Chip Companies Push For Tariff Bans On Complex Semiconductors

May 25 2012 - 9:35AM

Dow Jones News

SARATOGA SPRINGS, N.Y. (Dow Jones)-Global semiconductor

companies agreed to request tariff bans on chips that pack many

capabilities into one small package, something that would help them

better compete in the global marketplace.

Semiconductor CEOs and other representatives met in upstate New

York this week for their annual World Semiconductor Council

meeting. The group included representatives from various U.S.

companies such as Micron Technology Inc. (MU) and Analog Devices

Inc. (ADI), as well as companies from Europe, China, Taiwan, Korea

and Japan.

The organization gathers high-level executives once a year to

discuss trade policy, intellectual-property law and other

regulations that affect the entire industry. The companies seek to

reach agreements as a group that they then recommend to their

respective governments.

The biggest issue that the companies agreed on was seeking a ban

on import taxes for what the group dubbed "multicomponent chips."

As semiconductor technology becomes more advanced, chip designers

seek to include more functionality in one complete package, such as

processing, memory and sensing capabilities. That reduces cost and

typically makes it easier for customers to create their products.

Such chips are common in smartphones, tablets, PCs and other

consumer devices.

The topic was discussed at a roundtable late Thursday hosted by

the chief executives of Micron, Freescale Semiconductor Holdings I

Ltd. (FSL) and contract chip manufacturer Globalfoundries, along

with the chairman of Analog Devices and the president of the

Semiconductor Industry Association.

Freescale Chief Executive Rich Beyer said campaigns by the WSC

have helped eliminate most global tariffs on semiconductors, but

some nations impose steep taxes on the chips that combine many

functionalities in one package.

"Some of these tariffs are as much as 10%, which could eliminate

the ability of companies outside of those nations to successfully

compete," Beyer said.

The companies also discussed encryption, seeking to ensure

specific nations don't force the industry to revel what steps are

taken by customers to encrypt data.

"Our customers will develop encryption that will sometimes be

put into the chips," Beyer said. "Some nations around the world

would like insights into that."

Other issues discussed include regional stimulus and bailout

provisions, anti-counterfeiting efforts, and greenhouse gas

emissions and chemicals management.

Micron Chief Executive Mark Durcan said some incentives to buoy

companies can be positive, but government action at the point of

company failure can "create significant disruptions and damage to

the industry as a whole."

"There's not a lot of consensus on how that should be

addressed," he said. Durcan said the group will discuss the topic

in future sessions, noting it took about seven years to reach

agreement about tariffs for chips that include many capabilities in

one package.

The WSC hosted the meeting near the site for a recently

constructed Globalfoundries chip factory in Malta, N.Y. The

factory, along with university efforts in semiconductor research,

has earned the region the moniker of "Tech Valley."

-By Shara Tibken, Dow Jones Newswires, 212-416-2189,

shara.tibken@dowjones.com

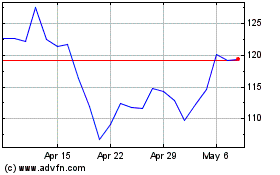

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Aug 2024 to Sep 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Sep 2023 to Sep 2024