UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2014

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other

jurisdiction

of incorporation) |

|

001-02217

(Commission

File Number) |

|

58-0628465

(IRS Employer

Identification No.) |

|

One Coca-Cola Plaza

Atlanta, Georgia

(Address of principal executive offices) |

|

30313

(Zip Code) |

Registrant’s telephone number, including area code: (404) 676-2121

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On October 1, 2014, The Coca-Cola Company (the “Company”) issued a press release announcing that the Compensation Committee of its Board of Directors has adopted Equity Stewardship Guidelines for the Company’s existing 2014 Equity Plan. In addition, a blog post about the announcement, dated October 1, 2014, was posted on the Company’s “Unbottled” Blog by Maria Elena Lagomasino, Chair of the Company’s Compensation Committee.

The Company’s press release, the Equity Stewardship Guidelines and the “Unbottled” blog post are filed as Exhibits 99.1, 99.2 and 99.3, respectively, to this Form 8-K and are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release of The Coca-Cola Company, dated October 1, 2014, regarding Equity Stewardship Guidelines

99.2 Equity Stewardship Guidelines for the 2014 Equity Plan

99.3 Posting on The Coca-Cola Company’s “Unbottled” Blog, dated October 1, 2014, by Maria Elena Lagomasino

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE COCA-COLA COMPANY |

|

|

(REGISTRANT) |

|

|

|

|

|

|

|

Date: October 1, 2014 |

By: |

/s/ Bernhard Goepelt |

|

|

|

Bernhard Goepelt |

|

|

|

Senior Vice President, General Counsel and Chief Legal Counsel |

2

Exhibit 99.1

|

|

Contacts:

Investors and Analysts:

Tim Leveridge

T +01 404.676.7563

Media:

Petro Kacur

T +01 404.676.2683

tcccpressinquiries@coca-cola.com |

|

The Coca-Cola Company

Global Public Affairs & Communications Department

P.O. Box 1734

Atlanta, GA 30301 |

THE COCA-COLA COMPANY ADOPTS

EQUITY STEWARDSHIP GUIDELINES

Guidelines Extend the Years Shares Will Last under Existing 2014 Equity Plan

ATLANTA, Oct. 1, 2014 — The Coca-Cola Company today announced that the Compensation Committee of its Board of Directors has adopted Equity Stewardship Guidelines for the Company’s existing 2014 Equity Plan, which was approved by shareowners at the Company’s 2014 Annual Meeting in April. The Equity Plan was designed to provide significant flexibility in how and to whom long-term equity awards are made.

The Guidelines will extend the years shares will last under the approved Equity Plan by using fewer shares each year, increase transparency about equity awards, formalize the Company’s existing practice of share repurchases to minimize dilution, and renew commitments to continue an open dialogue with shareowners on compensation matters. Full guidelines at link here.

“The flexibility of our 2014 Equity Plan enabled us to create an even stronger program within the existing plan that reinforces our pay-for-performance approach to compensation,” said Muhtar Kent, Chairman and Chief Executive Officer, The Coca-Cola Company. “Further to the approval of the 2014 Equity Plan in April of this year, we have developed Guidelines that further align compensation to the long-term interests of shareowners. We will continue to provide long-term incentive awards to a broad-based group of employees with performance metrics that drive line-of-sight accountability directly to business results.”

Pursuant to the Guidelines, the Compensation Committee will manage equity grants under the Equity Plan to an annual “burn rate” (the number of shares granted as a percentage of outstanding shares) of no more than 0.8% in 2015 and to an average of 0.4% for the remaining life of the plan.

Consistent with the Guidelines, the shares under the existing Equity Plan will be used as follows.

· The long-term incentive program will continue to provide awards to a broad-based population of employees. The majority of employees currently eligible for long-term

awards will begin receiving long-term incentives as performance cash awards in 2015, which will continue to provide competitive incentives consistent with the Company’s pay-for-performance philosophy.

· For the employees who remain eligible for equity awards, the mix of equity awards will be adjusted to be more heavily weighted to performance shares and less heavily weighted to stock options. After a one-year transition, by 2016, the mix is expected to be approximately 2/3 performance shares and 1/3 stock options.

· Beginning in 2015, performance metrics applied to long-term awards will provide a balanced approach to incentives, increase alignment with local operations and pay for results that employees can more directly influence. Further details will be announced in the coming months.

As a result, we expect the shares authorized under the Equity Plan will last the plan’s full term of ten years.

“Shareowner engagement has produced positive results for our Company on a variety of fronts, including on compensation matters,” said Maria Elena Lagomasino, Chair of the Company’s Compensation Committee. “Shareowner input on this important topic has directly led to the development of these new Guidelines, which are in line with the long-term interests of shareowners.”

About The Coca-Cola Company

The Coca-Cola Company (NYSE: KO) is the world’s largest beverage company, refreshing consumers with more than 500 sparkling and still brands. Led by Coca-Cola, one of the world’s most valuable and recognizable brands, our Company’s portfolio features 17 billion-dollar brands including Diet Coke, Fanta, Sprite, Coca-Cola Zero, vitaminwater, Powerade, Minute Maid, Simply, Georgia and Del Valle. Globally, we are the No. 1 provider of sparkling beverages, ready-to-drink coffees, and juices and juice drinks. Through the world’s largest beverage distribution system, consumers in more than 200 countries enjoy our beverages at a rate of 1.9 billion servings a day. With an enduring commitment to building sustainable communities, our Company is focused on initiatives that reduce our environmental footprint, support active, healthy living, create a safe, inclusive work environment for our associates, and enhance the economic development of the communities where we operate. Together with our bottling partners, we rank among the world’s top 10 private employers with more than 700,000 system associates. For more information, visit Coca-Cola Journey at www.coca-colacompany.com, follow us on Twitter at twitter.com/CocaColaCo, visit our blog, Coca-Cola Unbottled, at www.coca-colablog.com or find us on LinkedIn at www.linkedin.com/company/the-coca-cola-company.

2

Forward-Looking Statements

This press release may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from The Coca-Cola Company’s historical experience and our present expectations or projections. These risks include, but are not limited to, obesity concerns; water scarcity and poor quality; evolving consumer preferences; increased competition and capabilities in the market place; product safety and quality concerns; increased demand for food products and decreased agricultural productivity; changes in the retail landscape or the loss of key retail or foodservice customers; an inability to expand operations in emerging and developing markets; fluctuations in foreign currency exchange rates; interest rate increases; an inability to maintain good relationships with our bottling partners; a deterioration in our bottling partners’ financial condition; increases in income tax rates, changes in income tax laws or unfavorable resolution of tax matters; increased or new indirect taxes in the United States or in other major markets; increased cost, disruption of supply or shortage of energy or fuels; increased cost, disruption of supply or shortage of ingredients, other raw materials or packaging materials; changes in laws and regulations relating to beverage containers and packaging; significant additional labeling or warning requirements or limitations on the availability of our products; an inability to protect our information systems against service interruption, misappropriation of data or breaches of security; unfavorable general economic conditions in the United States; unfavorable economic and political conditions in international markets; litigation or legal proceedings; adverse weather conditions; climate change; damage to our brand image and corporate reputation from negative publicity, even if unwarranted, related to product safety or quality, human and workplace rights, obesity or other issues, even if unwarranted; changes in, or failure to comply with, the laws and regulations applicable to our products or our business operations; changes in accounting standards; an inability to achieve our overall long-term growth objectives; deterioration of global credit market conditions; one or more of our counterparty financial institutions default on their obligations to us or fail; an inability to realize additional benefits targeted by our productivity and reinvestment program; an inability to renew collective bargaining agreements on satisfactory terms, or we or our bottling partners experience strikes, work stoppages or labor unrest; future impairment charges; multi-employer plan withdrawal liabilities in the future; an inability to successfully integrate and manage our Company-owned or -controlled bottling operations; global or regional catastrophic events; and other risks discussed in our Company’s filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2013, which filing is available from the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Coca-Cola Company undertakes no obligation to publicly update or revise any forward-looking statements.

###

3

Exhibit 99.2

The Coca-Cola Company

2014 Equity Plan

Equity Stewardship Guidelines

The Compensation Committee remains committed to being good stewards of the shares authorized under the Company’s existing 2014 Equity Plan. In order to document guidelines on equity granting practices beginning in 2015, enhance the understanding of the 2014 Equity Plan and increase transparency, we have adopted the following Equity Stewardship Guidelines:

1. Burn rate (number of shares granted as a percent of shares outstanding): We will manage equity grants under the existing 2014 Equity Plan to an annual burn rate of a maximum of 0.8% in 2015, and an average of 0.4% for the remaining life of the plan. With these burn rates, we expect the shares authorized under the existing 2014 Equity Plan to last the plan’s full term of 10 years.

2. Transparency: Every year in the proxy statement for our annual meeting of shareowners, we will show the following information regarding our existing equity plans:

· Actual dilution

· Burn rate

· Overhang

3. Share repurchases: Consistent with our past practice, 100% of the proceeds from stock option exercises by employees will be used to repurchase shares, minimizing dilution. This is separate from, and in addition to, our normal share repurchase program.

4. Open dialogue: We will continue to encourage ongoing open dialogue with all of our shareowners and seek feedback on equity compensation, including the mix of equity vehicles, performance metrics and alignment of pay with performance.

Exhibit 99.3

The following blog post by Maria Elena Lagomasino, Chair of the Company’s Compensation Committee, dated October 1, 2014, was posted on The Coca-Cola Company’s “Unbottled” Blog at www.coca-colacompany.com/coca-cola-unbottled.

Dear Fellow Shareowners:

Today, the Compensation Committee of The Coca-Cola Company’s Board of Directors announced Equity Stewardship Guidelines for the Company’s existing 2014 Equity Plan, which was approved by shareowners at the Company’s 2014 Annual Meeting in April. View Press Release and Guidelines. I want to take a moment to tell you more about this announcement.

When the existing 2014 Equity Plan was up for approval earlier this year, and even after it was approved at our Annual Meeting of Shareowners, we heard many points of view. We heard positive feedback, not so positive feedback, and everything in between. We know that not all of our shareowners agree on every issue, especially on a topic like equity compensation where views can vary greatly. The Compensation Committee thinks this kind of debate is healthy and constructive, and welcomes the views of all shareowners — after all, we represent you.

Throughout this process of reviewing the existing Equity Plan, “stewardship” was at the forefront of our minds. By approving the Equity Plan in April, our shareowners authorized the Compensation Committee to manage something precious — shares of The Coca-Cola Company. The Compensation Committee and entire Board of Directors of this great Company continue to take very seriously this responsibility. This simple concept guided our adoption of the Equity Stewardship Guidelines.

The existing Equity Plan was designed to provide significant flexibility in how and to whom long-term equity awards are made. These Guidelines are designed to be clear and simple, driven by our desire to enhance transparency with our shareowners. While the Guidelines and the announcement include some technical terms like burn rate and dilution, the key point is that, starting in 2015, we will be using substantially fewer shares for long-term equity awards overall. We will also be significantly reducing the use of stock options.

Importantly, we are not changing or reducing eligibility for long-term awards; it is important to the Compensation Committee to keep the long-term incentive program broad-based. In addition, we are not changing or increasing any of the award ranges for long-term incentive compensation.

1

Our Continued Commitment to You

The Compensation Committee will continue to encourage open dialogue with our shareowners about compensation. In addition, the Compensation Committee will continue to review how we use equity compensation and the mix of awards at least annually. When making determinations about compensation, we listen to shareowner feedback, and also look at market trends, how best to attract and retain world-class talent and most effectively align pay with performance. We commit to you that we will continue to approach these decisions with great care and be mindful of our stewardship role.

As always, thank you for the trust that you have placed in us to oversee the compensation programs of The Coca-Cola Company.

Mel Lagomasino

2

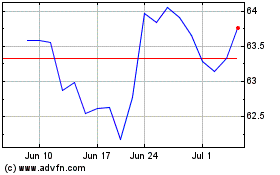

Coca Cola (NYSE:KO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Sep 2023 to Sep 2024