Oppenheimer Rochester® AMT-Free Municipal Fund

Oppenheimer Rochester® AMT-Free New York Municipal Fund

Oppenheimer Rochester® Arizona Municipal Fund

Oppenheimer Rochester® California Municipal Fund

Oppenheimer Rochester® Intermediate Term Municipal Fund

Oppenheimer Rochester® Limited Term California Municipal

Fund

Oppenheimer Rochester® Limited Term Municipal Fund

Oppenheimer Rochester® Maryland Municipal Fund

Oppenheimer Rochester® Massachusetts Municipal Fund

Oppenheimer Rochester® Michigan Municipal Fund

Oppenheimer Rochester® New Jersey Municipal Fund

Oppenheimer Rochester® North Carolina Municipal Fund

Oppenheimer Rochester® Ohio Municipal Fund

Oppenheimer Rochester® Pennsylvania Municipal Fund

Oppenheimer Rochester® Short Term Municipal Fund

Oppenheimer Rochester® Virginia Municipal Fund

Supplement dated February 11, 2014 to the

Summary Prospectus

This supplement amends the Summary Prospectus of each of the above

referenced funds (each, a “Fund”) and is in addition to any other supplements to those Funds.

The second paragraph under the section titled “

Special

Risks of Investing in U.S. Territories, Commonwealths and Possessions

” in the summary prospectus is deleted in its entirety

and replaced with the following:

Certain of the municipalities in which the Fund invests,

including Puerto Rico, currently experience significant financial difficulties. As a result, securities issued by certain of these

municipalities are currently considered below-investment-grade securities. A credit rating downgrade relating to, default by, or

insolvency or bankruptcy of, one or several municipal security issuers of a state, territory, commonwealth or possession in which

the Fund invests could affect the market values and marketability of many or all municipal obligations of such state, territory,

commonwealth or possession.

|

February 11, 2014

|

PS0000.114

|

OPPENHEIMER ROCHESTER® SHORT TERM MUNICIPAL

FUND

Supplement dated December 10, 2013

to the Summary Prospectus dated November

29, 2013

This supplement amends the Oppenheimer Rochester

Short Term Municipal Fund (the “Fund”) summary prospectus (the “Summary Prospectus”) dated November 29,

2013, and is in addition to any other supplements.

Effective as of December 7, 2013, the Summary

Prospectus is revised as follows:

|

|

1.

|

The section titled “Risks of Non-Diversification” is deleted in its entirety.

|

|

December 10, 2013

|

PS0621.006

|

Oppenheimer Rochester® Intermediate

Term Municipal Fund

Oppenheimer Rochester® Short Term

Municipal Fund

Supplement dated December 6, 2013 to

the Summary Prospectus

This supplement amends the Summary Prospectus of each fund

referenced above (each, a “Fund”), and is in addition to any other supplement(s).

Effective February 3, 2014:

|

|

1.

|

The first paragraph in the section titled

“Purchase and Sale of Fund Shares”

is deleted in its entirety and replaced by the following:

|

Purchase and Sale of Fund Shares.

You can buy

most classes of Fund shares with a minimum initial investment of $1,000. Traditional and Roth IRA, Asset Builder Plan, Automatic

Exchange Plan and government allotment plan accounts may be opened with a minimum initial investment of $500. For wrap fee-based

programs, salary reduction plans and other retirement plans and accounts, there is no minimum initial investment. Once your account

is open, subsequent purchases may be made in any amount.

Effective July 1, 2014:

|

|

2.

|

All references to Class N are deleted and replaced with references to Class R, in connection

with the re-naming of Class N as Class R.

|

|

December 6, 2013

|

PS0000.104

|

|

|

OPPENHEIMER

Rochester® Short Term Municipal Fund

Summary Prospectus

November 29, 2013

|

|

NYSE Ticker Symbols

|

|

Class A

|

ORSTX

|

|

Class C

|

ORSCX

|

|

Class Y

|

ORSYX

|

|

|

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks.

You can find the Fund's prospectus, Statement of Additional Information, Annual Report and other information about the Fund

online at https://www.oppenheimerfunds.com/fund/RochesterShortTermMunicipalFund. You can also get this information at no cost by calling 1.800.225.5677 or by sending an email request to: info@oppenheimerfunds.com.

The Fund's prospectus and Statement of Additional Information ("SAI"), both dated November 29, 2013, and through page 80 of its most recent Annual Report, dated May 31, 2013, are incorporated by reference into this Summary Prospectus. You can access the Fund's

prospectus

and

SAI

at https://www.oppenheimerfunds.com/fund/RochesterShortTermMunicipalFund

. The Fund's prospectus is also available from financial intermediaries who are authorized to sell Fund shares.

|

|

Investment Objective.

The Fund seeks tax-free income.

Fees and Expenses of the Fund.

This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. You may qualify

for sales charge discounts if you (or you and your spouse) invest, or agree to invest in the future, at least $100,000 in

certain funds in the Oppenheimer family of funds. More information about these and other discounts is available from your

financial professional and in the section "About Your Account" beginning on page 13 of the prospectus and in the sections "How to Buy Shares" beginning on page 55 and "Appendix A" in the Fund's Statement of Additional Information.

|

Shareholder Fees

(fees paid directly from your investment)

|

|

|

|

|

Class A

|

Class C

|

Class Y

|

|

Maximum Sales Charge (Load) imposed on purchases (as % of offering price)

|

2.25%

|

None

|

None

|

|

Maximum Deferred Sales Charge (Load) (as % of the lower of the original offering price or redemption proceeds)

|

None

|

1%

|

None

|

|

Annual Fund Operating Expenses

1

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Class A

|

Class C

|

Class Y

|

|

Management Fees

|

0.47%

|

0.47%

|

0.47%

|

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

1.00%

|

None

|

|

Other Expenses

|

|

|

|

|

Interest and Fees from Borrowing

|

0.02%

|

0.02%

|

0.02%

|

|

Other Expenses

|

0.12%

|

0.12%

|

0.12%

|

|

Total Other Expenses

|

0.14%

|

0.14%

|

0.14%

|

|

Total Annual Fund Operating Expenses

|

0.86%

|

1.61%

|

0.61%

|

1. Expenses have been restated to reflect current fees.

Example.

The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other

mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated.

The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the

same. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows:

|

If shares are redeemed

|

If shares are not redeemed

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Class A

|

$

|

311

|

$

|

494

|

$

|

693

|

$

|

1,266

|

$

|

311

|

$

|

494

|

$

|

693

|

$

|

1,266

|

|

Class C

|

$

|

265

|

$

|

512

|

$

|

883

|

$

|

1,926

|

$

|

165

|

$

|

512

|

$

|

883

|

$

|

1,926

|

|

Class Y

|

$

|

63

|

$

|

196

|

$

|

341

|

$

|

764

|

$

|

63

|

$

|

196

|

$

|

341

|

$

|

764

|

Portfolio Turnover.

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio).

A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect

the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 16% of the average value of its portfolio.

Principal Investment Strategies.

Currently, under normal market conditions, the Fund invests at least 80% of its net assets, plus borrowings for investment

purposes, in securities that pay interest that is, in the opinion of bond counsel to the issuer at the time the security is

issued, exempt from federal individual income tax. Securities that generate income subject to the alternative minimum tax

("AMT") will count toward this 80% requirement, however, the Fund will not invest more than 5% of its net assets in securities

that produce income subject to the AMT.

The Fund invests primarily in municipal bonds, municipal notes and interests in municipal leases and commercial paper

issued by the governments of states, their political subdivisions (such as cities, towns and counties), the District of Columbia,

or by their agencies, instrumentalities and authorities. Those securities may be "general obligation" bonds that are secured

by the issuer's full faith and credit or "revenue obligations" that are payable only from a particular facility or other revenue

source. The Fund can borrow money to purchase additional securities, creating "leverage" of up to one third of its total assets.

As of January 25, 2014, under normal market conditions, and as a fundamental policy, the Fund invests at least 80% of

its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to

the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund's state income tax. The

Fund selects investments with regard to the AMT. The Fund will not invest more than 5% of its net assets in securities that

produce income subject to the AMT.

The Fund invests in municipal securities issued by the governments of states, their political subdivisions (such as

cities, towns, counties, agencies and authorities) and the District of Columbia, U.S. territories, commonwealths and possessions

or by their agencies, instrumentalities and authorities. These primarily include municipal bonds (long-term (more than one-year)

obligations), municipal notes (short-term obligations), interests in municipal leases, and tax-exempt commercial paper. Municipal

securities generally are classified as general or revenue obligations. General obligations are secured by the issuer's pledge

of its full faith, credit and taxing power for the payment of principal and interest. Revenue obligations are bonds whose

interest is payable only from the revenues derived from a particular facility or class of facilities, or a specific excise

tax or other revenue source. The Fund can borrow money to purchase additional securities, creating "leverage" of up to one

third of its total assets.

The Fund seeks to maintain a dollar-weighted average effective portfolio maturity of two years or less; however, it

can buy securities that have short, intermediate or long maturities. A substantial percentage of the securities the Fund buys

may be "callable," meaning that the issuer can redeem them before their maturity date. Because of events affecting the bond

markets and interest rate changes, the maturity of the portfolio might not meet that target for temporary periods.

The Fund will not invest more than 5% of its total assets in securities that are rated below investment grade (sometimes

referred to as "junk bonds") by a nationally recognized statistical rating organization, such as Standard & Poor's, or, if

unrated, assigned a comparable rating by the Sub-Adviser, OppenheimerFunds, Inc. The Fund also will not invest more than 15%

of its total assets in securities rated below the top three investment grade categories. For unrated securities, the Sub-Adviser

may internally assign ratings to those securities in investment-grade or below-investment-grade categories similar to those

of nationally recognized statistical rating organizations, after assessing their credit quality and other factors. There can

be no assurance, nor is it intended, that the Sub-Adviser's credit analysis process is consistent or comparable with the credit

analysis process used by a nationally recognized statistical rating organization. The Fund will not invest more than 5% of

its total assets in securities that are unrated by a nationally recognized statistical rating organization. However, this

limitation does not apply to an unrated security that the Sub-Adviser, in its discretion, determines to be comparable to another

security (i) that has substantially similar characteristics, (ii) that is comparable in priority and security (if applicable),

(iii) that is issued by the same issuer or guaranteed by the same guarantor, and (iv) that is rated by a nationally recognized

statistical rating organization.

In selecting investments for the Fund, the portfolio managers generally look for high current income; favorable credit

characteristics; a wide range of issuers including different municipalities, agencies, sectors and revenue sources; unrated

bonds or securities of smaller issuers that might be overlooked by other investors; and special situations that may offer

high current income or opportunities for value. The portfolio managers may consider selling a security if any of these factors

no longer applies, but are not required to do so.

Principal Risks.

The price of the Fund's shares can go up and down substantially. The value of the Fund's investments may change because of

broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund

to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment

objective. When you redeem your shares, they may be worth more or less than what you paid for them.

These risks mean that you can lose money by investing in the Fund.

Main Risks of Investing in Municipal Securities.

Municipal securities may be subject to interest rate risk, duration risk, credit risk, credit spread risk, extension risk, reinvestment

risk and prepayment risk. Interest rate risk is the risk that when prevailing interest rates fall, the values of already-issued

debt securities generally rise; and when prevailing interest rates rise, the values of already-issued debt securities generally

fall, and they may be worth less than the amount the Fund paid for them. When interest rates change, the values of longer-term

debt securities usually change more than the values of shorter-term debt securities. Risks associated with rising interest

rates are heightened given that interest rates in the U.S. are at, or near, historic lows. Duration risk is the risk that

longer-duration debt securities will be more volatile and more likely to decline in price in a rising interest rate environment

than shorter-duration debt securities. Credit risk is the risk that the issuer of a security might not make interest and

principal payments on the security as they become due. If an issuer fails to pay interest or repay principal, the Fund's income

or share value might be reduced. Adverse news about an issuer or a downgrade in an issuer's credit rating, for any reason,

can also reduce the market value of the issuer's securities. "Credit spread" is the difference in yield between securities

that is due to differences in their credit quality. There is a risk that credit spreads may increase when the market expects

lower-grade bonds to default more frequently. Widening credit spreads may quickly reduce the market values of the Fund's lower-rated

and unrated securities. Some unrated securities may not have an active trading market or may trade less actively than rated

securities, which means that the Fund might have difficulty selling them promptly at an acceptable price. Extension risk is

the risk that an increase in interest rates could cause principal payments on a debt security to be repaid at a slower rate

than expected. Extension risk is particularly prevalent for a callable security where an increase in interest rates could

result in the issuer of that security choosing not to redeem the security as anticipated on the security's call date. Such

a decision by the issuer could have the effect of lengthening the debt security's expected maturity, making it more vulnerable

to interest rate risk and reducing its market value. Reinvestment risk is the risk that when interest rates fall the Fund

may be required to reinvest the proceeds from a security's sale or redemption at a lower interest rate. Callable bonds are

generally subject to greater reinvestment risk than non-callable bonds. Prepayment risk is the risk that the issuer may redeem

the security prior to the expected maturity or that borrowers may repay the loans that underlie these securities more quickly

than expected, thereby causing the issuer of the security to repay the principal prior to the expected maturity. The Fund

may need to reinvest the proceeds at a lower interest rate, reducing its income.

Municipal Market Volatility and Illiquidity.

The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated securities.

Liquidity can be reduced unpredictably in response to overall economic conditions or credit tightening. During times of reduced

market liquidity, the Fund may not be able to readily sell bonds at the prices at which they are carried on the Fund's books.

If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could

further reduce the bonds' prices.

Municipal Sector Focus Risk.

The Fund will not concentrate its investments in issuers in any one industry. The Securities and Exchange Commission has

taken the position that investment of more than 25% of a fund's total assets in issuers in the same industry constitutes concentration

in that industy. Many types of municipal securities (such as general obligation, government appropriation, municipal leases,

special assessment and special tax bonds) are not considered a part of any "industry" for purposes of this policy. Therefore,

the Fund may invest more than 25% of its total assets in those types of municipal securities. Those municipal securities may

finance or pay interest from the revenues of projects that are subject to similar economic, business or political developments

that could increase their credit risk. Education, hospitals, healthcare and housing are some examples of sectors that may

include similar types of projects or revenue streams. Legislation that affects the financing of a particular municipal project,

or economic factors that have a negative impact on a project, would be likely to affect many other similar projects.

Special Risks of Investing in U.S. Territories, Commonwealths and Possessions.

The Fund also invests in obligations of the governments of the U.S. territories, commonwealths and possessions such as Puerto

Rico, the U.S. Virgin Islands, Guam, or the Northern Mariana Islands to the extent such obligations are exempt from regular

federal individual income taxes. Accordingly, the Fund may be adversely affected by local political, economic and social conditions

and developments within these U.S. territories, commonwealths and possessions affecting the issuers of such obligations.

Certain of the municipalities in which the Fund invests, including Puerto Rico, currently experience significant financial

difficulties. A credit rating downgrade relating to, default by, or insolvency or bankruptcy of, one or several municipal

security issuers of a state, territory, commonwealth or possession in which the Fund invests could affect the market values

and marketability of many or all municipal obligations of such state, territory, commonwealth or possession.

Main Risks of Shorter-Term Securities.

Normally, when interest rates change, the values of shorter-term debt securities change less than the values of securities

with longer maturities. The Fund tries to reduce the volatility of its share prices by seeking to maintain a shorter average

effective portfolio maturity. However, shorter-term securities may have lower yields than longer-term securities. Shorter-term

securities are also subject to extension and reinvestment risk. The Fund is subject to extension risk when principal payments

on a debt security occur at a slower rate than expected, potentially extending the average life of the security. For securities

with a call date in the near future, there is the risk that an increase in interest rates could result in the issuer of that

security choosing not to redeem the security as anticipated on the security's call date. Such a decision by the issuer may

effectively change a short- or intermediate-term security into a longer term security, which could have the effect of locking

in a below-market interest rate on the security, increasing the security's duration, making the security more vulnerable to

interest rate risk, reducing the security's market value and increasing the Fund's average effective portfolio maturity. Under

such circumstances, because the values of longer term securities generally fluctuate more widely in response to interest rate

changes than shorter term securities, the Fund's volatility could increase. Reinvestment risk is the risk that if interest

rates fall the Fund may need to invest the proceeds of redeemed securities in securities with lower interest rates.

Risks of Non-Diversification.

The Fund is classified as a "non-diversified" fund under the Investment Company Act of 1940. Accordingly, the Fund may invest

a greater portion of its assets in the securities of a single issuer than if it were a "diversified" fund. To the extent that

the Fund invests a higher percentage of its assets in the securities of a single issuer, the Fund is more subject to the risks

associated with and developments affecting that issuer than a fund that invests more widely.

Main Risks of Borrowing and Leverage.

The Fund can borrow up to one-third of the value of its assets (including the amount borrowed), as permitted under the Investment

Company Act of 1940. It can use those borrowings for a number of purposes, including purchasing securities, which creates

"leverage." In that case, changes in the value of the Fund's investments will have a larger effect on its share price than

if it did not borrow. Borrowing results in interest payments to the lenders and related expenses. Borrowing for investment

purposes might reduce the Fund's return if the yield on the securities purchased is less than those borrowing costs. The Fund

may also borrow to meet redemption obligations or for temporary and emergency purposes. The Fund participates in a line of

credit with other Oppenheimer funds for its borrowing.

The Fund can participate in a committed reverse repurchase agreement program. Reverse repurchase agreements that the Fund

may engage in also create leverage. A reverse repurchase agreement is the sale by the Fund of a debt obligation to a party

for a specified price, with the simultaneous agreement by the Fund to repurchase that debt obligation from that party on a

future date at a higher price. Similar to a borrowing, reverse repurchase agreements provide the Fund with cash for investment

and operational purposes. When the Fund engages in reverse repurchase agreements, changes in the value of the Fund's investments

will have a larger effect on its share price than if it did not engage in these transactions due to the effect of leverage.

Reverse repurchase agreements create fund expenses and require that the Fund have sufficient cash available to repurchase

the debt obligation when required. Reverse repurchase agreements also involve the risk that the market value of the debt obligation

that is the subject of the reverse repurchase agreement could decline significantly below the price at which the Fund is obligated

to repurchase the security.

Who Is the Fund Designed For?

The Fund is designed for investors seeking tax-free income. Because it invests in tax-exempt securities, the Fund is not

appropriate for a retirement plan or other tax-exempt or tax-deferred account. The Fund is not a complete investment program.

You should carefully consider your own investment goals and risk tolerance before investing in the Fund.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation

or any other government agency.

The Fund's Past Performance.

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's

performance (for Class A Shares) from calendar year to calendar year and by showing how the Fund's average annual returns for the periods of time shown in

the table compare with those of a broad measure of market performance. The Fund's past investment performance (before and

after taxes) is not necessarily an indication of how the Fund will perform in the future. More recent performance information

is available by calling the toll-free number on the back of this prospectus and on the Fund's website:

https://www.oppenheimerfunds.com/fund/RochesterShortTermMunicipalFund

Sales charges and taxes are not included and the returns would be lower if they were. During the period shown, the highest

return for a calendar quarter was 1.56% (2nd Qtr 2011) and the lowest return was 0.46% (4th Qtr 2012). For the period from January 1, 2013 to June 30, 2013 the cumulative return before sales charges and taxes was 0.10%.

The following table shows the average annual total returns for each class of the Fund's shares. After-tax returns are calculated

using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Your

actual after-tax returns, depending on your individual tax situation, may differ from those shown and after-tax returns shown

are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual

retirement accounts. After-tax returns are shown for only one class and after-tax returns for other classes will vary.

|

Average Annual Total Returns

for the periods ended December 31, 2012

|

|

|

1 Year

|

5 Years

(or life of class, if less)

|

|

Class A (inception12/6/10)

|

|

|

|

|

|

Return Before Taxes

|

1.31%

|

|

2.50%

|

|

|

Return After Taxes on Distributions

|

1.31%

|

|

2.50%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

1.52%

|

|

2.40%

|

|

|

Class C (inception 12/6/10)

|

1.86%

|

|

2.86%

|

|

|

Class Y (inception 12/6/10)

|

3.93%

|

|

3.86%

|

|

|

Barclays 1-Year Municipal Bond Index

|

0.84%

|

|

1.16%

2

|

|

|

(reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

|

Barclays Municipal Bond Index

1

|

6.78%

|

|

7.35%

2

|

|

|

(reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

|

Consumer Price Index

|

1.74%

|

|

2.34%

2

|

|

|

(reflects no deduction for fees, expenses or taxes)

|

|

|

|

|

-

The Fund has changed its primary benchmark from the Barclays Municipal Bond Index to the Barclays 1-Year Municipal Bond Index,

which it believes is a more appropriate measure of the Fund's performance. The Fund will not show performance for the Barclays

Municipal Bond Index in its next annual update.

-

As of 11/30/10.

Investment Adviser.

OFI Global Asset Management, Inc. (the "Manager") is the Fund's investment adviser. OppenheimerFunds, Inc. (the "Sub-Adviser")

is its sub-adviser.

Portfolio Managers.

Daniel G. Loughran, CFA, Scott S. Cottier, CFA, Troy E. Willis, CFA, Mark R. DeMitry, CFA, Michael L. Camarella, CFA, and

Charles S. Pulire, CFA, are Vice Presidents of the Fund and each has been a portfolio manager of the Fund since its inception.

Elizabeth S. Mossow, CFA, has been an associate portfolio manager of the Fund since July 2013.

Purchase and Sale of Fund Shares.

In most cases, you can buy Fund shares with a minimum initial investment of $1,000 and make additional investments with as

little as $50. For certain investment plans and retirement accounts, the minimum initial investment is $500 and, for some,

the minimum additional investment is $25. For certain fee based programs the minimum initial investment is $250.

Shares may be purchased through a financial intermediary or the Distributor and redeemed through a financial intermediary

or the Transfer Agent on days the New York Stock Exchange is open for trading. Shareholders may purchase or redeem shares

by mail, through the website at www.oppenheimerfunds.com or by calling 1.800.225.5677. Share transactions may be paid by check,

by Federal Funds wire or directly from or into your bank account.

Taxes.

Dividends paid from net investment income on tax-exempt municipal securities will be excludable from gross income for federal

individual income tax purposes. Dividends that are derived from interest paid on certain "private activity bonds" may be an

item of tax preference if you are subject to the federal alternative minimum tax. Certain distributions may be taxable as

ordinary income or as capital gains. The tax treatment of dividends is the same whether they are taken in cash or reinvested.

Payments to Broker-Dealers and Other Financial Intermediaries.

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund, the Sub-Adviser,

or their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create

a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over

another investment. Ask your salesperson or visit your financial intermediary's website for more information.

For More Information About Oppenheimer Rochester Short Term Municipal Fund

You can access the Fund's

prospectus

and

SAI

at https://www.oppenheimerfunds.com/fund/RochesterShortTermMunicipalFund. You can also request additional information about the Fund or your account:

|

By Telephone:

|

Call OppenheimerFunds Services toll-free:

1.800.CALL OPP (225.5677)

|

|

By Mail:

|

For requests by mail:

OppenheimerFunds Services

P.O. Box 5270

Denver, Colorado 80217-5270

|

For courier or express mail requests:

OppenheimerFunds Services

12100 East Iliff Avenue, Suite 300

Aurora, Colorado 80014

|

|

On the Internet:

|

You can read or download information on the OppenheimerFunds website at:

www.oppenheimerfunds.com

|

|

The Fund's shares are distributed by OppenheimerFunds Distributor, Inc.

|

|

PR0621.001.1113

|

|

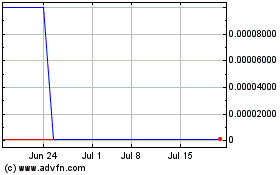

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Apr 2023 to Apr 2024