Current Report Filing (8-k)

April 01 2014 - 3:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 26, 2014

| |

|

JBI, Inc.

|

|

|

| |

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

|

000-52444

|

|

90-0822950

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

20 Iroquois Street

Niagara Falls, NY

|

|

14303

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (716) 278-0015

N/A

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 3 — Securities and Trading Markets

Item 3.02 Unregistered Sales of Equity Securities.

Between March 17, 2014 and March 26, 2014, JBI, Inc. (the “Company”) consummated a private placement with ten investors for the sale of 3.2 million shares of its common stock and warrants (the “Warrants”) to purchase up to an additional 3.2 million shares of its common stock pursuant to Subscription Agreements (the “Purchase Agreements”). The purchase price per share was $0.10 and the gross proceeds to the Company were $320,000. The Company plans to use the proceeds to fund working capital needs and for general corporate purposes. The Warrants are three-year warrants exercisable at any time during the three-year term and have an initial exercise price of $0.15 per share of common stock. The form of Purchase Agreement and Warrant are substantially the same as the form executed by the Company in connection with the private placement reported in the Company’s Form 8-K dated February 18, 2014, except for the increases in price per share and warrant exercise price.

On February 19, 2014, the Company issued to consultants a total of 1.5 million shares of common stock and warrants to purchase 2.5 million shares of common stock as certain compensation due for public relations and other consulting services to be provided to the Company.

The above-described sales or issuances were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Act”) and Regulation D promulgated thereunder on the basis that the sales or issuances did not involve a public offering and the recipients made certain representations to the Company, including without limitation, that the recipients of the securities were “accredited investors” as defined in Rule 501 under the Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

JBI, Inc.

|

| |

|

|

April 1, 2014

|

By:

|

/s/ Richard Heddle

|

| |

Name:

|

Richard Heddle

|

| |

Title:

|

Chief Executive Officer

|

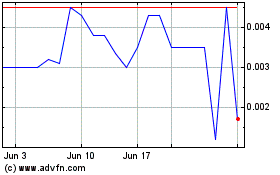

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

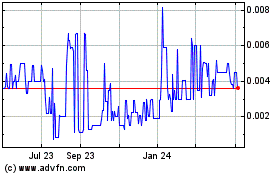

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Apr 2023 to Apr 2024