Commerce Bancshares, Inc. (Nasdaq: CBSH) announced record

earnings of $.74 per share for the three months ended March 31,

2012 compared to $.66 per share in the first quarter of 2011, or an

increase of 12.1%. Net income for the first quarter amounted to

$65.8 million compared to $60.5 million in the same quarter last

year. For the quarter, the return on average assets totaled 1.29%,

the return on average equity was 12.0% and the efficiency ratio was

58.9%.

In announcing these results, David W. Kemper, Chairman and CEO,

said, “We were pleased to report record first quarter earnings per

share of $.74. The growth over last year resulted mainly from a

decline in our provision for loan losses of $7.6 million coupled

with revenue growth in our corporate card, capital markets and

money management businesses of 17%, 46% and 6%, respectively.

Additionally, non-interest expense declined 2% compared to the same

period last year. Average loans grew $70.8 million, or 1%, this

quarter compared to the previous quarter, as a result of growth in

business, business real estate and personal real estate loans.

Average deposits also grew by $270.2 million this quarter, or 2%.

While net interest income declined 1% compared to the previous

quarter, the margin remained stable.”

Further, Mr. Kemper noted, “Net loan charge-offs for the current

quarter totaled $11.2 million, compared to $15.6 million in the

previous quarter and $18.8 million in the first quarter of 2011.

Commercial net loan charge-offs totaled $1.8 million this quarter,

down $2.2 million from the previous quarter, while bankcard net

loan charge-offs totaled $6.2 million, or 3.4% of average bankcard

loans. During the current quarter, the provision for loan losses

totaled $8.2 million, or $3.0 million less than net loan

charge-offs, and reflected the improving credit trends in our loan

portfolio. Our allowance for loan losses amounted to $181.5 million

this quarter, representing 2.6 times our non-performing loans.

Total non-performing assets decreased $6.3 million to $87.5 million

this quarter. At March 31, 2012, our ratio of tangible common

equity to assets remained strong at 10.1%, and during the quarter

we repurchased approximately 811,000 shares of Company stock at an

average price per share of $39.”

Total assets at March 31, 2012 were $20.5 billion, total loans

were $9.3 billion, and total deposits were $16.8 billion.

Commerce Bancshares, Inc. is a registered bank holding company

offering a full line of banking services, including investment

management and securities brokerage. The Company currently operates

in approximately 360 locations in Missouri, Illinois, Kansas,

Oklahoma and Colorado. The Company also has operating subsidiaries

involved in mortgage banking, credit related insurance, and private

equity activities.

Summary of Non-Performing Assets and Past Due Loans

(Dollars in thousands)

12/31/2011

3/31/2012 3/31/2011 Non-Accrual

Loans $ 75,482 $

68,875 $ 77,914 Foreclosed

Real Estate $ 18,321

$ 18,585 $ 25,061

Total Non-Performing Assets $

93,803 $ 87,460

$ 102,975 Non-Performing

Assets to Loans 1.02 %

.95 % 1.10 %

Non-Performing Assets to Total Assets .45

% .43 % .54

% Loans 90 Days & Over Past Due — Still Accruing

$ 14,958 $

16,428 $ 18,717

This financial news release, including management’s

discussion of first quarter results, is posted to the Company’s web

site at www.commercebank.com.

COMMERCE BANCSHARES, INC. and

SUBSIDIARIES

FINANCIAL

HIGHLIGHTS

For the Three Months Ended (Unaudited) December

31,2011

March 31, 2012 March 31,2011

FINANCIAL SUMMARY (In thousands, except per share data) Net

interest income $ 161,757

$ 159,737 $

160,973 Taxable equivalent net interest income 167,940

165,666 166,479 Non-interest income 94,035

94,583

95,906 Investment securities gains, net 4,942

4,040 1,327

Provision for loan losses 12,143

8,165 15,789 Non-interest

expense 156,030

150,461 153,960 Net income attributable to

Commerce Bancshares, Inc. 61,504

65,799 60,453 Cash

dividends 19,504

20,438 20,054 Net total loan charge-offs

15,649

11,165 18,789 Business 650

110 2,010 Real

estate — construction and land 2,624

220 1,986 Real estate —

business 731

1,495 1,064 Consumer credit card 6,986

6,173 9,038 Consumer 2,682

2,631 4,013 Revolving home

equity 884

360 367 Real estate — personal 798

69 274

Overdraft 294

107 37 Per common share: Net income — basic $

.69

$ .74 $ .66 Net income — diluted $ .69

$

.74 $ .66 Cash dividends $ .219

$ .230 $ .219

Diluted wtd. average shares o/s 88,653

88,556 91,178

RATIOS Average

loans to deposits (1) 56.01 %

55.53 % 62.47 % Return

on total average assets 1.19 %

1.29 % 1.32 % Return

on total average equity 11.39 %

12.04 % 11.95 %

Non-interest income to revenue (2) 36.76 %

37.19 %

37.34 % Efficiency ratio (3) 60.71 %

58.91

% 59.64 %

AT PERIOD END Book value per share

based on total equity $ 24.40

$ 24.83 $ 22.64 Market

value per share $ 38.12

$ 40.52 $ 38.51 Allowance for

loan losses as a percentage of loans 2.01 %

1.96 %

2.08 % Tier I leverage ratio 9.55 %

9.70 % 10.27 %

Tangible common equity to assets ratio (4) 9.91 %

10.12

% 10.24 % Common shares outstanding 88,952,166

88,583,809 91,444,081 Shareholders of record 4,218

4,213 4,302 Number of bank/ATM locations 363

360 365

Full-time equivalent employees 4,745

4,713 4,814

OTHER QTD

INFORMATION High market value per share $ 38.67

$

41.28 $ 40.64 Low market value per share $ 31.49

$ 37.57 $ 36.70

(1) Includes loans held for sale. (2) Revenue

includes net interest income and non-interest income. (3) The

efficiency ratio is calculated as non-interest expense (excluding

intangibles amortization) as a percent of revenue. (4) The tangible

common equity ratio is calculated as stockholders’ equity reduced

by goodwill and other intangible assets (excluding mortgage

servicing rights) divided by total assets reduced by goodwill and

other intangible assets (excluding mortgage servicing rights).

COMMERCE BANCSHARES, INC. and

SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF INCOME

For the Three Months Ended (Unaudited)

(In thousands, except per share data)

December 31,2011

March 31, 2012

March 31,2011 Interest income $ 173,223

$ 169,966 $ 175,826 Interest expense

11,466

10,229 14,853 Net interest

income 161,757

159,737 160,973 Provision for loan losses

12,143

8,165 15,789 Net interest income

after provision for loan losses 149,614

151,572

145,184

NON-INTEREST INCOME Bank card

transaction fees 36,162

34,733 37,462 Trust fees 22,095

22,814 21,572 Deposit account charges and other fees 20,623

19,336 19,300 Capital market fees 4,591

6,871 4,720

Consumer brokerage services 2,142

2,526 2,663 Loan fees and

sales 1,647

1,561 1,824 Other 6,775

6,742

8,365 Total non-interest income 94,035

94,583 95,906

INVESTMENT SECURITIES GAINS

(LOSSES), NET Impairment (losses) reversals on debt securities

(796 )

5,587 6,305 Noncredit-related losses (reversals) on

securities not expected to be sold 14

(5,907 )

(6,579 ) Net impairment losses (782 )

(320 ) (274 )

Realized gains on sales and fair value adjustments 5,724

4,360 1,601 Investment securities gains, net

4,942

4,040 1,327

NON-INTEREST

EXPENSE Salaries and employee benefits 88,010

89,543

87,392 Net occupancy 11,674

11,260 12,037 Equipment 5,583

5,189 5,577 Supplies and communication 5,550

5,613

5,532 Data processing and software 17,873

17,469 16,467

Marketing 3,469

3,822 4,258 Deposit insurance 2,680

2,520 4,891 Debit overdraft litigation 7,400

— —

Indemnification obligation (3,073 )

— (1,359 ) Other 16,864

15,045 19,165 Total non-interest

expense 156,030

150,461 153,960 Income

before income taxes 92,561

99,734 88,457 Less income taxes

29,514

32,920 27,507 Net income 63,047

66,814 60,950 Less non-controlling interest expense 1,543

1,015 497

Net income attributable to

Commerce Bancshares, Inc. $ 61,504

$

65,799 $ 60,453 Net income per common share —

basic $ .69

$ .74 $ .66 Net

income per common share — diluted $ .69

$ .74 $ .66

COMMERCE BANCSHARES, INC. and

SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

(Unaudited)

(In thousands)

December 31,2011

March 31, 2012

March 31,2011

ASSETS Loans $ 9,177,478

$ 9,247,971 $ 9,374,923 Allowance for loan losses

(184,532 )

(181,532 ) (194,538 )

Net loans

8,992,946

9,066,439 9,180,385 Loans

held for sale 31,076

9,673 53,411 Investment securities:

Available for sale 9,224,702

9,120,399 7,499,577 Trading

17,853

34,178 17,000 Non-marketable 115,832

120,734 104,721

Total investment

securities 9,358,387

9,275,311 7,621,298

Short-term federal funds sold and securities purchased under

agreements to resell 11,870

40,925 3,600 Long-term

securities purchased under agreements to resell 850,000

850,000 700,000 Interest earning deposits with banks 39,853

12,038 203,940 Cash and due from banks 465,828

381,462 362,148 Land, buildings and equipment — net 360,146

353,866 378,721 Goodwill 125,585

125,585 125,585

Other intangible assets — net 7,714

7,070 10,182 Other

assets 405,962

404,548 378,026

Total

assets $ 20,649,367

$ 20,526,917 $

19,017,296

LIABILITIES AND STOCKHOLDERS’ EQUITY

Deposits: Non-interest bearing $ 5,377,549

$

5,209,381 $ 4,558,630 Savings, interest checking and money

market 8,933,941

9,038,283 8,074,055 Time open and C.D.’s of

less than $100,000 1,166,104

1,143,687 1,388,004 Time open

and C.D.’s of $100,000 and over 1,322,289

1,380,409

1,518,786

Total deposits 16,799,883

16,771,760 15,539,475 Federal funds purchased and securities

sold under agreements to repurchase 1,256,081

1,122,988

923,014 Other borrowings 111,817

111,520 111,972 Other

liabilities 311,225

321,443 372,345

Total liabilities 18,479,006

18,327,711

16,946,806 Stockholders’ equity: Preferred stock —

—

— Common stock 446,387

446,387 436,043 Capital surplus

1,042,065

1,032,985 976,101 Retained earnings 575,419

620,780 596,177 Treasury stock (8,362 )

(22,872

) (733 ) Accumulated other comprehensive income 110,538

118,056 61,134

Total stockholders’

equity 2,166,047

2,195,336 2,068,722 Non-controlling

interest 4,314

3,870 1,768

Total

equity 2,170,361

2,199,206 2,070,490

Total liabilities and equity $ 20,649,367

$ 20,526,917

$ 19,017,296

COMMERCE BANCSHARES, INC. and

SUBSIDIARIES

AVERAGE BALANCE

SHEETS — AVERAGE RATES AND YIELDS

(Unaudited)

(Dollars in thousands)

For the Three Months Ended December 31, 2011

March

31, 2012 March 31, 2011

AverageBalance

Avg. RatesEarned/Paid

AverageBalance

Avg. RatesEarned/Paid

AverageBalance

Avg. RatesEarned/Paid

ASSETS: Loans: Business (A) $

2,819,598 3.53 %

$ 2,893,973 3.52 % $

3,052,611 3.65 % Real estate — construction and land 386,738 4.52

380,484 4.34 451,536 4.49 Real estate — business

2,162,052 4.67

2,184,893 4.57 2,081,359 4.92 Real

estate — personal 1,421,296 4.64

1,441,520 4.58

1,443,707 5.00 Consumer 1,111,299 6.08

1,107,878 5.93

1,147,049 6.47 Revolving home equity 464,694 4.24

454,782

4.18 475,437 4.28 Consumer credit card 733,712 11.62

731,030 11.78 775,271 10.92 Overdrafts 7,101

—

7,587 — 7,121

—

Total loans (B) 9,106,490

5.01

9,202,147

4.95 9,434,091 5.15 Loans held

for sale 36,987 2.55

12,147 3.48 58,148 2.08

Investment securities: U.S. government and federal agency

obligations 328,641 2.49

328,106 2.08 434,656 3.84

Government-sponsored enterprise obligations 305,003 1.93

283,494 2.01 208,866 2.07 State and municipal

obligations (A) 1,239,330 4.16

1,263,303 4.17

1,112,740 4.63 Mortgage-backed securities 4,453,362 2.71

4,190,982 2.85 2,929,270 3.93 Asset-backed securities

2,645,538 1.12

2,761,896 1.16 2,321,312 1.44 Other

marketable securities (A) 164,545 5.39

162,616 4.11 175,860

5.91 Total available for sale securities (B)

9,136,419 2.46

8,990,397 2.48 7,182,704 3.22 Trading

securities (A) 19,785 2.87

32,628 2.95 19,016 2.88

Non-marketable securities (A) 110,486 10.81

116,873 8.55 103,810

7.04

Total investment securities 9,266,690

2.56

9,139,898

2.56 7,305,530 3.28 Short-term

federal funds sold and securities purchased under agreements to

resell 10,162 .39

13,695 .50 5,100 .80 Long-term

securities purchased under agreements to resell 850,000 1.97

850,000 2.02 567,778 1.54 Interest earning deposits

with banks 122,953 .25

87,919

.25 146,493 .25

Total

interest earning assets 19,393,282 3.67

19,305,806 3.66 17,517,140 4.20

Non-interest earning assets (B) 1,121,569

1,160,906 1,034,350

Total assets $

20,514,851

$ 20,466,712 $ 18,551,490

LIABILITIES AND EQUITY: Interest bearing

deposits: Savings $ 529,027 .17

$ 549,998

.15 $ 500,386 .14 Interest checking and money market

8,068,003 .29

8,311,734 .24 7,398,662 .37 Time open

& C.D.’s of less than $100,000 1,186,324 .75

1,155,882

.73 1,426,157 1.06 Time open & C.D.’s of $100,000 and

over 1,367,472 .59

1,444,252

.53 1,433,564 .76

Total interest bearing deposits 11,150,826 .43

11,461,866 .32 10,758,769

.50

Borrowings: Federal funds purchased

and securities sold under agreements to repurchase 1,147,421 .05

1,287,245 .07 1,022,784 .25 Other borrowings 112,024

3.26

111,800 3.26

112,381 3.30

Total borrowings

1,259,445 .33

1,399,045

.33 1,135,165 .55

Total

interest bearing liabilities 12,410,271 .37 %

12,860,911 .32 % 11,893,934 .51

% Non-interest bearing deposits 5,173,106

5,132,305

4,437,032 Other liabilities 789,564

275,349 168,248

Equity 2,141,910

2,198,147 2,052,276

Total liabilities and equity $ 20,514,851

$ 20,466,712 $ 18,551,490 Net interest

income (T/E) $ 167,940

$ 165,666 $

166,479 Net yield on interest earning assets

3.44 %

3.45 %

3.85 % (A) Stated on a tax equivalent

basis using a federal income tax rate of 35%. (B) The allowance for

loan losses and unrealized gains/(losses) on available for sale

securities are included in non-interest earning assets.

COMMERCE BANCSHARES, INC.Management

Discussion of First Quarter ResultsMarch 31, 2012

For the quarter ended March 31, 2012, net income attributable to

Commerce Bancshares, Inc. (net income) amounted to $65.8 million,

an increase of $5.3 million over the same quarter last year, and an

increase of $4.3 million compared to the previous quarter. During

the current quarter, the Company recorded a loss in fair value of

$3.0 million pre-tax on an office building which formerly housed

its operations center, which is held for sale. Also, the Company

recognized certain incentives totaling $1.1 million, pre-tax,

associated with new bankcard network agreements that became

effective in the first quarter. The after-tax effect of these items

amounted to a decrease in net income for the quarter of $1.3

million, or $.01 per share. For the current quarter, the return on

average assets was 1.29%, the return on average equity was 12.0%,

and the efficiency ratio was 58.9%.

Compared to the same quarter last year, net interest income (tax

equivalent) decreased by $813 thousand to $165.7 million, while

non-interest income decreased slightly to $94.6 million, and

included both the fair value adjustment on the office building

noted above and a decline of $5.9 million in debit card interchange

income due to regulatory changes in 2011. Investment securities

gains this quarter totaled $4.0 million compared to gains of $1.3

million in the same period last year, with virtually all of these

gains due to fair value adjustments on the Company's private equity

investments. Non-interest expense for the current quarter totaled

$150.5 million, a decrease of $3.5 million from the same period

last year. The provision for loan losses totaled $8.2 million,

representing a decline of $7.6 million from the amount recorded in

the same quarter last year.

Balance Sheet Review

During the 1st quarter of 2012, average loans, including loans

held for sale, increased $70.8 million compared to the previous

quarter but decreased $277.9 million, or 2.9%, compared to the same

period last year. The increase in average loans compared to the

previous quarter was mainly due to an increase in business,

business real estate and personal real estate loans of $74.4

million, $22.8 million and $20.2 million, respectively. Within the

consumer loan portfolio, marine/RV loans continued to run off this

quarter by approximately $24.0 million on average; however,

consumer auto loans increased $16.8 million due to higher new loan

originations. The demand for construction loans continues to be

affected by the weak housing industry and, overall, these loans

declined by 1.6% this quarter.

Total available for sale investment securities (excluding fair

value adjustments) averaged $9.0 billion this quarter, down $146.0

million compared to the previous quarter. The decrease in the

average balance was mainly the result of maturities and pay-downs

totaling $643.2 million in the 1st quarter of 2012, offset by

purchases of new securities of $540.9 million during the current

quarter. At March 31, 2012, the duration of the investment

portfolio was 2.3 years, and maturities of approximately $1.6

billion are expected to occur during the next 12 months.

Total average deposits increased $270.2 million, or 1.7%, during

the 1st quarter of 2012 compared to the previous quarter. This

increase in average deposits resulted mainly from growth in money

market deposit balances of $232.0 million. Also, certificate of

deposit (CD) average balances increased $46.3 million. The average

loans to deposits ratio in the current quarter was 55.5%, compared

to 56.0% in the previous quarter.

During the current quarter, the Company's average borrowings

increased $139.6 million compared to the previous quarter. This

increase was mainly due to an increase in customer repurchase

agreement balances.

Net Interest Income

Net interest income (tax equivalent) in the 1st quarter of 2012

amounted to $165.7 million, compared with $167.9 million in the

previous quarter, or a decrease of $2.3 million. Net interest

income this quarter was down $813 thousand compared to the 1st

quarter of last year. During the 1st quarter of 2012, the net yield

on earning assets (tax equivalent) was 3.45%, compared with 3.44%

in the previous quarter and 3.85% in the same period last year.

The decrease in net interest income (tax equivalent) in the 1st

quarter of 2012 from the previous quarter was mainly due to fewer

days in the current quarter and lower rates earned on loans, which

were partly offset by a decline in rates paid on deposit accounts.

Interest on loans, including held for sale loans, declined $2.0

million (tax equivalent), mainly due to lower average rates earned

on business real estate, personal real estate and consumer loans,

but partly offset by higher average balances of business, business

real estate and personal real estate loans. When compared to the

previous quarter, interest income on investment securities declined

by $1.5 million (tax equivalent), mainly due to lower average

balances of mortgage-backed securities and lower rates earned on

U.S. government and non-marketable securities. Inflation income

earned on inflation-protected securities declined by $358 thousand

this quarter and was not significant.

Interest expense on deposits declined $1.3 million in the 1st

quarter of 2012 compared with the previous quarter mainly due to

lower rates paid on money market and CD accounts. Overall rates

paid on total interest bearing deposits declined 5 basis points to

.32% this quarter. Interest expense on borrowings increased

slightly this quarter, due mainly to higher average rates paid on

repurchase agreement balances.

The tax equivalent yield on interest earning assets of 3.66% in

the 1st quarter of 2012 was consistent with the yield earned in the

4th quarter of 2011, while the overall cost of interest bearing

liabilities decreased 5 basis points to .32%.

Non-Interest Income

For the 1st quarter of 2012, total non-interest income amounted

to $94.6 million, a decrease of $1.3 million when compared to $95.9

million in the same period last year. Also, current quarter

non-interest income increased $548 thousand when compared to $94.0

million recorded in the previous quarter. The decrease in

non-interest income from the same period last year was mainly due

to a decline in debit card interchange fees this quarter, coupled

with a loss of $3.0 million due to fair value adjustments recorded

on an office building mentioned above, but offset by higher

corporate card and capital market fees.

Bank card fees in the current quarter declined $2.7 million, or

7.3%, from the same period last year as a result of a decline in

debit card interchange fees of $5.9 million, or 41.4%, (effect of

new regulations in 2011) but was partly offset by growth in

corporate card fees of $2.3 million, or 16.8%. Corporate card and

debit card fees for the current quarter totaled $15.7 million and

$8.4 million, respectively. Merchant fees grew by 15.1% and totaled

$5.7 million for the quarter.

Trust fees for the quarter increased 5.8% compared to the same

period last year resulting mainly from growth in both personal and

institutional trust fees. Deposit account fees increased slightly

this quarter compared to last year as corporate cash management and

other personal account fees grew by $925 thousand but overdraft

fees declined $888 thousand, or 9.6%. Capital market fees increased

$2.2 million this quarter compared to last year as a result of

growth in sales of mainly fixed income securities to correspondent

banks and other commercial customers. Other non-interest income

included the $3.0 million fair value loss on the office building

mentioned above.

Investment Securities Gains and Losses

Net securities gains amounted to $4.0 million in the 1st quarter

of 2012, compared to net gains of $4.9 million in the previous

quarter and net gains of $1.3 million in the same quarter last

year. The current quarter included a pre-tax gain of $4.1 million

related to quarterly fair value adjustments on the Company's

private equity investments. Minority interest expense related to

these gains totaled $893 thousand and is included in

non-controlling interest expense.

Also during the current quarter, the Company recorded

credit-related impairment losses of $320 thousand on certain

non-agency guaranteed mortgage-backed securities identified as

other-than-temporarily impaired, compared to losses of $782

thousand in the previous quarter and $274 thousand in the same

quarter last year. The cumulative credit-related impairment reserve

on these bonds totaled $10.2 million at quarter end. At March 31,

2012, the par value of non-agency guaranteed mortgage-backed

securities identified as other-than-temporarily impaired totaled

$131.7 million, compared to $169.4 million at March 31, 2011.

Non-Interest Expense

Non-interest expense for the current quarter amounted to $150.5

million, a decrease of $3.5 million, or 2.3%, from the same quarter

last year and a decrease of $5.6 million compared to the previous

quarter. During the current quarter, the Company signed new

bankcard network agreements and realized incentives which reduced

data processing expense by $1.1 million this quarter.

Compared to the 1st quarter of last year, salaries and benefits

expense increased $2.2 million, or 2.5%, mainly due to higher

incentive compensation of $725 thousand and higher medical costs,

payroll taxes, and 401K expense which totaled $817 thousand.

Full-time equivalent employees totaled 4,713 and 4,814 at March 31,

2012 and 2011, respectively.

Occupancy and equipment expense declined $1.2 million on a

combined basis partly due to the mild winter and lower depreciation

costs, while FDIC insurance expense declined $2.4 million as a

result of new assessment rules which became effective in the 2nd

quarter of 2011. Expense related to foreclosed property declined

$852 thousand, mainly due to lower losses on fair value adjustments

in the first quarter of 2012.

Income Taxes

The effective tax rate for the Company was 33.3% in the current

quarter, compared with 32.4% in the previous quarter and 31.3% in

the 1st quarter of 2011.

Credit Quality

Net loan charge-offs in the 1st quarter of 2012 amounted to

$11.2 million, compared with $15.6 million in the prior quarter and

$18.8 million in the 1st quarter of last year. The $4.5 million

decline in net loan charge-offs in the 1st quarter of 2012 compared

to the previous quarter was mainly the result of lower net loan

charge-offs on construction loans of $2.4 million, coupled with

lower losses on consumer credit card, business and personal real

estate loans. Net loan charge-offs on business real estate loans

increased modestly to $1.5 million this quarter. The ratio of

annualized net loan charge-offs to total average loans was .49% in

the current quarter compared to .68% in the previous quarter.

For the 1st quarter of 2012, annualized net loan charge-offs on

average consumer credit card loans amounted to 3.40%, compared with

3.78% in the previous quarter and 4.73% in the same period last

year. Consumer loan net charge-offs for the quarter amounted to

.96% of average consumer loans, compared to .96% in the previous

quarter and 1.42% in the same quarter last year. The provision for

loan losses for the current quarter totaled $8.2 million, a

decrease of $4.0 million from the previous quarter and $7.6 million

lower than in the same period last year. The current quarter

provision for loan losses was $3.0 million less than net loan

charge-offs for the current quarter, thereby reducing the allowance

for loan losses to $181.5 million. At March 31, 2012 this allowance

was 1.96% of total loans, excluding loans held for sale, and was

264% of total non-accrual loans.

At March 31, 2012, total non-performing assets amounted to $87.5

million, a decrease of $6.3 million from the previous quarter.

Non-performing assets are comprised of non-accrual loans ($68.9

million) and foreclosed real estate ($18.6 million). At March 31,

2012, the balance of non-accrual loans, which represented .7% of

loans outstanding, included construction and land loans of $21.1

million, business loans of $20.1 million and business real estate

loans of $20.7 million. Loans more than 90 days past due and still

accruing interest totaled $16.4 million at March 31, 2012.

Other

During the quarter ended March 31, 2012, the Company purchased

810,642 shares of treasury stock at an average cost of $38.98.

Forward Looking Information

This information contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include future financial and operating results,

expectations, intentions and other statements that are not

historical facts. Such statements are based on current beliefs and

expectations of the Company's management and are subject to

significant risks and uncertainties. Actual results may differ

materially from those set forth in the forward-looking

statements

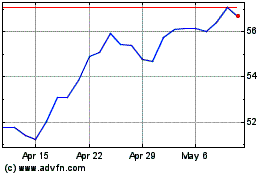

Commerce Bancshares (NASDAQ:CBSH)

Historical Stock Chart

From Apr 2024 to May 2024

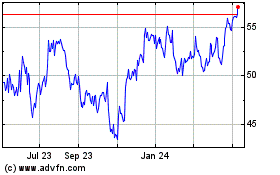

Commerce Bancshares (NASDAQ:CBSH)

Historical Stock Chart

From May 2023 to May 2024