As filed with the U.S. Securities and Exchange

Commission on May 14, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ANI PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in

its Charter)

|

Delaware

|

|

58-2301143

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

210 Main Street West

Baudette, Minnesota 56623

(218) 634-3500

|

|

(Address, Including Zip Code and Telephone

Number, Including Area Code, of Registrant’s Principal Executive Offices)

Charlotte C. Arnold

Vice President, Finance and Chief Financial

Officer

ANI Pharmaceuticals, Inc.

210 Main Street West

Baudette, Minnesota 56623

(218) 634-3500

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Paul A. Gajer, Esq.

Jeffrey A. Baumel, Esq.

Dentons US LLP

1221 Avenue of the Americas

New York, New York 10020

(212) 768-6700

Approximate date of commencement of proposed sale to public

:

From time to time or at one time after this registration statement becomes effective in light of market conditions and other factors.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities

Act"), other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box.

x

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated

filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

¨

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

x

|

CALCULATION OF REGISTRATION FEE

Title Of Each Class Of Securities

To Be Registered

|

|

Amount To Be

Registered

|

|

|

Proposed Maximum

Offering

Price Per Unit

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount Of

Registration

Fee

|

|

|

Primary Offering:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

(1)(2)

|

|

|

|

(1)(2)

|

|

|

|

(2)(3)

|

|

|

|

|

|

|

Preferred Stock, par value $.0001 per share

|

|

|

(1)(2)

|

|

|

|

(1)(2)

|

|

|

|

(2)(3)

|

|

|

|

|

|

|

Common Stock, par value $.0001 per share

|

|

|

(1)(2)

|

|

|

|

(1)(2)

|

|

|

|

(2)(3)

|

|

|

|

|

|

|

Warrants

|

|

|

(1)(2)

|

|

|

|

(1)(2)

|

|

|

|

(2)(3)

|

|

|

|

|

|

|

Total Primary Offering

|

|

$

|

250,000,000(3)

|

|

|

|

100%

|

|

|

$

|

250,000,000

|

|

|

$

|

32,200(4)

|

|

|

Secondary Offering:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $.0001 per share

|

|

|

3,500,000(5)

|

|

|

$

|

30.60(6)

|

|

|

$

|

107,100,000

|

|

|

$

|

13,795

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

$

|

357,100,000

|

|

|

$

|

45,995

|

|

|

|

(1)

|

There are being registered under this registration statement

such indeterminate number of shares of common stock and preferred stock of the registrant, such indeterminate number of warrants

of the registrant and such indeterminate principal amount of debt securities of the registrant, as shall have an aggregate initial

offering price not to exceed $250,000,000. There are being registered under this registration statement such indeterminate number

of each identified class of the identified securities as may be issued upon conversion, exchange, or exercise of any other securities

that provide for such conversion, exchange or exercise, up to a proposed maximum offering price of $250,000,000. In addition,

pursuant to Rule 416 under the Securities Act, the shares of common stock and preferred stock being registered hereunder include

such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered

hereunder as a result of stock splits, stock dividends or similar transactions. The common stock to be issued pursuant to this

registration statement may include the issuance of shares of common stock issuable pursuant to currently outstanding warrants

as follows: (a) up to 6,667 shares issuable upon exercise of warrants at an exercise price of $90.00 per share through June 9,

2014; (b) up to 66,666 shares issuable upon exercise of warrants at an exercise price of $90.00 per share through August 12, 2014;

(c) up to 144,508 shares issuable upon exercise of warrants at an exercise price of $74.88 per share through September 8, 2015;

(d) up to 99,088 shares issuable upon exercise of warrants at an exercise price of $88.20 per share through June 23, 2015; (e)

up to 147,058 shares issuable upon exercise of warrants at an exercise price of $72.00 per share through December 30, 2015; and

(f) up to 63,333 shares issuable upon exercise of warrants at an exercise price of $9.00 per share through August 16, 2017. If

any debt securities are issued at an original issue discount, then the debt securities registered pursuant to this registration

statement shall include such greater principal amount as shall result in an amount to be registered hereunder that equals the

aggregate initial offering price, but in no event shall the initial public offering price of securities registered hereunder exceed

$250,000,000 less the aggregate dollar amount of all securities previously issued hereunder, or the equivalent thereof in one

or more foreign currencies. Any securities registered under this registration statement may be sold separately or as units with

other securities registered under this registration statement. The proposed maximum initial offering prices per unit will be determined,

from time to time, by the registrant in connection with the issuance by the registrant of the securities registered under this

registration statement.

|

|

|

(2)

|

Not specified with respect to each class of securities

being registered under this registration statement pursuant to General Instruction II.D. of Form S-3 under the Securities Act.

|

|

|

(3)

|

Estimated solely for the purpose of calculating the registration

fee in accordance with Rule 457(o) under the Securities Act. No additional consideration will be received for common stock, preferred

stock or debt securities that are issued upon conversion into or exchange for or exercise of preferred stock or debt securities.

The proposed maximum aggregate offering price per class of security will be determined from time to time by the registrant in

connection with the issuance by the registrant of the securities registered hereunder and is not specified as to each class of

security pursuant to General Instruction II.D of Form S-3 under the Securities Act.

|

|

|

(4)

|

Pursuant to Rule 457(o) under the Securities Act, the

registration fee is calculated on the maximum offering price of all securities listed, and the table does not specify information

by each class about the amount to be registered. Pursuant to Rule 415(a)(6) under the Securities Act, this registration statement

includes a total of $53,846,782 of unsold securities that had previously been registered under the Registrant’s registration

statement on Form S-3, initially filed with the U.S. Securities and Exchange Commission (the "SEC") on May 27, 2011

(No. 333-174597) (the "2011 Registration Statement"). The 2011 Registration Statement initially registered securities

for a maximum aggregate offering price of $150,000,000 and of that amount the Registrant has previously sold common stock and

warrants for an aggregate offering price of $96,153,218, leaving a balance of unsold securities with an aggregate offering price

of $53,846,782. The Registrant is paying herewith a registration fee of $25,265 in connection with the registration of $196,153,218

of newly registered securities. Pursuant to Rule 415(a)(6), the offering of the unsold securities registered under the 2011 Registration

Statement will be deemed terminated as of the date of effectiveness of this registration statement. If the Registrant sells any

of such unsold securities pursuant to the 2011 Registration Statement after the date of the initial filing, and prior to the date

of effectiveness, of this registration statement, the registrant will file a pre-effective amendment to this registration statement

which will reduce the number of such unsold securities included on this registration statement and increase the additional securities

registered hereon so that the total amount of securities registered hereon will equal $250,000,000, and will pay the additional

registration fee resulting therefrom.

|

|

|

(5)

|

Pursuant to Rule 416 under the Securities Act, the shares of Common Stock registered for resale are deemed to include an unspecified

number of additional shares of Common Stock to prevent dilution resulting from any further stock split, stock dividend or similar

transaction.

|

|

|

(6)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act

to be equal to $30.60 per share, the average of the high and low prices of the Common Stock as reported on The NASDAQ Global Market

on May 13, 2014.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. The Registrant may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to

buy these securities in any state where an offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

MAY 14, 2014

PROSPECTUS

$250,000,000

ANI Pharmaceuticals, Inc.

Debt Securities, Preferred Stock, Common

Stock,

Debt Warrants and Equity Warrants

and

3,500,000 Shares

of

Common Stock

Offered for Resale by Selling Stockholders

The Company may sell from time to time

in one or more offerings up to $250,000,000 in the aggregate of:

|

|

·

|

the Company's secured or unsecured debt securities, in one or more series, which may be either senior, senior subordinated

or subordinated debt securities;

|

|

|

·

|

shares of the Company's preferred stock in one or more series;

|

|

|

·

|

shares of the Company's common stock;

|

|

|

·

|

any combination of the foregoing.

|

In addition, the selling stockholders to

be named in prospectus supplement may offer and sell, from time to time, up to 3,500,000 shares of the Company's common stock,

par value $.0001 per share. The selling stockholders may offer the shares of common stock from time to time through public or private

transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The

Company will not receive any of the proceeds from the sale of shares of the Company's common stock by the selling stockholders.

Neither the Company nor the selling stockholders are required to sell any securities.

When the Company decides to sell particular

securities or when the selling stockholders decide to sell shares of common stock, the Company will provide you with the specific

terms and the offering price of the securities the Company or the selling stockholders, as applicable, are then offering in one

or more prospectus supplements to this prospectus. The prospectus supplement may add to, change or update information contained

in this prospectus. The prospectus supplement may also contain important information about U.S. federal income tax consequences.

You should carefully read this prospectus, together with any prospectus supplements and information incorporated by reference in

this prospectus and any prospectus supplements, before you decide to invest.

This prospectus may not be used to

offer or sell any securities unless accompanied by a prospectus supplement.

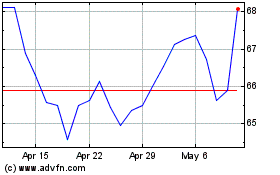

The Company's common stock is quoted on

The NASDAQ Global Market under the trading symbol "ANIP."

Any common stock sold pursuant to this prospectus

or any prospectus supplement will be listed on that exchange, subject to official notice of issuance. Each prospectus supplement

to this prospectus will contain information, where applicable, as to any other listing on any national securities exchange of the

securities covered by the prospectus supplement.

The aggregate market value of the Company's

outstanding common stock held by non-affiliates is $237,796,811 based on 11,282,982 shares of outstanding common stock, of which

7,636,378 are held by non-affiliates, and a per share price of $31.14 based on the closing sale price of the Company's common stock

on May 7, 2014.

Investing in the Company's securities

involves significant risks. See "Risk Factors" beginning on page 5.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 14, 2014.

TABLE OF CONTENTS

This prospectus is part of a registration

statement the Company filed with the Securities and Exchange Commission. You should rely only on the information the Company has

provided or incorporated by reference in this prospectus or any prospectus supplement. Neither the Company nor the selling stockholders

have authorized anyone to provide you with additional or different information. The Company and the selling stockholders are not

making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in

this prospectus is accurate as of any date other than the date on the front of the prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that the Company filed with the U.S. Securities and Exchange Commission (the "SEC") utilizing a "shelf"

registration process or continuous offering process, which allows the Company to offer and sell any combination of the securities

described in this prospectus in one or more offerings. Using this prospectus, the Company may offer up to a total dollar amount

of $250,000,000 of these securities. In addition, the selling stockholders to be identified in a prospectus supplement may from

time to time sell up to 3,500,000 shares of the Company's common stock in one or more offerings.

This prospectus provides you with a general

description of the securities the Company or selling stockholders may offer. Each time the Company or selling stockholders sell

securities pursuant to this registration statement and the prospectus contained herein, the Company will provide a prospectus supplement

that will contain specific information about the terms of that offering. That prospectus supplement may include additional risk

factors about the Company and the terms of that particular offering. Prospectus supplements may also add to, update or change the

information contained in this prospectus. To the extent that any statement that the Company makes in a prospectus supplement is

inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded

by those made in such prospectus supplement. In addition, as described in the section entitled "Where You Can Find More Information,"

the Company has filed and plans to continue to file other documents with the SEC that contain information about the Company and

the business conducted by the Company and its subsidiaries. Before you decide whether to invest in any of these securities, you

should read this prospectus, the prospectus supplement that further describes the offering of these securities and the information

the Company files with the SEC.

In this prospectus and any prospectus supplement,

unless otherwise indicated, the terms "ANI" and "the Company" refer and relate to ANI Pharmaceuticals, Inc.,

and its consolidated subsidiary.

ABOUT THE COMPANY

The Company's Business

ANI

Pharmaceuticals,

Inc. and its consolidated subsidiary, ANIP Acquisition Company d/b/a ANI Pharmaceuticals, Inc. ("ANIP" or "Subsidiary"),

is an integrated specialty pharmaceutical company developing, manufacturing, and marketing branded and generic prescription pharmaceuticals.

The Company's targeted areas of product development currently include narcotics, oncolytics (anti-cancers), hormones and steroids,

and complex formulations involving extended release and combination products. The Company has two pharmaceutical manufacturing

facilities located in Baudette, Minnesota, which are capable of producing oral solid dose products, as well as liquids and topicals,

narcotics, and potent products that must be manufactured in a fully-contained environment. The Company's strategy is to continue

to use these manufacturing assets to develop, produce, and distribute niche generic pharmaceutical products.

On June 19,

2013, pursuant to a merger agreement dated as of April 12, 2013, ANIP became a wholly-owned subsidiary of BioSante

Pharmaceuticals

,

Inc. ("BioSante") in an all-stock, tax-free reorganization (the "Merger"). The Merger was accounted for as

a reverse acquisition, pursuant to which ANIP was considered the acquiring entity for accounting purposes. BioSante was a publicly-held

pharmaceutical company focused on developing high value, medically-needed products. ANIP entered into the Merger to secure additional

capital and gain access to capital market opportunities as a public company.

In addition,

in

July

2013, the Company's stockholders approved and the Company subsequently effected (i)

a one-for-six reverse stock split of the

Company's

common stock and class C special stock,

with a proportional reduction in the number of authorized shares of its common stock, class C special stock and blank check preferred

stock, and (ii) a change of the Company's name from "BioSante Pharmaceuticals, Inc." to "ANI Pharmaceuticals, Inc."

Products, Markets and Contract Manufacturing

Products

The

Company's

established

product portfolio consists of both branded and generic pharmaceuticals,

including:

|

Generic Products

|

|

Branded Products

|

|

Esterified Estrogen with Methyltestosterone Tablets

|

|

Cortenema

®

|

|

Fluvoxamine Maleate Tablets

|

|

Reglan

®

Tablets

|

|

Hydrocortisone Enema

|

|

|

|

Metoclopramide Syrup

Opium Tincture

|

|

|

Esterified

Estrogen

with Methyltestosterone ("EEMT") is used to treat moderate to severe vasomotor

symptoms of menopause, such as hot flashes and heart

palpations

that are not improved by estrogen

medications alone. For the year ended December 31, 2013, EEMT comprised 33% of the Company’s net sales, a substantial increase

over the prior year wherein EEMT comprised only 9% of the Company’s net sales. In the third quarter of 2013, a significant

competitor stopped producing EEMT, which led to a material increase in the Company’s market share for the product and enabled

the Company to significantly increase the price it charges for the product.

Fluvoxamine

Maleate

is used to treat obsessions and compulsions in patients with obsessive-compulsive

disorder. It is generally used when the obsessions and compulsions in a patient interfere with the patient’s ability to function

socially and occupationally.

Hydrocortisone Enema and its branded equivalent,

Cortenema

®

are used for the treatment of ulcerative colitis, especially distal forms,

including

ulcerative proctitis, ulcerative proctosigmoiditis, and left-sided ulcerative colitis. The products have also proved useful in

some cases involving the transverse and ascending colons.

Metoclopramide syrup and its branded equivalent,

Reglan

®

, in tablet form, are prescribed for periods of four to twelve weeks for heartburn symptoms with gastroesophageal

reflux disease when certain other treatments do not work. The products relieve daytime heartburn and heartburn after meals and

also help ulcers in the esophagus to heal. The products also relieve symptoms of slow stomach emptying in people with diabetes

and help treat symptoms such as nausea, vomiting, heartburn, feeling full long after a meal, and loss of appetite.

Opium Tincture is used is to treat severe

diarrhea by slowing the movement of the intestines and decreasing the number and frequency of bowel movements.

Markets

In determining which products to pursue

for development, the Company targets markets whose products are complex to manufacture and therefore have higher barriers to entry.

These market factors provide opportunities for the Company's growth consistent with its competitive strengths at the same time

that they decrease the number of potential competitors in the markets. These markets currently include hormone and steroidal drugs,

oncolytics, and narcotics and complex formulations, including extended release and combination products.

Hormone and Steroidal Drugs

The market for hormone and steroidal drugs

includes hormone therapy to alleviate menopausal symptoms in women, contraceptives, testosterone replacement therapies for men,

and therapies for treating hormone-sensitive and other cancers.

Hormone Therapy ("HT") has been

an accepted medical treatment for alleviating the symptoms of menopause since the 1930s, with formal U.S. Food and Drug Administration

(the "FDA") approval for that use granted in 1942. Initially, HT consisted of estrogen only, but has evolved to include

combination therapies of estrogen, progesterone and androgens. The Company targets niche products in the HT and steroidal products

market for several reasons, including:

|

|

·

|

hormone and steroid products are a core competency based

on the Company’s manufacturing and product development teams' long history of manufacturing these types of products; and

|

|

|

·

|

the aging baby boom population, of which women represent

a majority, is expected to support continued growth in the HT market.

|

Oncolytics

The Company is positioned to develop and

manufacture niche oncolytic (anti-cancer) drugs due to the capabilities of the Company's containment facility and its expertise

in manufacturing segregation. In particular, the Company is targeting products subject to priority review by the FDA – those

with no blocking patents and no generic competition. In addition to one such product already under development, the Company has

identified additional priority review opportunities in oncolytics.

Narcotics

The Company's main manufacturing facility

in Baudette, Minnesota is licensed by the Drug Enforcement Administration for the manufacture and distribution of Schedule II

narcotics, i.e., drugs considered to have a high abuse risk but that also have safe and accepted medical uses in the United

States. In addition to its existing pipeline of four Abbreviated New Drug Applications, the Company has identified additional product

development opportunities in this market.

Contract Manufacturing

The Company manufactures pharmaceutical

products for several branded and generic companies, which outsource production to the Company in order to:

|

|

·

|

free-up internal resources to focus on sales and marketing

as well as research and development;

|

|

|

·

|

employ internal capacity to manufacture higher volume

or more critical products; and

|

|

|

·

|

utilize the Company’s specialized equipment

and expertise.

|

The Company considers contract manufacturing

to be an important component of its ongoing business. Given its highly specialized manufacturing capabilities, the Company is focused

on attracting niche contract manufacturing opportunities that fill idle capacity and offer high margins.

Trademark Notice

Cortenema®

and

Reglan® are

registered

trademarks of ANI

Pharmaceuticals

,

Inc. (

Baudette, Minnesota

).

Corporate Information

The Company’s principal executive

offices are located at 210 Main Street West, Baudette, Minnesota, 56623, its telephone number is (218) 634-3500, and its website

address is www.anipharmaceuticals.com. The website and the information contained therein or connected thereto are not incorporated

into this prospectus. The Company’s common stock is listed on The NASDAQ Global Market under the symbol "ANIP."

RISK FACTORS

Before

you

invest

in any of the Company's securities, in addition to the

other information in this prospectus and the applicable prospectus supplement, you

should

carefully consider the

risk

factors under the heading "Risk

Factors" contained in Part I, Item 1A in the Company's most recent Annual Report on Form 10-K and any risk

factors disclosed under the heading "Risk Factors" in Part II, Item 1A in any Quarterly Report on Form 10-Q

that the Company files after its most recent Annual Report on Form 10-K, which are incorporated by reference into this

prospectus

and the applicable prospectus supplement, as the same may be updated from time to time by the Company's future filings under the

Exchange Act.

The risks and uncertainties the Company

describes are not the only ones facing the Company. Additional risks and uncertainties not presently known to the Company or that

the Company currently deems immaterial may also impair its business or operations. Any adverse effect on the Company's business,

financial condition or operating results could result in a decline in the value of the securities and the loss of all or part of

your investment. The prospectus supplement applicable to each series of securities the Company or the selling stockholders offer

may contain a discussion of additional risks applicable to an investment in the Company and the securities the Company or the selling

stockholders are offering under that prospectus supplement.

FORWARD-LOOKING STATEMENTS

This prospectus and certain information

incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934 (the "Exchange Act").

Such statements include, but are not limited to, statements about the potential benefits of the recent Merger, the Company’s

plans, objectives, expectations and intentions with respect to future operations and products, the anticipated financial position,

operating results and growth prospects of the Company and other statements that are not historical in nature, particularly those

that utilize terminology such as "anticipates," "will," "expects," "plans," "potential,"

"future," "believes," "intends," "continue," other words of similar meaning, derivations

of such words and the use of future dates. Forward-looking statements by their nature address matters that are, to different degrees,

subject to change. You should not place undue reliance on those statements because they are subject to numerous uncertainties,

risks and other factors relating to the Company’s operations and business environment and other factors, all of which are

difficult to predict and many of which are beyond the Company’s control.

Uncertainties and risks may cause

the Company’s actual results to be materially different than those expressed in or implied by such forward-looking statements.

Uncertainties and risks include, but are not limited to, the risk that the Company may in the future face increased difficulty

in importing raw materials and/or increased competition, for its Esterified Estrogen with Methyltestosterone Tablet product; competitive

conditions for the Company's other products may intensify; the Company may be required to seek the approval of the FDA for its

unapproved products or withdraw such products from the market; general business and economic conditions; the Company’s expectations

regarding trends in markets for the Company’s current and planned products; the Company’s future cash flow and its

ability to support its operations; the Company’s ability to obtain additional financing as needed; the difficulty of developing

pharmaceutical products, obtaining regulatory and other approvals and achieving market acceptance of such products; and the marketing

success of the Company’s licensees or sublicensees.

More detailed information on these

and additional factors that could affect the Company’s actual results are described in the "Risk Factors" section

in Part I, Item 1A. of the Company's most recent annual report on Form 10-K and in other cautionary statements and risks included

in other reports the Company files with the SEC. All forward-looking statements in this prospectus speak only as of the date made

and are based on the Company’s current beliefs, assumptions, and expectations. The Company undertakes no obligation to update

or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

USE OF PROCEEDS

Unless otherwise indicated in the prospectus

supplement, the Company will use the net proceeds from the sale of securities offered by this prospectus primarily to research,

develop, commercialize and expand its drug products; to acquire complementary businesses and technologies; and for other working

capital and general corporate purposes. As of the date of this prospectus supplement, the Company has not identified any specific

material proposed uses of the anticipated proceeds.

The amounts and timing of any expenditures

will vary depending on: the type, number, costs, and results of the product candidate development programs which the Company is

pursuing or may choose to pursue in the future; the scope, progress, expansion, costs, and results of its clinical trials; competitive

and technological developments; and the rate of growth, if any, of its business. Accordingly, unless otherwise indicated in the

prospectus supplement, the Company's management will have significant flexibility in applying the net proceeds of the offerings,

and investors will be relying on the judgment of the Company's management regarding the application of these net proceeds. Pending

the application of the net proceeds, the Company intends to invest the proceeds in short-term, interest-bearing instruments or

other investment-grade securities.

The Company will not receive any of the

proceeds from the sale of the Company's common stock by the selling stockholders.

DESCRIPTION OF DEBT

SECURITIES

The following description, together with

the additional information the Company includes in any applicable prospectus supplements, summarizes the material terms and provisions

of the debt securities that the Company may offer under this prospectus. While the terms the Company has summarized below will

apply generally to any future debt securities the Company may offer under this prospectus, the Company will describe the particular

terms of any debt securities that the Company may offer in more detail in the applicable prospectus supplement. The terms of any

debt securities the Company offers under a prospectus supplement may differ from the terms described below. However, no prospectus

supplement shall fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered

and described in this prospectus at the time of its effectiveness. As of December 31, 2013, the Company had no outstanding indebtedness,

including accrued interest.

The Company will issue the senior debt

securities under the senior indenture that the Company will enter into with the trustee named in the senior indenture. The Company

will issue the subordinated debt securities under the subordinated indenture that the Company will enter into with the trustee

named in the subordinated indenture. The Company has filed forms of these documents as exhibits to the registration statement which

includes this prospectus. The Company uses the term "indentures" in this prospectus to refer to both the senior indenture

and the subordinated indenture.

The indentures will be qualified under

the Trust Indenture Act of 1939. The Company uses the term "trustee" to refer to either the senior trustee or the subordinated

trustee, as applicable.

The following summaries of material provisions

of the senior debt securities, the subordinated debt securities and the indentures are subject to, and qualified in their entirety

by reference to, all the provisions of the indenture applicable to a particular series of debt securities. Except as the Company

may otherwise indicate, the terms of the senior indenture and the subordinated indenture are identical.

General

Debt securities may be issued in separate

series without limitation as to aggregate principal amount. The Company may specify a maximum

aggregate

principal amount for the debt securities of any series.

The Company is not limited as to the amount

of debt securities it may issue under the indentures. The prospectus supplement will set forth:

|

|

·

|

whether the debt securities will be senior or subordinated;

|

|

|

·

|

any limit on the aggregate principal amount;

|

|

|

·

|

the person who shall be entitled to receive interest, if other than the record holder on the record date;

|

|

|

·

|

the date the principal will be payable;

|

|

|

·

|

the interest rate, if any, the date interest will accrue, the interest payment dates and the regular record dates;

|

|

|

·

|

the place where payments may be made;

|

|

|

·

|

any mandatory or optional redemption provisions;

|

|

|

·

|

if applicable, the method for determining how the principal, premium, if any, or interest will be calculated by reference to

an index or formula;

|

|

|

·

|

if other than U.S. currency, the currency or currency units in which principal, premium, if any, or interest will be payable

and whether the Company or the holder may elect payment to be made in a different currency;

|

|

|

·

|

the portion of the principal amount that will be payable upon acceleration of stated maturity, if other than the entire principal

amount;

|

|

|

·

|

if the principal amount payable at stated maturity will not be determinable as of any date prior to stated maturity, the amount

which will be deemed to be the principal amount;

|

|

|

·

|

any defeasance provisions if different from those described below under "Satisfaction and Discharge; Defeasance;"

|

|

|

·

|

any conversion or exchange provisions;

|

|

|

·

|

any obligation to redeem or purchase the debt securities pursuant to a sinking fund;

|

|

|

·

|

whether the debt securities will be issuable in the form of a global security;

|

|

|

·

|

any subordination provisions, if different from those described below under "Subordinated Debt Securities;"

|

|

|

·

|

any deletions of, or changes or additions to, the events of default or covenants; and

|

|

|

·

|

any other specific terms of such debt securities.

|

Unless otherwise specified in the prospectus

supplement:

|

|

·

|

the debt securities will be registered debt securities; and

|

|

|

·

|

registered debt securities denominated in U.S. dollars will be issued in denominations of $1,000 or an integral multiple of

$1,000.

|

Debt securities may be sold at a substantial

discount below their stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below

market rates.

Exchange and Transfer

Debt securities may be transferred or exchanged

at the office of the security registrar or at the office of any transfer agent designated by the Company.

The Company will not impose a service charge

for any transfer or exchange, but the Company may require holders to pay any tax or other governmental charges associated with

any transfer or exchange.

In the event of any potential redemption

of debt securities of any series, the Company will not be required to:

|

|

·

|

issue, register the transfer of, or exchange, any debt security of that series during a period beginning at the opening of

business 15 days before the day of mailing of a notice of redemption and ending at the close of business on the day of the mailing;

or

|

|

|

·

|

register the transfer of or exchange any debt security of that series selected for redemption, in whole or in part, except

the unredeemed portion being redeemed in part.

|

The Company may initially appoint the trustee

as the security registrar. Any transfer agent, in addition to the security registrar, initially designated by the Company will

be named in the prospectus supplement. The Company may designate additional transfer agents or change transfer agents or change

the office of the transfer agent. However, the Company will be required to maintain a transfer agent in each place of payment for

the debt securities of each series.

Global Securities

The debt securities of any series may be

represented, in whole or in part, by one or more global securities. Each global security will:

|

|

·

|

be registered in the name of a depositary that the Company will identify in a prospectus supplement;

|

|

|

·

|

be deposited with the depositary or nominee or custodian; and

|

|

|

·

|

bear any required legends.

|

No global security may be exchanged in

whole or in part for debt securities registered in the name of any person other than the depositary or any nominee unless:

|

|

·

|

the depositary has notified the Company that it is unwilling or unable to continue as depositary or has ceased to be qualified

to act as depositary;

|

|

|

·

|

an event of default is continuing; or

|

|

|

·

|

any other circumstances described in a prospectus supplement.

|

As long as the depositary, or its nominee,

is the registered owner of a global security, the depositary or nominee will be considered the sole owner and holder of the debt

securities represented by the global security for all purposes under the indenture. Except in the above limited circumstances,

owners of beneficial interests in a global security:

|

|

·

|

will not be entitled to have the debt securities registered in their names,

|

|

|

·

|

will not be entitled to physical delivery of certificated debt securities, and

|

|

|

·

|

will not be considered to be holders of those debt securities under the indentures.

|

Payments on a global security will be made

to the depositary or its nominee as the holder of the global security. Some jurisdictions have laws that require that certain purchasers

of securities take physical delivery of such securities in definitive form. These laws may impair the ability to transfer beneficial

interests in a global security.

Institutions that have accounts with the

depositary or its nominee are referred to as "participants." Ownership of beneficial interests in a global security will

be limited to participants and to persons that may hold beneficial interests through participants. The depositary will credit,

on its book-entry registration and transfer system, the respective principal amounts of debt securities represented by the global

security to the accounts of its participants.

Ownership of beneficial interests in a

global security will be shown on and effected through records maintained by the depositary, with respect to participants’

interests, or any participant, with respect to interests of persons held by participants on their behalf.

Payments, transfers and exchanges relating

to beneficial interests in a global security will be subject to policies and procedures of the depositary.

The depositary policies and procedures

may change from time to time. Neither the Company nor the trustee will have any responsibility or liability for the depositary’s

or any participant’s records with respect to beneficial interests in a global security.

Payment and Paying Agent

The provisions of this paragraph will apply

to debt securities unless otherwise indicated in the prospectus supplement. Payment of interest on a debt security on any interest

payment date will be made to the person in whose name the debt security is registered at the close of business on the regular record

date. Payment on debt securities of a particular series will be payable at the office of a paying agent or paying agents designated

by the Company. However, at the Company's option, the Company may pay interest by mailing a check to the record holder. The corporate

trust office initially will be designated as the Company's sole paying agent.

The Company may also name any other paying

agents in the prospectus supplement. The Company may designate additional paying agents, change paying agents or change the office

of any paying agent. However, the Company will be required to maintain a paying agent in each place of payment for the debt securities

of a particular series.

All moneys paid by the Company to a paying

agent for payment on any debt security which remain unclaimed at the end of two years after such payment was due will be repaid

to the Company. Thereafter, the holder may look only to the Company for such payment.

Consolidation, Merger and Sale of Assets

The Company may not consolidate with or

merge into any other person, in a transaction in which it is not the surviving corporation, or convey, transfer or lease the Company's

properties and assets substantially as an entirety to, any person, unless:

|

|

·

|

the successor, if any, is a U.S. corporation, limited liability company, partnership, trust or other entity;

|

|

|

·

|

the successor assumes the Company's obligations on the debt securities and under the indenture;

|

|

|

·

|

immediately after giving effect to the transaction, no default or event of default shall have occurred and be continuing; and

|

|

|

·

|

certain other conditions are met.

|

If the debt securities are convertible

for the Company's other securities or securities of other entities, the person with whom the Company consolidates or merges or

to whom the Company sells all of its property must make provisions for the conversion of the debt securities into securities which

the holders of the debt securities would have received if they had converted the debt securities before the consolidation, merger

or sale.

Events of Default

Unless the Company informs you otherwise

in the prospectus supplement, the indenture will define an event of default with respect to any series of debt securities as one

or more of the following events:

(1) failure to pay principal of or any premium on

any debt security of that series when due and payable;

(2) failure to pay any interest on any debt security

of that series when it becomes due and payable, and continuation of that failure for a period of 90 days (unless the entire amount

of such payment is deposited by the Company with the trustee or paying agent prior to the expiration of the 90-day period);

(3) failure to deposit any sinking fund payment, when

and as due in respect of any debt security of that series;

(4) failure to perform or breach of any other covenant

or warranty by the Company in the indenture (other than a covenant or warranty that has been included in the indenture solely for

the benefit of a series of debt securities other than the series), which failure continues uncured for a period of 90 days after

the Company receives the notice required in the indenture;

(5) the Company's bankruptcy, insolvency or reorganization;

and

(6) any other event of default with respect to debt

securities of that series that is described in the applicable prospectus supplement accompanying this prospectus.

An event of default of one series

of debt securities is not necessarily an event of default for any other series of debt securities.

If an event of default, other than an event

of default described in clause (5) above, shall occur and be continuing, either the trustee or the holders of at least 25% in aggregate

principal amount of the outstanding securities of that series may declare the principal amount of the debt securities of that series

to be due and payable immediately.

If an event of default described in clause

(5) above shall occur, the principal amount of all the debt securities of that series will automatically become immediately due

and payable. Any payment by the Company on the subordinated debt securities following any such acceleration will be subject to

the subordination provisions described below under "Subordinated Debt Securities."

After acceleration the holders of a majority

in aggregate principal amount of the outstanding securities of that series may, under certain circumstances, rescind and annul

such acceleration if all events of default, other than the non-payment of accelerated principal, or other specified amount, have

been cured or waived.

Other than the duty to act with the required

care during an event of default, the trustee will not be obligated to exercise any of its rights or powers at the request of the

holders unless the holders shall have offered to the trustee security and indemnity satisfactory to it against the costs, expenses

and liabilities to be incurred in compliance with such request.

Generally, the holders of a majority in

aggregate principal amount of the outstanding debt securities of any series will have the right to direct the time, method and

place of conducting any proceeding for any remedy available to the trustee or exercising any trust or power conferred on the trustee.

A holder will not have any right to institute

any proceeding under the indentures, or for the appointment of a receiver or a trustee, or for any other remedy under the indentures,

unless:

(1) the holder has previously given to the trustee

written notice of a continuing event of default with respect to the debt securities of that series;

(2) the holders of at least 25% in aggregate principal

amount of the outstanding debt securities of that series have made a written request and have offered reasonable indemnity to the

trustee to institute the proceeding; and

(3) the trustee has failed to institute the proceeding

and has not received direction inconsistent with the original request from the holders of a majority in aggregate principal amount

of the outstanding debt securities of that series within 90 days after the original request.

A holder may not use the indenture to prejudice

the rights of any holder, or to obtain or to seek to obtain priority or preference over another holder or to enforce any right

under the indenture, except in the manner provided in the indenture and for the equal and ratable benefit of all holders (it being

understood that the trustee does not have an affirmative duty to ascertain whether or not such actions or forbearances are unduly

prejudicial to such holders).

Holders may, however, sue to enforce the

payment of principal, premium or interest on any debt security on or after the due date or to enforce the right, if any, to convert

any debt security without following the procedures listed in (1) through (3) above.

The Company will furnish the trustee an

annual statement by its officers as to whether or not the Company is in default in the performance of the indenture and, if so,

specifying all known defaults.

Modification and Waiver

The Company and the trustee may make modifications

and amendments to the indentures with the consent of the holders of a majority in aggregate principal amount of the outstanding

securities of each series affected by the modification or amendment.

However, neither the Company nor the trustee

may make any modification or amendment without the consent of the holder of each outstanding security of that series affected by

the modification or amendment if such modification or amendment would:

|

|

·

|

change the stated maturity of any debt security;

|

|

|

·

|

reduce the principal, premium, if any, or interest on any debt security;

|

|

|

·

|

reduce the principal of an original issue discount security or any other debt security payable on acceleration of maturity;

|

|

|

·

|

reduce the rate of interest on any debt security;

|

|

|

·

|

change the currency in which any debt security is payable;

|

|

|

·

|

impair the right to enforce any payment after the stated maturity or redemption date;

|

|

|

·

|

waive any default or event of default in payment of the principal of, premium or interest on any debt security;

|

|

|

·

|

waive a redemption payment or modify any of the redemption provisions of any debt security;

|

|

|

·

|

adversely affect the right to convert any debt security in any material respect; or

|

|

|

·

|

change the provisions in the indenture that relate to modifying or amending the indenture.

|

Satisfaction and Discharge; Defeasance

The Company may be discharged from its

obligations on the debt securities of any series that have matured or will mature or be redeemed within one year if the Company

deposits with the trustee enough cash to pay all the principal, interest and any premium due to the stated maturity date or redemption

date of the debt securities.

Each indenture will contain a provision

that permits the Company to elect:

|

|

·

|

to be discharged from all of the Company's obligations, subject to limited exceptions, with respect to any series of debt securities

then outstanding; and/or

|

|

|

·

|

to be released from the Company's obligations under the following covenants and from the consequences of an event of default

resulting from a breach of these covenants: (1) the subordination provisions under a subordinated indenture; and (2) covenants

as to payment of taxes and maintenance of corporate existence.

|

To make either of the above elections,

the Company must deposit in trust with the trustee enough money to pay in full the principal, interest and premium on the debt

securities. This amount may be made in cash and/or U.S. government obligations. As a condition to either of the above elections,

the Company must deliver to the trustee an opinion of counsel that the holders of the debt securities will not recognize income,

gain or loss for Federal income tax purposes as a result of the action.

If any of the above events occurs, the

holders of the debt securities of the series will not be entitled to the benefits of the indenture, except for the rights of holders

to receive payments on debt securities or the registration of transfer and exchange of debt securities and replacement of lost,

stolen or mutilated debt securities.

Notices

Notices to holders will be given by mail

to the addresses of the holders in the security register.

Governing Law

The indentures and the debt securities

will be governed by, and construed under, the law of the State of New York.

Regarding the Trustee

The indentures will limit the right of

the trustee, should it become a creditor of the Company, to obtain payment of claims or secure its claims.

The trustee will be permitted to engage

in certain other transactions. However, if the trustee, acquires any conflicting interest, and there is a default under the debt

securities of any series for which they are trustee, the trustee must eliminate the conflict or resign.

Subordinated Debt Securities

Payment on subordinated debt securities

will, to the extent provided in the indenture, be subordinated in right of payment to the prior payment in full of all of the Company's

senior indebtedness. Subordinated debt securities also are effectively subordinated to all debt and other liabilities, including

trade payables and lease obligations, if any, of the Company's subsidiaries.

Upon any distribution of the Company's

assets upon any dissolution, winding up, liquidation or reorganization, the payment of the principal of and interest on subordinated

debt securities will be subordinated in right of payment to the prior payment in full in cash or other payment satisfactory to

the holders of senior indebtedness of all senior indebtedness. In the event of any acceleration of the subordinated debt securities

because of an event of default, the holders of any senior indebtedness would be entitled to payment in full in cash or other payment

satisfactory to such holders of all senior indebtedness obligations before the holders of subordinated debt securities are entitled

to receive any payment or distribution. The indentures will require the Company to promptly notify holders of designated senior

indebtedness if payment of subordinated debt securities is accelerated because of an event of default.

The Company may not make any payment on

subordinated debt securities, including upon redemption at the option of the holder of any subordinated debt securities or at the

Company's option, if:

|

|

·

|

a default in the payment of the principal, premium, if any, interest, rent or other obligations in respect of designated senior

indebtedness occurs and is continuing beyond any applicable period of grace, which is called a "payment default"; or

|

|

|

·

|

a default other than a payment default on any designated senior indebtedness occurs and is continuing that permits holders

of designated senior indebtedness to accelerate its maturity, and the trustee receives notice of such default, which is called

a "payment blockage notice" from the Company or any other person permitted to give such notice under the indenture, which

is called a "non-payment default".

|

The Company may resume payments and distributions

on subordinated debt securities:

|

|

·

|

in the case of a payment default, upon the date on which such default is cured or waived or ceases to exist; and

|

|

|

·

|

in the case of a non-payment default, the earlier of the date on which such nonpayment default is cured or waived or ceases

to exist and 179 days after the date on which the payment blockage notice is received by the trustee, if the maturity of the designated

senior indebtedness has not been accelerated.

|

No new period of payment blockage may be

commenced pursuant to a payment blockage notice unless 365 days have elapsed since the initial effectiveness of the immediately

prior payment blockage notice and all scheduled payments of principal, premium and interest, including any liquidated damages,

on the notes that have come due have been paid in full in cash. No non-payment default that existed or was continuing on the date

of delivery of any payment blockage notice shall be the basis for any later payment blockage notice unless the non-payment default

is based upon facts or events arising after the date of delivery of such payment blockage notice.

If the trustee or any holder of the notes

receives any payment or distribution of the Company's assets in contravention of the subordination provisions on subordinated debt

securities before all senior indebtedness is paid in full in cash, property or securities, including by way of set-off, or other

payment satisfactory to holders of senior indebtedness, then such payment or distribution will be held in trust for the benefit

of holders of senior indebtedness or their representatives to the extent necessary to make payment in full in cash or payment satisfactory

to the holders of senior indebtedness of all unpaid senior indebtedness.

In the event of the Company's bankruptcy,

dissolution or reorganization, holders of senior indebtedness may receive more, ratably, and holders of subordinated debt securities

may receive less, ratably, than the Company's other creditors (including the Company's trade creditors). This subordination will

not prevent the occurrence of any event of default under the indenture.

Unless the Company informs you otherwise

in the prospectus supplement, the Company will not be prohibited from incurring debt, including senior indebtedness, under any

indenture relating to subordinated debt securities. The Company may from time to time incur additional debt, including senior indebtedness.

The Company is obligated to pay reasonable

compensation to the trustee and to indemnify the trustee against certain losses, liabilities or expenses incurred by the trustee

in connection with its duties relating to subordinated debt securities. The trustee’s claims for these payments will generally

be senior to those of noteholders in respect of all funds collected or held by the trustee.

Certain Definitions

"indebtedness" means:

(1) all indebtedness, obligations and other liabilities

for borrowed money, including overdrafts, foreign exchange contracts, currency exchange agreements, interest rate protection agreements,

and any loans or advances from banks, or evidenced by bonds, debentures, notes or similar instruments, other than any account payable

or other accrued current liability or obligation incurred in the ordinary course of business in connection with the obtaining of

materials or services;

(2) all reimbursement obligations and other liabilities

with respect to letters of credit, bank guarantees or bankers’ acceptances;

(3) all obligations and liabilities in respect of

leases required in conformity with generally accepted accounting principles to be accounted for as capitalized lease obligations

on the Company's balance sheet;

(4) all obligations and liabilities, contingent or

otherwise, as lessee under leases for facility equipment (and related assets leased together with such equipment) and under any

lease or related document (including a purchase agreement, conditional sale or other title retention or synthetic lease agreement)

in connection with the lease of real property or improvement thereon (or any personal property included as part of any such lease)

which provides that such Person is contractually obligated to purchase or cause a third party to purchase the leased property or

pay an agreed upon residual value of the leased property, including the obligations under such lease or related document to purchase

or cause a third party to purchase such leased property (whether or not such lease transaction is characterized as an operating

lease or a capitalized lease in accordance with GAAP) or pay an agreed upon residual value of the leased property to the lessor;

(5) all obligations with respect to an interest rate

or other swap, cap or collar agreement or other similar instrument or agreement or foreign currency hedge, exchange, purchase agreement

or other similar instrument or agreement;

(6) all direct or indirect guaranties or similar agreements

in respect of, and the Company's obligations or liabilities to purchase, acquire or otherwise assure a creditor against loss in

respect of, indebtedness, obligations or liabilities of others of the type described in (1) through (5) above;

(7) any indebtedness or other obligations described

in (1) through (6) above secured by any mortgage, pledge, lien or other encumbrance existing on property which is owned or held

by the Company; and

(8) any and all refinancings, replacements, deferrals,

renewals, extensions and refundings of, or amendments, modifications or supplements to, any indebtedness, obligation or liability

of the kind described in clauses (1) through (7) above.

"senior indebtedness" means the

principal, premium, if any, interest, including any interest accruing after bankruptcy, and rent or termination payment on or other

amounts due on the Company's current or future indebtedness, whether created, incurred, assumed, guaranteed or in effect guaranteed

by the Company, including any deferrals, renewals, extensions, refundings, amendments, modifications or supplements to the above.

However, senior indebtedness does not include:

|

|

·

|

indebtedness that expressly provides that it shall not be senior in right of payment to subordinated debt securities or expressly

provides that it is on the same basis or junior to subordinated debt securities;

|

|

|

·

|

the Company's indebtedness to any of the Company's majority-owned subsidiaries; and

|

|

|

·

|

subordinated debt securities.

|

DESCRIPTION OF PREFERRED

STOCK

As of the date of this prospectus, the

Company has authorized 1,666,667 shares of preferred stock, par value $.0001 per share, none of which are outstanding. Under the

Company's Restated Certificate of Incorporation, the Company's Board of Directors is authorized to issue shares of the Company's

preferred stock from time to time, in one or more classes or series, without stockholder approval. Prior to the issuance of shares

of each series, the Board of Directors is required by the General Corporation Law of the State of Delaware to adopt resolutions

and file a Certificate of Designation with the Secretary of State of the State of Delaware, fixing for each such series the designations,

powers, preferences, rights, qualifications, limitations and restrictions of the shares of such series. Any exercise of the Company's

Board of Directors of its rights to do so may affect the rights and entitlements of the holders of the Company's common stock as

set forth below.

The Company's Board of Directors could

authorize the issuance of shares of preferred stock with terms and conditions which could have the effect of discouraging a takeover

or other transaction which holders of some, or a majority, of such shares might believe to be in their best interests or in which

holders of some, or a majority, of such shares might receive a premium for their shares over the then-market price of such shares.

General

Subject to limitations prescribed by the

General Corporation Law of the State of Delaware, the Company's Restated Certificate of Incorporation and the Company's Amended

and Restated Bylaws ("Bylaws"), the Company's Board of Directors is authorized to fix the number of shares constituting

each series of preferred stock and the designations, powers, preferences, rights, qualifications, limitations and restrictions

of the shares of such series, including such provisions as may be desired concerning voting, redemption, dividends, dissolution

or the distribution of assets, conversion or exchange, and such other subjects or matters as may be fixed by resolution of the

Board of Directors. Each series of preferred stock that the Company offers under this prospectus will, when issued, be fully paid

and nonassessable and will not have, or be subject to, any preemptive or similar rights.

The applicable prospectus supplement(s)

will describe the following terms of the series of preferred stock in respect of which this prospectus is being delivered:

|

|

·

|

the title and stated value of the preferred stock;

|

|

|

·

|

the number of shares of the preferred stock offered, the liquidation preference per share and the purchase price of the preferred

stock;

|

|

|

·

|

the dividend rate(s), period(s) and/or payment date(s) or the method(s) of calculation for dividends;

|

|

|

·

|

whether dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred

stock shall accumulate;

|

|

|

·

|

the procedures for any auction and remarketing, if any, for the preferred stock;

|

|

|

·

|

the provisions for a sinking fund, if any, for the preferred stock;

|

|

|

·

|

the provisions for redemption, if applicable, of the preferred stock;

|

|

|

·

|

any listing of the preferred stock on any securities exchange or market;

|

|

|

·

|

the terms and conditions, if applicable, upon which the preferred stock will be convertible into common stock or another series

of the Company's preferred stock, including the conversion price (or its manner of calculation) and conversion period;

|

|

|

·

|

the terms and conditions, if applicable, upon which preferred stock will be exchangeable into the Company's debt securities,

including the exchange price, or its manner of calculation, and exchange period;

|

|

|

·

|

voting rights, if any, of the preferred stock; a discussion of any material and/or special U.S. federal income tax considerations

applicable to the preferred stock;

|

|

|

·

|

whether interests in the preferred stock will be represented by depositary shares;

|

|

|

·

|

the relative ranking and preferences of the preferred stock as to dividend rights and rights upon liquidation, dissolution

or winding up of the Company's affairs;

|

|

|

·

|

any limitations on issuance of any series of preferred stock ranking senior to or on a parity with the preferred stock as to

dividend rights and rights upon liquidation, dissolution or winding up of the Company's affairs; and

|

|

|

·

|

any other specific terms, preferences, rights, limitations or restrictions on the preferred stock.

|

Unless otherwise specified in the prospectus

supplement, the preferred stock will, with respect to dividend rights and rights upon liquidation, dissolution or winding up of

the Company rank:

|

|

·

|

senior to all classes or series of the Company's common stock, and to all equity securities issued by the Company the terms

of which specifically provide that such equity securities rank junior to the preferred stock with respect to dividend rights or

rights upon the liquidation, dissolution or winding up of the Company;

|

|

|

·

|

on a parity with all equity securities issued by the Company that do not rank senior or junior to the preferred stock with

respect to dividend rights or rights upon the liquidation, dissolution or winding up of the Company; and

|

|

|

·

|

junior to all equity securities issued by the Company the terms of which do not specifically provide that such equity securities

rank on a parity with or junior to the preferred stock with respect to dividend rights or rights upon the liquidation, dissolution

or winding up of the Company (including any entity with which the Company may be merged or consolidated or to which all or substantially

all of the Company's assets may be transferred or which transfers all or substantially all of the Company's assets).

|

As used for these purposes, the term "equity

securities" does not include convertible debt securities.

Transfer Agent and Registrar

The transfer agent and registrar for any

series of preferred stock will be set forth in the applicable prospectus supplement.

DESCRIPTION OF COMMON

STOCK

This description of the Company's common

stock is a summary. You should keep in mind, however, that it is the Company's Restated Certificate of Incorporation and Bylaws,

and not this summary, which define any rights you may acquire as a stockholder. There may be other provisions in such documents

which are also important to you. You should read such documents for a full description of the terms of the Company's common stock,

along with the applicable provisions of Delaware law.

As of the date of this prospectus, the

Company has authorized 33.3 million shares of common stock, par value $0.0001 per share. As of May 7, 2014, there were 11,282,982

shares of common stock outstanding, which does not include:

|

|

·

|

approximately 555 thousand shares of the Company's common stock issuable upon the exercise of warrants outstanding as of May

7, 2014, at weighted average price of $71.46 per share (without giving effect to any of the anti dilution adjustment provisions

thereof);

|

|

|

·

|

approximately 165 thousand shares of the Company's common stock issuable upon the exercise of options outstanding as of May

7, 2014, at weighted average price of $47.16 per share (without giving effect to any of the anti dilution adjustment provisions

thereof);

|

|

|

·

|

approximately 79 thousand shares of common stock available for future grant under the Company's Third Amended and Restated

2008 Stock Incentive Plan, as amended and restated, as of June 1, 2012 (the "Current Plan"); and

|

|

|

·

|

approximately 894 thousand shares of common stock that will become available for future grant under the Company's Fourth Amended

and Restated 2008 Stock Incentive Plan upon the Company's stockholders' approval of the plan at the 2014 annual meeting of stockholders

to be held on May 22, 2014 (in addition to the approximately 79 thousand available under the Company's Current Plan). Such 894

thousand shares include approximately 325 thousand shares issuable upon exercise of options at a weighted average price of $6.39

per share and approximately 30 thousand restricted stock awards, each of which were approved by the Board of Directors of the Company

and are subject to stockholder approval at the Company's 2014 annual meeting of stockholders.

|

Subject to any preferential rights of any

preferred stock created by the Company's Board of Directors, as a holder of the Company's common stock you are entitled to such

dividends as the Company's Board of Directors may declare from time to time out of funds that the Company can legally use to pay

dividends. The holders of common stock possess exclusive voting rights, except to the extent the Company's Board of Directors specifies

voting power for any preferred stock that may be issued in the future.

As a holder of the Company's common