UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): October 23, 2014

CASS INFORMATION SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Missouri |

|

000-20827 |

|

43-1265338 |

| (State or other jurisdiction of |

|

(Commission |

|

(I.R.S. Employer |

| incorporation or organization) |

|

File Number) |

|

Identification No.) |

|

|

|

| 12444 Powerscourt Drive, Suite 550 |

|

|

| St. Louis, Missouri |

|

63131 |

| (Address of principal executive offices) |

|

(Zip Code) |

(314) 506-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act. |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

| Item 2.02. |

Results of Operations and Financial Condition. |

On October 23, 2014, Cass Information Systems, Inc.

(the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2014. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information reported under this Item 2.02 of Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 8.01. |

Other Matters. |

On October 20, 2014, the Company’s Board of Directors declared a third quarter

cash dividend of $0.21 per share payable December 15, 2014 to shareholders of record December 5, 2014.

The Company’s Board of Directors

also authorized the repurchase of up to 500,000 shares of the Company’s common stock pursuant to the Company’s treasury stock buyback program. Repurchases will be made in the open market or through negotiated transactions from time to

time, depending on market conditions.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press release issued by Cass Information Systems, Inc. dated October 23, 2014. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: October 23, 2014

|

|

|

| CASS INFORMATION SYSTEMS, INC. |

|

|

| By: |

|

/s/ Eric H. Brunngraber |

| Name: |

|

Eric H. Brunngraber |

| Title: |

|

President and Chief Executive Officer |

|

|

| By: |

|

/s/ P. Stephen Appelbaum |

| Name: |

|

P. Stephen Appelbaum |

| Title: |

|

Chief Financial Officer |

3

Exhibit 99.1

Contact Kenn Entringer at Casey Communications, (314)721-2828 or kentringer@caseycomm.com

October 23, 2014

Cass Information Systems, Inc. Posts 3.8% Increase

in

3rd Quarter 2014 Earnings; Raises Dividend by 5% and

Increases Share Buyback Program to

500,000 Shares

ST. LOUIS – Cass Information Systems, Inc. (NASDAQ: CASS), the nation’s leading provider

of transportation, energy, telecom and environmental invoice payment and information services, reported third quarter 2014 earnings of $.55 per diluted share, a 3.8% increase over the $.53 per diluted share it earned in the third quarter of 2013.

Net income for the period was $6.4 million, 4.3% higher than the $6.1 million the company earned in 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

3rd Quarter |

|

|

% |

|

|

YTD |

|

|

% |

|

| |

|

2014 |

|

|

2013 |

|

|

Change |

|

|

2014 |

|

|

2013 |

|

|

Change |

|

| Transportation Dollar Volume |

|

$ |

6.7 billion |

|

|

$ |

6.1 billion |

|

|

|

10.0 |

% |

|

$ |

19.3 billion |

|

|

$ |

17.4 billion |

|

|

|

10.8 |

% |

| Facility Expense Dollar Volume* |

|

$ |

3.3 billion |

|

|

$ |

3.2 billion |

|

|

|

1.1 |

% |

|

$ |

9.6 billion |

|

|

$ |

8.6 billion |

|

|

|

11.2 |

% |

| Revenues |

|

$ |

29.6 million |

|

|

$ |

29.1 million |

|

|

|

1.9 |

% |

|

$ |

87.6 million |

|

|

$ |

86.7 million |

|

|

|

1.1 |

% |

| Net Income |

|

$ |

6.4 million |

|

|

$ |

6.1 million |

|

|

|

4.3 |

% |

|

$ |

18.2 million |

|

|

$ |

18.2 million |

|

|

|

— |

|

| Diluted Earnings per Share |

|

$ |

.55 |

|

|

$ |

.53 |

|

|

|

3.8 |

% |

|

$ |

1.57 |

|

|

$ |

1.57 |

|

|

|

— |

|

| * |

Includes Energy, Telecom and Environmental |

2014 3rd

Quarter Recap

A 10% increase in transportation volume, mainly attributed to a large number of new customers and heightened activity

from core transportation clients, fueled the quarterly upturn. Even as new sales remained strong, facility expense dollar volume was muted as recent competitor consolidation in the energy sector affected customer retention.

Operating expenses decreased by $0.2 million, or .9%, due mainly to lower pension expense. The

decline was recorded even as Cass continued to invest in staff and technology to support growth and win new business.

“For the

second consecutive quarter, our transportation payment processing group posted a double-digit gain in processing volume which enabled the company to post record earnings for the quarter,” said Eric H. Brunngraber, Cass president

and chief executive officer. “Also notable is the diminished impact that the low interest rate environment had on earnings year over year. Our focus remains on fostering growth across all business lines as we position Cass to fully participate

in an improving economy.”

Nine-Month 2014 Recap

For the nine-month period ended September 30, 2014, the company earned $1.57 per diluted share, the same as it earned in the comparable

period in 2013. Net income was $18.2 million, approximately the same as in 2013. Revenues rose 1.1%, from $86.7 million in 2013 to $87.6 million in 2014.

Operating expenses were up 1.2%, or $0.7 million, due to the cost of investing in staff and technology offset by lower pension expense, as

discussed above.

Cash Dividend and Buyback Program

On October 20, 2014, the company’s board of directors declared a third quarter dividend of $.21 per share payable December 15,

2014 to shareholders of record December 5, 2014. The new quarterly dividend is one cent, or 5% higher than the previous pay-out of 20 cents per share.

The board of directors also authorized the repurchase of up to 500,000 shares of the company’s common stock.

“These actions reflect the company’s strong capital base, solid growth in transaction

fees and the confidence of our board of directors in the company’s future,” said Brunngraber. Cass has continuously paid regularly scheduled cash dividends since 1934.

About Cass Information Systems

Cass

Information Systems is the leading provider of transportation, energy, telecom and environmental invoice payment and information services. The company, which has been involved in the payables services and information support business since 1956,

disburses $35 billion annually on behalf of customers from locations in St. Louis, Mo., Columbus, Ohio, Boston, Mass., Greenville, S.C., Wellington, Kansas and Jacksonville, Fla. The support of Cass Commercial Bank, founded in 1906,

makes Cass Information Systems unique in the industry. Cass is part of the Russell 2000® Index.

Note to Investors

Certain matters set

forth in this news release may contain forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results

to differ materially from those in such statements. For a discussion of certain factors that may cause such forward-looking statements to differ materially from the company’s actual results, see the company’s reports filed from time to

time with the Securities and Exchange Commission including the company’s annual report on Form 10-K for the year ended December 31, 2013.

Selected Consolidated Financial Data

The following table presents selected unaudited consolidated financial data (in thousands, except per share data) for the periods ended

September 30, 2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter

Ended

September 30,

2014 |

|

|

Quarter

Ended

September 30,

2013 |

|

|

Nine Months

Ended

September 30,

2014 |

|

|

Nine Months

Ended

September 30,

2013 |

|

| Transportation Invoice Volume |

|

|

8,856 |

|

|

|

8,389 |

|

|

|

25,489 |

|

|

|

23,668 |

|

| Transportation Dollar Volume |

|

$ |

6,725,524 |

|

|

$ |

6,113,332 |

|

|

$ |

19,283,017 |

|

|

$ |

17,398,391 |

|

| Facility Expense Transaction Volume |

|

|

5,188 |

|

|

|

4,978 |

|

|

|

15,464 |

|

|

|

14,396 |

|

| Facility Expense Dollar Volume |

|

$ |

3,250,130 |

|

|

$ |

3,213,889 |

|

|

$ |

9,585,101 |

|

|

$ |

8,616,645 |

|

| Payment and Processing Fees |

|

$ |

19,743 |

|

|

$ |

18,398 |

|

|

$ |

57,694 |

|

|

$ |

52,422 |

|

| Net Investment Income |

|

|

9,387 |

|

|

|

9,360 |

|

|

|

27,881 |

|

|

|

28,958 |

|

| Gain on Sales of Securities |

|

|

23 |

|

|

|

866 |

|

|

|

23 |

|

|

|

4,003 |

|

| Other |

|

|

457 |

|

|

|

431 |

|

|

|

2,033 |

|

|

|

1,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

$ |

29,610 |

|

|

$ |

29,055 |

|

|

$ |

87,631 |

|

|

$ |

86,685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and Benefits |

|

$ |

16,515 |

|

|

$ |

16,460 |

|

|

$ |

49,166 |

|

|

$ |

48,998 |

|

| Occupancy |

|

|

783 |

|

|

|

765 |

|

|

|

2,345 |

|

|

|

2,109 |

|

| Equipment |

|

|

945 |

|

|

|

970 |

|

|

|

3,092 |

|

|

|

2,801 |

|

| Other |

|

|

2,953 |

|

|

|

3,189 |

|

|

|

8,924 |

|

|

|

8,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

$ |

21,196 |

|

|

$ |

21,384 |

|

|

$ |

63,527 |

|

|

$ |

62,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from Operations before Income Taxes |

|

$ |

8,414 |

|

|

$ |

7,671 |

|

|

$ |

24,104 |

|

|

$ |

23,895 |

|

| Income Tax Expense |

|

|

2,013 |

|

|

|

1,533 |

|

|

|

5,857 |

|

|

|

5,652 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

6,401 |

|

|

$ |

6,138 |

|

|

$ |

18,247 |

|

|

$ |

18,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic Earnings per Share |

|

$ |

.56 |

|

|

$ |

.54 |

|

|

$ |

1.59 |

|

|

$ |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Earnings per Share |

|

$ |

.55 |

|

|

$ |

.53 |

|

|

$ |

1.57 |

|

|

$ |

1.57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Earning Assets |

|

$ |

1,243,375 |

|

|

$ |

1,210,560 |

|

|

$ |

1,233,136 |

|

|

$ |

1,184,662 |

|

| Net Interest Margin |

|

|

3.43 |

% |

|

|

3.45 |

% |

|

|

3.45 |

% |

|

|

3.72 |

% |

| Allowance for Loan Losses to Loans |

|

|

1.75 |

% |

|

|

1.84 |

% |

|

|

1.75 |

% |

|

|

1.84 |

% |

| Non-performing Loans to Total Loans |

|

|

.22 |

% |

|

|

.30 |

% |

|

|

.22 |

% |

|

|

.30 |

% |

| Net Loan (Recoveries) Charge-offs to Loans |

|

|

— |

|

|

|

(.05 |

%) |

|

|

(.03 |

%) |

|

|

.19 |

% |

| Provision for Loan Losses |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

500 |

|

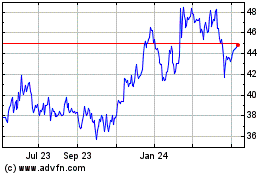

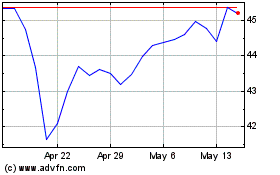

Cass Information Systems (NASDAQ:CASS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cass Information Systems (NASDAQ:CASS)

Historical Stock Chart

From Sep 2023 to Sep 2024