SCHEDULE 14 C

(Rule 14c-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

|

|

|

|

Check the appropriate box:

[X] Preliminary Information Statement

|

|

|

[ ] Definitive Information Statement

|

|

|

[ ] Confidential, For Use of the Commission Only

(as permitted by Rule 14c-5(d)(2))

|

|

BRAVO MULTINATIONAL, INC.

_____________________________________________________________________________________________

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X ] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14c5(g) and 0-11.

(1)Title of each class of securities to which transaction applies:

Not Applicable

(2)Aggregate number of securities to which transaction applies:

Not Applicable

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing is calculated and state how it was determined):

Not Applicable

(4)Proposed maximum aggregate value of transaction:

Not Applicable

(5)Total fee paid:

Not Applicable

[ ] Fee paid previously with preliminary materials:

_____________________________________________________________________________________________

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of its filing.

(1) Amount previously paid:

Not Applicable

(2) Form, Schedule or Registration Statement No.

Not Applicable

(3) Filing Party:

Not Applicable

(4) Date Filed:

Not Applicable

-1-

INFORMATION STATEMENT

Relating to a Reverse Stock Split and Annual Meeting of Bravo Multinational, Inc.

BRAVO MULTINATIONAL, INC.

Dear Bravo Multinational, Inc. Shareholders:

NOTICE IS HEREBY GIVEN that we have received written consents in lieu of a meeting from stockholders representing a majority of our outstanding shares of voting stock, approving the following actions:

1.) Approval of a 300 for 1 reverse stock split and recapitalization.

2.) Approval of the election of Directors.

3.) Approval of an amendment of our articles of incorporation to increase the number of authorized preferred shares and to authorize undesignated preferred shares.

4.)To approve the ratification of Kappin Certified Public Accountants, as our outside auditors.

As of the close of business on January 16, 2017, the record date for shares entitled to notice of and to sign written consents in connection with the recapitalization, there were 257,560,828 shares of our common stock and 5,000,000 shares of our preferred stock outstanding. Prior to the mailing of this Information Statement, certain shareholders who represent a majority of our outstanding voting shares, signed written consents approving each of the actions listed above on the terms described herein (the “Actions”). As a result, the Actions have been approved and neither a meeting of our stockholders nor additional written consents are necessary.

We are not asking you for a Proxy and you are requested not to send us a Proxy

. The Actions will be effective 20 days from the mailing of this Information Statement, which is expected to take place on February 13, 2017, and such Actions will result in the following:

1.) Each three hundred shares of common stock outstanding will be converted into one share of common stock of the Company.

The Plan of Recapitalization provides for the mandatory exchange of shares from the current common stock to new common stock representing one-three hundredth (1/300

th

) of the previous number of shares held. We urge you to follow the instructions set forth in the attached Information Statement under “Exchange of Stock”.

2.) The following persons were elected to the board of directors to serve until the next annual meeting or until their replacement is elected:

Paul Parliament

Director

Douglas Brooks

Director

Richard Kaiser

Director

2

3.)

The Articles of Incorporation will be amended to increase the authorized shares to 1,050,000,000, consisting of 1,000,000,000 shares of common stock and 50,000,000 shares of preferred stock. The common and preferred shares will have a par value of $.0001 per share. The preferred shares are blank check preferred and they may be issued with the preferences determined by the board of directors.

4.)

Kappin Certified Public Accountants, will be approved to act as our outside auditors for our fiscal year ending December 31, 2016 and December 31, 2017.

The Company will pay all costs associated with the distribution of the Information Statement, including the cost of printing and mailing. The Company will reimburse brokerage and other custodians, nominees and fiduciarie

s

for reasonable expenses incurred by them in sending the Information Statement to the beneficial owners of the Company’s common stock.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS: NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN, AND NO PROXY OR VOTE IS SOLICITED BY THIS NOTICE. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ACTIONS, DESCRIBED MORE SPECIFICALLY BELOW, HAVE ALREADY BEEN APPROVED BY WRITTEN CONSENT OF HOLDERS OF A MAJORITY OF THE OUTSTANDING SHARES OF COMMON STOCK OF THE COMPANY. A VOTE OF THE REMAINING SHAREHOLDERS IS NOT NECESSARY.

By Order of the Board of Directors,

/s/ Paul Parliament

Paul Parliament, President

3

PROPOSAL TO APPROVE A PLAN OF RECAPITALIZATION AND TO AMEND THE COMPANY’S ARTICLES OF INCORPORATION TO PROVIDE

FOR A REVERSE STOCK SPLIT

INTRODUCTION

The Board of Directors of the Company has unanimously approved a proposal to amend the Company’s Articles of Incorporation to effect a plan of recapitalization that provides for a one-for-three hundred (1-for-300) reverse stock split of our common stock, subject to the approval of such action by the shareholders. Pursuant to written resolutions, the shareholders of the Company voted to approve the proposal to authorize the reverse split. We are now notifying you and the other shareholders that did not participate in the action of the majority of the shareholders. The reverse stock split will take effect, after we file a Certificate of Amendment to the Articles of Incorporation with the Secretary of State of the State of Delaware.

We expect that the Certificate of Amendment will be filed promptly after your receipt of this Information Statement. However, our board of directors may elect not to file, or to delay the filing of, the Certificate of Amendment if they determine that filing the Certificate of Amendment would not be in the best interest of our shareholders.

Under the plan of recapitalization and reverse stock split, each three hundred (300) shares of the Company’s outstanding common stock on the effective date (the “Old Common Stock”) of the reverse stock split (the “Effective Date”) will be automatically changed into and will become one share of the Company’s New Common Stock (the “New Common Stock”). Any resulting fractional shares will not be issued. Shareholders entitled to receive a fractional share as a result of the reverse split will instead receive from the Company a whole share of common stock. The reverse stock split will not change the current per share par value of the Company’s common stock nor change the current number of authorized shares of common stock. See “Approval of the Amendment To Increase Authorized Shares and To Authorize Preferred Shares.” The effective date of the reverse stock split will be the date the articles of amendment are accepted for filing by the Delaware Secretary of State.

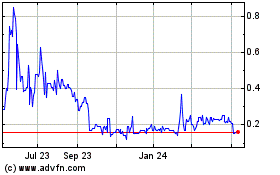

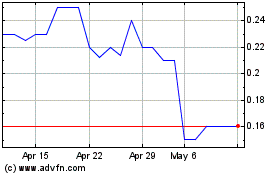

REASONS FOR THE REVERSE STOCK SPLIT

The Board of Directors has reviewed the Company’s current business and financial performance. The Board then determined that a reverse stock split was desirable in order to attempt to achieve the following benefits, each of which is described below in more detail:

§

encourage greater investor interest in the Company’s common stock by making the stock price more attractive to the many investors who refrain from investing in lower-priced stocks; and

§

reduce trading fees and commissions incurred by shareholders, since these costs are based to some extent on the number of shares traded.

The number of shares reserved for issuance under the Company’s existing stock option plans and employee stock purchase plan, if any, will be reduced to one-three hundredth (1/300

th

) the number of shares currently included in the plans.

ENCOURAGE GREATER INVESTOR INTEREST IN THE COMPANY'S COMMON STOCK

The Board of Directors believes that the reverse stock split will encourage greater interest in the Company’s common stock by the investment community. The Board of Directors believes that the current market price of the Company’s common stock may impair its acceptability to institutional investors, professional investors and other members of the investing public. Many institutional and other investors look upon stocks trading at low prices as unduly speculative in nature and, as a matter of policy, avoid investing in such stocks. Further, various brokerage house policies and practices tend to discourage individual brokers from dealing in low-priced stocks. If effected, the reverse stock split would reduce the number of outstanding shares of the Company’s common stock, and the Board of Directors anticipates that the trading price of the common stock would increase. The Board of Directors believes that raising the trading price of the Company’s common stock will increase the attractiveness of the common stock to the investment community and possibly promote greater liquidity for the Company’s existing shareholders.

4

Even though a reverse stock split, by itself, does not impact a company’s assets or prospects, a reverse stock split could result in a decrease in our aggregate market capitalization. Our board of directors, however, believes that this risk is offset by the prospect that the reverse stock split will improve the trading price of its common stock. There can be no assurance, however, that the reverse stock split will succeed in raising the bid price of our common stock, or that a bid price increase, if achieved, would be maintained.

Our common stock is currently registered under Section 12 of the Exchange Act, and as a result, we are subject to the periodic reporting and other requirements of the Exchange Act. The reverse stock split will not affect the registration of our common stock under the Exchange Act and we have no present intention of terminating its registration under the Exchange Act in order to become a private company.

The reverse split will not materially affect the proportionate equity interest in the Company of any current shareholder or the relative rights, preferences, privileges or priorities of any such shareholder. The Company’s business, management (including all directors and officers), the location of its offices, assets, liabilities and net worth (other than the cost of the reverse split, which are immaterial) will remain the same after the reverse split. The reverse stock split will have the effect of creating additional authorized and unissued shares of our common stock. We have no current plans to issue these shares, however, these shares may be used by us for general corporate purposes in the future.

As of January 1, 2017, there were approximately 113 holders of record of the Company’s existing common stock. The Company does not anticipate that the reverse split will cause the number of holders of record or the beneficial owners to change significantly. The reverse stock split may result in some shareholders owning odd lots of less than 100 shares of common stock. Brokerage commissions and other transaction costs in odd lots are generally somewhat higher than the costs of transactions in round-lots of even multiples of 100 shares.

The direct result of the reverse stock split will be that the approximately 257,560,828 shares of common stock outstanding on January 1, 2017 will become approximately 858,536 shares of common stock, and any other shares issued prior to the effectiveness of this proposal will be similarly adjusted. The common stock issued pursuant to the reverse split will be fully paid and non-assessable. All shares of the common stock issued will have the same voting rights and other rights as shares of the existing common stock. If the proposed amendment becomes effective, each option to purchase common stock, outstanding on the effective date, will be automatically adjusted so that the number of shares of common stock issuable upon their exercise shall be divided by three hundredth (300) (and corresponding adjustments will be made to the number of shares vested under each outstanding option and under the Company’s option plans) and the exercise price of each option shall be multiplied by three hundred (300), subject to rounding. The result of this adjustment will be that the aggregate exercise price of such options required to be paid after the reverse split will be the same as that required prior to the reverse split and the proportionate ownership interest on exercise of such options will also remain the same.

5

REDUCE TRADING FEES AND COMMISSIONS INCURRED BY SHAREHOLDERS

Because broker commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current share price of the Company’s common stock, in the absence of the reverse stock split, may continue to result in individual shareholders paying transaction costs (commissions, markups or markdowns) which are a higher percentage of their total share value than would be the case if the stock price was substantially higher. This factor may further limit the willingness of institutions to purchase the Company’s common stock at its current market price.

The Company’s Board of Directors also took into consideration a number of negative factors associated with reverse stock splits, including: the negative perception of reverse stock splits held by many investors, analysts and other stock market participants; the fact that the stock price of some companies that have recently effected reverse stock splits has subsequently declined back to pre-reverse stock split levels; and the costs associated with implementing the reverse stock split. The Board, however, determined that these negative factors were outweighed by the expected benefits described above.

There can be no assurance that the reverse stock split will result in the benefits described above. Specifically, there can be no assurance that the market price of the Company’s common stock immediately after the effective date of the proposed reversed stock split would be maintained for any period of time or that such market price per share would approximate five hundred times the market price of the Company’s common stock before the reverse stock split. There can also be no assurance that the reverse stock split will not further adversely impact the market price of the Company’s common stock. In addition, it is possible that the liquidity of the Company’s common stock will be adversely affected by the reduced number of shares outstanding after the reverse stock split.

SHARE CERTIFICATES AND FRACTIONAL SHARES

The reverse split will occur on the filing of the Certificate of Amendment with the Delaware Secretary of State without any further action on the part of shareholders of the Company and without regard to the date or dates on which shares of existing common stock are actually surrendered by each holder thereof for shares of the New Common Stock that the shareholder is entitled to receive as a consequence of the reverse split. After the effective date of the amendment, the certificates representing shares of existing common stock will be deemed to represent one-three hundredth (1/300th) of the number of shares of New Common Stock. As described more fully in the paragraph below under the heading Exchange of Stock shares of New Common Stock will be issued electronically to the account of each stockholder. Any certificates outstanding will be submitted for exchange to the transfer agent.

EXCHANGE OF STOCK

Following the delivery of this Information Statement we will instruct our corporate secretary and transfer agent to begin implementing the exchange to holders of outstanding common stock. As soon as practicable after the effectiveness of the proposed amendment, holders of our common stock will be notified, and/or transfer agent will electronically exchange the shares in the accounts of shareholders to New Common Stock. Beginning on the date the proposed amendment becomes effective, each certificate representing shares of our Old Common Stock will be deemed for all corporate purposes to evidence ownership of as many shares of New Common Stock after applying the split and otherwise making adjustments for fractional shares described below. Until surrendered to the Transfer Agent, certificates for Old Common Stock retained by shareholders will be deemed for all purposes including voting and payment of dividends, if any, to represent the number of whole shares of New Common Stock to which its shareholders are entitled as a result of the reverse split.

6

Most of our shares are held in electronic form at various broker dealers. Shareholders who hold physical certificates, if any, should not send their old certificates to the transfer agent until after the effective date. Shares of Old Common Stock surrendered after the effective date will be replaced by certificates representing shares of New Common Stock as soon as practicable after the surrender. No service charge will be paid by existing shareholders for the exchange of the shares and the Company will pay all expenses of the exchange and issuance of new shares.

FRACTIONAL SHARES

No fractional shares of common stock will be issued as a result of the reverse stock split. In lieu of receiving fractional shares, all such fractions shall be rounded up so that you will receive one whole share for each fractional share to which you would otherwise be entitled.

FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE SPLIT

The following description of the material federal income tax consequences of the reverse stock split is based upon the Internal Revenue Code, the applicable Treasury Regulations promulgated thereunder, judicial authority and current administrative rulings and practices all as in effect on the date of this information statement. Changes to these laws could alter the tax consequences described below, possibly with retroactive effect. The Company has not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the reverse stock split. This discussion is for general information only and does not discuss consequences which may apply to special classes of taxpayers (for example, foreign persons, dealers in securities, tax-exempt organizations, broker-dealers or insurance companies) and does not discuss the tax consequences under the laws of any foreign, state or local jurisdictions. Shareholders are urged to consult their own tax advisors to determine the particular tax consequences to them.

The Company believes that because the reverse stock split is not part of a plan to increase any shareholder’s proportionate interest in the Company’s assets or earnings and profits, the reverse stock split will likely have the following federal income tax effects: Shareholders who receive New Common Stock solely in exchange for their Old Common Stock will not recognize gain or loss on the exchange. Consequently, the holding period of shares of New Common Stock will include your holding period for the shares of Old Common Stock, provided that the shares of common stock are held by you as a capital asset at the time of the exchange. In addition, your aggregate basis in the New Common Stock will be the same as your aggregate basis of the shares of the Old Common Stock.

YOU SHOULD CONSULT WITH YOUR OWN TAX ADVISOR ABOUT THE TAX CONSEQUENCES OF THE REVERSE SPLIT IN LIGHT OF YOUR PARTICULAR CIRCUMSTANCES, INCLUDING THE APPLICATION OF ANY STATE, LOCAL OR FOREIGN TAX LAW.

NO DISSENTER'S RIGHTS

Under Delaware law, you are not entitled to dissenter’s rights of appraisal with respect to the amendment of the articles of incorporation and the reverse stock split.

7

AMENDMENT TO THE ARTICLES OF INCORPORATION

The Reverse Stock Split Amendment will amend Article IV of the Company’s Articles of Incorporation to add a new paragraph. At the effective date, without further action on the part of the Company or the holders, each share of common stock will be converted into one-three hundredth (1/300th) of a share of common stock. The Reverse Split Amendment will be filed with the Secretary of State of Delaware and will become effective on the date of the filing. The amendment to the Articles of Incorporation will also add additional authorized but unissued preferred stock. After the filing of the amendment the Company will have 1,000,000,000 shares of common stock authorized and 50,000,000 shares of preferred stock authorized. See “Approval of the Amendment to Increase Authorized Shares to Authorize Preferred Shares”.

RECOMMENDATION OF THE BOARD OF DIRECTORS

For the above reasons, we believe that the reverse stock split is in the Company’s best interest and in the best interests of our shareholders. There can be no guarantee, however, that the market price of our common stock after the reverse stock split will be equal to the market price before the reverse stock split multiplied by the split number, or that the market price following the reverse stock split will either exceed or remain in excess of the current market price.

PROPOSAL TO ELECT DIRECTORS

The Board currently consists of three members, each of whom serve one year terms or until their successor is elected. The current board consists of Paul Parliament, Douglas Brooks and Richard Kaiser. These individuals have been elected by the vote of the Shareholders to serve as Directors until the Annual Meeting of Shareholders in Fiscal 2018, until their successors have been duly elected and qualified or until their earlier death, resignation or removal.

The following table provides information concerning our officers and directors.

|

|

|

|

|

Name and Address

|

Age

|

Position(s)

|

|

Paul Parliament

|

51

|

President, C.E.O.,Director

|

|

Douglas Brooks

|

49

|

V.P.,Director

|

|

Richard Kaiser

|

52

|

Secretary, Director

|

The directors named above serve for one year terms or until their successors are elected or they are re-elected at the annual stockholders’ meeting. Officers hold their positions at the pleasure of the board of directors, absent any employment agreement. There is no arrangement or understanding between any of our directors or officers and any other person pursuant to which any director or officer was or is to be selected as a director or officer, and there is no arrangement, plan or understanding as to whether non-management shareholders will exercise their voting rights to continue to elect the current directors to the Company’s board.

Executive Officers

The following individuals serve as Bravo’s executive officers as of January 1, 2017:

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Position

|

|

Paul Parliament

|

51

|

Chairman of the Board, Chief Executive Officer, President

|

|

Martin Wolfe

|

68

|

Chief Financial Officer, Principal Accounting Officer, and Treasurer

|

|

Douglas Brooks

|

49

|

Vice President

|

|

Richard Kaiser

|

52

|

Secretary and Corporate Governance Officer

|

8

The members of our board of directors are subject to change from time to time by the vote of the stockholders at special or annual meetings to elect directors.

The foregoing notwithstanding, except as otherwise provided in any resolution or resolutions of the board, directors who are elected at an annual meeting of stockholders, and directors elected in the interim to fill vacancies and newly created directorships, will hold office for the term for which elected and until their successors are elected and qualified or until their earlier death, resignation or removal.

Whenever the holders of any class or classes of stock or any series thereof are entitled to elect one or more directors pursuant to any resolution or resolutions of the board, vacancies and newly created directorships of such class or classes or series thereof may generally be filled by a majority of the directors elected by such class or classes or series then in office, by a sole remaining director so elected or by the unanimous written consent or the affirmative vote of a majority of the outstanding shares of such class or classes or series entitled to elect such director or directors. Officers are elected annually by the directors.

We may employ additional management personnel, as our board of directors deems necessary. Bravo Multinational has not identified or reached an agreement or understanding with any other individuals to serve in management positions, but does not anticipate any problem in employing qualified staff.

Paul Parliament has been a member of our board since October 31, 2012. From April 1994 to present Mr. Parliament has served as president of The Parliament Corporation and six years as President of The Parliament Apartment Corporation, which are companies in the real estate re-development business. Mr. Parliament has over 28 years as a successful real estate developer, and as president of Marsadi Layne Properties, Inc., The Parliament Corporation, P.D.P Developments, Inc., and The Parliament Apartment Corporation. Mr. Parliament has knowledge of property acquisitions, corporate finance, planning, permitting, staffing, management, and strategic business planning.

Martin Wolfe is a BA, CA (Chartered Accountant) and CPA (Chartered Professional Accountant) who received his designation in 1980. Mr. Wolfe has served on the board of Bravo Multinational Incorporated from June 2014 to September 2016, and is currently our chief financial officer. Mr. Wolfe has over 35 years of experience in both public practice and in industry. Currently, Mr. Wolfe, in addition to operating as a sole practitioner, provides consulting services to the insolvency and restructuring industry.

Douglas Brooks has been a member of our board since September 25, 2015. Mr. Brooks has had a successful career in real estate. From 1994 to 2000, he was secretary and director of Marsadi Layne Properties Inc., a large real estate property manager and developer in Southern Ontario. From 1996 to present, Mr. Brooks has been president of Rentcom Plus Inc., a privately owned real estate based corporation. Mr. Brooks has also been involved in the corporate business, including property management, finance and real estate redevelopment. He is a Member Broker and Broker of Record for the Real Estate Council of Ontario.

9

Richard Kaiser, is our corporate secretary and corporate governance officer, a position that he has held since March 24, 2015. Mr. Kaiser has also served since July 1991 as Co-owner of Yes International, a full service investor relations and venture capital firm. He has a Bachelor of Arts degree in International Economics from Oakland University (formerly known as Michigan State University-Honors College).

On November 9, 2015, we added Allen Simon, as a Senior Advisor to the Executive Committee of Bravo Multinational Incorporated. Mr. Simon has no voting privileges with respect to his position.

Committees of the Board

We currently have an Executive Committee of our board of directors which was established on March 24, 2015. However, we do not currently have an Audit, Executive, Finance, Compensation, or Nominating Committee, or any other committee of the board of directors. We have adopted a charter for the Executive Committee as well as charters for the other committees, in the event that we elect to implement them. Copies of the charters for each committee have been previously filed with the Securities and Exchange Commission. In addition, we have posted copies of the charters for each committee on our website at www.bravomultinational.com. We will provide to any person without charge, upon request, a copy of the charter for any of our committees. In addition, we intend to post on our website all disclosures that are required by law concerning any amendments to our committees or their charters. Any such request should be directed to Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (757) 306-6090, or email him at info@bravomultinational.com. The information contained in our website shall not constitute part of these Proxy Materials.

For the areas where we don’t have committees, such responsibilities are fulfilled by our board of directors and all of our directors participate in such responsibilities, none of whom is “independent” as defined under Rule 4200(a)(15) of the NASDAQ’s listing standards described below. Our financial position has made it extremely difficult to attract and retain qualified independent board members. Since we do not have any of the subject committees, other than our Executive Committee, our entire board of directors participates in all of the considerations with respect to our audit, finance, compensation, and nomination deliberations.

Rule 4200(a)(15) of the NASDAQ’s listing standards defines an “independent director” as a person other than an executive officer or employee of the company or any other individual having a relationship which, in the opinion of the issuer’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The following persons shall not be considered independent:

·

A director who is, or at any time during the past three years was, employed by the company;

·

A director who accepted or who has a Family Member who accepted any compensation from the company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than the following: (i) compensation for board or board committee service; (ii) compensation paid to a Family Member who is an employee (other than as an executive officer) of the company; or (iii) benefits under a tax-qualified retirement plan, or non-discretionary compensation. Provided, however, that in addition to the requirements contained in this paragraph, audit committee members are also subject to additional, more stringent requirements under NASDAQ Rule 4350(d).

10

·

A director who is a Family Member of an individual who is, or at any time during the past three years was, employed by the company as an executive officer;

·

A director who is, or has a Family Member who is, a partner in, or a controlling stockholder or an executive officer of, any organization to which the company made, or from which the company received, payments for property or services in the current or any of the past three fiscal years that exceed five percent of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than the following: (i) payments arising solely from investments in the company’s securities; or (ii) payments under non-discretionary charitable contribution matching programs;

·

A director of the issuer who is, or has a Family Member who is, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of the issuer serve on the compensation committee of such other entity; or

·

A director who is, or has a Family Member who is, a current partner of the company’s outside auditor, or was a partner or employee of Bravo’s outside auditor who worked on the company’s audit at any time during any of the past three years.

We hope to add qualified independent members of our board of directors at a later date, depending upon our ability to reach and maintain financial stability.

Executive Committee

In accordance with Article III of our bylaws, our board of directors has established an Executive Committee which consists of members who have been appointed by the board of directors. The initial chairman of the Executive Committee is Paul Parliament. Thereafter, the chairman of the Executive Committee shall be appointed by the members of the Executive Committee. The remaining member of the Executive Committee is Douglas Brooks. The members of the Executive Committee shall serve at the pleasure of the board of directors or until their successors shall be duly designated. Vacancies in the Executive Committee shall be filled by the board of directors.

During the intervals between the meetings of the board of directors, the Executive Committee shall have and may exercise all of the authority of the board of directors in the management of the business affairs of Bravo to the extent authorized by the resolution providing for the Executive Committee or by subsequent resolution adopted by a majority of the whole board of directors. This authorization is subject to the limitations imposed by law, the bylaws of Bravo Multinational Incorporated or the board of directors.

During the fiscal year ended December 31, 2016, the Executive Committee held no formal meetings.

Audit Committee

The entire board of directors performs the functions of an audit committee, but no written charter governs the actions of the board when performing the functions of what would generally be performed by an audit committee. The board approves the selection of our independent accountants and meets and interacts with the independent accountants to discuss issues related to financial reporting. In addition, the board reviews the scope and results of the audit with the independent accountants, reviews with management and the independent accountants our annual operating results, considers the adequacy of our internal accounting procedures and considers other auditing and accounting matters including fees to be paid to the independent auditor and the performance of the independent auditor. At the present time, Paul Parliament, our chief executive officer is considered to be our expert in financial and accounting matters.

11

Nominating Committee

Our size and the size of our board, at this time, do not require a separate nominating committee. When evaluating director nominees, our directors consider the following factors:

·

The appropriate size of our board of directors;

·

Our needs with respect to the particular talents and experience of our directors;

·

The knowledge, skills and experience of nominees, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the board;

·

Experience in political affairs;

·

Experience with accounting rules and practices; and

·

The desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new board members.

Our goal is to assemble a board that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the board will also consider candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the board may also consider such other factors as it may deem in our best interests as well as in the best interests of our stockholders. In addition, the board identifies nominees by first evaluating the current members of the board willing to continue in service. Current members of the board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the board does not wish to continue in service or if the board decides not to re-nominate a member for re-election, the board then identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the board are polled for suggestions as to individuals meeting the criteria described above. The board may also engage in research to identify qualified individuals. To date, we have not engaged third parties to identify or evaluate or assist in identifying potential nominees, although we reserve the right in the future to retain a third party search firm, if necessary. The board does not typically consider stockholder nominees because it believes that its current nomination process is sufficient to identify directors who serve our best interests.

Finance Committee

Although we currently do not have a Finance Committee, we have adopted a charter which provides that when established it will oversee all areas of corporate finance for Bravo and its subsidiaries, including capital structure, equity and debt financings, capital expenditures, cash management, banking activities and relationships, investments, foreign exchange activities and share repurchase activities. The Finance Committee will consist of a minimum of three members of the board of directors, the majority of whom shall meet the same independence and experience requirements of the Audit Committee of Bravo and the applicable provisions of federal law and the rules and regulations promulgated thereunder and the applicable rules of The NASDAQ Stock Market, the New York Stock Exchange, or any other exchange where the shares of Bravo may be listed or quoted for sale. The members of the Finance Committee are to be recommended by the Nominating and Corporate Governance Committee and are appointed by and serve at the discretion of the board of directors.

12

Compensation Committee

Although we currently do not have a Compensation Committee, we have adopted a charter which provides that when established it is to assist the board of directors in meeting its responsibilities with regard to oversight and determination of executive compensation and to review and make recommendations to the board of directors with respect to major compensation plans, policies and programs of Bravo. The Compensation Committee shall consist of not fewer than two members of the board of directors, with the exact number being determined by the board. Members of the Compensation Committee shall be appointed from time to time to serve in such capacity by the Board. Each member shall meet the independence and outside director requirements of applicable tax and securities laws and regulations and stock market rules.

Conflicts of Interest

With respect to transactions involving real or apparent conflicts of interest, we have adopted written policies and procedures, which are contained in our Corporate Governance Principles, and which require that:

·

The fact of the relationship or interest giving rise to the potential conflict be disclosed or known to the directors who authorize or approve the transaction prior to such authorization or approval;

·

The transaction be approved by a majority of our disinterested outside directors; and

·

The transaction be fair and reasonable to us at the time it is authorized or approved by our directors.

Code of Ethics for Senior Executive Officers and Senior Financial Officers

We have adopted an amended Code of Ethics for Senior Executive Officers and Senior Financial Officers that applies to our president, chief executive officer, chief operating officer, chief financial officer, and all financial officers, including the principal accounting officer. The code provides as follows:

·

Each officer is responsible for full, fair, accurate, timely and understandable disclosure in all periodic reports and financial disclosures required to be filed by us with the Securities and Exchange Commission or disclosed to our stockholders and/or the public.

·

Each officer shall immediately bring to the attention of the audit committee, or disclosure compliance officer, any material information of which the officer becomes aware that affects the disclosures made by us in our public filings and assist the audit committee or disclosure compliance officer in fulfilling its responsibilities for full, fair, accurate, timely and understandable disclosure in all periodic reports required to be filed with the Securities and Exchange Commission.

13

·

Each officer shall promptly notify our general counsel, if any, or the president or chief executive officer as well as the audit committee of any information he may have concerning any violation of our Code of Business Conduct or our Code of Ethics, including any actual or apparent conflicts of interest between personal and professional relationships, involving any management or other employees who have a significant role in our financial reporting, disclosures or internal controls.

·

Each officer shall immediately bring to the attention of our general counsel, if any, the president or the chief executive officer and the audit committee any information he may have concerning evidence of a material violation of the securities or other laws, rules or regulations applicable to us and the operation of our business, by us or any of our agents.

·

Any waiver of this Code of Ethics for any officer must be approved, if at all, in advance by a majority of the independent directors serving on our board of directors. Any such waivers granted will be publicly disclosed in accordance with applicable rules, regulations and listing standards.

Code of Business Conduct

We have adopted a Code of Business Conduct, which applies to Bravo and all of our subsidiaries, whereby we expect each employee to use sound judgment to help us maintain appropriate compliance procedures and to carry out our business in compliance with laws and high ethical standards. Each of our employees is expected to read our Code of Business Conduct and demonstrate personal commitment to the standards set forth in our Code of Business Conduct. Our officers and other supervising employees are expected to be leaders in demonstrating this personal commitment to the standards outlined in our Code of Business Conduct and recognizing indications of illegal or improper conduct. All employees are expected to report appropriately any indications of illegal or improper conduct. An employee who does not comply with the standards set forth in our Code of Business Conduct may be subject to discipline in light of the nature of the violation, including termination of employment.

Copies of our Corporate Governance Principles, our amended Code of Ethics for Senior Executive Officers and Senior Financial Officers, and our Code of Business Conduct have been previously filed with the Securities and Exchange Commission. In addition, we have posted copies of our Corporate Governance Principles, our amended Code of Ethics for Senior Executive Officers and Senior Financial Officers, and our Code of Business Conduct on our website at www.bravomultinational.com. We will provide to any person without charge, upon request, a copy of our Corporate Governance Principles, our amended Code of Ethics for Senior Executive Officers and Senior Financial Officers, and our Code of Business Conduct. In addition, we intend to post on our website all disclosures that are required by law concerning any amendments to our Corporate Governance Principles, our amended Code of Ethics for Senior Executive Officers and Senior Financial Officers, and our Code of Business Conduct. Any request for review of such documents should be directed to Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (757) 306-6090, or email him at info@bravomultinational.com. The information contained in our website shall not constitute part of this Information Statement.

Board of Directors Meetings

During the year ended December 31, 2016, our board of directors held four formal meetings and no meetings were held where board actions were taken by written consent. All of Bravo’s directors attended 100% of our meetings in 2016.

14

Communication with Directors

Stockholders and other interested parties may contact any of our directors by writing to them at Bravo Multinational Incorporated, 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, Attention: Corporate Secretary, telephone (716) 803-0621, or email at info@bravomultinational.com.

Our board has approved a process for handling letters received by us and addressed to any of our directors. Under that process, our vice president reviews all such correspondence and regularly forwards to the directors a summary of all such correspondence, together with copies of all such correspondence that, in the opinion of our vice president, deal with functions of the board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that are addressed to members of the board and request copies of such correspondence.

Director Compensation

As a result of the election of Mr. Brooks as a director of Bravo, Mr. Brooks was awarded 2,000,000 shares of our restricted common stock. Moreover, due to his election as a director, Mr. Brooks made a $100,000 direct investment in Bravo on October 1, 2015, in exchange for a convertible promissory note, providing for conversion rights into shares of our common stock based on Bravo’s common stock price low as of September 23, 2015, which was $0.0212 per share. You may obtain a copy of the convertible promissory note executed by Bravo at www.sec.gov or by clicking on the Securities and Exchange Commission Filings link on the Investor Relations section of our website at www.bravomultinational.com, or by contacting Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (716) 803-0621, or email him at info@bravomultinational.com.

At the meeting of the board of directors of Bravo Multinational Incorporated held on September 25, 2015, the board of directors voted that any new director elected to the board of directors of Bravo shall receive $25,000 per year in shares of our common stock registered pursuant to a registration statement on Form S-8 filed with the Securities and Exchange Commission to be paid quarterly. In addition, any new director shall be required to make a direct investment of not less than $100,000 into Bravo in exchange for a convertible promissory note to be submitted to the board of directors for approval.

The following table provides information relating to compensation of our directors for our fiscal year ended December 31, 2016. The current directors do not receive compensation for their duties as directors.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Fees Earned or

Paid in Cash ($)

|

Stock Awards ($)

|

Option Awards ($)

|

Non-Equity Incentive

Plan Compensation ($)

|

Nonqualified Deferred Compensation

Earnings

($)

|

All Other

Compensation

($)

|

Total

($)

|

|

|

|

|

|

|

|

|

|

|

Paul Parliament

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Richard Kaiser

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Douglas Brooks

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

BOARD OF DIRECTORS; ELECTION OF OFFICERS

15

All directors hold their office until the next annual meeting of shareholders or until their successors are duly elected and qualified. Any vacancy occurring in the board of directors may be filled by the shareholders, or the board of directors. A director elected to fill a vacancy is elected for the unexpired term of his predecessor in office. Any directorship filled by reason of an increase in the number of directors shall expire at the next shareholders’ meeting in which directors are elected, unless the vacancy is filled by the shareholders, in which case the term shall expire on the later of (i) the next meeting of the shareholders or (ii) the term designated for the director at the time of creation of the position being filled.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information regarding the beneficial ownership of all shares of our common stock and preferred stock as of January 1, 2017, by:

·

Each person who owns beneficially more than five percent of the outstanding shares of our common stock;

·

Each person who owns beneficially more than five percent of the outstanding shares of our preferred stock;

·

Each director;

·

Each named executive officer; and

·

All directors and officers as a group.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Beneficially Owned (2)

|

Shares of Preferred Stock

Beneficially Owned (2)

|

|

Name of Beneficial Owner (1)

|

Number

|

Percent

|

Number

|

Percent

|

|

Paul Parliament (3)

|

4,488,139

|

1.74

|

1,500,000

|

30

|

|

Martin Wolfe (4)

|

0

|

-0-

|

1,500,000

|

30

|

|

Douglas Brooks (5)

|

4,017,789

|

1.56

|

500,000

|

10

|

|

Richard Kaiser (6)

|

3,346,902

|

1.30

|

750,000

|

15

|

|

All directors and officers as a group (four persons)

|

11,852,829

|

4.60

|

4,250,000

|

85

|

|

Julios Kosta (7)

|

46,584,411

|

18.09

|

500,000

|

10

|

|

Jack Frydman (8)

|

28,033,005

|

10.88

|

250,000

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

________

(1)

Unless otherwise indicated, the address for each of these stockholders is c/o Bravo Multinational Incorporated Co., at 590 York Road, Unit 3, Niagara On The Lake, Ontario, L0S 1J0, CANADA. Also, unless otherwise indicated, each person named in the table above has the sole voting and investment power with respect to our shares of common stock or preferred stock which he beneficially owns.

(2)

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. As of January 1, 2017, there were outstanding 257,560,828 shares of our common stock, and we have 5,000,000 shares of

16

our Series A preferred stock issued. Each share of the Series A preferred stock has voting rights equal to 100 shares of our common stock. Further, each share of the Series A preferred stock may be converted into 10 shares of our common stock. However, there are restrictions on the conversion rights of the Series A preferred stock as stated elsewhere in this Information Statement. Taken together, the holders of the Series A preferred stock have voting rights equal to 500,000,000 shares of our common stock, which number exceeds our outstanding shares of common stock on January 1, 2017. As of January 1, 2017, none of the Series A preferred stock has been converted into shares of our common stock. As a result of their ownership of 5,000,000 shares of our Series A preferred stock and 86,470,245 shares of our common stock in the aggregate, Messrs. Parliament, Brooks, Wolfe, Kaiser, Kosta, and Frydman, the “controlling stockholders,” have voting control over 586,470,245 shares of our common stock, which number exceeds our outstanding shares of common stock on January 1, 2017. Therefore, the controlling stockholders, as a group, have voting control over all matters which may be acted upon by our stockholders. There are no voting agreements among the controlling stockholders, other than the voting agreement between Messrs. Wolfe and Frydman discussed below.

(3)

Mr. Parliament is our chairman of the board of the directors, chief executive officer, president and a director. On October 3, 2016 Mr. Parliament returned 34,725,323 common shares to Bravo treasury for cancellation in exchange for a convertible promissory note with a face value of $1,128,573.00.

(4)

Mr. Wolfe is our chief financial officer, principal accounting officer, and treasurer. Mr. Wolfe declined to stand for reelection as director due to personal reasons. On October 3, 2016 Mr. Wolfe returned 6,422,547 common shares to Bravo treasury for cancellation in exchange for a convertible promissory note with a face value of $208,732.78.

(5)

Mr. Brooks is our vice president and a director. On October 3, 2016 Mr. Brooks returned 13,591,363 common shares to Bravo treasury for cancellation in exchange for a convertible promissory note with a face value of $441,719.29.

(6)

Mr. Kaiser is our secretary and corporate governance officer, and director. On October 3, 2016 Mr. Kaiser returned 3,050,329 common shares to Bravo treasury for cancellation in exchange for a convertible promissory note with a face value of $99,135.69.

(7)

Mr. Kosta has a Consulting Agreement with Bravo Multinational Incorporated. On October 3 and 11 Mr Kosta returned 1,122,997 and 5,333,334 common shares to Bravo treasury for cancellation in exchange for convertible promissory notes with a face value of $36,497.40 and $160,000.

(8)

Mr. Frydman had a Consulting Agreement with Bravo Multinational Incorporated which was cancelled on January 6

th

, 2017.

Pursuant to an Assignment of Voting Rights dated December 31, 2015, Jack Frydman assigned to Martin Wolfe all voting rights possessed by Mr. Frydman in the 250,000 shares of the Series A preferred stock of Bravo Multinational Incorporated owned by Mr. Frydman. You may obtain a copy of Assignment of Voting Rights by accessing this Information Statement as filed with the Securities and Exchange Commission on the Internet at www.sec.gov or by clicking on the Securities and Exchange Commission Filings link on the Investor Relations section of our website at www.bravomultinational.com, or by contacting Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (716) 803-0621, or email him at info@bravomultinational.com.

17

As a result of the common stock and preferred stock ownership by Messrs. Parliament, Brooks, Wolfe, Kaiser, Kosta, and Frydman, the “controlling stockholders” herein, they will be able to control all matters requiring stockholder approval, including the election of directors, merger or consolidation. This concentration of ownership may delay, deter or prevent acts which could reduce the market price of our common stock.

Consulting Agreements

During the fiscal years ended December 31, 2015, and December 31, 2016, we executed consulting agreements with the following:

·

Consulting Agreement dated as of October 1, 2014, between Yes International and Bravo Multinational Incorporated with respect to investor relations, consulting, press services and Edgar filing services. Currently there is no consulting agreement and the press and Edgar services are provided by Yes at no cost to Bravo. Yes does charge Bravo for press release wire services.

·

Consulting Agreement dated as of October 1, 2015, between Vincent Caruso and Bravo Multinational Incorporated with respect to advice on marketing and business development on a non-exclusive basis. This contract has since been terminated for non-performance.

·

Consulting Agreement dated as of October 1, 2015, between Stephen Simon and Bravo Multinational Incorporated with respect to advice on marketing and business development on a non-exclusive basis. This contract has since been terminated for non-performance.

·

Consulting Agreement dated July 23, 2015, between Delaney Equity Group, LLC and Bravo Multinational Incorporated with respect to efforts to advise Bravo Multinational Incorporated and/or any of its projects, or otherwise arrange for Bravo Multinational Incorporated to receive capital on terms and conditions acceptable to Bravo Multinational Incorporated, through any legal means, whether equity, debt or any combination thereof. Delaney Equity Group, LLC shall receive a combination of cash, warrants for the purchase of shares of our common stock, and shares of our common stock as described in the agreement. This contract has since been terminated for non-performance.

·

Consulting Agreement dated November 9, 2015, between FMW Media Works Corp. and Bravo Multinational Incorporated with respect to advice as will assist in maximizing the effectiveness of Bravo Multinational Incorporated’s business model both relative to its business model and to its present and contemplated capital structure. This contract has since been terminated for non-performance.

·

On October 1, 2015, we engaged Jack Frydman in a new consulting agreement to advise Bravo Multinational Incorporated on corporate development matters. On January 6, 2017 this contract was terminated by the board of directors for non-performance. A mutual release was signed by all parties and any compensation amounts due under the contract from September 1, 2016 onward were cancelled.

·

On October 1, 2015, we executed a Mutual Release with Julios Kosta in connection with the termination of a Consulting Agreement dated October 1, 2013. Pursuant to the Mutual Release we acknowledged that Mr. Kosta had received 16,000,000 shares of our restricted common stock as a final payment for all services under the Consulting Agreement dated October 1, 2013.

·

On October 1, 2015, we engaged Julios Kosta in a new consulting agreement to advise Bravo Multinational Incorporated on international corporate development matters.

18

You may obtain copies of the above described Consulting Agreements by clicking on the Securities and Exchange Commission Filings link on the Investor Relations section of our website at www.bravomultinational.com, or by contacting Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (716) 803-0621, or email him at info@bravomultinational.com.

Other than as stated herein, there are no arrangements or understandings, known to us, including any pledge by any person of our securities:

·

The operation of which may at a subsequent date result in a change in control of Bravo Multinational Incorporated; or

·

With respect to the election of directors or other matters.

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

At present, Bravo Multinational has four executive officers. Beginning in March 2015, the compensation program for our executives consists of three key elements:

·

A base salary;

·

Additional compensation; and

·

Periodic grants and/or options of our common stock.

Base Salary

. Our executive officers receive compensation based on such factors as competitive industry salaries, a subjective assessment of the contribution and experience of the officer, and the specific recommendation by our board of directors.

Additional Compensation

. Each of our officers receives additional compensation as provided in the officer’s employment agreement. All payments to officers must be approved by our board of directors or compensation committee based on the individual officer’s performance and company performance.

Stock Incentive

. Stock grants and options are awarded to executive officers based on their positions and individual performance. Stock grants and options provide incentive for the creation of stockholder value over the long term and aid significantly in the recruitment and retention of executive officers. The board of directors or compensation committee considers the recommendations of the chief executive officer for stock grants and options to executive officers (other than the chief executive officer) and approves, disapproves or modifies such recommendation. Stock grants and options for our executive officers will be recommended and approved by our board of directors.

19

Summary Compensation Table

The following table sets forth compensation for our named executive officers for the two completed fiscal years ended December 31, 2015 and December 31, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and

Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock Awards

($)

|

Option Awards

($)

|

Non-Equity Incentive Plan Compensation

($)

|

Nonqualified

deferred

compensation

earnings

($)

|

All Other Compensation

($)

|

Total

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

P. Parliament (1)

|

2016

|

-0-

|

-0-

|

300,000

|

-0-

|

-0-

|

-0-

|

-0-

|

300,000

|

|

|

2015

|

-0-

|

-0-

|

132,812

|

-0-

|

-0-

|

-0-

|

-0-

|

132,812

|

|

M. Wolfe (2)

|

2016

|

42,000

|

-0-

|

78,000

|

-0-

|

-0-

|

-0-

|

-0-

|

120,000

|

|

|

2015

|

31,500

|

-0-

|

57,402

|

-0-

|

-0-

|

-0-

|

-0-

|

88,542

|

|

D. Brooks (3)

|

2016

|

-0-

|

-0-

|

120000

|

-0-

|

-0-

|

-0-

|

-0-

|

120,000

|

|

|

2015

|

-0-

|

-0-

|

32,500

|

-0-

|

-0-

|

-0-

|

-0-

|

32,500

|

|

R. Kaiser (4)

|

2016

|

42,000

|

-0-

|

78,000

|

-0-

|

-0-

|

-0-

|

-0-

|

120,000

|

|

|

2015

|

31,500

|

-0-

|

33,645

|

-0-

|

-0-

|

-0-

|

-0-

|

65,145

|

__________

(1)

Mr. Parliament is our chief executive officer, president, and chairman of the board.

(2)

Mr. Wolfe is our chief financial officer, and was previously a director.

(3)

Mr. Brooks is our vice president and director.

(4)

Mr. Kaiser is our corporate secretary and governance officer, and director.

All 2016 current executive compensation has been calculated using standard comparable computations then adjusted to reflect the reasonable current economic condition of Bravo Multinational Incorporated; please note the extreme decrease in wages for the current management in comparison to the previous management.

Outstanding Equity Awards at Fiscal Year-End

None.

Employment Agreements

As of January 1, 2016, Bravo Multinational Incorporated has employment agreements with Paul Parliament, our chairman of the board of directors, chief executive officer, and president, Martin Wolfe, our chief financial officer, principal accounting officer, and treasurer, Douglas Brooks, our Vice- President, and Richard Kaiser, our Secretary and Corporate Governance Officer.

Paul Parliament Employment Agreement.

On March 24, 2015, Bravo Multinational Incorporated and Paul Parliament executed an employment agreement, which provides for a term of two years, and a base salary of $42,000 per year, payable in equal monthly installments of $3,500 paid in S-8 shares of Bravo common stock on the first day of each month during the term of Mr. Parliament’s employment, pro rated for any partial employment period. Mr. Parliament is to devote full time hours per week of his time and attention to the performance of his duties at Bravo Multinational Incorporated.

In addition to the base compensation, Mr. Parliament shall be entitled to receive additional compensation of $108,000 per year, payable in equal monthly installments of $9,000 paid in S-8 shares of our common stock on the first day of each month during the term of Mr. Parliament’s employment, pro rated for any partial employment period. The contract was revised on December 15

th

,2016 to provide for an additional one time payment of $150,000 in S-8 shares of our common stock in compensation payment for additional services rendered during the fiscal year 2016.

Douglas Brooks Employment Agreement.

On September 25, 2015, Bravo Multinational Incorporated and Douglas Brooks executed an employment agreement, which provides for a term of two years, and a base salary of $42,000 per year, payable in equal monthly installments of $3,500 paid in the S-8 shares of Bravo common stock on the first day of each month during the term of Mr. Brooks’ employment, pro rated for any partial employment period. Mr. Brooks is to devote part of his time and attention to the performance of his duties for Bravo.

20

In addition to the base compensation, Mr. Brooks shall be entitled to receive additional compensation of $78,000 per year, payable in equal monthly installments of $6,500 paid in S-8 shares of our common stock on the 1st day of each month during the term of Mr. Brooks’ employment, pro rated for any partial employment period.

Martin Wolfe Employment Agreement.

On March 24, 2015, Bravo Multinational Incorporated and Martin Wolfe executed an employment agreement, which provides for a term of one year, and a base salary of $42,000 per year, payable in equal monthly installments of $3,500 paid in S-8 shares of Bravo common stock on the 1st day of each month during the term of Mr. Wolfe’s employment, pro rated for any partial employment period. Mr. Wolfe is to devote part of his time and attention to the performance of his duties for Bravo.

In addition to the base compensation, Mr. Wolfe shall be entitled to receive additional compensation of $58,000 per year, payable in equal monthly installments of $4,833.33, paid in S-8 shares of our common stock on the first day of each month during the term of Mr. Wolfe’s employment, pro rated for any partial employment period. This contract was revised on March 31, 2016 to provide for an increase to $78,000 per year, payable in equal monthly installments of $6,500.00 paid in S-8 shares of our common stock on the first of each month for a term of one year.

Richard Kaiser Employment Agreement.

On March 24, 2015, Bravo Multinational Incorporated and Richard Kaiser executed an employment agreement, which provides for a term of two years, and a base salary of $42,000 per year, payable in equal monthly installments of $3,500 paid in S-8 shares of Bravo common stock on the 1st day of each month during the term of Mr. Kaiser’s employment, pro rated for any partial employment period. Mr. Kaiser is to devote part of his time and attention to the performance of his duties of Bravo.

In addition to the base compensation, Mr. Kaiser shall be entitled to receive additional compensation of $38,000 per year, payable in equal monthly installments of $3,166.67 paid in S-8 shares of our common stock on the first day of each month during the term of Mr. Kaiser’s employment, pro rated for any partial employment period. The contract was revised on March 31, 2016, to provide for an increase to $78,000 per year, payable in equal monthly installments of $6,500 paid in S-8 shares of our common stock on the 1st of each month for a term of one year.

You may obtain copies of the employment agreements with Messrs. Parliament, Brooks, Wolfe, and Kaiser at www.sec.gov or by clicking on the Securities and Exchange Commission Filings link on the Investor Relations section of our website at www.bravomultinational.com, or by contacting Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (716) 803-0621, or email him atinfo@bravomultinational.com.

All of the above referenced S-8 shares are to be registered on an S-8 registration statement filed with the SEC.

Director Compensation

As a result of the election of Mr. Brooks as a director of Bravo, Mr. Brooks was awarded 2,000,000 shares of the restricted common stock of Bravo. Moreover, due to his election as a director of Bravo, Mr. Brooks made a $100,000 direct investment in Bravo on October 1, 2015, in exchange for a convertible promissory note, providing for conversion rights into common stock of Bravo based on Bravo’s common stock price low as of September 23, 2015, which was $0.0212 per share. You may obtain a copy of the convertible promissory note executed by Bravo at www.sec.gov or by clicking on the Securities and Exchange Commission Filings link on the Investor Relations section of our website at www.bravomultinational.com, or by contacting Mr. Richard Kaiser, our corporate secretary, at 3419 Virginia Beach Boulevard, Unit 252, Virginia Beach, Virginia 23452, telephone (716) 803-0621, or email him at

info@bravomultinational.com

.

21

At the meeting of the board of directors of Bravo held on September 25, 2015, the board of directors voted that any new director elected to the board of directors of Bravo shall receive $25,000 per year in shares of our common stock registered pursuant to a registration statement on Form S-8 filed with the SEC to be paid quarterly. In addition, any new director shall be required to make a direct investment of not less than $100,000 into Bravo in exchange for a convertible promissory note to be submitted to the board of directors for approval. This will exclude newly elected director Rich Kaiser as he was an executive of the company prior to his election to the board of directors on September 29, 2016.

Equity Compensation Plans

We did not have any equity compensation plans as of December 31, 2016.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Other than as stated above, during our fiscal year ended December 31, 2016, there have been no transactions between various officers, directors and affiliates of Bravo Multinational Incorporated.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10 percent of a registered class of our equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our equity securities. Officers, directors and greater than 10 percent stockholders are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely upon a review of copies of such forms filed on Forms 3, 4, and 5, and amendments thereto furnished to us, we believe that as of January 1, 2017, all of our executive officers, directors and greater than 10 percent beneficial owners have complied on a timely basis with all Section 16(a) filing requirements.

Fees to Independent Registered Public Accounting Firm for Fiscal Years 2015 and 2016

During the fiscal years ended December 31, 2016 and 2015, the Company retained Scrudato & Co. to provide services as follows:

|

|

|

|

|

|

Fees for the Year Ended

December 31

|

|

Services

|

2015

|

2016

|

|

Audit Fees (1)

|

$ 14,000

|

$ 14,000

|

|

Audit-Related Fees (2)

|

$ 0

|

$ 0

|

|

Tax Fees (3)

|

$ 0

|

$ 0

|

|

All Other Fees (4)

|

$ 0

|

$ 0

|

|

|

|

|

|

Total audit and non-audit fees

|

$ 14,000

|

$ 14,000

|

22

(1)

“Audit Fees” consist of fees billed for professional services rendered for the audit of our annual financial statements for the years ended December 31, 2015 and 2016, and for the review of the Company’s interim financial statements and services performed during Fiscal 2016. The Company paid $14,000 for the audit of its financial statements for the year ended December 31, 2015. The Company has incurred approximately $14,000 in fees for the audit of its financial statements for the year ended December 31, 2016.

(2)

“Audit-Related Fees” consist of fees billed for professional services reasonably related to the performance of the audit review that are not otherwise reported under Audit Fees.

(3)

“Tax Fees” consist of fees billed for professional services rendered in connection with tax compliance, tax advice and tax planning. The Company did not incur any Tax Fees for the year ended December 31, 2015 or December 31, 2016.

(4)

“All Other Fees” consist of fees billed for professional services rendered that are not otherwise reported above. For the year ended December 31, 2015 and 2016, the Company did not incur any “Other Fees” for auditor services.

Policy on Board of Directors Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Board of Directors pre-approves all audit and non-audit services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services. The Company’s independent auditors may be engaged to provide non-audit services only after the Board of Directors has first considered the proposed engagement and has determined in each instance that the proposed services are not prohibited by applicable regulations and the auditors’ independence will not be materially impaired as a result of having provided these services. In making this determination, the Board of Directors will take into consideration whether a reasonable investor, knowing all relevant facts and circumstances, would conclude that the Directors’ exercise of objective and impartial judgment on all issues encompassed within the auditors’ engagement would be materially impaired.

SHAREHOLDER PROPOSALS FOR 2018 ANNUAL MEETING OF SHAREHOLDERS

Any shareholder of the Company wishing to submit a proposal for action at the Company’s 2018 Annual Meeting of Shareholders must provide a written copy of the proposal to the management of the Company at its principal executive offices no later than July 6, 2017 and must otherwise comply with the rules and regulations of the Commission applicable to shareholder proposals.

FORM 10-K

A copy of the Company’s Form 10-K for the period ending December 31, 2015 or 2016, when filed with the United States Securities and Exchange Commission, will be furnished without charge to shareholders as of the date of this Information Statement upon written request to Bravo Multinational, Inc.

APPROVAL OF THE AMENDMENT TO INCREASE AUTHORIZED SHARES AND TO AUTHORIZE PREFERRED SHARES

General

Our Shareholders have approved an amendment to the Company’s Articles of Incorporation which increases our total number of authorized shares from 1,000,000,000 common shares, with a par value of $.0001 per share, and 5,000,000 preferred shares with a par value of $.0001, to 1,050,000,000 shares, consisting of 1,000,000,000 common shares and 50,000,000 undesignated preferred shares, each with a par value of $.0001 (the “Amendment”). As of January 1, 2017, there were 257,560,828 common shares outstanding and 5,000,000 Series A preferred shares outstanding.

23

Reason for the Amendment

The Board of Directors and the shareholders, deem it advisable to increase the number of our authorized shares in order to provide us with increased flexibility in structuring possible future financings and acquisitions and in meeting other corporate needs which might arise. We have no current commitments or plans for the issuance of the common shares or the preferred shares. Neither the Board of Directors nor our management is aware of any specific effort to accumulate our securities or to obtain control over us by means of a merger or tender offer.