Willdan Group, Inc. (“Willdan”) (NASDAQ:WLDN), today

announced financial results for its fourth quarter and fiscal year

2011 ended December 30, 2011.

For the fourth quarter of 2011, Willdan reported total contract

revenue of $30.0 million and a net loss of $0.8 million, or $0.11

per basic and diluted share.

For the fiscal year ended December 30, 2011, Willdan reported

total contract revenue of $107.2 million and net income of $1.8

million, or $0.25 per basic share and $0.24 per diluted share.

Tom Brisbin, Willdan’s Chief Executive Officer, stated: “We’re

pleased with our results for 2011. The investments we have made in

diversifying our business are paying off and we are now on a clear

path to sustained long-term growth. Our diversification into the

energy efficiency market, in particular, has significantly

contributed to our recovery and growth over the past three years.

We are excited about the future and believe that Willdan is poised

to deliver improved profits and stockholder returns in 2012 and

beyond.”

Fourth Quarter 2011 Results

For the fourth quarter of fiscal 2011, revenue was $30.0

million, up $10.1 million, or 51.0%, from revenue of $19.9 million

for the comparable period last year. On a sequential basis, revenue

was up $1.4 million, or 4.9%, from the third quarter of 2011.

Income from operations was $0.3 million for the fourth quarter of

fiscal 2011, as compared to $30,000 for the comparable period last

year. On a sequential basis, income from operations decreased $2.1

million from $2.4 million in the third quarter of 2011.

Net loss was $0.8 million for the fourth quarter of fiscal 2011,

as compared to net income of $0.3 million in the comparable period

last year and net income of $2.2 million in the third quarter of

2011.

Basic and diluted loss per share for the fourth quarter of

fiscal 2011 was $0.11 as compared to basic and diluted earnings per

share of $0.04 for the comparable period last year.

Willdan used $3.7 million in cash flow from operations in the

fourth quarter of fiscal 2011.

Fiscal Year 2011 Results

Revenue for fiscal year 2011 was $107.2 million, up $29.3

million, or 37.6%, from revenue of $77.9 million for fiscal year

2010. Income from operations was $3.4 million for fiscal year 2011

as compared to $3.1 million for fiscal year 2010. Net income was

$1.8 million for fiscal year 2011 as compared to $2.7 million for

fiscal year 2010.

Basic and diluted earnings per share for fiscal year 2011 were

$0.25 and $0.24, respectively, as compared to basic and diluted

earnings per share of $0.38 and $0.37, respectively, for fiscal

year 2010.

Willdan used $0.7 million in cash flow from operations in the

year ended December 30, 2011.

Three Months Ended Twelve Months

Ended In thousands (except EPS data) December 30,

2011

December 31,

2010

December 30,

2011

December 31,

2010

Revenue $ 30,006 $ 19,872 $ 107,165 $ 77,896 Income from

operations 347 30 3,401 3,074 Interest income — 3 5 12 Interest

expense (24 ) (17 ) (77 ) (54 ) Other, net (4 ) 15 1 32 Income tax

(expense) benefit (1,098 ) 251 (1,500 ) (344 ) Net (loss) income $

(779 ) $ 282 $ 1,830 $ 2,720 (Loss) earnings per share Basic

$ (0.11 ) $ 0.04 $ 0.25 $ 0.38 Diluted $ (0.11 ) $ 0.04 $ 0.24 $

0.37 Weighted average shares outstanding: Basic 7,273 7,245

7,262 7,233 Diluted 7,273 7,380 7,485 7,311

Use of Non-GAAP Financial Measures

Adjusted EBITDA is a supplemental measure used by Willdan’s

management to measure its operating performance. Willdan defines

Adjusted EBITDA as net income (loss) plus net interest expense,

income tax expense (benefit), depreciation and amortization and

other non-recurring income and expense items occurring in such

period. Willdan’s definition of Adjusted EBITDA may differ from

those of many companies reporting similarly named measures. This

measure should be considered in addition to, and not as a

substitute for or superior to, other measures of financial

performance prepared in accordance with U.S. generally accepted

accounting principles, or GAAP, such as net income. Willdan

believes Adjusted EBITDA enables management to separate

non-recurring income and expense items from its results of

operations to provide a more normalized and consistent view of

operating performance on a period-to-period basis. Willdan uses

Adjusted EBITDA to evaluate its performance for, among other

things, budgeting, forecasting and incentive compensation purposes.

Willdan also believes Adjusted EBITDA is useful to investors,

research analysts, investment bankers and lenders because it

removes from its operational results the impact of certain

non-recurring income and expense items, which may facilitate

comparison of its results from period-to-period.

Adjusted EBITDA is not a recognized term under GAAP and does not

purport to be an alternative to operating income or net income as

an indicator of operating performance or any other GAAP

measure.

Adjusted EBITDA increased to $4.3 million for fiscal year 2011

from $4.1 million for fiscal year 2010.

The following is a reconciliation of net income (loss) to

Adjusted EBITDA:

In thousands

Twelve Months Ended December 30,

2011

December 31,

2010

Net income $ 1,830 $ 2,720 Interest income (5 ) (12 )

Interest expense 77 54 Income tax expense 1,500 344 Lease

abandonment expense (recovery) 2 (68 ) Depreciation and

amortization 944 1,053 Loss (gain) on sale of assets 2 (17 )

Adjusted EBITDA $ 4,350 $ 4,074

Liquidity and Capital Resources

Willdan had $3.0 million in cash and cash equivalents at

December 30, 2011, compared with $6.6 million at December 31, 2010.

Willdan had $0.3 million in outstanding borrowings under a $5.0

million revolving line of credit at the end of fiscal year

2011.

Conference Call and Webcast

Chief Executive Officer Thomas Brisbin and Chief Financial

Officer Kimberly Gant plan to host a conference call on March 27,

2012 at 5:00 p.m. Eastern/2:00 p.m. Pacific to discuss Willdan’s

financial results.

Interested parties may participate in the conference call by

dialing 877-941-8609 (480-629-9692 for international callers). When

prompted, ask for the “Willdan Group, Inc., Fourth Quarter 2011

Conference Call.” The conference call will be webcast

simultaneously on Willdan’s website at www.willdan.com under

Investors: Events.

The telephonic replay of the conference call may be accessed

approximately two hours after the call through April 10, 2012, by

dialing 800-406-7325 (303-590-3030 for international callers). The

replay access code is 4512338. The webcast replay will be archived

for 12 months.

About Willdan Group, Inc.

Founded over 45 years ago, Willdan is a provider of professional

technical and consulting services to small and mid-sized public

agencies, large public utilities and, to a lesser extent, private

industry primarily located in California, New York and Arizona.

Willdan provides a broad range of services to clients, including

civil engineering and planning, energy efficiency and

sustainability, economic and financial consulting, and homeland

security and communications and technology. For additional

information, visit Willdan’s website at www.willdan.com.

Forward-Looking Statements

Safe Harbor Statement: Statements in this press release which

are not purely historical, including statements regarding Willdan’s

intentions, hopes, beliefs, expectations, representations,

projections, estimates, plans or predictions of the future are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements involve risks and uncertainties including, but not

limited to, the risk that Willdan will not be able to expand its

services or meet the needs of customers in markets in which it

operates. It is important to note that Willdan’s actual results

could differ materially from those in any such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, a slowdown in the local

and regional economies of the states where Willdan conducts

business and the loss of or inability to hire additional qualified

professionals. Willdan’s business could be affected by a number of

other factors, including the risk factors listed from time to time

in Willdan’s SEC reports including, but not limited to, the Annual

Report on Form 10-K to be filed for the year ended December 30,

2011. Willdan cautions investors not to place undue reliance on the

forward-looking statements contained in this press release. Willdan

disclaims any obligation to, and does not undertake to, update or

revise any forward-looking statements in this press release.

WILLDAN GROUP, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 30,2011 December

31,2010 Assets Current assets: Cash and cash

equivalents $ 3,001,000 $ 6,642,000 Accounts receivable, net of

allowance for doubtful accounts of $421,000 and $959,000

at December 30, 2011 and December 31,

2010, respectively

16,782,000 14,484,000 Costs and estimated earnings in excess of

billings on uncompleted contracts 20,672,000 11,343,000 Other

receivables 175,000 176,000 Prepaid expenses and other current

assets 1,724,000 1,714,000 Total current assets 42,354,000

34,359,000 Equipment and leasehold improvements, net

1,217,000 1,496,000 Goodwill 15,208,000 12,475,000 Other intangible

assets, net 49,000 95,000 Other assets 383,000 407,000 Deferred

income taxes 5,100,000 622,000 Total assets $ 64,311,000 $

49,454,000

Liabilities and Stockholders’ Equity

Current liabilities: Excess of outstanding checks over bank balance

$ 1,777,000 $ 1,223,000 Borrowings under line of credit 256,000

1,000,000 Accounts payable 8,182,000 5,380,000 Accrued liabilities

10,192,000 5,985,000 Billings in excess of costs and estimated

earnings on uncompleted contracts 752,000 1,041,000 Current portion

of notes payable 600,000 90,000 Current portion of capital lease

obligations 163,000 173,000 Current portion of deferred income

taxes 7,349,000 1,407,000 Total current liabilities 29,271,000

16,299,000 Notes payable, less current portion 77,000

131,000 Capital lease obligations, less current portion 136,000

96,000 Deferred lease obligations 534,000 766,000 Total liabilities

30,018,000 17,292,000 Commitments and contingencies

Stockholders’ equity: Preferred stock, $0.01 par value, 10,000,000

shares authorized, no shares issued and

outstanding

— — Common stock, $0.01 par value, 40,000,000 shares authorized;

7,274,000 and 7,246,000

shares issued and outstanding at December

30, 2011 and December 31, 2010, respectively

73,000 72,000 Additional paid-in capital 34,065,000 33,765,000

Accumulated earnings (deficit) 155,000 (1,675,000 ) Total

stockholders’ equity 34,293,000 32,162,000 Total liabilities and

stockholders’ equity $ 64,311,000 $ 49,454,000

WILLDAN GROUP, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

Fiscal Year 2011 2010

2009 Contract revenue $ 107,165,000 $ 77,896,000 $

61,605,000 Direct costs of contract revenue (exclusive of

depreciation and amortization shown separately below): Salaries and

wages 25,714,000 21,607,000 18,130,000 Subconsultant services

34,195,000 16,523,000 7,997,000 Other direct costs 4,818,000

3,892,000 2,715,000

Total direct costs of contract revenue

64,727,000 42,022,000 28,842,000 General and administrative

expenses: Salaries and wages, payroll taxes and employee benefits

22,594,000 17,582,000 20,325,000 Facilities and facility related

4,875,000 4,290,000 4,430,000 Stock-based compensation 201,000

235,000 272,000 Depreciation and amortization 877,000 1,042,000

1,814,000 Lease abandonment (recovery), net 2,000 (68,000 ) 707,000

Impairment of goodwill — — 2,763,000 Litigation accrual (reversal)

— — (1,125,000 ) Other 10,488,000 9,719,000 11,070,000 Total

general and administrative expenses 39,037,000 32,800,000

40,256,000 Income (loss) from operations 3,401,000 3,074,000

(7,493,000 ) Other (expense) income: Interest income 5,000

12,000 30,000 Interest expense (77,000 ) (54,000 ) (38,000 ) Other,

net 1,000 32,000 (5,000 ) Total other (expense) income, net (71,000

) (10,000 ) (13,000 ) Income (loss) before income taxes 3,330,000

3,064,000 (7,506,000 ) Income tax expense (benefit)

1,500,000 344,000 (1,931,000 ) Net income (loss) $ 1,830,000 $

2,720,000 $ (5,575,000 ) Earnings (loss) per share: Basic $

0.25 $ 0.38 $ (0.78 ) Diluted $ 0.24 $ 0.37 $ (0.78 )

Weighted-average shares outstanding: Basic 7,262,000 7,233,000

7,192,000 Diluted 7,485,000 7,311,000 7,192,000

WILLDAN GROUP, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

Fiscal Year 2011 2010

2009 Cash flows from operating activities: Net income (loss)

$ 1,830,000 $ 2,720,000 $ (5,575,000 ) Adjustments to reconcile net

income (loss) to net cash (used in) provided by

operating activities:

Non-cash revenue from subcontractor settlement (902,000 ) — —

Depreciation and amortization 944,000 1,053,000 1,814,000 Deferred

income taxes 1,465,000 389,000 (1,890,000 ) Goodwill impairment — —

2,763,000 Lease abandonment expense (recovery), net 2,000 (68,000 )

707,000 Loss (gain) on sale of equipment 2,000 (17,000 ) 6,000

Provision for doubtful accounts 209,000 20,000 1,829,000

Stock-based compensation 201,000 235,000 272,000 Changes in

operating assets and liabilities: Accounts receivable (2,507,000 )

(4,407,000 ) 936,000 Costs and estimated earnings in excess of

billings on uncompleted contracts (8,427,000 ) (4,694,000 )

1,632,000 Income tax receivable — 51,000 905,000 Other receivables

1000 (103,000 ) (25,000 ) Prepaid expenses and other current assets

(10,000 ) (214,000 ) 284,000 Other assets 24,000 (89,000 ) 55,000

Accounts payable 2,802,000 3,923,000 (654,000 ) Accrued liabilities

4,206,000 1,476,000 (959,000 ) Billings in excess of costs and

estimated earnings on uncompleted contracts (289,000 ) 11,000

326,000 Deferred lease obligations (234,000 ) (189,000 ) (272,000 )

Net cash (used in) provided by operating activities (683,000 )

97,000 2,154,000 Cash flows from investing activities:

Purchase of equipment and leasehold improvements (395,000 )

(685,000 ) (386,000 ) Proceeds from sale of equipment 6,000 40,000

— Payments related to business acquisitions (2,733,000 ) (2,104,000

) (2,373,000 ) Net cash used in investing activities (3,122,000 )

(2,749,000 ) (2,759,000 ) Cash flows from financing

activities: Changes in excess of outstanding checks over bank

balance 554,000 735,000 40,000 Payments on notes payable (211,000 )

(17,000 ) (46,000 ) Proceeds from notes payable 667,000 214,000 —

Borrowings under line of credit 33,965,000 14,123,000 3,553,000

Repayments of line of credit (34,709,000 ) (14,123,000 ) (2,553,000

) Principal payments on capital leases (202,000 ) (173,000 )

(172,000 ) Proceeds from stock option exercise 7,000 3,000 —

Proceeds from sales of common stock under employee stock purchase

plan 93,000 87,000 84,000 Net cash provided by financing activities

164,000 849,000 906,000 Net (decrease) increase in cash and

cash equivalents (3,641,000 ) (1,803,000 ) 301,000 Cash and cash

equivalents at beginning of the year 6,642,000 8,445,000 8,144,000

Cash and cash equivalents at end of the year $ 3,001,000 $

6,642,000 $ 8,445,000 Supplemental disclosures of cash flow

information: Cash paid during the period for: Interest $ 77,000 $

52,000 $ 40,000 Income taxes 70,000 48,000 3,000 Supplemental

disclosures of noncash investing and financing activities:

Equipment acquired under capital leases $ 247,000 $ 240,000 $

60,000

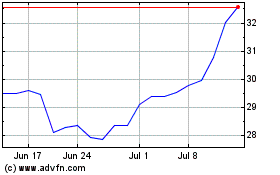

Willdan (NASDAQ:WLDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

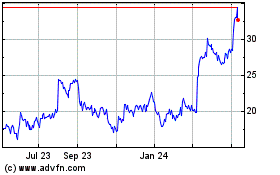

Willdan (NASDAQ:WLDN)

Historical Stock Chart

From Apr 2023 to Apr 2024