THE ADVISORS' INNER CIRCLE FUND

[GRAPHIC OMITTED]

WESTWOOD SHORT DURATION HIGH YIELD FUND

Summary Prospectus | March 1, 2014

Ticker: A Class Shares -- WSDAX

Before you invest, you may want to review the Fund's complete prospectus,

which contains more information about the Fund and its risks. You can find

the Fund's prospectus and other information about the Fund online at

http://www.westwoodfunds.com/literature/FundLiterature.aspx. You can also get

this information at no cost by calling 1-877-386-3944, by sending an e-mail

request to westwoodfunds@seic.com, or by asking any financial intermediary that

offers shares of the Fund. The Fund's prospectus and statement of additional

information, both dated March 1, 2014, are incorporated by reference into this

summary prospectus and may be obtained, free of charge, at the website, phone

number or e-mail address noted above.

FUND INVESTMENT OBJECTIVE

The investment objective of the Westwood Short Duration High Yield Fund (the

"Fund") is to generate a high level of current income while experiencing lower

volatility than the broader high yield market.

FUND FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy and hold

A Class Shares of the Fund. You may qualify for sales charge discounts if you

and your family invest, or agree to invest in the future, at least $100,000 in

the Fund. More information about these and other discounts is available from

your financial professional and in the section "Sales Charges" on page 69 of

the prospectus.

SHAREHOLDER FEES (FEES PAID DIRECTLY FROM YOUR INVESTMENT)

A CLASS SHARES

------------------------------------------------------------------------------------------

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of

offering price) 2.25%

------------------------------------------------------------------------------------------

Maximum Deferred Sales Charge (Load) (as a percentage of net asset value) None

------------------------------------------------------------------------------------------

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and

Other Distributions (as a percentage of offering price) None

------------------------------------------------------------------------------------------

Redemption Fee (as a percentage of amount redeemed, if applicable) None

------------------------------------------------------------------------------------------

|

ANNUAL FUND OPERATING EXPENSES (EXPENSES THAT YOU PAY EACH YEAR AS A PERCENTAGE

OF THE VALUE OF YOUR INVESTMENT)

A CLASS SHARES

Management Fees 0.75%

--------------------------------------------------------------------------------

Distribution (12b-1) Fees 0.25%

--------------------------------------------------------------------------------

Other Expenses 0.32%

-----

--------------------------------------------------------------------------------

Total Annual Fund Operating Expenses 1.32%

--------------------------------------------------------------------------------

Less Fee Reductions and/or Expense Reimbursements (0.17)%

-----

--------------------------------------------------------------------------------

Total Annual Fund Operating Expenses After Fee Reductions

and/or Expense Reimbursements(1) 1.15%

--------------------------------------------------------------------------------

|

(1) Westwood Management Corp. (the "Adviser") has contractually agreed to

reduce fees and reimburse expenses in order to keep Total Annual Fund

Operating Expenses After Fee Reductions and/or Expense Reimbursements for A

Class Shares (excluding interest, taxes, brokerage commissions, acquired

fund fees and expenses, and extraordinary expenses (collectively, "excluded

expenses")) from exceeding 1.15% of the Fund's A Class Shares' average

daily net assets until February 28, 2016. In addition, if at any point

Total Annual Fund Operating Expenses (not including excluded expenses) are

below the expense cap, the Adviser may receive from the Fund the difference

between the Total Annual Fund Operating Expenses (not including excluded

expenses) and the expense cap to recover all or a portion of its prior fee

reductions or expense reimbursements made during the preceding three-year

period during which this Agreement (or any prior agreement) was in place.

This Agreement may be terminated: (i) by the Board of Trustees of The

Advisors' Inner Circle Fund (the "Trust"), for any reason at any time; or

(ii) by the Adviser, upon ninety (90) days' prior written notice to the

Trust, effective as of the close of business on February 28, 2016.

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund

with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods

indicated and then redeem all of your shares at the end of those periods. The

Example also assumes that your investment has a 5% return each year and that

the Fund's operating expenses (including capped expenses for the period

described in the footnote to the fee table) remain the same.Although your

actual costs may be higher or lower, based on these assumptions your costs

would be:

1 YEAR 3 YEARS 5 YEARS 10 YEARS

$340 $600 $900 $1,750

2

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or "turns over" its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when Fund

shares are held in a taxable account. These costs, which are not reflected in

total annual fund operating expenses or in the example, affect the Fund's

performance. During its most recent fiscal year, the Fund's portfolio turnover

rate was 49% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

Under normal circumstances, the Fund invests at least 80% of its net assets,

plus any borrowings for investment purposes, in high yield securities. This

investment policy may be changed by the Fund upon 60 days' prior written notice

to shareholders. High yield securities, also referred to as "junk" bonds, are

securities rated BB+, Ba1 or below by independent rating agencies at the time

of purchase by the Fund, or securities that are unrated but judged to be of

comparable quality by SKY Harbor Capital Management, LLC (the "Sub-Adviser").

The Fund may invest in securities of any rating, including securities that are

in default.

In seeking to achieve the Fund's objective, the Sub-Adviser generally invests

in a portfolio of high yield securities of U.S. companies, as described in

further detail below. While the Sub-Adviser may purchase securities of any

maturity, under normal market conditions, the Sub-Adviser generally expects to

invest in high yield securities, including privately placed securities, that

have an expected redemption through maturity, call or other corporate action

within three years or less, although this may vary if, in the Sub-Adviser's

opinion, it is warranted by current market conditions. While there is no

maximum duration on individual securities, the average maximum "duration to

worst" of the Fund is expected to be under three years. "Duration to worst" is

the duration of a bond computed using the bond's nearest call date or maturity,

whichever comes first. The Sub-Adviser believes such a portfolio serves to

reduce volatility and preserve capital when compared to traditional high yield

portfolios. In the Sub-Adviser's view, traditional high yield portfolios

generally possess durations to worst of longer than three years. Portfolios

with longer durations to worst are generally more sensitive to interest rate

changes and other market risks. Accordingly, the Sub-Adviser seeks to achieve

less volatility and better preservation of capital for the Fund relative to

traditional high yield portfolios by maintaining a duration to worst for the

Fund that is significantly shorter than that of traditional high yield

portfolios. The Fund also invests in high yield securities of non-U.S.

companies, and the Sub-Adviser expects that the Fund's investments in non-U.S.

companies will normally represent less than 25% of the Fund's assets, and may

include investments in emerging markets.

3

In selecting securities for the Fund's portfolio, the Sub-Adviser seeks issuers

that exhibit attractive characteristics including, but not limited to: stable

businesses with projectable cash flows; positive year-over-year cash flow

comparisons supported by stable industry conditions; generation of cash in

excess of corporate and financial obligations; and management intentions for

use of cash flows favorable to bond holders. In making investment decisions,

the Sub-Adviser utilizes an investment process that is based on fundamental

analysis of issuers, markets, and general macro-economic conditions and

supported by quantitative valuation and risk monitoring tools. The goal of the

investment process is to identify high yield securities with attractively

priced income streams and to achieve superior long term returns from

investments. The Sub-Adviser employs an established selling discipline and may

generally sell a security for one of three non-exclusive reasons: (i) there is

a negative change in the Sub-Adviser's fundamental assessment of a security;

(ii) the security becomes overvalued relative to other opportunities; or (iii)

the Sub-Adviser is shifting the portfolio from one sector or risk segment to

another.

PRINCIPAL RISKS

As with all mutual funds, a shareholder is subject to the risk that his or her

investment could lose money. A Fund share is not a bank deposit and it is not

insured or guaranteed by the FDIC or any government agency. The principal risk

factors affecting shareholders' investments in the Fund are set forth below.

HIGH YIELD BOND RISK -- High yield, or "junk," bonds are highly speculative

securities that are usually issued by smaller, less creditworthy and/or highly

leveraged (indebted) companies. Compared with investment-grade bonds, high

yield bonds are considered to carry a greater degree of risk and are considered

to be less likely to make payments of interest and principal. In particular,

lower-quality high yield bonds (rated CCC, CC, C, or unrated securities judged

to be of comparable quality) are subject to a greater degree of credit risk

than higher-quality high yield bonds and may be near default. High yield bonds

rated D are in default. Market developments and the financial and business

conditions of the corporation issuing these securities generally influence

their price and liquidity more than changes in interest rates, when compared to

investment-grade debt securities.

LIQUIDITY RISK -- Insufficient liquidity in the non-investment grade bond

market may make it more difficult to dispose of non-investment grade bonds and

may cause the Fund to experience sudden and substantial price declines.

VALUATION RISK -- A lack of reliable, objective data or market quotations may

make it more difficult to value non-investment grade bonds accurately.

4

CREDIT RISK -- The credit rating or financial condition of an issuer may affect

the value of a fixed income debt security. Generally, the lower the credit

quality of a security, the greater the perceived risk that the issuer will fail

to pay interest fully and return principal in a timely manner. If an issuer

defaults or becomes unable to honor its financial obligations, the security may

lose some or all of its value. The issuer of an investment-grade security is

considered by the rating agency or the Sub-Adviser to be more likely to pay

interest and repay principal than an issuer of a lower quality bond. Adverse

economic conditions or changing circumstances may weaken the capacity of the

issuer to pay interest and repay principal.

INTEREST RATE RISK -- As with most funds that invest in fixed income

securities, changes in interest rates are a factor that could affect the value

of your investment. Rising interest rates tend to cause the prices of fixed

income securities (especially those with longer maturities) and the Fund's

share price to fall.

The concept of duration is useful in assessing the sensitivity of a fixed

income fund to interest rate movements, which are usually the main source of

risk for most fixed-income funds. Duration measures price volatility by

estimating the change in price of a debt security for a 1% change in its yield.

For example, a duration of five years means the price of a debt security will

change about 5% for every 1% change in its yield. Thus, the longer the

duration, the more volatile the security.

Fixed income debt securities have a stated maturity date when the issuer must

repay the principal amount of the bond. Some fixed income debt securities,

known as callable bonds, may repay the principal earlier than the stated

maturity date. Fixed income debt securities are most likely to be called when

interest rates are falling because the issuer can refinance at a lower rate.

PRIVATE PLACEMENTS RISK -- Investment in privately placed securities may be

less liquid than in publicly traded securities. Although these securities may

be resold in privately negotiated transactions, the prices realized from these

sales could be less than those originally paid by the Fund or less than what

may be considered the fair value of such securities. Further, companies whose

securities are not publicly traded may not be subject to the disclosure and

other investor protection requirements that might be applicable if their

securities were publicly traded.

FOREIGN SECURITIES RISK -- Investing in securities of foreign issuers poses

additional risks since political and economic events unique to a country or

region will affect foreign securities markets and their issuers. These risks

will not necessarily affect the U.S. economy or similar issuers located in the

United States. In addition, investments in securities of foreign issuers are

generally denominated in a foreign currency. As a result, changes in the value

of those currencies compared to the U.S. dollar may affect (positively or

negatively) the value of the Fund's investments. These currency movements may

occur separately from, and in response to, events

5

that do not otherwise affect the value of the security in the issuer's home

country. In an attempt to reduce currency risk associated with non-U.S.

denominated securities, the Fund intends to hedge its foreign currency exposure

by entering into forward currency contracts. A forward currency contract

involves an obligation to purchase or sell a specific amount of currency at a

future date or date range at a specific price, thereby fixing the exchange rate

for a specified time in the future. However, the Sub-Adviser has limited

ability to direct or control foreign exchange execution rates, and there is no

guarantee that such hedging strategies will be successful in reducing the

currency risk associated with investing in foreign securities. Foreign

companies may not be registered with the SEC and are generally not subject to

the regulatory controls imposed on U.S. issuers and, as a consequence, there is

generally less publicly available information about foreign securities than

is available about domestic securities. Income from foreign securities owned by

the Fund may be reduced by a withholding tax at the source, which tax would

reduce income received from the securities comprising the portfolio. The Fund's

investments in foreign securities are also subject to the risk that the

securities may be difficult to value and/or valued incorrectly.

The Fund may invest in securities of European issuers. The European financial

markets have recently experienced volatility and adverse trends due to concerns

about rising government debt levels of certain European countries, each of

which may require external assistance to meet its obligations and run the risk

of default on its debt, possible bail-out by the rest of the European Union

("EU") or debt restructuring. Assistance given to an EU member state may be

dependent on a country's implementation of reforms in order to curb the risk of

default on its debt, and a failure to implement these reforms or increase

revenues could result in a deep economic downturn. These events may adversely

affect the economic and market environment in Europe, which in turn may

adversely affect the price or liquidity of high yield securities issued by

European issuers and therefore may adversely affect the Fund and its

investments in such securities.

EMERGING MARKETS SECURITIES RISK -- Investments in emerging markets securities

are considered speculative and subject to heightened risks in addition to the

general risks of investing in foreign securities. Unlike more established

markets, emerging markets may have governments that are less stable, markets

that are less liquid and economies that are less developed. In addition, the

securities markets of emerging market countries may consist of companies with

smaller market capitalizations and may suffer periods of relative illiquidity;

significant price volatility; restrictions on foreign investment; and possible

restrictions on repatriation of investment income and capital. Furthermore,

foreign investors may be required to register the proceeds of sales, and future

economic or political crises could lead to price controls, forced mergers,

expropriation or confiscatory taxation, seizure, nationalization or creation of

government monopolies.

6

PERFORMANCE INFORMATION

The bar chart and the performance table below illustrate the risks and

volatility of an investment in the Fund by showing changes in the Fund's

performance from year to year and by showing how the Fund's average annual

returns for 1 year and since inception compare with those of a broad measure of

market performance. Of course, the Fund's past performance (before and after

taxes) does not necessarily indicate how the Fund will perform in the future.

Updated performance information is available on the Fund's website at

www.westwoodfunds.com or by calling 1-877-FUND-WHG (1-877-386-3944).

A Class Shares of the Fund commenced operations on June 28, 2013 and therefore

do not have performance history for a full calendar year. Consequently, the bar

chart shows the performance of the Fund's Institutional Class Shares and the

performance table compares the average annual total returns of the Fund's

Institutional Class Shares to those of a broad measure of market performance.

The Fund's Institutional Class Shares are offered in a separate prospectus. A

Class Shares of the Fund would have substantially similar performance as

Institutional Class Shares because the shares are invested in the same portfolio

of securities and the annual returns would differ only to the extent that the

expenses of A Class Shares are higher than the expenses of the Institutional

Class Shares and, therefore, returns for the A Class Shares would be lower than

those of the Institutional Class Shares. Institutional Class Shares performance

presented has been adjusted to reflect the Distribution (12b-1) fees and, for

the performance table, the Maximum Sales Charge (Load), applicable to A Class

Shares. Institutional Class Shares first became available on December 28, 2011.

[BAR CHART OMITTED - PLOT POINTS AS FOLLOWS]

6.08% 5.15%

--------------------

2012 2013

BEST QUARTER WORST QUARTER

2.53% (0.83)%

(09/30/2013) (06/30/2013)

|

7

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2013

After-tax returns are calculated using the historical highest individual

federal marginal income tax rates and do not reflect the impact of state and

local taxes. Your actual after-tax returns will depend on your tax situation

and may differ from those shown. After-tax returns shown are not relevant to

investors who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement accounts.

SINCE INCEPTION

WESTWOOD SHORT DURATION HIGH YIELD FUND 1 YEAR (12/28/11)

--------------------------------------------------------------------------------

Fund Returns Before Taxes 5.15% 5.59%

--------------------------------------------------------------------------------

Fund Returns After Taxes on Distributions 2.99% 3.63%

--------------------------------------------------------------------------------

Fund Returns After Taxes on Distributions and

Sale of Fund Shares 2.90% 3.48%

--------------------------------------------------------------------------------

BofA Merrill Lynch U.S. High Yield Index (reflects

no deduction for fees, expenses, or taxes) 7.42% 11.48%

--------------------------------------------------------------------------------

|

INVESTMENT ADVISER

Westwood Management Corp. ("Westwood") serves as investment adviser to the

Fund. SKY Harbor Capital Management, LLC serves as investment sub-adviser to

the Fund.

PORTFOLIO MANAGER

Anne Yobage, CFA, Lead Portfolio Manager and co-founder of SKY Harbor Capital

Management, LLC, has managed the Fund since its inception in 2011.

8

PURCHASE AND SALE OF FUND SHARES

To purchase shares of the Fund for the first time, including an initial

purchase through an individual retirement account ("IRA") or other tax

qualified account, you must invest at least $5,000. There is no minimum for

subsequent investments.

If you own your shares directly, you may redeem your shares on any day that the

New York Stock Exchange is open for business by contacting the Fund directly by

mail at Westwood Funds, P.O. Box 219009, Kansas City, MO 64121-9009 (Express

Mail Address: Westwood Funds, c/o DST Systems, Inc., 430 West 7th Street,

Kansas City, MO 64105) or telephone at 1-877-FUND-WHG (1-877-386-3944).

If you own your shares through an account with a broker or other institution,

contact that broker or institution to redeem your shares. Your broker or

institution may charge a fee for its services in addition to the fees charged

by the Fund.

TAX INFORMATION

The Fund intends to make distributions that may be taxed as ordinary income or

capital gains, unless you are investing through a tax-deferred arrangement,

such as a 401(k) plan or individual retirement account, in which case your

distribution will be taxed when withdrawn from the tax-deferred account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial

intermediary (such as a bank), the Fund and its related companies may pay the

intermediary for the sale of Fund shares and related services. These payments

may create a conflict of interest by influencing the broker-dealer or other

intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your financial intermediary's web

site for more information.

9

WHG-SM-015-0200

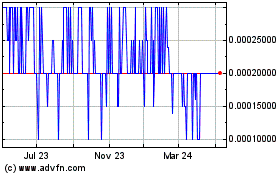

North Bay Resources (PK) (USOTC:NBRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

North Bay Resources (PK) (USOTC:NBRI)

Historical Stock Chart

From Apr 2023 to Apr 2024