SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 24, 2014

(Exact name of Registrant as Specified in Charter)

|

| | | | |

Georgia | | 1-13941 | | 58-0687630 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

309 E. Paces Ferry Road, N.E. Atlanta, Georgia | |

30305-2377 |

(Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (404) 231-0011

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On October 24, 2014, Aaron's, Inc. (the “Company”) issued a press release to announce its financial results for the three- and nine-month periods ended September 30, 2014. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The press release presents the Company’s net earnings and diluted earnings per share (“EPS”) in accordance with generally accepted accounting principles in the United States (“GAAP”) and in a format that is not in accordance with GAAP that excludes the items described below.

2014 Adjustments

| |

• | Progressive Acquisition. On April 14, 2014, the Company completed its acquisition of Progressive Finance Holdings, LLC (“Progressive”) for cash consideration of approximately $700 million. The press release presents earnings and EPS excluding (i) $11.3 million in amortization of intangibles related to the acquisition during the third quarter of 2014 and (ii) $9.7 million in amortization of intangibles related to the acquisition, as well as, acquisition-related fees and expenses (including financial advisory and legal fees) of $5.5 million during the second quarter of 2014. The Company had never previously completed an acquisition of the magnitude of the Progressive transaction. |

| |

• | Retirement Charges. As previously disclosed, Ronald W. Allen, formerly Chief Executive Officer of the Company, retired from the Company, effective August 31, 2014, and on July 24, 2014, David L. Buck, formerly Chief Operating Officer of the Company, notified the Company that he is retiring as an employee of the Company effective December 31, 2014, and in connection with his retirement relinquished his duties as Chief Operating Officer effective August 1, 2014. The Company incurred $9.1 million in expenses pertaining to the retirement of these two officers during the third quarter of 2014. While charges related to retirement do arise from time to time, management regards the charges incurred in the third quarter of 2014 as uncommon in nature and size. |

| |

• | California Regulatory Investigation. During the third quarter of 2014, the Company resolved the previously reported regulatory investigation by the California Attorney General into the Company’s business. The press release presents earnings and EPS excluding a $1.2 million reduction during the third quarter of 2014 of previously recognized regulatory expense upon such resolution. Management believes that the circumstances and costs of this particular matter differentiated it from the Company’s normal course legal and regulatory proceedings. |

| |

• | Strategic Matters. The Company and its Board addressed various strategic matters during the second quarter of 2014, including an unsolicited acquisition offer, two proxy contests and shareholder proposals. The Company incurred $12.4 million in financial advisory and legal costs to address them during the second quarter. These matters were unprecedented in the Company’s history, and the level of the professional fees associated with them was similarly exceptional. |

| |

• | Restructuring Charges. In connection with its previously announced new strategy, which includes an initiative to rationalize the Company’s store base, the Company incurred approximately $6.9 million and $2.3 million in restructuring charges related to store closures in the third and second quarters of 2014, respectively. While the Company has routinely closed and sold stores on an |

opportunistic basis in the ordinary course of business in the past, and has also disposed of non-core businesses in substantially their entirety, it has not previously implemented a store rationalization program across the Company’s entire core business, so management regards these restructuring charges as unusual.

2013 Adjustments

| |

• | California Regulatory Investigation. The Company accrued $13.4 million and $15.0 million for loss contingencies in connection with this now-resolved investigation during the third quarter of 2013 and second quarter of 2013, respectively. |

| |

• | Retirement and Vacation Related Charges. As previously disclosed, William K. Butler, Jr., formerly Chief Operating Officer of the Company, retired from the Company effective May 1, 2013. The Company also implemented changes to its vacation policies last year. The Company recorded $4.9 million in charges in the second quarter related to this retirement and change in vacation policies. While charges related to retirement or employee benefit actions or policy changes do arise from time to time, management regards the charges incurred in the quarter ended June 30, 2013 as uncommon in both nature and size. |

While some of the matters described above may not be considered as non-recurring in nature in a strictly accounting sense, management regards the circumstances and magnitude of these matters as not arising out of the ordinary course of business and as not entirely susceptible to prediction or effective management. For these reasons, management believes that presentation of net earnings and diluted EPS excluding these adjustments is useful because it gives investors supplemental information to evaluate and compare the performance of the Company’s underlying core business from period to period.

The press release also presents the earnings before interest, taxes, depreciation and amortization of each of the Company’s segments, adjusted to exclude the Progressive-related transaction costs, financial advisory and legal costs related to strategic matters, restructuring expenses, executive retirement and vacation-related charges and reversal of regulatory expense related to the resolution of the California Attorney General investigation described above (“Adjusted EBITDA”). Adjusted EBITDA is also not a measure presented in accordance with GAAP. Management believes presenting the Company’s Adjusted EBITDA is useful to investors because it provides some indication of what the results of Progressive would have been absent the effects of the Company’s acquisition of Progressive, which arise principally from the debt financing of the transaction and acquisition-related accounting for intangible assets. It also provides additional information on what the results of the Company would have been absent the Progressive acquisition and the aforementioned special charges.

Non-GAAP financial measures should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted EPS and the GAAP operating income of the Company’s segments, which are also presented in the press release.

ITEM 2.05. COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES

On July 15, 2014, the Company announced that a rigorous evaluation of the Company-operated store portfolio had been performed, which would result in the closing of 44 underperforming stores in the third quarter of 2014.

The restructuring was completed during the third quarter of 2014 and total restructuring charges of approximately $9.1 million were recorded during the nine months ended September 30, 2014, principally comprised of $4.8 million related to contractual lease obligations, $3.3 million related to the write-off and impairment of property, plant and equipment and $600,000 related to workforce reductions. The Company does not currently anticipate any remaining costs related to this restructuring plan to be material. Cash costs are projected to be approximately 65% percent of the total charges.

* * * *

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this Current Report on Form 8-K regarding the Company’s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “expect,” “forecast,” “guidance,” “intend,” “believe,” “could,” “project,” “estimate,” “anticipate,” “should” and similar terminology. These risks and uncertainties include factors such as changes in general economic conditions, competition, pricing, legal and regulatory proceedings, customer privacy, information security, customer demand, the integration of the Progressive acquisition, the execution and results of the Company’s new strategy, risks related to Progressive’s “virtual” lease-to-own business with which the Company may be unfamiliar, and the other risks and uncertainties discussed under “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013 as updated in its Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2014 and June 30, 2014. Statements in this Current Report that are “forward-looking” include without limitation, statements regarding any future restructuring costs. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the filing date of this Current Report. Except as required by law, the Company undertakes no obligation to to update these forward-looking statements to reflect subsequent events or circumstances after the filing date of this Current Report.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

|

| |

Exhibit No. | Description |

99.1 | Aaron’s, Inc. press release dated October 24, 2014, announcing the Company’s financial results for the third quarter and first nine months of 2014. |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | AARON’S, INC. |

| | By: |

/s/ Gilbert L. Danielson |

| Date: October 24, 2014 | | Gilbert L. Danielson interim Chief Executive Officer, Executive Vice President and Chief Financial Officer |

|

|

Contact: Sharon J. Lawrence |

Vice President, Finance |

404-231-0011 |

Aaron's, Inc. Reports Third Quarter Results

| |

• | Total Revenues of $707.6 Million |

| |

• | Net Earnings of $9.3 Million; Diluted EPS of $.13 |

| |

• | Non-GAAP Diluted EPS of $.39 Excluding Special Charges |

| |

• | Progressive Continues to Exceed Expectations |

| |

• | Executing on Strategic Cost Initiatives |

ATLANTA, October 24, 2014 - Aaron's, Inc. (NYSE: AAN), a leader in the sales and lease ownership and specialty retailing of furniture, consumer electronics, home appliances and accessories, today announced revenues and earnings for the three and nine months ended September 30, 2014.

For the third quarter of 2014, revenues increased 32% to $707.6 million compared to $537.2 million for the same period in 2013. Net earnings were $9.3 million versus $21.1 million a year ago. Diluted earnings per share were $.13 compared to $.28 per share last year. The $170.3 million increase in revenue was due to $189.8 million in revenue from Progressive, partially offset by a decrease in revenue from Aaron’s core business.

“We are making significant progress on the strategic initiatives outlined earlier this year to strengthen our core business,” said Gilbert L. Danielson, interim Chief Executive Officer and Chief Financial Officer of Aaron’s, Inc. “Improving the customer’s experience is a priority and through meeting their needs in all areas of our operations, including e-commerce and the personal relationship at Aaron’s stores, we believe our overall customer reach will expand.”

“Progressive once again exceeded expectations and is rapidly growing its business,” Mr. Danielson continued. “The number of customers entering into Progressive lease ownership transactions continues to grow through both existing and new retailer relationships. We are also

well on our way to capturing significant synergy opportunities for the overall Company resulting from the April acquisition.”

“While our core business continues to experience challenges in the current economic environment, we believe consumers still need and want the household furnishings we offer. With our strengthened omni-channel platform, we are removing obstacles to doing business by meeting our customers where they want to do business with us, which we expect will increase demand and customer satisfaction.”

“We continue to expect that approximately $50 million in annual cost savings will be achieved by the end of 2015. Among other actions, during the third quarter we closed 44 under-performing stores and restructured our home office and field support to more closely align with current business conditions. Overall, we believe we are on the right path in transforming Aaron's,” Mr. Danielson concluded.

Financial Summary

For the first nine months of 2014, revenues increased 17% to $1.965 billion compared to $1.681 billion for the same period of 2013. Net earnings were $56.1 million versus $98.0 million last year. Diluted earnings per share for the first nine months were $.77 for 2014 compared to $1.28 in 2013.

During the third quarter of 2014, pre-tax earnings were negatively impacted by $9.1 million of expenses pertaining to the retirement of both the Company’s Chief Executive Officer and Chief Operating Officer, $6.9 million in restructuring charges resulting from store closings and the realignment of operations in the Aaron’s core business and $11.3 million in amortization expense related to the Progressive acquisition, partially offset by a $1.2 million reduction in previously recognized regulatory expense upon the resolution of the regulatory investigation by the California Attorney General into Aaron's leasing, marketing and privacy practices. In addition, during the second quarter of 2014, pre-tax earnings were negatively impacted by $9.7 million in amortization expense and $5.5 million in transaction costs related to the Progressive acquisition. The Company also incurred $12.4 million in financial advisory and legal costs related to addressing strategic matters, including proxy contests, and $2.3 million in restructuring charges during the second quarter of 2014.

Included in 2013 pre-tax earnings was a third quarter $13.4 million accrual related to the then-pending regulatory investigation by the California Attorney General, and, in the second

quarter, a $15.0 million accrual related to the same investigation and $4.9 million of retirement expenses and a change in the Company's vacation policies.

On a non-GAAP basis, excluding the special charges, costs and expenses described above from all periods, net earnings for the third quarter of 2014 would have been $28.2 million compared to $30.8 million for the same period in 2013, and earnings per share assuming dilution would have been $.39 compared to $.40 a year ago. Net earnings for the first nine months of 2014 would have been $93.6 million compared to $119.6 million in 2013, and earnings per share assuming dilution would have been $1.29 versus $1.56 last year.

Adjusted EBITDA for the Company, adjusted to exclude the aforementioned special fees and expenses, was $60.0 million and $201.1 million for the three and nine months ended September 30, 2014, respectively. Adjusted EBITDA is calculated as the Company's earnings before interest, depreciation on property, plant and equipment, amortization of intangible assets, income taxes and special fees and expenses.

Same store revenues (revenues earned in Company-operated stores open for the entirety of the quarter) decreased 2.8% during the third quarter of 2014 compared to the third quarter of 2013, and customer count on a same store basis was down 3.9%. For Company-operated stores open over two years at the end of September 2014, same store revenues decreased 3.7% during the third quarter of 2014 compared to the third quarter of 2013. The Company had 1,072,000 customers and its franchisees had 574,000 customers at the end of the most recent quarter, a 3.8% decrease in total customers over the number at the end of the third quarter a year ago (customers of franchisees, however, are not customers of Aaron's, Inc.).

The effective tax rate increased in the third quarter of 2014 to 29.6% compared to 28.2% in the third quarter of 2013. The effective tax rate also increased for the first nine months of 2014 to 35.8% compared to 35.0% in the same period a year ago. The increase in the tax rate for both the quarter and nine months ended September 30, 2014 is primarily the result of decreased tax benefits related to the Company’s furniture manufacturing operations and the loss of federal credits that have not been renewed by Congress. It is anticipated that the effective tax rate for the entire year 2014 will be approximately 36.0%.

The Company reacquired 1,000,952 shares during the first quarter of 2014 at the completion of the previously announced accelerated share repurchase program. The Company has authorization to purchase an additional 10,496,421 shares.

Division Results

Aaron's Sales & Lease Ownership division revenues decreased $14.4 million, or 3%, in the third quarter of 2014 to $501.7 million compared to $516.1 million in revenues in the third quarter of 2013. Sales and lease ownership revenues for the first nine months of 2014 decreased 2% to $1.584 billion compared to $1.614 billion for the same period a year ago.

Revenues of the HomeSmart division were $15.6 million in the third quarter of 2014, a 5% increase over the $14.8 million in revenues in the third quarter of 2013. HomeSmart revenues for the first nine months of 2014 were $48.9 million versus $47.6 million for the same period a year ago, a 3% increase.

As noted above, the Company recorded a $6.9 million restructuring charge in the third quarter related to the closing of 44 Company-operated stores and the realignment of home office and field support operations.

The Progressive division generated revenues of $189.8 million and a pre-tax profit of $1.7 million in the third quarter, and for the period from the April 14, 2014 acquisition date recorded $328.7 million in revenues and a pre-tax profit of $1.4 million. Progressive’s EBITDA included in the Company’s results during the third quarter and nine months ended September 30, 2014 was $18.6 million and $32.5 million, respectively.

Components of Revenue

Consolidated lease revenues and fees for the third quarter and first nine months of 2014 increased 42% and 22%, respectively, over the comparable prior year periods. In addition, franchise royalties and fees decreased 4% and 3% in the third quarter and first nine months of 2014 compared to the same periods in 2013, respectively. The decreases in the Company's franchise royalties and fees are the result of a decrease in revenues of the Company's franchisees, which collectively had revenues of $240.1 million during the third quarter and $754.1 million for the first nine months of 2014, decreases of 2% and 1% from the comparable 2013 periods, respectively. Same store revenues and customer counts for franchised stores were down 2.5% and 4.1%, respectively, for the third quarter of 2014 compared to the same quarter last year (revenues and customers of franchisees, however, are not revenues and customers of Aaron's, Inc.). Non-retail sales, which are primarily sales of merchandise to Aaron's Sales and Lease Ownership franchisees, decreased 7% for the third quarter and 3% for the first nine months compared to the same periods last year.

Store Count

During the third quarter of 2014, the Company closed 43 Aaron's Sales & Lease Ownership stores and one HomeSmart store, and opened nine Company-operated Aaron's Sales & Lease Ownership stores and six franchised stores. The Company also acquired two Aaron's Sales & Lease Ownership franchised stores. Five Aaron's Sales & Lease Ownership franchised stores and one HomeSmart franchised store were closed during the quarter. Through the three and nine months ended September 30, 2014, the Company awarded area development agreements to open six and 23 additional franchised stores, respectively. At September 30, 2014, there were area development agreements outstanding for the opening of 142 franchised stores over the next several years.

At September 30, 2014, the Company had 1,234 Company-operated Aaron's Sales & Lease Ownership stores, 783 franchised Aaron's Sales & Lease Ownership stores, 82 Company-operated HomeSmart stores, and two franchised HomeSmart stores. The total number of stores open at September 30, 2014 was 2,101.

Fourth Quarter and Full Year 2014 Outlook

The Company is updating its guidance for the fourth quarter and full year 2014. Diluted earnings per share is presented both on a GAAP basis and on a non-GAAP adjusted basis that excludes transaction-related amortization and special fees and expenses. The Company currently expects to achieve the following:

| |

• | Consolidated fourth quarter revenues (excluding revenues of franchisees) of approximately $740 million, including Progressive revenues of approximately $205 million. |

| |

• | Fiscal year 2014 revenues (excluding revenues of franchisees) of approximately $2.71 billion, including Progressive revenues of approximately $534 million since the April 14 acquisition. |

| |

• | Fourth quarter and fiscal year adjusted EBITDA in the range of approximately $57 million to $62 million and $257 million to $262 million, respectively, including Progressive EBITDA in the range of $15 million to $18 million and $47 million to $50 million, respectively. |

| |

• | Fourth quarter and fiscal year GAAP diluted earnings per share in the range of $.24 to $.29 and $1.01 to $1.06, respectively. |

| |

• | Fourth quarter and fiscal year 2014 non-GAAP adjusted diluted earnings per share in the range of $.34 to $.39 and $1.62 to $1.67, respectively. |

| |

• | EPS guidance does not assume any significant repurchases of the Company's common stock. |

| |

• | The Company expects for the full year 2014 no new store growth in Company-operated Aaron's stores, on a net basis after store closings. |

Conference Call

Aaron's will hold a conference call to discuss its quarterly financial results on Friday, October 24, 2014, at 10:00 a.m. Eastern Time. The public is invited to listen to the conference call by webcast accessible through the Company's Investor Relations website, investor.aarons.com. The webcast will be archived for playback at that same site.

About Aaron's, Inc.

Aaron's, Inc. (NYSE: AAN), a leader in the sales and lease ownership and specialty retailing of furniture, consumer electronics, home appliances and accessories, currently has more than 2,100 Company-operated and franchised stores in 48 states and Canada. Aaron's was founded in 1955, is headquartered in Atlanta and has been publicly traded since 1982. Progressive Leasing, a wholly-owned subsidiary and leading virtual lease-to-own company, provides lease-purchase solutions through over 15,000 retail locations in 46 states. Aaron's, Inc. includes the Aarons.com, ShopHomeSmart.com and ProgLeasing.com brands. For more information, visit www.aarons.com.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this news release regarding Aaron's, Inc.'s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as "may," "expect," "forecast," "guidance", "intend," "believe," "could," "project," "estimate," "anticipate," "should" and similar terminology. These risks and uncertainties include factors such as changes in general economic conditions, competition, pricing, legal and regulatory proceedings, customer privacy, information security, customer demand, the integration of the Progressive acquisition, the execution and results of our new strategy, risks related to Progressive's "virtual" lease-to-own business with which the Company may be unfamiliar, and the other risks and uncertainties discussed under “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013 as updated in its Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2014 and June 30, 2014. Statements in this release that are “forward-looking” include without limitation: Aaron's projected results (including Progressive’s results) for future periods, including statements under the heading “Fourth Quarter and Full Year 2014 Outlook"; statements on cost reductions and strategic initiatives; and statements regarding the future effects of the Progressive acquisition on the Company's business; statements regarding the Company's omni-channel distribution plans; and statements regarding the effects of planned promotions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this press release.

Aaron's, Inc. and Subsidiaries

Consolidated Statements of Earnings

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | |

| | (Unaudited)

Three Months Ended | (Unaudited)

Nine Months Ended |

| | September 30, | September 30, |

| | 2014 | 2013 | 2014 | 2013 |

Revenues: | | | | | |

Lease Revenues and Fees | | $ | 603,601 |

| $ | 425,734 |

| $ | 1,625,931 |

| $ | 1,330,526 |

|

Retail Sales | | 8,094 |

| 9,315 |

| 31,023 |

| 32,618 |

|

Non-Retail Sales | | 78,503 |

| 84,412 |

| 254,021 |

| 262,152 |

|

Franchise Royalties and Fees | | 15,838 |

| 16,530 |

| 50,147 |

| 51,564 |

|

Other | | 1,528 |

| 1,233 |

| 4,375 |

| 3,919 |

|

Total | | 707,564 |

| 537,224 |

| 1,965,497 |

| 1,680,779 |

|

| | | | | |

Costs and Expenses: | | | | | |

Depreciation of Lease Merchandise | | 260,819 |

| 154,495 |

| 661,446 |

| 475,900 |

|

Retail Cost of Sales | | 5,409 |

| 5,681 |

| 19,900 |

| 19,295 |

|

Non-Retail Cost of Sales | | 71,403 |

| 76,792 |

| 230,537 |

| 238,335 |

|

Operating Expenses | | 334,294 |

| 259,708 |

| 918,129 |

| 759,541 |

|

Financial Advisory and Legal Costs | | 385 |

| — |

| 13,661 |

| — |

|

Restructuring Expenses | | 6,876 |

| — |

| 9,140 |

| — |

|

Retirement and Vacation Charges | | 9,094 |

| — |

| 9,094 |

| 4,917 |

|

Progressive-Related Transaction Costs | | 371 |

| — |

| 6,638 |

| — |

|

Regulatory (Income) Expenses | | (1,200 | ) | 13,400 |

| (1,200 | ) | 28,400 |

|

Other Operating (Income) Expense, Net | | (197 | ) | (1,038 | ) | (869 | ) | 1,218 |

|

Total | | 687,254 |

| 509,038 |

| 1,866,476 |

| 1,527,606 |

|

| | | | | |

Operating Profit | | 20,310 |

| 28,186 |

| 99,021 |

| 153,173 |

|

Interest Income | | 634 |

| 719 |

| 2,461 |

| 2,241 |

|

Interest Expense | | (6,162 | ) | (1,497 | ) | (13,174 | ) | (4,516 | ) |

Other Non-Operating (Expense) Income, Net | | (1,583 | ) | 2,012 |

| (837 | ) | (49 | ) |

Earnings Before Income Taxes | | 13,199 |

| 29,420 |

| 87,471 |

| 150,849 |

|

| | | | | |

Income Taxes | | 3,904 |

| 8,282 |

| 31,332 |

| 52,857 |

|

| | | | | |

Net Earnings | | $ | 9,295 |

| $ | 21,138 |

| $ | 56,139 |

| $ | 97,992 |

|

| | | | | |

Earnings Per Share | | $ | .13 |

| $ | .28 |

| $ | .78 |

| $ | 1.29 |

|

Earnings Per Share Assuming Dilution | | $ | .13 |

| $ | .28 |

| $ | .77 |

| $ | 1.28 |

|

| | | | | |

Weighted Average Shares Outstanding | | 72,340 |

| 76,101 |

| 72,350 |

| 75,922 |

|

Weighted Average Shares Outstanding Assuming Dilution | | 72,660 |

| 76,676 |

| 72,713 |

| 76,611 |

|

Selected Balance Sheet Data

(In thousands)

(Unaudited)

|

| | | | | | | | |

| | September 30, 2014 | | December 31, 2013 |

Cash and Cash Equivalents | | $ | 10,401 |

| | $ | 231,091 |

|

Investments | | 21,704 |

| | 112,391 |

|

Accounts Receivable, Net | | 89,821 |

| | 68,684 |

|

Lease Merchandise, Net | | 1,036,407 |

| | 869,725 |

|

Property, Plant and Equipment, Net | | 224,301 |

| | 231,293 |

|

Other Assets, Net | | 905,294 |

| | 313,992 |

|

| | | | |

Total Assets | | 2,287,928 |

| | 1,827,176 |

|

| | | | |

Debt | | 557,237 |

| | 142,704 |

|

Total Liabilities | | 1,086,682 |

| | 687,213 |

|

Shareholders' Equity | | $ | 1,201,246 |

| | $ | 1,139,963 |

|

| | | | |

Use of Non-GAAP Financial Information:

This press release presents the Company's net earnings and diluted earnings per share in accordance with generally accepted accounting principles in the United States ("GAAP") and in a format that is not in accordance with GAAP that excludes third quarter 2014 charges of (i) $11.3 million in Progressive-related amortization expense, (ii) $9.1 million in expenses pertaining to the retirement of both the Company's Chief Executive Officer and Chief Operating Officer, (iii) $6.9 million of restructuring expenses, (iv) a $1.2 million reduction of previously recognized regulatory expense upon the resolution of a regulatory investigation and second quarter 2014 charges of (v) $9.7 million in amortization expense and $5.5 million in transaction costs related to the Progressive acquisition, (vi) $12.4 million of financial advisory and legal costs related to addressing strategic matters, including proxy contests, and (vii) $2.3 million of restructuring expenses. Excluded from prior year net earnings and diluted earnings per share are (viii) third quarter 2013 charges of $13.4 million related to a then-pending regulatory investigation, (ix) second quarter 2013 charges of $15.0 million related to the same regulatory investigation and (x) second quarter 2013 retirement and vacation-related charges of $4.9 million. In addition, this press release presents the adjusted EBITDA of the Company and its operating segments. Adjusted EBITDA is also not a measure in accordance with GAAP.

Management regards the circumstances of the special charges mentioned above as not arising out of the ordinary course of business. The adjustments include matters that are not entirely susceptible to prediction or effective management, and consequently management believes that presentation of net earnings and diluted earnings per share excluding these adjustments is useful because it gives investors supplemental information to evaluate and compare the performance of the Company's underlying core business from period to period. Management believes presenting the Company's adjusted EBITDA is useful to investors because it provides some indication of what the results of Progressive would have been absent the effects of the Company’s acquisition of Progressive, which arise principally from the debt financing of the transaction and acquisition-related accounting for intangible assets. It also provides additional information on what the results of the Company would have been absent the Progressive acquisition and the aforementioned special charges.

Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company's GAAP basis net earnings and diluted earnings per share and the GAAP operating income of the Company's segments, which are also presented in the press release. Please refer to our Current Report on Form 8-K furnishing this earnings release to the SEC on the date hereof for further information on our use of non-GAAP financial measures.

Reconciliation of Net Earnings and Earnings Per Share Assuming Dilution to Non-GAAP

Net Earnings and Earnings Per Share Assuming Dilution

(In thousands, except earnings per share)

|

| | | | | | | | | | | | |

| (Unaudited)

Three Months Ended

September 30, | (Unaudited)

Nine Months Ended

September 30, |

| 2014 | 2013 | 2014 | 2013 |

Net Earnings | $ | 9,295 |

| $ | 21,138 |

| $ | 56,139 |

| $ | 97,992 |

|

Add Preliminary Progressive-Related Amortization Expense (1) | 7,984 |

| — |

| 13,502 |

| — |

|

Add Financial Advisory and Legal Costs (2) | 271 |

| — |

| 8,768 |

| — |

|

Add Progressive-Related Transaction Costs (3) | 261 |

| — |

| 4,260 |

| — |

|

Add Restructuring Expenses (4) | 4,842 |

| — |

| 5,866 |

| — |

|

Add Regulatory (Income) Expenses (5)(6) | (845 | ) | 9,628 |

| (770 | ) | 18,449 |

|

Add Retirement and Vacation Charges (7)(8) | 6,404 |

| — |

| 5,837 |

| 3,194 |

|

Non-GAAP Net Earnings | $ | 28,212 |

| $ | 30,766 |

| $ | 93,602 |

| $ | 119,635 |

|

| | | | |

Earnings Per Share Assuming Dilution | $ | .13 |

| $ | .28 |

| $ | .77 |

| $ | 1.28 |

|

Add Preliminary Progressive-Related Amortization Expense | .11 |

| — |

| .19 |

| — |

|

Add Financial Advisory and Legal Costs | — |

| — |

| .12 |

| — |

|

Add Progressive-Related Transaction Costs | — |

| — |

| .06 |

| — |

|

Add Restructuring Expenses | .07 |

| — |

| .08 |

| — |

|

Add Regulatory (Income) Expenses | (.01 | ) | .13 |

| (.01 | ) | .24 |

|

Add Retirement and Vacation Related Charges | .09 |

| — |

| .08 |

| .04 |

|

| | | | |

Non-GAAP Earnings Per Share Assuming Dilution (9) | $ | .39 |

| $ | .40 |

| $ | 1.29 |

| $ | 1.56 |

|

| | | | |

Weighted Average Shares Outstanding Assuming Dilution | 72,660 |

| 76,676 |

| 72,713 |

| 76,611 |

|

| |

(1) | Net of taxes of $3,354 for the three months and $7,535 for the nine months ended September 30, 2014 calculated using the effective tax rates for the three and nine months ended September 30, 2014. |

| |

(2) | Net of taxes of $114 for the three months and $4,893 for the nine months ended September 30, 2014 calculated using the effective tax rates for the three and nine months ended September 30, 2014. |

| |

(3) | Net of taxes of $110 for the three months and $2,378 for the nine months ended September 30, 2014 calculated using the effective tax rates for the three and nine months ended September 30, 2014. |

| |

(4) | Net of taxes of $2,034 for the three months and $3,274 for the nine months ended September 30, 2014 calculated using the effective tax rates for the three and nine months ended September 30, 2014. |

| |

(5) | Net of taxes of $355 for the three months and $430 for the nine months ended September 30, 2014 calculated using the effective tax rates for the three and nine months ended September 30, 2014. |

| |

(6) | Net of taxes of $3,772 for the three months and $9,951 for the nine months ended September 30, 2013 calculated using the effective tax rates for the three and nine months ended September 30, 2013. |

| |

(7) | Net of taxes of $2,690 for the three months and $3,257 for the nine months ended September 30, 2014 calculated using the effective tax rates for the three and nine months ended September 30, 2014. |

| |

(8) | Net of taxes of $1,723 for the nine months ended September 30, 2013 calculated using the effective tax rate for the nine months ended September 30, 2013. |

| |

(9) | In some cases the sum of individual EPS amounts may not equal total EPS calculations. |

Aaron's, Inc. and Subsidiaries

Non-GAAP Financial Information

Quarterly Segment EBITDA

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2014 |

| Sales & Lease Ownership | Progressive | HomeSmart | Franchise | Manufacturing | Other | Consolidated Total |

Net Income | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 9,295 |

|

Provision for Income Taxes | — |

| — |

| — |

| — |

| — |

| — |

| 3,904 |

|

Operating Income | 23,814 |

| 1,689 |

| (906 | ) | 12,542 |

| (17 | ) | (23,923 | ) | 13,199 |

|

Interest Expense | 1,966 |

| 5,247 |

| 217 |

| — |

| 12 |

| (1,280 | ) | 6,162 |

|

Depreciation | 8,260 |

| 327 |

| 646 |

| 388 |

| 385 |

| 3,328 |

| 13,334 |

|

Amortization | 353 |

| 11,338 |

| 42 |

| — |

| — |

| — |

| 11,733 |

|

EBITDA | 34,393 |

| 18,601 |

| (1 | ) | 12,930 |

| 380 |

| (21,875 | ) | 44,428 |

|

Financial Advisory and Legal Costs | — |

| — |

| — |

| — |

| — |

| 385 |

| 385 |

|

Progressive-Related Transaction Costs | — |

| — |

| — |

| — |

| — |

| 371 |

| 371 |

|

Restructuring Expenses | 2,572 |

| — |

| 6 |

| — |

| — |

| 4,298 |

| 6,876 |

|

Regulatory Income | — |

| — |

| — |

| — |

| — |

| (1,200 | ) | (1,200 | ) |

Retirement Charges | — |

| — |

| — |

| — |

| — |

| 9,094 |

| 9,094 |

|

Adjusted EBITDA | $ | 36,965 |

| $ | 18,601 |

| $ | 5 |

| $ | 12,930 |

| $ | 380 |

| $ | (8,927 | ) | $ | 59,954 |

|

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, 2013 |

| Sales & Lease Ownership | Progressive | HomeSmart | Franchise | Manufacturing | Other | Consolidated Total |

Net Income | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 21,138 |

|

Provision for Income Taxes | — |

| — |

| — |

| — |

| — |

| — |

| 8,282 |

|

Operating Income | 37,193 |

| — |

| (1,582 | ) | 13,084 |

| 22 |

| (19,297 | ) | 29,420 |

|

Interest Expense | 1,876 |

| — |

| 217 |

| — |

| 20 |

| (616 | ) | 1,497 |

|

Depreciation | 9,080 |

| — |

| 614 |

| 441 |

| 381 |

| 2,762 |

| 13,278 |

|

Amortization | 708 |

| — |

| 232 |

| — |

| — |

| — |

| 940 |

|

EBITDA | 48,857 |

| — |

| (519 | ) | 13,525 |

| 423 |

| (17,151 | ) | 45,135 |

|

Regulatory Expenses | — |

| — |

| — |

| — |

| — |

| 13,400 |

| 13,400 |

|

Adjusted EBITDA | $ | 48,857 |

| $ | — |

| $ | (519 | ) | $ | 13,525 |

| $ | 423 |

| $ | (3,751 | ) | $ | 58,535 |

|

Aaron's, Inc. and Subsidiaries

Non-GAAP Financial Information

Year to Date Segment EBITDA

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2014 |

| Sales & Lease Ownership | Progressive | HomeSmart | Franchise | Manufacturing | Other | Consolidated Total |

Net Income | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 56,139 |

|

Provision for Income Taxes | — |

| — |

| — |

| — |

| — |

| — |

| 31,332 |

|

Operating Income | 111,806 |

| 1,366 |

| (1,492 | ) | 38,173 |

| 441 |

| (62,823 | ) | 87,471 |

|

Interest Expense | 5,891 |

| 9,501 |

| 688 |

| — |

| 40 |

| (2,946 | ) | 13,174 |

|

Depreciation | 25,766 |

| 587 |

| 1,944 |

| 1,217 |

| 1,152 |

| 9,677 |

| 40,343 |

|

Amortization | 1,458 |

| 21,037 |

| 249 |

| — |

| — |

| — |

| 22,744 |

|

EBITDA | 144,921 |

| 32,491 |

| 1,389 |

| 39,390 |

| 1,633 |

| (56,092 | ) | 163,732 |

|

Financial Advisory and Legal Costs | — |

| — |

| — |

| — |

| — |

| 13,661 |

| 13,661 |

|

Progressive-Related Transaction Costs | — |

| — |

| — |

| — |

| — |

| 6,638 |

| 6,638 |

|

Restructuring Expenses | 4,836 |

| — |

| 6 |

| — |

| — |

| 4,298 |

| 9,140 |

|

Regulatory Income | — |

| — |

| — |

| — |

| — |

| (1,200 | ) | (1,200 | ) |

Retirement Charges | — |

| — |

| — |

| — |

| — |

| 9,094 |

| 9,094 |

|

Adjusted EBITDA | $ | 149,757 |

| $ | 32,491 |

| $ | 1,395 |

| $ | 39,390 |

| $ | 1,633 |

| $ | (23,601 | ) | $ | 201,065 |

|

| | | | | | | |

| | | | | | | |

| Nine Months Ended September 30, 2013 |

| Sales & Lease Ownership | Progressive | HomeSmart | Franchise | Manufacturing | Other | Consolidated Total |

Net Income | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 97,992 |

|

Provision for Income Taxes | — |

| — |

| — |

| — |

| — |

| — |

| 52,857 |

|

Operating Income | 162,409 |

| — |

| (2,376 | ) | 40,841 |

| 67 |

| (50,092 | ) | 150,849 |

|

Interest Expense | 5,613 |

| — |

| 683 |

| — |

| 64 |

| (1,844 | ) | 4,516 |

|

Depreciation | 27,005 |

| — |

| 1,836 |

| 1,350 |

| 1,640 |

| 7,792 |

| 39,623 |

|

Amortization | 2,153 |

| — |

| 793 |

| — |

| — |

| — |

| 2,946 |

|

EBITDA | 197,180 |

| — |

| 936 |

| 42,191 |

| 1,771 |

| (44,144 | ) | 197,934 |

|

Regulatory Expenses | — |

| — |

| — |

| — |

| — |

| 28,400 |

| 28,400 |

|

Retirement and Vacation Charges | — |

| — |

| — |

| — |

| — |

| 4,917 |

| 4,917 |

|

Adjusted EBITDA | $ | 197,180 |

| $ | — |

| $ | 936 |

| $ | 42,191 |

| $ | 1,771 |

| $ | (10,827 | ) | $ | 231,251 |

|

| | | | | | | |

Reconciliation of 2014 Projected Guidance for Earnings Per Share

Assuming Dilution to Non-GAAP Earnings Per Share Assuming Dilution

|

| | | | | | | | | | | | |

| Fourth Quarter 2014 | Fiscal Year 2014 |

| Low Range | High Range | Low Range | High Range |

Projected Earnings Per Share Assuming Dilution | $ | .24 |

| $ | .29 |

| $ | 1.01 |

| $ | 1.06 |

|

Add Progressive-Related Amortization Expense | .10 |

| .10 |

| .28 |

| .28 |

|

Add Financial Advisory and Legal Costs | — |

| — |

| .12 |

| .12 |

|

Add Progressive-Related Transaction Costs | — |

| — |

| .06 |

| .06 |

|

Add Restructuring Expenses | — |

| — |

| .08 |

| .08 |

|

Add Regulatory (Income) | — |

| — |

| (.01 | ) | (.01 | ) |

Add Retirement Charges | — |

| — |

| .08 |

| .08 |

|

Projected Non-GAAP Earnings Per Share Assuming Dilution | $ | .34 |

| $ | .39 |

| $ | 1.62 |

| $ | 1.67 |

|

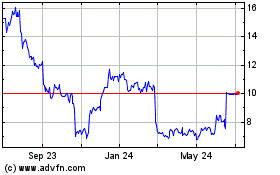

Aarons (NYSE:AAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

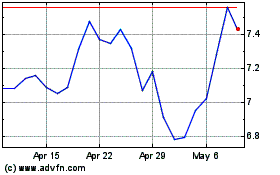

Aarons (NYSE:AAN)

Historical Stock Chart

From Apr 2023 to Apr 2024