UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

INFORMATION REQUIRED IN A PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the

Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

[ ] Definitive Proxy Statement

[

] Definitive Additional Materials

[ ] Soliciting Material

Pursuant to Rule 14a-11(c) or Rule 14a-12

WOLVERINE EXPLORATION INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Paymentof Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act

Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction

applies: N/A

(2) Aggregate number of securities to which transaction

applies: N/A

(3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): N/A

(4) Proposed maximum aggregate value of transaction: N/A

(5) Total fee paid: N/A

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee if offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: N/A

(2) Form, Schedule or Registration Statement No.: N/A

(3) Filing Party: N/A

(4) Date Filed: N/A

WOLVERINE EXPLORATION INC.

4055 McLean Road

Quesnel, British Columbia

V2J 6V5

NOTICE OF ANNUAL AND SPECIAL MEETING OF

STOCKHOLDERS

TO BE HELD ON SEPTEMBER 13, 2013 at 2:00 p.m. (Pacific

Time)

NOTICE IS HEREBY GIVEN

that Wolverine Exploration Inc.,

a Nevada corporation, will hold an annual and special meeting of stockholders on

Friday, September 13, 2013 at 2:00 p.m. (local time) at 400 - 570 Granville

Street, Vancouver, British Columbia V6C 3P1 (the "

Meeting

"). The Meeting

is being held for the following purposes:

|

1.

|

to elect Lee Costerd and Luke Rich to serve as directors

of our company;

|

|

|

|

|

2.

|

to ratify the appointment of Saturna Group Chartered

Accountants LLP as our independent public accounting firm for the year

ending May 31, 2014;

|

|

|

|

|

3.

|

to conduct an advisory vote on the compensation of our company's Named Executive Officers (the "Say-on-Pay Proposal);

|

|

|

|

|

4.

|

to conduct an advisory vote on the frequency of future advisory votes on the compensation of our company's Named Executive Officers (the "Say-When-on-Pay Proposal");

|

|

|

|

|

5.

|

to approve an amendment to our Articles of Incorporation

to increase the authorized number of shares of our common stock from

200,000,000 shares of common stock, par value $0.001 to 500,000,000 shares

of common stock, par value of $0.001 per share (the "

Amendment

");

and

|

|

|

|

|

5.

|

to transact such other business as may properly come

before the Meeting or any adjournment or postponement

thereof.

|

Our board of directors recommends that you vote "for" each

of the nominees and vote "for" each proposal.

Our board has fixed the close of business on July 22, 2013 as

the record date for determining the stockholders entitled to notice of, and to

vote at, the Meeting or any adjournment or postponement of the Meeting. At the

Meeting, each holder of record of shares of common stock, $0.001 par value per

share, will be entitled to one vote per share of common stock held on each

matter properly brought before the Meeting.

THE VOTE OF EACH STOCKHOLDER IS IMPORTANT. YOU CAN VOTE YOUR

SHARES BY ATTENDING THE MEETING OR BY COMPLETING AND RETURNING THE PROXY CARD

SENT TO YOU. PLEASE SUBMIT A PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN

BE VOTED AT THE MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS. FOR SPECIFIC

INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS ON THE PROXY CARD OR

THE INFORMATION FORWARDED BY YOUR BROKER, BANK OR OTHER HOLDER OF RECORD. EVEN

IF YOU HAVE VOTED YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE

MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A

BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE IN PERSON AT THE MEETING, YOU

MUST OBTAIN FROM SUCH BROKER, BANK OR OTHER NOMINEE, A PROXY ISSUED IN YOUR

NAME.

Dated: July 17, 2013.

By Order of the Board of Directors,

/s/ Lee Costerd

Lee Costerd

President and Director

|

|

|

IMPORTANT:

Please complete, date, sign and

promptly return the enclosed proxy card in the prepaid envelope (if

mailing within the United States) to ensure that your shares will be

represented. If you attend the meeting, you may choose to vote in person

even if you have previously sent in your proxy card.

|

Important Notice Regarding the Availability of Proxy

Materials for the Stockholders Meeting to Be Held on September 13, 2013—the

proxy statement and the annual report are available at

http://www.wolverineexplorationinc.com/index.cfm?page=investors.

WOLVERINE EXPLORATION INC.

4055 McLean Road

Quesnel, British Columbia V2J

6V5

Proxy Statement for the Annual and Special Meeting of

Stockholders

The enclosed proxy is solicited on behalf of our Board of

Directors (the "

Board

") for use at the Annual and Special Meeting of

Stockholders (the "

Meeting

") to be held on September 13, 2013 at 2:00

p.m. (local time) at 400 - 570 Granville Street, Vancouver, British Columbia, or

at any continuation, postponement or adjournment thereof, for the purposes

discussed in this proxy statement and in the accompanying Notice of Annual and

Special Meeting and any business properly brought before the Meeting. Proxies

are solicited to give all stockholders of record an opportunity to vote on

matters properly presented at the Meeting. We intend to mail this proxy

statement and accompanying proxy card on or about July 31, 2013 to all

stockholders entitled to vote at the Meeting.

Unless the context requires otherwise, references to "we", "us"

"our" and "Wolverine" refer to Wolverine Exploration Inc.

Who Can Vote

You are entitled to vote if you were a holder of record of

shares of our common stock, $0.001 par value per share (the "

Common

Stock

") as of the close of business on July 22, 2013 (the "

Record

Date

"). Your shares can be voted at the Meeting only if you are present in

person or represented by a valid proxy.

Shares Outstanding and Quorum

Holders of record of Common Stock at the close of business on

the Record Date will be entitled to receive notice of and vote at the Meeting.

At the Meeting, each of the shares of Common Stock represented will be entitled

to one (1) vote on each matter properly brought before the Meeting. As of July

22, 2013, the record date, there were 186,583,333 shares of Common Stock issued

and outstanding.

In order to carry on the business of the Meeting, we must have

a quorum. Under our bylaws, a quorum is five percent (5%) of the issued and

outstanding entitled to vote, represented in person or by proxy.

Proxy Card and Revocation of Proxy

In voting, please specify your choices by marking the appropriate spaces on the enclosed proxy card, signing and dating the proxy card and returning it in the accompanying envelope. If no directions are given and the signed proxy is returned, the proxy holders will vote the shares in favor of Proposals 1 through 5 and, at their discretion, on any other matters that may properly come before the Meeting. The Board knows of no other business that will be presented for consideration at the Meeting. In addition, since no stockholder proposals or nominations were received by us on a timely basis, no such matters may be brought at the Meeting.

Any stockholder giving a proxy has the power to revoke the

proxy at any time before the proxy is voted. In addition to revocation in any

other manner permitted by law, a proxy may be revoked by an instrument in

writing executed by the stockholder or by his attorney authorized in writing,

or, if the stockholder is a corporation, under its corporate seal or by an

officer or attorney thereof duly authorized, and deposited at the offices of our

transfer agent, Empire Stock Transfer, 1859 Whitney Mesa Dr., Henderson, NV

89014, at any time up to and including the last business day preceding the day

of the Meeting, or any adjournment thereof, or with the chairman of the Meeting

on the day of the Meeting. Attendance at the Meeting will not in and of itself

constitute revocation of a proxy.

Voting of Shares

Stockholders of record on July 22, 2013 record date are

entitled to one (1) vote for each share of Common Stock held on all matters to

be voted upon at the Meeting. You may vote in person or by completing and

mailing the enclosed proxy card. All shares entitled to vote and

represented by properly executed proxies received before the polls are closed at

the Meeting, and not revoked or superseded, will be voted at the Meeting in

accordance with the instructions indicated on those proxies.

- 2 -

YOUR VOTE IS IMPORTANT

.

Counting of Votes

All votes will be

tabulated by the inspector of election

appointed for the Meeting, who will separately tabulate affirmative and negative

votes and abstentions. Shares represented by proxies that reflect abstentions as

to a particular proposal will be counted as present and entitled to vote for

purposes of determining a quorum. An abstention is counted as a vote against

that proposal. Shares represented by proxies that reflect a broker "non-vote"

will be counted as present and entitled to vote for purposes of determining a

quorum. A broker "non-vote" will be treated as not-voted for purposes of

determining approval of a proposal and will not be counted as "for" or "against"

that proposal. A broker "non-vote" occurs when a nominee holding shares for a

beneficial owner does not vote on a particular proposal because the nominee does

not have discretionary authority or does not have instructions from the

beneficial owner.

Solicitation of Proxies

We will bear the entire cost of solicitation of proxies,

including preparation, assembly and mailing of this proxy statement, the proxy

and any additional information furnished to stockholders. Copies of solicitation

materials will be furnished to banks, brokerage houses, depositories,

fiduciaries and custodians holding shares of Common Stock in their names that

are beneficially owned by others to forward to these beneficial owners. We may

reimburse persons representing beneficial owners for their costs of forwarding

the solicitation material to the beneficial owners of the Common Stock. Original

solicitation of proxies by mail may be supplemented by telephone, facsimile,

electronic mail or personal solicitation by our directors, officers or other

regular employees. No additional compensation will be paid to directors,

officers or other regular employees for such services. To date, we have not

incurred costs in connection with the solicitation of proxies from our

stockholders, however, our estimate for total costs is $8,000.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO

BE ACTED UPON

Except as disclosed elsewhere in this Proxy Statement, since

May 31, 2012, being the commencement of our last completed financial year, none

of the following persons has any substantial interest, direct or indirect, by

security holdings or otherwise in any matter to be acted upon:

|

|

1.

|

any director or officer of our corporation;

|

|

|

|

|

|

|

2.

|

any proposed nominee for election as a director of our

corporation; and

|

|

|

|

|

|

|

3.

|

any associate or affiliate of any of the foregoing

persons.

|

The shareholdings of our directors and officers are listed

below in the section entitled "Principal Stockholders and Security Ownership of

Management". To our knowledge, no director has advised that he intends to oppose

the Amendments to our authorized capital or to the Sale, as more particularly

described herein.

PRINCIPAL STOCKHOLDERS AND SECURITY OWNERSHIP OF

MANAGEMENT

As of July 22, 2013, we had a total of 186,583,333 shares of

common stock ($0.001 par value per share) issued and outstanding.

The following table sets forth, as of July 22, 2013, certain

information with respect to the beneficial ownership of our common and preferred

stock by each stockholder known by us to be the beneficial owner of more than 5%

of our common and preferred stock and by each of our current directors and

executive officers. Each person has sole voting and investment power with respect to the shares of

common stock and preferred stock, except as otherwise indicated. Beneficial

ownership consists of a direct interest in the shares of common and preferred

stock, except as otherwise indicated.

- 3 -

Name and Address of Beneficial Owner

|

Amount and Nature of

Beneficial

Ownership

|

Percentage

of

Class

(1)

(2)

|

0969015 B.C. Ltd.

1311 Borregard Road

Quesnel, British Columbia V2S 3Z7

|

35,000,000

|

18.76%

|

Lee Costerd

4055 McLean Road

Quesnel,

British Columbia

|

3,612,913

|

1.94%

|

Luke Rich

PO Box 65

Natuashish, NL

A0P 1A0

|

625,140

|

0.34%

|

|

Directors and Executive Officers as a

Group

|

4238,053

|

2.27%

|

(1) Based on 186,583,333 shares of common stock issued and

outstanding as of July 22, 2013. Beneficial ownership is determined in

accordance with the rules of the SEC and generally includes voting and

investment power with respect to securities. Except as otherwise indicated, we

believe that the beneficial owners of the common stock listed above, based on

information furnished by such owners, have sole investment and voting power with

respect to such shares, subject to community property laws where applicable.

EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS

Our entire board of directors is responsible for setting and administering policies that govern executive salaries, cash bonus awards and equity incentive awards and approves the annual compensation, including equity grants for our company's executive officers.

Our compensation programs are designed to award our named executive officers for their contributions to our company's achievements aimed at long-term strategic management and enhancement of stockholder value, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

Executive compensation is reviewed by our board of directors on an annual basis.

The particulars of the compensation paid to the following

persons:

-

our principal executive officer;

-

each of our two most highly compensated executive officers who were serving

as executive officers at the end of the years ended May 31, 2012 and 2011; and

-

up to two additional individuals for whom disclosure would have been

provided under (b) but for the fact that the individual was not serving as our

executive officer at the end of the years ended May 31, 2012 and 2011,

who we will collectively refer to as the named executive

officers of our company, are set out in the following summary compensation

table, except that no disclosure is provided for any named executive officer,

other than our principal executive officers, whose total compensation did not

exceed $100,000 for the respective fiscal year:

|

SUMMARY COMPENSATION TABLE

|

Name

and Principal

Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-

Equity

Incentive

Plan

Compensa-

tion

($)

|

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)

|

All

Other

Compensa-

tion

($)

|

Total

($)

|

Lee Costerd

(1)

Chief

Executive Officer and

Chief Financial Officer

|

2012

2011

|

36,023

32,930

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

36,023

32,930

|

- 4 -

Other than as set out below, there are no arrangements or plans

in which we provide pension, retirement or similar benefits for directors or

executive officers. Our directors and executive officers may receive share

options at the discretion of our board of directors in the future. We do not

have any material bonus or profit sharing plans pursuant to which cash or

non-cash compensation is or may be paid to our directors or executive officers,

except that share options may be granted at the discretion of our board of

directors.

Stock Option Grants to our Named Executive Officers

During the period from inception (February 23, 2006) to May 31,

2012, we granted 550,000 stock options with an exercise price of $0.14 per share

and an expiry date of May 28, 2015 to our executive officer. On September 9,

2011 the exercise price of the stock options was amended to $0.05 per share.

Outstanding Equity Awards at Fiscal Year End

There were no outstanding equity awards granted to any named

executive officer as of May 31, 2012 or 2011.

Aggregated Option Exercises in Last Fiscal Year and Fiscal

Year-End Values

There were no options exercised, by any named executive

officers during the years ended May 31, 2012 or 2011.

Compensation of Directors

We do not have any agreements for compensating our directors

for their services in their capacity as directors, although such directors are

expected in the future to receive stock options to purchase shares of our common

stock as awarded by our board of directors.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension,

retirement or similar benefits for directors or executive officers. We have no

material bonus or profit sharing plans pursuant to which cash or non-cash

compensation is or may be paid to our directors or executive officers, except

that stock options may be granted at the discretion of the board of directors or

a committee thereof.

Indebtedness of Directors, Senior Officers, Executive

Officers and Other Management

None of our directors or executive officers or any associate or

affiliate of our company during the last two fiscal years, is or has been

indebted to our company by way of guarantee, support agreement, letter of credit

or other similar agreement or understanding currently outstanding.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

The persons named as proxy holders in the enclosed proxy have

been selected by the Board of Directors to serve as proxy and will vote the

shares represented by valid proxies at the Meeting and any adjournments thereof.

It is indicated that, unless otherwise specified in the proxy, they intend to

vote for the election as director each of the persons named as a nominee listed

below under "Nominees for Director" unless authority to vote in the election of

directors is withheld on each proxy. Each nominee is currently a member of the

Board of Directors. Each duly elected director will hold office until the next

Annual Meeting of Stockholders or until their successor shall have been elected

and qualified. Although the Board of Directors of our company does not

contemplate that a nominee will be unable to serve, if such situation arises

prior to the Meeting, the persons named in the enclosed proxy will vote for the

election of such other person as may be nominated by the Board of Directors.

Our bylaws provide for our board of directors to consist of at

least one director. Each director is elected by a plurality of votes at each

annual meeting. We currently operate with a board of directors consisting of two

directors.

- 5 -

The nominees for election at the Meeting to fill the positions

on our board of directors are Lee Costerd and Luke Rich.

Our board of directors unanimously recommends a vote "FOR" the

nominees: Lee Costerd and Luke Rich. The election of director will require the

approval of stockholders holding at least a majority of shares of our common

stock entitled to vote at the Meeting.

For further information, please refer to the heading below

"Nominees for Director".

Nominees for Director

The Board of Directors unanimously recommends a vote

FOR

the election of the nominees listed below.

For each of our company’s directors, the following table sets

forth their names, ages, principal occupations, other directorships of public

companies held by them and length of continuous service as a director:

Name

|

Position Held

with the Company

|

Age

|

Date First Elected or

Appointed

|

Lee Costerd

|

President, Chief Executive

Officer, Chief

Financial

Officer & Director

|

60

|

February 23, 2006

|

Luke Rich

|

Vice

President, Exploration

and Business Development

and Director

|

48

|

June 14, 2010

|

Business Experience

The following is a brief account of the education and business

experience during at least the past five years of each director, executive

officer and key employee of our company, indicating the person’s principal

occupation during that period, and the name and principal business of the

organization in which such occupation and employment were carried out.

Lee Costerd, President, Chief Executive Officer, Chief

Financial Officer and Director

Mr. Costerd was appointed a director and officer on February

23, 2006.

Mr. Costerd has acted as a director and officer since our

inception on February 23, 2006. Mr. Costerd has been involved in the mining

industry for the past 20 years. Mr. Costerd was the mine manager for a placer

mining operation in British Columbia and a supervisor at a hard rock mining

operation also in British Columbia.

Luke Rich, Vice President, Exploration and Business

Development and Director

Mr. Rich was appointed a director and as Vice President,

Exploration and Business Development on June 14, 2010. Mr. Rich is a member of

the Innu Nation and Mushuau Innu First Nations and is a former VP of the Innu

Nation. Prior to joining Wolverine, Mr. Rich was also Co-CEO of the Innu

Development Limited Partnership (“IDLP”) from October 2007 to April 2010. IDLP

participated in the construction of the mine and mill for the Voisey Bay Nickel

Project. Mr. Rich is also a board member of various IDLP owned companies

including Innu Mikun Airlines, Innu Keiwit Constructor LP and the Innu/SNC

Lavalin Partnership.

- 6 -

Information About the Board of Directors

Board and Committee Meetings

Our board of directors held formal meetings during the year

ended May 31, 2012 and all other proceedings of the board of directors were

conducted by resolutions consented to in writing by all the directors and filed

with the minutes of the proceedings of the directors. Such resolutions consented

to in writing by the directors entitled to vote on that resolution at a meeting

of the directors are, according to the Nevada Corporate Law and our By-laws, as

valid and effective as if they had been passed at a meeting of the directors

duly called and held.

Audit Committee

We do not have an Audit Committee, our entire board of

directors performs the functions of an Audit Committee. The current size of our

board of directors does not facilitate the establishment of a separate

committee.

Nominating Committee

We do not have a Nominating Committee, our entire board of

director performs the functions of a Nominating Committee and oversees the

process by which individuals may be nominated to our board of directors.

The current size of our board of directors does not facilitate

the establishment of a separate committee. We hope to establish a separate

Nominating Committee consisting of independent directors, if the number of our

directors is expanded.

Compensation Committee

We do not have a compensation committee, our entire board of director performs the functions of a Compensation Committee and oversees the process by which our named executive officers and directors are compensated.

Family Relationships

There are no family relationships between any director or

executive officer.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or

executive officers has, during the past ten years:

|

1.

|

been convicted in a criminal proceeding or been subject

to a pending criminal proceeding (excluding traffic violations and other

minor offences);

|

|

|

|

|

2.

|

had any bankruptcy petition filed by or against the

business or property of the person, or of any partnership, corporation or

business association of which he was a general partner or executive

officer, either at the time of the bankruptcy filing or within two years

prior to that time;

|

|

|

|

|

3.

|

been subject to any order, judgment, or decree, not

subsequently reversed, suspended or vacated, of any court of competent

jurisdiction or federal or state authority, permanently or temporarily

enjoining, barring, suspending or otherwise limiting, his involvement in

any type of business, securities, futures, commodities, investment,

banking, savings and loan, or insurance activities, or to be associated

with persons engaged in any such activity;

|

|

|

|

|

4.

|

been found by a court of competent jurisdiction in a

civil action or by the SEC or the Commodity Futures Trading Commission to

have violated a federal or state securities or commodities law, and the

judgment has not been reversed, suspended, or vacated;

|

|

|

|

|

5.

|

been the subject of, or a party to, any federal or state

judicial or administrative order, judgment, decree, or finding, not

subsequently reversed, suspended or vacated (not including any settlement

of a civil proceeding among private litigants), relating to an

alleged violation of any federal or state securities or commodities law or

regulation, any law or regulation respecting financial institutions or

insurance companies including, but not limited to, a temporary or

permanent injunction, order of disgorgement or restitution, civil money

penalty or temporary or permanent cease-and-desist order, or removal or

prohibition order, or any law or regulation prohibiting mail or wire fraud

or fraud in connection with any business entity; or

|

- 7 -

|

6.

|

been the subject of, or a party to, any sanction or

order, not subsequently reversed, suspended or vacated, of any

self-regulatory organization (as defined in Section 3(a)(26) of the

Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in

Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or

any equivalent exchange, association, entity or organization that has

disciplinary authority over its members or persons associated with a

member.

|

Code of Ethics

We adopted a Code of Ethics applicable to all of our directors,

officers, employees and consultants, which is a "code of ethics" as defined by

applicable rules of the SEC. Our Code of Ethics is attached as an exhibit to our

registration statement on Form S-1 filed on July 15, 2008. If we make any

amendments to our Code of Ethics other than technical, administrative, or other

non-substantive amendments, or grant any waivers, including implicit waivers,

from a provision of our Code of Ethics to our chief executive officer, chief

financial officer, or certain other finance executives, we will disclose the

nature of the amendment or waiver, its effective date and to whom it applies in

a Current Report on Form 8-K filed with the SEC.

We will provide a copy of the Code of Ethics to any person

without charge, upon request. Requests can be sent to: Wolverine Exploration

Inc., 4055 McLean Road, Quesnel, British Columbia V2J 6V5.

Audit Committee and Audit Committee Financial Expert

Our board of directors has determined that it does not have a

director who qualifies as an "audit committee financial expert" as defined in

Item 407(d)(5)(ii) of Regulation S-K, and is "independent" as the term is used

in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934,

as amended.

We believe that the members of our board of directors are

collectively capable of analyzing and evaluating our financial statements and

understanding internal controls and procedures for financial reporting. We

believe that retaining an independent director who would qualify as an "audit

committee financial expert" would be overly costly and burdensome and is not

warranted in our circumstances given the early stages of our development and the

fact that we have not generated any material revenues to date. In addition, we

currently do not have nominating, compensation or audit committees or committees

performing similar functions nor do we have a written nominating, compensation

or audit committee charter. Our board of directors does not believe that it is

necessary to have such committees because it believes the functions of such

committees can be adequately performed by our board of directors.

Compliance with Section 16(a) of the Securities Exchange Act

of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires

our executive officers and directors and persons who own more than 10% of our

common stock to file with the Securities and Exchange Commission initial

statements of beneficial ownership, reports of changes in ownership and annual

reports concerning their ownership of our common stock and other equity

securities, on Forms 3, 4 and 5 respectively. Executive officers, directors and

greater than 10% stockholders are required by the SEC regulations to furnish us

with copies of all Section 16(a) reports that they file.

Based solely on the reports received by our company and on

written representations from certain reporting persons, we believe that the

directors, executive officers and persons who beneficially own more than 10% of

our company’s common stock during the fiscal year ended May 31, 2012 have been

in compliance with Section 16(a).

- 8 -

Transactions with Related Director Independence

Except as disclosed herein, no director, executive officer,

shareholder holding at least 5% of shares of our common stock, or any family

member thereof, had any material interest, direct or indirect, in any

transaction, or proposed transaction since the year ended May 31, 2012, in which

the amount involved in the transaction exceeded or exceeds the lesser of

$120,000 or one percent of the average of our total assets at the year end for

the last three completed fiscal years.

Director Independence

We currently act with two directors, consisting of Lee Costerd

and Luke Rich. We have determined that we do not have a director who is an

"independent director" as defined in NASDAQ Marketplace Rule 4200(a)(15).

We do not have a standing audit, compensation or nominating

committee, but our entire board of directors acts in such capacities. We believe

that our members of our board of directors are capable of analyzing and

evaluating our financial statements and understanding internal controls and

procedures for financial reporting. The board of directors of our company does

not believe that it is necessary to have an audit committee because we believe

that the functions of an audit committee can be adequately performed by the

board of directors. In addition, we believe that retaining an independent

director who would qualify as an "audit committee financial expert" would be

overly costly and burdensome and is not warranted in our circumstances given the

early stages of our development.

PROPOSAL NO. 2 - RATIFICATION OF APPOINTMENT OF

INDEPENDENT AUDITOR

Stockholder ratification of the appointment of Saturna Group,

Chartered Accountants LLP as our independent auditor is not required by our

bylaws or otherwise. However, our board of directors is submitting the selection

of Saturna Group, Chartered Accountants LLP to the stockholders for ratification

as a matter of corporate practice. If the stockholders fail to ratify the

selection, our board of directors will reconsider whether or not to retain that

firm. Even if the selection is ratified, our board of directors in its

discretion may direct the appointment of a different independent accounting firm

at any time during the year if our board of directors determines that such a

change would be in the best interests of our company and its stockholders.

Our board of directors has considered and determined that the

services provided by Saturna Group, Chartered Accountants LLP are compatible

with maintaining the principal accountant’s independence.

Representatives of Saturna Group, Chartered Accountants LLP are

not expected to be present at the Meeting.

Our board of directors unanimously recommends a vote "FOR" the

ratification of the appointment of Saturna Group, Chartered Accountants LLP as

our independent auditors for the ensuing fiscal year.

The following table sets forth the fees billed to the company

for professional services rendered by the company's independent registered

public accounting firm, for the years ended May 31, 2012 and 2011:

|

Services

|

2012

|

|

2011

|

|

|

CDN$

|

|

CDN$

|

|

|

|

|

|

|

Audit fees

|

13,300

|

|

13,400

|

|

Tax fees

|

1,000

|

|

Nil

|

|

Audit related fees

|

Nil

|

|

Nil

|

|

All other fees

|

Nil

|

|

Nil

|

|

|

|

|

|

|

Total fees

|

14,300

|

|

13,400

|

Audit Fees.

Consist of fees billed for professional

services rendered for the audits of our financial statements, reviews of our

interim consolidated financial statements included in quarterly reports,

services performed in connection with filings with the Securities and Exchange

Commission and related comfort letters and other services that are normally

provided in connection with statutory and regulatory filings or engagements.

- 9 -

Tax Fees.

Consist of fees billed for professional

services for tax compliance, tax advice and tax planning. These services include

assistance regarding federal, state and local tax compliance and consultation in

connection with various transactions and acquisitions.

We do not use Saturna Group, Chartered Accountants LLP, for

financial information system design and implementation. These services, which

include designing or implementing a system that aggregates source data

underlying the financial statements or generates information that is significant

to our financial statements, are provided internally or by other service

providers. We do not engage Saturna Group, Chartered Accountants LLP to provide

compliance outsourcing services.

Effective May 6, 2003, the Securities and Exchange Commission

adopted rules that require that before Saturna Group, Chartered Accountants LLP

is engaged by us to render any auditing or permitted non-audit related service,

the engagement be:

-

approved by our audit committee (the functions of which are performed by

our entire board of directors); or

-

entered into pursuant to pre-approval policies and procedures established

by the board of directors, provided the policies and procedures are detailed

as to the particular service, the board of directors is informed of each

service, and such policies and procedures do not include delegation of the

board of directors' responsibilities to management.

Our entire board of directors pre-approves all services

provided by our independent auditors. All of the above services and fees were

reviewed and approved by our directors either before or after the respective

services were rendered.

Our board of directors has considered the nature and amount of

fees billed by Saturna Group, Chartered Accountants LLP and believe that the

provision of services for activities unrelated to the audit is compatible with

maintaining Saturna Group, Chartered Accountants LLP’s independence.

PROPOSAL NO. 3 - ADVISORY VOTE ON EXECUTIVE COMPENSATION

(SAY-ON-PAY VOTE)

This year, as required by Section 14A of the Exchange Act, we are providing stockholders the opportunity to advise our Board regarding the compensation of our Named Executive Officers, as such compensation is described in this Proxy Statement, the tabular disclosure regarding such compensation and the accompanying narrative disclosure, beginning on page 3 of this Proxy Statement. We urge our stockholders to review these disclosures for further insight into our compensation policies.

The goal of our company's executive officer compensation program is to retain and reward highly qualified, talented leaders who create long term stockholder value. The program is designed to align management’s interest with that of stockholders and motivate senior executives to increase our long-term growth and profitability while attempting to minimize risks that could result from compensation decisions. As described in this proxy statement, our board weighs the appropriate mix of compensation elements, including the allocation between cash and equity, for each executive officer to help achieve those objectives. Our Compensation Discussion and Analysis contained in this proxy statement describes our executive compensation program and the decisions made by our board in more detail.

Accordingly, our board is asking our stockholders to indicate their support for the compensation of our named executive officers as described in this proxy statement by casting a non-binding advisory vote “FOR” the following resolution:

"RESOLVED, that the compensation paid to the company's named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED."

As an advisory vote, this proposal is not binding on our board. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to management and our board, and, accordingly, our board intends to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Advisory approval of this proposal requires the vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

IN FAVOR OF PROPOSAL 3

PROPOSAL NO. 4 - ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON THE

COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

(SAY-WHEN-ON-PAY VOTE)

Accordingly, our company is asking stockholders to indicate whether they would prefer an advisory vote every year, every other year or every three years. For the reasons described below, our board recommends that the stockholders select a frequency of three years.

After considering the benefits and consequences of each alternative, our board recommends that the advisory vote on the compensation of our company’s named executive officers be submitted to the stockholders once every three years.

Our board believes that a triennial advisory vote makes sense for our company and its stockholders for the following reasons:

-

A triennial advisory vote will allow stockholders to better evaluate our executive compensation programs relative to a pattern of performance over time, which is a more appropriate perspective than the short-term approach that an annual vote could encourage. We seek to encourage a long-term focus among our executives by, for example, granting equity awards that vest over long periods and are designed to correlate closely with the creation of long-term stockholder value. In addition, our compensation programs do not change significantly from year to year. We are concerned that annual votes on our executive compensation program could foster a short-term focus and lead to an over-emphasis on the near-term effect of our compensation programs and thus undermine some of our program’s long-term features. We believe that a vote on our compensation by our stockholders every three years will encourage stockholders to take the same long-term approach to our compensation programs taken by our executives and our compensation committee.

- 10 -

-

A triennial advisory vote will provide us the appropriate time to understand any concerns expressed by our stockholders, thoughtfully evaluate and respond to our stockholders and effectively implement any desired changes to our executive compensation program. As a practical matter, because our critical compensation actions are taken in the first quarter of each fiscal year, any changes to our executive compensation program that were responsive to stockholder concerns would not be fully implemented until the year following the vote, and, as result, would not be disclosed in the compensation tables and reflected in the Compensation Discussion and Analysis section of our proxy statement until the second completed fiscal year following the advisory vote. A triennial advisory vote will permit our stockholders to observe and evaluate the impact of any changes to our executive compensation policies and practices that have occurred since the last advisory vote on executive compensation, including changes made in response to the outcome of a prior advisory vote on executive compensation.

-

An annual advisory vote may frustrate stockholder communication. While an advisory vote on executive compensation may reflect general satisfaction or dissatisfaction with a company’s practices, a dialogue about executive compensation between our stockholders and our board or Compensation Committee members can provide a forum that is more conducive to expressing precise views regarding specific compensation practices. Our board believes that stockholders should not have to wait for a formal vote at an annual meeting. We encourage our stockholders to convey their compensation concerns to us and view the advisory vote as an additional, but not exclusive, opportunity for our stockholders to communicate with us regarding executive compensation.

While our board believes that its recommendation is appropriate at this time, stockholders are not voting to approve or disapprove that recommendation, but are instead asked to indicate their preference, on an advisory basis, as to whether the non-binding stockholder advisory vote on the approval of our executive officer compensation practices should be held every year, every two years, or every three years. The frequency option that receives votes from the holders of at least a majority of shares present or represented and voting at the Annual Meeting will be considered the preferred frequency of future advisory votes on the compensation of our named executive officers by our stockholders. Our board values the opinions of our stockholders in this matter, and, to the extent there is any significant vote in favor of one frequency over the other options, even if fewer than a majority of the votes cast, our board will consider the stockholders’ concerns and evaluate any appropriate next steps. However, because this vote is advisory and not binding on our board or our company in any way, our board may decide that it is in the best interests of our stockholders and our company to hold an advisory vote on executive compensation more or less frequently than the option indicated by our stockholders.

OUR BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE THREE YEAR FREQUENCY OF

STOCKHOLDER ADVISORY VOTES ON COMPENSATION

ON PROPOSAL 4.

PROPOSAL NO.5 - AMENDMENT TO OUR

CORPORATION'S ARTICLES – COMMON STOCK

Our Articles of Incorporation (the "

Articles

") currently

authorize the issuance of 200,000,000 shares of common stock, $0.001 par value.

On June 11, 2013 our Board of Directors approved, subject to receiving the

approval of a majority of the stockholders of our common stock, an amendment to

our Articles to increase our authorized shares of common stock to 500,000,000

shares, par value $0.001 per share:

Proposal No. 5 is solely to approve the Amendment to our Articles of Incorporation to increase our authorized common stock to 500,000,000, par value $0.001.

The general purpose and effect of the amendment to our

corporation's Articles is to increase our authorized share capital, which will

enhance our company’s ability to finance the development and operation of our

business.

Our board of directors approved the amendment to our

corporation's Articles to increase our authorized share capital so that such

shares will be available for issuance for general corporate purposes, including

financing activities, without the requirement of further action by our

stockholders. Potential uses of the additional authorized shares may include

public or private offerings, conversions of convertible securities, issuance of

options pursuant to employee benefit plans, acquisition transactions and other

general corporate purposes. Increasing the authorized number of shares of our

common stock will give us greater flexibility and will allow us to issue such

shares in most cases without the expense of delay of seeking stockholder

approval. Our company is at all times investigating additional sources of

financing which our board of directors believes will be in our best interests

and in the best interests of our stockholders. We do not currently have any agreements for any

transaction that would require the issuance of additional shares of common

stock. Our common shares carry no pre-emptive rights to purchase additional

shares. The adoption of the amendment to our Articles of Incorporation will not

of itself cause any changes in our capital accounts.

The amendment to our corporation's Articles to increase our

authorized share capital will not have any immediate effect on the rights of

existing stockholders.

However, our board of directors will have the

authority to issue authorized common stock without requiring future stockholders

approval of such issuances, except as may be required by applicable law or

exchange regulations. To the extent that additional authorized common shares are

issued in the future, they will decrease the existing stockholders' percentage

equity ownership and, depending upon the price at which they are issued, could

be dilutive to the existing stockholders.

The increase in the authorized number of shares of our common

stock and the subsequent issuance of such shares could have the effect of

delaying or preventing a change in control of our company without further action

by the stockholders. Shares of authorized and unissued common stock could be

issued (within limits imposed by applicable law) in one or more transactions.

Any such issuance of additional stock could have the effect of diluting the

earnings per share and book value per share of outstanding shares of common

stock, and such additional shares could be used to dilute the stock ownership or

voting rights of a person seeking to obtain control of our company.

We do not have any provisions in our Articles, by laws, or

employment or credit agreements to which we are party that have anti-takeover

consequences. We do not currently have any plans to adopt anti-takeover

provisions or enter into any arrangements or understandings that would have

anti-takeover consequences. In certain circumstances, our management may issue

additional shares to resist a third party takeover transaction, even if done at

an above market premium and favoured by a majority of independent stockholders.

Stockholders should note that our company does not have any current plans, intentions, agreements or understandings to issue any of our common stock, that will result if Proposal No. 5 is approved.

Dissenters’ Rights of Appraisal

Under Nevada law, our stockholders are not entitled to

appraisal rights with respect to the Amendments and we will not independently

provide our stockholders with any such right.

Voting Procedure

The Amendments to our Articles will require the approval of

stockholders holding at least a majority of shares of our common stock entitled

to be voted at the Meeting.

If Proposal No. 5 is accepted by the stockholders, the Articles of our company will be amended in substantially the same form as attached Schedule "A", with changes as may be required by the Nevada Secretary of States.

"HOUSEHOLDING" OF PROXY MATERIAL

The Securities and Exchange Commission permits companies and

intermediaries (e.g. brokers) to satisfy the delivery requirements for proxy

statements with respect to two or more stockholders sharing the same address by

delivering a single proxy statement addressed to those stockholders. This

process, commonly referred to as "householding", potentially means extra

conveniences for stockholders and cost savings for companies.

A number of brokers with accountholders who are stockholders of

our Company will be "householding" our proxy materials. As indicated in the

notice previously provided by these brokers to stockholders, a single proxy

statement will be delivered to multiple stockholders sharing an address unless

contrary instructions have been received from an affected stockholder. Once you

have received notice from your broker that they will be "householding"

communications to your address, "householding" will continue until you are

notified otherwise or until you revoke your consent. If at any time, you no

longer wish to participate in "householding" and would prefer to receive a

separate proxy statement, please notify your broker.

- 11 -

Stockholders who currently receive multiple copies of the proxy

statement at their address and would like to request "householding" of their

communications should contact their broker.

OTHER BUSINESS

The Board knows of no other business that will be presented for

consideration at the Meeting. If other matters are properly brought before the

Meeting; however, it is the intention of the persons named in the accompanying

proxy to vote the shares represented thereby on such matters in accordance with

their best judgment.

If there are insufficient votes to approve any of the proposals

contained herein, the Board may adjourn the Meeting to a later date and solicit

additional proxies. If a vote is required to approve such adjournment, the

proxies will be voted in favor of such adjournment.

By Order of the Board of Directors,

/s/ Lee Costerd

Lee Costerd

Director

PROXY CARD

ANNUAL AND SPECIAL MEETING OF STOCKHOLDERS OF

WOLVERINE

EXPLORATION INC.

(the "

Company

")

TO BE HELD AT 400 - 570 GRANVILLE STREET, VANCOUVER, BRITISH

COLUMBIA

ON FRIDAY, SEPTEMBER 13, 2013 at 2:00 p.m. (local time)

(the

"

Meeting

")

|

The undersigned stockholder ("Registered Stockholder") of

the Company hereby appoints, Lee Costerd, an officer of the Company, or

failing this person, Luke Rich, an officer of the Company, or in the place

of the foregoing, [print name] as proxyholder for and on behalf of the

Registered Stockholder with the power of substitution to attend, act and

vote for and on behalf of the Registered Stockholder in respect of all

matters that may properly come before the Meeting and at every adjournment

thereof, to the same extent and with the same powers as if the undersigned

Registered Stockholder were present at the said Meeting, or any

adjournment thereof.

|

|

|

|

The Registered Stockholder hereby directs the proxyholder

to vote the securities of the Company registered in the name of the

Registered Stockholder as specified herein.

|

|

|

|

[ ]

Please check this box only if you intend to attend and vote at the Meeting

|

|

|

|

To assist the Company in tabulating the votes submitted

by proxy prior to the Meeting, we request that you mark, sign, date and

return this Proxy by 2:00 p.m., September 11, 2013 using the enclosed

envelope.

|

|

|

|

THIS PROXY IS SOLICITED ON BEHALF MANAGEMENT OF

THE COMPANY.

|

|

|

|

PLEASE MARK YOUR VOTE IN THE BOX.

|

In their discretion, the Proxies are authorized to vote upon

such other business as may proper

|

PROPOSAL 1: Election of Directors:

|

|

|

|

|

|

a)

Lee

Costerd

|

FOR

|

[ ]

|

WITHHELD

|

[ ]

|

|

b)

Luke Rich

|

FOR

|

[ ]

|

WITHHELD

|

[ ]

|

|

|

|

|

|

|

|

PROPOSAL 2: To ratify the appointment of Saturna Group

Chartered

Accountants LLP as the Company’s independent public

accounting firm for the

fiscal year ending May 31, 2014

|

FOR

|

[ ]

|

AGAINST

|

[ ]

|

|

|

|

|

|

|

PROPOSAL 3: Advisory Vote on the compensation of our company's named

executive officers

|

FOR

|

[ ]

|

AGAINST

|

[ ]

|

|

|

|

|

|

|

PROPOSAL 4: Advisory Vote on the frequency of future advisory votes on

the compensation of our company's named executive officers

|

1 Year

[ ]

|

2 Years

[ ]

|

3 Years

[ ]

|

|

|

|

|

|

|

|

|

PROPOSAL 5: Amendment to Articles – increase in

authorized share capital

|

FOR

|

[ ]

|

AGAINST

|

[ ]

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Meeting. This Proxy, when properly executed, will be voted in the manner directed by the Registered Stockholder. If no direction is made, this Proxy will be voted "FOR" each of the nominated directors and "FOR" the remaining Proposals, with the exception of Proposal 4 for which our board has recommended a vote for 3 Years.

|

Dated: ______________________________

|

Signature:

_________________________________________

|

Please sign exactly as name appears below. When shares are held

jointly, both Registered Stockholders should sign. When signing as attorney,

executor, administrator, trustee or guardian, please indicate full title as

such. If a corporation, please indicate full corporate name; and if signed by

the president or another authorized officer, please specify the officer's

capacity. If a partnership, please sign in partnership name by authorized

person.

|

SIGN HERE:

|

|

|

|

|

|

|

|

Please Print Name:

|

|

|

|

|

|

|

|

Date:

|

|

|

|

|

|

|

|

Number of Shares Represented by Proxy

|

|

|

THIS PROXY FORM IS

NOT VALID

UNLESS

IT IS

SIGNED AND

DATED

.

SEE IMPORTANT INFORMATION AND INSTRUCTIONS ON

REVERSE.

INSTRUCTIONS FOR COMPLETION OF PROXY

1. This

form of proxy ("Instrument of Proxy")

must be signed

by you,

the Registered Stockholder

, or by your attorney duly authorized by you in

writing, or, in the case of a corporation, by a duly authorized officer or

representative of the corporation; and

if executed by an attorney, officer,

or other duly appointed representative

, the original or a notarial copy of

the instrument so empowering such person, or such other documentation in support

as shall be acceptable to the Chairman of the Meeting, must accompany the

Instrument of Proxy.

2.

If this Instrument of Proxy is not dated

in the space

provided, authority is hereby given by you, the Registered Stockholder, for the

proxyholder to date this proxy seven (7) calendar days after the date on which

it was mailed to you, the Registered Stockholder.

3.

A Registered Stockholder who wishes to

attend

the Meeting and vote on

the resolutions in person

, may

simply register with the Scrutineer

before the Meeting begins.

4.

A

Registered Stockholder who is

not able to attend

the

Meeting in person but wishes to vote on the resolutions

, may do the

following:

(a)

appoint one of the management proxyholders

named on the Instrument of

Proxy, by leaving the wording appointing a nominee as is; OR

(b)

appoint another proxyholder

.

5. The

securities represented by this Instrument of Proxy will be voted or withheld

from voting in accordance with the instructions of the Registered Stockholder on

any poll of a resolution that may be called for and, if the Registered

Stockholder specifies a choice with respect to any matter to be acted upon, the

securities will be voted accordingly. Further, the securities will be voted by

the appointed proxyholder with respect to any amendments or variations of any of

the resolutions set out on the Instrument of Proxy or matters which may properly

come before the Meeting as the proxyholder in its sole discretion sees fit.

INSTRUCTIONS AND OPTIONS FOR VOTING:

To be represented at the Meeting, this Instrument of Proxy

must be DEPOSITED at the office of

Empire Stock Transfer.

, by mail

in the enclosed business reply envelope, at any time up to and including 2:00

p.m. (Pacific time) on September 11, 2013, or at least 48 hours (excluding

Saturdays, Sundays and holidays) before the time that the Meeting is to be

reconvened after any adjournment of the Meeting.

SCHEDULE A

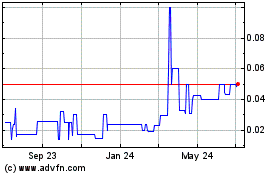

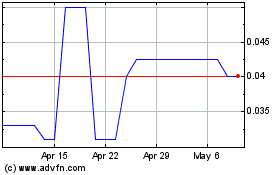

Wolverine Resources (PK) (USOTC:WOLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wolverine Resources (PK) (USOTC:WOLV)

Historical Stock Chart

From Apr 2023 to Apr 2024