It's All About Expectations - Ahead of Wall Street

March 07 2014 - 10:20AM

Zacks

Friday, March 7,

2014

Finally a better jobs report, despite all the weather-related

distortions. Not only the ‘headline’ tally comes ahead of

expectations, but the report’s internals are also pointing in the

right direction. We may not have sorted out the weather issue

entirely, but this is definitely welcome news.

A total of 175K non-farm jobs were created in the economy, ahead of

consensus estimates that had steadily been coming down following

Wednesday’s weak jobs tally from payroll processor ADP.

Importantly, the tallies for the prior two months were revised

higher by a total of 25K, with January going up to 129K (from 113K)

and December going up to 84K (from 75K). The private sector added

162K in February, up from 145K in January and 86K in December (the

263K private sector jobs created in February 2013 seem to be from a

different era altogether).

A material positive in the report concerns wage gains, which went

up +0.4% from January to $24.31 per hour. Average weekly hours

ticked down to 34.2 hours, likely a function of weather-related

distortions. The relatively fewer jobs created by the goods

producing sector (22K in February vs. 50K in January) are

also likely pointing in the weather direction. Of the industries

within the goods producing side of the economy, construction jobs

were down materially from the month before while manufacturing jobs

were essentially unchanged. The unemployment rate ticked up to 6.7%

from 6.6% the month before.

The overall ‘level’ of jobs created in February isn’t that much,

but what matters for the markets is the level of ‘surprise’ in the

report – and the ‘surprise factor’ in today’s report is positive.

It’s all relative to expectations and estimates had come down

materially in the run up to this report. Expectations for 2014 Q1

GDP estimates have also come down quite a bit in recent weeks,

increasing the odds of positive economic surprises down the road.

All in all, a favorable backdrop for stocks.

Sheraz Mian

Director of Research

AUTOMATIC DATA (ADP): Free Stock Analysis Report

SPDR-GOLD TRUST (GLD): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

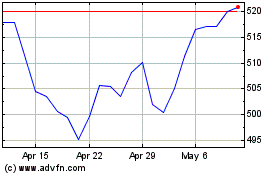

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2024 to May 2024

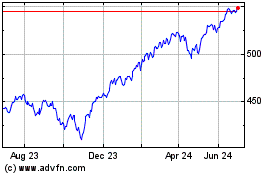

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From May 2023 to May 2024