Bergio International Announces Second Quarter Results

August 19 2013 - 5:38PM

Marketwired

Bergio International, Inc. (OTCQB: BRGO) ("Bergio" or the

"Company") announced today its results for the six months ended

June 30, 2013.

For the first six-month period, which ended on June 30, 2013,

the Company reported revenues of $695,256 as compared to $780,500

for the same period in the prior year. This decline is due to

slowdowns in sales in the U.S. and Russian markets as well as lower

gold prices. During this time, we have invested in marketing in

order to penetrate the market with the expectation of increased

revenues in the future. Additional unexpected legal fees to address

the chill from the Depository Trust & Clearing Corporation

caused the Company to report operating loss for the first six

months ending on June 30, 2013 of $269,378 as compared to operating

income of $16,616 for the same period in the prior year.

Due to the increase in stock price the Company incurred a large

derivative liability, which created a non-cash derivative liability

on its balance sheet of $1,487,796. This caused the company to show

a stockholder equity of $548,082 compared to $1,506,796 as of

December 31, 2012. If the non-cash derivative liability is reversed

the stockholder equity should be $2,035,878, which is an increase

by 26% since the beginning of 2013. Looking at the balance sheet

our inventory has improved by 11%, and after the derivative

liability is reversed our asset to liability ratio is 3:1.

Berge Abajian, CEO of Bergio, stated, "We had flat revenue for

the first six months of 2013, but we are hopeful that investments

made in marketing as well as existing negotiations could improve

the revenue numbers for the second half of the year."

He spoke, "I would like to report that we are working on several

potential avenues of expansion including: continued negotiations

with a large jewelry wholesaler, as previous reported; sustained

sales of Bergio products in conjunction with Sterling proven by

their last sales report; the introduction of the Bergio Amazon

web-store which we anticipate will launch within the next two

weeks; and the planned addition of ten new stores in Moscow, Russia

carrying Bergio products. These expansion opportunities are in

development, but these processes have taken longer than originally

anticipated."

He added, "We will be on the air with ShopHQ once again on

October 17, 2013 although this date is still tentative. A press

release will be sent out once we have received a final confirmation

of airing time and date. We expect positive publicity and revenue

from this based on the results of our first appearance with ShopHQ,

which garnered net sales of $42,978.91 during a 45-minute time

span."

He continued, "I would like to announce that we are advancing

negotiations involving several different leasing agents in order to

locate a store on Madison Ave in New York, NY to open the very

first exclusive Bergio boutique, furthering brand exposure in the

American and International consumer markets. Thank you again to all

of our shareholders for your support and patience."

We will endeavor to continue to update our shareholders as the

Company progresses with execution of the Company's business

plan.

We encourage everyone to read our full results of operations

contained in our Quarterly Report on Form 10-Q filed on August 19,

2013 with the United States Securities and Exchange Commission and

accessible at www.sec.gov.

About Bergio International, Inc.

Bergio International, Inc. is a leading jeweler creating a

diversified jewelry designer and manufacturer through acquisitions

and consolidation in the estimated $160 billion a year highly

fragmented independently owned jewelry industry. Bergio currently

sells its jewelry to approximately 50 jewelry retailers across the

United States. Bergio has manufacturing control over its line

through its manufacturing facility in New Jersey, as well as

subcontracts with facilities in the United States and Italy.

The information contained herein includes forward-looking

statements. These statements relate to future events or to our

future financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking

statements. You should not place undue reliance on forward-looking

statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

our control and which could, and likely will, materially affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects our current views with

respect to future events and is subject to these and other risks,

uncertainties and assumptions relating to our operations, results

of operations, growth strategy and liquidity. We assume no

obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results

could differ materially from those anticipated in these

forward-looking statements, even if new information becomes

available in the future.

Contact: Bergio International, Inc. Investor Relations

973-227-3230 Ext13 www.bergio.com

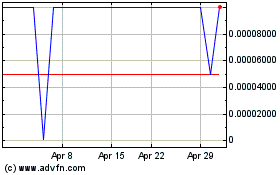

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

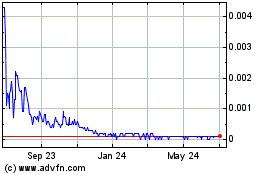

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Apr 2023 to Apr 2024