UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

July 23, 2014

Date of Report (Date of earliest event reported)

APPLE INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| California |

|

000-10030 |

|

94-2404110 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

1 Infinite Loop

Cupertino, California 95014

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code

(408) 996-1010

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

The Description of Common

Stock set forth in Exhibit 99.1 is being filed for the purpose of providing an updated description of the capital stock of Apple Inc. (the “Company”). The Description of Common Stock set forth in Exhibit 99.1 is incorporated herein by

reference, modifies and supersedes any prior description of the capital stock of the Company in any registration statement or report filed with the Securities and Exchange Commission (the “Commission”) and will be available for

incorporation by reference into certain of the Company’s filings with the Commission pursuant to the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the rules and forms promulgated thereunder.

| Item 9.01 |

Financial Statements and Exhibits. |

The following exhibit is filed

herewith:

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Description of Common Stock. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLE INC.

(Registrant) |

|

|

|

|

| Date: July 23, 2014 |

|

|

|

By: |

|

/s/ D. Bruce Sewell |

|

|

|

|

|

|

|

|

D. Bruce Sewell Senior Vice

President, General Counsel and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Description of Common Stock. |

Exhibit 99.1

DESCRIPTION OF COMMON STOCK

The following is a description of the rights of the common

stock of Apple Inc. (the “Company”), related provisions of the Company’s Restated Articles of Incorporation (the “Articles”), and Amended and Restated Bylaws (the “Bylaws”) and applicable California law. This

description is intended as a summary and is qualified in its entirety by, and should be read in conjunction with, the Articles, Bylaws and applicable California law.

Authorized Capital Stock

The Company’s authorized capital stock

consists of 12,600,000,000 shares of common stock, par value $0.00001 (the “Common Stock”).

Common Stock

Fully Paid and Nonassessable

All of the outstanding shares of the Company’s Common Stock are fully paid and nonassessable.

Voting Rights

The holders of shares of Common Stock are entitled to

one vote per share on all matters to be voted on by such holders.

Dividends

The holders of shares of Common Stock are entitled to receive such dividends, if any, as may be declared from time to time by the

Company’s Board of Directors in its discretion from funds legally available therefor.

Right to Receive Liquidation

Distributions

Upon liquidation, dissolution or winding-up, the holders of shares of Common Stock are entitled to

receive pro rata all assets remaining available for distribution to holders of such shares.

No Preemptive or Similar

Rights

The Common Stock has no preemptive or other subscription rights, and there are no conversion rights or

redemption or sinking fund provisions with respect to such shares of Common Stock.

Anti-Takeover Provisions of the Articles, Bylaws and California Law

Provisions of the Articles and Bylaws may delay or discourage transactions involving an actual or potential change in the Company’s

control or change in its management, including transactions in which shareholders might otherwise receive a premium for their shares, or transactions that its shareholders might otherwise deem to be in their best interests. Among other things, the

Articles and Bylaws:

| |

• |

|

provide that, except for a vacancy caused by the removal of a director as provided in the Bylaws, a vacancy may be filled by a person selected by a

majority of the remaining directors then in office, whether or not less than a quorum, or by a sole remaining director; |

| |

• |

|

provide that shareholders seeking to present proposals before a meeting of shareholders or to nominate candidates for election as directors at a

meeting of shareholders must provide notice in writing in a timely manner, and also specify requirements as to the form and content of a shareholder’s notice; and |

| |

• |

|

do not provide for cumulative voting rights for the election of directors. |

In addition, as a California corporation, the Company is subject to the provisions of Section 1203 of the California General

Corporation Law (the “CGCL”), which requires it to provide a fairness opinion to its shareholders in connection with their consideration of any proposed “interested party” reorganization transaction.

Limitation on Liability and Indemnification Matters

Section 317 of the CGCL authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers who are parties or are threatened to be made parties to

any proceeding (with certain exceptions) by reason of the fact that the person is or was an agent of the corporation, against expenses, judgments, fines, settlements and other amounts actually and reasonably incurred in connection with the

proceeding if that person acted in good faith and in a manner the person reasonably believed to be in the best interests of the corporation and, in the case of a criminal proceeding, had no reasonable cause to believe the conduct of the person was

unlawful.

Section 204 of the CGCL provides that a corporation’s articles of incorporation may not limit the

liability of directors (i) for acts or omissions that involve intentional misconduct or a knowing and culpable violation of law, (ii) for acts or omissions that a director believes to be contrary to the best interests of the corporation or

its shareholders or that involve the absence of good faith on the part of the director, (iii) for any transaction from which a director derived an improper personal benefit, (iv) for acts or omissions that show a reckless disregard for the

director’s duty to the corporation or its shareholders in circumstances in which the director was aware, or should have been aware, in the ordinary course of performing a director’s duties, of a risk of a serious injury to the corporation

or its shareholders, (v) for acts or omissions that constitute an unexcused pattern of inattention that amounts to an abdication of the director’s duty to the corporation or its shareholders, (vi) under Section 310 of the CGCL

(concerning transactions between corporations and directors or corporations having interrelated directors) or (vii) under Section 316 of the CGCL (concerning directors’ liability for distributions, loans, and guarantees).

Section 204 further provides that a corporation’s articles of incorporation may not limit the liability of directors for any

act or omission occurring prior to the date when the provision became effective or any act or omission as an officer, notwithstanding that the officer is also a director or that his or her actions, if negligent or improper, have been ratified by the

directors. Further, Section 317 has no effect on claims arising under federal or state securities laws and does not affect the availability of injunctions and other equitable remedies available to a corporation’s shareholders for any

violation of a director’s fiduciary duty to the corporation or its shareholders.

In accordance with Section 317, the Articles of the Company limit the liability of a

director to the Company or its shareholders for monetary damages to the fullest extent permissible under California law. The Articles further authorize the Company to provide indemnification to its agents (including officers and directors), subject

to the limitations set forth above. The Bylaws also provide the Company with the power to indemnify corporate agents in accordance with the CGCL.

Pursuant to the authority provided in the Articles and Bylaws, the Company has entered into indemnification agreements with each of its executive officers and directors, indemnifying them against certain

potential liabilities that may arise as a result of their service to the Company, and providing for certain other protection. The Company also maintains insurance policies which insure its officers and directors against certain liabilities.

The foregoing summaries are necessarily subject to the complete text of the statutes, the Articles, the Bylaws and the

agreements referred to above and are qualified in their entirety by reference thereto.

Listing

The Common Stock is listed on the NASDAQ Stock Market LLC under the trading symbol “AAPL.”

Transfer Agent and Registrar

Computershare Trust Company, N.A. is the transfer agent and registrar of the Common Stock.

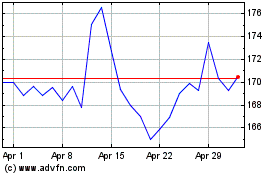

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2024 to May 2024

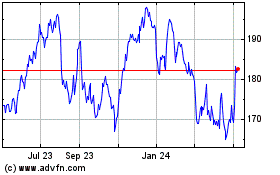

Apple (NASDAQ:AAPL)

Historical Stock Chart

From May 2023 to May 2024