SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2014

BioMarin Pharmaceutical Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-26727 |

|

68-0397820 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 770 Lindaro, San Rafael, California |

|

94901 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (415) 506-6700

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 30, 2014, BioMarin Pharmaceutical Inc. (the “Company”) announced financial results for the second quarter ended

June 30, 2014. The Company’s press release issued on July 30, 2014, is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

In its press release, the Company included net loss for the three and six months ended June 30, 2014 and June 30, 2013 and financial

guidance for the year ending December 31, 2014, both as determined in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) except for non-GAAP net income/loss, which is determined on a non-GAAP basis. In the

press release, the non-GAAP net income/loss is based on GAAP earnings before interest, taxes, depreciation and amortization (EBITDA) and further adjusted to also exclude certain non-cash stock compensation expense, non-cash contingent consideration

expense and certain other nonrecurring material items (non-GAAP net income/loss). The reconciliation of the non-GAAP financial measures to the comparable GAAP financial measures are included in the press release attached hereto as Exhibit 99.1.

The Company believes that this non-GAAP information is useful to investors, taken in conjunction with the Company’s GAAP information

because it provides additional information regarding the performance of BioMarin’s core ongoing business, VIMIZIM, Naglazyme, Kuvan, Aldurazyme and Firdapse, and development of the Company’s pipeline. By providing information about both

the overall GAAP financial performance and the non-GAAP measures that focus on continuing operations, the Company believes that the additional information enhances investors’ overall understanding of the Company’s business and prospects

for the future. Further, the Company uses both the GAAP and the non-GAAP results and expectations internally for its operating, budgeting and financial planning purposes.

The information in this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of

any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

| |

(a) |

Financial Statements of Business Acquired. |

Not applicable.

| |

(b) |

Pro Forma Financial Information. |

Not Applicable.

| |

(c) |

Shell Company Transactions. |

Not Applicable.

Exhibit 99.1 Press Release of the Company dated July 30, 2014

- 2 -

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BioMarin Pharmaceutical Inc., a

Delaware corporation |

|

|

|

|

| Date: July 30, 2014 |

|

|

|

By: |

|

/s/ G. Eric Davis |

|

|

|

|

|

|

G. Eric Davis |

|

|

|

|

|

|

Senior Vice President, General Counsel & Secretary |

- 3 -

Exhibit 99.1

|

|

|

|

|

| Contact: |

|

|

|

|

| Investors: |

|

|

|

Media: |

| Traci McCarty |

|

|

|

Debra Charlesworth |

| BioMarin Pharmaceutical Inc. |

|

|

|

BioMarin Pharmaceutical Inc. |

| (415) 455-7558 |

|

|

|

(415) 455-7451 |

BioMarin Announces Second Quarter 2014 Financial Results

- VIMIZIM® Sales Top $14 million in First Full Quarter of Sales

- Full Year Total BioMarin Revenue Guidance Increased

Financial Highlights ($ in millions, except per share data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

% Change |

|

|

2014 |

|

|

2013 |

|

|

% Change |

|

| Total BioMarin Revenue |

|

$ |

191.7 |

|

|

$ |

136.8 |

|

|

|

40.1 |

% |

|

$ |

343.3 |

|

|

$ |

264.7 |

|

|

|

29.7 |

% |

| VIMIZIM Net Product Revenue |

|

|

14.3 |

|

|

|

— |

|

|

|

|

|

|

|

15.2 |

|

|

|

— |

|

|

|

|

|

| Naglazyme Net Product Revenue |

|

|

98.3 |

|

|

|

69.9 |

|

|

|

40.6 |

% |

|

|

178.4 |

|

|

|

139.3 |

|

|

|

28.1 |

% |

| Kuvan Net Product Revenue |

|

|

46.9 |

|

|

|

40.9 |

|

|

|

14.7 |

% |

|

|

92.1 |

|

|

|

78.5 |

|

|

|

17.3 |

% |

| Aldruazyme Net Product Revenue |

|

|

24.1 |

|

|

|

17.5 |

|

|

|

37.7 |

% |

|

|

42.2 |

|

|

|

34.2 |

|

|

|

23.4 |

% |

| Aldruazyme Royalty Revenue (excluding Net Product Transfer Revenue)—non-GAAP |

|

|

24.4 |

|

|

|

21.2 |

|

|

|

15.1 |

% |

|

|

46.3 |

|

|

|

40.5 |

|

|

|

14.3 |

% |

| Firdapse Net Product Revenue |

|

|

4.6 |

|

|

|

4.1 |

|

|

|

12.2 |

% |

|

|

9.3 |

|

|

|

7.7 |

|

|

|

20.8 |

% |

|

|

|

|

|

|

|

| Non-GAAP Net Income (Loss) |

|

$ |

10.8 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

9.1 |

|

|

$ |

(8.0 |

) |

|

|

|

|

| Non-GAAP Net Income (Loss) per Share—Basic |

|

$ |

0.07 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

0.06 |

|

|

$ |

(0.06 |

) |

|

|

|

|

| Non-GAAP Net Income (Loss) per Share—Diluted |

|

$ |

0.06 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

0.05 |

|

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net Loss |

|

$ |

(33.5 |

) |

|

$ |

(21.5 |

) |

|

|

|

|

|

$ |

(71.6 |

) |

|

$ |

(61.3 |

) |

|

|

|

|

| GAAP Net Loss per Share—Basic |

|

$ |

(0.23 |

) |

|

$ |

(0.15 |

) |

|

|

|

|

|

$ |

(0.49 |

) |

|

$ |

(0.46 |

) |

|

|

|

|

| GAAP Net Loss per Share—Diluted |

|

$ |

(0.23 |

) |

|

$ |

(0.16 |

) |

|

|

|

|

|

$ |

(0.50 |

) |

|

$ |

(0.46 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,080.8 |

|

|

$ |

518.5 |

|

|

|

108.4 |

% |

SAN RAFAEL, Calif., July 30, 2014 – BioMarin Pharmaceutical Inc. (NASDAQ: BMRN) today announced financial results

for the second quarter ended June 30, 2014. Non-GAAP net income was $10.8 million, or $0.07 per basic share and $0.06 per diluted share for the second quarter of 2014, compared to non-GAAP net loss of $0.0 million for the second quarter of

2013. Non-GAAP net income was $9.1 million, or $0.06 per basic share and $0.05 per diluted share for the six months ended June 30, 2014, compared to a loss of ($8.0) million, or ($0.06) per basic and diluted share for the six months ended

June 30, 2013.

GAAP net loss was ($33.5) million, or ($0.23) per basic and diluted share for the second quarter of 2014, compared to GAAP net loss

of ($21.5) million, or ($0.15) per basic share and ($0.16) per diluted share for the second quarter of 2013. GAAP net loss for the six months ended June 30, 2014 was ($71.6) million, or ($0.49) per basic share and ($0.50) per diluted share, as

compared to GAAP net loss of ($61.3) million, or ($0.46) per basic and diluted share for the six months ended June 30, 2013.

The increased non-GAAP

net income for the second quarter of 2014 compared to the second quarter of 2013 was primarily due to strong uptake of VIMIZIM® in its first full quarter of commercial sales, and significant

growth in revenues from our other commercial products including, Naglazyme®, KUVAN®, Aldurazyme® and Firdapse®. Naglazyme revenue growth of 41% in the quarter compared to the prior year reflected both continued growth in number of

patients consistent with long term trends, and also included significant purchases from certain governmental entities which potentially reflects patient demand in future quarters. These revenue increases were partially offset by increased research

and development expenses for PEG PAL, BMN 190 and BMN 673, as

1

well as increased selling, general and administrative expenses related to VIMIZIM launch activities. Increased GAAP net loss was also driven by increased income tax expense and interest expense

in the second quarter. These measures are excluded from the non-GAAP measurements. As of June 30, 2014, BioMarin had cash, cash equivalents and investments totaling $1,080.8 million, as compared to $518.5 million on June 30, 2013.

“With the strong launch of VIMIZIM and continued double-digit year over year growth of our other products, we believe the ultra-orphan business model is

as robust as ever. We are extremely pleased with the momentum of the U.S. commercial launch of VIMIZIM. At the end of the second quarter, 132 patients had started receiving commercial VIMIZIM,” said Jean-Jacques Bienaimé, Chief Executive

Officer of BioMarin. “Since receiving approval of VIMIZIM in the European Union in April, we are making good progress seeking reimbursement on a country by country basis. The excitement we are seeing in the Morquio community is driving our

expectation of continued, rapid uptake of VIMIZIM across all our commercial markets. With E.U. approval in hand, we believe VIMIZIM sales combined with the strength of our other marketed products will help BioMarin reach over $1 billion in revenues

over the next 2-3 years.”

Net Product Revenue (unaudited)

Total Revenue Growth (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

$ Change |

|

|

% Change |

|

|

2014 |

|

|

2013 |

|

|

$ Change |

|

|

% Change |

|

| VIMIZIM |

|

$ |

14.3 |

|

|

$ |

— |

|

|

$ |

14.3 |

|

|

|

— |

|

|

$ |

15.2 |

|

|

$ |

— |

|

|

$ |

15.2 |

|

|

|

— |

|

| Naglazyme (1) |

|

|

98.3 |

|

|

|

69.9 |

|

|

|

28.4 |

|

|

|

40.6 |

% |

|

|

178.4 |

|

|

|

139.3 |

|

|

|

39.1 |

|

|

|

28.1 |

% |

| Kuvan |

|

|

46.9 |

|

|

|

40.9 |

|

|

|

6.0 |

|

|

|

14.7 |

% |

|

|

92.1 |

|

|

|

78.5 |

|

|

|

13.6 |

|

|

|

17.3 |

% |

| Aldurazyme |

|

|

24.1 |

|

|

|

17.5 |

|

|

|

6.6 |

|

|

|

37.7 |

% |

|

|

42.2 |

|

|

|

34.2 |

|

|

|

8.0 |

|

|

|

23.4 |

% |

| Firdapse |

|

|

4.6 |

|

|

|

4.1 |

|

|

|

0.5 |

|

|

|

12.2 |

% |

|

|

9.3 |

|

|

|

7.7 |

|

|

|

1.6 |

|

|

|

20.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product revenue |

|

|

188.2 |

|

|

|

132.4 |

|

|

|

55.8 |

|

|

|

42.1 |

% |

|

|

337.2 |

|

|

|

259.7 |

|

|

|

77.5 |

|

|

|

29.8 |

% |

| Collaborative agreement revenue |

|

|

0.5 |

|

|

|

0.9 |

|

|

|

(0.4 |

) |

|

|

|

|

|

|

0.9 |

|

|

|

1.0 |

|

|

|

(0.1 |

) |

|

|

|

|

| Royalty and license revenue |

|

|

3.0 |

|

|

|

3.5 |

|

|

|

(0.5 |

) |

|

|

|

|

|

|

5.2 |

|

|

|

4.0 |

|

|

|

1.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total BioMarin revenue—GAAP |

|

|

191.7 |

|

|

|

136.8 |

|

|

|

54.9 |

|

|

|

40.1 |

% |

|

|

343.3 |

|

|

|

264.7 |

|

|

|

78.6 |

|

|

|

29.7 |

% |

| Less: Previously recognized Aldurazyme net product transfer revenue |

|

|

(0.3 |

) |

|

|

(3.7 |

) |

|

|

3.4 |

|

|

|

|

|

|

|

(4.1 |

) |

|

|

(6.3 |

) |

|

|

2.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total BioMarin revenues (excluding Aldurazyme net product transfer

revenue)—Non-GAAP (2) |

|

$ |

192.0 |

|

|

$ |

140.5 |

|

|

$ |

51.5 |

|

|

|

36.7 |

% |

|

$ |

347.4 |

|

|

$ |

271.0 |

|

|

$ |

76.4 |

|

|

|

28.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Aldurazyme Revenues (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

$ Change |

|

|

% Change |

|

|

2014 |

|

|

2013 |

|

|

$ Change |

|

|

% Change |

|

| Aldurazyme revenue reported by Genzyme |

|

$ |

62.3 |

|

|

$ |

53.6 |

|

|

$ |

8.7 |

|

|

|

16.2 |

% |

|

$ |

118.2 |

|

|

$ |

102.1 |

|

|

$ |

16.1 |

|

|

|

15.8 |

% |

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

$ Change |

|

|

|

|

|

2014 |

|

|

2013 |

|

|

$ Change |

|

|

|

|

| Aldurazyme Royalties due from Genzyme—Non-GAAP (2) |

|

$ |

24.4 |

|

|

$ |

21.2 |

|

|

$ |

3.2 |

|

|

|

|

|

|

$ |

46.3 |

|

|

$ |

40.5 |

|

|

$ |

5.8 |

|

|

|

|

|

| Previously recognized net product transfer revenue (3) |

|

|

(0.3 |

) |

|

|

(3.7 |

) |

|

|

3.4 |

|

|

|

|

|

|

|

(4.1 |

) |

|

|

(6.3 |

) |

|

|

2.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Aldurazyme net product revenue—GAAP |

|

$ |

24.1 |

|

|

$ |

17.5 |

|

|

$ |

6.6 |

|

|

|

|

|

|

$ |

42.2 |

|

|

$ |

34.2 |

|

|

$ |

8.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Naglazyme revenues experience quarterly fluctuations due to the timing of government ordering patterns in certain countries. The Company does not believe these fluctuations reflect a change in underlying demand.

|

| (2) |

BioMarin believes that this non-GAAP information is useful to investors, taken in conjunction with BioMarin’s GAAP information because it provides additional information regarding the end-user demand for

Aldurazyme. The Aldurazyme net product transfer revenue is the result of timing of deliveries to Genzyme Corp. and is therefore not representative of patient demand for the product. By providing information about both the GAAP and non-GAAP revenue

measures, the Company believes that the additional information enhances investors’ overall understanding of the Company’s business and in particular allows for more consistent period to period evaluation of the revenue. |

| (3) |

To the extent units shipped to third party customers by Genzyme exceed BioMarin inventory transfers to Genzyme, BioMarin will record a decrease in net product revenue from the royalty payable to BioMarin for the amount

of previously recognized product transfer revenue. If BioMarin inventory transfers exceed units shipped to third party customers by Genzyme, BioMarin will record incremental net product transfer revenue for the period. |

Priority Review Voucher Sold for $67.5 million

The

Company also announced today that it had sold the Rare Pediatric Disease Priority Review Voucher (PRV) it obtained in February of this year. The Company received the voucher under an FDA program intended to encourage the development of treatments

for rare pediatric diseases. BioMarin was awarded the voucher when it received approval of VIMIZIM®, a new biological product for patients with Mucopolysaccharidosis type IVA, also known as

Morquio A syndrome. BioMarin received $67.5 million from Regeneron Ireland, an indirect, wholly-owned subsidiary of Regeneron Pharmaceuticals, Inc., in exchange for the voucher.

2

Updated 2014 Guidance, as of July 30, 2014

Revenue Guidance

($ in millions)

|

|

|

|

|

| Item |

|

Initially Provided

February 26, 2014 |

|

Updated

July 30, 2014

|

| Total BioMarin Revenues |

|

$650 to $680 |

|

$745 to $765* |

| Naglazyme Net Product Revenue |

|

$290 to $310 |

|

$305 to $320 |

| Kuvan Net Product Revenue |

|

$180 to $200 |

|

$180 to $200 |

| VIMIZIM |

|

$60 to $70 |

|

$60 to $70 |

| |

* |

Includes of $67.5 million for the sale of the Priority Review Voucher. |

Selected Income Statement Guidance

($ in millions, except percentages)

|

|

|

|

|

| Item |

|

Initially Provided

February 26, 2014 |

|

Updated

July 30, 2014 |

| Cost of Sales (% of Total Revenue) |

|

17.5% to 18.5% |

|

16.5% to 17.5% |

| Research and Development Expense |

|

$500 to $530 |

|

$460 to $480 |

| Selling, General and Admin. Expense |

|

$265 to $285 |

|

$280 to $295 |

| GAAP Net Loss |

|

$(255) to $(285) |

|

$(180) to $(195)* |

| Non-GAAP Net Loss |

|

$(100) to $(130) |

|

$(60) to $(80) |

| |

* |

Includes $50 million net of taxes, related to the sale of the Priority Review Voucher. |

Anticipated

Upcoming Milestones

4Q 2014: Enrollment completion of Phase 1/2 trial with BMN 190 for the treatment of Batten disease

1Q 2015: IND filing or equivalent for BMN 270 for the treatment of Hemophilia A

2Q 2015: Data on first three cohorts in Phase 2 with BMN 111 for the treatment of Achondroplasia

1H 2015: Enrollment completion of Phase 2/3 trial with BMN 701 for the treatment of Pompe disease

2H 2015: Results from Phase 1/2 trial with BMN 190 for the treatment of Batten disease

2H 2015: Enrollment completion of Phase 3 trial with talazoparib (BMN 673) for the treatment of mBC

Mid-2015: IND filing or equivalent for BMN 250 for the treatment of MPS IIIB

4Q 2015: Results from pivotal Phase 3 trial with PEG PAL for the treatment of PKU

1Q 2016: Submission of PEG PAL BLA to the FDA for the treatment of PKU

Commercial and Regulatory Update on VIMIZIM for Mucopolysaccharidosis type IVA

| |

• |

|

E.U.: On April 28, 2014 the European Commission granted marketing authorization for VIMIZIM, the first specific treatment approved in the European Union (E.U.) for Mucopolysaccharidosis type IVA in patients

of all ages. As the first drug ever approved for Morquio A syndrome, VIMIZIM has been granted orphan drug status in the E.U., which confers ten years of market exclusivity. The commercial launch of VIMIZIM in the E.U. is underway. |

Advanced Clinical Programs

| |

• |

|

Phase 3 with PEG PAL for PKU: The Company expects top-line results from this study in 4Q15. Patients enrolling in the BMN 165-302 Phase 3 study will need to demonstrate a pre-specified reduction in blood Phe

prior to entering the trial. The design includes: (1) an open-label study to evaluate safety and blood Phe levels in naïve patients; and, (2) a randomized controlled study of the open-label study patients who meet the pre-specified

eligibility criteria to evaluate blood Phe levels and neurocognitive endpoints. |

| |

• |

|

BioMarin was Issued the International Nonproprietary Name (INN) Talazoparib for its Oncology Product, BMN 673. The World Health Organization (WHO) has approved the INN “talazoparib” (pronounced

ta-la-ZO-parib) for the Company’s poly ADP-ribose polymerase (PARP) inhibitor to treat genetically defined cancers. |

Phase 3 with talazoparib (BMN 673) for gBRCA breast cancer: The Company is conducting a Phase 3 trial to study talazoparib for the

treatment of deleterious germline BRCA mutation metastatic breast cancer and is currently enrolling patients. The Phase 3 trial is an open-label, 2:1 randomized, parallel, two-arm study of talazoparib as compared to monotherapy of physicians’

choice (capecitabine, eribulin, gemcitabine

3

or vinorelbine) in germline BRCA mutation subjects with locally advanced and/or metastatic breast cancer who have received no more than two prior chemotherapy regimens for metastatic disease. The

global study will enroll approximately 429 subjects. The primary objective of the study is to compare progression-free survival (PFS) of subjects treated with talazoparib as a monotherapy relative to those treated with protocol-specific

physicians’ choice.

| |

• |

|

Phase 2/3 with BMN 701 for Pompe Disease: In May 2014, the Company announced that it had dosed the first patient in the Phase 3 INSPIRE trial with BMN 701, GILT-tagged Recombinant Human GAA, for the treatment of

Pompe disease. This single-arm Phase 2/3 trial is enrolling patients previously treated with alglucosidase alfa and switching them to a treatment of BMN 701 at 20 mg/kg administered every other week for 24 weeks. The primary endpoint of the study

will be change from baseline in the respiratory parameter Maximal Inspiratory Pressure (MIP). |

| |

• |

|

Phase 2 with BMN 111 for Achondroplasia: In the first quarter of 2014, the Company announced that it had dosed the first child in the Phase 2 trial with BMN 111, an analog of C-type Natriuretic Peptide (CNP), for

the treatment of children with achondroplasia. Achondroplasia is the most common form of disproportionate short stature or dwarfism. The Phase 2 study is an open-label, sequential cohort, dose-escalation study of BMN 111 in children who are 5-14

years old. The primary objective of this study is to assess the safety and tolerability of daily subcutaneous doses of BMN 111 administered for 6 months. Prior to enrolling in the Phase 2 study, all patients will have participated in a 6 month

natural history study to determine baseline growth velocity data. |

Early-stage Clinical Programs

| |

• |

|

BMN 190 for LINCL (Batten disease): The Company is conducting a Phase 1/2 trial with BMN 190, a recombinant human tripeptidyl peptidase 1 (rhTPP1), for the treatment of patients with late-infantile neuronal

ceroid lipofuscinosis type 2 (NCL-2), a form of Batten disease. This is the first time that patients with Batten Disease have been treated with an enzyme replacement therapy in a clinical trial setting. The Phase 1/2 study is an open-label,

dose-escalation study in patients with NCL-2. The primary objectives are to evaluate the safety and tolerability of BMN 190 and to evaluate effectiveness using an NCL-2-specific rating scale score in comparison with natural history data after 48

weeks of treatment. Secondary objectives are to evaluate the impact of treatment on brain atrophy in comparison with NCL-2 natural history after 48 weeks of treatment and to characterize pharmacokinetics and immunogenicity. The study will enroll

approximately 22 subjects for a treatment duration of 48 weeks. |

Preclinical Programs

| |

• |

|

BMN 270 for Hemophilia A: In January 2014, the Company announced that it had selected an AAV-factor VIII gene therapy drug candidate, BMN 270, to develop for the treatment of hemophilia A and has initiated

IND-enabling studies. |

| |

• |

|

BMN 250 for MPS IIIB: In February 2014, the Company announced that it had selected an BMN 250, an intracerebroventricular enzyme replacement therapy, for the treatment of Mucopolysaccharidosis IIIB (MPS IIIB) or

Sanfilippo Syndrome Type B (Sanfilippo B). BioMarin has initiated IND-enabling studies. |

Non-GAAP Net Income (Loss) and Reconciliation

The results for the three and six months ended June 30, 2014 and June 30, 2013 and the guidance for 2014 include both GAAP net loss and

non-GAAP net income/loss. As used in this release, non-GAAP net income/loss is based on GAAP earnings before interest, taxes, depreciation and amortization (EBITDA) and further adjusted to exclude certain non-cash stock compensation expense,

non-cash contingent consideration expense and certain other nonrecurring material items (non-GAAP net income/loss).

4

The following table presents the reconciliation of GAAP to non-GAAP financial metrics:

Reconciliation of GAAP Net Loss to Non-GAAP Net Income (Loss)

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

Year Ending

December 31,

2014 Guidance |

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

| GAAP Net Loss |

|

$ |

(33.5 |

) |

|

$ |

(21.5 |

) |

|

$ |

(71.6 |

) |

|

$ |

(61.3 |

) |

|

$(180.0) - $(195.0) |

| Interest expense, net |

|

|

7.5 |

|

|

|

— |

|

|

|

15.5 |

|

|

|

1.0 |

|

|

31.3 |

| Provision for (benefit from) income taxes |

|

|

5.8 |

|

|

|

1.2 |

|

|

|

9.3 |

|

|

|

(3.5 |

) |

|

14.5 -19.5 |

| Depreciation expense |

|

|

8.0 |

|

|

|

6.6 |

|

|

|

14.6 |

|

|

|

12.7 |

|

|

32.0 |

| Amortization expense |

|

|

2.9 |

|

|

|

3.6 |

|

|

|

5.5 |

|

|

|

6.2 |

|

|

11.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA Loss |

|

|

(9.3 |

) |

|

|

(10.1 |

) |

|

|

(26.7 |

) |

|

|

(44.9 |

) |

|

(86.1) - (106.1) |

| Stock-based compensation expense |

|

|

17.3 |

|

|

|

13.9 |

|

|

|

33.6 |

|

|

|

25.5 |

|

|

84.6 |

| Contingent consideration expense (1) |

|

|

2.6 |

|

|

|

(3.8 |

) |

|

|

10.8 |

|

|

|

1.0 |

|

|

17.6 |

| Non-recurring: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale of Priority Review Voucher (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(67.5) |

| Gain on termination of lease (2) |

|

|

(0.5 |

) |

|

|

— |

|

|

|

(9.3 |

) |

|

|

— |

|

|

(9.3) |

| Debt conversion expense (3) |

|

|

0.7 |

|

|

|

— |

|

|

|

0.7 |

|

|

|

10.4 |

|

|

0.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net Income (Loss) |

|

$ |

10.8 |

|

|

$ |

— |

|

|

$ |

9.1 |

|

|

$ |

(8.0 |

) |

|

$(60.0) - $(80.0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Represents the expense associated with the change in the fair value of contingent acquisition consideration payable for the period, resulting from changes in estimated probabilities and timing of achieving certain

developmental milestones. |

| (2) |

Represents the net gain due to the early termination of the Company’s operating lease and the realization of the remaining balance in deferred rent upon acquisition of the San Rafael Corporate Center where the

Company’s corporate headquarters are located, as well as other facilities the Company has acquired that were previously under operating lease. |

| (3) |

Represents debt conversion expense associated with the early conversion of a portion of our 2017 convertible notes. |

| (4) |

Represents the total sales price of $67.5 million for the PRV, or approximately $50.0 million net of tax. |

BioMarin believes that this non-GAAP information is useful to investors, taken in conjunction with BioMarin’s GAAP information because it provides

additional information regarding the performance of BioMarin’s core ongoing business, VIMIZIM, Naglazyme, Kuvan, Aldurazyme and Firdapse, and development of the Company’s pipeline. By providing information about both the overall GAAP

financial performance and the non-GAAP measures that focus on continuing operations, the Company believes that the additional information enhances investors’ overall understanding of the Company’s business and prospects for the future.

Further, the Company uses both the GAAP and the non-GAAP results and expectations internally for its operating, budgeting and financial planning purposes.

Conference Call Details

BioMarin will host a conference

call and webcast to discuss second quarter 2014 financial results today, Wednesday, July 30, at 4:30 p.m. ET. This event can be accessed on the investor section of the BioMarin website at www.BMRN.com.

U.S. / Canada Dial-in Number: 877.303.6313

International Dial-in

Number: 631.813.4734

Conference ID: 59207209

Replay

Dial-in Number: 855.859.2056

Replay International Dial-in Number: 404.537.3406

Conference ID: 59207209

5

About BioMarin

BioMarin develops and commercializes innovative biopharmaceuticals for serious diseases and medical conditions. The company’s product portfolio comprises

five approved products and multiple clinical and pre-clinical product candidates. Approved products include: Naglazyme® (galsulfase) for mucopolysaccharidosis VI (MPS VI), a product wholly

developed and commercialized by BioMarin; Aldurazyme® (laronidase) for mucopolysaccharidosis I (MPS I), a product which BioMarin developed through a 50/50 joint venture with Genzyme

Corporation; KUVAN® (sapropterin dihydrochloride) Powder for Oral Solution and Tablets, for phenylketonuria (PKU), developed in partnership with Merck Serono, a division of Merck KGaA of

Darmstadt, Germany; Firdapse® (amifampridine), which has been approved by the European Commission for the treatment of Lambert Eaton Myasthenic Syndrome (LEMS); and VIMIZIM® (elosulfase alfa) for the treatment of Morquio A (MPS IVA). Product candidates include: BMN 165 (PEGylated recombinant phenylalanine ammonia lyase), also referred to as PEG PAL, which is

currently in Phase 3 clinical development for the treatment of PKU; talazoparib (BMN 673), a poly ADP-ribose polymerase (PARP) inhibitor, which is currently in Phase 3 clinical development for the treatment of germline BRCA breast cancer; BMN 701, a

novel fusion of acid alpha glucosidase (GAA) with a peptide derived from insulin like growth factor 2, which is currently in Phase 3 clinical development for the treatment of Pompe disease; BMN 111, a modified C-natriuretic peptide, which is

currently in Phase 2 clinical development for the treatment of achondroplasia; and BMN 190, a recombinant human tripeptidyl peptidase-1 (rhTPP1), which is currently in Phase 1 for the treatment of late-infantile neuronal ceroid lipofuscinosis

(CLN2), a form of Batten Disease. For additional information, please visit www.BMRN.com. Information on BioMarin’s website is not incorporated by reference into this press release.

Forward-Looking Statement

This press release contains

forward-looking statements about the business prospects of BioMarin Pharmaceutical Inc., including, without limitation, statements about: the expectations of revenue and sales related to VIMIZIM, Naglazyme, Kuvan, Aldurazyme and Firdapse; the

financial performance of BioMarin as a whole; the timing of BioMarin’s clinical trials of PEG PAL, talazoparib (BMN 673), BMN 701, BMN 111, BMN 190, BMN 270, BMN 250 and other product candidates; the continued clinical development and

commercialization of Aldurazyme, Naglazyme, Kuvan, Firdapse, VIMIZIM and its product candidates; and actions by regulatory authorities. These forward-looking statements are predictions and involve risks and uncertainties such that actual results may

differ materially from these statements. These risks and uncertainties include, among others: our success in the commercialization of VIMIZIM, Naglazyme, Kuvan, and Firdapse; Genzyme Corporation’s success in continuing the commercialization of

Aldurazyme; results and timing of current and planned preclinical studies and clinical trials, particularly with respect to PEG PAL, talazoparib (BMN 673), BMN 701, BMN 111 and BMN 190; our ability to successfully manufacture our products and

product candidates; the content and timing of decisions by the U.S. Food and Drug Administration, the European Commission and other regulatory authorities concerning each of the described products and product candidates; the market for each of these

products and particularly Aldurazyme, Naglazyme, Kuvan, VIMIZIM and Firdapse; actual sales of Aldurazyme, Naglazyme, Kuvan, VIMIZIM and Firdapse; Merck Serono’s activities related to Kuvan; and those factors detailed in BioMarin’s filings

with the Securities and Exchange Commission, including, without limitation, the risk factors contained under the caption “Risk Factors” in BioMarin’s 2013 Annual Report on Form 10-K, and the factors contained in BioMarin’s

reports on Form 10-Q. Stockholders are urged not to place undue reliance on forward-looking statements, which speak only as of the date hereof. BioMarin is under no obligation, and expressly disclaims any obligation to update or alter any

forward-looking statement, whether as a result of new information, future events or otherwise.

BioMarin®, VIMIZIM®, Naglazyme®, Kuvan®, and Firdapse® are registered trademarks of BioMarin Pharmaceutical Inc.

Aldurazyme® is a registered trademark of BioMarin/Genzyme LLC.

6

BIOMARIN PHARMACEUTICAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

June 30, 2014 and December 31, 2013

(In thousands of U.S. dollars, except share and per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2014 |

|

|

December 31,

2013(1) |

|

| |

|

| |

|

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

584,717 |

|

|

$ |

568,781 |

|

| Short-term investments |

|

|

251,901 |

|

|

|

215,942 |

|

| Accounts receivable, net (allowance for doubtful accounts: $568 and $529, respectively) |

|

|

122,282 |

|

|

|

117,822 |

|

| Inventory |

|

|

193,498 |

|

|

|

162,605 |

|

| Current deferred tax assets |

|

|

30,561 |

|

|

|

30,561 |

|

| Other current assets |

|

|

37,268 |

|

|

|

41,707 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,220,227 |

|

|

|

1,137,418 |

|

| Noncurrent assets: |

|

|

|

|

|

|

|

|

| Investment in BioMarin/Genzyme LLC |

|

|

440 |

|

|

|

816 |

|

| Long-term investments |

|

|

244,148 |

|

|

|

267,700 |

|

| Property, plant and equipment, net |

|

|

469,862 |

|

|

|

319,316 |

|

| Intangible assets, net |

|

|

163,045 |

|

|

|

163,147 |

|

| Goodwill |

|

|

54,258 |

|

|

|

54,258 |

|

| Long-term deferred tax assets |

|

|

147,143 |

|

|

|

145,234 |

|

| Other assets |

|

|

46,562 |

|

|

|

156,171 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

2,345,685 |

|

|

$ |

2,244,060 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

166,720 |

|

|

$ |

183,271 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

166,720 |

|

|

|

183,271 |

|

| Noncurrent liabilities: |

|

|

|

|

|

|

|

|

| Long-term convertible debt |

|

|

650,872 |

|

|

|

655,566 |

|

| Long-term contingent acquisition consideration payable |

|

|

40,466 |

|

|

|

30,790 |

|

| Other long-term liabilities |

|

|

25,658 |

|

|

|

33,392 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

883,716 |

|

|

|

903,019 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par value: 250,000,000 shares authorized at June 30, 2014 and December 31, 2013; 147,067,950 and

143,463,668 shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively. |

|

|

147 |

|

|

|

144 |

|

| Additional paid-in capital |

|

|

2,249,445 |

|

|

|

2,059,101 |

|

| Company common stock held by Nonqualified Deferred Compensation Plan |

|

|

(10,146 |

) |

|

|

(7,421 |

) |

| Accumulated other comprehensive income |

|

|

9,941 |

|

|

|

5,018 |

|

| Accumulated deficit |

|

|

(787,418 |

) |

|

|

(715,801 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

1,461,969 |

|

|

|

1,341,041 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

2,345,685 |

|

|

$ |

2,244,060 |

|

|

|

|

|

|

|

|

|

|

| (1) |

December 31, 2013 balances were derived from the audited consolidated financial statements. |

7

BIOMARIN PHARMACEUTICAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

Three and Six Months Ended June 30, 2014 and 2013

(In thousands of U.S. dollars, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product revenues |

|

$ |

188,244 |

|

|

$ |

132,400 |

|

|

$ |

337,248 |

|

|

$ |

259,744 |

|

| Collaborative agreement revenues |

|

|

506 |

|

|

|

889 |

|

|

|

921 |

|

|

|

1,024 |

|

| Royalty, license and other revenues |

|

|

3,037 |

|

|

|

3,521 |

|

|

|

5,170 |

|

|

|

3,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

191,787 |

|

|

|

136,810 |

|

|

|

343,339 |

|

|

|

264,738 |

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales (excludes amortization of certain acquired intangible assets) |

|

|

31,210 |

|

|

|

22,567 |

|

|

|

54,026 |

|

|

|

43,067 |

|

| Research and development |

|

|

107,702 |

|

|

|

85,661 |

|

|

|

193,868 |

|

|

|

169,404 |

|

| Selling, general and administrative |

|

|

68,089 |

|

|

|

50,656 |

|

|

|

128,158 |

|

|

|

101,706 |

|

| Intangible asset amortization and contingent consideration |

|

|

3,668 |

|

|

|

(2,022 |

) |

|

|

12,625 |

|

|

|

3,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

210,669 |

|

|

|

156,862 |

|

|

|

388,677 |

|

|

|

317,711 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

|

(18,882 |

) |

|

|

(20,052 |

) |

|

|

(45,338 |

) |

|

|

(52,973 |

) |

| Equity in the loss of BioMarin/Genzyme LLC |

|

|

(539 |

) |

|

|

(163 |

) |

|

|

(877 |

) |

|

|

(564 |

) |

| Interest income |

|

|

1,735 |

|

|

|

650 |

|

|

|

2,858 |

|

|

|

1,368 |

|

| Interest expense |

|

|

(9,221 |

) |

|

|

(603 |

) |

|

|

(18,327 |

) |

|

|

(2,328 |

) |

| Debt conversion expense |

|

|

(674 |

) |

|

|

— |

|

|

|

(674 |

) |

|

|

(10,420 |

) |

| Other income (expense) |

|

|

(147 |

) |

|

|

(123 |

) |

|

|

6 |

|

|

|

105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAXES |

|

|

(27,728 |

) |

|

|

(20,291 |

) |

|

|

(62,352 |

) |

|

|

(64,812 |

) |

| Provision for (benefit from) income taxes |

|

|

5,774 |

|

|

|

1,242 |

|

|

|

9,265 |

|

|

|

(3,469 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(33,502 |

) |

|

$ |

(21,533 |

) |

|

$ |

(71,617 |

) |

|

$ |

(61,343 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS PER SHARE, BASIC |

|

$ |

(0.23 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.46 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS PER SHARE, DILUTED |

|

$ |

(0.23 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.46 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding, basic |

|

|

146,120 |

|

|

|

139,400 |

|

|

|

145,066 |

|

|

|

133,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding, diluted |

|

|

146,351 |

|

|

|

139,596 |

|

|

|

145,297 |

|

|

|

133,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE LOSS |

|

$ |

(30,836 |

) |

|

$ |

(20,247 |

) |

|

$ |

(66,694 |

) |

|

$ |

(58,700 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCK-BASED COMPENSATION EXPENSE

Total stock-based compensation expense included in the Condensed Consolidated Statements of Comprehensive Loss was as follows (unaudited):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Cost of sales |

|

$ |

1,640 |

|

|

$ |

1,130 |

|

|

$ |

2,726 |

|

|

$ |

2,174 |

|

| Research and development |

|

|

6,894 |

|

|

|

6,381 |

|

|

|

14,009 |

|

|

|

11,705 |

|

| Selling, general and administrative |

|

|

8,716 |

|

|

|

6,418 |

|

|

|

16,820 |

|

|

|

11,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

17,250 |

|

|

$ |

13,929 |

|

|

$ |

33,555 |

|

|

$ |

25,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

###

8

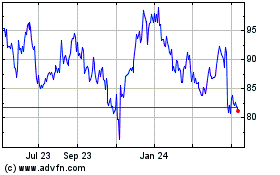

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

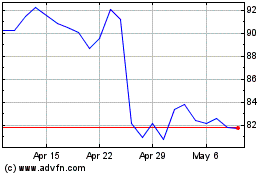

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024