Registration No. 333-156339

As filed with the Securities and Exchange Commission on July 30, 2014

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 1

TO

FORM S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FULTON

FINANCIAL CORPORATION

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

Pennsylvania

|

|

23-2195389

|

|

(State or other jurisdiction of incorporation)

|

|

(IRS Employer Identification Number)

|

|

|

|

|

One Penn Square

Lancaster, Pennsylvania 17604

(717) 291-2411

|

|

E. Phillip Wenger

Chairman, Chief Executive Officer and President

One Penn Square

Lancaster, PA 17604

(717)

294-2411

|

|

(Address including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

|

|

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

|

With Copies To:

Daniel R. Stolzer

Corporate Secretary and General Counsel

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

(717) 294-2411

Kimberly J. Decker

Barley Snyder LLC

126

East King Street

Lancaster, PA 17602-2893

(717) 299-5201

Approximate date of

commencement of proposed sale to the public

: From time to time after the effective date of this Registration Statement.

If the only securities

being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

x

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

¨

If this form is filed to register additional securities for an offering pursuant to rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or

additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registration is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the definitions of “large accelerated filer”, “accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

|

|

Smaller reporting company

|

|

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Maximum

Offering Share

Price

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, $2.50 par value

|

|

*

|

|

*

|

|

*

|

|

*

|

|

|

|

|

This registration statement is being amended to reflect amendments to the Fulton Financial

Corporation Dividend Reinvestment and Stock Purchase Plan adopted by the Board of Directors on July 15, 2014.

PROSPECTUS

FULTON FINANCIAL CORPORATION

One Penn Square

Lancaster, Pa 17602

Dividend

Reinvestment and Stock Purchase Plan

This prospectus

describes the Fulton Financial Corporation Dividend Reinvestment and Stock Purchase Plan (the “Plan”), which provides holders of record of Fulton Financial Corporation’s common stock with a simple and convenient method of reinvesting

cash dividends and making optional cash payments to acquire common stock of Fulton Financial Corporation (“Fulton Financial”). Fulton Financial’s common stock is listed on the NASDAQ Capital Stock Market under the symbol

“FULT”.

Shares of common stock to be issued under the Plan will be (i) purchased on the open market or (ii) purchased

directly from us from authorized but unissued shares. All purchases will be made at market prices determined in the manner described in the Plan.

This Prospectus relates to an additional 10,000,000 shares of the $2.50 par value common stock of Fulton Financial to be issued under the

Plan.

You should retain this Prospectus for future reference.

Investing in our securities involves risks. Before buying any securities, you should carefully read the discussion of material risks

involved in investing in our securities under the heading “

Risk Factors

” beginning on page 2.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have not

authorized anyone to provide you with information that is different from what is contained in this prospectus. The date of this Prospectus is July 30, 2014. You should not assume that the information in this prospectus is still accurate as of

any later date.

Table of Contents

1

RISK FACTORS

There are risks and uncertainties involved with an investment in shares of our common stock. See the “Risk Factors” sections of our

annual reports on Form 10-K and quarterly reports on Form 10-Q, which we file with the Securities and Exchange Commission and incorporate by reference into this prospectus, for a discussion of the factors that should be considered in connection with

such an investment.

INFORMATION CONCERNING FULTON FINANCIAL CORPORATION

Fulton Financial is a Pennsylvania business corporation and a registered financial holding company that maintains its headquarters in

Lancaster, Pennsylvania. As a financial holding company, Fulton Financial engages in general commercial and retail banking and trust business, and also in related financial businesses, through its directly-held bank and non-bank subsidiaries. Fulton

Financial’s bank subsidiaries currently operate banking offices in Pennsylvania, Maryland, Delaware, New Jersey and Virginia. As of June 30, 2014, Fulton Financial had consolidated total assets of approximately $17.0 billion.

The principal assets of Fulton Financial are its six wholly-owned bank subsidiaries:

|

|

|

|

|

•

Fulton Bank, N.A.

, a national banking association which is a member of the Federal Reserve System

|

|

•

Swineford National Bank

, a national banking association which is a member of the Federal Reserve System

|

|

|

|

|

•

Lafayette Ambassador Bank

, a Pennsylvania banking company which is a member of the Federal Reserve System

|

|

•

FNB Bank, N.A.

, a national banking association which is a member of the Federal Reserve System

|

|

|

|

|

•

Fulton Bank of New Jersey

, a New Jersey bank which is not a member of the Federal Reserve System

|

|

•

The Columbia Bank

, a Maryland bank which is not a member of the Federal Reserve System

|

In addition, Fulton Financial has the following wholly-owned non-bank direct subsidiaries:

|

|

|

|

|

•

Fulton Financial Realty Company

, which holds title to or leases certain properties upon which Fulton Financial’s branch offices and other facilities are located

|

|

•

Fulton Reinsurance Company, LTD

, which engages in the business of reinsuring credit life and accident and health insurance directly related to extensions of credit by the banking subsidiaries of Fulton

Financial

|

|

|

|

|

•

Central Pennsylvania Financial Corp.

, which owns certain limited partnership interests in partnerships invested primarily in low and moderate income housing projects

|

|

•

FFC Management, Inc.

, which owns certain investment securities and other passive investments

|

2

|

|

|

|

|

|

|

|

•

FFC Penn Square, Inc.

, which owns trust preferred securities issued by a subsidiary of Fulton Bank, N.A

|

|

•

Fulton Insurance Services Group, Inc.

, which engages in the sale of various life insurance products

|

|

|

|

|

•

Fulton Capital Trust I,

an issuer of trust preferred securities

|

|

•

Columbia Bancorp Statutory Trust, Columbia Bancorp Statutory Trust II & Columbia Bancorp Statutory Trust III

, which are issuers of trust preferred securities

|

As a registered financial holding company, Fulton Financial is subject to regulation under the federal

Bank Holding Company Act of 1956, as amended, and the rules adopted by the Board of Governors of the Federal Reserve System (“Federal Reserve Board”) thereunder. Under applicable Federal Reserve Board policies, a financial holding company

such as Fulton Financial is expected to act as a source of financial strength for each of its subsidiary banks and to commit resources to support each subsidiary bank in circumstances when it might not do so absent such a policy. Any capital loans

made by a financial holding company to any of its subsidiary banks would be subordinate in right of payment to the claims of depositors and certain other creditors of such subsidiary banks.

The principal executive offices of Fulton Financial are located at One Penn Square, P.0. Box 4887, Lancaster, Pennsylvania 17604, and its

telephone number is (717) 291-2411.

DESCRIPTION OF THE PLAN

The following is a question and answer statement of the provisions of the Fulton Financial Corporation Dividend Reinvestment and Stock

Purchase Plan.

Purpose

|

1.

|

What is the purpose of the Plan?

|

The purpose of the Plan is to provide shareholders of the

$2.50 par value common stock of Fulton Financial Corporation with a convenient and economical method of investing cash dividends and optional cash payments in additional shares of Fulton Financial common stock. To the extent that the shares are

purchased directly from Fulton Financial under the Plan, Fulton Financial will receive additional funds for its general corporate purposes.

Advantages

|

2.

|

What are the advantages of the Plan?

|

Participation in the Plan offers a number of advantages:

a. The Plan provides shareholders of Fulton Financial with the opportunity to reinvest their dividends automatically in additional shares

of Fulton Financial common stock.

3

b. Participants’ funds will be fully utilized through the crediting of fractional shares to

their accounts under the Plan.

c. Participants may acquire additional shares of Fulton Financial common stock by making optional cash

payments.

d. Participants will receive periodic statements of all transactions for their accounts under the Plan.

Administration

|

3.

|

Who administers the Plan for participants?

|

Fulton Bank, N.A., the “

Plan

Agent

” will administer the Plan as agent for the participants, and in such capacity will send periodic statements of account to participants and perform other administrative duties relating to the Plan. Shares purchased for a participant

under the Plan will be held by the Plan Agent and registered in the name of the Plan Agent or its nominee.

Any notices, questions or

other communications relating to the Plan should include the participant’s account number and should be addressed to:

Fulton

Bank, N.A.

Dividend Reinvestment Department

P.O. Box 3215

Lancaster, PA

17604-3215

Participants who have questions regarding the Plan may also contact the Plan Agent by telephoning 1-800-626-0255.

Participation

|

4.

|

Who is eligible to participate in the Plan?

|

All record holders of common stock of Fulton

Financial are eligible to participate in the Plan; however, Fulton Financial reserves the right to deny participation to a shareholder who resides in a state which requires registration, qualification or exemption of the common stock to be issued

under the Plan or registration or qualification of Fulton Financial or any of its officers or employees as a broker, dealer, salesman or agent, if such registration, qualification or exemption would be unduly burdensome or expensive for Fulton

Financial. Beneficial owners whose shares are registered in the name of a nominee, such as a brokerage firm or securities depository, may not participate in the Plan, unless such shares are transferred into the name of the beneficial owner.

|

5.

|

How does an eligible shareholder become a participant in the Plan?

|

Any eligible

shareholder may join the Plan at any time by completing and signing the authorization form included with the prospectus and returning it to the Plan Agent. Additional authorization forms may be obtained at any time from the Plan Agent at the address

listed above. An authorization form must be received at least two (2) business days before a dividend record date for dividends to begin to be reinvested upon payment of that dividend.

4

|

6.

|

Must a shareholder authorize dividend reinvestment on a minimum number of shares?

|

No, there is

no minimum number of shares required for participation in the Plan.

|

7.

|

May a shareholder participate in the Plan with less than all of his or her shares?

|

Yes, a

shareholder may participate in the Plan with respect to all or any portion of his or her shares. A shareholder who wishes to participate with a portion of his or her shares may elect to: (i) have the dividends reinvested on a fixed percentage

of shares, (ii) have the dividends reinvested on a fixed number of shares, or (iii) have a fixed dollar amount of cash dividends reinvested.

|

8.

|

May a shareholder deposit shares registered in his or her name with the Plan?

|

There is no

requirement that participants deposit the shares registered in their names with the Plan; however, participants may deposit currently held certificates for shares of Fulton Financial common stock with the Plan Agent for safekeeping. To do so, a

participant should send the stock certificates, properly endorsed on the reverse side, to the Plan Agent with a letter of instructions requesting that the shares be added to the participant’s dividend reinvestment account and the dividends

thereon be reinvested in accordance with the Plan.

Optional Cash Payments

|

9.

|

Who is eligible to make optional cash payments?

|

Only participants who have elected to have

dividends reinvested under the Plan may make optional cash payments, which will be used for the purchase of additional shares of Fulton Financial common stock in accordance with the Plan.

|

10.

|

What are the limits on optional cash payments?

|

Participants may make optional cash

payments as often as once a month. The minimum optional cash payment is $25.00 per month, and the maximum optional cash payment is $25,000.00 per month. The same amount of optional cash payments need not be made each month, and there is no

obligation to make optional cash payments after a participant is enrolled in the Plan.

|

11.

|

How are optional cash payments made?

|

Participants who wish to make an optional cash

payment should forward a check or money order, or another form of payment acceptable to the Plan Agent, payable to the Plan Agent for the amount of the optional cash payment, with an authorization form when enrolling, or thereafter, with the payment

form attached to each statement of account. Optional cash payments must be received by the Plan Agent at least five (5) business days before the applicable investment date to be invested for that month. No interest will be paid on optional cash

payments held by the Plan Agent. Participants may request that optional cash payments be returned to them prior to investment, provided that the request is received by the Plan Agent at least five (5) business days before the next applicable

investment date.

5

Purchases

|

12.

|

How are shares of common stock acquired under the Plan?

|

The Plan agent will pool all of

the reinvested dividends and optional cash payments to purchase shares of Fulton Financial common stock for the accounts of the Plan’s participants. Each participant’s account will be credited with a pro rata share (computed to four

decimal places) of such purchased shares. The Plan Agent will purchase shares either directly from Fulton Financial or in the open market, or by a combination of the foregoing, at the direction of Fulton Financial. Shares purchased from Fulton

Financial may be authorized but unissued shares or treasury shares.

|

13.

|

When will shares of common stock be purchased under the Plan?

|

Purchases of shares of common

stock from Fulton Financial will be made as of the investment date, which will be the dividend payment date during a month in which a dividend is paid, and in any other month will be the fifteenth day of such month. If, however, the investment date

falls on a date that is not a trading day, the next trading day will be the investment date. Purchases of shares of common stock on the open market will be made as soon as reasonably possible after the applicable investment date, but not more than

thirty (30) days after such date.

|

14.

|

What will be the price of stock purchased under the Plan?

|

For shares of common stock

purchased directly from Fulton Financial by the Plan Agent, the purchase price will be the fair market value of the stock as of the applicable investment date. During the time that Fulton Financial common stock is listed on the NASDAQ National

Market System, the fair market value will be the average of the highest and lowest trading price for the stock on the applicable investment date. For purchases of shares of common stock on the open market, the purchase price will be the average of

the prices actually paid for the shares (including brokerage commissions, if any) at the time such purchases are made.

|

15.

|

How many shares will be purchased for participants?

|

The number of shares that will be

purchased for each participant will depend on the amount of dividends to be reinvested for the participant and the optional cash payments, if any, received from the participant.

|

16.

|

Will dividends on shares in participants’ accounts be used to purchase shares?

|

Yes,

dividends subsequently paid on shares that have been purchased under the Plan will also be used to purchase Fulton Financial common stock, thereby compounding each participant’s investment. Fractional shares held under the Plan for a

participant’s account will receive dividends in the same way as a whole share, but in proportion to the size of the fractional share.

6

|

17.

|

Are there any expenses to participants in connection with purchases under the Plan?

|

Fulton

Financial will pay all costs of administration of the Plan. No brokerage fees will be charged to participants in connection with the purchase of stock from Fulton Financial, but participants will be charged the actual cost (including any brokerage

commissions, if any) of all shares purchased on the open market. In addition, the Plan Agent may charge Participants applicable costs and service fees to process transactions requested by Participants.

Reports to Participants

|

18.

|

What reports will be sent to participants in the Plan?

|

Each participant will receive periodic

statements of account showing the amount of dividends and optional cash payments, if any, invested; the taxes withheld, if any; the net amount invested; the number of shares purchased; the price per share; and the total number of shares accumulated

under the Plan. These statements are records of the participant’s transactions under the Plan and should be retained for income tax purposes. In addition, each participant will continue to receive copies of the same communications sent to all

other holders of Fulton Financial common stock, including quarterly reports and annual reports to shareholders, a notice of the annual meeting and proxy statement, and Internal Revenue Service information for reporting dividend income received.

Voting Rights

|

19.

|

How will a participant’s shares be voted at meetings of shareholders?

|

For each meeting of

shareholders of Fulton Financial, each participant in the Plan will receive a proxy that will enable him or her to vote shares registered in his or her name as well as whole shares credited to his or her Plan account. The shares held by the Plan for

the account of a participant who does not return a proxy will not be voted.

Federal Income Tax Information

|

20.

|

What are the federal income tax consequences of participating in the Plan?

|

For federal income

tax purposes, a participant in the Plan will be treated as having received, on the dividend payment date, in addition to any tax withheld by Fulton Financial in connection with the dividend payment, a dividend in an amount equal to the number of

shares of common stock of Fulton Financial acquired for the participant’s account with reinvested dividends, multiplied by the price per share at which such shares were acquired, as reported on the periodic statement of account delivered to

each participant. The per share tax basis of shares acquired by a participant under the Plan, whether pursuant to reinvested dividends or optional cash payments, will be the price per share as reported on the periodic statement of account delivered

to each participant after each applicable investment date.

The holding period for shares acquired pursuant to the Plan will begin on the

day after the date the shares are acquired for a participant’s account. In the case of any participant as to whom federal income tax withholding on dividends is required, and in the case of a foreign participant whose taxable income under the

Plan is subject to federal income tax withholding, dividends will be reinvested net of the amount of tax withheld under applicable law.

7

A participant will not realize any taxable income upon receipt of certificates for whole

shares credited to the participant’s account, either upon the participant’s withdrawal of those shares from the Plan or upon termination of participation in the Plan. A participant who sells or exchanges shares previously received from the

Plan may, however, recognize gain or loss. A participant will recognize gain or loss upon the receipt of a cash payment for a fractional share credited to the participant’s account upon termination of participation in the Plan. The amount of

gain or loss in either case will be the difference between the amount the participant receives for the shares or fractional share and the participant’s tax basis in such shares or fractional share.

The foregoing summary is based upon an interpretation of current federal income tax law; however, participants should consult their own tax

advisors to determine particular tax consequences, including state tax consequences, which may result from participation in the Plan, and any subsequent disposal of shares acquired pursuant to the Plan.

Withdrawal of Shares from Plan Accounts

|

21.

|

How may a participant withdraw shares purchased under the Plan?

|

A participant may withdraw

all or a portion of the whole shares of common stock credited to his or her account by notifying the Plan Agent in writing to that effect and specifying in the notice the number of shares to be withdrawn. Certificates for whole shares of common

stock so withdrawn will be registered in the name of the participant and issued to the participant or, at the participant’s election, to the Participant’s broker. Participants may also direct their registered broker to request the Plan

Agent to transfer whole Plan Shares in their accounts to the Participant’s brokerage account through a notice of withdrawal. Certificates for fractional shares will not be issued under any circumstances. Any notice of withdrawal received less

than five (5) business days prior to a dividend record date will not be effective until dividends paid for such record date have been reinvested and the shares credited to the participant’s account.

Dividends on shares withdrawn from a participant’s account will continue to be reinvested unless the participant otherwise notifies the

Plan Agent in writing. A participant who withdraws all of the whole and fractional shares from his or her account will be deemed to have terminated participation in the Plan.

|

22.

|

May a participant elect to have the withdrawn shares sold?

|

A participant who withdraws shares

from his or her account and receives certificates for such shares may sell the shares on the open market through a broker chosen by the participant.

In the alternative, a participant who holds 50 or fewer shares may request that Fulton Financial Corporation purchase all (but not less than

all) of the participant’s shares at their fair market value as of the 15th calendar day of the month following the month in which the request was made (the “Purchase Date”). If the Purchase Date falls on a date which is not a trading

day, the Purchase Date shall be the next trading day thereafter. Fulton Financial will promptly notify the Participant, in writing, whether it will purchase the shares or not. However, if a request for

8

repurchase is received by Fulton Financial Corporation less than fifteen (15) business days before the Purchase Date, Fulton Financial may elect to purchase the shares on the 15th calendar

day of the second month following the month in which the request was received, or reject the request using such notice as is reasonably practicable. The Plan Agent has the right to charge a service fee in connection with all such purchases, to be

deducted from the net proceeds payable to the Participant. A request for shares to be purchased must be signed by all persons in whose name the account appears, with signatures guaranteed.

Termination of Participation

|

23.

|

How does a participant terminate participation in the Plan?

|

A participant may terminate

his or her participation in the Plan at any time by sending written notice to the Plan Agent. When a participant terminates his or her participation in the Plan, the Plan Agent will deliver to the participant certificates for whole shares credited

to the participant’s account under the Plan (provided that the Participant may elect to have such shares be held in street name by the Participant’s broker), a check representing any uninvested dividends and optional cash payments, and a

check in lieu of the issuance of a fractional share, based on the then current market price for Fulton Financial common stock.

|

24.

|

May a participant request shares to be sold?

|

A participant holding fewer than 50 shares

may request shares to be purchased by Fulton Financial as described above in the answer to Question 22. In all other cases, a participant wishing to sell shares held in the Plan must first transfer such shares out of the Plan, with signatures

guaranteed.

Certificates for Shares

|

25.

|

Will certificates automatically be issued for shares purchased under the Plan?

|

No,

certificates for shares purchased for a participant’s account under the Plan will not automatically be issued. However, a certificate will be issued if a participant withdraws shares from his or her account under the Plan or terminates his or

her participation in the Plan, unless the participant holds fewer than 50 shares and requests such shares to be sold on his or her behalf by the Plan Agent.

|

26.

|

In whose name will shares be registered when certificates are issued to participants?

|

Certificates will be issued in the name or names that appear on the participant’s account under the Plan. If a participant requests a

certificate to be registered in a name other than that shown on the account, the request must be signed by all persons in whose names the account appears.

Other Information

|

27.

|

May a participant pledge shares held under the Plan or transfer rights under the Plan?

|

9

No, shares credited to a participant’s account under the Plan may not be pledged or

assigned, nor may any rights under the Plan be transferred, pledged or assigned, and any such purported pledge, assignment or transfer shall be void. A participant who wishes to pledge or assign his or her shares must withdraw such shares from the

Plan.

|

28.

|

What happens if a participant sells or transfers shares of common stock registered in his or her name?

|

As long as the Plan Agent holds shares for the participant’s account under the Plan, a participant who no longer has shares of Fulton

Financial common stock registered in his or her name may continue to participate in the Plan.

|

29.

|

What happens if Fulton Financial declares a stock dividend or a stock split?

|

If Fulton

Financial declares a stock dividend or effects a stock split, any shares resulting from such stock dividend or stock split with respect to common stock in a participant’s account will be credited to such account. In the event of any change in

the common stock of Fulton Financial subject to the Plan as a result of a stock split, reverse stock split, stock dividend or other similar transaction, the number of shares subject to the Plan shall be appropriately adjusted.

|

30.

|

May the Plan be modified or terminated?

|

Fulton Financial reserves the right to suspend or

terminate the Plan at any time, or to make modifications to the Plan. Participants will receive prior notice of any suspension, termination or material modification of the Plan. Fulton Financial also reserves the right to terminate any

shareholder’s participation in the Plan at any time. Fulton Financial may adopt rules and regulations at any time to facilitate the administration of the Plan.

|

31.

|

What are the responsibilities of Fulton Financial and the Plan Agent under the Plan?

|

Fulton

Financial and the Plan Agent, in administering the Plan, shall not be liable for any act done in good faith or for any good faith omission to act, including, without limitation, any claims of liability (i) arising out of failure to terminate a

participant’s account upon such participant’s death, and (ii) with respect to the prices at which shares are purchased or sold, the times when purchases or sales are made, the manner in which purchases or sales are made, the decision

whether to purchase shares on the open market or from Fulton Financial, and fluctuations in the fair market value of the common stock.

USE OF PROCEEDS

Fulton Financial is unable to predict the number of shares of common stock that will be purchased from it under the Plan or the prices at

which such shares will be purchased. The net proceeds to Fulton Financial from the sale of stock offered hereby will provide additional equity capital to Fulton Financial to support its growth and the growth of its subsidiaries.

10

EXPERTS

The consolidated financial statements of Fulton Financial Corporation and subsidiaries as of December 31, 2013 and 2012, and for each of

the years in the three-year period ended December 31, 2013, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2013 have been incorporated by reference herein and in the

registration statement in reliance upon the report of KPMG LLP, independent registered public accounting firm, appearing elsewhere and incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

LEGAL OPINIONS

Barley Snyder LLC, 126 East King Street, Lancaster, Pennsylvania 17602, legal counsel to Fulton Financial, will pass upon the validity of the

common stock offered pursuant to the Plan, certain tax matters in connection with the Plan, and certain other legal matters.

WHERE TO FIND MORE INFORMATION

Fulton Financial is subject to the informational requirements of the Securities Exchange Act of

1934, as amended, and in accordance therewith files reports and other information with the SEC. Reports, proxy and information statements and other information filed by Fulton Financial can be inspected and copied at the public reference facilities

maintained by the SEC at 100 F Street, NE, Washington, D.C. 20549. You may call the SEC at 1-800-SEC-0330 for further information on the public reference room. Fulton Financial’s common stock is listed for trading on the NASDAQ National Market.

Reports, proxy and information statements, and other information concerning Fulton Financial may also be inspected at the offices of NASDAQ at 1735 K Street, N.W., Washington, D.C. 20006. The SEC maintains a Web site that contains reports, proxy and

information statements and other information regarding registrants, like Fulton Financial, that file electronically with the SEC. The address of the SEC Web site is http.//www.sec.gov.

Fulton Financial has filed with the SEC a Registration Statement on Form S-3 (together with all amendments and exhibits thereto, the

“Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered hereby. This document does not contain all the information set forth in the Registration

Statement, certain portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information with respect to Fulton Financial and the securities offered hereby, reference is made to the Registration Statement

and the exhibits and the financial statements, notes and schedules filed as a part thereof or incorporated by reference therein, which may be inspected at the public reference facilities of the SEC at the addresses set forth above or through the SEC

Web site. Statements made in this document concerning the contents of any documents referred to herein are not necessarily complete, and in each instance are qualified in all respects by reference to the copy of such document filed as an exhibit to

the Registration Statement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

Some of the information that you may want to consider in deciding whether to purchase shares of common stock is not physically included in

this document, but rather is “incorporated by reference” to documents that have been filed by Fulton Financial with the SEC. As permitted by the SEC, the following documents are incorporated by reference in this document:

11

1. Fulton Financial’s Annual Report on Form 10-K for the year ended December 31,

2013, filed March 3, 2014;

2. Fulton Financial’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, filed

May 12, 2014;

3. Fulton Financial’s Current Reports on Form 8-K, filed on the following dates in 2014:

January 21, February 10 and 20, March 24, April 22, May 8, 12 and 28, June 17, July 18 and July 22.

4. The description of Fulton Financial common stock contained in Fulton Financial’s registration statement on Form 8-A, dated

July 3, 1989, and any amendment or reports filed for purposes of updating such description.

All documents filed by Fulton

Financial pursuant to Section 13, 14 or 15(d) of the Exchange Act after the date of this document and prior to the termination of the offering of the securities made by this document shall be deemed to be incorporated by reference in this

document and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this

document to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this document.

Fulton Financial hereby undertakes to

provide without charge to each person, including any beneficial owner, to whom a copy of this document has been delivered, on the written or oral request of any such person, a copy of any and all of the documents referred to above that have been

incorporated by reference in this reference to such documents. Written or telephone requests for such copies should be directed to the Corporate Secretary, One Penn Square, Lancaster, Pennsylvania 17602, telephone number (717) 291-2411.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Securities Act”) may be permitted to

directors, officers and controlling persons of Fulton, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

12

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

The following table sets forth the

estimated expenses to be incurred by Fulton Financial Corporation in connection with the issuance and distribution of the shares being registered:

|

|

|

|

|

|

|

Printing Expenses

|

|

$

|

1,000

|

|

|

Accounting Expenses

|

|

|

5,000

|

|

|

Legal Expenses

|

|

|

5,000

|

|

|

|

|

|

|

|

|

TOTAL

|

|

$

|

11,000

|

|

|

Item 15.

|

Indemnification of Directors and Officers

.

|

Pennsylvania law provides that a

Pennsylvania corporation may indemnify directors, officers, employees and agents of the corporation against liabilities they may incur in such capacities for any action taken or any failure to act, whether or not the corporation would have the power

to indemnify the person under any provision of law, unless such action or failure to act is determined by a court to have constituted recklessness or willful misconduct. Pennsylvania law also permits the adoption of a bylaw amendment, approved by

shareholders, providing for the elimination of a director’s liability for monetary damages for any action taken or any failure to take any action unless (1) the director has breached or failed to perform the duties of his office and

(2) the breach or failure to perform constitutes self-dealing, willful misconduct or recklessness.

The bylaws of Fulton Financial

provide for (1) indemnification of directors, officers, employees and agents of the registrant and its subsidiaries and (2) the elimination of a director’s liability for monetary damages, to the fullest extent permitted by

Pennsylvania law.

Directors and officers are also insured against certain liabilities for their actions, as such, by an insurance

policies obtained by Fulton Financial.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be

permitted to directors, officers or controlling persons, the registrant has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is therefore

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by a registrant of expenses incurred or paid by a director, officer or controlling person of the registrant) is asserted be such directors,

officer of controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court or appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

13

The following exhibits are filed as part of this Registration Statement:

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

|

|

|

|

99.1

|

|

Amended and Restated Dividend Reinvestment and Stock Purchase Plan

|

1. The undersigned registrant hereby undertakes as follows:

(A) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the

Commission pursuant to Rule 424(b) (§230.424(b) of this chapter) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement;

(iii) to include any material information with respect to the Plan of

distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

(B) Paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the registration statement is on Form S–8 (§239.16b of this

chapter), and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities

Exchange Act of 1934 (15 U.S.C. 78m or 78o(d)) that are incorporated by reference in the registration statement; and

(C) Paragraphs

(a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S–3 (§239.13 of this chapter) or Form F–3 (§239.33 of this chapter) and the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the

registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) (§230.424(b) of this chapter) that is part of the registration statement.

14

(D)

Provided further

,

however

, that paragraphs (a)(1)(i) and (a)(1)(ii) do not

apply if the registration statement is for an offering of asset-backed securities on Form S–1 (§239.11 of this chapter) or Form S–3 (§239.13 of this chapter), and the information required to be included in a post-effective

amendment is provided pursuant to Item 1100(c) of Regulation AB (§229.1100(c)).

2. That, for the purpose of determining any

liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering.

4. That, for the purpose of determining liability under the Securities

Act of 1933 to any purchaser:

(i) If the registrant is relying on Rule 430B (§230.430B of this chapter):

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) (§230.424(b)(3) of this chapter) shall be deemed to be part of the

registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) (§230.424(b)(2), (b)(5), or (b)(7) of this chapter) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule

415(a)(1)(i), (vii), or (x) (§230.415(a)(1)(i), (vii), or (x) of this chapter) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the

registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for

liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

Provided, however,

that no statement made in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to

such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

15

(ii) If the registrant is subject to Rule 430C (§230.430C of this chapter), each prospectus

filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A (§230.430A of this chapter), shall be

deemed to be part of and included in the registration statement as of the date it is first used after effectiveness.

Provided, however,

that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first

use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

5. That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to

this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will

be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or

prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424 (§230.424 of this chapter);

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the

undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information

about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other

communication that is an offer in the offering made by the undersigned registrant to the purchaser.

6. The undersigned registrant hereby

undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

16

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-3 and has duly caused this amendment to registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Lancaster, Commonwealth of Pennsylvania on

July 30, 2014.

|

|

|

FULTON FINANCIAL CORPORATION

|

|

|

|

/s/ E. Phillip Wenger

|

|

By: E. Phillip Wenger

Chairman of the Board,

Chief Executive Officer and President

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Daniel R. Stolzer, Mark A.

Crowe and John R. Merva, as their true and lawful attorney-in-fact and agent, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities to sign the Form S-3

Registration Statement and any and all amendments thereto, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting unto each said attorney-in-fact and

agent full power and authority to do and perform each and every act and thing requisite and necessary to be done as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said

attorney-in-fact and agent, or either one of his or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this amendment to registration statement has been signed by the following persons

in the capacities and on the dates listed.

|

|

|

|

|

|

|

Name

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ E. Phillip Wenger

E. Phillip Wenger

|

|

Chairman of the Board, Chief Executive Officer (Principal Executive Officer), President and Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Patrick S. Barrett

Patrick S. Barrett

|

|

Senior Executive Vice President and Chief Financial Officer (Principal Financial Officer)

|

|

July 30, 2014

|

17

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael J. DePorter

Michael J. DePorter

|

|

Senior Vice President and Controller

(Principal Accounting Officer)

|

|

July 30, 2014

|

|

|

|

|

|

/s/ John M. Bond, Jr.

John M. Bond, Jr.

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Lisa Crutchfield

Lisa Crutchfield

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Craig A. Dally

Craig A. Dally

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Denise L. Devine

Denise L. Devine

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Patrick J. Freer

Patrick J. Freer

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ George W. Hodges

George W. Hodges

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Albert Morrison III

Albert Morrison III

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ R. Scott Smith, Jr.

R. Scott Smith, Jr.

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Gary A. Stewart

Gary A. Stewart

|

|

Director

|

|

July 30, 2014

|

|

|

|

|

|

/s/ Ernest J. Waters

Ernest J. Waters

|

|

Director

|

|

July 30, 2014

|

18

EXHIBIT INDEX

Required Exhibits

|

|

|

|

|

Number

|

|

Title

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

|

|

|

|

99.1

|

|

Amended and Restated Dividend Reinvestment and Stock Purchase Plan

|

19

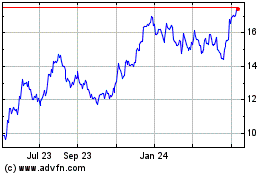

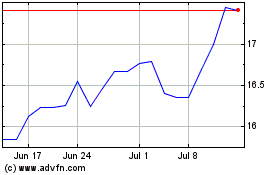

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Apr 2023 to Apr 2024