SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or

15(d) of the Securities Act of 1934

Date of Report (Date of earliest event reported):

October 29, 2013

GREENFIELD FARMS FOOD, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-157281

|

|

26-2909561

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification Number)

|

319 Clematis Street, Suite 400

West Palm Beach, Florida 33401

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (561) 514-9042

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Effective October 29, 2013, Greenfield Farms Food, Inc., (the “Company”) entered into an Asset Purchase Agreement (the “Agreement”) by and among COHP, LLC, an Ohio limited liability corporation (“COHP”); and Carmela’s Pizzeria CO, Inc., a Colorado corporation (“Carmela’s CO”), and its parent Greenfield Farms Food, Inc., a Nevada corporation (“Greenfield”) pursuant to which the Company acquired certain of the assets and liabilities of COHP including the operations of Carmela’s Pizzeria in exchange for 1,000 shares of the Company’s Series C Convertible Preferred Stock (“Series C”) and warrants. Carmela's Pizzeria presently has three Dayton, Ohio area locations offering authentic New York style pizza with a fourth slated to open in November. Carmela's offers a full service menu for Dine In, Carry out and Delivery as well as pizza buffets in select stores. Carmela’s has been noted in Dayton Daily News as one of “The Best Pizzerias” in Dayton.

The Series C shares are convertible, on a pro-rata basis, into that number of fully paid and non-assessable shares of Corporation’s common stock on terms that would equal 67% of the total issued and outstanding shares of the Corporation's common stock on a fully-diluted basis (the “Conversion Shares”) immediately upon approval by the Corporation’s stockholders and effectiveness of an increase in the number of authorized shares of Common Stock sufficient to issue the Conversion Shares. The Series C Preferred Stock may be converted by the holders at any time following the approval by the Corporation’s stockholders and effectiveness of an increase in the number of authorized shares of Common Stock sufficient to issue the Conversion Shares.

On October 31, 2013, upon approval from FINRA, the Company effected a 1 for 100 reverse split of its common stock whereby the 949,839,719 pre-split shares of common stock outstanding became 9,498,402 shares post-split. There was no change in authorized shares of the Company, which equal 950,000,000 shares of authorized common stock and 50,000,000 shares of authorized preferred stock. The reverse split triggered the effectiveness of an increase in authorized shares necessary for the 1,000 shares of Series C issued in the transaction to become convertible into the Conversion Shares. Accordingly, the Series C shares are now convertible into 53,965,942 shares of the Company’s common stock at any time at the option of the holder.

In addition, COHP and its assigns received warrants to purchase a total of 53,965,942 shares of the Company’s common stock for a period of five years in the amounts and exercise prices as follows: 17,988,648 at $0.015; 17,988,647 at $0.02; and 17,988,647 at $0.025.

Item 3.02 Unregistered Sales of Equity Securities.

Disclosure regarding an Asset Purchase Agreement through which the Company issued equity securities, is hereby incorporated by reference into this Item 3.02 from disclosure presented in Items1.01 Entry into a Material Definitive Agreement and Item 2.01 Completion of Acquisition or Disposition of Assets above.

Pursuant to the Agreement, the Company issued 1,000 shares of Series C stock that is convertible into 53,965,942 shares of common stock valued at $539,569 on October 31, 2013, or $0.01 per share based on the closing price of the Company’s common stock on that date.

Item 5.01 Changes in Control of Registrant.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Disclosure regarding an Asset Purchase Agreement resulting from which there was a change in control of the Company, is hereby incorporated by reference into this Item 5.01 from disclosure presented in Items 1.01 Entry into a Material Definitive Agreement and Item 2.01 Completion of Acquisition or Disposition of Assets above.

Concurrent with closing of the Agreement and effective on October 29, 2013, Mr. Henry Fong resigned as Chief Executive Officer of the Company and Mr. Ronald Heineman was appointed to serve as a Director and Chief Executive Officer of the Corporation. Mr. Fong was then appointed to serve as Chief Financial Officer and Secretary of the Corporation. Mr. Heineman was also appointed sole Director and Chief Executive Officer of Carmela’s CO concurrent with the resignation of Mr. Fong from those positions.

Mr. Heineman received 388 Series C shares that are convertible into 24,883,823 shares of common stock along with warrants to purchase 25,633,821 shares of common stock.In addition, Mr. Darren Dulsky, a member of COHP, also received 388 Series C shares that are convertible into 24,883,823 shares of common stock along with warrants to purchase 25,633,821shares of common stock. The shares of common stock issuable to Messrs. Heineman and Dulsky upon the full conversion of the Series C stock and warrants would represent 91% of the outstanding common stock of the Company in the event all shares of common stock underlying the Series C and warrants are issued. The ownership of these securities along with the appointment of Mr. Heineman to the board and as Chief Executive Officer of the Company represents a change in control.

Ronald Heineman, Chairman and CEO of Carmela's is also Managing Director of Diversified Capital, a Venture Capital fund. He has investments in several Service sector companies including Restaurants concepts Wendy's Restaurants, Frisch's Big Boy restaurants and Carmela's Pizzeria's Restaurants. Mr. Heineman is experienced as a CEO, CRO and board member of public companies. In addition he is experienced in M&A and capital markets. Prior to his current Venture initiatives, Mr. Heineman, was employed for 23 years as Vice President of HR & Training with Frisch's Restaurants Inc, a public AMEX company operating Big Boy, Golden Coral, hotels and specialty restaurants including company owned and franchise restaurants in the Midwest. Mr. Heineman has earned bachelors and masters degrees and is an adjunct professor teaching Entrepreneurship and Entrepreneurial Finance at Cedarville University.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Disclosure regarding a reverse split of the Company’s common stock, is hereby incorporated by reference into this Item 5.03 from disclosure presented in Items 1.01 Entry into a Material Definitive Agreement and Item 2.01 Completion of Acquisition or Disposition of Assets above.

|

Item 9.0

|

Financial Statements and Exhibits.

|

| (a) |

Not applicable. |

| (b) |

Not applicable. |

| (c) |

Not applicable. |

| (d) |

Exhibits |

|

Exhibit

|

|

Description

|

|

4.1

|

|

Certificate of Designation of Series C Convertible Preferred Stock. Filed herewith.

|

|

10.1

|

|

Asset Purchase Agreement (the “Agreement”) by and among COHP, LLC, an Ohio limited liability corporation (“COHP”); and Carmela’s Pizzeria CO, Inc., a Colorado corporation (“Carmela’s CO”), and its parent Greenfield Farms Food, Inc., a Nevada corporation (“Greenfield”) dated October 29, 2013 (filed herewith)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GREENFIELD FARMS FOOD, INC. |

|

| |

|

|

|

|

Date: November 4, 2013

|

By:

|

/s/ Henry Fong |

|

| |

|

Henry Fong, Chief Financial Officer & Secretary |

|

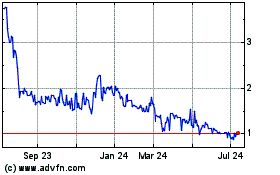

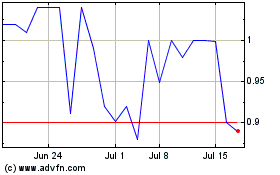

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024