered into a Convertible Note Agreement with GEL Properties LLC. The registrant issued a $25,000 convertible

note with interest of 10% per annum, unsecured, and due February 4, 2015. The note is convertible into common shares of the

registrant at any time from the date of issuance at a conversion rate of 55% of the market price, calculated as the lowest

trading price in the previous 10 days leading up to the date of conversion. As of September 30, 2014, GEL Properties LLC

converted the entire principle balance of $25,000 into 48,017,966 shares of common stock.

On February 4, 2014, the registrant entered

into a Convertible Note Agreement with LG Capital Funding LLC whereby there is a front end and a back end note with the same terms.

On February 4, 2014, the registrant issued a $25,000 front end convertible note with interest of 10% per annum, unsecured, and

due February 4, 2015. The note is convertible into common shares of the registrant at any time from the date of issuance at a conversion

rate of 55% of the market price, calculated as the lowest trading price in the previous 10 days leading up to the date of conversion.

On August 7, 2014, the registrant issued a back end note of $25,000 with the same terms. As of September 30, 2014, LG Capital Funding

LLC converted the entire principle balance of the front end note, $25,000, and $1,312 of accrued interest into 47,864,258 shares

of our common stock. As of September 30, 2014, the registrant has an outstanding convertible note balance to LG Capital Funding

LLC which pertains to the back end note dated February 4, 2014.

On February 6, 2014, the registrant entered

into a Securities Purchase Agreement with Asher Enterprises Inc. for a $37,500 convertible note payable due interest at 8% per

annum, unsecured, and due November 10, 2014. The note is convertible into common shares of the registrant at any time from the

date of issuance at a conversion rate of 58% of the market price, calculated as the average of the three lowest trading prices

in the previous 30 days leading up to the date of conversion. As of September 30, 2014, Asher converted the entire principle balance

of $37,500 and $4,500 of accrued interest into 99,765,528 shares of common stock.

On February 25, 2014, the registrant

entered into a Convertible Note Agreement with Iconic Holdings, LLC. The registrant issued a $27,500 convertible note with interest

of 10% per annum, unsecured, and due February 25, 2015. The note is convertible into common shares of the registrant at any time

from the date of issuance at a conversion rate of 55% of the market price, calculated as the lowest trading price in the previous

10 days leading up to the date of conversion. As of September 30, 2014, Iconic Holdings, LLC converted the entire principle balance

of $27,500 into 68,750,000 shares of common stock.

On March 25, 2014, the registrant entered

into a Convertible Note Agreement with LG Capital Funding LLC. The registrant issued a $40,000 convertible note with interest of

10% per annum, unsecured, and due March 25, 2015. The note is convertible into common shares of the registrant at any time from

the date of issuance at a conversion rate of 55% of the market price, calculated as the lowest trading price in the previous 10

days leading up to the date of conversion. As of September 30, 2014, LG Capital Funding LLC converted the entire principle balance

of $40,000 and $171 of accrued interest into 77,224,305 shares of common stock.

On April 15, 2014, the registrant entered

into a Convertible Note Agreement with Caesar Capital Group, LLC. The registrant issued a $50,000 convertible note with interest

of 8% per annum, unsecured, and due April 15, 2015. The note is convertible into common shares of the registrant at any time from

the date of issuance at a conversion rate of 55% of the market price, calculated as the lowest trading price in the previous 10

days leading up to the date of conversion. As of September 30, 2014, Caesar Capital Group, LLC has not converted any principle

on this note.

On April 30, 2014, the registrant entered

into a Convertible Note Agreement with ARRG, Corp. The registrant issued a $50,000 convertible note with interest of 8% per annum,

unsecured, and due April 30, 2015. The note is convertible into common shares of the registrant at any time from the date of issuance

at a conversion rate of 55% of the market price, calculated as the lowest trading price in the previous 10 days leading up to the

date of conversion. As of September 30, 2014, ARRG Corp has not converted any principle on this note.

On May 8, 2014, the registrant entered

into a Securities Purchase Agreement with KBM Worldwide, Inc. for a $42,500 convertible note payable due interest at 8% per annum,

unsecured, and due February 12, 2014. The note is convertible into common shares of the registrant at any time from the date of

issuance at a conversion rate of 51% of the market price, calculated as the average of the three lowest trading prices in the previous

30 days leading up to the date of conversion. As of September 30, 2014, KBM Worldwide, Inc. has not converted any principle on

this note.

On May 12, 2014, we executed a Consulting

Agreement with Cicero Consulting Group, LLC and convertible promissory note in the amount of $200,000 due May 12, 2015. Cicero

Consulting Group, LLC will provide management consulting and business advisory services to Mind Solutions over a one year term.

We have compensated Cicero Consulting Group, LLC with a $200,000 convertible promissory note which is considered earned in full

as of May 12, 2014. The convertible note issued pursuant to the Consulting Agreement may be converted into shares of our common

stock after six months from the date of the executed note at a 10 percent discount to market based on the lowest trading price

during the 10 trading days prior to the conversion date. As of the date hereof, $200,000 of the Cicero Consulting Group, LLC note

remains unpaid.

On May 30, 2014, the registrant entered

into a Convertible Note Agreement with WHC Capital, LLC. The registrant issued a $60,000 convertible note with interest of 12%

per annum, unsecured, and due May 30, 2015. The note is convertible into common shares of the registrant at any time from the date

of issuance at a conversion rate of 50% discount to the market price, calculated as the lowest trading price in the previous 10

trading days leading up to the date of conversion. As of September 30, 2014, WHC Capital, LLC has not converted any principle on

this note.

On May 15, 2013, the registrant executed

a convertible promissory note with JMJ Financial in an amount up to $250,000 bearing interest on the unpaid balance at the rate

of 12 percent. While the note was in the original principal amount up to $250,000, it was only partially funded. On May 15, 2013,

the registrant received $30,000 pursuant to this convertible promissory note with JMJ Financial. On August 14, 2013, the registrant

received $20,000 pursuant to this convertible promissory note with JMJ Financial. On December 4, 2013, the registrant received

$25,000 pursuant to this convertible promissory note with JMJ Financial. On April 16, 2014, the registrant received $40,000 pursuant

to this convertible promissory note with JMJ Financial. On June 23, 2014, the registrant received $60,000 pursuant to this convertible

promissory note with JMJ Financial. The note is interest free for the first 180 days after which it accrues interest of 12% per

annum. The note is convertible after 180 days into common shares of the registrant at a conversion rate of 60% of the market price,

calculated as the lowest trade price in the 25 trading days previous to conversion. As of September 30, 2014, JMJ Financial converted

$93,333 in principle into 121,371,111 shares of common stock.

On July 22, 2014, the registrant entered

into a Securities Purchase Agreement (SPA) with KBM Worldwide, Inc. The registrant issued a $27,500 convertible note in connection

with the SPA which has interest of 8% per annum, unsecured, and due July 22, 2015. The note is convertible into common shares of

the registrant at any time from the date of issuance at a conversion rate of 51% of the market price, calculated as the average

of the three lowest trading prices in the previous 10 days leading up to the date of conversion. As of September 30, 2014, KBM

Worldwide, Inc. has not converted any principle on this note.

On August 28, 2014, the registrant entered

into a Convertible Note Agreement with GEL Properties LLC. The registrant issued a $25,000 convertible note with interest of 10%

per annum, unsecured, and due August 28, 2015. The note is convertible into common shares of the registrant at any time from the

date of issuance at a conversion rate of 55% of the market price, calculated as the lowest trading price in the previous 10 trading

days leading up to the date of conversion. As of September 30, 2014, GEL Properties LLC converted the entire principle balance

of $25,000 into 56,818,182 shares of common stock.

On September 4, 2014, the registrant

entered into a Convertible Note Agreement with LG Capital Funding LLC. The registrant issued a $31,500 convertible note with interest

of 10% per annum, unsecured, and due September 4, 2015. The note is convertible into common shares of the registrant at any time

from the date of issuance at a conversion rate of 55% of the market price, calculated as the lowest trading price in the previous

10 days leading up to the date of conversion. As of September 30, 2014, LG Capital Funding LLC has not converted any principle

on this note.

On September 22, 2014, the registrant

entered into a Convertible Note Agreement with JSJ Investments Inc. The registrant issued a $100,000 convertible note with interest

of 12% per annum, unsecured, and due March 22, 2015. The note is convertible into common shares of the registrant at any time from

the date of issuance at a conversion rate of 48% discount to the market price, calculated as the average of the three lowest trading

prices in the previous 20 trading days leading up to the date of conversion. As of September 30, 2014, JSJ Investments Inc. has

not converted any principle on this note.

On September 25, 2014, the

registrant entered into a Convertible Note Agreement with Iconic Holdings, LLC. The registrant issued a $27,500 convertible

note with interest of 10% per annum, unsecured, and due September 25, 2015. The note is convertible into common shares of the

registrant at any time from the date of issuance at a conversion rate of 55% of the market price, calculated as the lowest

trading price in the previous 10 days leading up to the date of conversion. As of September 30, 2014, Iconic Holdings, LLC

has not converted any principle on this note.

Conversion of convertible debt.

In the nine months ended September 30,

2014, Asher Enterprises converted 85,200 of convertible debt and $4,500 of accrued interest into 104,613,454 post reverse-split

shares of common stock, Magna Group, LLC converted $37,000 of convertible debt into 4,510,292 post reverse-split shares of common

stock, Hanover Holdings converted $94,500 of convertible debt into 106,789,630 post reverse-split shares of common stock, JMJ Financial

converted $93,333 into 121,371,111 post reverse-split shares of commons stock, GEL Properties, LLC converted $50,000 of convertible

debt into 104,836,148 post reverse-split shares of common stock, LG Capital Funding LLC converted $69,000 of convertible debt into

125,088,563 post reverse-split shares of common stock, Iconic Holdings, LLC converted $27,500 of convertible debt into 68,750,000

post reverse-split shares of common stock and IBC Funds LLC converted $61,085 of convertible debt and $2,030 of accrued interest

into 73,876,000 post reverse-split shares of common stock.

The following table summarizes the total

outstanding principle on convertible notes payable:

| | |

September 30, 2014 | |

December 31, 2013 |

| | |

| | | |

| | |

| Convertible Notes Payable- Asher Enterprises, Inc. | |

$ | — | | |

$ | 47,700 | |

| Convertible Notes Payable- Magna Group, LLC | |

| — | | |

| 37,000 | |

| Convertible Notes payable - Hanover Holdings, LLC | |

| — | | |

| 33,404 | |

| Convertible Notes Payable - JMJ Financial, LLC | |

| 81,667 | | |

| 69,168 | |

| Convertible Notes Payable - IBC Funds LLC | |

| — | | |

| 61,086 | |

| Convertible Notes Payable - LG Capital Funding LLC | |

| 52,500 | | |

| — | |

| Convertible Notes Payable - Iconic Holdings | |

| 27,500 | | |

| — | |

| Convertible Notes Payable - KBM Worldwide, Inc. | |

| 70,000 | | |

| — | |

| Convertible Notes Payable - Ceasar Capital Group, LLC | |

| 50,000 | | |

| — | |

| Convertible Notes Payable - WHC Capital, LLC | |

| 60,000 | | |

| — | |

| Convertible Notes Payable - ARRG Corp. | |

| 50,000 | | |

| — | |

| Convertible Notes Payable - Cicero Consulting Group, LLC | |

| 200,000 | | |

| — | |

| Convertible Notes Payable - JSJ Investments Inc. | |

| 100,000 | | |

| — | |

| Total | |

$ | 691,667 | | |

$ | 248,358 | |

In the nine months ended September 30,

2014, and 2013, the registrant recorded interest expense relating to the outstanding convertible notes payable in the amounts of

$23,414 and $6,478.

Derivative liability.

At September 30, 2014 and December 31,

2013, the Company had $1,043,967 and $19,907,242 in derivative liability. In the nine months ended September 30, 2014, the Company

reduced its derivative liability by $18,863,275 of which $14,062,385 was credited to additional paid in capital due to the conversion

of the convertible notes payable and $4,800,890 was credited as an Other Income Item- Gain on Derivative Adjustment due to the

change in derivative liability calculated by the Black Scholes Model pertaining to the outstanding convertible notes payable.

We calculate the derivative liability

using the Black Scholes Model which factors in the Company’s stock price volatility as well as the convertible terms applicable

to the outstanding convertible notes. The following is the range of variables used in revaluing the derivative liabilities at September

30, 2014 and December 31, 2013:

| | |

| September

30, 2014 | | |

| December

31, 2013 | |

| Annual dividend yield | |

| 0 | | |

| 0 | |

| Expected life (years) of | |

| 0.01 – .85 | | |

| 0.01 – .90 | |

| Risk-free interest rate | |

| 10 | % | |

| 10 | % |

| Expected volatility | |

| 475.6 | % | |

| 372.2 | % |

NOTE 11–

NOTES PAYABLE

The total amount due on notes payable

and related interest and penalty is as follows:

| | |

September 30, 2014 | |

December 31, 2013 |

| | |

| |

|

| Notes Payable | |

$ | 145,000 | | |

$ | 145,000 | |

| | |

| | | |

| | |

| Total | |

$ | 145,000 | | |

$ | 145,000 | |

The registrant has outstanding notes

due to a former director in the aggregate amount of $145,000. The notes are unsecured and accrue interest and penalty of 15% inasmuch

as they are past due. The former director elected not to participate with the holders of other promissory notes, including our

then executive officers, in the exchange of those notes for equity which occurred during January 2009. At September 30, 2014, and

December 31, 2013, total accrued interest and penalty pertaining to the outstanding $145,000 in notes payable is $272,772 and $251,019.

NOTE 12–

REVERSE STOCK SPLIT

On October 15, 2013, the registrant executed

a Plan of Merger with Mind Solutions, Inc. whereby the holders of stock in VOIS, Inc. received one share of common stock, $0.001

par value per share, in Mind Solutions, Inc. for every 2,000 shares of common stock in VOIS, Inc. (in effect, a one for 2,000 reverse

split). As a result, the then current common stockholders of VOIS, Inc. held all of the issued and outstanding shares of common

stock in the surviving corporation Mind Solutions, Inc. The registrant has adjusted the equity statement and equity portion of

the balance sheet to retroactively account for the reverse stock split as if it occurred at inception.

NOTE 13–

STOCKHOLDERS’

EQUITY

Authorized Common Stock

On May 17, 2013, the registrant’s

board voted to authorize an amendment to the registrant’s articles of incorporation to increase its authorized shares of

common stock from 1,000,000,000 to 3,000,000,000. On August 23, 2013, the registrant’s board authorized an amendment to the

registrant’s articles of incorporation to increase its authorized shares of common stock from 3,000,000,000 to 5,000,000,000.

Authorized Preferred Stock

The registrant is authorized to issue

10,000,000 shares of Series A Preferred Stock.

The board of directors passed a resolution

designating certain preferential liquidity, dividend, voting and other relative rights to Shares of Series A Preferred Stock. Each

share of Series A Preferred Stock may at the option of the holder be converted into 100 fully paid and non-assessable shares of

common stock.

Issued Preferred Stock

On September 12, 2014, the

registrant issued 5,000,000 Preferred A Shares to its chief executive officer, Kerry Driscoll, for one year of services to be

rendered to the registrant. The 5,000,000 shares were valued at par $0.001 which resulted in the registrant recording officer

compensation of $5,000 over the life of the contract.

On September 12, 2014, the

registrant issued 5,000,000 Preferred A Shares to a former officer of the registrant for one year of services to be rendered

to the registrant. The 5,000,000 shares were valued at par $0.001 which resulted in the registrant recording a consulting

expense of $5,000 over the life of the contract.

Issued Common Stock

In the year ended December 31, 2013,

the registrant issued 35,894,503 post reverse-split shares of common stock. Of the 35,894,503 post reverse-split shares issued,

22,088,000 post reverse-split shares were to consultants for services, 15,000 (post reverse-split) shares were issued in an asset

purchase agreement, 10,625 (post reverse-split) shares were issued to a related party for the reduction of $51,000 in related party

convertible debt, and 13,777,673 post reverse-split shares were issued to non-related convertible note holders for the reduction

of $469,346 in convertible debt. Of the 22,088,000 shares to consultants, 20,000,000 were issued to our chief executive officer

pursuant to a one year consulting agreement dated December 25, 2013. We recorded the portion of the contract not yet completed

as prepaid expense. The 22,088,000 shares issued for services rendered were valued at the closing price on the dates of their respective

agreements which resulted in the registrant recording a consideration of $1,467,703. Of the other 2,088,000 shares for services,

238,000 were to the Secretary of the registrant for consulting services provided over the past two years. The other 1,850,000 were

to unrelated third party consultants for investor related services completed by December 31, 2013.

In the nine months ended September 30,

2014, the registrant issued 1,005,330,974 post reverse-split shares of common stock, of which 252,895,776 shares were issued for

services and 752,435,198 shares were issued for the reduction of $513,801 in convertible notes payable debt and $11,723 of accrued

interest. The 252,897,776 shares issued for services rendered were valued at the closing price on the dates of their respective

agreements which resulted in the registrant recording a consulting expense of $447,598.

NOTE 14–

COMMITMENTS

We were a defendant in two actions, each

entitled 951 Yamato Acquisition registrant, LLC vs. VOIS, Inc., both as filed in December 2009 in the Circuit Court of the

15th Judicial Circuit in and for Palm Beach County, Florida under case numbers 502010CA040121XXXXMB and 502010CC19027XXXXBBRS,

which are related to the lease agreements for our former office space. A combined summary judgment was entered in April, 2010 against

VOIS, Inc. in the amount of $106,231. At September 30, 2014, and December 31, 2013, our liabilities as reported in our financial

statements contained elsewhere in this report reflect the principal amount of the judgment together with $44,617 and $39,837 in

accrued interest, respectively.

NOTE 15-

SUBSEQUENT EVENTS

Management has evaluated subsequent events

pursuant to the requirements of ASC Topic 855 and has determined that no other material subsequent events exist.

| 1. | In October, the registrant issued 40,028,704 shares of common stock for the conversion of $41,600

in principle convertible debt. |

Item 2. Management’s Discussion and Analysis

of Financial Condition and Results of Operations.

THE FOLLOWING DISCUSSION SHOULD BE READ

TOGETHER WITH THE INFORMATION CONTAINED IN THE FINANCIAL STATEMENTS AND RELATED NOTES INCLUDED ELSEWHERE IN THIS REPORT ON FORM

10-Q.

The following discussion reflects our

plan of operation. This discussion should be read in conjunction with the financial statements which are included in this Report.

This discussion contains forward-looking statements, including statements regarding our expected financial position, business and

financing plans. These statements involve risks and uncertainties. Our actual results could differ materially from the results

described in or implied by these forward-looking statements as a result of various factors, including those discussed below and

elsewhere in this Report.

Unless the context otherwise suggests,

“we,” “our,” “us,” and similar terms, as well as references to “VOIS” and “Mind

Solutions,” all refer to Mind Solutions as of the date of this report.

Mind Solutions has successfully developed

software applications described below that run on Emotive EEG headsets. We have experienced minimal sales of our software applications.

It was decided by management that to better position Mind Solutions in the market, we should develop our own unique EEG headset

that would allow us to have more market strength. We have invested a significant amount of money and time into developing a prototype

EEG headset. We have completed a prototype which has been successfully tested on several Android devices and tablets.

On August 1, 2012, Dr. Gordon Chiu, our

chief scientific adviser, filed an International Patent Application No. PCT/US2012/049135. Generally, the proprietary technology

we are using consists of a “Portable Brain Activity Monitor.” On February 12, 2011, Mind Technology, Inc., one of our

predecessors, and Dr. Gordon Chiu, our chief science advisor, granted us a license to use the technology covered by his patent

application. Through the series of mergers described in this report, Mind Solutions acquired the license granted to Mind Technology,

Inc. For the period, that Mind Technology, Inc. (now Mind Solutions) exists and funds the development and progress of the covered

invention, Dr. Chiu agreed to license the use of the technology to Mind Solutions. If Mind Solutions fails to support the launch,

progress and/or funding of the production of the invention, then the license may be terminated. The agreement provided that Dr.

Chiu will receive a non-refundable, non-dilatable cash royalty payment equal to 20% of the gross proceeds received by Mind Solutions

from the use of the covered technology. In addition, Brent Fouch, the former president of Mind Technology, and one of our advisors,

will receive a non-refundable, non-dilatable cash royalty payment equal to 5% of the gross proceeds received by Mind Solutions

from the use of the covered technology. See “Business – Patents and Intellectual Property.”

We believe a minimum of $350,000 is still

needed to complete the EEG device, which will cover costs associated with the SDK (operating system), the design work to create

a sleek, consumer-friendly final product and updates on the hardware including Bluetooth wireless updates. We have announced our

desire to partner with a larger technology firm to invest in the completion of the EEG headset in return for a negotiated interest

in the product. If successful, we will not need to raise this capital to complete the project. If we are not successful in attracting

a financial partner to assist in the completion of the EEG headset, we plans to raise funds by means of an equity offering to raise

the necessary capital to complete the project.

Mind Solutions currently has a need of

approximately $45,000 per month to sustain operations until sales of the software and anticipated sales of the EEG headset increase.

Going Concern

As of September 30, 2014, the registrant

had an accumulated deficit during development stage of $19,860,844. During the nine months ended September 30, 2014, the registrant

used net cash of $556,810 for operating activities. These factors raise substantial doubt about the registrant’s ability

to continue as a going concern.

While the registrant is attempting

to commence operations and generate revenues, the registrant’s cash position may not be significant enough to support

the registrant’s daily operations. Management intends to raise additional funds by way of a public or private offering.

Management believes that the actions presently being taken to further implement its business plan and generate revenues

provide the opportunity for the registrant to continue as a going concern. While the registrant believes in the viability of

its strategy to generate revenues and in its ability to raise additional funds, there can be no assurances to that effect.

The ability of the registrant to continue as a going concern is dependent upon the registrant’s ability to further

implement its business plan and generate revenues.

Three Months Ended September 30, 2014, Compared to

Three Months Ended September 30, 2013.

Revenues. During the three months

ended September 30, 2014, and 2013, the registrant recognized $534 and $0 of revenues. The $534 of product revenues recognized

were from the registrant’s sales of its software. We are aggressively looking for ways to leverage our technology to develop

revenue streams.

General and Administrative Expenses.

Consulting Fees. During the three

months ended September 30, 2014, consulting expense increased to $421,871 as compared to $460,880 from the prior three months ended